What is the Fructose Market Size?

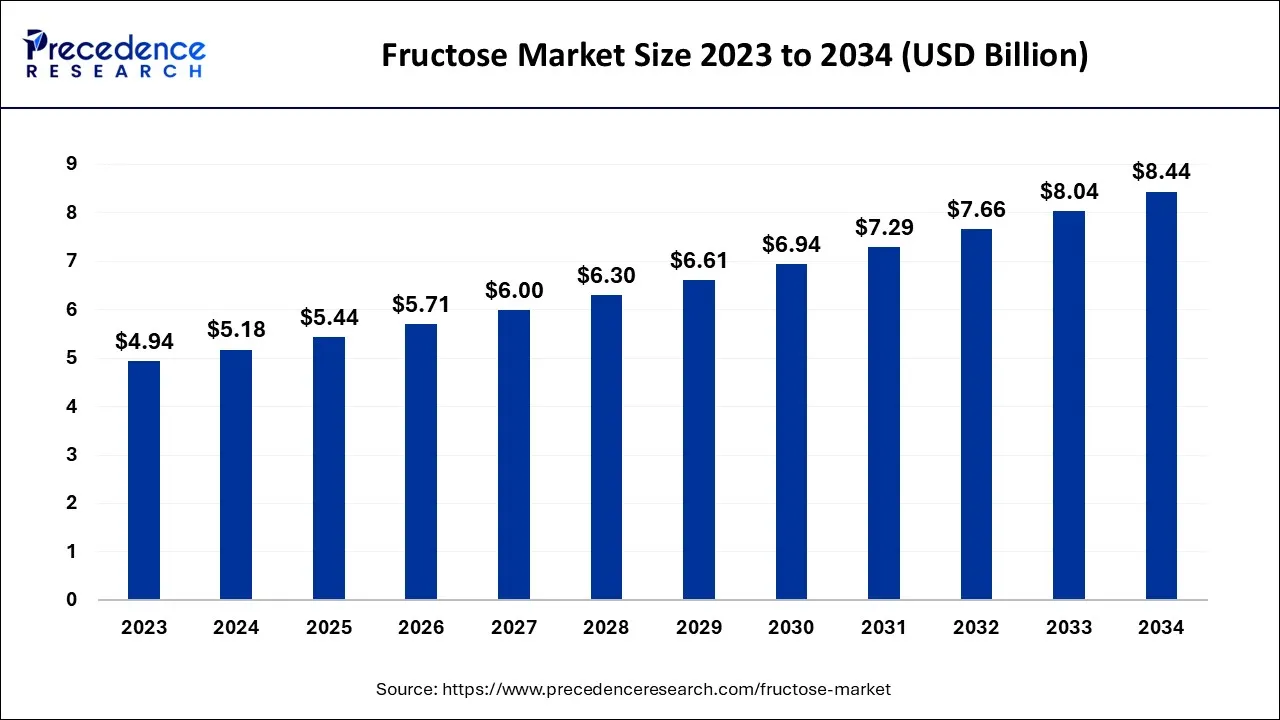

The global fructose market size was valued at USD 5.44 billion in 2025 and is predicted to increase from USD 5.71 billion in 2026 to approximately USD 8.83 billion by 2035, expanding at a CAGR of 4.96% over the forecast period from 2026 to 2035.

Fructose Market Key Takeaways

- In terms of revenue, the fructose market is valued at $5.44 billion in 2025.

- It is projected to reach $8.83 billion by 2035.

- The fructose market is expected to grow at a CAGR of 4.96% from 2026 to 2035.

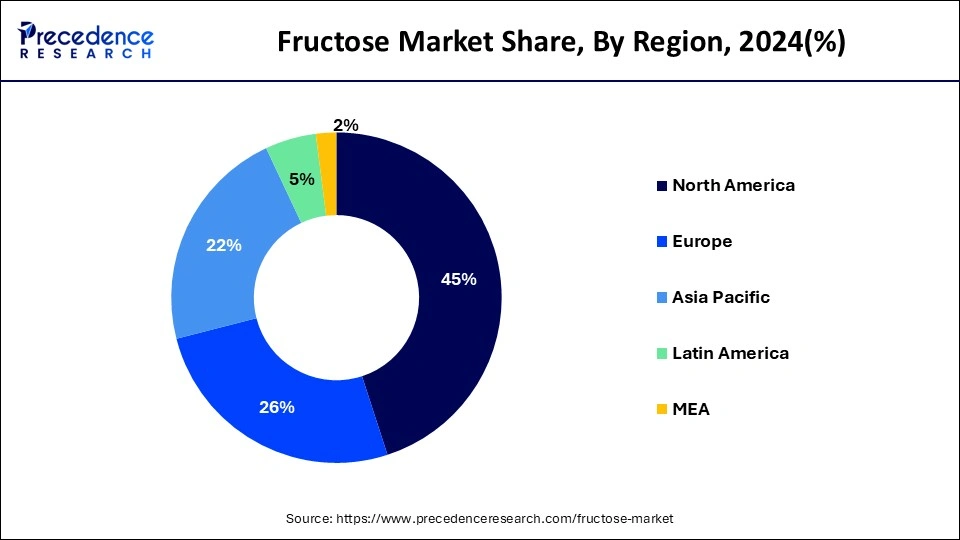

- North America dominated the global market and generated more than 45% revenue share in 2025.

- By product, the high fructose corn syrup segment dominated the market and captured more than 63% of revenue share in 2025.

- By application, the beverage application segment dominated the market and contributed for more than 70% of revenue share in 2025.

What is fructose?

Industry growth is anticipated to be fueled by rising consumer demand for processed low-calorie, low-fat, and low-sugar food products. While glucose and fructose have similar chemical formulas, they have different molecular structures. It can be found naturally in some plants, honey, fruits, and vegetables. Foods and beverages that employ fructose have better quality, flavor, and texture. Also, the product's low Glycemic Index (GI) compared to table sugar is likely to boost demand. Due to growing consumer awareness of the need of eating a healthy diet, the U.S. is predicted to experience significant growth.

How is AI contributing to the Fructose Industry?

Artificial intelligence assists with the study of fructose by simulating dietary, metabolic, and behavioral data. It determines the latent consumption patterns, anticipates risks of metabolism, and assists in the detection of diseases. AI enhances the knowledge of fructose metabolism pathways, genetic interactions, and conditions of the liver. It also allows optimization of formulation, individualized nutrition planning, therapeutic modeling, and real-time dietary coaching on healthier consumption of fructose.

Fructose Market Growth Factors

Consumers' search for a substitute for white sugar in their everyday diets to maintain fitness will aid the fructose industry's expansion over the anticipated time period. Yet, customers are choosing sustainable products, which will have some effect on market expansion. Sugarcane, beets, and maize are just a few of the basic ingredients that are used to make fructose. Because of its low price and high relative sweetness, the product has been widely used in the food and beverage industry.

The industry participants are going to face significant hurdles as a result of variables like fluctuating raw material prices and rising production expenses. The price of the finished product might be directly impacted by an increase in manufacturing costs. For instance, due to the increase in production costs, Tate & Lyle confirmed a price increase in September 2019 for its goods coming from the North American beverages and food solutions business.

Moreover, Cargill, Inc. stated in its 2019 annual report that the rise in energy and raw material prices in Europe contributed to a decline in revenue for its starch & sweetener products. According to a study, high fructose corn syrup can raise your chance of having hypertension, diabetes, cardiovascular disease, excess weight, cancer, liver failure and liver stress, high blood cholesterol, leaky gut syndrome, and a higher intake of mercury. As a result, consumers are choosing alternatives such as palm sugar, local honey, and tea, which is predicted to slow the industry's development.

Applications

Pharmaceuticals – Fructose in the pharmaceutical sector is used for the formulation process. For example, nutritional supplements and injections.

Personal care and cosmetics – The study states that fructose acts as a water-retaining agent and humectant for the products.

Functional foods – Fructose is popularly used along with other functional ingredients in healthy products like protein-based snacks and energy bars.

Market Outlook

- Industry Growth Overview: Industry is experiencing growth in processed food and sweetness efficiency, which is driving the fructose demand in beverages and bakery.

- Sustainability Trends: Bio-based sourcing and enzymatic processing are under focus to minimize the footprint on the environment.

- Major investors: Archer Daniels Midland, Cargill, Ingredion, Tate & Lyle, Roquette Freres, AGRANA, Kerry Group, DuPont Nutrition and Biosciences.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.44 Billion |

| Market Size in 2026 | USD 5.71 Billion |

| Market Size by 2035 | USD 8.83 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.96% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing consumer awareness of health issues and demand for sugar replacements

In emerging nations, rising disposable income and consumer health concerns have led to a surge in the market for sugar replacements like fructose, which has no calories. The preference for calorie-free sweeteners among diabetics and people with high sugar levels drives the rise of the fructose market. The ongoing need for fructose as a sweetener for several food products, such as bakery goods, health drinks, juices, and confectionary, from the food and beverage industry has significantly fueled the expansion of the worldwide fructose market.

Several culinary recipes call for fructose sweetener, which drives up demand from consumers and businesses worldwide for this non-caloric sweetener.

Restrain

Consuming too much fructose might cause major health issues.

In a while, a lot of scientists think that consuming too much fructose can cause major health issues like diabetes type II, cardiovascular disease, being overweight, and in some circumstances, cancer. The market growth has been constrained by the shifting customer preferences for natural sweeteners brought on by the decline in the availability of fructose and the emergence of these sweeteners.

Opportunity

Greater usage of fructose in a variety of applications.

The market is also being driven by the rising usage of fructose in numerous end-use industries, including ethanol production, medicines, cosmetics, foods, and feed. It can be utilized as a vitamin supplement in pharmaceutical goods like syrups and injections as well as a water-retentive ingredient in skincare and cosmetic serums. The company has established itself as the leader thanks to strong R&D and technological capabilities, and as a result, demand for crystallized sugar has increased over time.

Technological Advancement

Technological advancements in the fructose market feature fructose extraction, sustainable production, and glucose isomerase. The fructose extraction is a technique used to extract fructose from natural sources such as vegetables and fruits. It helps in maintaining the originality and purity. The innovative ways to achieve sustainable factors in production consist of finding an accurate alternative for feedstock sources and developing new methods for the same. Glucose isomerase is an enzyme that converts glucose to fructose, mainly used in the production of high fructose corn syrup (HFCS). Additionally, the researchers are putting efforts into optimizing this enzyme to increase the conversion rate for a more effective and efficient process. Technological advancement is unlocking growth and sustainability through innovations and research studies.

Segment Insights

Product Insights

Product, High fructose corn syrup dominated the market because to its adaptability and capacity to improve the texture, color, quality, and flavor of numerous foods and beverages, these products have become increasingly popular. High fructose corn syrup is also preferred by manufacturers due to its liquid condition, which makes manufacturing easier and is less expensive than other sweeteners. For instance, using sugar in soft drinks rather than high fructose corn syrup doubles the cost of the sweetener.

According to estimates, the segment for fructose syrups will grow at the fastest rate. The high growth rate is supported by fructose syrups' capacity to combine with other substances. In dry-mix beverages, flavored water, low-calorie items, carbonated goods, energy bars, bakery items, chocolate pudding, fruit packets, and morning cereals, fructose solids are predominantly obtained from maize starch. Fructose solids aid in preserving the desired tenderness and moistness of baked goods for a longer period of time.

Application Insights

Depending on the application, the fructose market can be further divided into the following categories: beverages, bakeries and cereals, milk products, confectionaries, sugary foods, and others. Due to reasons like the rise in the market for fructose sweeteners in drinks, a rise in the demand for energy drinks, and rising demand for protein shakes, coffee creamers, and soda, the Beverages category held the highest share in 2023. The Fructose Market is expanding as a result of the rising soft drink consumption in developing nations.

Regional Insights

What is the U.S. Fructose Market Size?

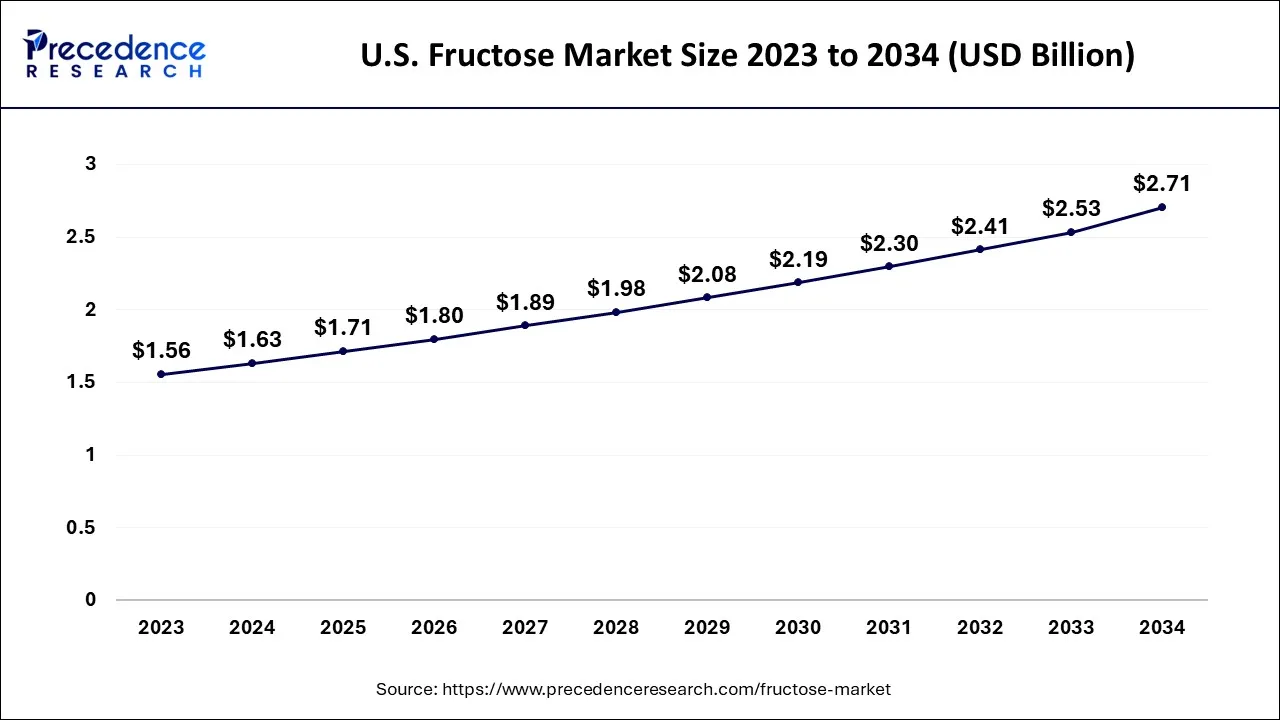

The U.S. fructose market size was exhibited at USD 1.71 billion in 2025 and is projected to be worth around USD 2.85 billion by 2035, growing at a CAGR of 5.24% from 2026 to 2035.

North America dominated the global market in 2025. The rise of the sector has been aided by the popularity of packaged beverages in the area, such as beverages, juice drinks, and soft drinks with carbonation.

North America is dominating the fructose market. North America holds the largest production and manufacturing hubs of maize. The large-scale production and consumption of high-fructose corn syrup accelerate the food and beverage market, indirectly promoting fructose in the market. The rising demand for HFCS boosts the market growth.

U.S. Fructose Market Trends

The area boasts of good processing facilities that favour fuel-sized production of fructose. The use of functional foods continues to increase. Sourcing preferences are affected by clean-label consciousness. In efforts to enhance competitiveness in the beverage, packaged food, and nutrition industries, producers invest in efficiency enhancement in their production processes.

The Asia Pacific area is anticipated to have the quickest rate of growth between 2025 and 2034,due to the rapidly rising beverage industries in China and India, Also, the demand for food products including bottled drinks, candies, and chocolates is projected to increase as a result of the changing consumer lifestyle and the growing population.

China Fructose Market Trends

Urbanization contributes to an increase in the consumption of processed food, which is an augmentation of fructose demand. The dependency on imports increases with the limitation in domestic production. Crystalline fructose is more popular in diet-oriented formulations. Upgrades in technology enhance purity, sustainability, and efficiency in the processing facilities through manufacturing facilities.

Europe held the lion's share of the global market for fructose due to the presence of large market players, extensive R&D spending, technologically advanced production techniques, and the accessibility of raw resources in the area. The use of processed sugar to develop medications has emerged as the most potential avenue for industry expansion.

Germany Fructose Market Trends

The fructose usage is promoted through the regulatory pressures to substitute the use of sucrose. Technical advantages are preferred in the confectionery and baking industries. Certified, high-purity production is motivated by the sustainability priorities. Manufacturers focus on quality compliance in compliance with the changing consumer demands for natural ingredients.

Value Chain Analysis of the Fructose Market

- Raw Material Procurement: Strategic sourcing of corn, sugarcane, or chicory will achieve consistency in quality and acquisition of suppliers at reasonable costs.

Key players: Archer Daniels Midland (ADM), Cargill, Ingredion - Processing and Preservation: The molecules of fructose are either chemically processed and made stable to maintain the integrity of the shelf life.

Key players: Tate & Lyle, Roquette Frères, Gulshan Polyols Ltd - Quality Testing and Certification: Laboratory testing guarantees food-grade purity and regulatory standards throughout the end-use industries.

Key players: SGS India, Eurofins Scientific, Intertek - Packaging and Branding: Protective packaging helps differentiate and conveys value, quality, and suitability of use.

Key players: Mondi Group, Amcor, Smurfit Kappa, Huhtamaki - Cold Chain Logistics and Storing of Fructose: Chemical stability: This is maintained by the use of temperature-controlled logistics that avoid crystallization during transportation.

Key players: Kloosterboer (now Lineage), Nichirei Logistics, VersaCold

Fructose Market Companies

- MacAndrews and Forbes Inc.: Holds diversified investments in consumer products, gaming, and entertainment via subsidiaries that help in the creation of long-duration value.

- JK Fructose Inc.: Specialises in the production and distribution of industrial sweetening and special formulation fructose of high quality.

- Ajinomoto Co. Inc.: Provides fructose as a part of a larger range of amino acids, seasonings, flavor systems, and functional sweeteners around the world.

Other Major Key Players

- The NutraSweet Co.

- Südzucker AG

- Guilin Layn Natural Ingredients Corp.

- Zhucheng Haotian Pharm Co., Ltd.

- HSWT

- DuPont

- ADM

- Tate & Lyle

- Ingredion Incorporated

- Cargill Incorporated

- Roquette Frères

- PureCircle

Recent Development

- In May 2025, Zabree's launched two new product lines designed to support the digestive system health and hydration needs of children. It also includes digestive care and regularity support products, and a triple-action hydration electrolyte drink.

- In January 2025, Jiva Technologies announced the launch of www.LIV3Health.com a kicking off presale orders for the revolutionary sugarshield supplement. The LIV3 will support weight management by preventing fructose metabolism.

- Tate & Lyle will unveil the VANTAGE sweetener solution design tools in July 2020. It is a set of brand-new, cutting-edge tools for designing sweetener solutions as well as a training programmed for making foods and beverages with less sugar and low-calorie sweeteners.

- Tate & Lyle was purchased by US-based investment firm KPS Capital Partners for $1.3 billion in July 2021. According to the terms of the transaction, Tate & Lyle and KPS Capital Partners will each own 50% of the new company. The newly established company will focus on producing plant-based goods for the industrial and food markets. Tate & Lyle is a UK-based business that manufactures sweeteners and additives for food and beverages.

Segment Covered in the Reports

By Product

- High Fructose Corn Syrup

- Fructose Syrups

- Fructose Solids

By Application

- Dairy Products

- Baked Goods

- Beverages

- Cosmetics And Personal Care

- Sports Nutrition

- Drug Formulations

- Other Applications

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting