Hematology Analyzer Market Size and Forecast 2025 to 2034

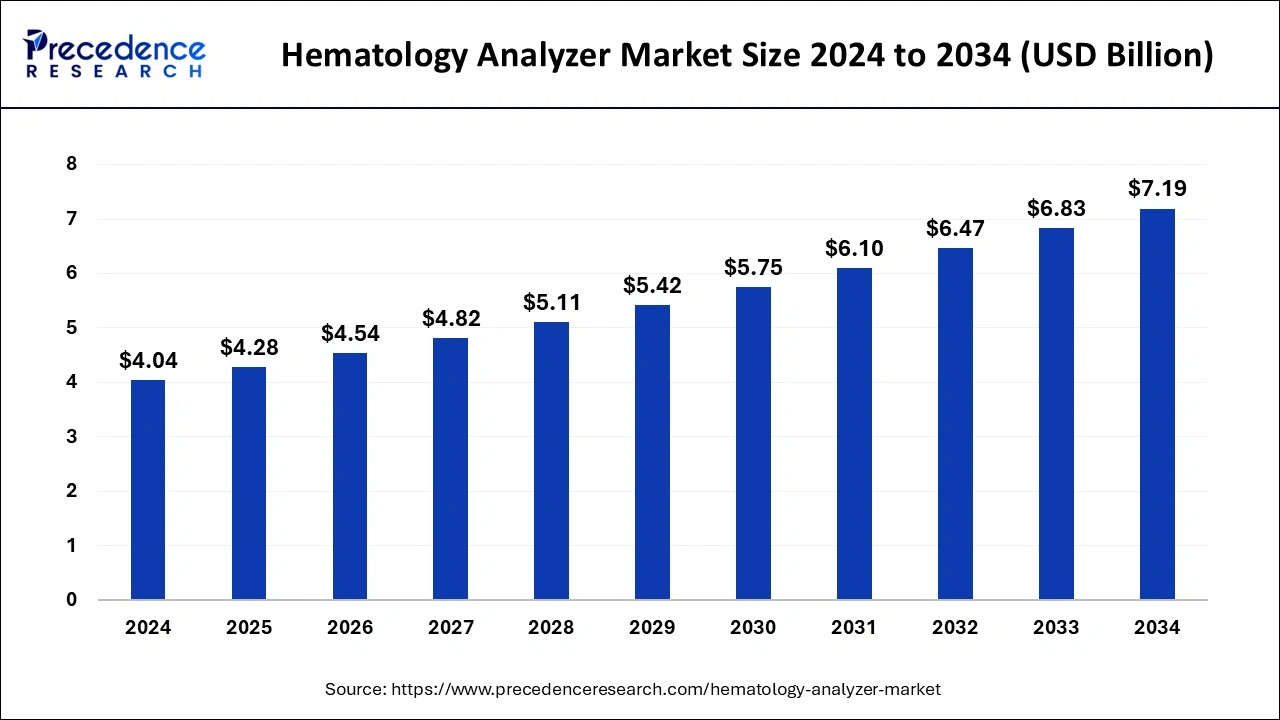

The global hematology analyzer market size was estimated at USD 4.04 billion in 2024 and is anticipated to reach around USD 7.19 billion by 2034, expanding at a CAGR of 5.93% from 2025 to 2034.

Hematology Analyzer Market Key Takeaways

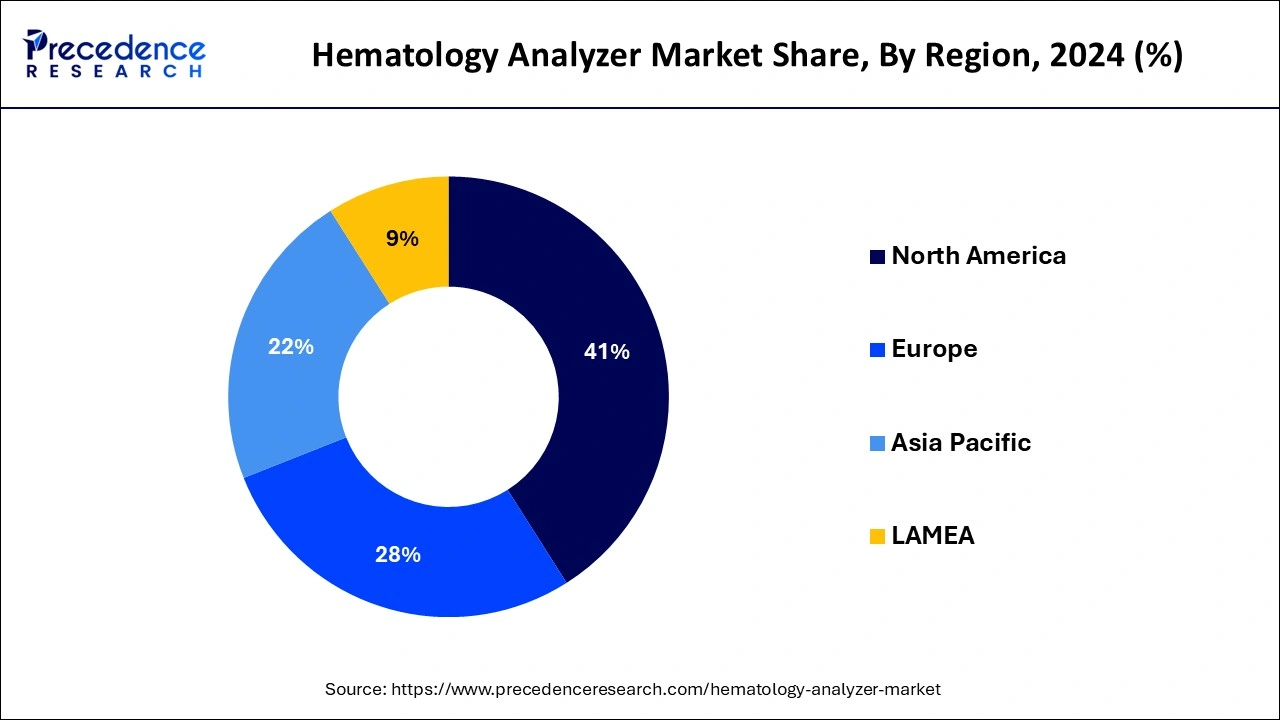

- North America led the global hematology analyzer market with the largest market share of 41% in 2024.

- Asia Pacific is projected to grow at a notable CAGR during the forecast period.

- By product type, the reagents segment has held a major market share in 2024.

- By end-use, the hospital segment dominated the market in 2024.

Integration of artificial intelligence (AI) with hematology analyzers

The integration of AI with hematology analyzers is helping to enhance diagnostic accuracy by classifying blood cells and automating interpretation, improving efficiency, streamlining workflow, and allowing personalized medicine by understanding unique genetic profiles and medical histories. AI is enabled to identify and grow patterns of data to understand patient disease and provide accurate diagnoses. AI not only helps to identify hematologic disorders like anemia, leukemia, and thrombocytopenia but also monitors their progress and treatment relevance. The quick decision-making has been possible thanks to the automation. To reduce human errors, improve data interpretations, and improve patient outcomes, the AI is playing a significant role in the hematology analyzer market.

U.S. Hematology Analyzer Market Size and Growth 2025 to 2034

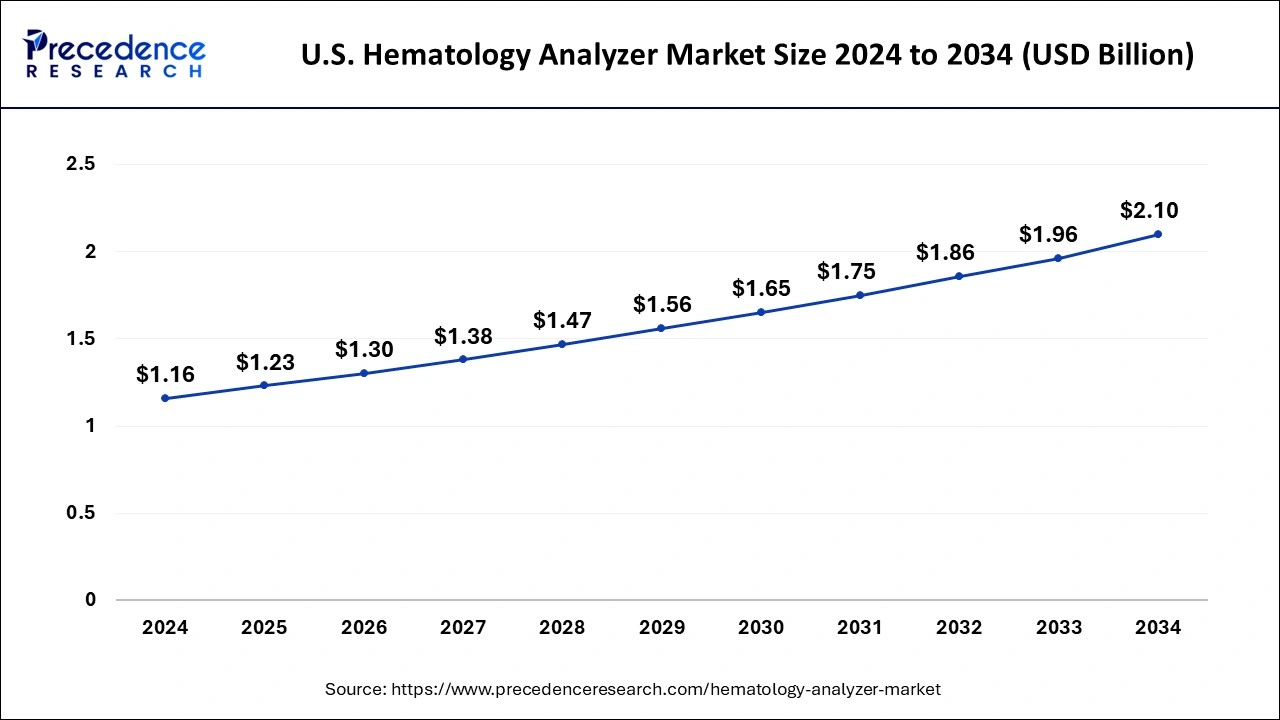

The U.S. hematology analyzer market size was evaluated at USD 1.16 billion in 2024 and is predicted to be worth around USD 2.10 billion by 2034, rising at a CAGR of 6.11% from 2025 to 2034.

Hematology analyzer sales are increasing steadily in the continent of North America. This is related to the increased incidence of various blood disorders as well as the expanding use of hematology analyzers in the diagnostic sector. For instance, anemia, a chronic disease that is more common in women of "childbearing age," affects about three million people in America. 1 in 5000 male babies is born with hemophilia A, according to a report from the Centers for Disease Control and Prevention (CDC) in 2020. 400 newborns are diagnosed with hemophilia A every year. In the U.S., a blood cancer diagnosis will be made every three minutes in 2021, according to the Leukemia and Lymphoma Society. It is expected that 186,400 Americans will be diagnosed with leukemia, melanoma, or lymphoma in 2021.

There are numerous market players in North America, and they are all focused on developing and introducing new products. In order to alleviate the resource and time constraints experienced by small-sized and mid-sized laboratories, Beckman Coulter released the DxH 560 AL desktop hematology analyzer in February 2021. Additionally, there are numerous organizations in the U.S. that aid scientists and medical professionals working to find a solution for various blood diseases around the globe. A few of the state's medical facilities are also pioneers in the detection and treatment of different blood diseases, and they work on numerous research initiatives to expand the diagnostic and therapeutic options for these conditions. These factors fuel the region of North America's need for hematology analyzers.

Market Overview

Hematology analyzers are available for both human and animal blood, which is helpful for research labs, zoos, and veterinarians. Hematology analyzers have different features, such as closed vial testing and open sampling testing. Some hematological analyzers give the customer the option of selecting their preferred testing method. The increased utilization of hematology analyzers in anemia and blood cancers are significant factors contributing to the market growth. With growing healthcare expenditure and advancements, the investment in innovation and developments of cutting-edge hematology analyzers has reached the top.

Due to advancements of several fields, including genetic treatments, pharmacogenomics, bleeding disorders, hemoglobinopathies, stem cell research, and proteomics, the global market for hematology analyzers is predicted to expand significantly during the forecast period. Likewise, the worldwide hematology market has been expanding due to factors such as the increase in public awareness and the consolidation of diagnostic laboratory chains. Additionally, It is expected that increasing adoption rates of automated hematology equipment and rising consumer demand for high-sensitivity hematological tests will propel the global market during the forecast period.

Hematology Analyzer Market Growth factors

- The market has been growing due to rising technological advancements, like the introduction of basic cytometry methods analyzers and the high throughput expansion of hematology analyzers, and the trend is anticipated to continue over the next seven years.

- The rising rates of blood donation activities are significant factors anticipated to propel the growth of the hematology analyzer market during the forecast period.

- Additionally, it is projected that a rise in the prevalence of blood disorders among patients would fuel the hematology analyzer market's expansion.

- Furthermore, the market for hematology analyzers is expected to grow because of the increase in product demand.

- The technology advancements, like point-of-care testing, to improve user-friendly features of hematology analyzers are fueling their adoption in hospitals as well as remote healthcare areas.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.93% |

| Market Size in 2025 | USD 4.28 Billion |

| Market Size by 2034 | USD 7.19 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type, By End-Use and By Price Range |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers

Rising awareness of chronic illnesses - The rising global awareness of chronic diseases is anticipated to fuel the market for hematology analyzers' revenue growth during the forecast period. With a high incidence, chronic diseases are the main cause of death. Globally, the rate of these diseases is increasing, spreading to every region of the world, and impacting people from all socioeconomic strata. Healthcare is strongly focused on the early detection and treatment of such disorders to control the progression of such diseases. Previously, only tissue biopsy tests can be used for early diagnosis of many chronic diseases, but blood analysis has grown in popularity over a period. The development of the market for hematology analyzers is significantly influenced by improvements in blood indicators for illnesses.

Increased prevalence of blood diseases - The prevalence of blood disorders is on the rise, technological improvements are accelerating, and automated hematology devices are being adopted at an increasing rate. With several causes and a high fatality rate, blood diseases have emerged as a global health concern. Anemia, blood malignancies, hemorrhagic diseases, and blood-borne infections are just a few of the blood problems that impact millions of individuals annually across all ages.

The Department of Health and Aged Care of the Australian Government reported in 2022 that there were about 330,000 affected babies born every year, 83% of whom had disorders of sickle cell and 17% had thalassemia, 7% of expectant mothers had hemoglobin disorders, and more than 1% of the couples worldwide were at risk. According to a World Federation of Hemophilia research study published in July 2022, there were a higher number of 1,125,000 males worldwide having an inherited problem of bleeding, and about 418,000 of these have a severe type of condition that is the most underdiagnosed. Early diagnosis, as well as treatment, are some of the most effective ways to maintain a patient's quality of life when they have a blood cell problem. The increased prevalence of blood diseases is therefore expected to boost the market in the future.

Key Market Challenges

Local players' emergence and the availability of less expensive automated hematology instruments in developing nations - The industry development is expected to be constrained by fierce competition between the existing players and the high price of hematology analyzers. Additionally, it is expected that time-consuming and strict regulatory standards for hematological instruments will restrain market expansion during the forecast period. The new hematology analyzing devices that are launched in the market are expensive as compared to the already existing analyzers and these automated products have less demand in the underdeveloped other developing nations of the world and this is one of the biggest challenges for the growth of the market.

Key Market Opportunities

Rising adoption of the new products in the market – In the upcoming years, the use of the product in combination with flow cytometry processes will offer further potential growth prospects for the hematology analyzer market. Moreover, in the hematology analyzers market, many new products are launched in the global market and these new product launches will proliferate the market to a great extent.

Product Type Insights

In 2024, the reagents reagents segment has held a major market share in 2024. Coulter's Principle is used in a three-part differential cell counter to determine the cell's volume and size. A solution of electrolytes is used to lyse and dissolve the sample in a larger container. For small hospitals, clinics, and physician offices that conduct sophisticated testing, 3-part hematology analyzer systems are the best option. Although 3-part hematology analyzers are more economical for typical hematological tests, 5-part hematology analyzers are gaining in popularity. Additionally, the market is anticipated to rise significantly due to technological developments, the global availability of these instruments, and their reasonable prices.

Transasia Bio-Medicals Ltd. debuted the fully automated 3-Part Differential (3PD) hematology controls, reagents, and analyzers in India in March 2019. Erba Lachema is a 100% owned Transasia subsidiary in Europe. Later in the month of September 2019, an announcement was made by Transasia Bio-Medicals Ltd. that it had sold more than 1,000 of its Erba Hematology analyzers in India. Additionally, convenience and reliable findings are the two main factors boosting the segment's growth over the projection period.

End Use Insights

The hospital segment dominated the market in 2024. Factors contributing to this segment's dominance include the identification of abnormal hemoglobin and cytochemistries in blood and bone marrow, as well as the rising prevalence of the disorders of the blood, like hereditary spherocytosis, lead poisoning of a chronic nature, sickle cell disease, and granulomatous disease.

Hematology Analyzer Market Companies

- Siemens Healthineers

- Sysmex Corporation

- Abbott Laboratories

- Beckman Coulter Inc. (Danaher Corporation)

- Bio-Rad Laboratories

- Boule Diagnostics AB

- F Hoffmann-La Roche Ltd

- Horiba Ltd

- Nihon Kohden Corporation

- Mindray Medical International Limited

- Stratec Biomedical Systems (DIATRON)

- Ortho Clinical Diagnostics

- Accurex Biomedical Pvt. Ltd

Latest From Industry Leaders'

- In September 2024, Abhay Nayak, President of Global Diagnostics at Zoetis, talked about the launch of the new hematology analyzer, Vetscan OptiCell™:

“This latest development of Zoetis strengthens companies' hematology story, especially when the company collaborated with Vetscan Imagyst AI Blood Smear, reinforcing the existing capabilities of Zoetis' Virtual Laboratory portfolio and providing a comprehensive and connected platform.” President of Global Diagnostics at Zoetis, Abhay Nayak said, “This latest innovation further strengthens our hematology story, particularly when partnered with Vetscan Imagyst AI Blood Smear – reinforcing the existing capabilities of Zoetis' Virtual Laboratory portfolio, providing a comprehensive and connected platform.”

Recent developments

June 2024, HORIBA, a global leader in analytical and measurement technology, expanded its award-winning compact hematology instrument range by introducing its novel model of Yumizen H550E (autoloader), H500E CT (closed tube), and Yumizen H500E OT (open tube) with Erythrocyte Sedimentation Rate (ESR) on board.

In September 2024, Zoetis Inc., the world's leading animal health company, introduced its novel hematology analyzer, Vetscan OptiCell™, a cartridge-based, AI-powered diagnostic tool designed to provide advanced Complete Blood Count (CBC) analysis.

Segments Covered in the Report

By Product Type

- Instruments

- Part Hematology Analyzer

- Part Hematology Analyzer

- Point-of-care Testing Hematology Analyzers

- Others

- Reagents

- Services

By End-Use

- Hospitals

- Clinical Laboratories

- Research Institutes

- Other

By Price Range

- Low-end Hematology Analyzers

- Mid-range Hematology Analyzers

- High-end Hematology Analyzers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting