Gaskets and Seals Market Size and Forecast 2025 to 2034

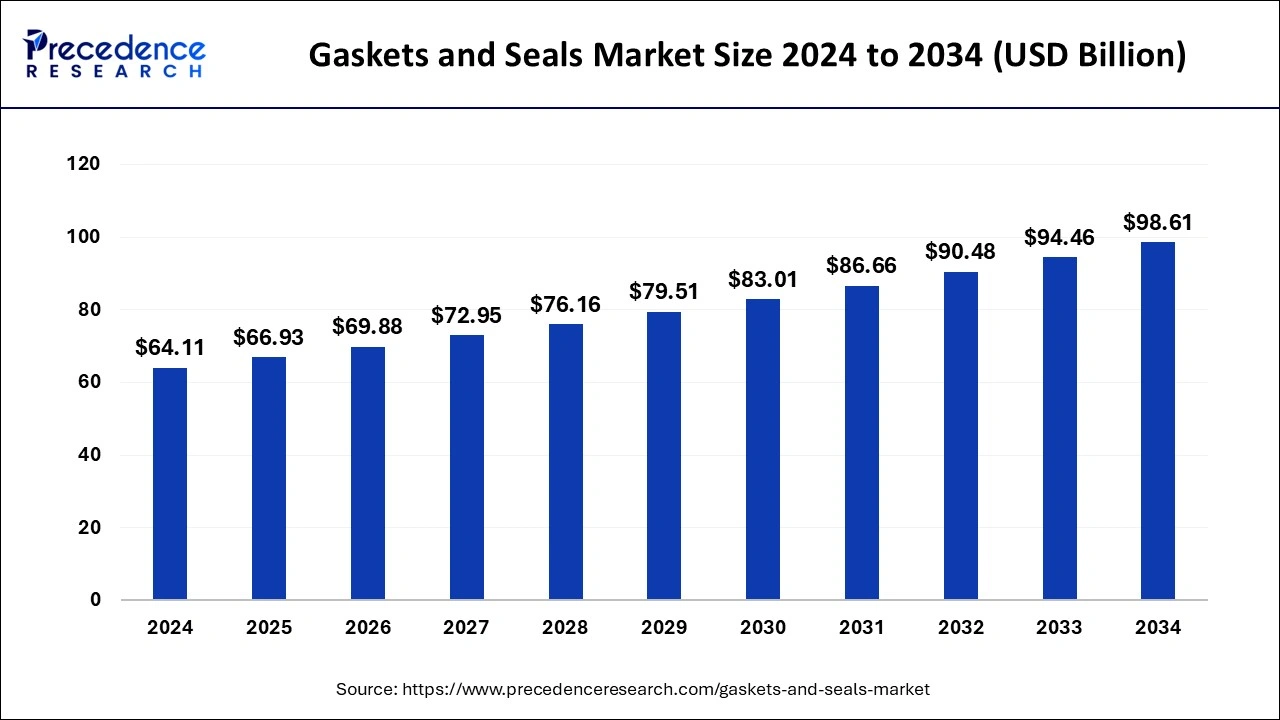

The global gaskets and seals market size was estimated at USD 64.11 billion in 2024 and is anticipated to reach around USD 98.61 billion by 2034, expanding at a CAGR of 4.40% from 2025 to 2034.

