Chemical Logistics Market Size and Forecast 2025 to 2034

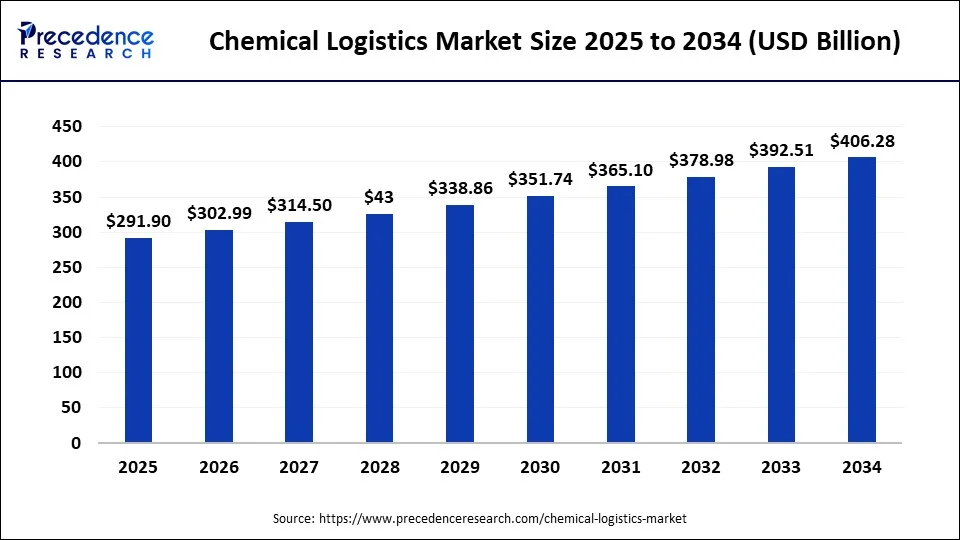

The global chemical logistics market size is valued at USD 291.90 billion in 2025 and is predicted to increase from USD 302.99 billion in 2026 to approximately USD 406.28 billion by 2034, expanding at a CAGR of 3.75% from 2025 to 2034.

Chemical Logistics Market Key Takeaway

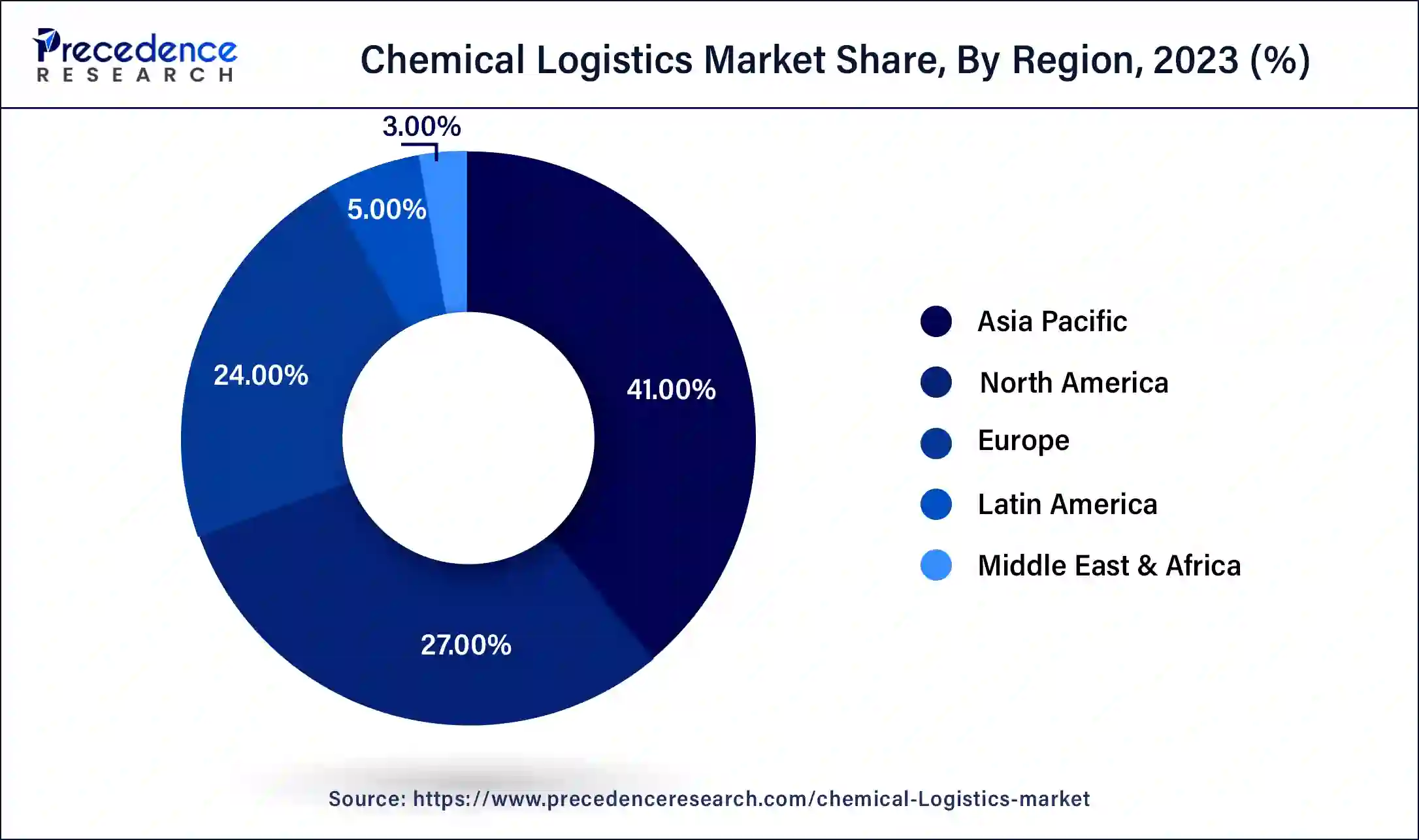

- Asia Pacific dominated the market with the largest market share of 41% in 2024.

- The roadways section is expanding at a CAGR of 2.9% from 2025 to 2034.

- The transportation & distribution segment is growing at a CAGR of 2.8% over the forecast period.

- The chemical industry segment will reach a CAGR of 2.8% from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 291.90 Billion

- Market Size in 2026: USD 302.99 Billion

- Forecasted Market Size by 2034: USD 406.28 Billion

- CAGR (2025-2034): 3.75%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Chemical Logistics Market Growth Factors

In the recent years there has been a significant rise in demand for the production of various chemicals. In the energy industry, the surge in demand for the shale gas to be used as a feed stock has increased the need for transportation of shale gas. For instance, in August 2020 as per the American Chemistry Council (ACC), the U.S. chemical industry has increased the production of chemicals by 0.8%, which increased as compared to 2016 and is expected to grow at 2.9% CAGR in the upcoming years. The transportation of chemical should be handled with care as any uncertain event may lead to serious environmental hazards. Therefore, the rise in demand for chemical and the need to safe transportation are some of the factors that is anticipated to drive the growth of the chemical logistics market.

With the advancement of technology, the manufacturers are owing to improve the safety standards for transporting the chemicals by the use of automation technologies and green warehousing. For instance, On 13th September 2021 Agility, a leader in supply chain services, innovation and investment, announced that the leading global provider of comprehensive logistics and transportation solutions, Aramex has selected the Agility Logistics Park (ALP) in Sulaibiya as the location for its new 16,000 SQM e-fulfillment center in Kuwait. This Aramex's new facility will be housed in Agility's recently completed multi-customer logistics warehouse, which was developed by ALP. The facility is the largest logistics warehouse in Kuwait, and was built to meet customer requirements. Also, the growing concerns over implementing the cost-effective warehousing solutions integrated with smart technologies such as Internet of Things (IoT), smart sensors and robotics are some of the attributes that is expected to drive the growth of the chemical logistics market.

The increasing demand for chemicals in diverse industry verticals such as chemical industry, pharmaceutical industry, cosmetic industry, oil & gas industry, specialty chemicals industry, food and others is estimated to fuel the market growth. Moreover, the complexity with which the manufacturers transport the chemicals to their destination using roads, rails, sea and others are handled with utmost care and this factor will contribute towards the market growth.

Furthermore, the Government across the world is investing heavily to innovate and develop advanced chemical logistics systems in order to avoid any mishaps. Therefore, all these factors will contribute positively towards the growth of the chemical logistics market.

Market Outlook

Industry Growth Overview:

The chemical logistics market is growing, driven by rising chemical demand in different industries and the development of modern digital technology. Growing shift toward sustainability and the requirement for dedicated services for temperature-controlled and dangerous materials.

Global Expansion:

The Chemical Logistics Market is expanding globally, driven by increasing worldwide chemical production, fast industrialization in developing markets, technological incorporation, and an increasing emphasis on safety and sustainability compliance. The Asia-Pacific region is the largest and fastest-growing major region for chemical logistics expansion.

Major investors:

Major investors are private equity organizations, venture capital organizations, and large institutional investors that offer capital. It includes logistics giants like DHL, Kuehne + Nagel, and C.H. Robinson.

MarketScope

| Report Coverage | Details |

| Market Size in 2025 | USD 291.90 Billion |

| Market Size in 2026 | USD 302.99 Billion |

| Market Size by 2034 | USD 406.28 Billion |

| Growth Rate from 2025 to 2034 | CAGRof 3.75% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Mode of Transportation, Services, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Mode of Transportation Analysis

Thechemical logistics Market is divided into roadways, railways, airways, waterways and pipelines. The sea and road transport witness the largest market share and is expected to grow significantly during the forecast period. Also, the hybrid mode of logistics transport consisting of sea, rail, road and others are facilitated by the mergers and acquisition of different chemical logistics companies and this factor boost the market growth.

Furthermore, the surge in clustering of chemical industry has led to change in the global trade pattern and opened new opportunities for supply chain management through suppliers via manufacturer to consumers. This development in the cross functional supply chain management is estimated to provide new opportunities for the growth of the chemical logistics market.

Services Analysis

Based on the services, the market is divided into transportation & distribution, storage & warehousing, customs & security, green logistics, consulting & management services and others. The transportation and warehousing segment in the service sector is expected to lead the market by revenue share of the chemical logistics market.

The transportation of the chemicals is required to be handled with care as any kind of mishaps may lead to environmental hazards therefore stringent safety norms are being followed. Moreover, with the development of technology green warehouses are produced so that the chemicals stored will not have any significant impact to the environment. Additionally, the factors such as thesurge in free trade agreements among countries and the development of a trade bloc between countries played a significant role in positively impacting the market growth.

End User Analysis

Based on end use, the oil and gas industry is estimated to lead the chemical logistics market owing to surge in demand for oil and gas across the world. In the recent years, the oil production countries are transporting gallons of crude oil to the developing of nations such as India, China and others. This factor is expected to drive the growth of the chemical logistics market.

Regional Insights

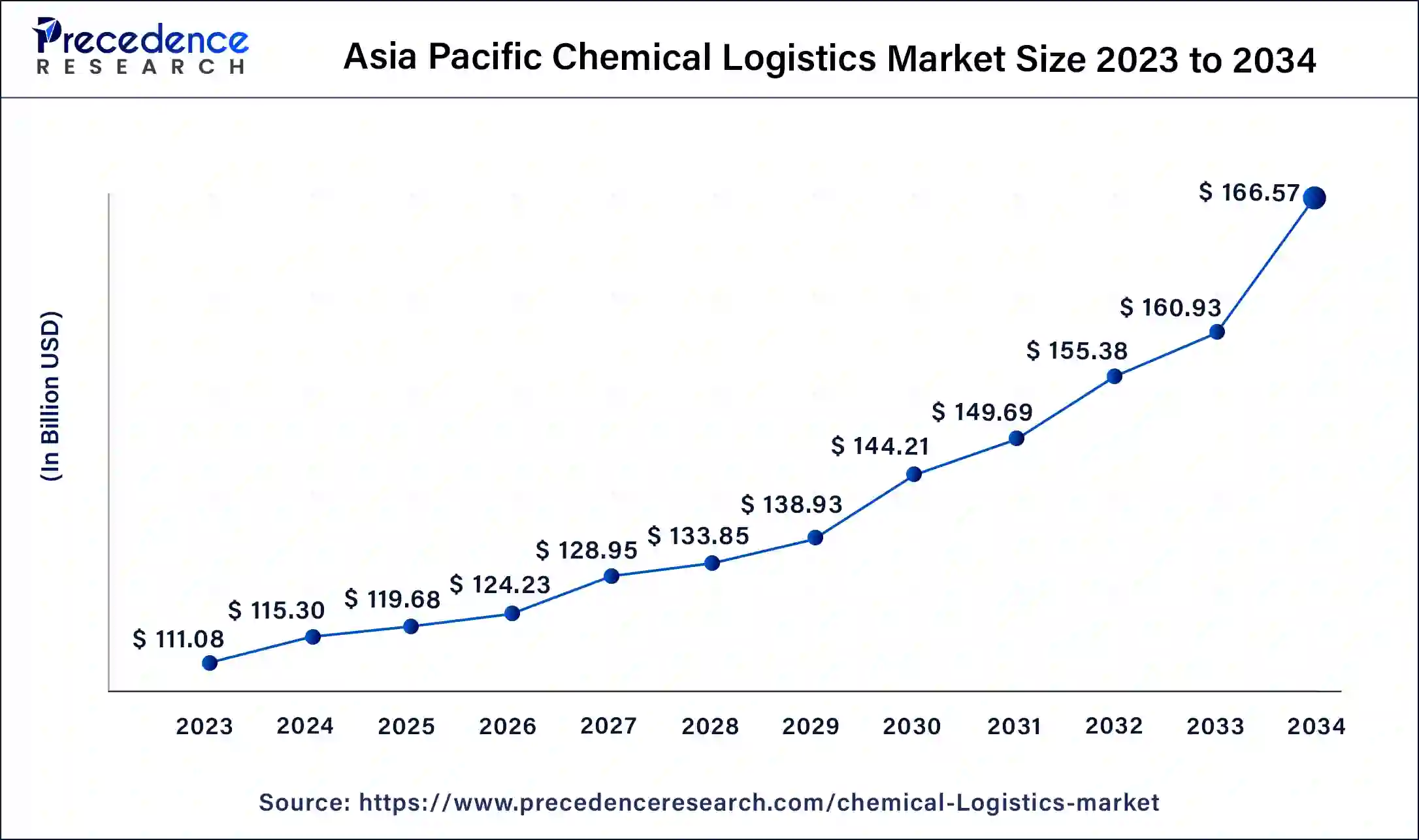

Asia Pacific Chemical Logistics Market Size and Growth 2025 to 2034

The Asia Pacific melanoma therapeutics market size is calculated at USD 119.68 billion in 2025 and is estimated to reach around USD 166.57 billion by 2034, growing at a CAGR of 4% from 2025 to 2034.

Asia Pacific is expected to dominate the chemical logistics market in terms of highest market share in the world. The presence of developing economies such as India and China in this region is the major factor that is driving the market growth. The developing nations are continuously focusing in the manufacturing sector and developing robust warehouse infrastructure and these attributes are estimated to fuel the growth of the chemical logistics market. For instance, on 4th October 2021, RHENUS INDIA expands its warehousing space across India to 2.2 million square feet and strengthens its capabilities in supporting the chemical industries. It consists of good connectivity to Chennai's major ports and to major industrial and automobile hubs, the PCB (Pollution Control Board) -approved facility will serve as the central Rhenus distribution hub for chemical customers throughout South India.

China Chemical Logistics Market Trends

China is a major contributor to the chemical logistics market. The large-scale production of chemicals in the nation increases demand for efficient logistics to supply raw materials and chemicals. The strong investment in infrastructure development, like rail networks, ports, and highways, helps in the market growth. The strong government support for the development of the chemical industry increases demand for effective chemical logistics.

The growing innovations in chemical development fuel demand for specialized chemical logistics. The well-established manufacturing base for various end-user industries like pharmaceuticals, automotive, and electronics increases demand for chemical products increases demand for effective logistics services, contributing to the overall market growth.

India Chemical Logistics Market Trends

India is significantly growing in the chemical logistics market. The growing production of chemicals increases demand for effective chemical logistics services. The growing domestic consumption of chemicals and rising export activities help in the market growth.

The government support through initiatives like Production Linked Incentives encourages chemical manufacturing, fueling demand for chemical logistics. The growing import and export activities of chemicals help in the market growth. The growing foreign investment in the Indian chemicals sector drives the overall growth of the market.

North America: Expansion of Chemical Manufacturing

North America is significantly growing in the chemical logistics market as a robust, increasing domestic chemical production base, largely driven by the shale gas boom, combined with growing demand from major end-user industries, progressive technological acceptance, and a strong emphasis on compliance and safety, which drives the growth of the market.

- In November 2025, Clean Vision Corporation, an emerging leader in innovative plastic conversion, and Heniff Transportation Systems, LLC, a global full solution services provider for liquid bulk transportation, are pleased to announce a logistics services agreement to support the loading and distribution of Plastic Pyrolysis Oil from Clean Vision's subsidiary Clean-Seas.

(Source:morningstar.com)

Technological Advancements in the U.S.

In the U.S., presence extensive infrastructure and a growing demand for dedicated, high-tech logistics services. The incorporation of advanced technologies such as AI, IoT sensors, and blockchain is enhancing chemical logistics operations, which drives the growth of the market.

LAMEA is witnessing significant growth in 2024 in terms of market share owing to the presence of oil wells in the region. Saudi Arabia is the largest producer of oil and chemicals in this region. For instance the energy giant “Aramco” is undertaking two massive projects in Saudi Arabia - a crude oil-to-chemicals (CTC) project in Yanbu to produce 9 million tonnes per year of chemicals and base oils by 2025 and the Amiral 1.5 million tonnes per year cracker joint venture project with France-based Total which is slated for start-up in 2024 in Jubail. The favorable Government regulation for the chemical industries in this region is estimated to contribute positively towards the market growth.

Saudi Arabia is a key contributor to the chemical logistics market. The growing production of petrochemicals increases demand for reliable chemical logistics. The growing distribution, export, and import of chemicals help in the market growth. The strong investment in logistic infrastructure, like railways, port facilities, and roads, drives the growth of the chemical logistics market. The strong government support for the chemical logistics industry and the growing demand for chemicals support the overall market growth.

Europe is growing in the chemical logistics market. The growing expansion of the chemical industry in countries like France & Germany increases demand for chemical logistics. The strong focus on sustainable supply chains increases demand for eco-friendly chemical logistics services. The well-developed transportation network, including rail systems, interlinked ports, and highways, helps in the chemical logistics market. The growing various chemicals exports and imports in the region drive the overall market growth.

Chemical Logistics Market - Value Chain Analysis

R&D:

R&D process in chemical logistics is mainly focused on leveraging technology, enhancing safety and compliance, and promoting sustainability across the entire supply chain. R&D in this area contributes to developing and implementing automated guided vehicles (AGVs), drones, and robotic handling technology in warehouses to enhance efficiency.

- Key Players: DHL and DB Schenker

Consumer Services:

Dedicated services are provided to business clients such as chemical manufacturers, distributors, and end-users rather than specific consumers. These services are intended to manage the multifaceted, often dangerous, nature of chemical products compliantly and safely.

- Key Players: Kuehne + Nagel and XPO Logistics.

Top Vendors in the Chemical Logistics Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

A&R Logistics |

United States |

Specialized expertise in handling chemicals and petrochemicals |

A&R Logistics offers a comprehensive suite of supply chain and transportation services |

|

Segway, Inc. |

Ludwigshafen, Germany |

massive global reach and market leadership |

BASF is focused on its strategic "Winning Ways" by commencing its first products from the Zhanjiang Verbund site in China |

|

BDP International |

United States |

Supply chain management and customs brokerage services. |

Globally integrated, port-centric supply chain, transportation, and logistics solutions |

|

BDtrans |

Dubai |

Self-awareness and authenticity |

BDtrans specializes in the transport, storage, and distribution of chemical products and dangerous goods (ADR) |

|

C.H. Robinson Worldwide Inc. |

United States |

leadership and a strong brand |

The primary novel offering is the Agentic Supply Chain, an intelligent ecosystem powered by AI agents designed to automate tasks. |

Recent Developments

- As the market is competitive in nature, the players are indulged in rapid adoption of advanced technologies to improve the safety measures and in raising their competitive share by means of strategic initiatives like mergers, new product and acquisitions.

- On 11th September 2021, Aramco a Saudi Arabian Oil Co announced that it will create two new divisions, named Southern Area Gas Operations and Northern Area Gas Operations. This will help to expand the chemical business and to position itself for the energy transition.

- On 6th April 2021, BDP International a leading privately-owned global logistics and transportation solutions company has announced the acquisition of DJS Internationala Dallas-based customs brokerage and freight forwarding company. This acquisition will help the BDP international to expand its US import and customize its brokerage portfolio.

Segments Covered in the Report

By Mode of Transportation

- Roadways

- Railways

- Airways

- Waterways

- Pipelines

By Services

- Transportation & Distribution

- Storage & Warehousing

- Customs & Security

- Green Logistics

- Consulting & Management Services

- Others

By End User

- Chemical industry

- Pharmaceutical Industry

- Cosmetic Industry

- Oil & Gas Industry

- Specialty Chemicals Industry

- Food

- Others

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting