What is Industrial Seals Market Size?

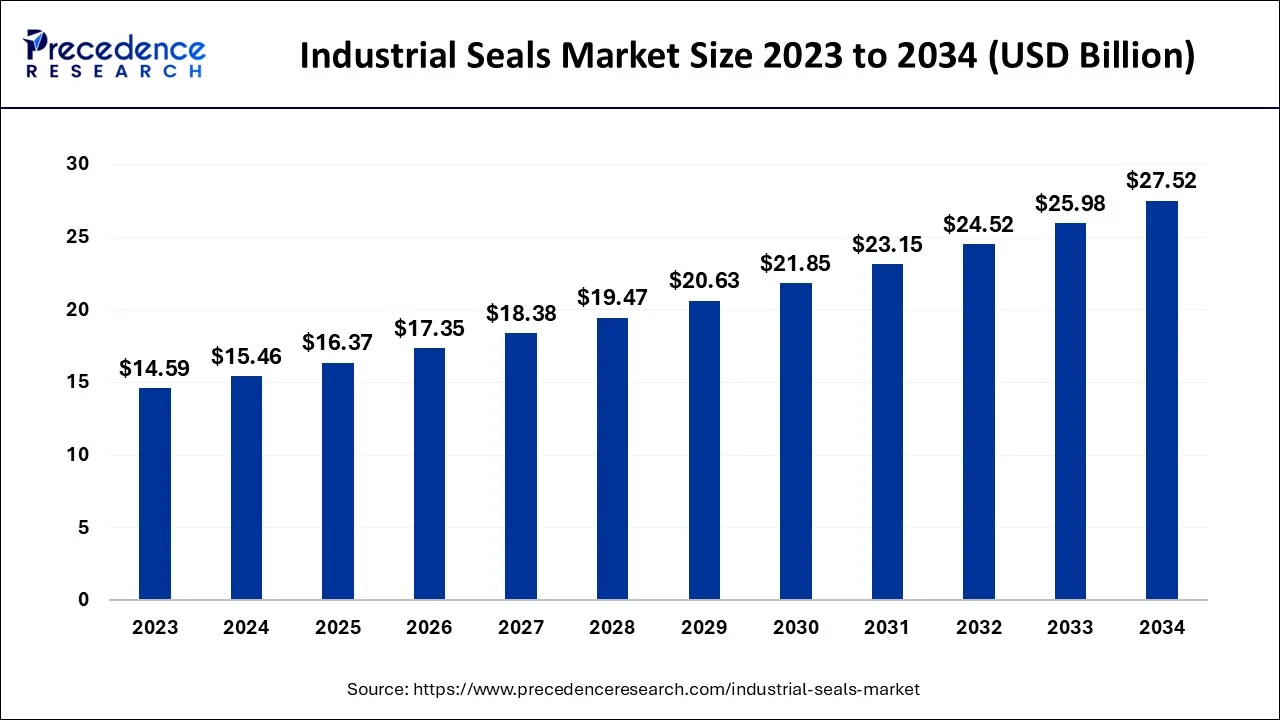

The global industrial seals market size accounted for USD 16.37 billion in 2025 and is anticipated to reach around USD 29.00 billion by 2035, expanding at a CAGR of 5.89% between 2026 and 2035.

Market Highlights

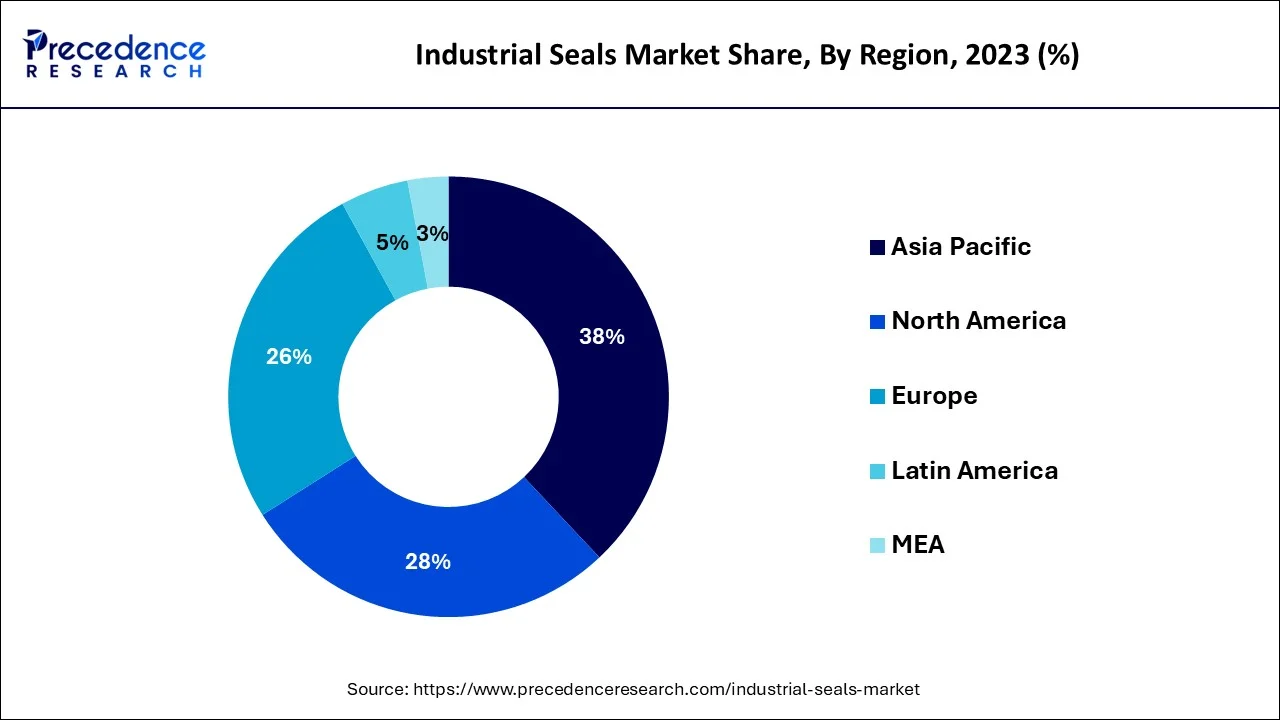

- Asia Pacific region is predicted to lead the global market from 2026 to 2035

- North America is expected to hold a substantial market share from2026 to 2035

- By Type, the radial seals segment is expected to register the biggest revenue share between 2026 to 2035

- By Material, the PTFE segment is projected to hold the highest market share between 2026 to 2035

- By End User, the food & beverage segment held the greatest revenue share and is expected to continue the same pattern from 2026 to 2035

Strategic Overview of the Global Industrial Seals Industry

Industrial seals are devices used to prevent the leakage of fluids, gases, or contaminants in various industrial applications. They are designed to create a barrier between two or more surfaces, such as between two machine parts or between a rotating shaft and its housing, to ensure proper functioning and prevent any loss or contamination of the substances being contained. Seals are typically made from materials that exhibit resistance to the specific substances they will come into contact with, such as rubber, metal, or synthetic materials like PTFE (Polytetrafluoroethylene).

The choice of material depends on factors such as the type of fluid or gas being sealed, the operating temperature and pressure, and the environmental conditions of the application. There is a different types of seals used in various industries including O-rings, gaskets, mechanical seals, leap seals and others. The industrial seal market is being driven by various factors such as the growing power industry, increasing product launches, the rising automotive industry, increasing technological advancements and the growing food & beverages industry.

- According to the statistics by Enerdata, the BRICS countries, where electricity consumption increased noticeably, especially in China (+9.7%), India (+4.8%), Russia (+6.4%), and Brazil (+9.5%), were the driving force behind the growth in global power generation (+8.5% in 2021, 10% above their 2019 level). In China, the majority of the increase in power generation came from coal, wind, and solar energy.

- According to the Federal Chamber of Automotive Industries, the number of cars shipped by the Australian automotive sector in April 2023 was 82,137, a 1.3% rise over the same month in 2022. Sales of electric cars increased to 8% in April 2023 from 1.1% in the same month last year.

Artificial Intelligence: The Next Growth Catalyst in Industrial Seals

Artificial Intelligenceis transforming the industrial seals industry by enabling smarter manufacturing, predictive maintenance, and enhanced product design through the integration of data analytics, IoT, and machine learning. AI algorithms analyze vast datasets from sensor-integrated smart seals to monitor performance in real-time, predict potential failures before they occur, and optimize maintenance schedules, which significantly reduces unplanned downtime and operational costs.

Market Outlook

- Market Growth Overview: The industrial seals market is expected to grow significantly between 2025 and 2034, driven by industrial automation and Industry 4.0, growth in conventional and electric vehicles, and infrastructure developments.

- Sustainability Trends: Sustainability trends involve material innovation, eco-friendly manufacturing, and smart scale digitalization.

- Major Investors: Major investors in the market include SKF Group, Freudenberg Group, Parker Hannifin Corporation, and John Crane.

- Startup Economy: The startup economy is focused on smart seals and IoT integration, e-commerce and direct sales models, and sustainable solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 16.37 Billion |

| Market Size in 2026 | USD 17.35 Billion |

| Market Size by 2035 | USD 29.00Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.89% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Material, and By End User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing industrialization

The increasing industrialization and infrastructure development across various regions are driving the demand for industrial seals. As more industries are being established and existing facilities are expanding, there is a greater need for reliable sealing solutions to prevent leaks and ensure the smooth operation of machinery and equipment. For instance, according to United Nations Sustainable Development Goals Report 2022, in 2021, the number of manufactured goods produced worldwide increased by 7.2% and surpassed its pre-pandemic level. Global manufacturing value added climbed from 16.2% in 2015 to 16.9% in 2021 as a percentage of total GDP. Thus, the growing industrialization across the globe is expected to drive the growth of the market during the forecast period.

Restraints

Technological complexity

Industrial seals need to meet stringent performance requirements and operate in diverse and challenging environments and operate in diverse and challenging environments. Designing and manufacturing seals that can withstand high pressures, extreme temperatures, corrosive chemicals, and other demanding conditions can be technologically complex. Developing and producing specialized seals may require substantial research and development investments, limiting the entry of new players and increasing the barriers to innovation.

Opportunities

Technological advancements

The continuous advancements in materials science, manufacturing processes, and seal designs offer opportunities for innovation and improvements in industrial seals. The development of new materials with enhanced properties, such as better resistance to extreme temperatures, chemicals, and wear, opens up new applications and markets. Innovative seal designs that provide superior performance and durability can also gain a competitive advantage. For instance, in July 2022, wheel seals from the Endurance Series have been introduced for commercial vehicles by Amsted Seals, the global leader in wheel-end and sealing solutions. The seal has a special rubber bumper design that gives them a longer service life even under the most adverse conditions. Thus, these type of innovative product launches in the market is expected to offer a lucrative opportunity for market growth over the forecast period.

Segment Insights

Type Insights

Based on the type, the global industrial seal market is segmented into axial seals, radial seals and mechanical seals. The radial seals segment is expected to capture the largest revenue share over the forecast period. The growth in the segment is attributed to the wide range of applications of radial seals in various industries including automotive, industrial machinery, aerospace and power generation. Moreover, the growth of this segment is driven by factors such as increased investment in infrastructure projects, rising demand for energy-efficient machinery, and the need for reliable sealing solutions in numerous industries. Additionally, the focus on minimizing environmental impact and compliance with regulations drives the demand for seals that offer low friction, reduced emissions, and sustainable performance.

On the other hand, mechanical seals are expected to grow significantly during the forecast period because they are suitable for a range of applications, mechanical seals are the favored sealing technology for most pump manufacturers. Additionally, the benefits offered by these seals such as reduced friction and loss of power, zero product leakage, elimination of excessive wear and others propels the market segment expansion.

Material Insights

Based on the material, the global industrial seal market is segmented into Fiber, Fluorosilicone, PTFE, Rubber and Others. The PTFE segment is expected to hold the largest market share during the forecast period. The growth in the segment is attributed to its advantages such as chemical resistance, low friction, wide temperature range and non-stick characteristics. Moreover, the growing usage of PTFE seals in the food & beverages industry is expected to propel the market growth during the forecast period. These seals are employed in food & beverage processing equipment, ensuring the hygienic and leak-free operation of pumps, mixers, valves, and other components.

They offer compliance with food safety regulations and resistance to food ingredients and cleaning agents. Furthermore, the increasing utilization of PTFE seals in the pharmaceutical and medical industry is expected to fuel the segment expansion. These seals are utilized in pharmaceutical and medical applications, such as pharmaceutical processing equipment,medical devices, and laboratory instruments. They offer compatibility with a variety of drugs and fluids and meet stringent quality and regulatory requirements. Thus, the increasing use of PTFE seals in different industries for specific requirements is expected to drive market growth over the forecast period.

End User Insights

Based on the end user, the global industrial seals market is divided into food & beverage, mining, oil & gas, energy & power, aerospace, marine, construction and others. The food & beverage segment held the largest revenue share and is expected to continue the same pattern during the forecast period. The segment growth is driven by the increasing food & beverage production, stringent hygiene and safety regulations and the growing demand for reliable sealing solutions in various processing and packaging applications.

Regional Insights

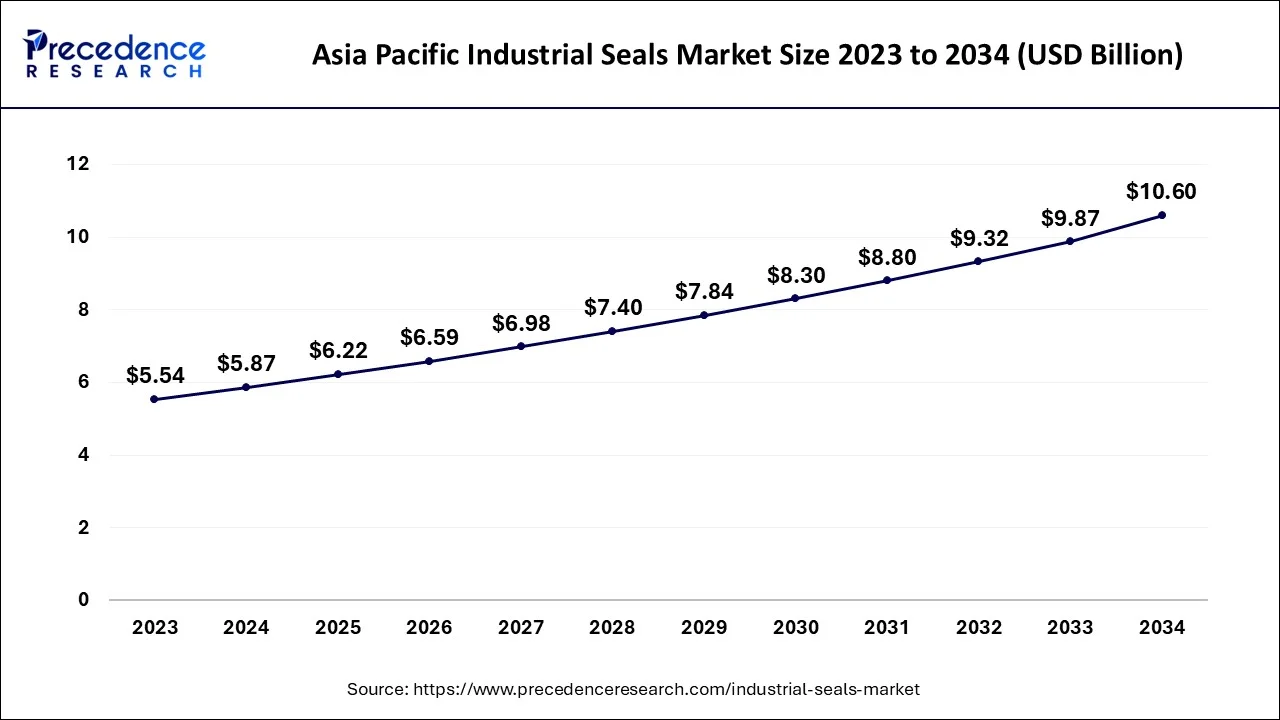

Asia Pacific Industrial Seals Market Size and Growth 2026 to 2035

The Asia Pacific industrial seals market size is estimated at USD 6.22 billion in 2025 and is predicted to be worth around USD 11.21 billion by 2035, growing at a CAGR of 6.07% from 2026 to 2035

The Asia Pacific is expected to dominate the market during the forecast period.The market size is driven by the presence of major industries, such as manufacturing, automotive, chemical processing, oil and gas, and food and beverage, which require a wide range of sealing solutions. The region's rapid industrialization, economic growth, and increasing investments in infrastructure projects contribute to the growth of the industrial seal market. For instance, for the development of transportation infrastructure, China aimed to construct a 15-year plan in 2021. The nation intends to increase the size of its high-speed rail network by 2035.

Additionally, Beijing intends to increase the length of the country's high-speed rail network by more than 84% from 2020 to 70,000 km (43,500 miles) by 2035. The plan includes requiring the construction of a 25,000 km network of excellent inland waterways, a 460,000 km network of national expressways, and regular highways. The railroad network in China working length, however, expanded to 150,000 km in 2021, up 2.5% from the previous year. Thus, the growing infrastructural projects in the region drive the growth of the industrial seals market over the forecast period.

North America is expected to hold a substantial market share over the forecast period.The market size is influenced by the presence of various industries, including manufacturing, oil and gas, chemicals, automotive, and pharmaceuticals, which have a significant demand for sealing solutions. The region's focus on advanced technology, innovation, and stringent safety regulations drives the growth of the market. The North American region is known for its significant presence in the oil and gas industry, particularly in the United States and Canada. This industry demands high-performance industrial seals for critical applications, including pumps, compressors, valves, pipelines, and refineries.

The exploration and production activities, as well as the shale gas boom, drive the demand for reliable sealing solutions in this sector. For instance, according to the Monthly Crude Oil and Natural Gas Production report, U.S. crude oil output increased by 5.6%, or 0.6 million barrels per day (b/d), from 2021 to 2022, averaging 11.9 million b/d. Texas and New Mexico, the two states that make up the Permian Basin, contributed most to the increase in U.S. crude oil output in 2022. Therefore, driving regional growth.

China Industrial Seals Market Trends

China's industrial expansion in machinery, oil & gas, construction, and petrochemicals fuels the demand. Rising infrastructure and urbanization, strong domestic production, and EV growth increased the need for seals in powertrain, chassis, and interiors.

U.S. Industrial Seals Market Trend

U.S. rising usage in engines, powertrains, and interiors; also sees demand for lightweight, composite seals. Growing use of engineered plastics and customizable elastomers for better resistance to chemicals, oil, and extreme temperatures.

How Did Europe Notably Grow in the Industrial Sectors Market?

With Europe's surge in high-performance EVs and aerospace expansion, the sealing industry is pivoting toward specialized materials capable of withstanding extreme operational environments. Stricter global sustainability mandates and the rise of industrial automation further necessitate high-precision, leak-proof solutions to minimize emissions and enhance machinery longevity.

Germany Industrial Seals Market Trend

Germaine's rising focus on manufacturing and automation, shift towards automotive, and growing emphasis on eco-friendly materials and green manufacturing align with stricter EU regulations.

Value Chain Analysis of the Industrial Seals Market

- Raw Material Sourcing/Inbound Logistics

This initial stage involves procuring the basic materials, such as metal, rubber (fluoroelastomers, EPDM, HNBR), and plastics (PTFE), necessary for seal production.Key Players: E. I. du Pont de Nemours and Company, Solvay S.A., 3M Company, and Saint-Gobain S.A. - Operations/Manufacturing

During this stage, raw materials are transformed into finished industrial seals (e.g., O-rings, mechanical seals, lip seals) through processes like molding, machining, and assembly. Key Players: Freudenberg Group, SKF Group, John Crane (Smiths Group plc), Trelleborg Sealing Solutions, and Parker Hannifin Corporation. - Outbound Logistics/Distribution

This stage focuses on storing and efficiently moving the final products from manufacturing plants to distributors, original equipment manufacturers (OEMs), and end-user facilities. Key Players: ERIKS Group (SHV), Dichtomatik

Top Companies in the Industrial Seals Market & Their Offerings

- Tuck's Industrial Packings and Seals Pty Ltd:This Australian-based manufacturer specializes in custom gaskets, pump and valve packings, and mechanical seals for power generation and chemical industries.

- Seal Innovations: A leading Australia-New Zealand joint venture, they serve as a premium supplier of high-quality sealing equipment by importing and distributing locally and globally manufactured products.

- Flexaseal Engineered Seals and Systems, LLC: Flexaseal specializes in custom-engineered mechanical seals and support systems, notably for the oil and gas and pharmaceutical sectors.

- Industrial Seals: This US-based firm provides essential sealing solutions for a wide range of industrial machinery, focusing on reliability in rotating equipment.

- SSP Manufacturing Inc.: SSP is a pioneer in using 3D printing for rapid seal prototyping, significantly reducing waste and production costs for high-performance O-rings.

- Yoson Seals: Based in China, Yoson Seals is a key contributor to the global supply chain, manufacturing high-volume mechanical and radial seals for various industries.

- Stein Seal: Stein Seal specializes in the design and manufacture of precision seals for the aerospace and defense sectors, including high-speed shaft seals.

- Chesterton Customseal: Chesterton is a leading provider of high-performance stationary and rotating sealing solutions designed to improve plant reliability and reduce total cost of ownership.

- Systemseals: Systemseals provides specialized engineering and manufacturing of high-performance seals, focusing on custom solutions for heavy-duty industrial applications.

Industrial Seals Market Companies

- Tuck's Industrial Packings and Seals Pty Ltd

- Seal Innovations

- Flexaseal Engineered Seals and Systems, LLC

- Industrial Seals

- SSP Manufacturing Inc.

- Yoson Seals

- Stein Seal

- Chesterton Customseal

- Systemseals

- Renseal

- Trelleborg Group

- ERIKS Seals and Plastics, Inc.

- Tenneco Inc.

- Flowserve Corporation

- Technetics Group

- SKF

- JK Fenner

- InproSeal

- Freudenberg FST GmbH

Recent Development

- In October 2025, Freudenberg & Hydrogenious LOHC partnership focused on developing specialized gaskets and seals for Liquid Organic Hydrogen Carrier (LOHC) systems, a critical infrastructure for global hydrogen transport.

- In April 2023, the Type SB2/SB2A USP seal was introduced by John Crane, a pioneer in rotating equipment solutions and a provider of engineered technologies and services to process industries. It combines the Type SB2/SB2A heavy-duty twin cartridge seal with their proprietary Upstream Pumping (USP) technology. The Type SB2/SB2A from John Crane, which is known for its great performance, is now included in the company's current USP product line, increasing service in the pulp & paper and mining sectors.

- In October 2022, the beginning of the Tran-Secure Fluid Sealing Management Program was announced by Trelleborg Sealing Solutions. With the help of Trelleborg's Tran-Secure Program, essential parts for railcar maintenance and repair are immediately available to the chemical transportation sector in America. The Tran-Secure program is supported by Trelleborg's worldwide resources, local assistance, and unmatched material research. It consists of high-performance engineering solutions, such as manway and flat gasket, O-Rings, and Valve repair kits. To maximize seal life and save maintenance and downtime, consumers obtain the appropriate seal for their tank car regardless of the product being transported.

- In February 2023, through its subsidiary Momentum Industrial, Momentum Group entered into a contract to buy all of the outstanding shares of LocTech AB. The purchase of LocTech, a complete provider of seals for rotational and stationary applications, improves Momentum Industrial's position in the market.

Segments Covered in the Report

By Type

- Axial Seals

- Radial Seals

- Mechanical Seals

By Material

- Fiber

- Fluorosilicone

- PTFE

- Rubber

- Others

By End User

- Food & Beverage

- Mining

- Oil & Gas

- Energy & Power

- Aerospace

- Marine

- Construction

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content