Gaskets and Seals Market Key Takeaways

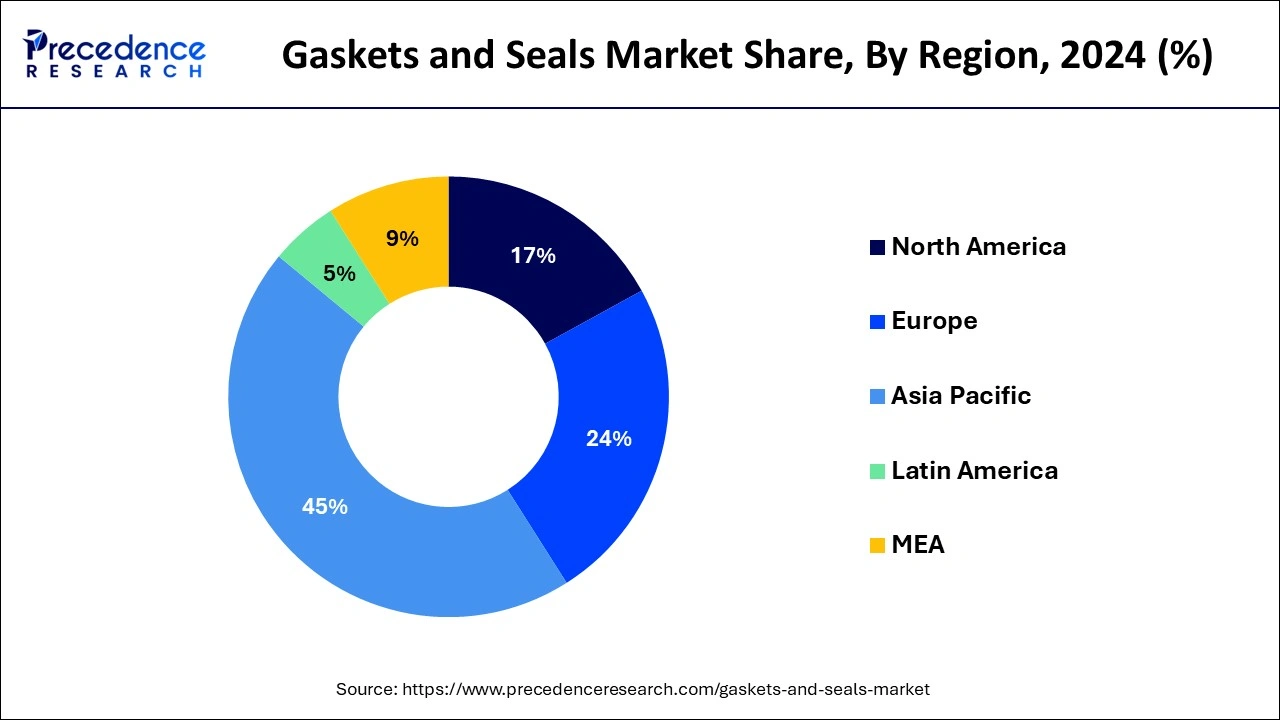

- Asia Pacific dominated the global gaskets and seals market with the largest market share of 45% in 2024.

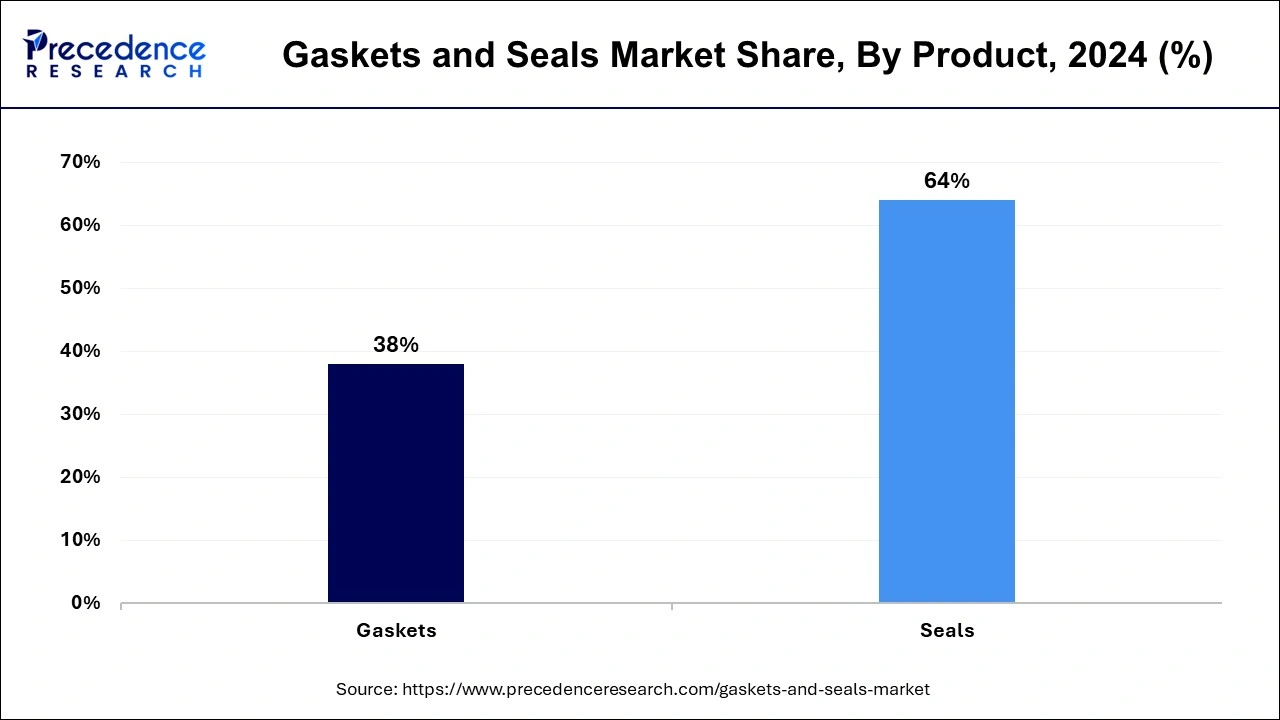

- By product, the seals segment contributed the highest market share of 64% in 2024.

- By product, the gaskets segment is projected to grow at a CAGR of 5% during the forecast period.

- By industry, the automotive segment has held the biggest market share of 35% in 2024.

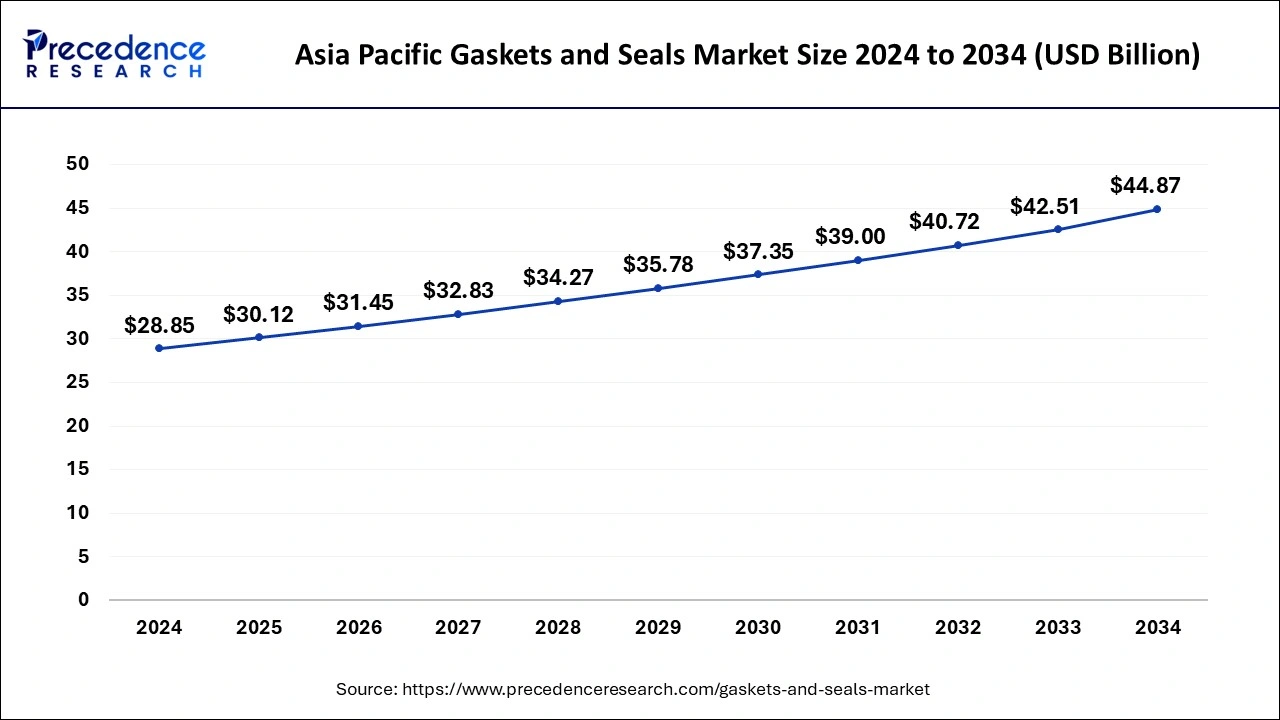

Asia Pacific Gaskets and Seals Market Size and Growth 2025 to 2034

The Asia Pacific gaskets and seals market size was evaluated at USD 28.85 billion in 2024 and is predicted to be worth around USD 44.87 billion by 2034, rising at a CAGR of 4.51% from 2025 to 2034.

Asia Pacific dominated the global gaskets and seals market with the largest market share of 45% in 2024. As this region as is involved in the production of innumerable chemicals. Also, the consumption of the gaskets and seals is increasing in China as well as the other Asia Pacific regions, as the automotive sector in this area is growing. There is a high demand for gaskets and seals as china produce rubber seal products which have high quality raw materials used.

In North America, the gaskets and seals market is dominated by US due to the use of the products in the oil and gas and the automotive industry. Due to the presence of large number of small sized and medium companies that produce low volumes of gaskets and seals, the market in Asia Pacific is also expected to grow due to low manufacturing cost, high consumption volume of gaskets and seal and notable manufacturing base present in this region.

Market Overview

Due to the lockdown during COVID-19 pandemic, there has been a negative impact on this market. As there were social distancing protocols and the production of the gaskets and seals had dropped down due to supply chain issues and a delay in raw materials. There was also a scarcity of the raw materials used in the manufacturing owing to a slow growth of this market. All of these factors have resulted in the reduction of the revenues damaged the industry's economy. The gasket is used in order to retain the seal, which connects two surfaces or two different components. It helps in providing a complete barrier for any kind of leakages. The materials used for manufacturing gaskets are temperature and pressure resistant. The main function of the gaskets and seals is to control pressure apart from preventing the entry of any contaminating particles from the environment. They ensure ultimate safety and performance due to involvement of fuel and gas which is under pressure, while the working of the machines.

Gaskets and Seals Market Growth Factors

The gasket and seals market growth depends on factors such as the adoption rate of electric vehicles in the nations or the increasing electric vehicle infrastructure in developed nations, changes in the raw material prices. Due to rapid technological advancements in the automobile sector and as there is a growing need to improve the fuel efficiency and the performance of the vehicle, this market is expected to grow during the forecast period and these also happens to be the factors for the growth of this market. The use of gaskets and seals has helped with lower vehicle maintenance cost and has also increased the lifespan of the cars or the components of the automobiles. There is a mandate on incorporation of gaskets and seals in vehicles due to stringent emission policies by various nations across the world.

The international oil and gas industry has a huge potential to create a great demand for the industrial equipment, which is projected to drive the market of gaskets and seals. Due to a major increase in the offshore exploration of oil and gas and the related production activities in Asia Pacific region and North American region, the international gaskets and seals market is expected to grow.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD98.61 Billion |

| Market Size in 2025 | USD66.93 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.40% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Industry, Application, Distribution Channel, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Product Insights

On the basis of the type of the product, the market is segmented into gaskets and seals market. The seals market segment is expected to dominate the market globally as they are cost saving component. The seals segment contributed the highest market share of 64% in 2024.

The gaskets are expected to witness a great demand. Due to a demand in heat exchanger systems and pipelines, which are backed by the increasing oil and gas exploration activities. In order to control the fugitive emissions from the industries and the stringent laws by various nations' the gaskets segment is projected to grow at a CAGR of 5% during the forecast period.

Application Insights

The market for gaskets and seals can be segmented into pressure vessels, manhole covers, heat exchangers, valve bonnets, pipe flanges. As the heat exchangers help to maintain the pressure of the engine this sub segment has a larger market share. The application in electronics is expected to have a faster growth during the forecast period as there is an increase in demand for the electronic items.

Distribution Channel Insights

The sub segments of the distribution channel are original equipment manufacturers or the aftermarket. The original equipment manufacturers sub segment is expected to dominate the market globally as they are engaged in bulk manufacturing of the seals as well as the gaskets. The OEM segment was accounted 61% revenue share of the overall revenue in 2024.

Industry Insights

The automotive segment has held the biggest market share of 35% in 2024.The automotive segment is expected to dominate the market globally out of all the other industries. As there are several types of fluids and lubricants that are used in the engine the seals and gaskets come into play and therefore the automotive sector is expected to have the largest share during the forecasted period. For superior performance in the subsea oil discoveries a robust growth in the seals market is expected.

Due to a growth in the manufacturing sector and the automobiles in Asia Pacific region and due to stringent government policies, it is expected to have a good demand for OEM in manufacturing industries. Gaskets and seals are important components of the maintenance and repair of the manufacturing machines, the gaskets and seals are replaced each time there is a change in the gases and fluids of the machines.

Gaskets and Seals Market Companies

- SKF

- Freudenberg FST Gmb

- BRUS sealing systems GmbH

- Garlock family of companies

- SSP Manufacturing Inc.

- W.L Gore and associates

- IDT And AJ, rubber and sponge limited

- Trelleborg AB.

Recent Developments

- In order to strengthen the competitiveness in North America, in September 2020, SKF had decided to invest 550,000,000 in Sealing technologies in 2019.

- In order to enhance the gas sealing capability and to also enhance the engine efficiency by increasing the robustness and lowering the emissions, in May 2018, Federal Mogul Powertrain developed a piston ring E line for commercial vehicle diesel engines.

- In order to increase the safety and performance requirements in the aerospace industry a new material was introduced by Freudenberg sealing Technologies in 2019.

- In order to prevent the bearing damage and creating an electrical connection between housing and chefs, Freudenberger sealing technologies has developed a new conductive seal in the year 2019.

- In order to develop and supply diamond coated hard faces for the mechanical seals, Flowserve Corp signed an agreement with advanced Diamond Technologies Inc in the year 2013.

Segments covered in the report.

By Product

- Gaskets

- Metallic

- Semi-metallic

- Non-metallic

- Seals

- Shaft Seal

- Molded Packing & Seals

- Motor Vehicle Body Seal

- Others

By Application

- Pressure vessels

- Heat exchangers

- Manhole covers

- Valve bonnets

- Pipe flanges

By Distribution Channel

- Original equipment manufacturer (OEM)

- Aftermarket

By Industry

- Oil and gas

- Electricals

- Automotive

- Aerospace

- Marine and rail

- Paper and pulp industry

- Industrial manufacturing

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting