Glioblastoma Multiforme Treatment Market Size and Growth 2025 to 2034

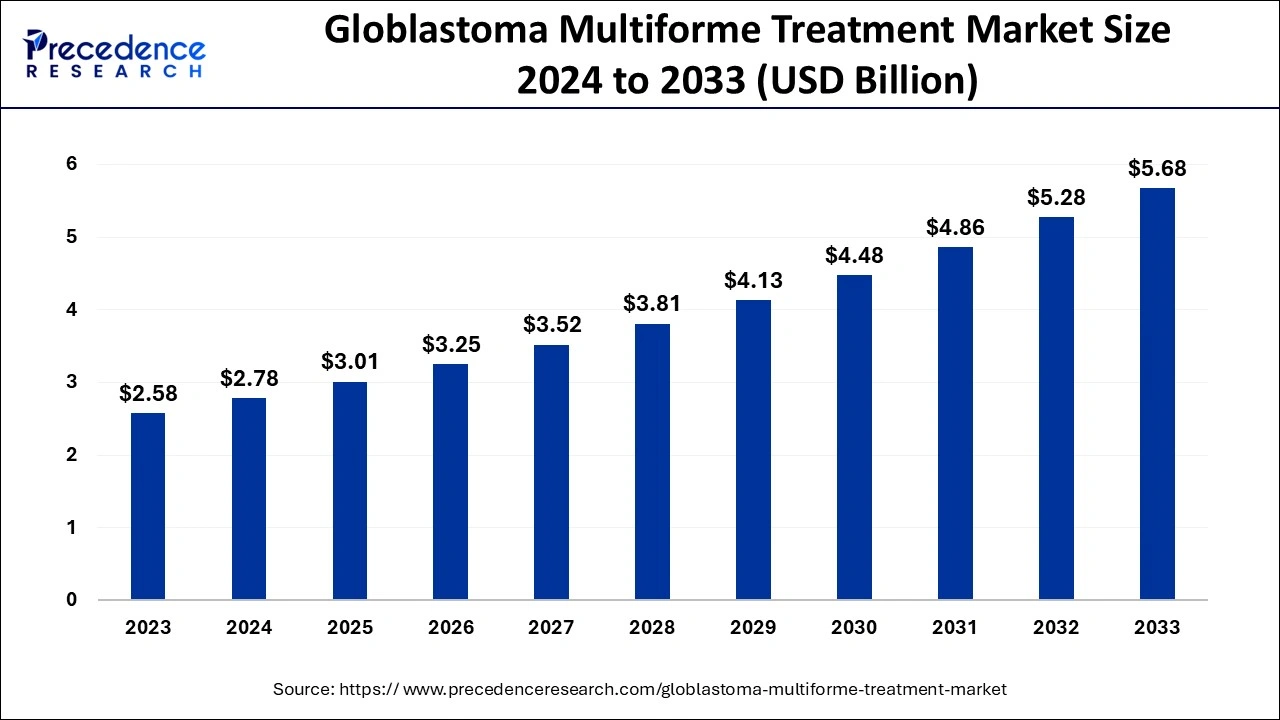

The global glioblastoma multiforme treatment market size was valued at USD 2.78 billion in 2024 and is anticipated to reach around USD 6.08 billion by 2034, growing at a CAGR of 9.40% from 2025 to 2034. The glioblastoma multiforme treatment market is driven by an increasing incidence of glioblastoma multiforme.

