Farm Tire Market Size and Forecast 2025 to 2034

The global farm tire market size accounted for USD 8.47 billion in 2024 and is predicted to increase from USD 8.97 billion in 2025 to approximately USD 15.08 billion by 2034, expanding at a CAGR of 5.94% from 2025 to 2034. The market is evolving more steadily due to the mechanization of agriculture, increasing demand for food, and improvements in tire technology.

Farm Tire MarketKey Takeaways

- In terms of revenue, the farm tire market is valued at $8.97 billion in 2025.

- It is projected to reach $15.08 billion by 2034.

- The market is expected to grow at a CAGR of 5.94% from 2025 to 2034.

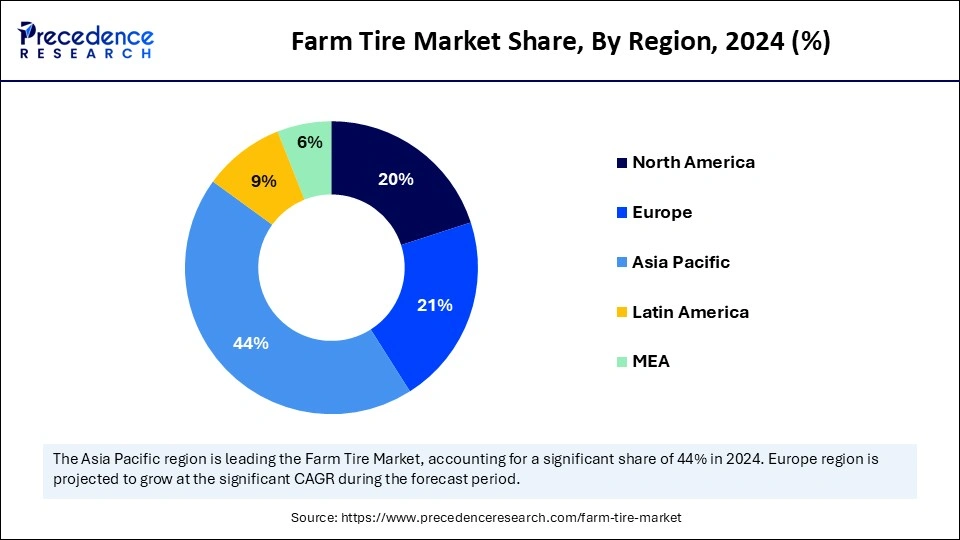

- Asia Pacific dominated the global market with the largest market share of 44% in 2024.

- Europe is expected to witness the fastest CAGR of 5.2% during the forecast period.

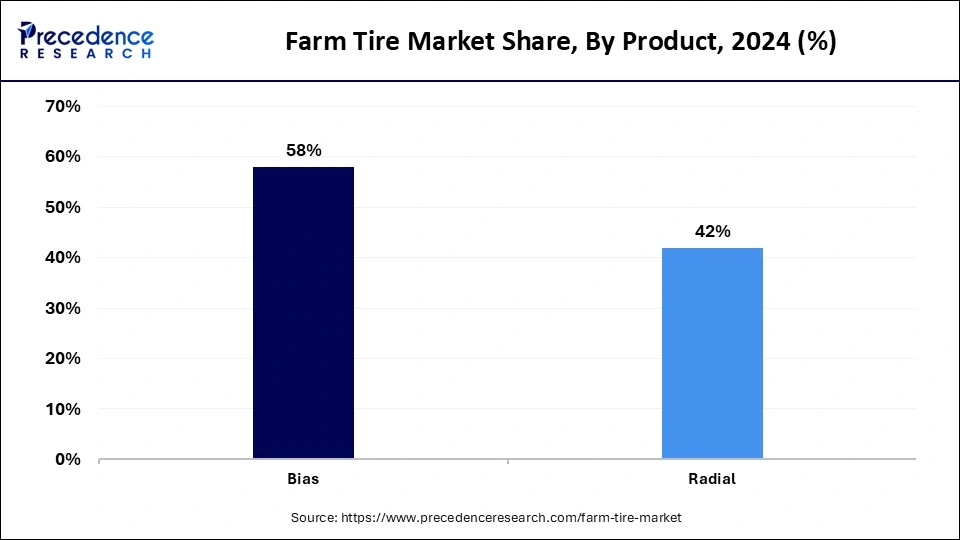

- By product, the bias tires segment held the largest revenue share of 58% in 2024.

- By product, the radial tires segment is expected to grow at a significant CAGR of 5.6% during the forecast period.

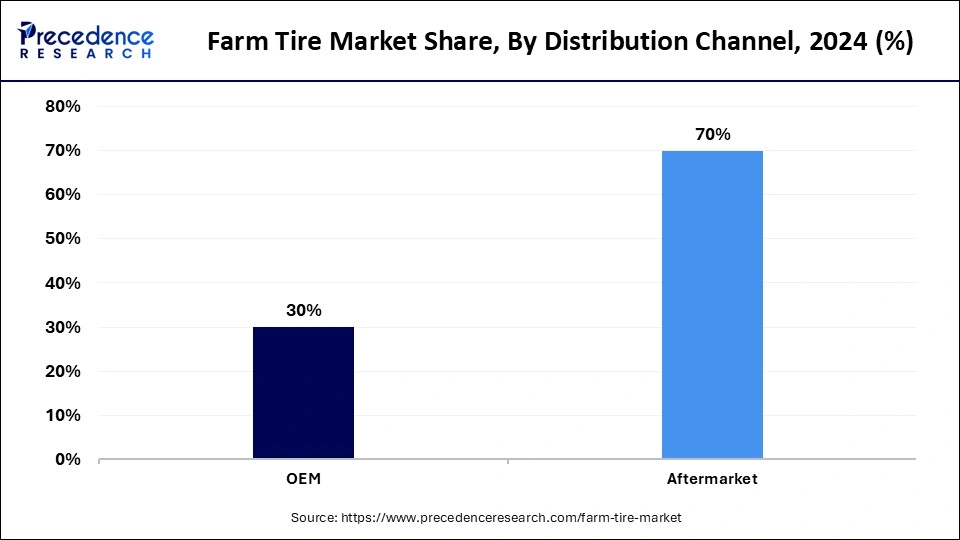

- By distribution channel, the aftermarket segment captured the biggest market share of 62% in 2024.

- By distribution channel, the OEM segment is anticipated to grow at a rapid pace in the market over the forecast period.

- By application, the tractors segment held the largest revenue share of 45% in 2024.

- By application, the harvesters segment is expected to expand at a significant CAGR in the upcoming period.

How is Artificial Intelligence Revolutionizing the Farm Tire Market?

The farm tire market is undergoing revolution, improving performance, efficiency, and precision. This is achieved through the integration of AI technology, which uses sensors embedded in tires to continuously monitor pressure, temperature, and wear. Farmers receive notifications about equipment failures and recommendations to optimize field performance. This data enables predictive maintenance and reduces downtime.

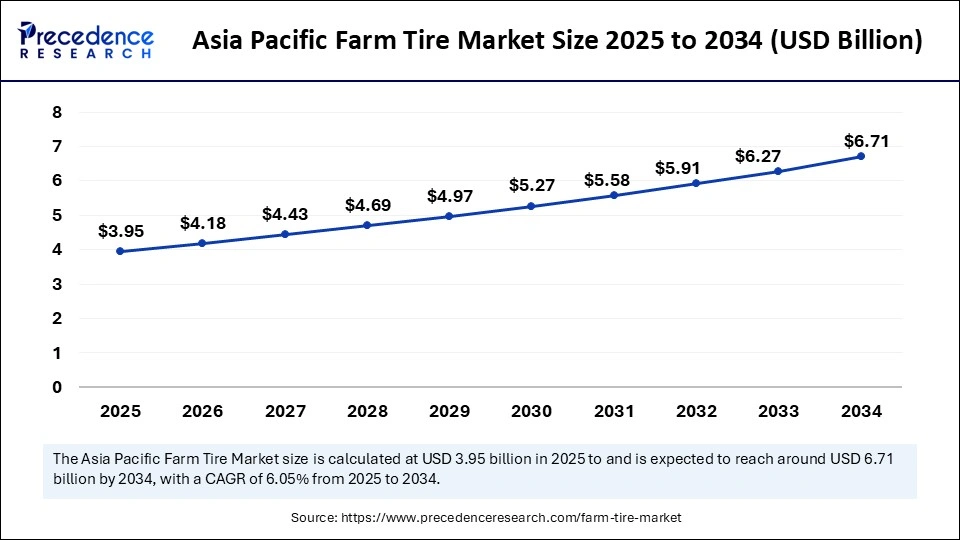

Asia Pacific Farm Tire Market Size and Growth 2025 to 2034

Asia Pacific farm tire market size was exhibited at USD 3.73 billion in 2024 and is projected to be worth around USD 6.71 billion by 2034, growing at a CAGR of 6.05% from 2025 to 2034.

Why did Asia Pacific Dominated the Farm Tire Market in 2024?

Asia Pacific registered dominance in the market by capturing the largest revenue share 44% in 2024. This is mainly due to a strong focus on mechanization of agriculture in countries like India, China, and Southeast Asia. The vast agricultural land, increasing use of modern farming equipment, and the demand for high-performance farm tires create significant profit margins. The availability of custom tire solutions and innovative rubber compounds tailored to specific crop harvesting conditions and soil types further boosts market growth in the Asia Pacific region.

China, as the world's largest agricultural producer, is a key player in the Asia Pacific farm tire market. Its leading position in producing commodities like rice and wheat drives the increasing demand for high-capacity harvesting and farming machinery. China's ongoing investments in precision farming and sustainable agricultural practices will continue to establish it as a leading market base, fostering innovation and growth in the global farm tire market.

European Farm Tire Market Trends

Europe is expected to witness the fastest growth during the forecast period. Favorable government policies, including funding programs and low-interest loans, have encouraged investments in modern farming machinery. These programs have supported the growth of the agricultural industry, enabling farmers to utilize modern machinery with specialized tires. The UK is the most dynamically developing market in Europe, with a focus on sustainable agricultural production models. There is a growing demand for “green” agricultural tires that enhance efficiency and minimize soil damage across various soil types.

North American Farm Tire Market Trends

North America is considered to be a significantly growing area. The presence of extensive fertile soils and large-scale agricultural operations in the region creates a high demand for sophisticated farming machinery and high-quality tires. A strong economy encourages frequent investment in the agricultural industry, leading farmers to invest in high-capacity machinery with durable tires to increase productivity. The region's focus on agricultural automation and mechanization makes it a world leader in adopting new farm technologies, which fuels demand for advanced, high-performance agricultural tires that meet modern farming needs.

Market Overview

The farm tires are special tires designed to be used on agricultural machinery like tractors, combines, sprayers, trailers, and harvesters. Such tires are critical in handling heavy-duty activities that take place in farming to ensure farmers have superior traction, durability, and load-carrying ability on a broad range of adverse terrains. Specifically, agricultural tires may feature deep lugs, self-cleaning bars as well as open shoulders, which will provide maximum grip and stability in conditions such as mud, sand, gravel and uneven terrain.

The global farm tire market is growing rapidly, driven by rising mechanization of farming. With the increasing global population, there is an increasing pressure to enhance the productivity of crops, which has increased demand for sophisticated agricultural machinery that is installed with special tires. Government incentives and subsidies to modernize agricultural practices also contribute to the progression of the market. This has been a result of technological advancements such as the development of radial and low-pressure tires that improved the tire durability, traction, and fuel efficiency, appealing to farmers who aim at cutting down costs in operating.

What are the Major Trends in the Farm Tires Market?

- Mechanization of Agriculture: The demand for specialized farm tires is increasing as farmers are using modern machines to enhance productivity and efficiency in farming. These tires are essential for heavy machines operating on various terrains.

- Government Support and Subsidies: Governmental initiatives and financial aid encourage farmers to adopt modern equipment, increasing the demand for high-quality farm tires that enhance performance and reduce operational costs.

- Technological Advancements in Tire Design: Innovations like radial construction and low-pressure tires improve fuel efficiency, traction, and soil preservation. These advancements lead to sustained high-performance tires, benefiting farm productivity and reducing maintenance costs, thereby fueling the growth of the farm tire market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 15.08 Billion |

| Market Size in 2025 | USD 8.97 Billion |

| Market Size in 2024 | USD 8.47 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.94% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

High Food Demand and Lack of Skilled Labor

The rising demand for food worldwide drives the growth of the farm tire market. Food demand is rising due to population growth, higher incomes, and improved living standards. This has spurred a significant shift towards mechanized farming, leading to greater use of tractors and heavy equipment. These machines require durable, high-performance tires designed to endure various terrains and demanding operational conditions.

Moreover, the growing shortage of skilled labor in the agricultural sector is accelerating the adoption of automated and machinery-based farming practices. With a reduced workforce available for manual tasks, farmers are increasingly reliant on technology-driven equipment, necessitating reliable, professionally engineered tires. Modern tractor technologies must be supported by equally advanced tires, ensuring optimal traction, efficient fuel consumption, and long-lasting durability.

Restraint

High Initial Costs and Environmental Concerns

The farm tire market faces several challenges. A primary challenge is the high initial investment required for specialized or technologically advanced tires. These elevated costs, compounded by the rising prices of raw materials, particularly rubber, make premium tire options less accessible for small to medium-scale farmers, thus impacting market adoption. Moreover, environmental concerns, such as soil compaction caused by heavy machinery equipped with conventional tires, are also major deterrents. Soil degradation can lead to reduced crop yields and long-term damage to soil health, attracting scrutiny from regulatory bodies and sustainability advocates. These factors contribute to farmers' reluctance to invest in new tires, especially in cost-sensitive markets.

Opportunity

Favorable Government Policies

Governmental subsidies for agricultural machinery purchases, along with tax incentives and grants, are aimed at modernizing farming practices. These policies help farmers, especially small- and mid-scaled farmers, in upgrading their equipment, which includes tires that are crucial in efficiency and productivity. Some policies emphasize sustainable farming and encourage the production and use of low-compaction, eco-friendly tires. This government support increases the purchasing power of farmers and contributes to overall mechanization of the agricultural sector. Consequently, such policies create favorable environments and provide a vibrant growth opportunity for manufacturers, enabling them to bring their products closer to customers and meet the increasing demand for reliable, high-performance agricultural tires.

Product Insights

Why did the Bias Tires Segment Dominate the Market in 2024?

The bias tires segment dominated the farm tire market with the largest revenue share 58% in 2024. This is mainly due to the increased preference for bias tires because their ruggedness, cost-effectiveness, and ability to endure challenging off-road conditions. These tires feature multiple layers of fabric cords arranged at angles, enhancing their strength and rigidity. This robust construction makes bias tires highly resistant to punctures and external damage, making them ideal for navigating rough terrains such as mud, gravel, and uneven soil commonly found in farming.

The durable nature of the bias tires extends service life and less need for replacements, thus preventing farmers from spending more money. With their high load-bearing capacity and sidewall strength, bias tires are well-suited for heavy machinery like tractors, harvesters, and trailers.

In March 2024, Bridgestone Americas (Bridgestone) introduced an advanced Regency Plus bias tire line for Firestone Ag. With a wide, affordable range of Applications from fronts and implements, through to solutions for utility, light construction, and lawn and garden equipment, Regency Plus bias tire will enable the farmers to increase their crops.

(Source: https://www.bridgestoneamericas.com)

The radial tires segment is expected to grow at a significant CAGR of 5.6% over the forecast period. One of the most convincing benefits of radial tires is their ability to balance the load of the machine and thus limit soil compaction and preserve soil health, which are key elements for sustainable agriculture. While radial tires involve a higher initial investment due to the use of synthetic rubber and advanced manufacturing techniques, they prove to be a cost-effective and performance-enhancing choice for long run. As farmers increasingly embrace precision farming and utilize high-powered machinery, the demand for advanced radial tires will grow, solidifying their position in the agricultural tire market.

In June 2024, TVS Srichakra introduced a new range of steel-belted radial agro-industrial tires. It is made to increase endurance and performance characteristics; these tires address modern farming equipment needs. The product focuses on the efficiency of agricultural activity, as advanced traction, wear resistance. Through this innovation, TVS wants to enhance its agro-industrial presence in India.

(Source: https://www.manufacturingtodayindia.com)

Distribution Channel Insights

What Made Aftermarket the Dominant Segment in 2024?

The aftermarket segment dominated the farm tire market with the maximum revenue share of 70% in 2024. Farm machinery operates in demanding terrains, leading to frequent tire replacements and driving demand in the aftermarket. The aftermarket offers a wide array of tire options for tractors, harvesters, and sprayers, enabling farmers to select tires tailored to their specific needs. This modularity appeals to end-users seeking cost-effective solutions without compromising functionality or durability. Enhanced accessibility and convenience through various purchasing channels like online platforms, authorized service centers, and third-party dealers further contribute to the long-term growth of the aftermarket segment in the farm tire industry.

The OEM segment is anticipated to grow at a rapid pace in the market over the forecast period. The growth of the segment is attributed to the rising demand for new modern equipment like tractors, harvesters, and sprayers, especially in developed economies. Since farmers are increasingly embracing technologically advanced and expensive equipment to enhance efficiency and productivity on vast areas of land, the demand for high-quality OEM tires has been on the rise. OEM tires are chosen by the equipment manufacturers because of compatibility, standard performance, and the contribution to their machines' warranties.

The rising demand for OEM tires is also facilitated by increasing vehicle production and the adoption of smart technologies in modern farm equipment. Despite the higher cost compared to aftermarket options, the OEM channel ensures reliability and durability, making it an attractive choice when acquiring new machinery.

Application Insights

How Does the Tractors Segment Dominate the Market in 2024?

The tractors segment dominated the farm tire market with a major revenue share of 45% in 2024. This is mainly due to the increased demand for high-horsepower tractors, given their ability to handle various and intensive farming operations. In addition, factors like rural to urban migration, increasing cost of labor, and limited skilled farm workforce, particularly in developing nations, are boosting the use of mechanized agricultural approaches. With a large number of farmers adopting tractors to enhance efficiency in operations while minimizing the use of manual work, the demand for robust tires that can endure rough terrains is on the increase.

The harvesters segment is expected to expand at a significant CAGR in the upcoming period. The expansion of farming operations and the ongoing development of mechanization are driving the need for efficient harvesting machines, especially in large-scale farming where crop collection is time-sensitive. These machines operate in diverse and often challenging field conditions, necessitating exceptional, high-traction, and durable tires. Harvester tires must provide increased stability and load-bearing capacity while also preserving soil health to maintain machine performance. The growing global demand for food and the shrinking agricultural labor force are spurring investments in automation solutions like combine harvesters, thereby promoting the expansion of this tire segment.

Recent Developments

- In March 2025, Ascenso Tire North America introduced its very high-flexion tire technology and its VHR 3000 ag tire. The VHR 3000 is now available worldwide and it can be tailor made for the harvesters, spreaders, sprayers combining harvesters, and grain carts.

- In May 2023, Mitas introduced the new AGRITERRA 02 SP for the Brazilian market during Agrishow 2023. Specifically made for modern agricultural trucks, high-speed trailers, spreaders, and tank containers, this radial tire has very high flexion (VF), made for carrying higher to be carried up to 40% reduction of soil compaction.

(Source: https://www.moderntiredealer.com)

(Source: https://www.mitas-tires.com)

Farm Tire Market Companies

- Balkrishna Industries Limited (BKT)

- Bridgestone Corporation

- Continental AG

- Compagnie Générale des Établissements Michelin (CGEM)

- Sumitomo Rubber Industries, Ltd.

- Titan International, Inc.

- Mitas

- TBC Corporation

- Apollo Tyres Ltd.

- Hankook Tire

- MRF Limited

- JK Tyre & Industries Ltd.

- CEAT

- The Carlstar Group, LLC

- Specialty Tires of America, Inc.

- Alliance Tire Group (ATG)

- Trelleborg AB

Segments Covered in the Report

By Product

- Bias

- Radial

By Application

- Tractors

- Harvesters

- Forestry

- Irrigation

- Implements

- Sprayers

By Distribution Channel

- OEM

- Aftermarket

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content