Glucosamine Market Size and Forecast 2025 to 2034

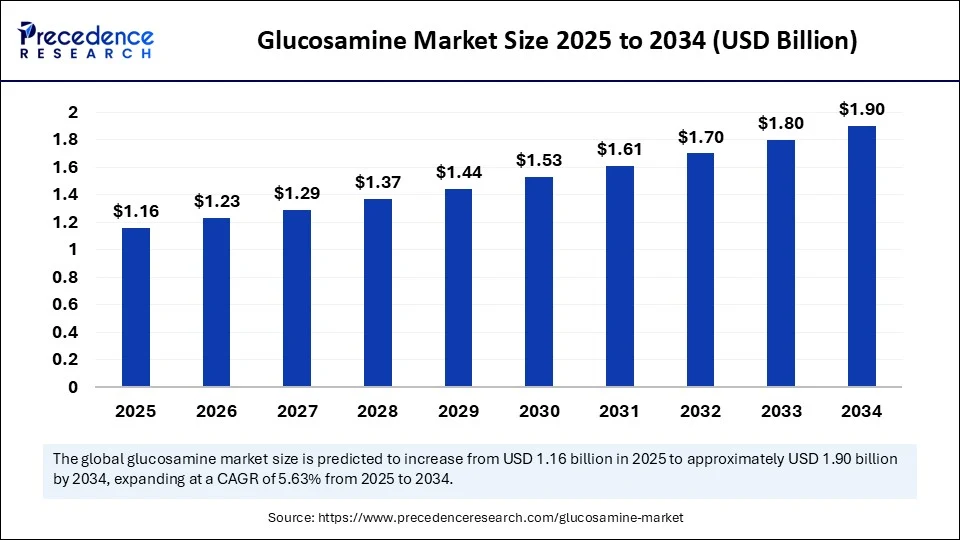

The global glucosamine market size accounted for USD 1.10 billion in 2024 and is predicted to increase from USD 1.16 billion in 2025 to approximately USD 1.90 billion by 2034, expanding at a CAGR of 5.63% from 2025 to 2034. The market growth is attributed to increasing consumer awareness of joint health and the rising adoption of preventive healthcare practices globally.

Glucosamine MarketKey Takeaways

- In terms of revenue, the global glucosamine market was valued at USD 1.10 billion in 2024.

- It is projected to reach USD 1.90 billion by 2034.

- The market is expected to grow at a CAGR of 5.63% from 2025 to 2034.

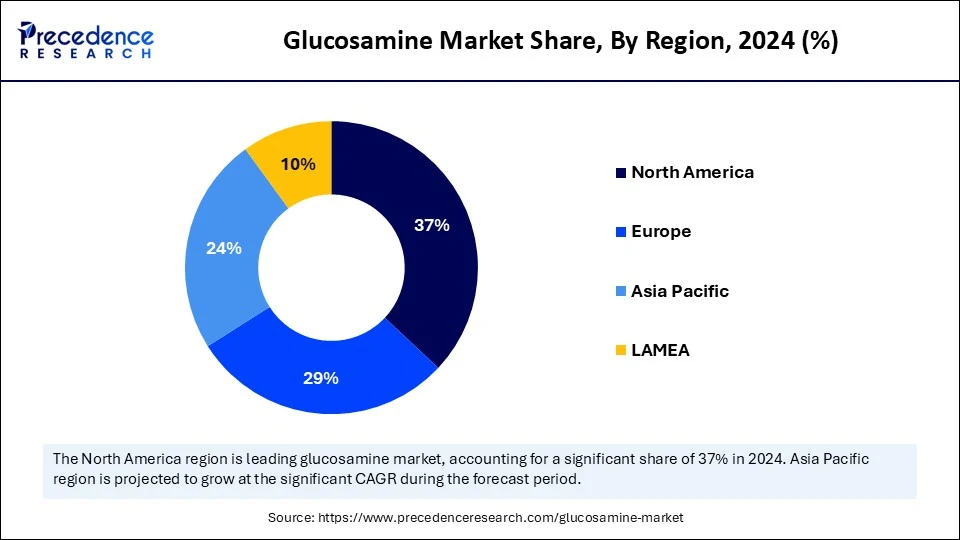

- North America accounted for the largest market share of 37% in 2024.

- Asia Pacific is expected to grow at a notable CAGR in the glucosamine market from 2025 to 2034.

- By product type, the glucosamine sulfate segment held the major market share in 2024.

- By product type, the N-acetyl glucosamine segment is projected to grow at a CAGR between 2025 and 2034.

- By source, the shellfish-based segment contributed the biggest market share in 2024.

- By source, the plant-based segment is expected to expand at a significant CAGR between 2025 and 2034.

- By application, the nutraceuticals and dietary supplements segment dominated the market in 2024.

- By application, the functional foods & beverages segment is expected to grow at a significant CAGR over the projected period.

- By end-user, the human healthcare segment dominated the global market with the largest market share in 2024.

- By form, the solid segment contributed the highest market share in 2024.

- By form, the gummies sub-segment is expected to grow at a notable CAGR from 2024 to 2034.

- By distribution channel, the pharmacies segment captured the highest market share in 2024.

- By distribution channel, the online sales segment is projected to grow at a CAGR between 2025 and 2034.

What Has the Impact of Artificial Intelligence Been on the Glucosamine Market?

The glucosamine industry has been positively impacted by utilizing Artificial Intelligence technology in terms of speed of research, a smarter production system, and consumer offerings. The companies use AI-powered data automation to assess the outcomes of clinical trials and monitor international trends in the joint health market. This anticipates changes in demand and designs glucosamine formulas that best serve developing customer preferences. Raw material requirements are predicted using machine learning tools and optimized supply chains, so production delays are decreased and the cost incurred is minimized. Furthermore, the firms that embrace these technologies can react to trends faster, be more innovative, and establish themselves in a competitive market environment better.

U.S. Glucosamine Market Size and Growth 2025 to 2034

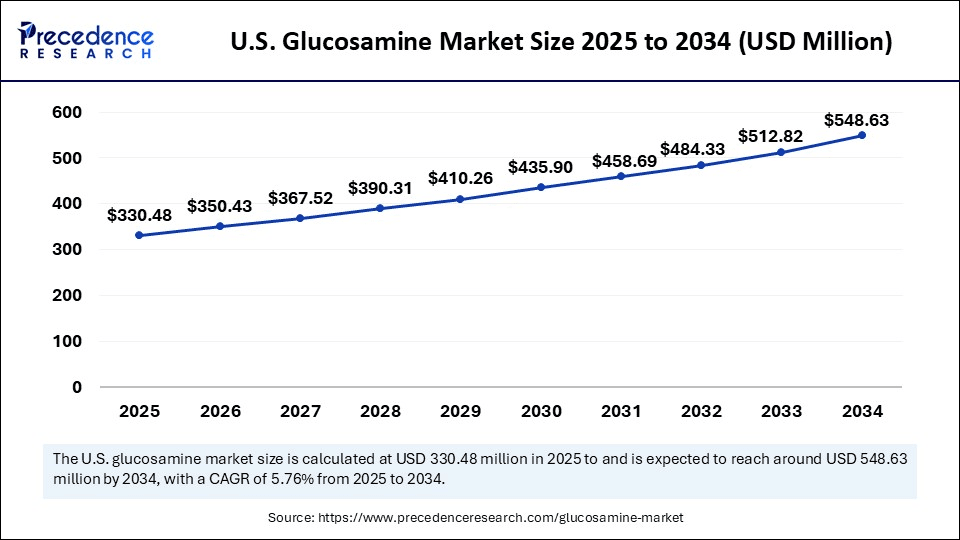

The U.S. glucosamine market size was exhibited at USD 313.39 million in 2024 and is projected to be worth around USD 548.63 million by 2034, growing at a CAGR of 5.76% from 2025 to 2034.

Which Regional Powerhouse Is Defining the Competitive Landscape of the Glucosamine Market?

North America led the glucosamine market, capturing the largest revenue share in 2024, accounting for an estimated 37% market share, due to influenced by the strong consumer awareness of joint health supplements, solid nutraceutical regulation, and the availability of superior goods to the consumers. This region is characterized by the presence of key players in the market, well-developed networks of retail pharmacies, and the increasing demand for middle-aged and elderly persons to use preventive healthcare methods.

According to the U.S. CDC, 18.9% of adult citizens had diagnosed arthritis in 2022, and the prevalence increased to 53.9% in groups aged 75 and above, illustrating that the need for supportive therapies is high. Mature joint care dietary supplement business in the U.S. and Canada, coupled with finite disposable income, is positive for the stable joint-care product expenditure. Furthermore, as per the Osteoarthritis Action Alliance, around 78 million people in the U.S. are expected to suffer from osteoarthritis, which further stimulates the demand for glucosamine products. (Source: https://www.cdc.gov)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to urbanization, growth in income levels, especially disposable incomes, and the move to preventive health, especially in the emerging economies. Government health activities to promote the awareness of musculoskeletal age-related disorders in China, Japan, and India are gaining popularity, so far, promoting the adoption of dietary supplements. Furthermore, the increase in e-commerce offers glucosamine products even in remote territories where physical retailing is barely established, further facilitating the market in this region. (Source: https://oaaction.unc.edu/)

Market Overview

The glucosamine market refers to the global industry involved in the production, processing, distribution, and sale of glucosamine, a naturally occurring amino sugar found in cartilage. It is widely used as a dietary supplement to support joint health, treat osteoarthritis symptoms, and aid in cartilage repair. Glucosamine is available in various chemical forms, such as glucosamine sulfate, glucosamine hydrochloride, and N-acetyl glucosamine, sourced from shellfish, plant-based raw materials, or synthetic processes. The market covers raw material suppliers, nutraceutical and pharmaceutical manufacturers, and retail distribution channels, catering to diverse end users, including human healthcare and veterinary applications.

The education process concerning joint health and prevention contributes to the growth of the glucosamine market, due to the growth in populations that regularly search out effective and non-invasive ways to treat osteoarthritis and other related conditions. The World Health Organization (WHO) estimates the number of patients affected by osteoarthritis globally at 528 million or more. The demand increases particularly for those over 55, with further increases associated with the availability of supporting therapy. Furthermore, the increasing trends in preventive healthcare promote the idea of using glucosamine supplements as a daily health program among the middle-aged and the elderly population.(Source: https://www.who.int)

Glucosamine MarketGrowth Factors

- Growing Adoption of Personalized Nutrition: Rising consumer demand for customized supplement regimens is driving innovation in glucosamine formulations tailored to individual health needs.

- Boosting Digital Health Integration: Increasing use of AI and health apps fuels personalized glucosamine recommendations, enhancing user engagement and adherence.

- Rising Interest in Combination Supplements: Growing preference for multi-ingredient products propels the development of glucosamine blends with complementary joint-support compounds.

- Driving Expansion in Emerging Markets:Economic growth and improving healthcare infrastructure in Asia-Pacific and Latin America boost glucosamine product accessibility and demand.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1.90 Billion |

| Market Size in 2025 | USD 1.16 Billion |

| Market Size in 2024 | USD 1.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.63% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Source, End User, Application, Form, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Increasing Demand for Joint Health Supplements Shaping the Future of the Glucosamine Market?

Increasing demand for joint health supplements is expected to strengthen glucosamine market growth. The growth is further boosted by the growing demand for joint-health supplements as the number of people suffering from osteoarthritis increases. According to the 2023 WHO report, osteoarthritis cases amounted to 528 million in 2019, compared to only 133 million in 1990. 73% of patients are aged above 55 years. According to healthcare workers, a daily dose of 1,500 mg of glucosamine sulfate is based on clinical evidence to reduce knee discomfort. This facilitates the preservation of cartilage and has a favourable safety profile.

Sports MDs also incorporate glucosamine into sports medicine treatment plans of athletes and physically active adults due to its pro-jointal effects, as shown in published research articles. The European regulatory bodies assess glucosamine through the health systems of several nations, which promotes its use among physicians and customers. Channels such as NIH and EFSA urge consumers to prioritize joint mobility and musculoskeletal health within ageing populations, thus indirectly supporting the demand for scientifically supported options. Furthermore, the consumption of a supplement combination of glucosamine, along with physical activity and a proper diet, to enhance joint support interventions is expected to propel the market in the coming year. (Source: https://www.who.int)

Restraint

How Have Concerns Over Product Safety and Side Effects Hampered the Glucosamine Market Growth?

Fears over the safety and side effects of the products are likely to impact consumer confidence and demand and hamper market growth. The inconsistency of clinical results in previous studies contributes to a poor perception of patients towards the field of dental surgery due to a lack of patient trust. Furthermore, the limited standardization and quality control of glucosamine products are anticipated to undermine market reliability.

Opportunity

How Is High Investment in Research and Development Going to Drive Innovation and Growth Within the Glucosamine Sector?

High investment in research and development is estimated to advance the industry through improved formulations and clinical validation, further creating immense opportunities for the market. Companies are undertaking extensive tests to estalish the effectiveness of glucosamine in reducing inflammation, in slowing the degeneration of cartilage, and improving the health of the joints. (Source: https://myorthoevidence.com)

A systematic review and meta-analysis of 25 randomized controlled trials in knee osteoarthritis performed in 2024 found that glucosamine sulfate significantly reduced the pace of joint-space narrowing in the tibiofemoral joint. Both glucosamine sulfate and chondroitin sulfate had strong safety profiles. In February 2024, guidance on the data needed to assess both the safety and bioavailability of novel sources of supplement ingredients was issued by EFSA nutrition experts. Giving a clear regulatory pathway to novel sources of glucosamine and allowing innovation with confidence, European Food Safety Authority+1. Additionally, the use of industry-academic collaborations is promoted with clearer utilization of glucosamine products, thus further fuelling the market in the coming years. (Source: https://www.efsa.europa.eu)

Product Type Insights

Which Product Type Is Steering the Glucosamine Market Toward Wider Consumer Adoption?

The glucosamine sulfate potassium chloride salt segment dominated the glucosamine market in 2024, accounting for an estimated 38% market share, as it has been clinically accepted and proven effective in managing osteoarthritis symptoms in most patients. According to the 2023 WHO report, approximately 73% of individuals with osteoarthritis are aged over 55, and around 60% are women. This type of glucosamine is highly bioavailable and resistant to degradation, which is why most medical practitioners are willing to use it when dealing with long-term maintenance of the joints.

It's the ability to be combined with additional ingredients of joint support, including chondroitin sulfate and methylsulfonylmethane (MSM). This empowers the manufacturers to develop combination products that have a broader appeal among consumers. Its market position has also been hardened by regulatory approvals in various countries and good recommendations in clinical guidelines. Furthermore, the increasing maturity of the world population, along with the rising preventive care, is likely to maintain a healthy demand, thus further fuelling the segment growth. (Source: https://www.who.int)

The N-acetyl glucosamine segment is expected to grow at the fastest rate/fastest CAGR in the coming years, as it continues to find use in more areas of supplement practice beyond joint health into gastrointestinal and dermatological health. This derivative presents specific biochemical effects, anti-inflammatory power, and mucosal health support, which have been recently in the spotlight in clinical studies. Additionally, the challenges to vegan and allergen-free sources of this sub-segment follow the growing demand for plant-based and hypoallergenic products.

Source Insights

Is the Dominant Source of Glucosamine Shaping Product Innovation and Market Competitiveness?

The shellfish-based segment held the largest revenue share in the glucosamine market in 2024, accounting for 54% of the market share, as extractive methods and fully embedded supply networks have been developed, which transform crustacean waste into chitin and then glucosamine. This source is the preferred choice of manufacturers due to its industry-scale chitin extraction and hydrolysis processes.

They provide reproducible yields and reliable impurity profiles, which facilitate dosing of tablets and capsules. Moreover, with such benefits in terms of operation and evidence, it is likely to be reported that glucosamine continues to have demand in the traditional pharmaceutical-grade and mass-market supplement channels.

Meanwhile, the plant-based segment is expected to grow at the fastest rate in the glucosamine sector in the coming years, owing to firmer consumer demand for vegan, allergen-free, and traceable ingredients and a clearer regulatory pathway for fermentation-derived products. This segment limits dependence on animal-derived feedstocks, a factor that encourages industry investment in corn-fermentation strategies. Additionally, the consumer-preference drivers that promote a healthy uptake of corn-fermentation glucosamine in the areas of functional foods, thus facilitating the segment.

Application Insights

Which Application Area Holds the Strongest Influence on Glucosamine Market Demand?

The nutraceuticals & dietary supplements segment dominated the glucosamine market in 2024, holding a market share of about 41%, due to their combination of accurate dosing, long shelf life, and cost-effectiveness. The stability of the glucosamine content in tablet forms with no quality devolution on storage is found useful to the health practitioners. This attaches high priority to the form's ability to ensure the consistency of the formulation.

- According to the 2023 Council for Responsible Nutrition report, about 75% of Americans use dietary supplements.

By 2024, brands Nature's Bounty, Blackmores, and Schiff Nutrition launched and began marketing optimized glucosamine tablets that match with chondroitin and MSM, upping combined joint-health efficacy. These tablets also use coating technologies to increase taste and promote sustained-release attributes, which improve patient adherence and satisfaction rates. Furthermore, these convenient dosage forms are sought by aging populations in North America, Europe, and Asia to maintain the health of their joints in the long term.(Source: https://www.crnusa.org)

The functional foods & beverages segment is expected to grow at the fastest CAGR in the coming years in the market for glucosamine, owing to the trends of preventive health and consumer demand for nutrition conveyed by the daily diet. Large companies such as Nestle Health Science and Danone would launch multi-health drinks that contain glucosamine in the Asia-Pacific and European markets. Additionally, the rapid rate of use is supported by the increased growth of sports nutrition and dietitian-endorsed joint-support fortified foods.

End User Insights

Is the Geriatric Population End-User Group Driving Sustained Growth in the Glucosamine Market?

The geriatric population segment held the largest revenue share in the glucosamine market in 2024, accounting for 48% market share, due to the prevalence of osteoarthritis, as the old age group is growing rapidly. According to the 2023 WHO report, around 344 million people with osteoarthritis experience moderate to severe symptoms that could benefit from rehabilitation.

Health systems around the globe are facing increased pressure with an ageing population, which contributes to rehabilitation requirements and a preventive care model that focuses on joint health. The use of nutraceuticals combined with physical therapy is becoming an increasing part of the care pathway to maintain mobility without the need for more advanced surgical procedures. Moreover, the effectiveness of nutraceuticals in geriatric patients and the information that informs recommendations, thus further facilitating the market growth. (Source: https://www.who.int)

The human healthcare segment is also expected to grow at the fastest rate in the coming years in the glucosamine market, owing to the focus of sports science on joint strength and injury prevention promoted by the use of individual supplements. Furthermore, the Product innovators retaliate by coming up with athlete-friendly forms, such as quick-mix powders, single-serving sticks, and in capsule formats, which further boost the demand for glucosamine products.

Form Insights

Which Form Factor Is Leading Consumer Preference in the Glucosamine Market?

The solid segment dominated the glucosamine market in 2024, accounting for 46% of the market share, due to its precision in dosing, stability, and economical production technique. Tablets are commonly used by healthcare professionals in chronic regimens since tablet drugs of tablets provide reliable active ingredient levels through prolonged shelf life. This helps sustain compliance among the various elderly and prescription-driven patient populations. Additionally, this segment's ability to ease inventory management and further counseling by pharmacists, thus allowing them to maintain their wide penetration in the market.

The gummies segment is expected to grow at the fastest CAGR in the coming years, owing to the increase in consumer demand for easy-to-chew formats and the enhancement of adoption by adults, who were previously not focused on children's vitamins. Research on food science has recorded technological breakthroughs that enhance the stability of nutrients. That allows the incorporation of functional actives in gummy frameworks, using alternate gelling agents and microencapsulation methodologies, making formulators consider changing joint-support ingredients to gummies in 2024. Furthermore, the launch of new gummies for joint pain for adults is expected to fuel the market growth in this region.

- Jan. 20, 2025, Pilly Labs has introduced Joint Support Gummies, a groundbreaking supplement that blends the power of natural ingredients with the convenience of a flavorful gummy format. Formulated to target common joint health issues—including discomfort, stiffness, and reduced mobility—this innovation aims to help consumers maintain an active, pain-free lifestyle with ease.(Source: https://finance.yahoo.com)

Distribution Channel Insights

Are Certain Distribution Channels Emerging as the Primary Growth Engines for the Glucosamine Market?

The pharmacies segment held the largest revenue share in the glucosamine market in 2024, accounting for 44% market share, as they are easily accessible, professionally advised, and full of consumer confidence. These sales channels continue to be a source of purchase of dietary supplements for joint health. They offer assistance in dosage, proof of the authenticity of the purchased goods, and safety concerns, particularly to older adults, who may also be taking numerous medicines under care. Furthermore, the in-store promotions and increased intervention of point-of-sale health consultation in the urban and semi-urban regions are expected to propel the market in the coming years.

The online sales segment is expected to grow at the fastest CAGR in the coming years, owing to the expanding encroachment of e-commerce platforms and the ease of direct-to-door deliveries. Consumers are expected to learn more about products, their brands, transparent ingredients, product comparisons, and access to supplement brands sold elsewhere globally through online sources. Additionally, the increased use of subscription-based services and personalized digital marketing promotion activities further facilitates the market.

Glucosamine MarketCompanies

- Amway Corporation

- Blackmores Limited

- Capsugel (Lonza Group)

- Cargill Incorporated

- Doctor's Best Inc.

- Glanbia plc

- Herbalife Nutrition Ltd.

- Jarrow Formulas, Inc.

- Nature's Way Products, LLC

- NBTY, Inc.

- NOW Foods

- NOW Health Group, Inc.

- Nutramax Laboratories, Inc.

- Panjin Huacheng Pharmaceutical Co., Ltd.

- Puritan's Pride, Inc.

- Reckitt Benckiser Group plc

- Schiff Nutrition International, Inc.

- TSI Group Ltd.

- Yantai Dongcheng Biochemicals Co., Ltd.

- Zhejiang Aoxing Biotechnology Co., Ltd.

Recent Developments

- In July 2025, Ahmedabad-based Torrent Pharmaceuticals expanded its consumer-focused nutrition portfolio with the launch of Shelcal Total, a premium nutritional supplement powder for adults. Originally introduced under the Shelcal brand name—acquired by Torrent Pharma in 2013 and previously used for adult and kids' gummies—this new formulation is designed to deliver targeted nutrients, including calcium, magnesium, vitamin D3, and vitamin K2 for bone strength. It also contains glucosamine and bamboo shoot extract to promote joint health. The company stated that Shelcal Total supports comprehensive bone and joint wellness as part of a daily nutrition regimen.

(Source: https://health.economictimes.indiatimes.com) - In June 2025, the makers of TYLENOL unveiled Proactive Support, a drug-free joint health supplement formulated to enhance comfort and mobility. Powered by a proprietary TamaFlex blend of turmeric and tamarind, the product is clinically shown to improve flexibility, joint function, and comfort in as little as five days. Its targeted mechanism of action promotes a healthy inflammatory response and supports active lifestyles, offering consumers a natural approach to maintaining mobility.

(Source: https://www.kenvue.com) - In April 2024, Slovenia-based PharmaLinea introduced >Your< Arthro Ease Capsules, its latest clinically supported private-label nutraceutical for joint care. This next-generation supplement leverages multiple modes of action, including cartilage tissue regeneration, anti-inflammatory benefits, and pain relief. Clinical studies have demonstrated its high efficacy in reducing joint pain severity, discomfort, swelling, and stiffness, while restoring mobility for individuals with osteoarthritis or lower back pain. The advanced formulation is designed to deliver comprehensive joint support for improved daily function.(Source: https://www.vitafoodsinsights.com)

- In August 2025, Ultimate Pet Nutrition announced the debut of Mobility Renew, a veterinarian-developed soft chew supplement formulated to support canine joint health, flexibility, and comfort. Created by renowned veterinarian Dr. Gary Richter, this premium pet health solution features clinically studied ingredients designed to help dogs of all ages stay active and maintain optimal joint function. The product is positioned as a convenient, palatable option for pet owners seeking to improve their dogs' mobility and overall well-being.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Product Type

- Glucosamine Sulfate

- Potassium Chloride Salt

- Sodium Chloride Salt

- Others

- Glucosamine Hydrochloride

- N-Acetyl Glucosamine

- Others

- Blended Forms

- Modified Glucosamine Derivatives

By Source

- Shellfish-based

- Crab

- Shrimp

- Lobster

- Others

- Plant-based

- Corn Fermentation

- Fungal Sources

- Others

- Synthetic

By Application

- Nutraceuticals & Dietary Supplements

- Tablets

- Capsules

- Powders

- Gummies

- Liquids

- Pharmaceuticals

- Prescription Osteoarthritis Treatments

- Over-the-Counter Joint Care Formulations

- Veterinary Use

- Pet Supplements (Dogs, Cats)

- Livestock Health Products

- Others

- Sports Nutrition

- Functional Foods & Beverages

By End User

- Human Healthcare

- Adults (18–40 Years)

- Geriatric Population

- Athletes

- Animal Healthcare

- Companion Animals

- Performance Animals

- Others

- Institutional Buyers (Hospitals, Clinics)

By Form

- Solid

- Tablets

- Capsules

- Powders

- Liquid

- Syrups

- Solutions

- Others

- Gummies

- Effervescent Tablets

By Distribution Channel

- Pharmacies

- Retail Pharmacies

- Hospital Pharmacies

- Health & Nutrition Stores

- Online Sales

- Supermarkets/Hypermarkets

- Others

- Direct Sales

- Specialty Clinics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East &Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting