Segmented Flow Analyzer (SFA) Market Size and Forecast 2025 to 2034

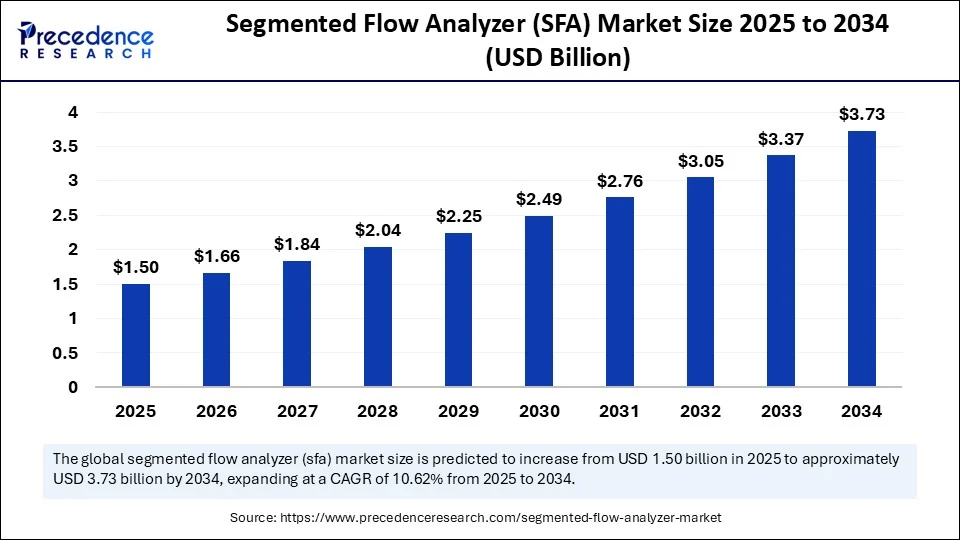

The global segmented flow analyzer market size accounted for USD 1.36 billion in 2024 and is predicted to increase from USD 1.50 billion in 2025 to approximately USD 3.73 billion by 2034, expanding at a CAGR of 10.62% from 2025 to 2034. The market growth is attributed to rising regulatory enforcement for environmental monitoring and increasing demand for high-throughput, automated analytical solutions.

Segmented Flow Analyzer (SFA) Market Key Takeaways

- In terms of revenue, the global container closure integrity testing service market was valued at USD 1.36 billion in 2024.

- It is projected to reach USD 3.73 billion by 2034.

- The market is expected to grow at a CAGR of 10.62% from 2025 to 2034.

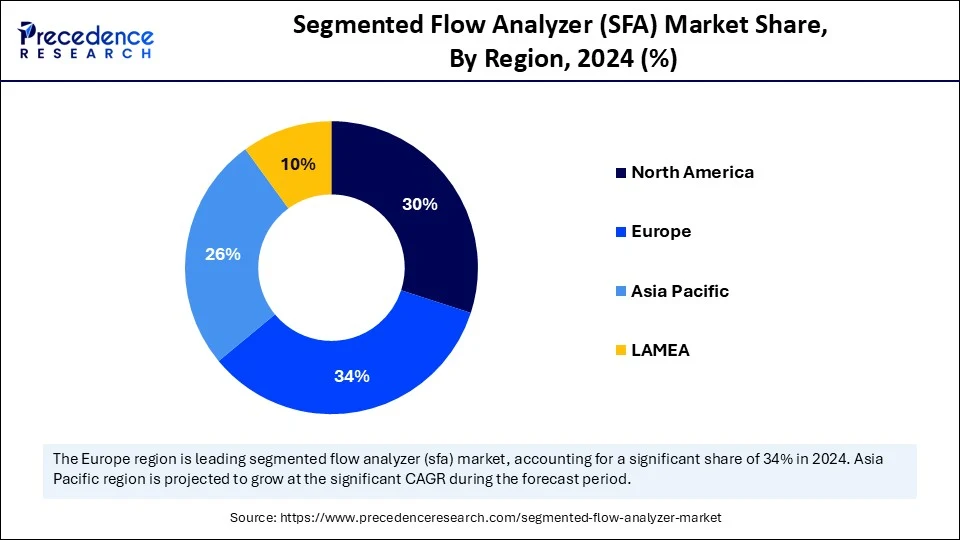

- Europe dominated the global market with the largest share in 2024, accounting for 34% of the market.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By product type, the multi-channel SFA systems segment held the major market share in 2024, accounting for 48% market share.

- By product type, the advanced systems with autosamplers segment is projected to grow at a CAGR between 2025 and 2034.

- By detection method, the colorimetric detection segment contributed the biggest market share in 2024, accounting for 52% market share.

- By detection method, UV-Vis with software-integrated detection segment is expected to expand at a significant CAGR between 2025 and 2034.

- By application, the water & wastewater testing segment dominated the market in 2024, accounting for 44% of the market share.

- By application, the food & beverage quality control segment is expected to grow at a significant CAGR over the projected period.

- By end-user, environmental agencies dominated the global market with the largest share in 2024 with holding a market share 41%.

- By end-user, the food & pharma manufacturing labs segment is expected to grow at a notable CAGR from 2025 to 2034.

Impact of Artificial Intelligence on the Segmented Flow Analyzer Market

The application of Artificial intelligence is disrupting the market of segmented flow analyzer (SFA) by providing breakthrough automation, increased reliability of the process, and better analytical precision. To facilitate analysis of created/tested samples, manufacturers currently install AI-based software into SFA systems to make the process less subject to manual interference to create consistent, quicker results. This change allows laboratories to load more samples and be more productive with fewer variations, and SFAs are more appealing to industries, such as environmental, food safety, and pharmaceuticals.

Europe Segmented Flow Analyzer (SFA) Market Size and Growth 2025 to 2034

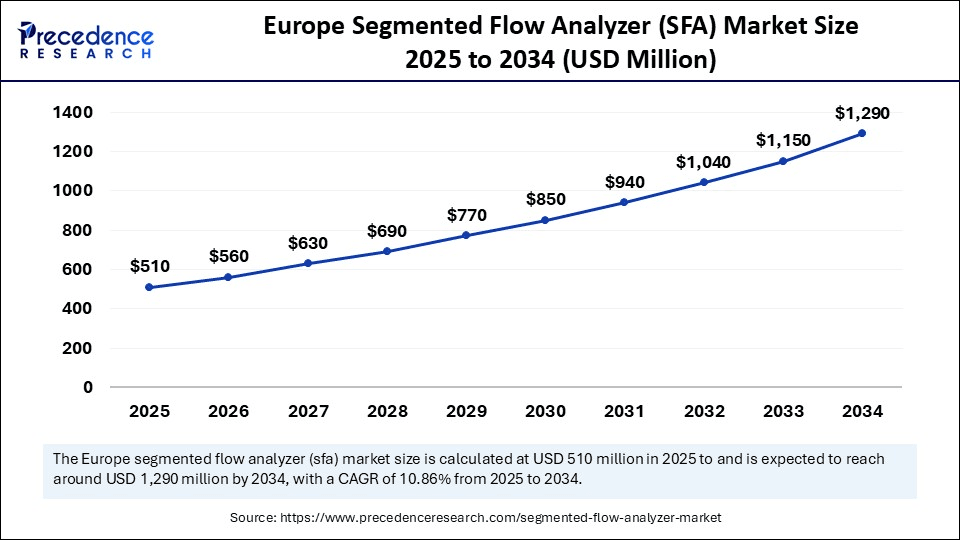

The Europe segmented flow analyzer market size is evaluated at USD 510 million in 2025 and is projected to be worth around USD 1,290 million by 2034, growing at a CAGR of 10.86% from 2025 to 2034.

How Has Europe Cemented Its Position as the Regional Leader in the Segmented Flow Analyzer Market?

Europe led the segmented flow analyzer market in 2024, capturing the largest revenue share in 2024, accounting for 34% of the market share, due to well-established control systems that checked the environment, food safety, and pharmaceutical products. The ECHA and the EEA required endless and high-resolution testing of pollutants, hence the wide usage of SFAs within municipal and commercial water systems.

According to the Joint Research Centre (JRC), in 2024, over 70% of nutrient and trace metal assessments in wastewater were performed by using automated analyzers within Western Europe wastewater treatment plants. Digital laboratories and modular instrumentation to optimize the process involved big investments that countries, including Germany, France, and the Netherlands, invested in. Additionally, the European Medicines Agency (EMA) also updated the 2024 guidance on pharmaceutical quality testing, which facilitated the quick implementation of analyzers in validated laboratories.

Asia Pacific is anticipated to grow at the fastest rate in the segmented flow analyzer market during the forecast period, owing to as a result of the growth in industrialization, improved regulatory scrutiny, and expansion of awareness in terms of health. The Chinese Academy of Sciences featured the incorporation of automated chemical analysers in provincial water, as part of China's 14th Five-Year Plan, and achieved an improvement in the quality monitoring of surface and groundwater.

The National Institute of Metrology, China, also issued new calibration measures to water analyzers, which facilitated a massive deployment across a greater number of provinces. The Indian Council of Medical Research (ICMR) and the Council of Scientific and Industrial Research (CSIR) increased utilization of FAs and SFAs in government and commercial laboratories in nutritional and pharmaceutical diagnostics. Additionally, rampant expansion in the environmental, food, and pharma industries is bound to propel the region to a global leader in the use of analytical instrumentation.

Market Overview

The segmented flow analyzer market refers to the market for automated laboratory instruments that use Segmented Flow Analysis (SFA), also known as Continuous Flow Analysis (CFA) to determine the concentration of chemical substances in liquid samples. SFA systems operate by pumping a continuous stream of sample and reagents, segmented by air bubbles, through a network of tubes and detectors to perform colorimetric or photometric analysis.

These systems are crucial for high-throughput, precise, and reproducible analysis in applications such as environmental monitoring, water and wastewater testing, soil and plant nutrient analysis, food safety, and pharmaceutical quality control. The market is driven by regulatory compliance needs, rising concerns over environmental contamination, and demand for automated analytical workflows in laboratories worldwide. Growing demand for water and environmental surveillance is likely to support the growth of the market.

Segmented Flow Analyzer (SFA) Market Growth Factors

- Rising Nutrient Monitoring in Agriculture: Increasing need to assess nitrate and phosphate levels in soil and water is fuelling demand for high-throughput flow analysis systems.

- Growing Trend of Lab Automation: Rising adoption of automated, software-integrated lab instruments is driving the shift toward advanced segmented flow analyzers.

- Boosting Nutritional Surveillance Programs: Expanded government-led initiatives for food fortification and nutrition analysis are propelling SFA utilization across public health labs.

- Expanding Water Reuse Projects: Growing implementation of municipal water recycling programs is driving precision nutrient monitoring, benefiting SFA adoption.

- Surge in Bioanalytical Research: Accelerated pharmaceutical and biochemical R&D is boosting the deployment of SFAs for reproducible, multi-parameter assays.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.73 Billion |

| Market Size in 2025 | USD 1.50 Billion |

| Market Size in 2024 | USD 1.36 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.62% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Detection Method, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Is Automation the Key to Accelerating Growth in the Segmented Flow Analyzer Market?

Increasing demand for automated analytical solutions is expected to drive market growth. Companies, such as laboratories in environmental monitoring, clinical diagnostics, and food testing, therefore value high-throughput systems that reduce human error and increase the efficiency of the process. Modular in nature and with software-controlled working, segmented flow analyzers automate the routine process of mixing reagents and diluting samples. These devices make work doable in a shorter time and guarantee replicate outputs of large sample batches, thereby validating the necessity of utilizing standardized testing procedures.

Laboratory-related automation-ready analyzers have been part of long-term efficiency plans as organizations go on with their modernization of laboratory facilities. By the year 2024, the National Institute of Standards and Technology (NIST) made it clear that automation was important in improving data reproducibility in chemical analysis, with its effect on intra-lab variability.(Source: https://www.ftc.gov)

Market Restraint

High Initial Capital Investment Challenges Market Adoption

Adoption through high initial capital investment, especially in resource-limited settings, is expected to hinder market growth. Segmented flow analyzers are mainly used in highly regulated laboratories with limited budgets. The total cost of ownership is also increased by maintenance and specialized reagents, and the training provided. Moreover, the availability of alternative analytical techniques is projected to affect demand, further hampering the market in the coming years.

Market Opportunity

Can Pharma and Biotech R&D Fuel the Next Wave of Growth in the Segmented Flow Analyzer Market?

Surging investment in pharmaceutical and biotechnology research is projected to expand market opportunities in the coming years. The protocols of drug development and quality control entail severe chemical and biochemical evaluation characterized using instruments that provide results that are reproducible and traceable. The major pharmaceutical organizations have implemented these analyzers in their GMP-aligned laboratories to speed up the process of releasing batches and addressing demands internationally.

The European Medicines Agency (EMA) has stated that validated, high-throughput testing in biologics development is important in its updated regulatory guidance on advanced therapy medicinal products in 2024. Furthermore, several biotechnology companies to implementing high-end segmented flow systems to analyze monoclonal samples in a parallel workflow to alleviate bottlenecks involved in the processing of analysis in the early phases of research.

(Source: https://www.ema.europa.eu)

Product Type Insight

What Makes Modular Segmented Flow Analyzers the Backbone of Segmented Flow Analyzer Market Demand?

Multi-channel SPA segment dominated the segmented flow analyzer market in 2024, accounting for an estimated 48% market share, as it had great accuracy concerning a variety of samples simultaneously. These vectors minimize the time required in the analytical cycle, elevate sample throughput, and permit multi-parameter testing to take place in a judicious time, which makes them favorable in high-volume processes.

Major players in the industry, such as Agilent Technologies, Thermo Fisher Scientific, and Metrohm AG, still invested in modular multi-channel systems to support regulatory requirements of the need for reproducibility and data integrity.

The advanced systems with an autosampler segment are expected to grow at the fastest rate in the coming years, owing to the automation of sample processing, minimal human error, and minimization of manual labour. Additionally, the increase in popularity with pharmaceutical and environmental monitoring processing labs in a need for completely automated workflows to suit their increased regulatory and productivity needs.

Detection Method Insights

Why Is Colorimetric Detection Leading the Charge in SFA Technology Adoption?

Colorimetric detection segment held the largest revenue share in the segmented flow analyzer market in 2024, accounting for 35% of the market share. This technique is simple, cheap, and be used across laboratories that monitor water quality and in agricultural settings, and food safety settings. Colorimetric detection presents quick visual or spectrophotometric evaluation of chemical reactions. Moreover, the colorimetric methods as additional regulations still prevail in established procedures of their testing endeavors, further facilitating the segment.

UV-Vis with software-integrated detection segment is expected to grow at the fastest CAGR in the coming years, as it helps in automated peak assessment, baseline adjustment, and real-time analysis. Such systems are increasingly being used in laboratories concerned more with trace-level measurements and that require high-throughput.

Application Insights

How Is Water & Wastewater Testing Driving the Core Growth of the Segmented Flow Analyzer Market?

Water & wastewater segment dominated the segmented flow analyzer market in 2024 that holding a market share of about 44%. Health agencies, city utilities, and industrial plants used segmented flow analyzers to measure important factors, such as ammonia, phosphate, nitrate, and total nitrogen. These systems have helped the company be in full compliance with national and international regulations. Furthermore, the U.S. National Institute of Standards and Technology (NIST) encouraged and facilitated the use of validated calibration standards for flow-based monitors, thus further fuelling the market in this sector.

Food & beverage quality control segment is expected to grow at the fastest rate in the coming years, owing to the increased number of regulatory checkups of food safety, nutritional labeling accuracy, and monitoring of contaminants. The segmented flow Analyzers provide the accuracy and speed of measuring chemical elements, such as sulfites, proteins, and preservatives in dairy products, processed foods, and beverages. Furthermore, the availability of new high-end SFA platforms with the option of connecting their systems to the laboratory automation software to enable smooth food testing processes further boosts the market growth.

End-User Insights

Why Do Environmental Agencies Dominate End-User Adoption in the Segmented Flow Analyzer Market?

The environmental agencies segment held the largest revenue share in the segmented flow analyzer market in 2024, accounting for an estimated 41% market share. Regulators increasingly turned to SFAs to enhance real-time tracking of pollutants, nutrient loads, and trace elements in freshwater systems, groundwater, and industrial effluent. These analyzers enabled the adherence to the strict regulations of environmental conservation set by various bodies, such as ECHA, U.S. EPA, and Health Canada. Additionally, smart water infrastructure also regards automated chemical analyzers as an essential element of their program, further driving the segment in the coming years.

Food & pharma manufacturing labs segment is expected to grow at the fastest CAGR in the coming years, owing to the growing focus on consistency of batches, ingredient checking, and control of contamination in food processing as well as drug production.

In 2024, the FSSAI and ISO revised the measures concerning chemical analysis in food-grade and API manufacturing, alongside emphasizing the use of a manually validated instrument. Furthermore, the segmented flow instruments have excellent throughput and carry out their responses with a high degree of reproducibility across various analytes, boosting their demand in the coming years.

Segmented Flow Analyzer Market Top Companies

- Agilent Technologies

- Elementar Analysensysteme GmbH

- Foss Analytical

- Lachat Instruments (Hach / Danaher Corp.)

- Metrohm AG

- OI Analytical (Xylem Inc.)

- PerkinElmer

- SEAL Analytical (Eijkelkamp Group)

- Skalar Analytical

- Systea S.p.A.

- Teledyne CETAC Technologies

- Thermo Fisher Scientific

Latest Announcements by Industry Leaders

Hydramotion

- Announcement: In July 2025, Hydramotion, a top manufacturer of process viscosity sensors, has launched ViscoMelt, its next-generation melt flow analyzer. Featuring the breakthrough Scorpion sensor technology, it delivers a complete real-time viscoelastic profile of thermoplastics, directly relating to MFI, IV, and molecular weight. These metrics were previously only available in labs or through costly, bulky, and slow mechanical systems.

(Source: https://www.packagingstrategies.com)

Recent Development

- In May 2025, BD, a global leader in medical technology, launched the world's first cell analyzer equipped with real-time imaging and spectral technologies. This innovation opens access for a broader range of researchers to gain deeper insights into previously undetectable cellular dynamics in flow cytometry, while improving throughput and simplifying operation.(Source: https://news.bd.com)

- In May 2025, Cytek Biosciences, Inc. unveiled the Cytek Aurora Evo system, an evolution of its original Aurora platform. Enhancing full spectrum flow cytometry with greater performance, the system builds on Cytek's Full Spectrum Profiling (FSP) technology already referenced in over 2,600 peer-reviewed publications further cementing its status as the global spectral cytometry standard.(Source: https://investors.cytekbio.com)

- In May 2025, Thermo Fisher Scientific Inc. introduced the Invitrogen™ Attune™ Xenith™ Flow Cytometer, a spectral-enabled solution that combines conventional and spectral flow cytometry. Designed to streamline immunology and oncology workflows, the device uses the company's legacy acoustic focusing technology to accelerate time-to-result and increase flexibility across multiple applications.(Source: https://www.businesswire.com)

- In April 2024, KPM Analytics launched NexaFlo, the latest in its line of segmented flow analyzers. Representing its fourth-generation innovation, the system enhances laboratory workflow by combining advanced chemical analysis capabilities with decades of wet chemistry expertise, delivering a safer and faster analytical solution for a variety of lab environments.(Source: https://www.kpmanalytics.com)

Segments Covered in the Report

By Product Type

- Basic Segmented Flow Analyzers

- Single-Channel Systems

- Multi-Channel Systems

- Advanced SFA Systems

- Systems with Autosamplers

- Systems with Integrated Data Management Software

- Modular / Customizable Units

By Detection Method

- Colorimetric Detection

- UV-Visible Spectroscopy

- Fluorescence-Based Detection (in niche systems)

- Turbidimetry / Absorbance

By Application

- Environmental Testing

- Water & Wastewater Analysis (e.g., nitrate, nitrite, phosphate, ammonia)

- Soil Nutrient Analysis

- Agricultural Testing

- Fertilizer Testing

- Plant Tissue Analysis

- Pharmaceutical & Life Sciences

- Raw Material and API Testing

- Drug Quality Control

- Food & Beverage Industry

- Additive/Contaminant Detection

- Nutrient Profiling

- Industrial Process Monitoring

- Academic & Research Institutions

By End-User

- Environmental Protection Agencies

- Agricultural Labs

- Municipal & Industrial Water Testing Facilities

- Pharmaceutical Manufacturers

- Food & Beverage Manufacturers

- Independent Testing Labs

- Universities & Research Organizations

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting