What is the Flow Cytometry Market Size?

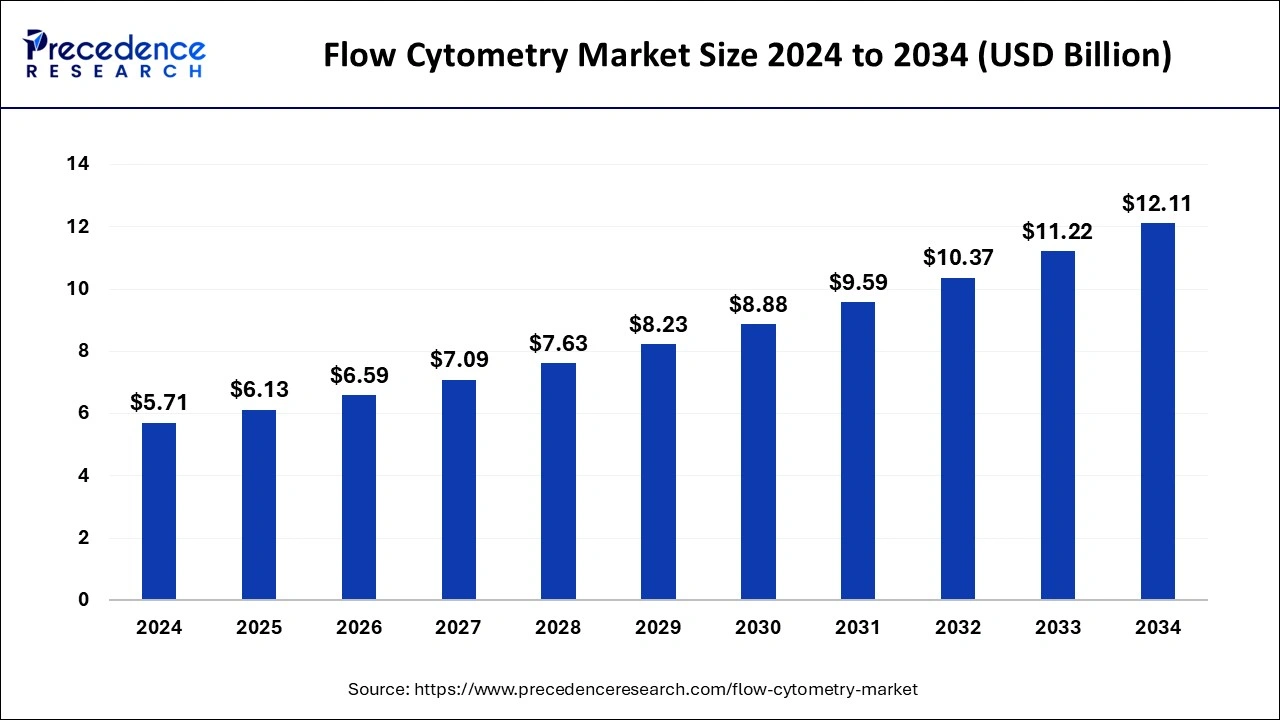

The global flow cytometry market size was USD 6.13 billion in 2025, accounted for USD 6.59 billion in 2026, and is expected to reach around USD 12.97 billion by 2035, expanding at a CAGR of 7.78% from 2026 to 2035. The flow cytometry market is growing due to its usage in healthcare for disease diagnosis and analysis of various specimens

The flow cytometry market share would increase as more people contract diseases like cancer and HIV. However, issues including expensive instrument and reagent costs, a lack of awareness among prospective end users, and a shortage of technical know-how are anticipated to restrain market expansion. The preference for ow cytometry in drug research, development, and diagnostics is anticipated to provide the market potential for ow cytometry.

Flow Cytometry Market Key Takeaways

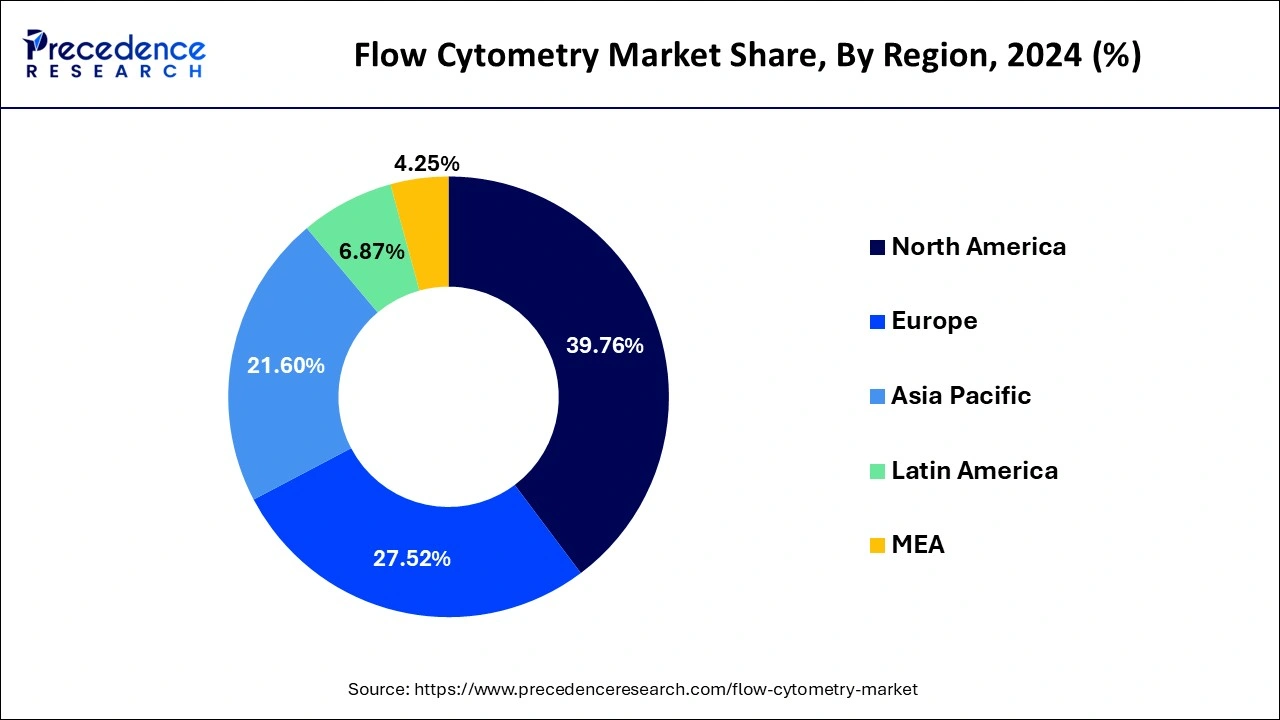

- North America led the market with the largest share of 39.76% in 2025.

- By product, the reagents and consumables segment is poised to grow at a CAGR of 8.22% from 2026 to 2035.

- By technology, the bead-based segment is growing at a CAGR of 7.79% during the forecast period.

- By application, the clinical segment is expected to reach a CAGR of 8.07% over the forecast period.

- By end user, the pharmaceutical companies segment is expected to witness growth at a CAGR of 7.92% over the forecast period.

- Asia-Pacific is expected to reach a CAGR of 8.35% over the forecast period from 2026 to 2035.

Integration of AI in the Flow Cytometry Market

Artificial intelligence (AI) has come a long way in the past ten years. The complexity of cell populations and the exponential rise of data make manual gating more challenging and impracticable. An answer to this problem is provided by AI and ML-powered automated gating algorithms. AI and machine learning (ML) are essential for data analysis and visualization in addition to automated gating. By enabling dimensionality reduction, cluster analysis, and cell identity interpretation, sophisticated algorithms enable researchers to glean valuable insights from intricate datasets. The foundation of this change will be advanced flow cytometry, which will use extremely complex, automated gating algorithms in place of manual gating.

Market Overview

In biology and medicine, flow cytometry is a potent analytical method that examines the physical and chemical properties of particles—usually cells or microorganisms as they pass past a laser beam in a fluid stream. It makes it possible to assess several aspects of individual cells at once, including size, granularity, and fluorescence intensity, which offers important information on the makeup, activity, and function of cells. Scientists and medical professionals may analyze and identify cell types, look into disease causes, and create tailored therapeutics thanks to the widespread use of flow cytometry in research, clinical diagnostics, and drug discovery.

Flow Cytometry Market Growth Factors

- Growing research in various diseases: The rising incidence of cancer and HIV/AIDS, the growing use of flow cytometry techniques in research, the expansion of public-private initiatives in immunology and immuno-oncology research, and the development of flow cytometry software are all major factors in the growth of the flow cytometry market.

- Multiple factors promote the growth of the market: the main factors driving the growth of the flow cytometry market are the rapid advancements in technology, the rise in chronic diseases that call for validation testing, and the demand for precise and delicate methods for disease validation.

- Usage in immunotherapy: In order to forecast the consequences of immunotherapy, researchers are increasingly adopting flow cytometry to subjectively and quantitatively study peripheral blood cells.

- Development of platforms: High resolution, increased effectiveness, and the development of effective statistical platforms are the main factors influencing the flow cytometry industry.

Major Trends

- There is increasing adoption of in-depth cellular profiling in immunology and oncology research and clinical studies.

- Growing use of automated systems and AI-driven data analysis software to simplify interpretation and improve reproducibility contributes to the market.

- Rising demand for table-top and portable flow cytometers in clinical laboratories and academic institutions drives the market.

- Increased fusion of flow cytometry with single-cell genomics and proteomics for comprehensive multi-omics analysis supports market expansion.

- Growth in contract research and outsourced cytometry services helps small laboratories manage capital expenditure efficiently.

Market Outlook

- Industry Growth Overview: The flow cytometry market continues to grow due to increasing cellular research, rising cancer incidence, and the widespread adoption of flow cytometry for clinical testing, immunotherapy R&D, and integration of clinical and basic lab practices.

- Sustainability Trends: Manufacturers are aligning with sustainability by incorporating energy-efficient lasers, reducing reagent use, and making consumables recyclable, supporting long-term environmental compliance in laboratory operations.

- Global Expansion: The market is growing worldwide, driven by advancing healthcare infrastructure, emerging biotech clusters, and government investment in life sciences and clinical diagnostics across several emerging economies.

- Startup Ecosystem: Startups are driving innovation with AI-supported cytometry analysis, microfluidic flow platforms, and reagent-free detection technologies, enabling small and medium-sized laboratories to adopt the technology more easily.

- Major Investors: Major investors in the market include global life science companies, venture capital firms, and private equity investors focused on biotechnology and laboratory diagnostics. Their investments drive innovation, support the development of advanced technologies like AI-assisted cytometry and microfluidic platforms, and expand accessibility for clinical and research laboratories, fueling overall market growth.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 7.78% |

| Market Size in 2026 | USD 6.59 Billion |

| Market Size in 2025 | USD 6.13 Billion |

| Market Size by 2035 | USD 12.97 Billion |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, By Technology, By Application, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Studies into immunology and immuno-oncology are receiving more attention

- The major factors driving the growth of the worldwide flow cytometry market are the growing emphasis on immunology and immuno-oncology research, the rising acceptance of flow cytometry methods in research activities and clinical trials, and the expanding technical improvements.

- The market is receiving support from the growing investment and public awareness of academic research. Currently, the United Nations has put over USD 38 billion into basic and lower secondary education to fill the external funding shortfall. This will contribute to the maintenance of high standards in education while fostering strategic growth that will positively affect the progress of the country. In today's technologically advanced world, several institutions and colleges are putting unique teaching techniques into practice. This new genome-based knowledge has sparked a new era of research into single cells.

- There doesn't seem to be a stop in sight for the growth of this sector. The workhorse of the pharmaceutical sector is becoming a significant player in biotechnology. Recent research has shown that microfluidic flow cytometry devices are useful tools for handling and examining the input of single cells and micron-sized particles. The development of new products, which is expected to drive market growth over the course of the forecast period, is where the major players in the market are focusing their efforts.

The increasing number of HIV cases

- A key market driver for flow cytometry is the rise in HIV diagnoses throughout the world. This is due to the direct use of flow cytometry technology in HIV diagnosis. Light scattering is used in flow cytometry to identify cells. Depending on the kind of scattering, these cells are given specific markers known as CDs (clusters of differentiation).

- The clusters of differentiation for the HIV virus cell are known as CD4s, and flow cytometry may be used to detect HIV based on the quantity of CD4s present in a medium. The need for diagnostic methods like flow cytometry is rising along with the worldwide HIV population.

Key Market Challenges

- The availability of cheaper and better substitutes - A significant barrier to the market for flow cytometry is the existence of better and less expensive alternatives. These alternatives include radioimmunoassay and ELISA (enzyme-linked immunosorbent assay). While all three techniques flow cytometry, ELISA, and radioimmunoassay help to diagnose HIV by identifying "problem cells" among a population of cells, ELISA and radioimmunoassay are less expensive and simpler than flow cytometry.

- High cost & lack of awareness - The prevalence of chronic illnesses like cancer and HIV is predicted to rise, which will increase the use of flow cytometry in diagnostic applications. On the other side, issues including high prices for equipment and reagents, a lack of awareness among prospective end users, and a lack of technical competence are anticipated to hinder the growth of the flow cytometry market.

Key Market Opportunities

The market observed substantial growth in the bioengineering segment

- In terms of market opportunity, the bioengineering segment and its applications in a number of industries, including drug development, cell culture, and stem cell treatment, have seen significant growth. Additionally, the market is anticipated to develop as a result of the rising frequency of infectious illnesses and the rising need for quick and accurate cancer prognostic tools. In general, it is anticipated that increased demand would be driven by rising applications in the life science sector. The growth of the market is more likely to be caused by the increase in healthcare organizations that support the use of high-quality treatments and medical procedures.

Increased use of flow cytometry methods in academic and research settings

- With millions of cells per second, flow cytometry is an advanced method for detecting individual cells and other particles in suspension. Extracellular vesicle analysis, environmental studies, and the ability to employ up to 30 distinct parameters are all now possible using flow cytometry. The context of immunology is where it is most frequently used. For instance, according to a News-Medical.net story from December 2018, cancer researchers frequently utilize fluorescent-tagged monoclonal antibodies in conjunction with flow cytometry. Similarly, high-throughput image-based flow cytometry is now acknowledged and widely utilized in scientific research and academia, notably in cancer biology, following more than 10 years of intensive study.

Segment Insights

Product Insights

The instruments segment led the flow cytometry market in 2024, accounting for the biggest revenue share of 35.07%. It is anticipated that this segment will continue to dominate the market during the forecast period. This high proportion is credited to recent technological developments and the introduction of innovative cytometers by significant players. The high cost of these devices is another factor in this segment's strong income creation.

Technology Insights

The market for flow cytometry was led by the cell-based category, which in 2024 had the highest revenue share (74.90%). Its biggest proportion is driven by rising interest in early diagnosis and expanding knowledge of the advantages of cell-based tests. Additionally, it is projected that improvements in cell-based assay technology, including innovation in tools, labels, affinity reagents, software, and algorithms, will spur usage in the upcoming years.

Infectious illness research uses tests using beads. Due to developments in molecular engineering and monoclonal antibody manufacturing and the benefits they bring, such as cost-effectiveness, a low sample need, and quick turnaround times, the market for these assays is anticipated to expand profitably throughout the projection period. These tests, also known as indirect or sandwich immunoassay formats are used to gauge the number of antibodies present in biological fluids. In these assays, conjugated antigen molecules are coated on beads to assess the presence of antibodies in the fluid.

Global Flow Cytometry Market Revenue, By Technology, 2022-2024 (USD Million)

| Technology | 2022 | 2023 | 2024 |

| Cell-based | 3,713.1 | 3,981.4 | 4,273.1 |

| Bead-based | 1,246.9 | 1,335.7 | 1,432.2 |

Application Insights

With a market share of 45.06% in 2024, the research sector led the industry. It is predicted that this dominance will continue during the forecast period. The rise in R&D efforts for infectious illnesses like COVID-19 and cancer can be blamed for this high percentage. Additionally, it is anticipated that rising R&D expenditures in the pharmaceutical and biotechnology sectors would foster market expansion.

Due to the rising need for affordable illness diagnosis and the benefits of flow cytometry in disease detection, such as quicker and more precise findings, the clinical diagnostic market is predicted to develop at the quickest rate. The launch of innovative flow cytometry technologies for clinical applications and ongoing organic expansion strategies by leading companies are also projected to considerably help segment growth. For instance, in April 2019, the Chinese FDA approved the use of Cytek Biosciences' new flow cytometer, DxP Athena, which is intended for clinical diagnostic applications in labs, hospitals, and clinics.

End-Use Insights

The universities segment dominated the flow cytometry market with the largest share in 2024. This is mainly due to the increased participation of universities in research studies. Universities often focus on the research and study of various fields like biology and medicine. As the participation of universities and academic institutions rises in research programs, the need for flow cytometry also increases. Flow cytometry allows scientists to study cellular functions and disease mechanisms

The research institutions segment is anticipated to expand at a significant growth rate in the coming years. These institutions often engaged in scientific discovery. The increasing focus on cancer research to develop targeted therapies boosts the adoption of flow cytometry. Adopting flow cytometry allows researchers to analyze cell populations and cellular functions and study disease mechanisms. The increasing government investments in R&D activities further contribute to segmental growth.

Regional Insights

What is the U.S. Flow Cytometry Market Size?

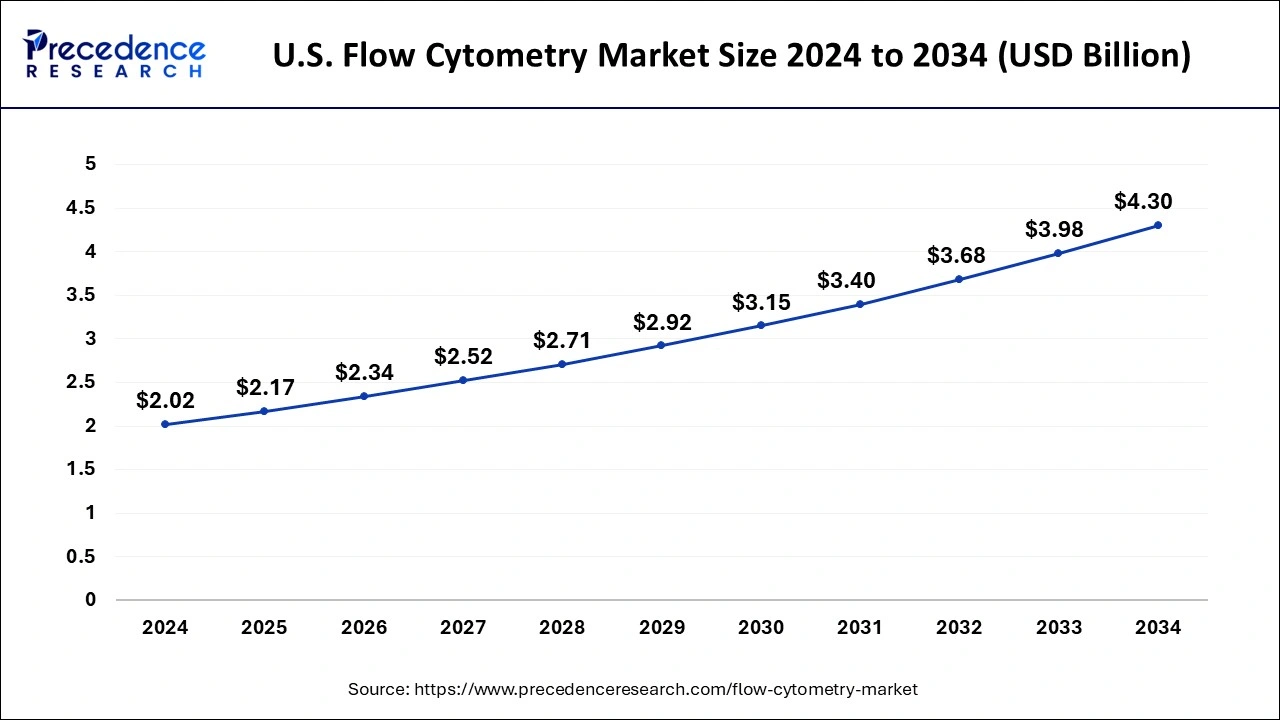

The U.S. flow cytometry market size was estimated at USD 2.17 billion in 2025 and is predicted to be worth around USD 4.61 billion by 2035, at a CAGR of 7.83% from 2026 to 2035.

North America dominated the flow cytometry market in 2024. The growth of the market is attributed to the rising advancements in the healthcare and pharmaceutical industry, the higher prevalence of advanced flow cytometry solutions, and well-established healthcare structures in countries like the United States and Canada are driving the growth of the flow cytometry market. Rising investments in the research and development program for the development of flow cytometry devices the rising investment in research activities by the research universities and the presence of the major pharmaceutical firms contribute to the growth of the flow cytometry Market.

U.S. Flow Cytometry Market Trends

The U.S. Flow Cytometry Market is seeing substantial expansion fueled by technological advancements and rising applications in multiple fields, especially in healthcare and research. The increasing incidence of chronic illnesses, like cancer and autoimmune conditions, has amplified the need for efficient diagnostic instruments. The rising availability of advanced flow cytometry technologies, robust U.S. healthcare systems, and advancing pharmaceutical and healthcare innovations support the growth of the market.

The market is expanding because of rising investments in research and development initiatives aimed at producing flow cytometry instruments. Capital and financing have led to a strong R&D framework in biotechnology, biopharmaceuticals, clinical studies, and life sciences research.

This is anticipated to enhance further research and development for cell analysis in new drug discovery and development efforts using flow cytometry methods. Flow cytometry is increasingly utilized as a standard technique in clinical labs for monitoring leukemia, lymphoma, and CD4/CD8 levels. Suppliers are providing combined reagents and service agreements for steady income and enhanced user convenience.

- Flow cytometry is used in clinical and laboratory; therefore, a high demand for flow cytometry solutions in the U.S. due to its advanced healthcare system. Rapid advancements in research and development support for the discovery of products are expected to provide great opportunities for the market.

Asia Pacific is expected to witness significant growth in the flow cytometry market during the forecast period. The region is expected the grow in the market owing to the rising healthcare infrastructure and the rising investments by the leading healthcare companies for the development of healthcare facilities are driving the growth of the flow cytometry Market. Additionally rising availability of biotechnology and pharmaceutical firms in emerging economies like India and China. The rising cases of chronic diseases and the use of cytometry devices in several applications are driving the growth of the flow cytometry market across the region.

The growth of pharmaceutical and biotechnology industries in emerging nations including China, and India reinforces the utilization of flow cytometry devices. The market growth is boosted by the increasing prevalence of chronic diseases and the growing utilization of cytometry devices across various applications.

Recent Breakthroughs in Indian Flow Cytometry Market

The flow cytometry market in India has been progressing in recent years. Cities like Delhi, Mumbai, and Bangalore lead the market because of their concentration of advanced healthcare facilities, research institutions, and a greater number of pharmaceutical and biotechnology firms. These cities enjoy enhanced access to advanced technologies and diagnostic tools, which aids their dominance in flow cytometry utilization. The Indian government has simplified the clinical trial approval process through the New Drugs and Clinical Trials Rules, 2019, enabling the application of advanced diagnostics like flow cytometry in clinical trials.

- For instance, in May 2023, BD Life Sciences-Biosciences, part of BD (Becton, Dickinson, and Company), partnered with Sehgal Path Lab to recently open its Center of Excellence (CoE) in Flow Cytometry for clinical research in Mumbai. Designed to function as the National Reference Center for clinical diagnostic purposes, this is the third clinical CoE in Flow Cytometry by BD in India.

What Are the Key Trends Driving Growth in Europe's Flow Cytometry Market?

The flow cytometry market in Europe is experiencing substantial growth. The growing attention to public health and biomedical development has substantiated the popularity of high-throughput and high-end flow cytometries, capable of performing a fast and accurate analysis of cells, essential in diagnostic and therapeutic research. Also, Europe has an active healthcare system and robust investment in life sciences research, which is the driving force of the market.

The UK market has been experiencing high growth as a result of a strategic partnership between the government agencies and the private sector. Through these alliances, innovative products in flow cytometry are in development and launch in both clinical diagnostic settings and in research settings. Various policies and funding programs directed towards promoting biomedical research are helping in enhancing the market penetration.

How Rapidly Is the Latin American Flow Cytometry Market Expanding?

The Latin American flow cytometry market is projected to grow at a notable compound annual growth rate. The governments and privately run organizations that are investing in research infrastructure to help improve the domestication of healthcare and biotechnology and this is driving demand for advanced flow cytometry products. Increasing uses in oncology, immunology, and personalized medicine are also increasing the demand for highly advanced flow cytometry instruments and reagents in the region. The increased finances and efforts of governments in encouraging innovation in the field of life science and adoption in clinical and research contexts are also being promoted.

How is the Opportunistic Rise of the Middle East & Africa in the Flow Cytometry Market?

The Middle East & Africa (MEA) is experiencing an opportunistic rise in the market due to expanding healthcare infrastructure, increasing investment in clinical diagnostics, and growing focus on research and biotechnology initiatives. Rising adoption of advanced diagnostic technologies in hospitals, academic institutions, and private laboratories is driving demand for flow cytometers across the region. Additionally, the growth of contract research organizations and outsourced cytometry services is creating new opportunities for market players to expand their presence in MEA.

Value Chain Analysis

- Raw Material and Reagent Sourcing:

This stage involves the supply of essential antibodies, fluorochromes, buffers, and consumables used in flow cytometry systems.

Key players: Thermo Fisher Scientific, Merck KGaA, and BD Biosciences. - Instrumentation and Equipment Manufacturing:

At this stage, companies design and manufacture flow cytometers, lasers, detectors, and fluidics systems.

Key players: BD Biosciences, Beckman Coulter, and Sysmex Corporation. - End-Users:

The final stage involves hospitals, academic research centers, biotech and pharmaceutical companies, which utilize flow cytometry for immunology, oncology, cell therapy, and diagnostics applications.

Key players: Cleveland Clinic, Mayo Clinic, and leading universities.

Flow Cytometry Market Companies

- Danaher Corporation

- Becton

- Dickinson and Company

- Luminex Corporation

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Miltenyi Biotec

- Sysmex Corporation

- Stratedigm, Inc.

- Apogee Flow Systems Ltd.

- Sony Biotechnology, Inc.

- Thermo Fisher Scientific, Inc.

Announcement by Industry Leaders:

- In May 2024, KCAS Bio continues to expand its global network, and Crux Biolabs, Melbourne Australia has been chosen as the provider of harmonized spectral flow cytometry in the US, Europe, and Australia.

- Stefan Cross, the CEO at Crux Biolabs said, “We are excited about this cooperation with KCAS Bio and to offer the highest quality services to the biopharma and pharmaceutical industries.

Recent Developments

- In January 2025, BD (Becton, Dickinson and Company) announced a collaboration with Biosero, a laboratory automation developer, to collaborate on the integration of robotic arms and the BD flow cytometry instruments. This partnership will aim to identify the automation of manual activities in drug discovery and development in order to improve efficiency and throughput in laboratory workflows.

(Source: https://news.bd.com) - In March 2024, Beckman Coulter Life Sciences received the FDA's 510(k) market approval to sell its DxFLEX Clinical Flow Cytometer in the United States. This development makes high-complexity flow cytometry testing more accessible to laboratories without the need for additional expense.

- In January 2024, Cytek Biosciences, Inc. contracted with the Centre for Genomic Regulation (CRG) and Pompeu Fabra University (UPF) to foster technological innovation and accelerate discoveries in the scientific community. The partnership underscores the major impact of Cytek's spectral flow cytometry technology, paving the way for growth into new applications.

Segment Covered in the Report

By Product

- Instruments

- Cell Analyzers

- Cell Sorters

- Reagents & Consumables

- Accessories

- Software

- Services

By Technology

- Cell-based

- Bead-based

By Application

- Research

- Pharmaceutical

- Drug Discovery

- Stem Cell

- In Vitro Toxicity

- Apoptosis

- Cell Sorting

- Cell Cycle Analysis

- Immunology

- Cell Viability

- Pharmaceutical

- Industrial

- Clinical

- Cancer

- Organ Transplantation

- Immunodeficiency

- Hematology

By End-Use

- Universities

- Research Institutions

- Pharmaceutical companies

- Biotech

- Other Institutions

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content