What is the Aroma Chemical Compounds Market Size?

The aroma chemical compounds market involves the production of scent ingredients used in perfumes, cosmetics, and flavors, driven by demand for unique and natural aromas. The market growth is attributed to the rising demand for sustainable, natural aroma compounds across personal care, food, and household applications.

Aroma Chemical Compounds Market Key Takeaways

- North America dominated the aroma chemical compounds market in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecast period.

- By type, the benzeoniods segment held the biggest market share in 2024.

- By source, the synthetic segment accounted for a considerable market share in 2024.

- By source, the natural segment is expected to grow at the highest CAGR in the coming years.

- By application, the personal care and cosmetics segment captured largest market share in 2024.

- By application, the food and beverages segment is projected to expand rapidly between 2025 and 2034.

Artificial Intelligence: The Next Growth Catalyst in Aroma Chemical Compounds

Artificial Intelligence (AI) accelerate both aroma chemical compound research and their creation to rapid commercialization. AI helps in identifying new compounds. AI-driven tools help study chemical compositions, enabling researchers and manufacturers develop new formulations. AI technology enables manufacturers to discover optimal formulations more rapidly with improved accuracy. Moreover, AI can optimize production processes by automating tasks like material scheduling, handling, and quality control.

Strategic Overview of the Global Aroma Chemical Compounds Industry

The aroma chemical compounds market is witnessing rapid growth due to the rising demand for fragrances. Consumers are increasingly seeking ingredients that are natural and sustainable. There is a high demand for environmentally friendly, plant-based products, which compels manufacturers to develop aroma compounds that are derived from natural sources. The European Chemicals Agency (ECHA), together with the U.S. Environmental Protection Agency (EPA), released new guidance about safe chemicals in 2024. This prioritized bio-based aroma compounds for reducing dangerous waste products. Furthermore, the regulatory approvals for bio-based compounds create conditions that lead to wider acceptance in various industries, further propelling the growth of the market.

Aroma Chemical Compounds Market Growth Factors

- Growing Urbanization: Expanding urban consumer bases are projected to drive demand for scented personal care and lifestyle products.

- High Smartphone Penetration: Increasing digital engagement is expected to boost awareness, and so is the demand for premium aroma-based products through e-commerce.

- Increasing Third-Party Manufacturing: Rising contract manufacturing in the cosmetics and food sectors is anticipated to create new growth avenues for aroma compound suppliers.

- Surging Clean-Label Preferences: The global push for clean-label formulations is likely to accelerate the adoption of naturally derived aroma chemicals.

- High Investment in R&D: Ongoing investment in green chemistry research is expected to foster the development of eco-friendly aroma compounds.

- Rising Need for Specialty Ingredients: The growing need for functional and specialty scent ingredients is projected to support diversified aroma compound production.

- Rising Focus on Sensory Branding: Increasing use of scent in brand differentiation strategies is anticipated to drive innovation in complex fragrance formulations.

Market Outlook

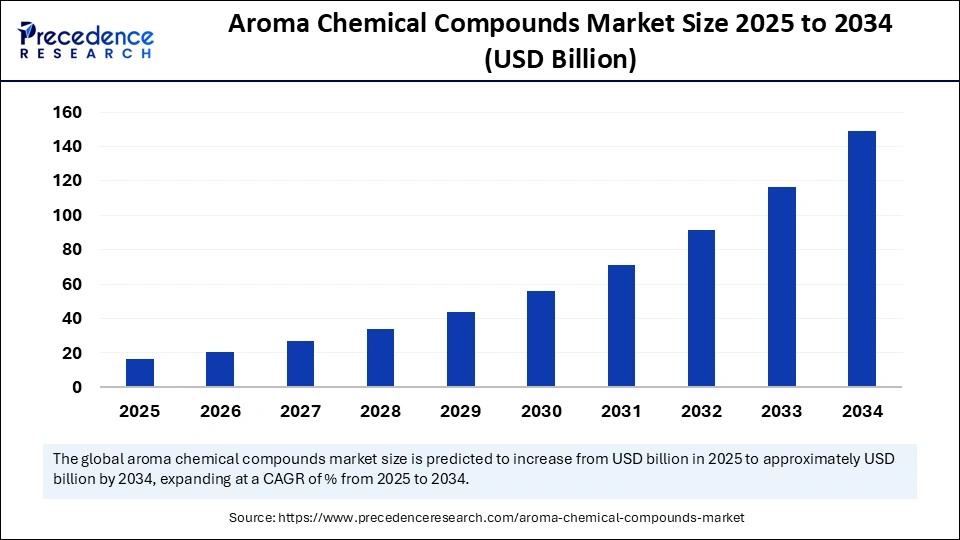

- Market Growth Overview: The Aroma Chemical Compounds market is expected to grow significantly between 2025 and 2034, driven by consumer preference for natural & sustainable products, rising disposable income, and innovations in production methods, such as biotechnology and green chemistry, enabling the creation of high-purity, nature-identical compounds with greater consistency and sustainability.

- Sustainability Trends: Sustainability trends involve a shift to bio-based and natural ingredients, advancement in green chemistry, and west minimization and circular production.

- Major Investors: Major investors in the market include Givaudan SA., International Flavors & Fragrances, Symrise AG, BASF SE, and DSM-Firmenich.

- Startup Economy: The startup economy is focused on biotechnology and green chemistry, niche product development, and venture capital investment

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Source, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for Natural and Sustainable Ingredients

Increasing consumer preference for eco-friendly and plant-based products is a key factor driving the growth of the aroma chemical compounds market. The rising popularity of natural fragrances further supports market growth. The U.S. Food and Drug Administration (FDA) issued a new cosmetic labeling doctrine in 2024, which compels manufacturers to reveal fragrant ingredients and use safe and natural raw elements. The development of sustainable ingredients substitutes synthetic resources relies on both biotechnological methods and green chemical science. The industry is transitioning to sustainability by creating effective aromatic compounds that meet product requirements. The World Health Organization (WHO) underlined product chemical exposure reduction in 2024, as synthetic substances might cause allergic reactions and respiratory issues in consumers. Moreover, the rising health consciousness among consumers is driving the demand for natural aroma chemical solutions, boosting the growth of the market.

Restraint

Health Risks Associated with Synthetic Aroma Chemicals

Increasing scrutiny surrounding the health and safety of synthetic aroma chemicals is projected to hinder the growth of the aroma chemical compounds market. Scientists discovered that phthalates and synthetic musks cause allergic reactions to the body. Regulatory authorities, including the U.S. Environmental Protection Agency (EPA) and European Chemicals Agency (ECHA), conducted a stricter assessment of widespread synthetic materials in 2024 to address potential health and environmental risks. Furthermore, the need for complete disclosure and non-chemical products affects both product formulation strategies and long-term development, thus hindering the market.

Opportunity

Increasing Investments in Green Chemistry and Biotechnological Advancements

Increasing investments in green chemistry and a strong emphasis on biotech-driven synthesis techniques are likely to create immense opportunities for key players operating in the aroma chemical compounds market. Green chemistry promotes the development of bio-based aroma chemical compounds derived from plants and microorganisms. CRISPR and microbial fermentation technologies enable industry players to produce unique aroma compounds. These manufacturing methods lower waste production while reducing dependence on natural materials. Furthermore, in 2024, the National Institutes of Health (NIH) declared that synthetic biology approaches, which include enzyme optimization and cell-free biosynthesis, enhance the production of safer and cleaner ingredients.

Type Insights

The benzenoids segment dominated the aroma chemical compounds market in 2024. This is mainly due to their extensive use in perfumes, personal care products, and flavor formulations. These chemical compounds provide high stability with strong aromatic properties, so manufacturers use them in various mixture formulations. Moreover, synthetic benzenoids are in high demand, as they serve the worldwide need for inexpensive, lasting scents without using precious plant species.

Source Insights

The synthetic segment held the largest share of the aroma chemical compounds market in 2024. This is mainly due to the cost-effectiveness, high availability, and versatility of synthetic aroma chemical compounds. Synthetic compounds provide diverse aromatic ranges, making them suitable for various cosmetic applications. Additionally, they provide long-lasting aromas with extended shelf life, making them suitable for large-scale production of fragrances.

The natural segment is projected to expand at the fastest rate in the coming years. The growth of the segment can be attributed to the rising consumer preferences for plant-based, sustainable products. People are becoming more aware of the environmental impact and health implications linked to synthetic chemicals. This, in turn, boosts the demand for natural aroma chemical compounds. Consumers in North America and Europe increasingly prioritize natural ingredients. The rising demand for natural fragrances is likely to contribute to segmental growth.

Application Insights

The personal care & cosmetics segment led the aroma chemical compounds market with the largest share in 2024. This is mainly due to the increased consumer demand for scented skincare, haircare, and grooming products. Leading cosmetic brands developed new fragrance collections and aromatherapeutic solutions to satisfy customer desires. Additionally, with the expansion of middle-class populations across emerging economies, spending on personal care has increased, boosting the demand for premium, long-lasting fragrances.

The food & beverages segment is expected to grow at a rapid pace during the forecast period. The growth of the segment can be attributed to the increasing demand for food flavors. Food & beverage manufacturers employ aroma chemicals to enhance taste, sensory appeal, and overall quality. Aroma compounds are used as a preservative to improve shelf life and quality of food items. The rising demand for packaged food products is expected to drive the growth of the segment in the coming years.

The U.S. Food and Drug Administration (FDA) maintained its regulatory stance regarding flavoring agent safety in 2024. It enabled revolutionary advancements in aroma-based solutions for food.

Regional Insights

North America registered dominance in the aroma chemical compounds market by capturing the largest share in 2024. The region's dominance is mainly attributed to the heightened consumer demand for natural ingredients. There is also a high demand for fragrances in various industries, such as food & beverages and personal care & cosmetics. The U.S. is a major contributor to the market in North America. There is an increasing demand for plant-based personal care ingredients, including aroma compounds. Fragrances and cosmetic manufacturers are prioritizing natural ingredients to fulfill consumers' demands.

Asia Pacific is anticipated to witness the fastest growth in the market during the forecast period, owing to the increasing adoption of scented personal care products and household goods. The preference for packaged food items is rising in countries like China, India, and Japan, driving the demand for aromatic food ingredients. Governments around the region are also promoting the use of natural ingredients, contributing to market growth. For instance, China's National Mission on Bioeconomy and Five-Year Plans for Green Development focuses on sustainable chemical manufacturing, leading to the rapid development of natural aroma chemical compounds. With the increasing consumer disposable income, spending on high-quality products with fragrances is rising, supporting market expansion.

Europe is expected to witness notable growth in the coming years. The growth of the European aroma chemical compounds market can be attributed to the rising demand for fragrances and the increasing adoption of premium aromatic items. The region is home to some leading market players, including Givaudan, Firmenich, and Symrise, facilitating high production capabilities and innovation in aroma compounds. With a strong emphasis on sustainable practices, there is a high demand for natural fragrances and skincare products, boosting the need for natural aroma compounds. In addition, the rising demand for high-quality fragrances contributes to regional market growth.

U.S. Aroma Chemical Compounds Trends

The U.S. shift towards natural and sustainable ingredients, dominance of fine fragrances and personal care, and technological innovation in production. The use of AI-assisted design is emerging as a trend to shorten development cycles and predict consumer preferences, helping perfumers and flavorists create customized and appealing scent profiles more efficiently.

China Aroma Chemical Compounds Market Trends

The Chinese aroma chemical compounds market is driven by a strong domestic infrastructure. Rising disposable incomes, rapid urbanization, and powerful e-commerce influence are fueling demand for premium personal care products and fine fragrances. Growing consumer preference for natural, clean-label ingredients, pushing R&D into biotechnology and green chemistry.

Germany Aroma Chemical Compounds Market Trends

Germany's aroma chemical compounds market is driven by a strong consumer demand for sustainable, natural, and premium ingredients across cosmetics, personal care, and food and beverage sectors. Leading German companies like BASF and Symrise are investing in green chemistry, biotechnology, and advanced production methods to meet these demands and comply with strict European regulations like REACH.

Aroma Chemical Compounds Market-Value Chain Analysis

- Raw Material Sourcing (Natural and Petrochemical)

This foundational stage involves sourcing basic chemicals and materials from natural sources (plants, fruits, essential oils) or petrochemical derivatives (terpenes, benzenes) to produce aroma compounds.

Key Players: BASF SE, Eastman Chemical Company, Symrise AG, International Flavors & Fragrances (IFF), various essential oil producers. - Manufacturing and Synthesis (Chemical & Biotech)

This stage involves the synthesis and processing of raw materials into specific aroma chemicals using various chemical processes, green chemistry, and increasingly, biotechnology (fermentation).

Key Players: Symrise AG, BASF SE, IFF, Givaudan, Firmenich (now part of DSM-Firmenich), Kao Corporation. - Compounding and Blending (Flavor & Fragrance Houses)

In this pivotal stage, perfumers and flavorists carefully blend and compound individual aroma chemicals into complex, proprietary fragrance and flavor formulations that meet specific client and consumer preferences.

Key Players: Givaudan, IFF, Symrise AG, Firmenich (DSM-Firmenich), Robertet Group, Mane Group. - Intermediate Product Production (Inks, Coatings, etc.)

The compounded fragrances or flavors are then integrated into intermediate products like specialized inks, coatings, plastics, or detergents, often using innovative delivery systems such as microencapsulation for controlled release.

Key Players: Manufacturers of specialty inks, coatings, and encapsulation technologies. - End-Product Manufacturing and Integration

This involves integrating the fragranced or flavored intermediate products into the final consumer and industrial goods, such as fine fragrances, personal care items, household cleaners, or food and beverages.

Key Players: Procter & Gamble, Unilever, L'Oréal, Coca-Cola, Nestlé, Estée Lauder Companies.

Top Companies in the Aroma Chemical Compounds Market & their Offerings:

- Agilex Flavors and Fragrances Inc. (now part of the Agilex Fragrances division of Firmenich, which is part of DSM-Firmenich): Agilex specializes in creating innovative and cost-effective fragrances tailored for specific consumer product applications, from personal care to household items.

- BASF SE: As a global chemical giant, BASF is a key producer of a wide range of synthetic aroma chemicals, including essential building blocks like citral, geraniol, and linalool, for the flavor and fragrance industry.

- Fermenich International SA (now part of DSM-Firmenich): Firmenich is a leading flavor and fragrance house that designs unique scent and taste experiences using a vast palette of aroma chemicals.

- Frutarom Industries Ltd. (now part of IFF - International Flavors and Fragrances): Frutarom specialized in the development and production of flavor and fine ingredient solutions, incorporating various aroma chemicals into their formulations.

- Givaudan SA: A global leader in flavors and fragrances, Givaudan is instrumental in the aroma chemicals market through its extensive R&D, creation, and supply of novel ingredients and compounds. They leverage advanced technologies and a deep understanding of consumer preferences to create proprietary and innovative scent profiles for top brands worldwide.

- Hindustan Mint & Agro Products Pvt. Ltd.: This company is a major producer and exporter of natural essential oils, menthol, and mint derivatives from India, serving as a key raw material supplier to the global aroma chemical market.

- International Flavors and Fragrances Inc. (IFF): IFF is a dominant global player that creates a wide array of fragrance and flavor solutions, sourcing and synthesizing numerous aroma chemicals to meet consumer demand for diverse product experiences. They heavily invest in R&D and acquisitions to maintain a leadership position in innovation and sustainable ingredient sourcing.

- Mane SA: Mane is a global flavor and fragrance company that provides creative solutions using a wide range of natural and synthetic aroma chemicals for food, beverage, and perfume markets. They focus on sensory innovation and natural extracts, ensuring the development of unique and high-quality scent and taste profiles for their clients.

- Symrise AG: Symrise is a major integrated supplier of flavors and fragrances, leveraging a strong focus on sustainability, R&D, and backward integration into raw material sourcing to ensure a consistent and high-quality supply of aroma chemicals.

Aroma Chemical Compounds Market Companies

- Agilex Flavors and Fragrances Inc.

- BASF SE

- Fermenich International SA

- Frutarom Industries Ltd.

- Givaudan SA

- Hindustan Mint & Agro Products Pvt. Ltd.

- International Flavors and Fragrances Inc.

- Mane SA

- Symrise AG

Latest Announcement by Industry Leader

- In April 2025, BASF Aroma Ingredients introduced L-Menthol FCC rPCF as its first aroma ingredient featuring a reduced Product Carbon Footprint (rPCF). This launch marks a pivotal step in supporting customers striving to meet their Scope 3 carbon reduction targets. BASF's rPCF aroma ingredients deliver a 10–15% reduction in product carbon footprint compared to the company's conventional offerings. The footprints are calculated following the standards set by the 'Together for Sustainability' (TfS) initiative, with TÜV Rheinland certifying the compliance of BASF's methodology. “The market introduction of L-Menthol FCC rPCF signifies a major achievement in advancing our sustainability goals,” stated Steffen Götz, Vice President of Aroma Ingredients at BASF. He further emphasized that expanding the rPCF product range positions BASF as the first aroma ingredient manufacturer to empower customers in actively reducing CO? emissions beyond their operational boundaries.

Recent Developments

- In March 2025, Isobionics, a biotechnology brand under BASF Aroma Ingredients, announced the launch of two new natural flavor ingredients: Isobionics Natural beta-Sinensal 20 and Isobionics Natural alpha-Humulene 90. These compounds are produced through an advanced fermentation-based process, offering a sustainable alternative to conventional extraction methods. The official unveiling took place at the FlavourTalk Raw Materials Exhibition 2025, held on March 26–27 at the Millennium Gloucester Hotel Conference Centre in London, UK, marking a significant milestone in the evolution of biotechnology-driven aroma solutions.

- In August 2024, Wanhua Chemical launched the world's largest citral production facility, marking a significant breakthrough in the company's independent research and development capabilities. Often referred to as the "crown jewel" of fine chemicals, citral is known for its complex production process and high technical standards. Serving as a vital intermediate in the manufacture of aroma compounds and nutritional products, citral plays a pivotal role in the fragrance raw materials market. Wanhua Chemical's citral is distinguished by its high purity, outstanding environmental sustainability, and dependable supply chain. This achievement sets a new industry benchmark, reinforcing Wanhua's commitment to advancing stable, responsible, and sustainable growth in the global aroma sector.

- In May 2024, LANXESS made its debut at SIMPPAR, the international exhibition of raw materials for perfumery, held in Grasse, France, on May 28–29. The specialty chemicals company showcased its high-purity, nature-identical aroma chemicals, including newly developed grades of Kalama benzyl benzoate and innovative aroma ingredients currently under development. The portfolio on display featured a diverse range of olfactory profiles—floral, spicy, citrus, woody, and earthy notes. Visitors at Stand No. G7 had the opportunity to explore and sample selected aroma compounds, highlighting LANXESS's commitment to innovation in the fragrance industry.

Segments Covered in the Report

By Type

- Benzenoids

- Musk Chemicals

- Terpenes

- Others

By Source

- Natural

- Synthetic

By Application

- Food & Beverages- Fastest

- Household Care Products

- Personal Care & Cosmetics- Dominated

- Pharmaceuticals

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting