Geriatric Medicines Market Size and Forecast 2025 to 2034

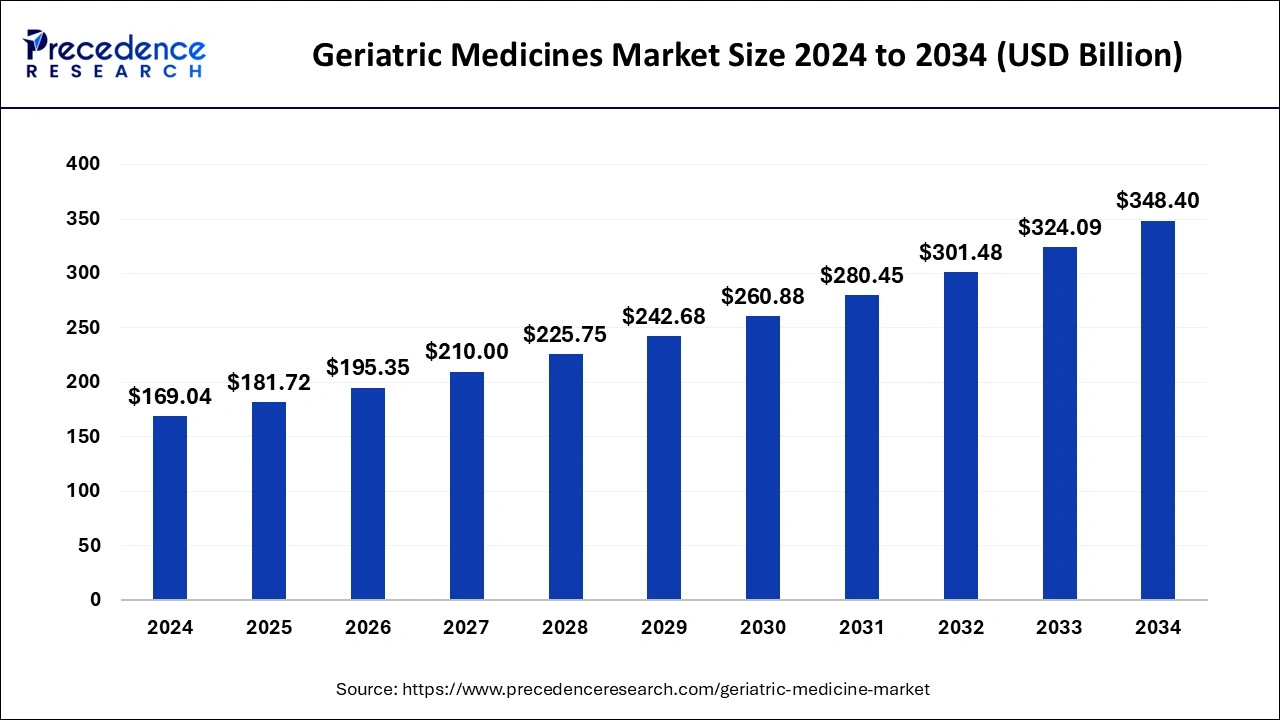

The global geriatric medicines market size was estimated at USD 169.04 billion in 2024 and is anticipated to reach around USD 348.40 billion by 2034, expanding at a CAGR of 7.50% from 2025 to 2034. The rising initiatives taken by the governments around the world is helping in increasing the demand for geriatric medicines market in the forecast period.

Geriatric Medicines Market Key Takeaways

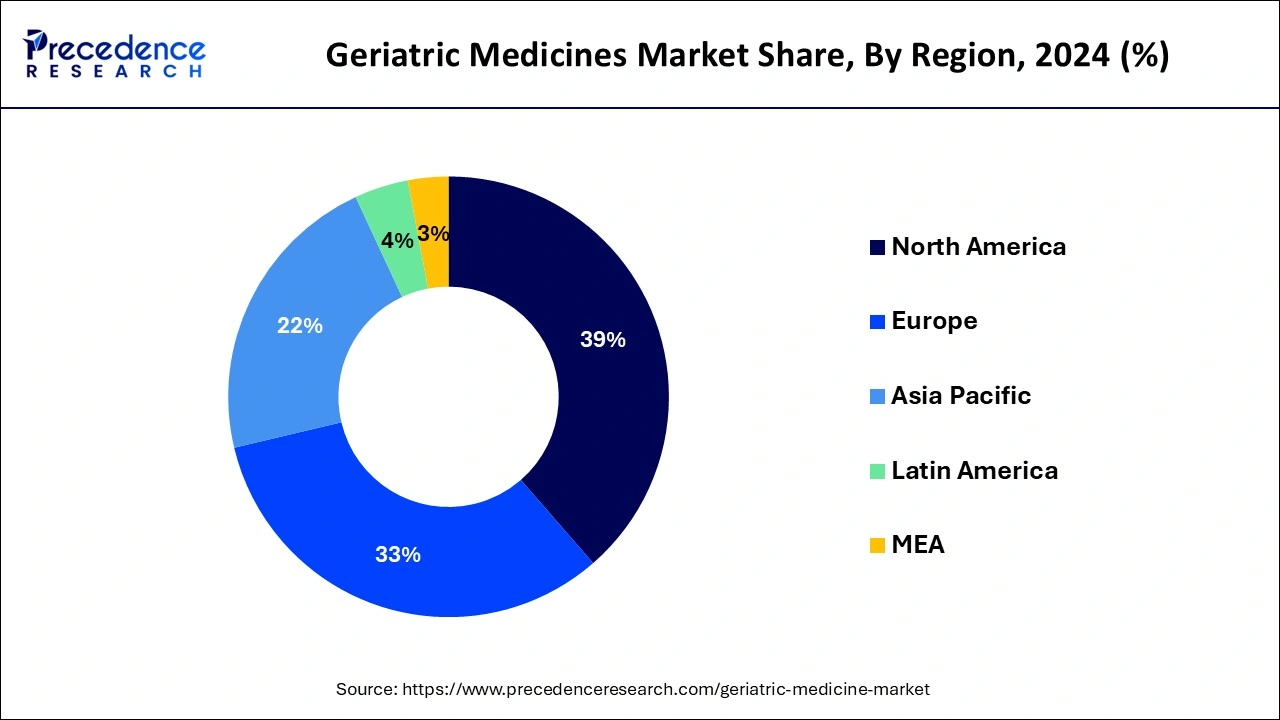

- North America dominated the global geriatric medicines market with the largest market share of 39% in 2024.

- Asia Pacific is expected to expand at a solid CAGR OF 9.11% during the forecast period.

- By distribution channels, the hospital pharmacies segment contributed the highest market share of 43% in 2024.

- By distribution channels, the online pharmacies segment is projected to grow at a notable CAGR of 9.12% during the forecast period.

- By therapeutics , the antihypertensive segment has held the major market share of 22% in 2024.

- By condition, the cardiovascular segment accounted for the highest market share of 34% in 2024.

Role of Artificial Intelligence in Drug Formulation

Artificial Intelligence (AI) has already proved itself in the healthcare and pharmaceuticals industry with its wide spread application across different process. AI can benefit the geriatric medicines industry. AI technology has taken incredible strides when in comes to predictive analysis and diagnostics for the elderly population. For example, an AI algorithm in Stanford Hospital, assess mortality risk. This algorithm is a combination of AI and machine learning (ML). The deep learning algorithm was run on 2 million patient records and flagged patients with 75% or higher risk of dying in 3 to 12 months. Such information can help the medical professions to come up and begin a treatment plan. AI driven tools have proven to be extremely useful in detection and diagnostics of chronic diseases like cancer in the radiology department. The utilization of AI in the geriatric medicines market will further aid its growth in the coming years.

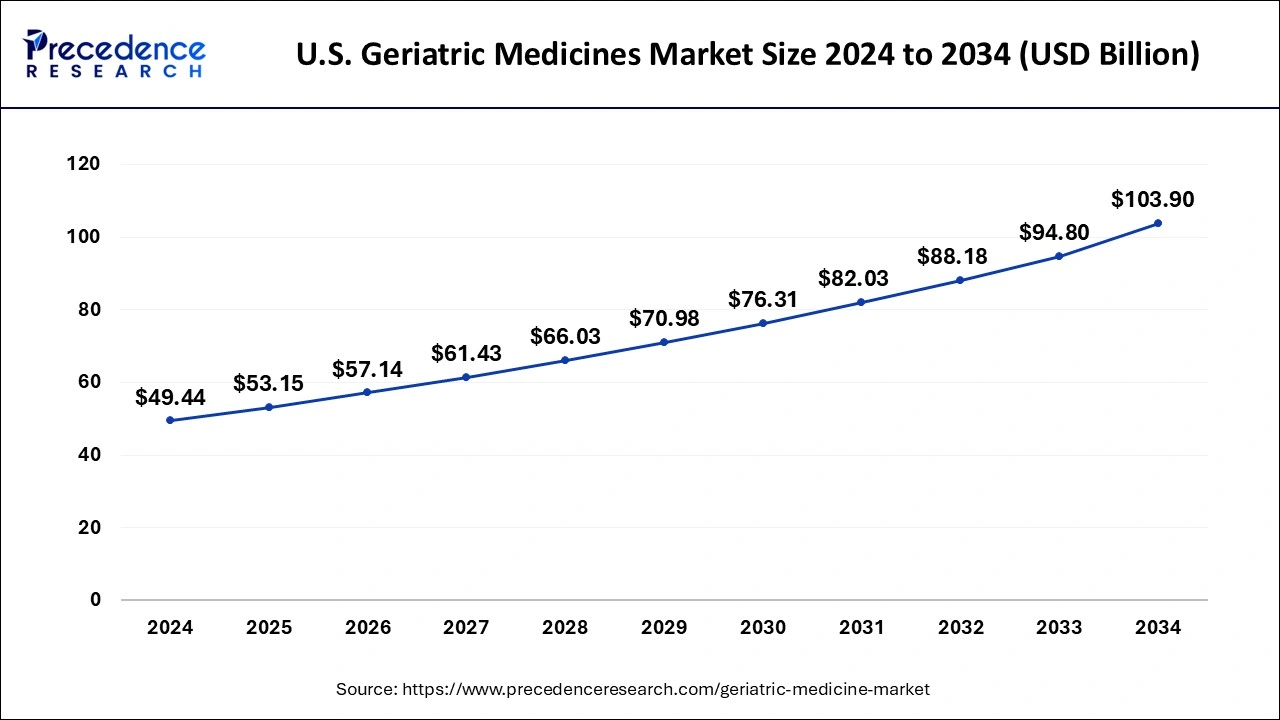

U.S. Geriatric Medicines Market Size and Growth 2025 to 2034

The U.S. geriatric medicines market size was evaluated at USD 49.44 billion in 2024 and is predicted to be worth around USD 103.90 billion by 2034, rising at a CAGR of 7.70% from 2025 to 2034.

North America dominated the global geriatric medicines market with the largest market share of 39% in 2024. The geriatric medicines market is growing due to rising incidence of chronic disorders which include cancer and diabetes. As per the International Diabetes Federation, approximately 48 million adults in North America have diabetes in 2019, with more than half of these patients being over the age of 65. This trend is expected to continue in the coming years, resulting in increased need for geriatric specific treatments, which will drive the geriatric medicines market in the North America region.

Asia Pacific is expected to expand at a solid CAGR OF 9.11% during the forecast period. The countries such as India, Japan, and China are holds largest share in the Asia-Pacific geriatric medicines market. The factors such as launch of generic medicines, rising disposable income, and expansion of healthcare industry are driving the growth of geriatric medicines market in the region. The growing trend of medical tourismis also creating growth prospects for Asia-Pacific geriatric medicines market.

Market Overview

The growing number of geriatric populations across the world combined with prevalence of ailments in them like cardiovascular issues, high blood pressure, diabetes, neurological disorders etc., is creating a need for geriatric medicine. The investment and expansion of medical and infrastructure is taking place across the world. The governments are focusing on developing and improving infrastructure for medical and healthcare facilities. Countries are putting in place plans that are specifically formulated to cater to the growing geriatric population. Such factors have boosted the demand for the geriatric medicines market in the recent years.

The geriatric population relies on medicines of some kind to keep them healthy, that also has side effects in the long run. Many initiatives and policies are being put in place to offer the geriatric populations easily available, affordable, quality medicines and care services to keep them healthy and comfortable. The ongoing technological advancements are improving the quality of health services available for the elderly population. All these factors will continue helping with the growth of geriatric medicines market during the forecast period.

Geriatric Medicines Market Growth Factors

- One of the key factors driving the growth of global geriatric medicines market is the growing population of geriatrics all around the world. As per the UN data from the World Population Prospects, the number of individuals over the age of 65 is expected to rise from 9% in 2019 to more than 16% by 2050.

- Another factor propelling the expansion of global geriatric medicines market is growing prevalence of stroke among geriatric population.

- In addition, the growing government initiatives are also boosting the growth of worldwide geriatric medicines market. Moreover, government agencies and public companies are highly investing and providing insurance policies to the consumers.

- The government is also providing tax benefits to the manufacturers of geriatric medicines. Those benefits are incentives and subsidies.

- The major market players are adopting strategies such as joint venture, partnership, product launch, business expansion, merger, and acquisition.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 181.72 Billion |

| Market Size by 2034 | USD 348.40 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.50% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapeutics, Condition, Distribution Channels, Route of Administration, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing geriatric population and prevalence of chronic diseases

The lifespan of people has continued to increase all over the world due to advancements in healthcare and technological developments. This has led to a growing number of elderly population that is aged above 65 years. The rise in geriatric population has led to a rising susceptibility of chronic diseases amongst the aged population. Cardiovascular issues, diabetes, blood pressure, neurological problems etc., are becoming more and more prevalent amongst the population. This has created a necessity to develop medicines that are suitable specially for the elderly and their health issues. The geriatric medicines market is anticipated to keep growing as the geriatric population continues to grow worldwide.

Restraint

Cost of drug development

The geriatric medicines market is facing some challenges that are creating issues for the industries as of now. The rising number of geriatric population and issues faced by the them is prompting extensive research and development activities in order to find innovative and effective treatments. Although the costs of developing and bringing a new drug into the market remains high. The geriatric population is generally on medicines for multiple issues at the same time, which causes a problem. The testing of these drugs along with finding a way to manage side effects is a high-cost process. The regulations of drug development for the elderly population are strict leading to compliances to follow for clinical trials.

Opportunity

Customized medicines

The requirement of multiple type of medicines to tackle different issues in the geriatric population is becoming a norm. There is extensive research and development on ongoing by the key players in regard to geriatric medicines. An opportunity to customize and personalize medicines that suit the varying needs of an individual is a promising potential. Different combinations can be worked on to help treat ageing population that is customized to suit their health requirements. The drugs tailored to address individual health concerns offers an innovative and lucrative opportunity for the geriatric medicine market.

Therapeutics Insights

The antihypertensive segment has held the major market share of 22% in 2024.The demand for analgesics is growing due to the surge in number of pain related disorders among old people. The bones of geriatric people are quite weak as compared to young population. The other factors driving the growth of analgesics segment is the growing drugs and medicines sales through over the counter (OTC) platforms and sales of prescription drugs.

The antidiabetic segment is expected to witness strong growth during forecast period. Diabetes affects a large percentage of the elderly. Around 20% of the population is affected by this disease by the age of 75. Diabetes in senior persons has a different metabolic profile than diabetes in younger patients, necessitating a different strategy to treatment. Due to all these factors, the antidiabetic segment is expanding at a rapid pace.

Condition Insights

The cardiovascular segment dominated the geriatric medicines market in 2024. Cardiovascular disorders are more common in the elderly and those over the age of 65. In geriatric population, age is an individual cause of cardiovascular diseases, although other variables such as obesity and diabetes augment these risks. These factors have been shown to adversely affect and worsen cardiac risk factors linked to old age.

The cancer segment is projected to hit remarkable growth from 2025 to 2034. Cancer risk rises rapidly with the age, without a fact. People aged 65 and up account for almost 60% of all cancer cases. In addition, this stage accounts roughly 70% of cancer related mortality. As a result, cancer is an old age disorder. Given the rise in cancer incidence and standard of living among the senior population, a unique approach to the treatment and longevity of geriatric cancer patients is required.

Geriatric Medicines Market Companies

- GlaxoSmithKline PLC

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Bristol-Myers Squibb Company

- Boehringer Ingelheim GmbH

- Merck & Company Inc.

- Abbott Laboratories Inc.

- Eli Lilly & Company

- AstraZeneca PLC

Recent Developments

- In September 2024, IMS-BHU fast tracked the construction of the third National Center of Ageing in India. The work for the 200-bed facility began in February of 2024 and now, has been fast tracked.

- In September 2024, a $5 million grant has expanded the access to geriatric care for the elderly population in the eastern part of Pennsylvania, U.S.

- In July 2024, a new ward that been specially designed for patients suffering from dementia opened at the Nottingham Hospital, UK. This £9.8m valued geriatric assessment unit opened at the Queen Medical Center (QMC) on 18th of July.

Segments Covered in the Report

By Therapeutics

- Analgesic

- Antihypertensive

- Statins

- Antidiabetic

- PPI

- Anticoagulant

- Antipsychotic

- Others

By Condition

- Cardiovascular

- Arthritis

- Neurological

- Cancer

- Osteoporosis

- Respiratory

- Others

By Distribution Channels

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

By Route of Administration

- Oral

- Parenteral

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting