Atrial Fibrillation Devices Market Size and Forecast 2025 to 2034

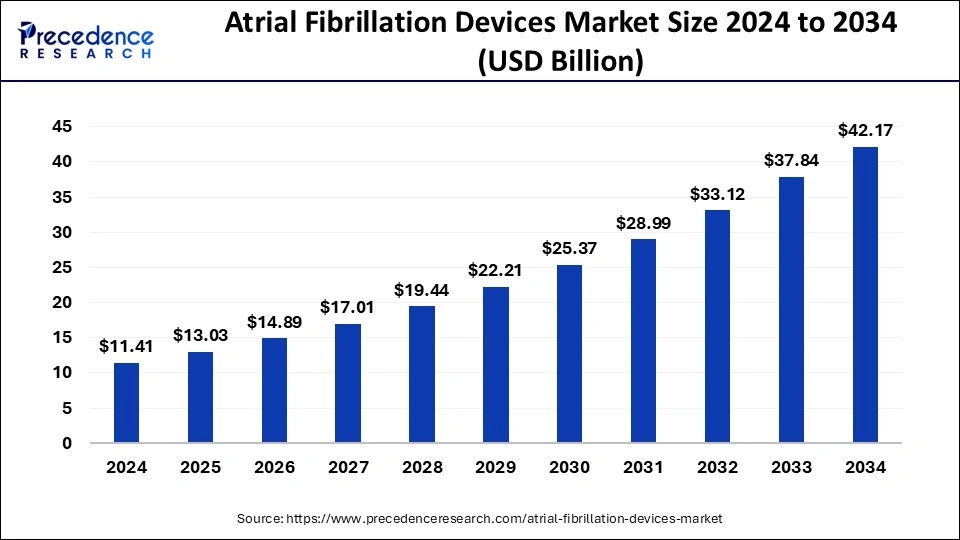

The global atrial fibrillation devices market size was estimated at USD 11.41 billion in 2024 and is predicted to increase from USD 13.03 billion in 2025 to approximately USD 42.17 billion by 2034, expanding at a CAGR of 13.97% from 2025 to 2034. The atrial fibrillation devices market is driven by the growing number of elderly people.

Atrial Fibrillation Devices MarketKey Takeaways

- The global atrial fibrillation devices market was valued at USD 11.41 billion in 2024.

- It is projected to reach USD 42.17 billion by 2034.

- The atrial fibrillation devices market is expected to grow at a CAGR of 13.97% from 2025 to 2034.

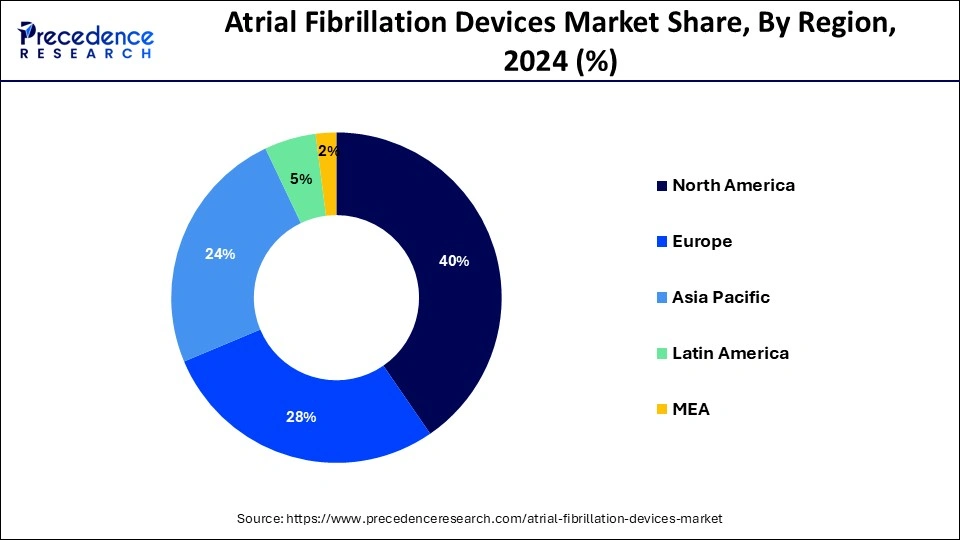

- North America dominated the market share of 40% in 2024.

- By product, the EP ablation catheters segment dominated the atrial fibrillation devices market in 20244.

- By end-use, the hospitals segment dominated the market in 2024.

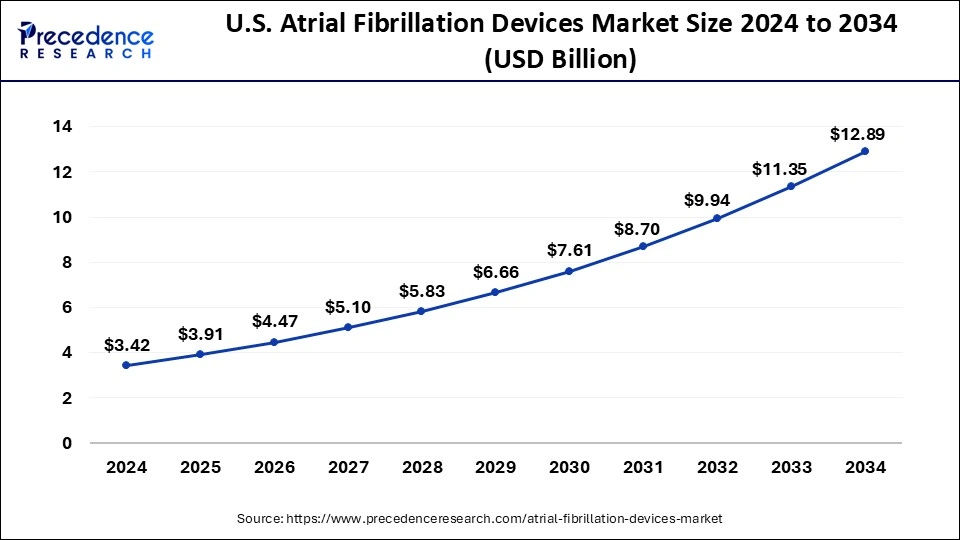

U.S.Atrial Fibrillation Devices Market Size and Growth 2025 to 2034

The U.S. atrial fibrillation devices market size was exhibited at USD 3.42 billion in 2024 and is projected to be worth around USD 12.89 billion by 2034, growing at a CAGR of 14.19%.

North America held the largest market share of 40% in 2024, the region is observed to sustain the growth rate during the forecast period. A frequent heart arrhythmia that affects millions of people worldwide is atrial fibrillation. Atrial fibrillation has become more common in North America due to aging population, changing lifestyles, obesity rates, and an increase in the frequency of chronic illnesses, including diabetes and hypertension. The demand for AF devices in the area has surged due to its increasing incidence. To develop and market cutting-edge AF devices, leading medical device companies, healthcare providers, and research institutions in North America are actively teaming and working together. These strategic partnerships make sharing of knowledge, resources, and technologies easier.

- In November 2023, according to a statement from Johnson & Johnson MedTech, the acquisition of Laminar, Inc., which focuses on removing the left atrial appendage in patients with non-valvular atrial fibrillation, has been completed.

Europe is observed to grow at a notable pace in the atrial fibrillation devices market throughout the predicted timeframe. Multiple European nations are frequently important centers for clinical trials and research in cardiology, particularly atrial fibrillation. This thorough research encourages creativity and demonstrates the effectiveness of novel AF devices, giving patients and healthcare professionals confidence. As a result, there is a greater likelihood of these cutting-edge technologies being adopted by European healthcare systems, which propels regional market expansion. Programs for patient education and awareness of atrial fibrillation and available treatments are highlighted.

The demand for cutting-edge treatment devices is driven by increased patient awareness, which results in early diagnosis and aggressive management of AF. In addition, advantageous medical device reimbursement regulations guarantee that AF treatments such as pacemakers, implanted cardioverter-defibrillators (ICDs), and catheter ablation systems are widely accessible.

- In August 2023, CardioVisio for Atrial Fibrillation (AFib), the newest digital tool from GE HealthCare, was unveiled during the European Society of Cardiology (ESC) Congress in Amsterdam in 2023. Uneven and fast heartbeats can be caused by faulty electrical signals coming from the heart's upper chambers, which raises the risk of stroke and other conditions. By analyzing data from many sources, the CardioVisio gadget creates a picture of the patient's heart over time. It provides medical professionals with actionable insights to support the management of AFib.

Market Overview

The atrial fibrillation devices market revolves around the offering of medical devices used to monitor, control, or cure atrial fibrillation (AF). AF is a frequent arrhythmia that affects the heart's upper chambers or atria. The diagnosis, treatment, and management of AF are greatly aided by these devices, which also help to lower the risk of consequences like heart failure, stroke, and other cardiovascular problems. Patients with atrial fibrillation who run the risk of experiencing abrupt cardiac arrest or potentially fatal arrhythmias frequently take it.

Blood clots that develop in the left atrial appendage put patients with atrial fibrillation at risk for stroke. Additionally, by shutting the appendage and preventing blood clots from growing and perhaps causing a stroke, devices help lower this risk.

- In December 2023, The FDA has granted authorization for the Pulse Select Pulsed Field Ablation (PFA) System to manage paroxysmal and persistent atrial fibrillation (AF). Medtronic plc, a leading global provider of healthcare technology, made this news public.

Atrial Fibrillation Devices MarketGrowth Factors

- The risk of atrial fibrillation rises with age, the rising prevalence is observed to expand the growth of the market.

- The demand for related products is driven by the earlier detection and treatment of atrial fibrillation, which is brought about by improved diagnostic methods and increased public awareness.

- Cardiovascular problems, including atrial fibrillation, are caused by several factors, including smoking, poor diet, and inactivity.

- Procedures like catheter ablation allow for less invasive and quicker recovery times compared to typical surgeries. The market is expanding due to rising healthcare costs in developing nations and rising device affordability.

- Devices are becoming more user-friendly, dependable, and efficient for both patients and medical personnel due to advancements.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 13.97% |

| Market Size in 2025 | USD 13.03 Billion |

| Market Size by 2034 | USD 42.17 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

High adoption rate of advanced technologies

Advanced technologies make more accurate detection and management of atrial fibrillation (AF) possible, improving patient outcomes and lowering complications. Advances in monitoring devices and diagnostic tools enable prompt intervention by facilitating early detection of AF and a more precise assessment of its severity.

Medical device technology always introduces new treatment methods at a rapid pace, propelling atrial fibrillation devices market's expansion through increased treatment alternatives and enhanced efficacy.

Rise in prevalence of rheumatic valvular heart diseases

Atrial fibrillation (AF) is a common cardiac arrhythmia that is frequently caused by rheumatic fever-induced damage to the heart valves in rheumatic valvular heart disorders. The risk of stroke and other cardiovascular problems is raised with AF. The frequency of atrial fibrillation (AF) increases with the incidence of rheumatic valvular illnesses. This increases the need for devices that treat and manage atrial fibrillation, such as pacemakers and defibrillators.

Restraint

Poor health care access and suboptimal therapy

Patients with atrial fibrillation (AF) cannot get a prompt diagnosis or suitable treatment because they do not have adequate access to healthcare services. This may result in cases of AF going undiagnosed or untreated, which would raise the morbidity and fatality rates. Furthermore, insufficient patient education, inadequate therapeutic alternatives, and a shortage of qualified healthcare personnel can all contribute to poor therapy and reduce the efficacy of managing atrial fibrillation. Such concerns act as a major restraint for the atrial fibrillation devices market.

Lack of awareness regarding enhanced medical technologies

This restriction is caused by several factors, such as poor patient education, insufficient physician training, and insufficient communication about the most recent developments in atrial fibrillation treatment alternatives. Because of their apparent complexity or lack of familiarity, healthcare practitioners may be reluctant to accept these technologies, and patients may not be aware of newer, more effective treatments. This ignorance may prevent new atrial fibrillation devices from being adopted and used.

Opportunity

Expanded indications for AF devices

Due to expanded indications, AF devices can now be used in more patients than just those with traditional indications. Patients with particular risk factors, comorbidities, or even at different stages of the disease may be included in this extension. As the number of patients eligible for device therapy increases, so does market demand. Companies in the atrial fibrillation devices market are driven to invest in research and development activities to create novel solutions by the possibility of extended indications. Because of the intense competition, new gadgets with better functionality, performance, and patient outcomes are introduced.

Product Insights

The EP ablation catheters segment dominated the atrial fibrillation devices market in 2024. The technology used in EP ablation catheters has advanced significantly over time. Innovations, including contact force monitoring, 3D mapping systems, and better catheter designs, have improved these procedures' precision, safety, and success rates. Due to these technological improvements, healthcare professionals choose EP ablation catheters over other options when treating atrial fibrillation. The disorder known as atrial fibrillation, which is defined by irregular heartbeats coming from the atria, can be effectively treated with EP ablation catheters. To restore normal cardiac rhythm, these catheters target and ablate, that is, destroy the aberrant heart tissue causing irregular electrical signals.

The mapping and recording systems segment is observed to show a notable growth in the atrial fibrillation devices market during the forecast period. One of the most prevalent heart arrhythmias, atrial fibrillation, affects millions of people globally. The need for more sophisticated diagnosis and treatment alternatives, such as mapping and recording devices, is rising as the world's population ages and lifestyle factors increase the prevalence of AF. Systems for mapping and recording are essential to minimally invasive treatments like catheter ablation, which is a standard therapy for atrial fibrillation. With these tools, electrophysiologists may more accurately identify and target aberrant cardiac electrical activity regions, improving patient outcomes and lowering risk.

End-use Insights

The hospitals segment dominated the atrial fibrillation devices market in 2024. Highly qualified medical staff with experience diagnosing and treating complex cardiac arrhythmias, such as atrial fibrillation, work in hospitals. Exceptionally trained in cardiac electrophysiology, electrophysiologists are skilled in implanting cardiac devices, performing catheter ablation operations, and handling difficulties associated with AF. It frequently has established connections with government and private healthcare programs, making getting paid for AF-related services and equipment easier. Hospitals can extend their AF treatment offers, hire top people, and invest in state-of-the-art equipment thanks to this financial help.

The cardiac centers segment is observed to be the fastest growing in the atrial fibrillation devices market during the forecast period. Highly qualified cardiologists, electrophysiologists, and cardiac surgeons specializing in treating various heart problems, including AF, work in cardiac centers. These professionals undergo a rigorous training program and have great expertise in complex operations like catheter ablation, a standard AF treatment. Patients frequently choose to receive treatment from these specialized clinics because of the medical staff's experience and the guarantee of receiving top-notch care.

To create and assess novel AF treatment modalities and technologies, numerous cardiac centers actively engage in clinical research and trials. These hospitals can provide patients with access to cutting-edge treatments and technologies before they are commercially available because they are at the forefront of medical research.

Recent Developments

- In November 2023, Medtronic introduced a heart implant to reduce the lifetime risk of stroke in patients with atrial fibrillation and improve the quality of life for patients undergoing open cardiac surgery.

- In January 2022, AliveCor, Inc. and Voluntis, a leading Aptar Pharma firm in digital therapies, have partnered to provide advanced management of atrial fibrillation for cancer patients.

Atrial Fibrillation Devices Market Companies

- Abbott Laboratories

- Johnson & Johnson

- Atricure Inc

- Microport Scientific Corporation

- Boston Scientific Corporation

- St. Jude Medical, Inc

- Medtronic Plc

- Koninklijke Philips N.V.

- Siemens AG

Segments Covered in the Report

By Product

- EP Ablation Catheters

- EP Diagnostic Catheters

- Mapping and Recording Systems

- Cardiac Monitors or Implantable Loop Recorder

- Access Devices

- Intracardiac Echocardiography (ICE)

- Left Atrial Appendage (LAA) Closure Devices

By End-use

- Hospitals

- Cardiac Centers

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content