What is the Tangential Flow Filtration Market Size?

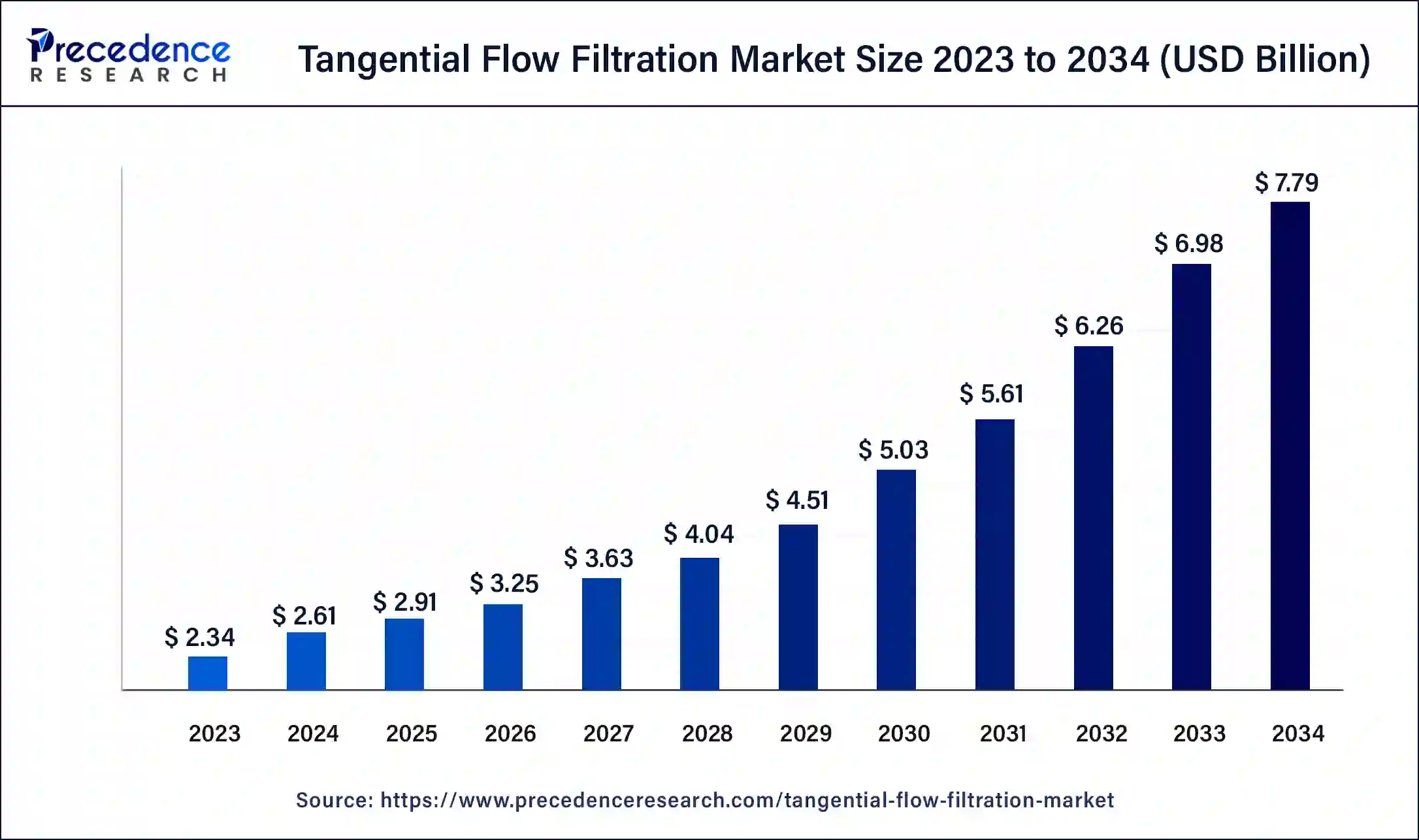

The global tangential flow filtration market size is calculated at USD 2.91 billion in 2025 and is predicted to increase from USD 3.25 billion in 2026 to approximately USD 8.54 billion by 2035, expanding at a CAGR of 11.37% from 2026 to 2035.

Tangential Flow Filtration Market Key Takeaways

- The global tangential flow filtration market was valued at USD 2.91billion in 2025.

- It is projected to reach USD 8.54billion by 2035.

- The tangential flow filtration market is expected to grow at a CAGR of 11.37% from 2026 to 2035.

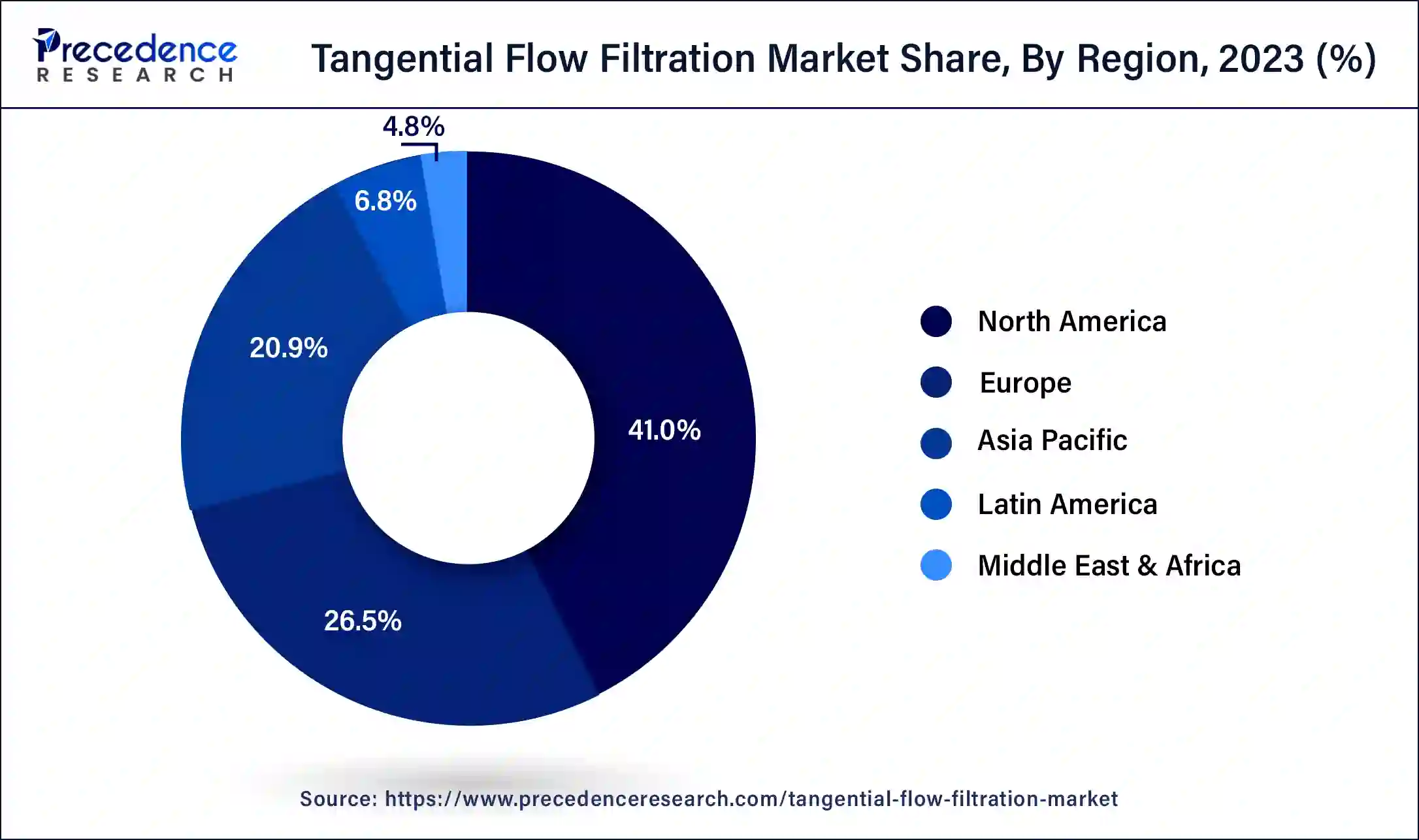

- North America contributed the largest market share of 41% in 2025.

- Asia Pacific is observed to expand notably in the market during the forecast period.

- By technology, the microfiltration segment generated the highest market share of 32% in 2025.

- By technology, the nanofiltration segment is expected to grow at a notable rate in the market during the forecast period.

- By product, the membrane filters segment recorded the major market share of 33% in 2025.

- By product, the single-use tangential flow filtration systems segment is expected to grow at a solid CAGR of 12.30% over the forecast period.

- By application, the protein purification segment accounted for the biggest market share of 29% in 2024.

- By application, the vaccine & viral vectors segment is expected to grow significantly in the market during the forecast period.

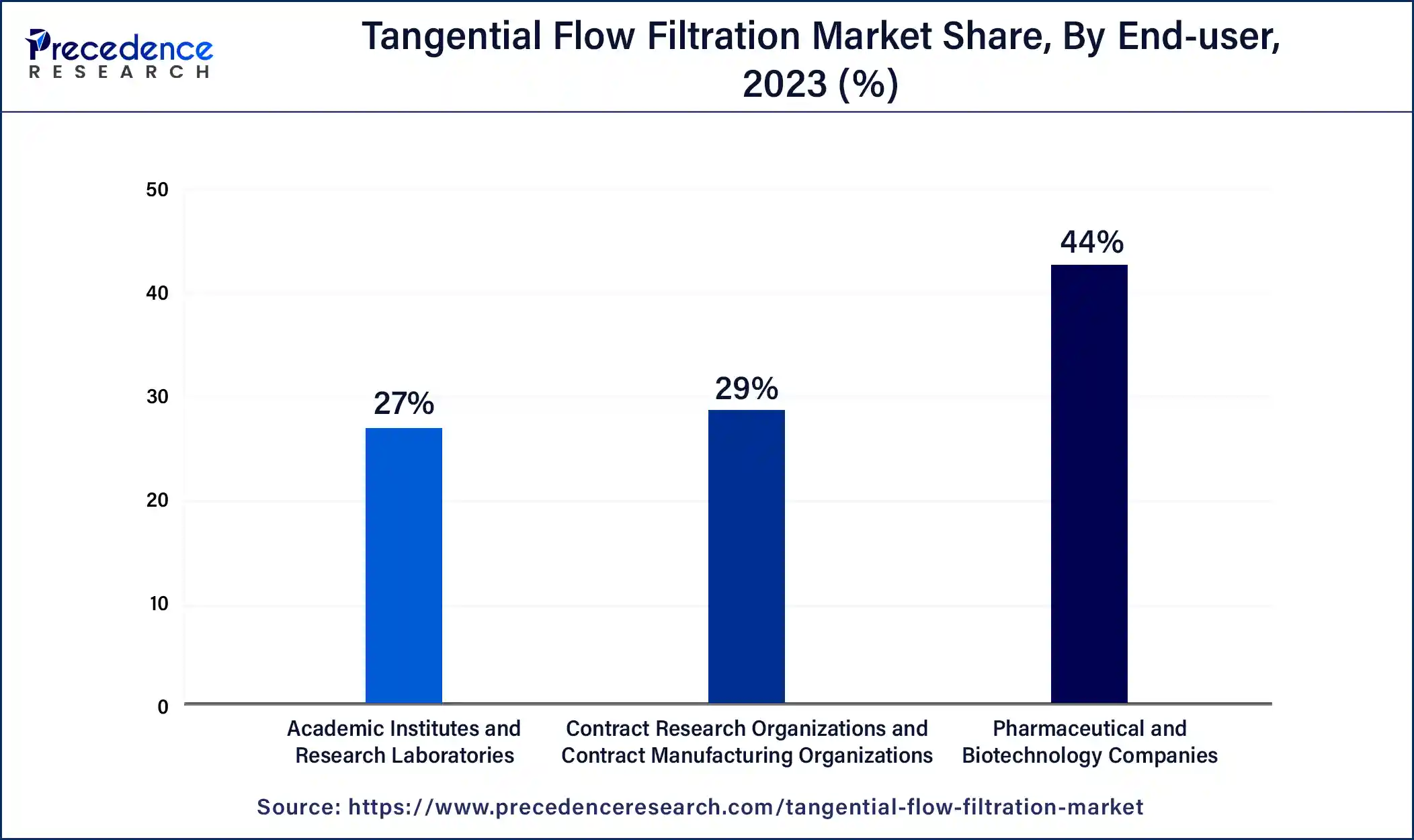

- By end-user, the pharmaceutical & biotechnology companies segment held the largest market share of 44% in 2025.

- By end-user, the contract research organizations (CROs) & contract manufacturing organizations (CMOs) segment is expected to grow at a fastest CAGR during the forecast period.

Market Overview

Tangential flow filtration (TFF) is also popularly known as crossflow filtration. TFF has increasingly gained prominence in bioprocessing. It plays a crucial role in applications such as protein purification, virus filtration, and other downstream processing tasks. TFF is a rapid, cost-effective, and efficient method for separating and purifying biomolecules by utilizing ultrafiltration membranes.

Tangential flow filtration is a technique that is most widely utilized for separating and purifying proteins and other biological molecules from mixtures such as cell culture media or lysates. Tangential flow filtration enables the efficient processing of large volumes of solution while minimizing sample loss and assisting in preserving the integrity of sensitive molecules. TFF allows immunology, microbiology, and biochemistry researchers to remove impurities and assist in retaining the desired molecules.

Technological Impacts on Biopharmaceutical Filtration Process

The rising adoption of single-use technologies in the biopharmaceutical industry positively impacts the growth of the tangential flow filtration market. Single-use technology offers several benefits throughout the entire manufacturing process. It has significantly transformed biopharmaceutical manufacturing by introducing cost-effective, convenient, contamination-reducing solutions. Moreover, the rapid innovation in TFF technology, including the development of new materials, membranes, and automation systems, is enhancing the efficiency, performance, and reliability of TFF systems.

- In September 2024, MilliporeSigma launched its Mobius ADC Reactor, a single-use reactor specifically designed for the production of antibody-drug conjugates (ADCs). ADCs, a rapidly growing class of therapeutic agents, offer targeted and selective killing of tumor cells while protecting healthy ones.

Tangential Flow Filtration Market Growth Factors

- The increasing investments in biopharmaceutical research and development activities are anticipated to fuel the market's expansion during the forecast period.

- The rise in life-threatening and chronic diseases is expected to support the market's growth during the forecast period.

- The rising demand for efficient separation and purification technologies in biopharmaceutical manufacturing is anticipated to spur the demand for the Tangential Flow Filtration system in the coming years.

- Companies are increasingly investing in bioprocessing and biomanufacturing to improve production efficiencies along with the ongoing demand for biopharmaceuticals, which contributes to the growth of the tangential flow filtration market.

- The increasing complexity of bioprocessing workflows and the demand for highly efficient filtration methods have significantly driven the adoption of TFF systems.

- The rising innovations in filtration technologies are anticipated to enhance the efficiency and effectiveness of tangential flow filtration, creating significant growth opportunities for the tangential flow filtration market during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 8.54 Billion |

| Market Size in 2025 | USD 2.91 Billion |

| Market Size in 2026 | USD 3.25 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.37% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Technology, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Expansion of the biopharmaceutical industry

The rapid expansion of the biopharmaceutical industry is expected to boost the growth of the tangential flow filtration market during the forecast period. TFF plays an integral part role in applications such as virus filtration, protein purification, and other downstream processing tasks. Single-use TFF systems are increasingly gaining momentum as these systems assist in reducing the risk of cross-contamination, offering flexibility, and lowering operational costs, which makes them a preferred choice in biopharmaceutical manufacturing.

The tangential flow filtration market has witnessed an increasing demand for biopharmaceutical products, such as recombinant proteins, monoclonal antibodies, and vaccines. Tangential flow filtration (TFF) is extensively utilized in the biopharmaceutical industry for the purification and concentration of these products. Additionally, biopharmaceutical companies are highly investing in innovative filtration solutions, which are anticipated to propel the growth of the market and maintain their crucial role in the future of bioprocessing.

Restraint

High initial investment

The high initial investment associated with the tangential flow filtration is anticipated to hamper the tangential flow filtration market growth. Significant capital expenditure is required to set up new production facilities. Small and medium-sized companies are discouraged from adopting TFF technology due to budget constraints. In addition, the easy availability of product substitutes is widely accepted in the market.

Opportunity

Increasing demand for gene therapy

The rising demand for gene therapy is expected to boost the growth of the tangential flow filtration market during the forecast period. The production of viral vectors is the most important step in gene therapy and vaccine manufacturing. Tangential flow filtration is an integral technology widely used in the downstream processing of viral vectors. The use of the right technologies ensures an efficient, optimized, and predictable process.

- According to the IQVIA report in March 2024, the expenses on cell and gene therapies are substantially rising over the period and reached USD 5.9 billion in 2023, rising 38% from 2022, although spending accounted for only 0.4% of the USD 1.6 trillion spent on medicines globally in 2023. As of the end of 2023,76 cell and gene therapies have been launched worldwide, more than double the number of therapies that had been launched by 2013.

Segment Insights

Technology Insights

The microfiltration segment led the global tangential flow filtration market in 2025. The segment is majorly driven by the increasing use of microfiltration technology during cell separation processes. In microfiltration, suspended solids are removed from the fluid using microporous media, and the pore size is in the range of 0.1 to 1 micron. Microfiltration is widely used for various applications such as cold sterilization of beverages and pharmaceutical products, separation of bacteria from water, and others. Microfiltration membranes offer effective solutions for challenges such as microbial removal, protein fractionation, and treatment of other membranes.

The nanofiltration segment is expected to grow at a notable rate in the tangential flow filtration market during the forecast period. Nanofiltration technology is widely utilized in the selective ion separation and end-stage sterilization process. Nanofiltration allows small ions to pass through while excluding larger ions and most organic components such as fats, proteins, bacteria, gums, spores, sugars, and others. In nanofiltration, the pore size of the membrane ranges from 1 to 10 nm. These membranes significantly use less energy while producing a high flux at low pressures.

Application Insights

The protein purification segment held the largest share of the tangential flow filtration market in 2025 and is expected to sustain its position throughout the forecast period owing to the rising production of therapeutic proteins that employ TFF during manufacturing. In several biomanufacturing industries, tangential flow filtration has eliminated the use of centrifugation. Moreover, there is a significant rise in the adoption of recombinant protein-based therapeutics.

- In November 2023, Repligen Corporation announced the commercial launch of TangenX SC, the industry's first holder-free, self-contained tangential flow filtration device. The technology is especially suited to the manufacture of biologics where fully closed systems are critical or ideal, including antibody-drug conjugates (ADCs), viral vectors, nucleic acids, and lipid nanoparticles, and can also be applied to monoclonal antibody, and recombinant protein production.

The vaccine & viral vectors segment is expected to grow significantly in the tangential flow filtration market during the forecast period. The segment's growth is majorly driven by the rising need for preventative treatment during the pandemic, such as COVID-19 vaccines. The extensive use of tangential flow filtration technology in the downstream process is anticipated to accelerate the segment's growth. TFF plays an important role in the clarification of vaccines. Additionally, TFF is most commonly used in viral vector manufacturing for two major purposes, defiltration and volume reduction, prior to the capture chromatography stage. Before the last sterile filtering, the final concentration is exchanged with the formulation buffer.

End-user Insights

The pharmaceutical & biotechnology companies segment held the largest share of the tangential flow filtration market in 2024. The rising incidence of chronic diseases increases the need for effective therapeutics, which compels pharmaceutical and biotechnology companies to adopt advanced filtration systems. These companies are highly investing to support their R&D efforts. Moreover, the COVID-19 vaccine production by pharmaceutical and biotechnological companies has significantly contributed to this segment's revenue generation.

- In November 2022, TFF Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company focused on developing and commercializing innovative drug products based on its patented Thin Film Freezing technology platform, announced a collaboration with Aptar Pharma, a global leader in drug delivery and active material science solutions and services.

The contract research organizations (CROs) & contract manufacturing organizations (CMOs) segment is expected to grow at the fastest rate in the tangential flow filtration market during the forecast period owing to the increasing demand for biopharmaceutical products, rising investment, and the increasing adoption of single-use technologies. Tangential flow filtration systems offer contract research organizations (CROs) and contract manufacturing organizations (CMOs) the required flexibility, save operating time, and enhance efficiency in the manufacturing process. This also enables these entities to produce biopharmaceutical products with high speed for commercialization.

Product Insights

The membrane filters segment led the global tangential flow filtration market in 2025 and is projected to continue its dominance over the forecast period. There are four most common types of membrane filtration: reverse osmosis, ultrafiltration, nanofiltration, and microfiltration. Factors such as the wide adoption of filtration systems by several industries, the rising awareness regarding the benefits of the TFF system over normal flow filtration, and rising accessibility to different filter types, including PES, PCTE, and PVDF.

The single-use tangential flow filtration systems segment will witness considerable growth in the tangential flow filtration market over the forecast period owing to the increasing demand for single-use technologies by contract organizations, pharmaceutical and biopharmaceutical industry, and research institutes. There are several benefits offered by single-use TFF systems, such as the elimination of cross-contamination, smaller footprints, and rapid processing times. In addition, technological improvements are expected to enhance the efficiency and scalability of single-use TFF systems, making them a pivotal tool in downstream processing.

Regional Insights

What is the U.S. Tangential Flow Filtration Market Size?

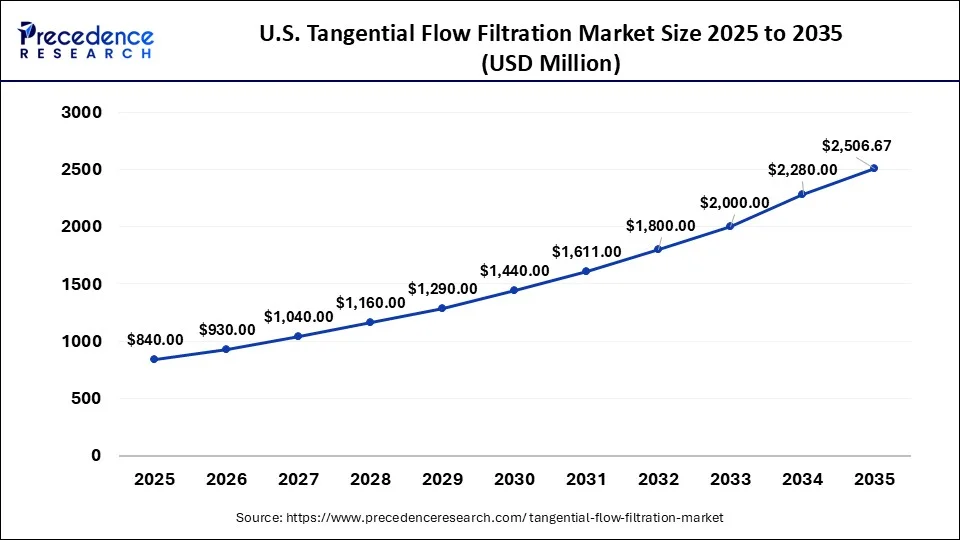

The U.S. tangential flow filtration market size was exhibited at USD 840 million in 2025 and is projected to be worth around USD 2,507 million by 2035, poised to grow at a CAGR of 11.55% from 2026 to 2035.

North America held the dominant share of the tangential flow filtration market in 2025 and is expected to witness prolific growth during the forecast period. The region is expected to witness significant growth during the forecast period owing to its well-established healthcare infrastructure, strong presence of TFF product manufacturers, increasing popularity of gene therapy, favorable government policies, rising focus on developing biosimilars and personalized medicine, increasing adoption of single-use TFF systems, and rising prevalence of chronic diseases and genetic disorders.

North America's extensive research and development activities in biopharmaceuticals, strong commitment to innovation, and rising adoption of advanced filtration technologies are anticipated to drive the market's growth. The United States is the major contributor to the market due to the presence of advanced biopharmaceutical production capabilities, increasing demand for innovative filtration technologies, and increasing demand for medical treatments and therapies. Furthermore, the rapid expansion of bioprocessing facilities fulfills the demand for biotherapeutics.

- In July 2021, the Government of Canada launched the Biomanufacturing and Life Sciences Strategy. This means more than USD 2.2 billion over seven years from budget 2021 to continue growing a strong and competitive sector and to ensure the country is prepared for future pandemics.

- According to the CDC data published in May 2024, every year in the United States, 1.7 million people are diagnosed with cancer, and more than 600,000 die from it, making it the second leading cause of death.

Asia Pacific is observed to expand notably in the tangential flow filtration market during the forecast period. The region's growth is driven by the substantial investment in the healthcare sector, rising demand for biologics and drugs, increasing incidences of chronic diseases, supportive Government framework, rising demand for biologics and drugs, increasing focus on the innovation of new treatments, and growing demand for low-cost therapeutics.

Rising investments from foreign and domestic companies and increasing CMOs in emerging economies such as Japan, China, India, and South Korea are expected to accelerate the growth of the tangential flow filtration market in the Asia Pacific region. China has a strong presence in the bioprocessing industry and is gaining significant momentum through rapid investments in the life sciences and biopharmaceuticals sectors.

- In August 2022, Repligen unveiled its new customer experience center for bioprocessing in Bengaluru. Bioprocessing technologies from Repligen are designed to deliver configurable options for end-to-end modern bioprocessing needs. With this new facility in India, Repligen is inspiring advances in bioprocessing for the customers it serves, primarily biopharmaceutical drug developers and contract development and manufacturing organizations across the country.

What are the Advancements in the Tangential Flow Filtration Market in Europe?

Europe is expected to witness significant growth in the market. This growth is because the region benefits from a strong regulatory framework that encourages innovation in biopharmaceutical manufacturing. The region is also witnessing increasing investments in healthcare and biotechnology, along with a growing emphasis on sustainable practices, thus driving market growth. Countries like Germany, France, and the UK are leading players.

Germany Tangential Flow Filtration Market Trends: The country has a strong commitment towards research and development, which opens up various opportunities in bioprocessing technologies. In addition to that, increasing investments from domestic and international companies helps to enhance production capabilities.

What are the Key Trends in the Tangential Flow Filtration Market in Latin America?

Latin America is expected to witness substantial growth in the upcoming years. This growth is fueled by the region's increasing healthcare expenditures, a rising number of biopharmaceutical companies, and a growing awareness of advanced filtration technologies. Countries like Brazil and Mexico are leading players, driven by supportive government initiatives that help to promote biotechnology sectors.

Brazil Tangential Flow Filtration Market Trends: The country's focus on research and development, coupled with favorable government policies, is expected to propel the market further, opening up new avenues of opportunities. Overall, Brazil is poised to remain one of Latin America's leading TFF markets, benefiting from technological advancements and increasing integration of TFF solutions in biotech and downstream processing applications.

MEA's Growing in the Tangential Flow Filtration Industry

The Middle East and Africa are expected to grow at a steady pace in the upcoming years, driven by increasing investments in healthcare infrastructure and a growing demand for biopharmaceuticals. Countries like South Africa and the UAE are leading players in the region as they are supported by strong government initiatives that are aimed at enhancing healthcare services and biotechnology sectors.

Saudi Arabia Tangential Flow Filtration Market Trends: The country's growth is gradual but steady, highlighting a growing interest. Research initiatives between academic institutions and industry players are gaining traction, driving technological advancements and fostering development.

Tangential Flow Filtration Market Companies

- Solaris Biotechnology SRL

- Danaher Corporation

- Merck KGaA

- Sartorius AG

- Repligen Corporation

- Parker Hannifin Corporation

- Alfa Laval

- Andritz Group

- Meissner Filtration Products, Inc.

- Sterlitech Corporation

Recent Developments

- In March 2022, the U.S. Food and Drug Administration approval processes comprise numerous steps to ensure the safety and efficacy of new drugs, therapies, and treatments. Navigating the process can be complex and time-consuming, and as a result, the FDA is proactively looking for methods to accelerate the pace of approval.

- In September 2024, Sartorius launched its Vivaflow SU tangential flow filtration for streamlining laboratory workflows. The new TFF cassette is designed for enhanced ease of use and flexibility in the laboratory and offers more efficient and sustainable ultrafiltration and diafiltration processes for 100 mL–1000 mL feed volumes.

- In September 2021, ABEC launched the TFF system. ABEC claims its TFF system offers the largest flow rates and filter areas in the industry in a single-use format. ABEC's custom single-run (CSR) tangential flow filtration systems were announced to increase downstream productivity for its bioprocess customers.

- In September 2024, Sartorius launched Vivaflow SU, setting a new standard for laboratory-dedicated tangential flow filtration. Designed for enhanced ease of use and flexibility, Vivaflow SU ensures more efficient and sustainable ultrafiltration and diafiltration processes for feed volumes ranging from 100 to 1,000 mL.

Segments Covered in the Report

By Product

- Single-use Tangential Flow Filtration Systems

- Reusable Tangential Flow Filtration Systems

- Membrane Filters

- Filtration Accessories

By Technology

- Ultrafiltration

- Microfiltration

- Nanofiltration

- Others

By Application

- Protein Purification

- Vaccine & Viral Vectors

- Antibody Purification

- Raw Material Filtration

- Others

By End-user

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations & Contract Manufacturing Organizations

- Academic Institutes & Research Laboratories

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting