What is the Flavors and Fragrances Market Size?

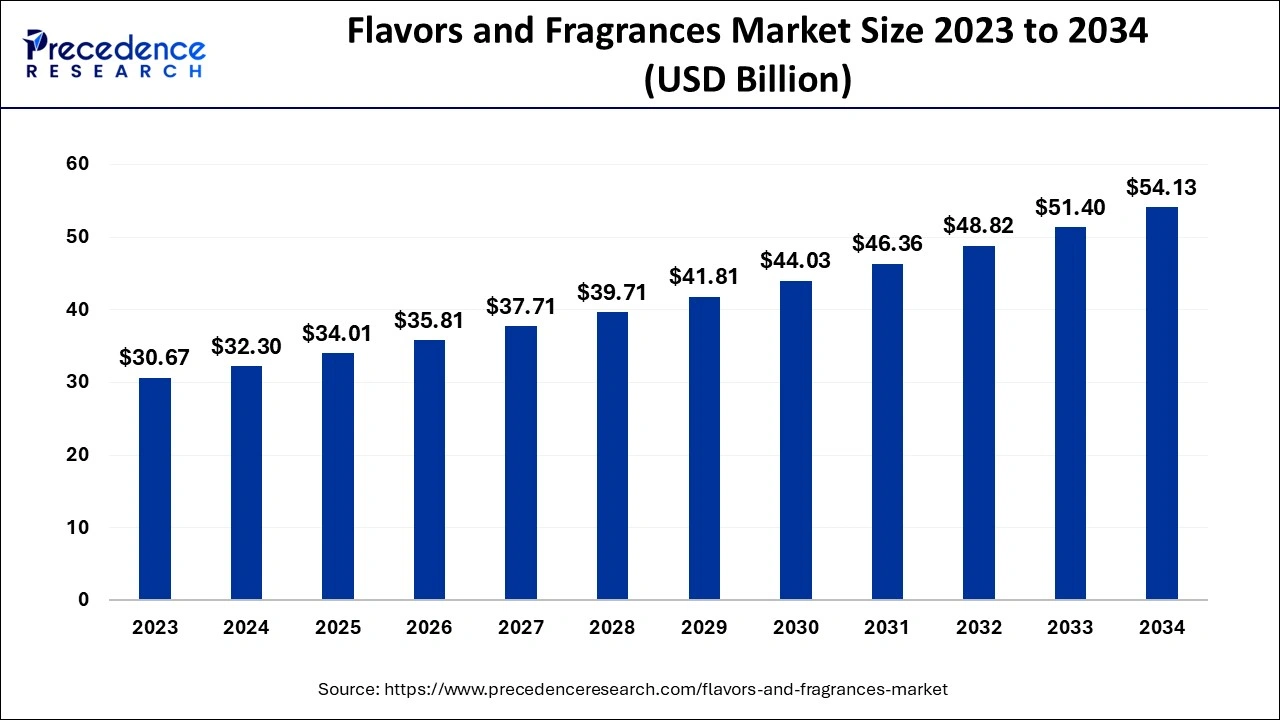

The global flavors and fragrances market size is estimated at USD 34.01 billion in 2025 and is anticipated to reach around USD 56.76 billion by 2035, expanding at a CAGR of 5.26% from 2026 to 2035

Market Highlights

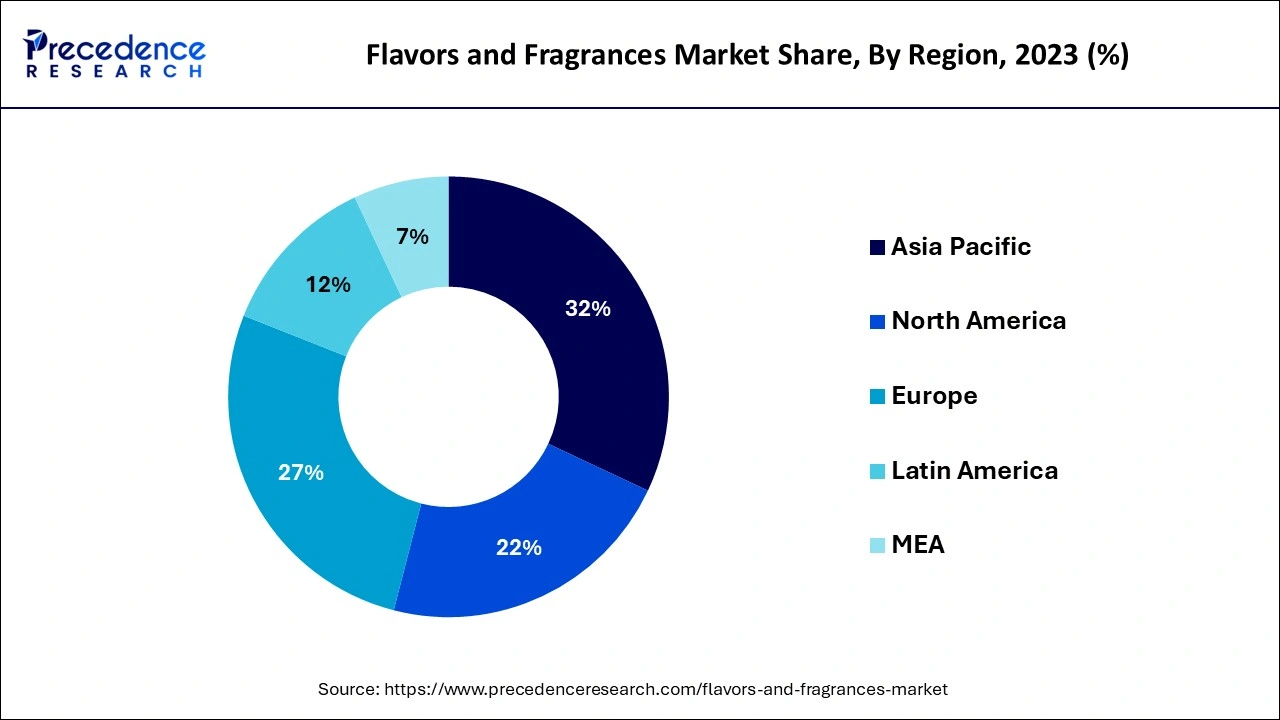

- Asia Pacific market was dominated by a 32% revenue share in 2025.

- By application, the fragrances segment has dominated revenue share of around 54% in 2025.

- The fabric care segment is expected to grow at a CAGR of 8.2% from 2026 to 2035

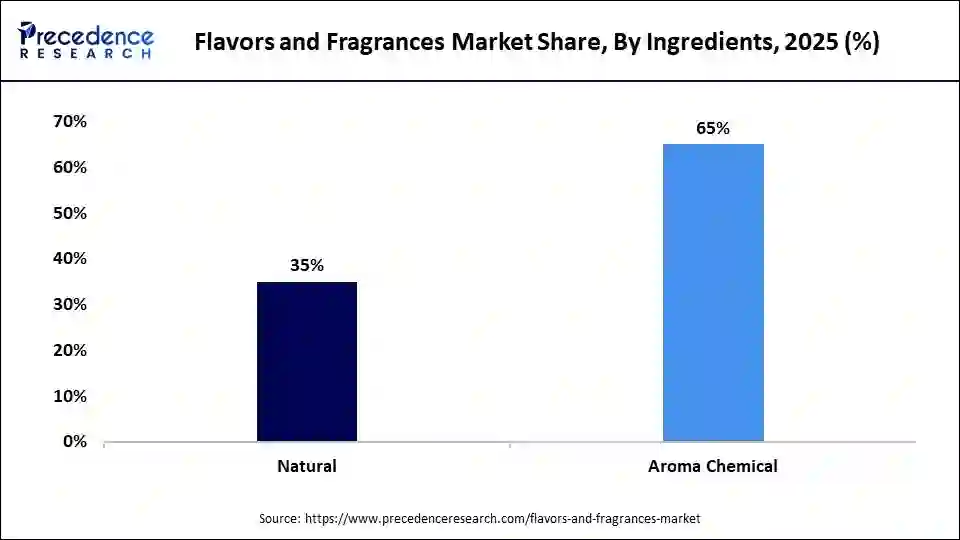

- By ingredients type, the aroma chemicals segment has accounted revenue share of over 65% in 2025.

- The natural segment is expected to reach around 5.6% from 2026 to 2035

Market Overview

The healthcare and pharmaceutical industries are increasingly using flavors and scents to give drugs that would normally taste & odor bitter a more pleasing flavor and aroma. These factors are fuelling the expansion of the flavors & fragrances industry. To promote customer perception, particularly among young children and infants, they are utilized in tablets, emulsions, syrups, ODT, and elixirs among many other products. For example, pharmaceutical goods including suspensions, antacid tablets, and purgative tablets frequently use peppermint as a flavoring ingredient. It mostly works as a topical therapy and has a cooling or reviving effect. Preference for organic or natural tastes and perfumes is rising as a result of customer recognition of environmental deterioration. For instance, Takasago International Company works with Largest River Citrus Producers, a major citrus processor in the United States, to make citrus oils and smells at the Citrus Centres in Florida.

Key market participants are taking advantage of the shift in consumer purchasing patterns from synthetic to natural scents and flavors to grow their markets and support sustainable development. Constantly new methods are being developed to improve the items' appeal and consumer acceptance. The first French company and a global leader, MANE, has been utilizing the extrusion technique. Both cost-effective and incredibly adaptable, this technology. These elements are anticipated to fuel market sales growth, and the current pattern is anticipated to last throughout the projected period.

Flavors and Fragrances Market Growth Factors

The increased demand and usage of packaged foods, personal-care products, including cosmetic items around the world are predicted to be the main drivers of the device's demand. Growing population expansion combined with rising expendable cash in emerging nations like China and India is anticipated to increase consumer demand for cosmetics and personal care items. Additionally, it is projected that the hectic lifestyle patterns maintained in both developed and emerging nations would increase the demand for processed foods & beverages, raising the need for flavors on the worldwide market.

Due to the high expense of processing natural perfumes and tastes and the scarcity of resources, industry players have created synthetic replacements that are less expensive. The benefits of these items include consistent supply, stable pricing, and cheaper production costs. It used to be common for dealers to enter into multi-year contracts with other dealers, but this sort of contract is no longer in vogue. While added as auxiliary raw ingredients to other items, flavors and scents are not directly consumed by people.

In addition to other end-user sectors, they are frequently employed in everyday chemicals, medicine, food, tobacco, feed, textiles, cosmetics, and leather. It may be minor, but it's important for product quality. Cultivating spices, rearing animals, producing petrochemicals, coal chemicals, and oil extraction are industries that are upstream of the taste and scent industry. Chemicals, tobacco, food and beverage, feed, as well as other industries, make up the majority of the downstream. This market's expansion is primarily attributable to the rising demand for ready meals, convenience foods, and foods promoting health and well-being worldwide. A rise in the demand for vehicle and room fresheners, and an increase in the popularity of aromatherapy, with growth within cosmetic and pharmaceutical sectors, are key drivers propelling the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 34.01 Billion |

| Market Size in 2026 | USD 35.81 Billion |

| Market Size by 2035 | USD 56.76 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.26% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

Ingredients,End-Use,Application, and Region |

| Regions Covered |

North America,Europe,Asia-Pacific,Latin America,Middle East & Africa |

Market Dynamics

Key Market Drivers

Consumer appetite for convenience foods is rising

Foods classified as convenience foods are those that have undergone commercial processing and need little to no additional preparation before eating. They consist of prepared food items, preserved meals, and packaged goods. Individual flavor components are added to certain food products to improve their flavor. Convenience food consumption has increased in both developing and developed nations' urban expansion and growth in the working-age population. Additionally, it is anticipated that rising middle-class discretionary income and rising convenience food spending will increase demand for convenient meals, which will then increase demand for tastes.

Growing innovation in the pharmaceutical and cosmetics sector will drive growth

Due to the emergence of new regions and scents, the market is anticipated to expand significantly throughout the forecast period. Additionally, it is projected that the acceptance of ready-to-eat foods and customers' evolving food tastes and preferences would boost regional market expansion. Additionally, the cosmetic and pharmaceutical industries' expansion is anticipated to fuel market expansion.

Key Market Challenges

Costs for raw ingredients and manufacture have increased when natural flavors and perfumes are made

A significant aspect affecting the growth of the flavors and perfumes economy's revenues is the increasing raw material costs as a result of climate change brought on by global climate change. For instance, Intercontinental Flavors & Perfumes Inc. declared on March 17, 2022, that it would undertake widespread price increases for flavors & fragrance solutions.

The main cause of the price increase is the ongoing and significant inflation of energy, raw material, and logistics as a consequence of the current political landscape. They continue to search for creative methods to provide clients value, such as taste innovations like intensifies and a large inventory of specialized ingredients. These elements have a major impact on the market's sales growth during the projection period.

Adherence to legal and regulatory requirements

The taste and fragrance sector are required by law to adhere to the rules and regulations set forth by numerous regulatory bodies. Each nation has its regulatory requirements, but they all aim to protect customers' safety. The rules established by many nations also place a strong emphasis on the use of flavors and perfumes as well as the accurate naming of consumer items. The introduction of new products may be slowed down or prevented by these strict rules, which may also raise costs and trigger product defects. As a result, adding new rules and modifications to those already in place has a detrimental impact on market expansion.

Key Market Opportunities

A digital transformation of the retail sector

Online foods and consumer goods purchasing, as well as the development of new apps that make it easier for customers to choose their chosen products, are some of the most recent trends pushing the tastes and scent sector. Due to its convenience and diversity, internet sales are preferred by customers. Nearly 25% of the population purchased food and groceries in 2018, according to Eurostat.

Commercial food shopping is becoming one of the venues for businesses to advertise and sell their goods as smartphone and internet use increases. Globally, the number of businesses taking payments online is growing. The general online grocery business is driven by factors like rising smartphone usage, specialized apps, and developing payment methods, which support the expansion of the tastes and fragrances market.

Segments Insights

Ingredients Insights

Chemical processes are used to create synthetic ingredients. It has differing qualities from its antecedents due to chemical modification. Chemicals are mixed in a complex way to create synthetic flavors. Due to their low cost and expanding use in a variety of end uses, including beverages, packaged foods, and home and personal care items, synthetic ingredients are now the most common. During the projection period, the industry for artificial chemicals will be driven by novel formulations by manufacturing businesses, innovations in flavoring components, and substantial demand for artificial flavors in numerous culinary & non-edible applications. Consumer desire for plant-based flavorings and fragrances, particularly in the food and beverage, medical, and cosmetics sectors, is helping natural ingredients and perfumes gather momentum, which is likely to boost this company's revenues.

The market for toiletries and household cleaners has been impacted by the movement toward organic ingredients. As a result of the need for "free-from" compositions or health food goods with openness, natural fragrances in laundry and dishwasher detergent, and cleaning solutions will see a rise in demand. This company's profit growth is also being driven by numerous technological advancements.

End-User Insights

The leading segment sector in the flavors and fragrances market is thought to be beverages as well as consumer goods. The bakery segment is anticipated to grow as a result of rising customer demands for aspirational purchases of international drinks and beverages and growing preference for dietary beverages due to the increasing proportion of well-being consumers. Due to the growth of structured large retailers, shifting lifestyles, and rising demand for a variety of consumer goods like personal grooming & homecare products, the consumer goods segment is predicted to expand.

Regional Insights

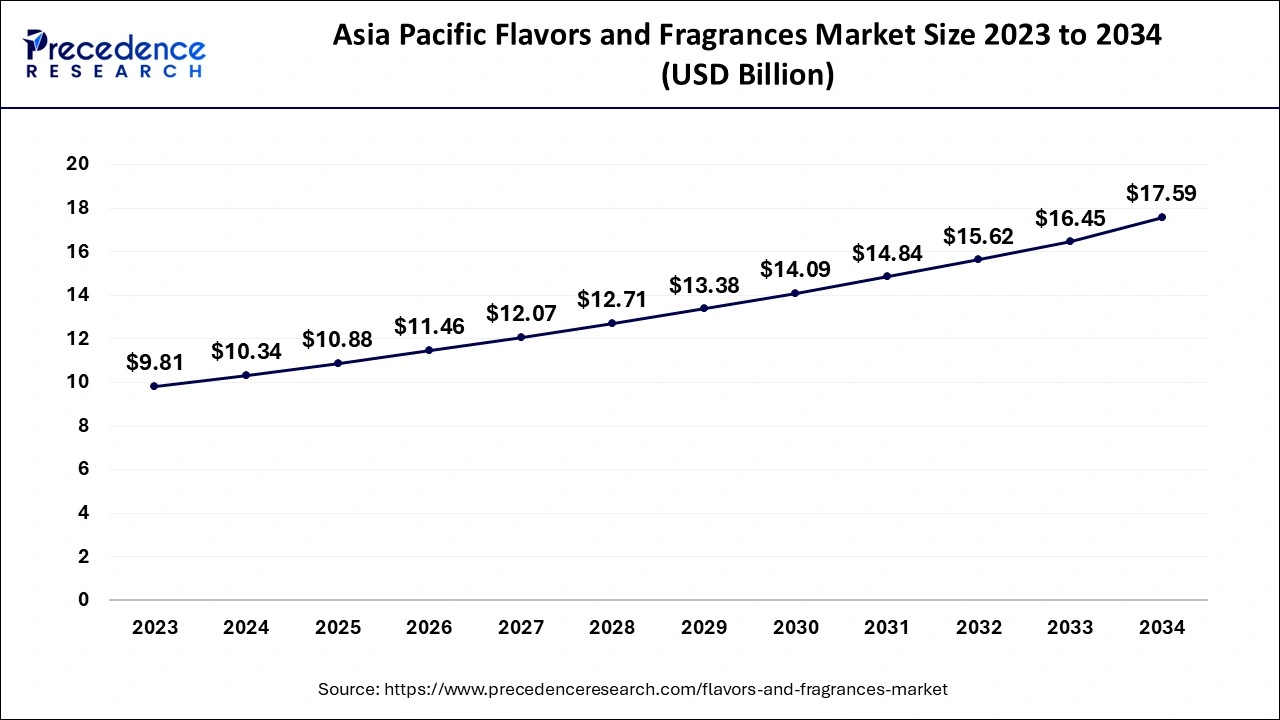

Asia Pacific Flavors and Fragrances Market Size and Growth 2026 to 2035

The Asia Pacific flavors and fragrances market size is anticipated at USD 10.88 billion in 2025 and is predicted to be worth around USD 18.52 billion by 2035, rising at a CAGR of 5.46% from 2026 to 2035.

APAC was expected to have the largest flavors and fragrances industry throughout the forecasted period in terms of value. In 2023, APAC was the largest market for flavors and fragrances. The market for flavors and perfumes in this region has been spurred by the changing lifestyles and rapid economic expansion of developing economies like India, China, Vietnam, and Indonesia. In particular, the region's tastes and perfumes market are expanding thanks to the quickly expanding food, drink, cosmetics, and home healthcare sectors.

During the projection period, Europe is anticipated to be the furthermore market for tastes and fragrances. In contrast to markets in developing nations, the tastes and perfume industry in Europe is developed. As a result, it is anticipated that during the forecast period, its growth will be somewhat slower than that of markets in other regions. Since a few decades ago, the use of flavors and perfumes has been widespread in European nations. Major sectors employ flavors and aromas to enhance the value of their products, including beverages,savory snacks & sweet snacks, bread, milk products, and basic goods. The biggest end-use markets for tastes and scents are, correspondingly, drinks and consumer goods.

Flavors and Fragrances Market Companies

- ADM (US)

- Agilex Fragrances (US)

- Akay Flavors & Aromatics Pvt. Ltd.

- Alpha Aromatics (Us)

- BASF SE (Germany)

- Bell Flavors & Fragrances (US)

- Biolandes (France)

- Comax MFG Corp (US)

- doTERRA International

- Elevance Renewable Sciences, Inc.

- Falcon Essential Oils

- Firmenich SA (Switzerland)

- Flavex Naturextrakte GmbH

- Givaudan (Switzerland)

- Indo World

- International Flavors & Fragrances Inc, (US)

- Mane (France)

- Manohar Botanical Extracts Pvt. Ltd.

- Ozone Naturals

- Robertet SA (France)

- Sensient Technologies Corporation (US)

- Symrise AG

- Synthite Industries Limited

- T.Hasegawa USA Inc. (Japan)

- Takasago International Corporation (Japan)

- Ungerer & Company (US)

- Universal Oleoresins

- Vigon International, Inc.

- Young Living Essential Oils (US)

Recent Developments

- Symrise made a legally binding bid to acquire the R. Romani Society branch d'Aromatiques as well as Neroli Capitalize DL in Mar 2022. Together businesses are headquartered in the French region of Grasse. With these deals, Symrise hopes to increase its fine perfume presence throughout southern France, boost its ability to compete in the creation of scent compositions, and grow its market share in important European, African, and Middle Eastern nations.

- Solvay released Eugenol Synth in January 2021 for perfume applications, with odor qualities resembling those of cloves.

- To better meet the specific demands of its customers and promote expansion in the Turkish, Middle Eastern, African, and Indian markets, IFF announced in October 2020 that they would be constructing an introduction to the new Taste Development Center in the United Arab Emirates. The application and development requirements of all significant categories, including savory, sweet, beverages, snacks, and dairy, will be met by this new lab.

- 2020 will mark the beginning of research cooperation between Givaudan and Novozymes in which the two companies will collaborate on the investigation and creation of novel, environmentally friendly cleaning, and food products.

- DuPont's Nutrition & Biosciences and Global Flavors and also Fragrances Inc. combined in 2020 to create high-value components and services for the food and beverage personal care, and health and wellness markets.

Segments Covered in the Report

By Ingredients

- Natural

- Essential Oils

- Orange Essential Oils

- Corn mint Essential Oils

- Eucalyptus Essential Oils

- Pepper Mint Essential Oils

- Lemon Essential Oils

- Citronella Essential Oils

- Patchouli Essential Oils

- Clove Essential Oils

- Ylang Ylang/Cananga Essential Oils

- Lavender Essential Oils

- Oleoresins

- Paprika Oleoresins

- Black Pepper Oleoresins

- Turmeric Oleoresins

- Ginger Oleoresins

- Others

- Essential Oils

- Aroma Chemical

- Esters

- Alcohol

- Aldehydes

- Phenol

- Terpenes

- Others

By End-Use

- Flavors

- Beverages

- Baby Drink

- Savory & Snacks

- Dairy Products

- Bakery

- Confectionary

- Others

- Fragrances

- Fine Fragrances

- Soaps & Detergents

- Cosmetics & Toiletries

- Aromatherapy

- Others

By Application

- Food & Beverages

- Homecare

- Pharmaceuticals & Healthcare

- Beauty & Personal Care

- Fabric Care

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting