Fluorosurfactant Market Size and Forecast 2025 to 2034

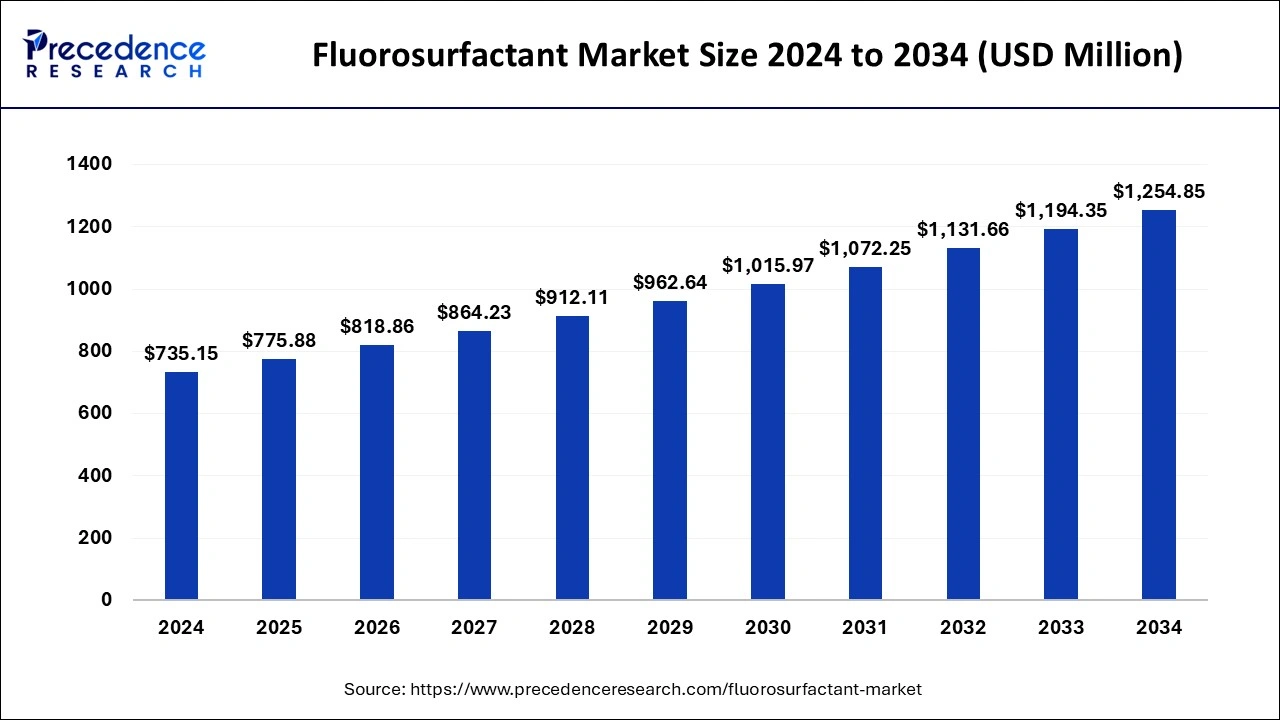

The global fluorosurfactant market size was estimated at USD 735.15 million in 2024 and is predicted to increase from USD 775.88 million in 2025 to approximately USD 1,254.85 million by 2034, expanding at a CAGR of 5.49% from 2025 to 2034. Sustainability and advanced formulations have become more important. Hence, bio-based fluorosurfactants are gaining traction from a wide spectrum of industries, thus fuelling the growth of the market globally.

Fluorosurfactant Market Key Takeaways

- The global fluorosurfactant market was valued at USD 735.15 million in 2024.

- It is projected to reach USD 1,254.85 million by 2034.

- The fluorosurfactant market is expected to grow at a CAGR of 5.49% from 2025 to 2034.

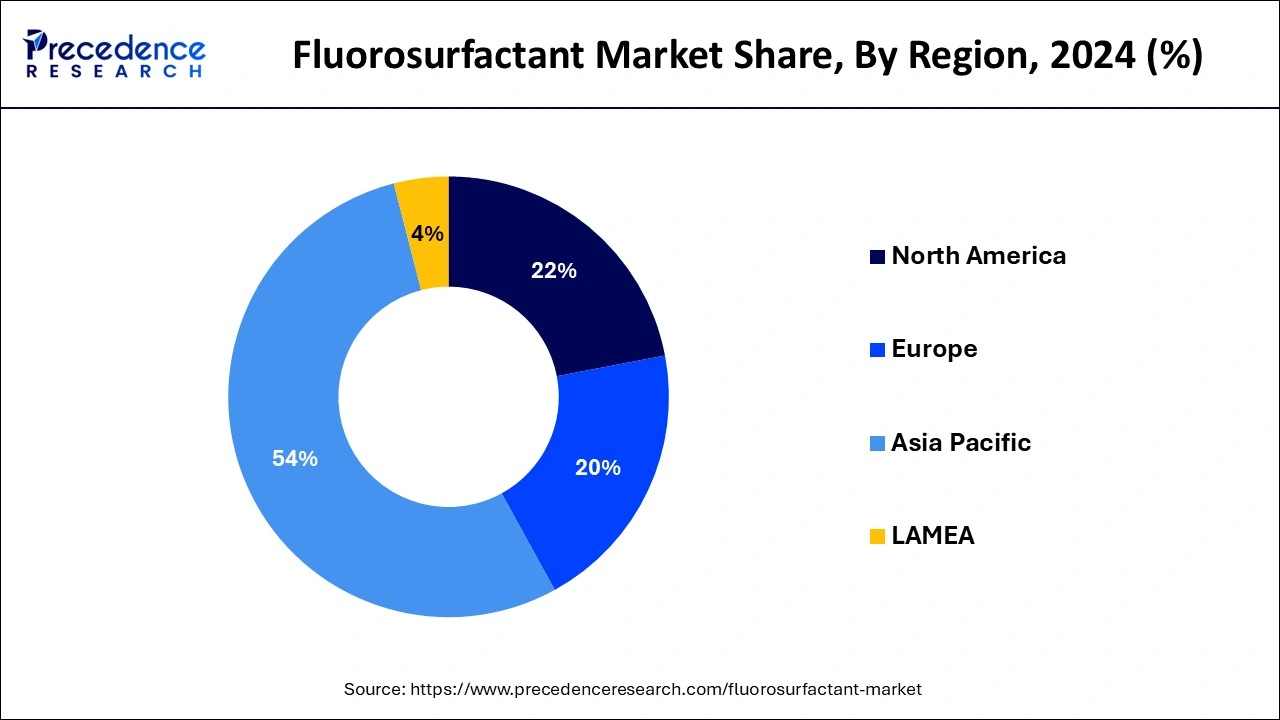

- Asia Pacific led the market with the largest market share of largest market share of 54% in 2024.

- North America emerges as a fast-growing region in the global market.

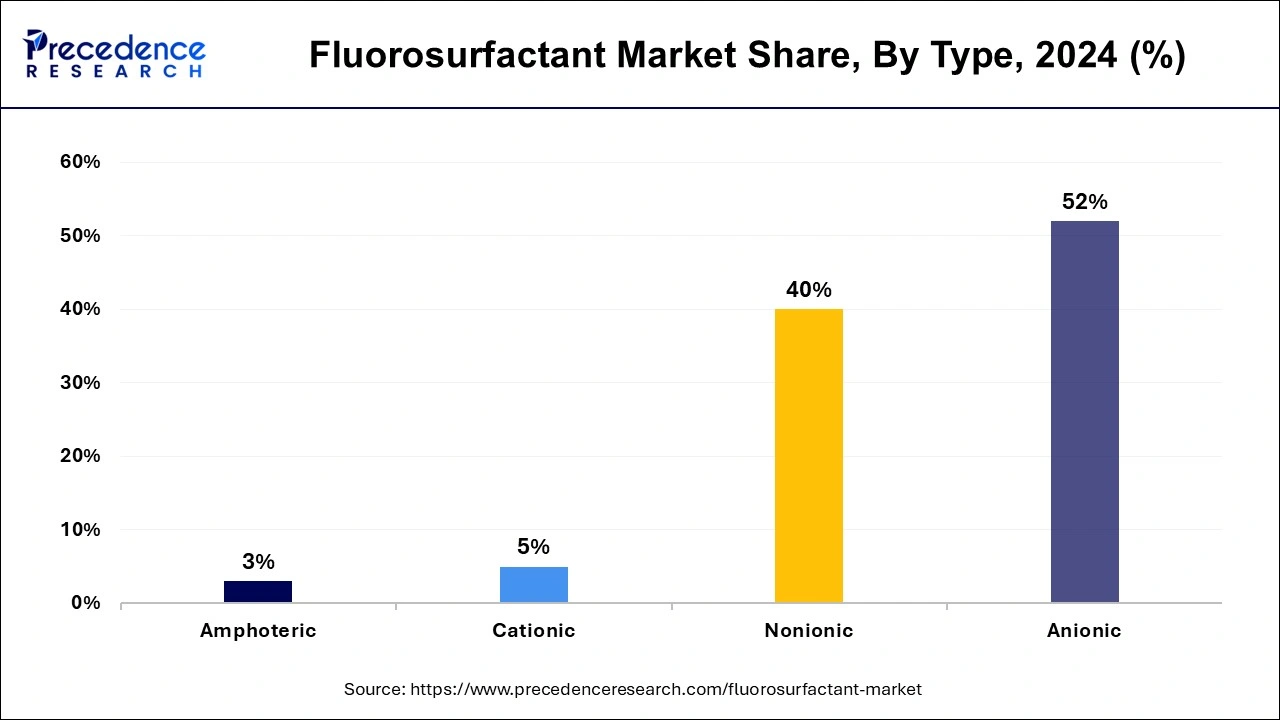

- By type, the anionic segment has held the major market share of 52% in 2024.

- By type, the nonionic segment is experiencing rapid growth in the market.

- By application, the paint & coating segment accounted for the highest share of the market in 2024.

- By application, the adhesive & sealant segment is observed to be the fastest-growing segment of the market.

Asia PacificFluorosurfactant Market Size and Growth 2025 to 2034

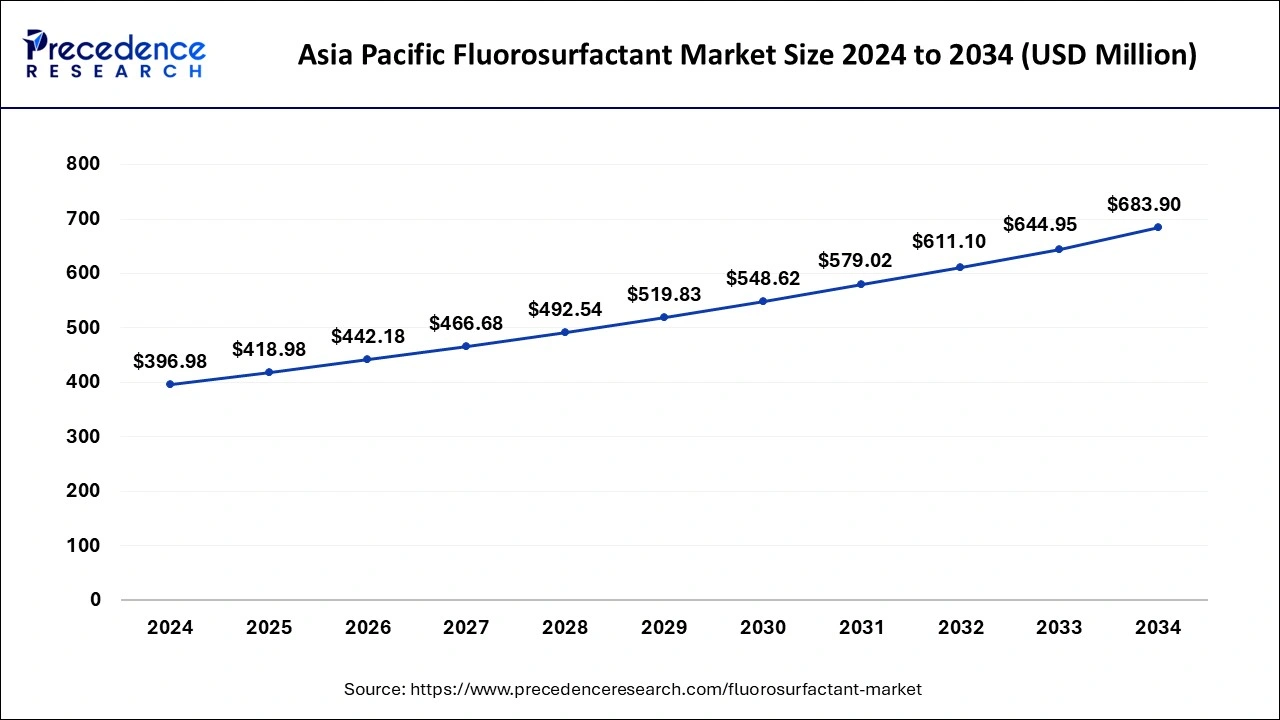

The Asia-Pacific fluorosurfactant market size was exhibited at USD 396.98 million in 2024 and is projected to be worth around USD 683.90 million by 2034, growing at a CAGR of 5.59% from 2025 to 2034.

Asia Pacific accounted for the highest market share in 2023. The region stands out as a dominant force in the fluorosurfactant market due to the several key factors that position it as a major hub for production, consumption, and innovation in this sector. The region's diverse and expanding end-user industries, such as construction, automotive, and electronics, drive the demand for fluorosurfactants in applications ranging from surface coatings to specialty cleaning agents.

Asia Pacific is experiencing rapid industrialization, particularly in countries such as China, India, and Southeast Asian nations. This industrial growth fuels demand for fluorosurfactants across various industries, including paints and coatings, textiles, electronics, and automotive, among others. With a strong manufacturing base, especially in China, the region is a significant producer of fluorosurfactants. This production capacity not only caters to domestic demand but also serves international markets, making the Asia Pacific a vital player in the global supply chain.

Countries in Asia Pacific, particularly India, Japan, and South Korea, are known for their advanced research and development capabilities. Investments in R&D foster innovation in fluorosurfactant technologies, leading to the development of new products and applications. Furthermore, India is expanding its commercial market notably. A number of projects have been going on in the country. Asia Pacific has a robust industrial base, expanding end-user industries, focus on innovation, and environmental considerations position it as a dominant force in the global fluorosurfactant market.

- The CommerzilI Commercial Office Complex construction worth USD 900 million started in 2022. The project involves the construction of a 43-story commercial office complex with a permissible floor area in Goregaon, Mumbai. The project is expected to be completed in 2027, thus benefitting the market growth during the forecast period.

North America emerges as a fast-growing region in the fluorosurfactant market, driven by several factors accelerating its growth trajectory, including cutting-edge technology and innovation hubs and fostering the development of advanced fluorosurfactant formulations and applications. The region's diverse industries, including automotive, aerospace, electronics, and healthcare, increasingly rely on fluorosurfactants for their unique properties, such as surface tension reduction and water repellences.

Significant investments in research and development by key players and academic institutions contribute to innovation in fluorosurfactant technologies, expanding their applications and driving market growth. Environmental regulations in North America drive the demand for eco-friendly alternatives, propelling the adoption of fluorosurfactants known for their effectiveness and relatively lower environmental impact.

Also, industries in North America recognize the performance benefits of fluorosurfactants, such as improved wetting and spreading properties, leading to increased adoption across various sectors. Due to these factors, with its technological backup, expanding end-user industries, regulatory environment, and emphasis on innovation, North America is positioned as a fast-growing region in the global fluorosurfactant market.

Market Overview

The fluorosurfactant market has grown steadily in recent years due to increasing demand from various industries, such as paints and coatings, oil and gas, and agrochemicals. Factors driving this growth include the need for improved performance and sustainability in formulations and stringent regulations regarding environmental impact.

Key players in the market are focusing on research and development to introduce innovative products with enhanced properties and lower environmental footprint. As sustainability becomes more important, bio-based fluorosurfactants are gaining traction. However, challenges such as high cost and regulatory hurdles remain. However, the fluorosurfactant market is expected to continue its growth trajectory, which is fueled by technological advancements and increasing applications across industries.

Fluorosurfactant Market Growth Factors

- Increasing demand from industries like paints and coatings, oil and gas, and agrochemicals.

- Need for improved performance and sustainability in formulations.

- Stringent regulations regarding environmental impact driving the adoption of fluorosurfactants.

- Research and development efforts led to the introduction of innovative products with enhanced properties.

- The rising popularity of bio-based fluorosurfactants is due to their lower environmental footprint.

- Continued advancements in technology driving product innovation.

- Expansion of applications across various industries, fuelling market growth.

- Despite the high cost and regulatory hurdles, the market is expected to maintain its growth trajectory.

- The market is also witnessing a shift towards bio-based fluorosurfactants, fueled by the growing emphasis on sustainability and eco-friendly alternatives. This transition towards bio-based options aligns with broader industry trends towards greener practices.

- The nonionic segment of the fluorosurfactant market is experiencing significant growth driven by its broad compatibility, low foaming properties, stability, environmental considerations, and continuous innovation.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.49% |

| Market Size in 2025 | USD 775.88 Million |

| Market Size in 2024 | USD 735.15 Million |

| Market Size by 2034 | USD 1,254.85 Million |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing demand in a wide range of industries

A major driver propelling the fluorosurfactant market forward is the increasing demand across various industries, including paints and coatings, oil and gas, and agrochemicals. Fluorosurfactants are prized for their ability to enhance the performance of formulations, offering benefits such as improved wetting, leveling, and surface tension reduction. Ongoing research and development efforts are leading to the introduction of innovative fluorosurfactant products with enhanced properties, catering to specific industry needs.

Moreover, stringent environmental regulations worldwide are pushing industries to adopt more sustainable solutions, driving the uptake of fluorosurfactants, known for their effectiveness and relatively lower environmental impact than traditional surfactants. As industries continue to seek ways to improve their product's performance and environmental footprint, the demand for fluorosurfactants is expected to remain robust, driving the market's growth in the foreseeable future.

Restraint

Higher manufacturing expenses

One of the primary restraints facing the fluorosurfactant market is the challenge posed by its relatively high cost compared to conventional surfactants. The production process for fluorosurfactants involves complex chemical synthesis and specialized equipment, contributing to higher manufacturing expenses. Consequently, the elevated cost of fluorosurfactants can deter widespread adoption, particularly in price-sensitive industries.

Additionally, stringent regulatory frameworks governing the use and disposal of fluorosurfactants present another obstacle to market growth. Environmental concerns surrounding the persistence and bioaccumulation of fluorinated compounds have prompted regulatory agencies to impose strict guidelines on their usage, limiting their application in certain regions or industries. Compliance with these regulations often requires extensive testing and documentation, adding further complexity and cost to the manufacturing and distribution processes.

Despite these challenges, ongoing efforts to address cost and regulatory concerns, along with technological advancements and sustainable manufacturing practices, are expected to mitigate these restraints and foster the continued growth of the fluorosurfactant market.

Opportunity

Advancements in technology and materials

One significant opportunity for the fluorosurfactant market lies in expanding applications across emerging industries and niche segments. While fluorosurfactants have traditionally been widely used in established sectors such as paints and coatings, oil and gas, and agrochemicals, there is growing potential for their use in novel applications. For instance, the aerospace and automotive industries, with their stringent performance requirements and focus on lightweight materials, could benefit from using fluorosurfactants in coatings and lubricants to reduce friction, improve durability, and enhance fuel efficiency.

The electronics industry presents a promising opportunity for fluorosurfactants due to their ability to improve the wetting and spreading properties of electronic components during manufacturing processes such as soldering and coating. Additionally, the increasing demand for high-performance and environmentally sustainable cleaning products opens avenues for the incorporation of fluorosurfactants in formulations for industrial and household cleaners, where their low surface tension and excellent soil-repellence properties can enhance cleaning efficiency.

As advancements in technology and materials continue to drive innovation and create new opportunities, the versatility and unique properties of fluorosurfactants position them well to penetrate diverse and emerging markets, thereby fueling the growth of the overall fluorosurfactant market.

Type Insights

The anionic segment was estimated to hold a significant share of the market in 2024 due to its wider adoption in the paint and coating industry. This segment's growth is attributed to the excellent permeability and leveling provided by anionics, which are mainly used in paint and coating applications. Anionics are characterized by their negatively charged hydrophilic heads, which makes them useful in extensive applications across various markets as they possess excellent surface-active properties and compatibility with water-based products used as a main foundation. Continuous research and development efforts focused on enhancing the properties and applications of anionic fluorosurfactants further strengthen their dominance in the market.

While other segments of the fluorosurfactant market, such as cationic and nonionic, continue to grow, the anionic segment maintains its dominant position due to its established performance advantages and widespread applicability across industries. Anionic fluorosurfactants exhibit versatility in formulation, allowing them to be incorporated into a wide range of products such as paints, coatings, adhesives, and cleaning agents. These surfactants offer high efficiency in reducing surface tension and enhancing wetting and spreading capabilities, making them indispensable in industries where surface properties are critical.

- In January 2023, 3M launched an innovative, multipurpose range of anionic flurosurfactants. These are specially designed for a spectrum of applications, including oil and gas, water treatment, and electronics.

The another segment that is consumed on a major scale in the fluorosurfactant market is the nonionic segment. The specialty of these surfactants is their PH balance, which ultimately leads to a smooth texture and coatings while reducing the surface tension between the two dissimilar surfaces. With increasing environmental regulations and consumer preferences for eco-friendly products, nonionic fluorosurfactants are gaining popularity due to their relatively lower environmental impact compared to some other types of surfactants.

The nonionic segment is experiencing rapid growth in the fluorosurfactant market as they often provide cost-effective solutions for formulators, offering superior performance at competitive prices compared to other types of fluorosurfactants. Nonionic fluorosurfactants are known for their low foaming characteristics, making them particularly suitable for applications where foam control is essential, such as in agrochemicals, detergents, and industrial cleaning agents. Nonionic fluorosurfactants often exhibit greater stability in extreme conditions, including high temperatures and pH ranges. This stability enhances their performance and reliability in demanding applications. As industries continue to seek high-performance and sustainable solutions, the demand for nonionic fluorosurfactants is expected to continue on an upward trajectory.

Application Insights

The paint & coating segment accounted for the highest revenue share of the market in 2024. Fluorosurfactants are widely used in paint and coatings formulations to reduce surface tension, promoting better wetting and spreading of the coating material over the substrate. This property helps improve the overall coating performance, including adhesion, coverage, and durability. They also contribute to improved leveling and flow properties in paint formulations, resulting in smoother and more uniform coating surfaces. This enhances the aesthetic appeal of the finished product and reduces defects such as brush marks and orange peel texture. As the demand for high-performance coatings continues to grow across various industries, the use of fluorosurfactants is expected to remain strong in this market.

Fluorosurfactants impart water and oil repellency to paint and coatings, making them resistant to moisture, stains, and environmental contaminants. This property extends the lifespan of coated surfaces and enhances their resistance to weathering and degradation. Also, fluorosurfactants exhibit compatibility with a wide range of paint and coating formulations, including water-based, solvent-based, and powder coatings.

This versatility allows formulators to incorporate fluorosurfactants into different types of coatings to achieve desired performance characteristics. Due to such vast applications, the paint and coatings segment remains a dominant part of the fluorosurfactant market. This is due to the essential role fluorosurfactants play in enhancing coating performance, durability, and environmental compliance.

The adhesive & sealant segment is observed to be the fastest-growing segment of the fluorosurfactant market due to the wide range of properties, including higher demand. Adhesives and sealants are essential components in various industries, including automotive, construction, aerospace, and electronics. Fluorosurfactants contribute to improved wetting and spreading of adhesive and sealant formulations, enabling better surface coverage and adhesion to substrates. This property is crucial for achieving strong and long-lasting bonds in challenging applications.

Fluorosurfactants lower the surface energy of adhesive and sealant formulations, resulting in enhanced wetting of low-energy surfaces such as plastics, metals, and composites. This improves the bonding performance and ensures reliable adhesion even in demanding environments. The need for high-performance formulations with superior bonding strength, durability, and resistance to environmental factors has driven the adoption of fluorosurfactants. Adhesives and sealants formulated with fluorosurfactants exhibit increased resistance to moisture, chemicals, temperature fluctuations, and UV radiation. This extends the lifespan of bonded joints and sealed surfaces, making them suitable for outdoor and harsh environments.

Recent Developments

- In February 2023, Chemour's Fluro surfactants business was acquired by 3M for USD 1.1 Billion. This acquisition aids in strengthening the footprint of 3M in the global Fluro surfactant market.

- In March 2022, Alfa Chemistry announced the launch of various flurosurfactants, including amphoteric, anionic, cationic, and non-ionic surfactants. They also introduced natural surfactants.

Fluorosurfactant Market Companies

- The Chemours Company (U.S.)

- Merck KGaA (Germany)

- The 3M Company (U.S.)

- OMNOVA Solutions, Inc. (U.S.)

- Tyco International Plc. (Ireland)

- Asahi Glass Co. Ltd. (Japan)

- DIC Corporation (Japan)

- Innovative Chemical Technologies, Inc. (U.S.)

- Advanced Polymers, Inc. (U.S.).

Segments Covered in the Report

By Type

- Anionic

- Cationic

- Nonionic

- Amphoteric

By Application

- Paints & Coatings

- Adhesives & Sealants

- Firefighting Foams

- Detergents

- Polymer Dispersion

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting