What is the Flax Fiber Market Size?

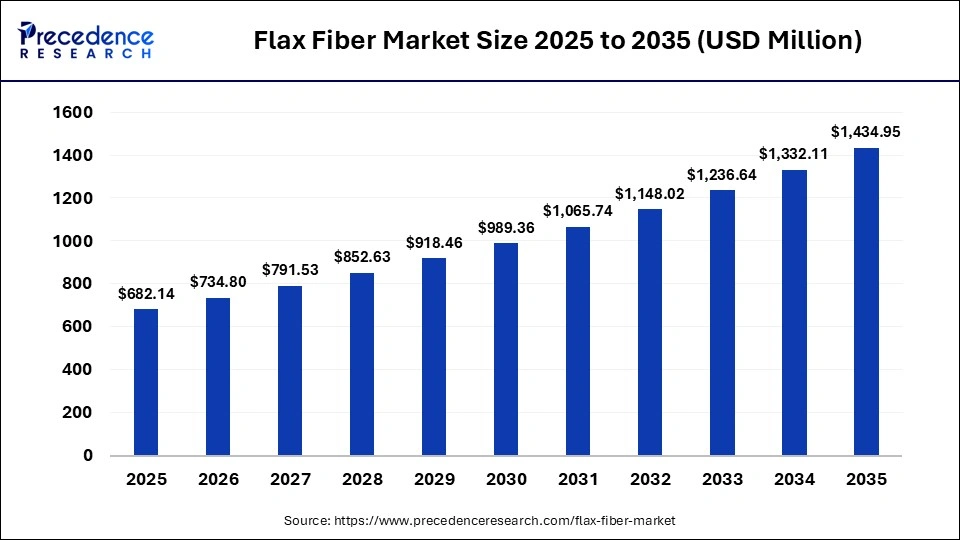

The global flax fiber market size was calculated at USD 682.14 million in 2025 and is predicted to increase from USD 734.8 billion in 2026 to approximately USD 1434.95 million by 2035, expanding at a CAGR of 7.72% from 2026 to 2035. The increasing preference for flax fiber for textile production is driven by its excellent durability, strength, and thermoregulatory properties.

Market Highlights

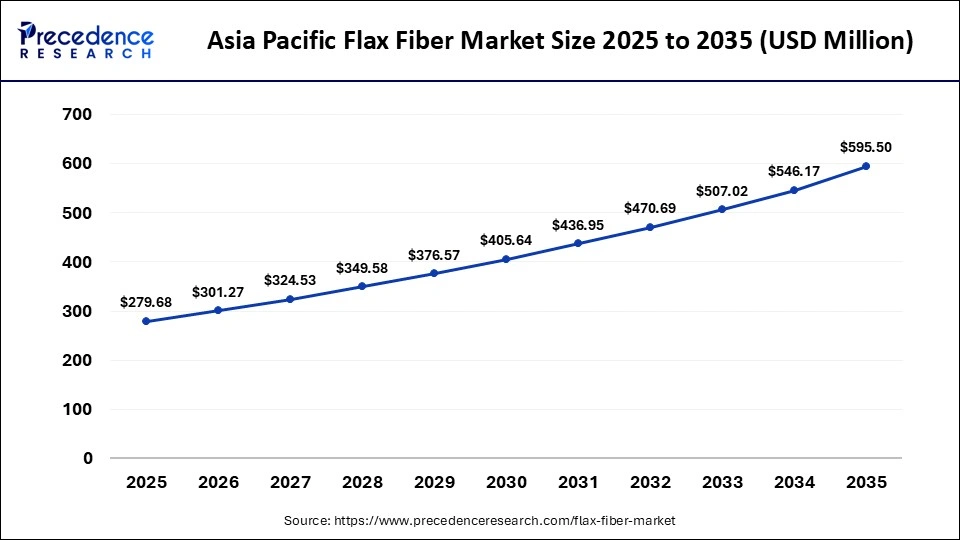

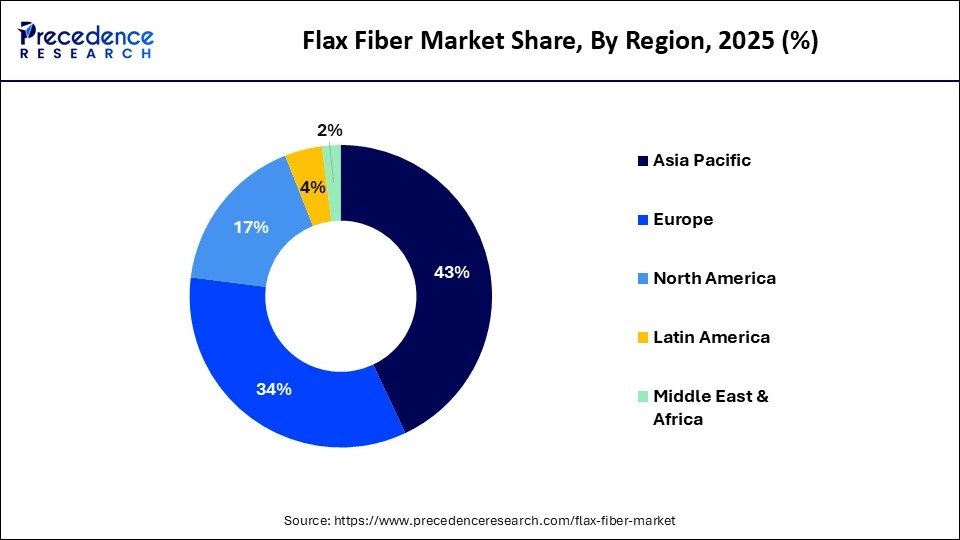

- Asia Pacific dominated the market in 2025, with a revenue share of approximately 40-43%, and is expected to grow at the fastest CAGR of 8% from 2026 to 2035.

- North America is expected to grow at a notable rate from 2026 to 2035.

- By product type, the long flax fiber segment dominated the market in 2025, with a revenue share of approximately 61%.

- By product type, the short flax fiber segment in the market is expected to grow at the fastest CAGR of 7.1% from 2026 to 2035.

- By application, the textiles & apparel segment dominated the market in 2025, with a share of approximately 50%, and the segment is expected to grow at the fastest rate of 6.5% from 2026 to 2035.

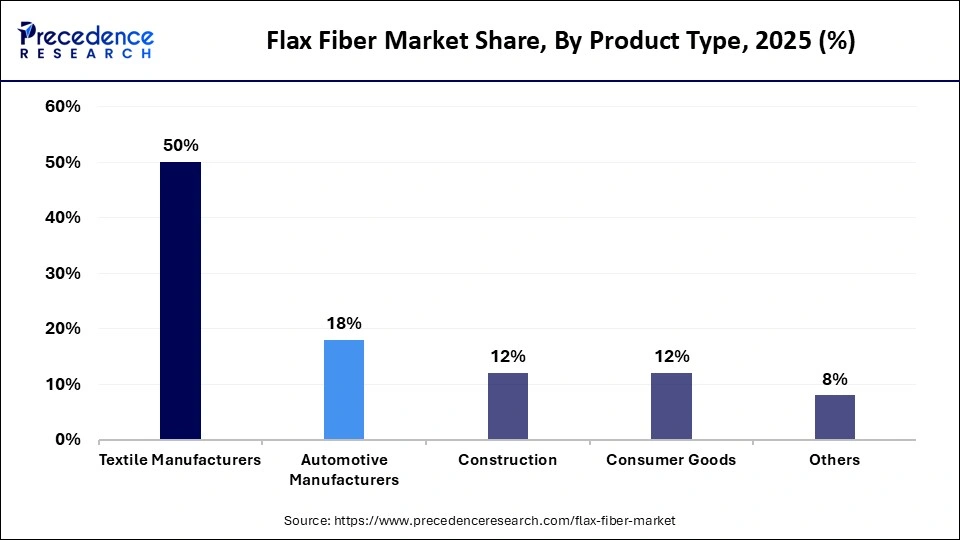

- By end-use industry, the textile manufacturers segment dominated the market in 2025, with a revenue share of approximately 50%.

- By end-use industry, the automotive manufacturers segment is expected to grow at the fastest CAGR of 6.8% from 2026 to 2035.

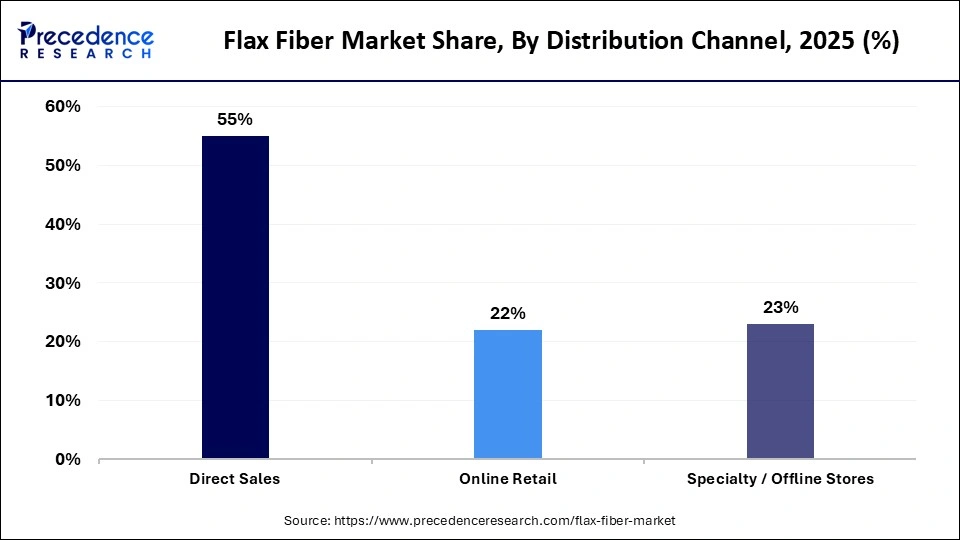

- By distribution channel, the direct sales segment dominated the market in 2025, with a revenue share of approximately 55%.

- By distribution channel, the online retail segment is expected to grow at the fastest CAGR of 6.7% from 2026 to 2035.

Flax Fiber: Production Surge and Industry Innovations

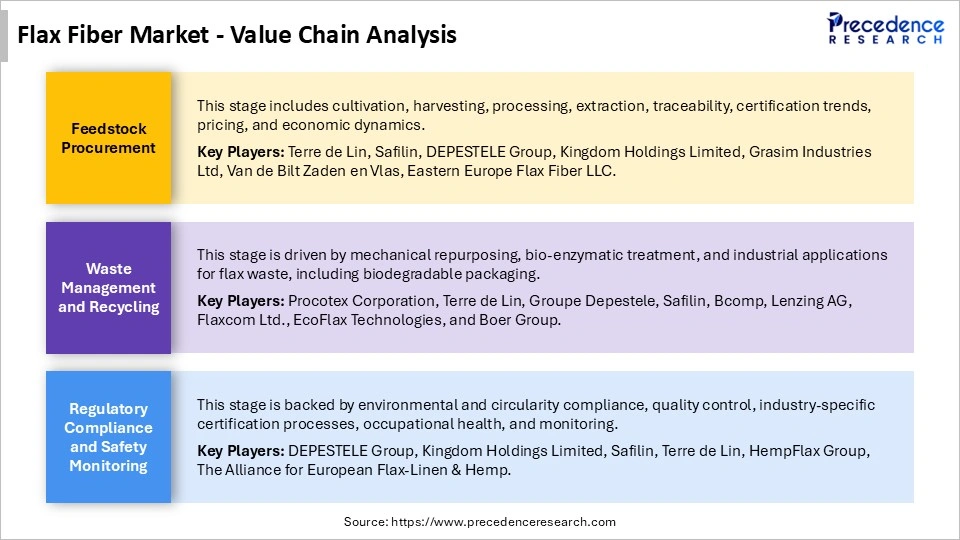

The flax fiber market involves the production, processing, and sale of fibers derived from the flax plant used in textiles, composites, insulation, and industrial applications. Flax fiber is valued for its sustainability, natural biodegradability, strength, and moisture-absorbing properties. Rising demand for eco-friendly materials in the fashion, automotive, and construction sectors bolsters growth.

Asia Pacific and Europe lead due to large textile industries and sustainability trends. Innovations in smart textiles and bio-composites drive emerging uses and higher adoption. Several

industrial innovations and initiatives have focused on sustainable packaging, including flax-based biodegradable solutions and compostable alternatives to plastic for major food brands. Leading companies such as Terre de Lin, Safilin, Kingdom Holdings Limited, and DEPESTELE Group are expanding capacity and investing in technical textiles, while rapid adoption in automotive composites and smart textiles continues to broaden end-use demand.

Advances in fiber retting, scutching, and spinning are improving yield consistency and mechanical performance. Growing collaboration between material suppliers and OEMs is accelerating qualification of flax-reinforced components. In parallel, lifecycle assessment data supporting carbon reduction claims is strengthening adoption in regulated markets.

How is AI transforming the Flax Fiber Market?

AI contributes to fabric authentication through image capture, feature extraction, pattern comparison, anomaly detection, and verification results. It is adopted in industrial workflow to drive innovation through luxury authentication platforms, smartphone-based spectrometers, and manufacturing integration. AI greatly impacts the flax fiber market due to its great impact on fabric verification. Manufacturers aim to reduce waste and errors with predictive AI, which ensures reliable production. The AI-verified product listings enable retailers to protect brand reputation. The consumers are empowered to verify product authenticity independently, due to which they gain confidence in with every purchase. The supply chains focus on building traceable records with the help of AI that ensure ethical sourcing and sustainability compliance.

Flax Fiber Market Trends

- Biodegradable Packaging Innovations: There is a huge adoption of flax-based packaging by high-end brands as a plastic alternative. The major automakers in certain regions, like Europe, increasingly prefer automotive and industrial composites.

- Smart Textiles & Wearables: The flax fiber market is growing with the heavy use of flax fiber as an eco-friendly alternative due to its durability for wearable electronic sensors.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 682.14 Million |

| Market Size in 2026 | USD 734.8 Million |

| Market Size by 2035 | USD 1434.95 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.72% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application, End-Use Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insights

How Does the Long Flax Fiber Segment Dominate the Flax Fiber Market in 2025?

The long flax fiber segment dominated the market in 2025 with a revenue share of approximately 61%, owing to its extensive applications in high-end textiles, industrial reinforcement, technical materials, and environmental sustainability. It delivers various technical performance benefits such as tensile strength, durability, surface quality, and specialized functions. It enables the manufacturing of sails, heavy-duty canvas, and marine ropes due to its potential technical properties.

The short flax fiber segment is expected to grow at the fastest CAGR of 7.1% in the flax fiber market during the forecast period due to its industrial and technical applications across automotive interiors, the paper industry, insulation, and construction. It has a wide role in agriculture and the environment in driving zero-waste sustainability and offering a nitrogen source. It holds stiffness, strength, dimensional stability, and mechanical properties.

Application Insights

What Made Textiles & Apparel the Dominant in the Flax Fiber Market in 2025?

The textiles and apparel segment dominated the market in 2025 with a revenue share of approximately 50%, and the segment is estimated to grow at the fastest rate of 6.5% during the forecast period due to growing consumer preference for high-quality flax fiber over other natural plant fibers in the textile sector. Flax fiber supports sustainable fabric innovation by enabling ethical fashion practices and the use of renewable raw materials. Its lightweight structure, breathability, and comfort make flax-based textiles suitable for both casual and premium apparel.

Rising demand for sustainable and low-impact fabrics among global fashion brands is reinforcing long-term adoption. Improved yarn processing and blending techniques are enhancing fabric softness and durability. In parallel, increased use of flax in seasonal and climate-adaptive clothing lines is expanding its application scope within the apparel industry.

End-Use Industry Insights

How Did the Textile Manufacturers Segment Dominate the Flax Fiber Market in 2025?

The textile manufacturers segment dominated the market in 2025 with a revenue share of approximately 50%, owing to the various benefits of flax fiber in performance and production, driven by high thermal conductivity, superior strength, and zero-waste circularity. Flax is highly used in technical textiles and composites for the sports and automotive industries. Long fibers are ideally used for high-end textiles, while short tow fibers are used for industrial composites and coarser yarns.

The automotive manufacturers segment is anticipated to grow at a notable rate of 6.8% in the flax fiber market during the upcoming period due to the increased focus on the use of hemp and flax materials to reduce the overall environmental impact of their products. Natural fibers are ideally used to reduce the carbon footprint in headliners, acoustic insulation, and interior moldings. Flax fiber is renowned as a serious production option for automotive and mobility components.

Distribution Channel Insights

Why Did the Direct Sales Segment Dominate the Flax Fiber Market in 2025?

The direct sales segment dominated the market in 2025 with a revenue share of approximately 55%, owing to the alternative to traditional employment offered by direct selling and its ability to provide flexible income opportunities that supplement household earnings. This model is particularly suitable for innovative or demonstration-based products that are not easily supported by conventional retail channels. Strong peer-to-peer engagement and personalized selling are improving customer trust and conversion rates. In addition, digital tools and social commerce platforms are expanding reach and scalability for direct sellers.

The online retail segment is predicted to grow at a rapid rate of 6.7% in the flax fiber market during the studied period due to easy access to the market, reduced overheads, and potential for rapid growth. It is possible to use online marketing tools to target new customers and website analysis tools. Online marketplaces enable the creation of a simple online shop and the selling of products within minutes.

Regional Insights

What is the Asia Pacific Flax Fiber Market Size?

The Asia Pacific flax fiber market size is expected to be worth USD 595.50 million by 2035, increasing from USD 279.68 million by 2025, growing at a CAGR of 7.85% from 2026 to 2035.

How Did Asia Pacific Dominate the Flax Fiber Market in 2025?

Asia Pacific dominated the market in 2025 with a revenue share of approximately 43%, and the region is expected to grow at the fastest CAGR in the flax fiber market during the forecast period, owing to the sustainable demand for textiles, the integration of flax into wearable electronics and smart textiles, and applications of flax in automotive lightweighting. The Asian Pacific countries, like China, are heavily investing in fiber technology and supporting export-oriented manufacturing. China is leading as a hub for flax fiber processing, India leads in flax fiber imports and consumption, while Vietnam leads in woven flax fabrics. In August 2025, Singapore-based Royal Golden Eagle (RGE), a leading player in manmade fibers, announced the investment of ₹4,953 crore in a manmade fiber plant in Thoothukudi that will boost Tamil Nadu's Southern industrial growth.

India Flax Fiber Market Analysis

The major driving forces that are leading the Indian market for flax fibers are their increasing use in the automotive and construction industries, sustainable fashion trends, and government policies for textiles. The Production Linked Incentive (PLI) Scheme for Textiles stands out as a transformative initiative to boost India's textile exports and investments, which also aims to promote manmade fiber manufacturing of fabrics, apparel, and technical textiles.

- In January 2026, the Government of India launched a district-based textile scheme to build export champions, announced at the National Conference of Textile Ministers in Guwahati.

How is the Noticeable Growth of North America in the Flax Fiber Market?

North America is expected to grow at a notable rate in the market due to the regulatory support by agencies like the U.S. EPA for the use of bio-based materials in manufacturing, processing innovation, and the adoption of flax-based biocomposites by the automotive industry. This region witnesses investments in fiber by private equity and government programs that ensure surging efforts of deployment in the coming years.

Flax Fiber Market Value Chain Analysis

Who are the Major Players in the Global Flax Fiber Market?

The major players in the flax fiber market include Terre de Lin, Safilin Group, DEPESTELE Group, Van de Bilt Zaden en Vlas, CELC (Compagnie Europ�enne du Lin et du Chanvre), Kingdom Holdings Limited, Eastern Europe Flax Fiber LLC, Lineo SAS, Swicofil AG, HempFlax Group BV, Procotex Corporation SA, Fibrex NV, SWM International, Biolin Research Inc., Jos Vanneste S.A.

Recent Developments

- In January 2026, BMW Group was honored with a prestigious innovation award for automobile components made from flax fibers, driving innovation and sustainability in automotive engineering.(Source: https://www.press.bmwgroup.com)

- In February 2025, Vardhman Textiles Ltd., a leading textile industry, redefined yarn innovation at Bharat Tex 2025.(Source: https://www.fibre2fashion.com)

Segments Covered in the Report

By Product Type

- Long Flax Fiber

- Short Flax Fiber

- Tow & Waste

By Application

- Textiles & Apparel

- Automotive & Composites

- Construction/Insulation

- Paper & Pulp

- Others (e.g., smart textiles)

By End-Use Industry

- Textile Manufacturers

- Automotive Manufacturers

- Construction

- Consumer Goods

- Others

By Distribution Channel

- Direct Sales

- Online Retail

- Specialty/Offline Stores

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content