Glioblastoma Multiforme Treatment Market Key Takeaways

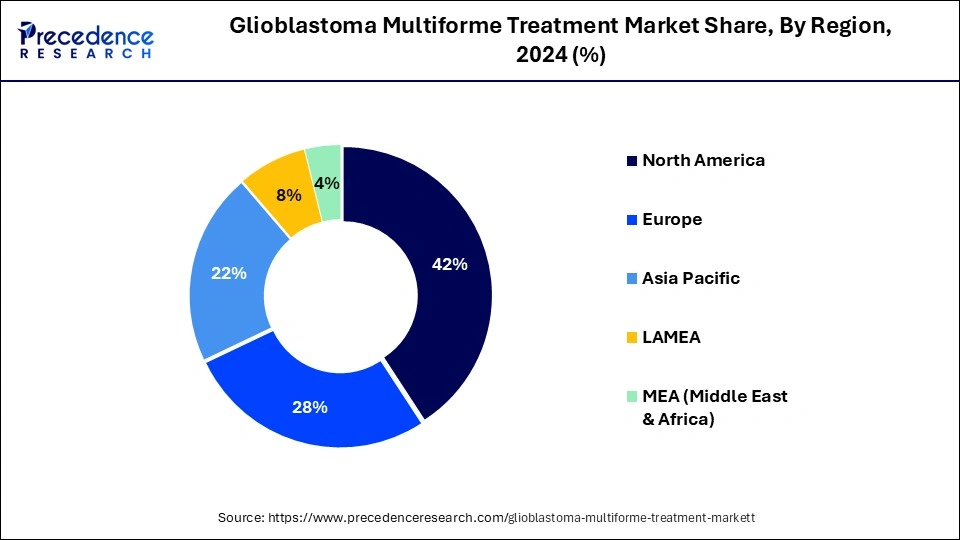

- The North America glioblastoma multiforme treatment market size accounted for USD 2.06 billion in 2024 and is expected to attain around USD 4.48 billion by 2034, poised to grow at a CAGR of 8.13% between 2025 and 2034.

- North America led the market with the largest revenue share of 42.34% in 2024.

- Asia- Pacific is observed to be the fastest growing in the market during the forecast period.

- By treatment, the surgery segment dominated the market with 33.00% of revenue share in 2024.

- By treatment, the radiation therapy segment is observed to be the fastest growing market during the forecast period.

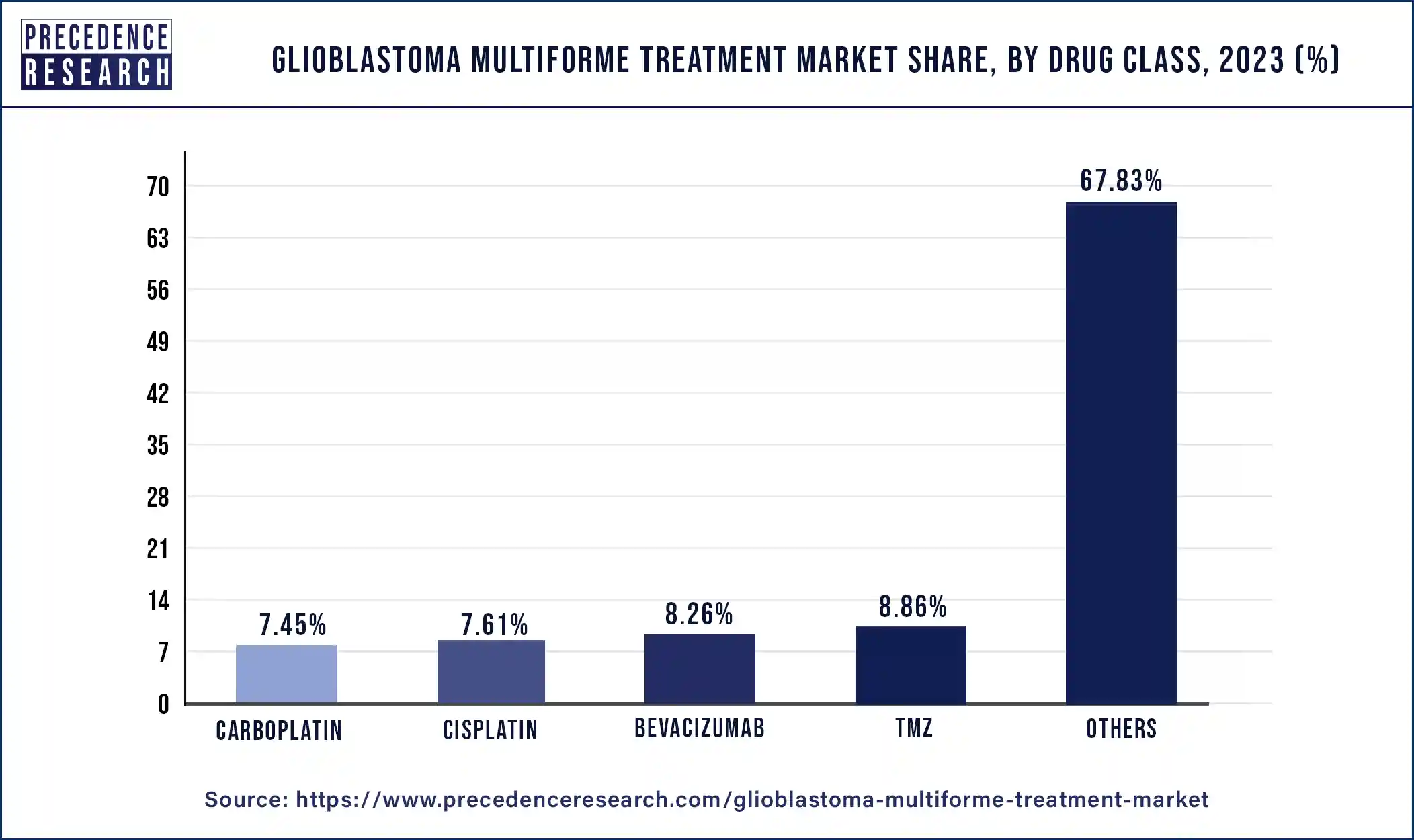

- By drug class, the TMZ segment dominated the glioblastoma multiforme treatment market in 2024.

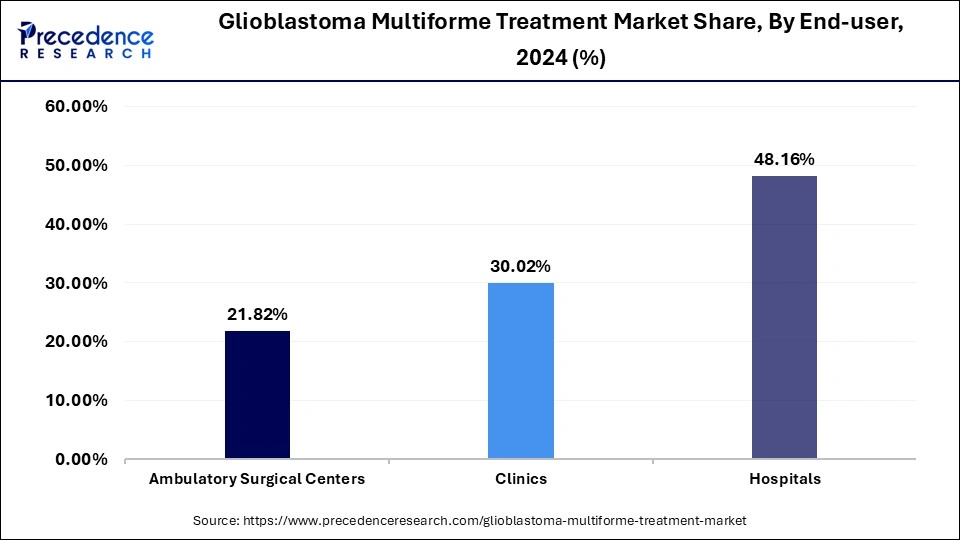

- By end-user, the hospitals segment dominated the market with 48.02% of revenue share in 2024.

- By end-user, the clinics segment was the second largest with 30.08% of revenue share in 2024.

What is the Role of AI in the Glioblastoma Multiforme Treatment Market?

Artificial intelligence (AI) based algorithms have demonstrated promising potential in improving diagnostics through imaging analysis, radiomics, and tumor segmentation. These technologies can allow non-invasive molecular profiling and early detection of glioblastoma multiforme (GBM). AI tools help to predict responses to cancer drugs. AI technology can help to expedite genetic subtyping of brain tumor tissue during a patient's surgery, dramatically speeding up treatment decisions for these patients.

AI-based diagnostic system reveals cancerous tissue that may not otherwise be visible during brain tumor surgery. This allows neurosurgeons to remove it while the patient is still under anesthesia or treat it afterwards with targeted therapies.

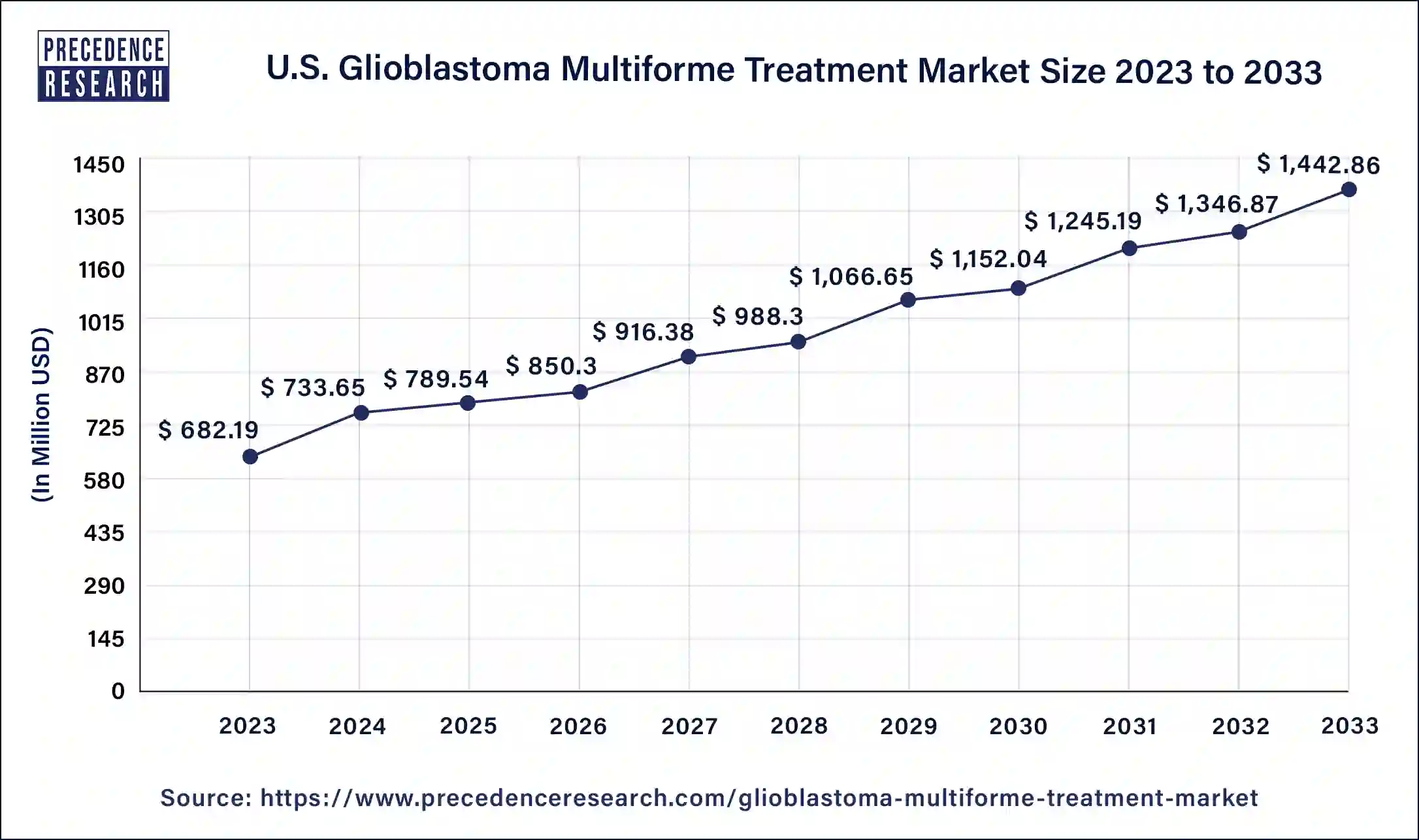

U.S. Glioblastoma Multiforme Treatment Market Size and Growth 2025 to 2034

The U.S. glioblastoma multiforme treatment market size was estimated at USD 733.65 million in 2024 and is predicted to be worth around USD 1,538.85 million by 2034 with a CAGR of 8.90% from 2025 to 2034.

North America had largest market share in 2024 in the glioblastoma multiforme treatment market. North America held the most significant revenue share in the global market for glioblastoma multiforme treatment. This can be attributed to the government's increased investments and programs aimed at enhancing human health and helping the area prevent and eradicate cancer.

For example, the U.S. Health Resources and Services Administration stated in May 2022 that community health centers will be able to collect $5 million to support impartial access to possibly life-saving cancer screenings. President Joe Biden's Unity Agenda and his call for action on early cancer diagnosis and screening are supported by this financing, which is by the Administration's Cancer Moonshot pledge to end cancer.

Asia-Pacific is observed to be the fastest growing in the glioblastoma multiforme treatment market during the forecast period. In Asia-Pacific, glioblastoma multiforme is becoming more common due to advancements in diagnosis and an aging population. This growth is influencing the need for efficient therapies. Governments and nonprofit groups are educating the public about brain cancers, such as glioblastoma, through awareness campaigns. Early diagnosis and treatment have improved patient outcomes. Asian nations are working more closely with multinational pharmaceutical corporations to introduce cutting-edge GBM therapies to the area. Clinical trials, technology transfer, and local treatment production are frequently a part of these partnerships.

North America held a significant share of the market in 2024.

- In September 2024, a potential treatment for glioblastoma, the most progressive and deadly form of brain cancer was launched by Researchers from China and the US.

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

Market Overview

Glioblastoma is a severe form of cancer that can arise in the brain or spinal cord. Glioblastoma growth originates from the astrocytes that sustain nerve cells. It can occur at any age but frequently strikes older people. Possible side effects include increased headaches, seizures, vomiting, and nausea. Glioblastoma, commonly known as glioblastoma multiforme, can be extremely difficult to treat and often has no approved treatment.

- In June 2022, The Centers for Disease Control and Prevention (CDC) announced the first-year funding allocations of $215 million over five years, with a $1.1 billion expenditure in three national cancer control and prevention projects. The CDC's and President Biden's Cancer Moonshot project depend on this financing to ensure that the resources available for cancer diagnosis and detection serve every American equitably.

Glioblastoma Multiforme Treatment Market Growth Factors

- An increasing number of cases of the aggressive brain tumor glioblastoma multiforme (GBM) are being diagnosed worldwide. This regrettable increase in incidence fuels the need for treatment solutions.

- The growing emphasis on enhancing patient outcomes through improved treatment approaches may drive the market need for efficient GBM treatments.

- An early and accurate diagnosis makes prompt intervention possible, which may increase the need for treatment.

- Market increase is encouraged by developing novel, more potent treatment options, such as immunotherapy and targeted medicines.

- Government programs and regulations that increase awareness and provide financing for GBM research and treatment can considerably impact the growth of the GBM market.

- Growing investment in oncology research and development

- Increasing awareness and early diagnosis of disease.

- Rising advancements in diagnostics and treatment modalities.

- Rising incidence of glioblastoma.

- Expanding research activities worldwide.

Glioblastoma Multiforme Treatment Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.01 Billion |

| Market Size in 2024 | USD 2.78 Billion |

| Market Size by 2034 | USD 6.08 Billion |

| Market Growth Rate | CAGR of 9.40% from 2025 to 2034 |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Treatment, Drug Class, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing incidence of brain tumors

Advances in neurosurgical methods improve tumor resection results. Thanks to developments like intensity-modulated radiation therapy (IMRT) and stereotactic radiosurgery (SRS), more accurate targeting of tumor cells is possible. To increase the survival rates and quality of life for GBM patients, new targeted therapeutics and chemotherapeutic drugs, including bevacizumab and temozolomide, are being developed and improved. New GBM treatments can enter the market more quickly when granted fast-track, orphan drug classification, or priority evaluation by regulatory bodies such as the FDA and EMA. This drives the growth of the glioblastoma multiforme treatment market.

Rise in awareness about chemotherapy treatment

Due to the proliferation of digital media and easy access to internet medical information, patients and caregivers are becoming increasingly informed about GBM and its treatment choices. Their heightened consciousness enables patients to pursue cutting-edge therapies, such as chemotherapy, and to stand up for themselves or their loved ones. Cancer awareness is a common topic of public health campaigns, highlighting the value of early detection and treatment. These advertisements emphasize the part chemotherapy plays in treating GBM, which helps increase demand and acceptance for it.

Restraints

Diversity within tumors can lead to the development of treatment-resistant cells and complicate the design of therapies

Genes can be amplified, or new mutations can be acquired by tumor cells to help them avoid the effects of drugs. For instance, EGFR gene mutations are frequently seen in GBM, and distinct mutations may result in differing degrees of EGFR drug resistance. Tumor cells can survive chemotherapy or radiation therapy by changing the expression of specific genes through modifications to DNA methylation and histone modifications.

High investment required for the treatment of glioblastoma multiforme treatment

Due to their knowledge, neurosurgeons, oncologists, radiologists, and other specialized healthcare workers command substantial wages. Comprehensive patient care necessitates multidisciplinary teams that include nurses, rehabilitation therapists, and support personnel, which drives up prices even more.

The availability of pricey GBM treatments may be restricted by financial constraints faced by healthcare providers and public health services. High expenses force difficult choices about how best to allocate resources, which may impact the availability and standard of care for GBM patients. This limits the growth of the glioblastoma multiforme treatment market.

Opportunity

Tumor-treating fields to broaden market prospects

The effectiveness of TTFields in extending progression-free and overall survival in patients with GBM has been shown in clinical trials. In the EF-14 phase III experiment, for example, patients who received TTFields in addition to temozolomide had a median overall survival of 20.9 months. In contrast, patients who received temozolomide alone had a median survival of 16 months. Moreover, TTFields are generally well tolerated; mild to severe skin irritation at the application site is the most frequent side effect. For many patients, including those who might not be able to withstand harsh treatments, TTFields is a good alternative due to its favorable safety profile.

Glioblastoma Multiforme Treatment Market Revenue (USD Million), by Treatment, 2022 to 2024

| By Treatment | 2022 | 2023 | 2024 |

| Surgery | 794.62 | 854.83 | 920.23 |

| Radiation Therapy | 532.99 | 576.25 | 623.45 |

| Chemotherapy | 505.77 | 549 | 596.34 |

| Targeted Therapy | 307.04 | 328.98 | 352.73 |

| Tumor Treating Field (TTF) Therapy | 95.73 | 102.78 | 110.42 |

| Immunotherapy | 157.29 | 170.7 | 185.32 |

Treatment Insights

The surgery segment dominated in 2024 with a 33.10% market share in the glioblastoma multiforme treatment market. If the tumor can be completely removed, reoperation should be suggested; if not, adjuvant therapy should be administered if the patient's prognosis warrants a second operation. A third procedure could not be helpful in cases of glioblastoma recurrence. In the US, primary malignant tumors of the brain and spinal cord were expected to affect 24,810 people in 2024.

The radiation therapy segment is observed to be the fastest-growing in the glioblastoma multiforme treatment market during the forecast period. It is anticipated that radiation therapy will rule the market. Radiation therapy is often administered for six weeks after glioblastoma multiforme surgery. The patient receives oral chemotherapy and minimal daily radiotherapy. Experts state that individuals who undergo both surgery and radiation therapy have better outcomes and live longer than those who merely receive surgery. This phenomenon fosters the expansion of the radiation therapy market and creates a need for radiation therapy. Since radiation treatment was initially utilized to treat GBM a few years ago, its techniques have significantly improved.

Previously, the entire brain was treated when neurological cancer occurred. Radiation therapy has, however, improved treatment protocols, leading to more precise and selective targeting of essential brain areas. This phenomenon elevates the rise of radiation therapy.

- In September 2022, Bispecific antibodies that target immune checkpoint inhibitors and Chitinase 3-like-1 have been discovered, according to Ocean Biomedical and Aesther Healthcare Acquisition Corp. These antibodies destroy glioblastoma and melanoma cells and prevent malignant melanoma cells from metastasizing to the lung by more than 90%.

The surgery segment held a dominant presence in the market in 2024.

- In March 2021, a plan to attack brain tumors with tiny, guided robots was launched by Bionaut labs.

Bionaut Labs launches with plans to attack brain tumors with tiny, guided robots | Fierce Biotech

The radiation therapy segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

Drug Class Insights

The TMZ segment dominated in the glioblastoma multiforme treatment market in 2024. A standard treatment for glioblastoma multiforme is Temozolomide (TMZ). The FDA approval of Temozolomide in the therapeutic management of glioblastoma multiforme has improved patient survival compared to radiation therapy alone. Furthermore, the discovery and study of combination medicines, such as Temozolomide, is intriguingly stimulating the growth of the TMZ market. In one study, for example, vaccines were administered in addition to radiation therapy and Temozolomide in a study on the function of vaccine treatment in glioblastoma published by Frontiers Media S.A.

- In June 2022, the American Society of Clinical Oncology published a Phase II study on the adjuvant temozolomide supplement SurVaxM Plus for newly identified glioblastoma. The study "Temozolomide-induced guanine mutations generating potential weaknesses of guanine-rich DNA and RNA sites in drug-resistant glioma" was published in June 2022 by the American Association for the Advancement of Science.

Moreover, partnerships between clinical development and pharmaceutical companies dramatically quicken the TMZ segment's expansion. For instance, to develop NMS-293, Nerviano Medical Sciences and Merck KGaA, located in Darmstadt, Germany, established a licensing arrangement and collaboration. In Phase I trials, NMS-293 is being studied as a monotherapy for patients with BRCA-mutated cancers and in combination with temozolomide to treat recurrent glioblastoma.

The TMZ segment accounted for a considerable share of the market in 2024 and is projected to experience the highest growth rate in the market between 2025 and 2034.

End-user Insights

The hospitals segment dominated in 2024 with 48.16% market share in the glioblastoma multiforme treatment market. With more cases of GBM patients, there is a greater need for glioblastoma multiforme procedures, which propels the expansion of the hospital segment. For example, as previously said, around 14,000 new cases of glioblastoma are diagnosed in the United States each year. This increases demand for surgical operations, radiation therapy, and chemotherapy, further driving the segment's growth.

The clinics segment was the second largest with 30.14% market share in 2023 in the glioblastoma multiforme treatment market. Clinics usually have access to the newest technologies and treatment procedures. This covers sophisticated surgical methods, the latest imaging technology, and innovative radiation treatments, including proton therapy and stereotactic radiosurgery. Clinics may be able to treat patients more precisely and successfully thanks to these capabilities, which could lead to better patient outcomes. Particularly for individuals residing in suburban or rural areas, clinics are frequently more accessible than large hospitals. Due to its geographic accessibility, patients can more easily receive follow-up care and frequent treatments without having to travel far, which can be especially difficult for individuals with severe medical disorders like GBM.

The hospitals segment registered its dominance over the market in 2024.

- In August 2024, more than £100000 raised in a day after fund raiser launched for NI boy (9) battling brain tumor.

The clinics segment is set to experience the fastest rate of the market growth from 2025 to 2034.

Recent Developments

- In September 2024, the commencement of the Phase II trial of absence epilepsy treatment of BMB-101, targeting adult patients with classic absence epilepsy and developmental epileptic encephalopathy (DEE) was launched by the Bright Mind Biosciences. This trial assesses the safety, tolerability, and effectiveness of BMB-101 in adults with epileptic conditions.

Bright Minds launches Phase II trial of absence epilepsy treatment - In June 2023, a new Phase IB trial of CHM 1101 (CLXT CART) cell therapy to treat patients with recurrent or progressive glioblastoma multiforme (GBM) therapy was launched by Chimeric.

https://www.clinicaltrialsarena.com/news/chimeric-phase-ib-glioblastoma-therapy/

Glioblastoma Multiforme Treatment Market Companies

- Merck & Co., Inc.

- Amgen, Inc.

- F. Hoffmann-La Roche Ltd.

- Pfizer Inc.

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Sumitomo Dainippon Pharma Oncology, Inc. (Boston Biomedical, Inc.)

- Arbor Pharmaceuticals, LLC

- Amneal Pharmaceuticals

- Karyopharm Therapeutics, Inc.

Segments Covered in the Report

By Treatment

- Surgery

- Radiation Therapy

- Chemotherapy

- Targeted Therapy

- Tumor Treating Field (TTF) Therapy

- Immunotherapy

By Drug Class

- TMZ

- Carboplatin

- Cisplatin

- Bevacizumab

- Others

By End-user

- Hospitals

- Clinics

- Ambulatory Surgical Centers

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting