What is the Chemical Distribution Market Size?

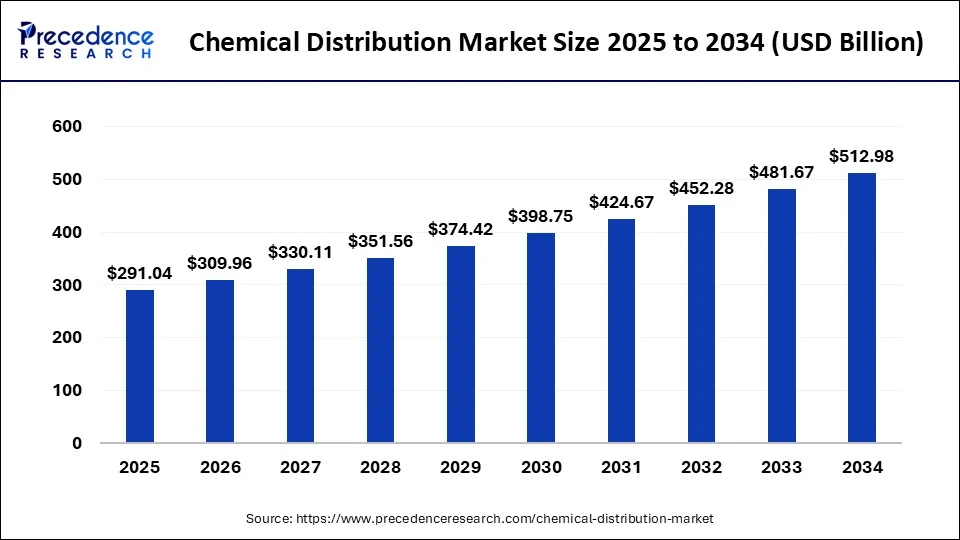

The global chemical distribution market size was estimated at USD 291.04billion in 2025 and is predicted to increase from USD 309.96 billion in 2026 to approximately USD 543.01 billion by 2035, expanding at a CAGR of 6.44% from 2026 to 2035. The market growth is primarily attributed to the rising consumption of chemicals in various industries.

Chemical Distribution Market Key Takeaways

- In terms of revenue, the global chemical distribution market was valued at USD 291.04billion in 2025.

- It is projected to reach USD 543.01billion by 2035.

- The market is expected to grow at a CAGR of 6.44% from 2026 to 2035.

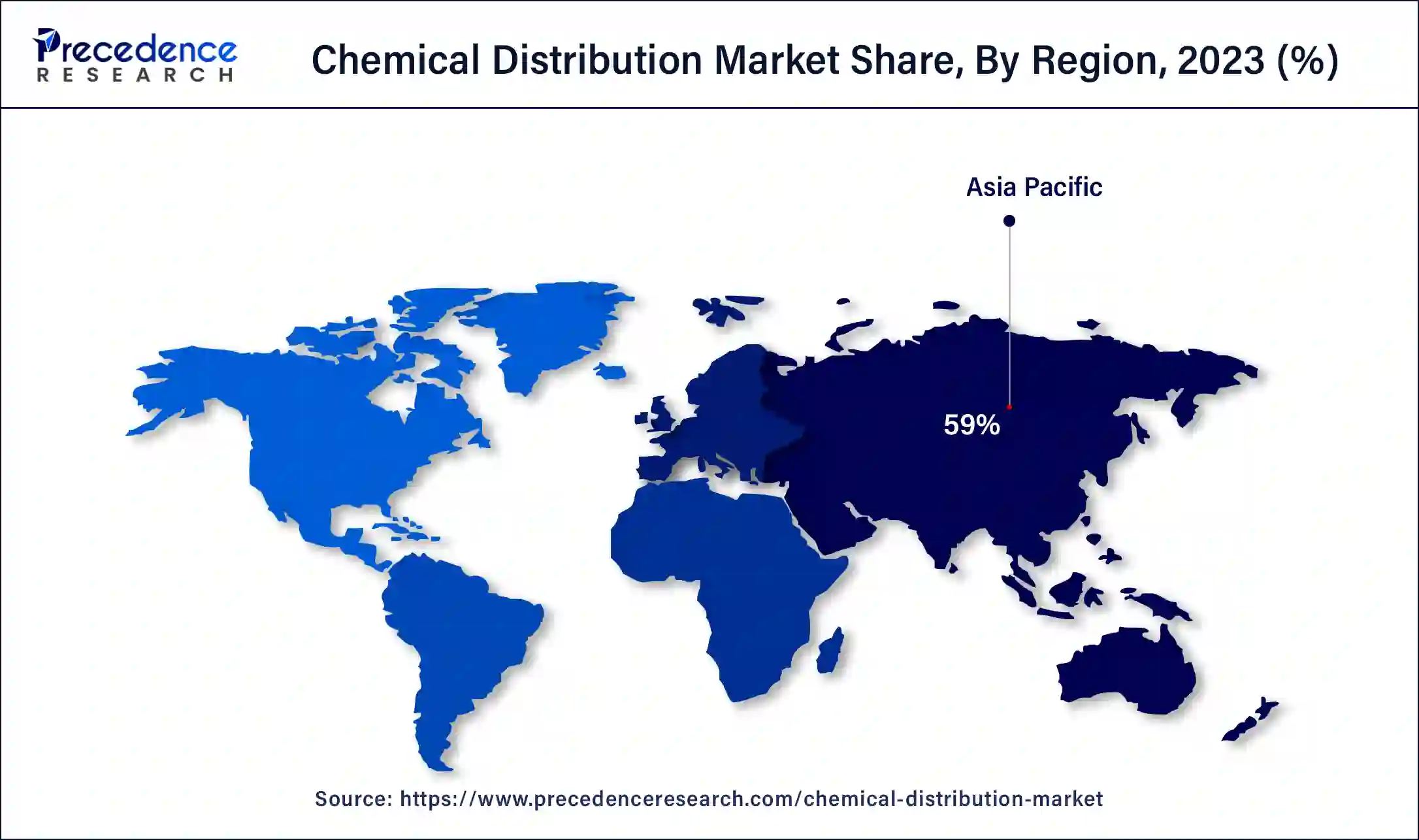

- Asia Pacific dominated the chemical distribution market with the highest market share of 59% in 2025.

- North America is expected to expand at the fastest CAGR during the forecast period.

- By Product, the commodity chemicals segment had the biggest market share of 60% in 2025

- By Product, the specialty chemicals segment is anticipated to grow at the fastest CAGR during the projected period.

- By End Use, the construction segment captured the major market share in 2025.

What is the Chemical Distribution?

The increasing chemical consumption in various end-use industries, such as plastics, polymers & resins, pharmaceuticals, and construction, drives the chemical distribution market. The chemical companies produce and supply the necessary raw materials to businesses in the industrial and manufacturing sectors. These raw materials are distributed or sold directly by producers to end-users. The distribution of specialty and commodity chemicals by third parties is expected to increase due to the rising outsourcing of value-added services, such as technical training, inventory management, waste removal, blending, packaging, and logistics. Additionally, the increasing consumer preferences toward high-quality products are expected to drive the growth of the chemical distribution market.

How is AI contributing to the Chemical Distribution Industry?

The AI reinforces the distribution of chemicals by utilizing demand forecasting, optimization of routes, predictive maintenance, and automation of compliance. It helps save money on inventory, increases the reliability of logistics, improves the safety performance, minimizes wastage, promotes regulatory compliance, and allows finding new applications of chemicals with the help of advanced data analytics.

Chemical Distribution Market Growth Factors

The chemical distribution market is growing at a sustainable rate owing to the innovative measures adopted by the chemical distributors to tackle the bottlenecks of the supply chain systems. The rising consumption of chemicals across various end use industries such as automotive, agriculture, construction, pharmaceuticals, and textiles is exponentially boosting the growth of the global chemical distribution market. The need for the chemical distributors emerged owing to the complexities faced by the chemical manufacturers. The chemical distributors offers convenience to the producers and helps to expand in the new markets, by eliminating supply chain complexity. The value-added services offered by the chemical distributors like inventory management is fostering the demand for the chemical distribution services among the chemical manufacturers. The chemical distributors are considered to be an essential part of the manufacturer's go-to-market strategy. The chemical distributors effectively reduces the cost of distribution and helps the chemical manufacturers to supply their products to new and developing markets at a convenient cost. The availability of wider variety of chemicals and its increased usage in huge number of different industries is boosting the growth of the global chemical distribution market.

The chemical distribution services serve as an important link for the producers to reach to the smaller customers that are situated in less developed regions. The chemical distributors helps the chemical manufacturers to reach to new markets that helps in the growth of the global chemical industry. Today, developing markets like Asia Pacific, Middle East, Latin America, and Africa are critically important as these regions offers immense growth opportunities to the chemical industry. The chemical industry is also a prominent contributor to the GDP of developed and developing markets. For instance, the chemical industry contributed around 3.5% of the Europe's GDP, 2.9% in North America, and 7.3% in Asia Pacific. Hence, the exponential growth of the chemical industry is boosting the growth of the global chemical distribution market.

Market Outlook

- Growth Outlook: Outsourced logistics, digital, and increased specialty chemical market growth are fueling market expansion.

- Sustainability Trends: The adoption of the circular economy is accelerating the bio-based chemicals, recycling efforts, and reduced environmental impact distribution.

- Big Investors: Brenntag SE, Univar Solutions, with the support of Apollo Global Management, IMCD N.V., Azelis Holdings, Barentz, HELM AG, and Caldic pushes amalgamation.

- Startup Ecosystem: Startups promote chemical recycling, biodegradable packaging, and bio-based solutions that help increase the sustainability of the supply chain.

Market Scope

| Report Highlights | Details |

| Market Size by 2035 | USD 543.01Billion |

| Market Size in 2025 | USD 291.04Billion |

| Market Size in 2026 | USD 309.96 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.44% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, End User Type, Region Type |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Market Dynamics

Driver

Increasing demand for chemicals

The increasing demand for chemicals in various industries, such as agriculture, automotive, construction, and manufacturing, is a major factor driving the growth of the market. Chemical providers play an important role in supplying a wide range of chemicals to address the burgeoning demands of industries. Moreover, key players competing in the market are increasing their production capacities to meet the overall increasing demand for chemicals. For instance,

- In March 2024, Mitsui Chemicals announced that it has increased manufacturing capacity at the meta-Xylylene Diisocyanate plant across its Omuta Works to meet the demand for hardeners used in hardly yellowing coatings.

Additionally, chemical distribution companies offer high-quality services, such as logistics, transportation, packaging, and storage, which help streamline complicated supply chains for end-users and manufacturers. Chemical providers offer technical support, customized packaging solutions, and inventory management to improve supply chain flexibility and efficiency, further contributing to the market's growth.

Restraint

Logistics challenges and supply chain disruptions

Supply chain disruptions due to transportation bottlenecks, geopolitical tensions, and natural disasters may impact the delivery and availability of chemicals to consumers, thus restraining the market. Chemical distributors must manage diversified suppliers and inventory risks and implement contingency plans to ensure continuity of supply and mitigate disruptions.

Opportunity

Increasing emphasis on eco-friendly chemicals

The increasing focus on the distribution and development of eco-friendly and sustainable chemicals creates lucrative opportunities in the market. Factors such as the increasing regulations and guidelines for chemical usage and increased environmental pollution across various regions encourage chemical manufacturers to develop sustainable chemicals. Key raw materials that are used in the production of chemicals are subject to strict environmental regulations. Hence, it is necessary to identify products that are economical and sustainable.

- For instance, in 2024, Synthos launched Synthos Synexil SAB O5, a dispersion for producing eco-friendly construction chemicals.

Impact of AI on the chemical distribution market

Implementing AI in chemical distribution requires a strategic and thoughtful approach to ensure successful adoption and seamless integration. AI analyzes a vast amount of data and streamlines logistics operations, thereby optimizing supply chains. It also predicts future demand and identifies faults in equipment used in chemical distribution facilities. By optimizing processes, AI can help companies reduce waste and adopt greener practices.

- For instance, AI can guide the selection of more sustainable solvents and raw materials for chemical reactions, refining operations to minimize energy waste, and optimizing energy use in manufacturing processes.

Segment Insights

Product Insights

Based on product, the commodity chemicals segment dominated the global chemical distribution market, accounting for the largest market share in 2024. The segment growth is primarily attributed to the high consumption of commodity chemicals across various industries, such as food & beverages, pharmaceuticals, agriculture, electronics, and construction. Almost every industry uses commodity chemicals to manufacture a wide range of goods.

The specialty chemicals segment is anticipated to expand at the fastest growth rate during the forecast period. The use of specialty chemicals is highly under the scrutiny of the government, and they are used for special applications across different industries. The rising usage of specialty chemicals in the polymer and pharmaceutical industries is expected to drive the growth of this segment.

End Use Insights

Based on end use, the construction segment dominated the global chemical distribution market in 2024 and is expected to sustain its dominance during the forecast period. The segment growth is attributable to the rising construction activities worldwide. The rising industrialization and urbanization in developing regions and the rising demand for specialty chemicals in the construction industry further contributed to the segmental growth.

The pharmaceuticals segment is expected to be the fastest-growing segment during the forecast period due to the rising usage of chemicals. The rapid expansion of the biopharmaceutical industry in developed regions, such as North America and Europe, is expected to drive the segment. Pharmaceutical industry heavily uses chemicals to dispose of pharmaceutical wastes.

Regional Insights

What is the Asia Pacific Chemical Distribution Market Size?

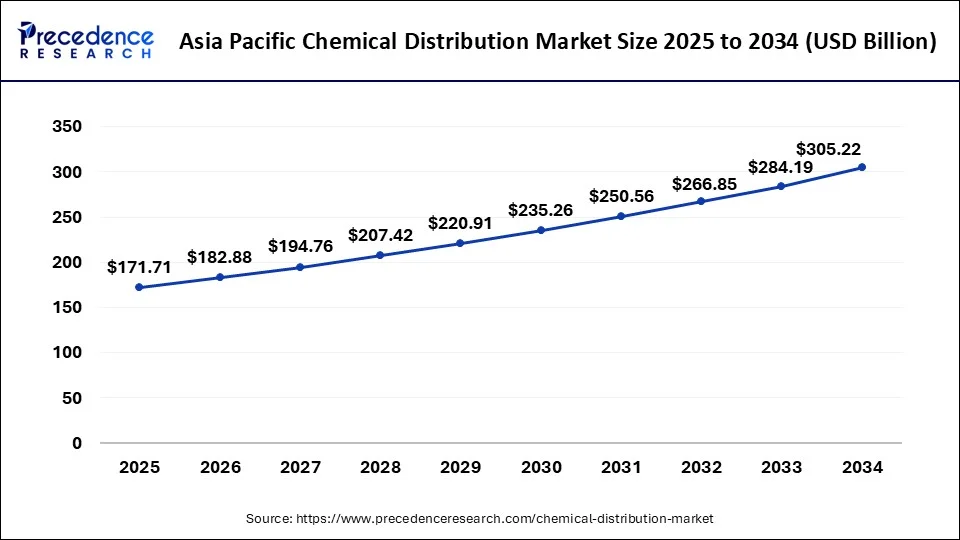

The Asia Pacific chemical distribution market size was estimated at USD 171.71 billion in 2025 and is predicted to surpass around USD 323.79 billion by 2035, at a CAGR of 6.59% from 2026 to 2035.

Asia Pacific dominated the global chemical distribution market in 2025 and is projected to sustain its dominance during the forecast period. The rapid growth of the industries in the major Asia Pacific economies such as China, Japan, India, South Korea, and Australia has significantly played a crucial role in the growth and development of the chemical distribution market in the past. Moreover, rapid industrialization in the region and the expansion of the chemical industry contributed to the market growth.

China Chemical Distribution Market Trends

China is an industry powerhouse as it adjusts to supply chain re-engineering. The focus of distributors is on specialized logistics, green chemistry portfolio, and domestic value-added service. Specialty chemical networks are enhanced through consolidation, especially to benefit the electronics and pharmaceutical industries in the backdrop of changing global sourcing strategies.

North America is expected to witness significant growth in the upcoming years. The North American chemical distribution market is highly influenced by the presence of top players such as IMCD, Univar, and Brenntag, which hold the largest market share. The rapidly growing automotive, construction, and pharmaceutical industries in the region are expected to drive the growth of the market in North America. Moreover, the rising expenditure by the chemical companies for the expansion of production units boosts the market.

U.S. Chemical Distribution Market Trends

Distributors in the U.S. have specialized more in chemicals than commodities. Digital systems allow inventory tracking and effective logistics in real-time. Nearshoring enhances strength. The use of AI aids in e-commerce, personalized recipes, autonomous maintenance, and responsiveness to demand in the manufacturing sector.

What Are the Driving Factors of The Chemical Distribution Market in Europe?

Europe is expected to grow at a significant rate during the forecast period. Europe is a well-established market with regulations in the chemical distribution. Green chemistry is driven by sustainability requirements. Distributors target automobile and pharmaceutical, automotive, and technical services specialties, compliance, and specialty chemicals. The environmental standards influence sourcing, the selection of packaging, and the circular economy.

Germany Chemical Distribution Market Trends

Germany focuses on green chemistry, circularity, and compliance with regulations. Distributors are investing in automation in order to reduce the cost of energy. Technical consulting, custom blending, and regulatory advice to customers who require high-performance specialty chemicals are some of the value-added services.

Value Chain Analysis of the Chemical Distribution Market

- Feedstock Procurement: Purchasing of raw materials and inputs that are necessary in the manufacturing and distribution processes of the chemicals.

Key Players: ExxonMobil, SABIC - Chemical Synthesis and Processing: The conversion of raw materials into chemical products by controlled reactions and processes.

Key Players: BASF SE, Dow Inc. - Compound Formulation and Blending: This is a procedure of setting chemical components in the proper relationships and producing desired performance qualities.

Key Players: Anupam Rasayan, Tata Chemicals - Quality Testing and Certification: This is to ensure that the products are safe, that they fit into the regulatory requirements, and also that they satisfy the industry certification.

Key Players: FSSAI

Chemical Distribution Market Companies

- Helm AG: International marketing and distribution of chemicals, fertilizers, and pharmaceuticals with a large network of international logistics.

- Univar Inc.: Global chemical distributor that provides logistics, technical services, regulatory solutions, as well as integrated supply chain services.

- Omya AG: manufacturer of industrial minerals that supplies specialty chemicals with a specialty in calcium carbonate solutions in the various industries around the globe.

Other Major Key Players

- Jebsen& Jessen Offshore Pte. Ltd.

- TER Group

- Barentz B.V.

- Azelis Holding S.A.

- Solvadis

- Ashland, Inc.

- Brenntag AG

- Nexeo Solution Holding LLC

- ICC Chemicals, Inc.

Recent Developments

- In January 2026, ChemCeed announces a strategic expansion of its product offerings to include Rubber Accelerators and Antioxidants. This expansion is made possible through a partnership with PMI, a trusted supplier in the rubber chemical industry. (Source: https://www.desmoinesregister.com )

- In November 2025, Lindsay Goldberg will acquire EMCO Chemical Distributors, a Wisconsin-based company supplying over 5,000 chemical SKUs like solvents and acids. EMCO's core services include distribution, blending, and packaging, catering to diverse markets such as agriculture, pharmaceuticals, food and beverage, and water treatment. (Source: https://peprofessional.com )

- In April 2024, Rhenus Logistics and Brenntag, a chemical distribution company, launched their first-ever fully electric truck in India. The vehicle will be utilized to streamline their supply chain systems.

- In June 2023, two leading chemical distributors, Chemisphere and ChemSolv, introduced the Integrity Partners Group (IPG), a full-line chemical distribution platform. IPG offers solutions that include solvent recycling, repurchasing, custom logistics, white-label formulations, quality testing, packaging, and blending.

Segments Covered in the Report

By Product

- Specialty Chemicals

- CASE

- Electronic

- Agrochemical

- Construction

- Specialty Resins & Polymers

- Commodity Chemicals

- Synthetic Rubber

- Petrochemicals

- Plastic & Polymers

- Explosives

- Others

By End Use

- Automotive & Transport

- Agriculture

- Construction

- Consumer Goods

- Industrial Manufacturing

- Textiles

- Pharmaceuticals

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting