What is the hERG Screening Market Size?

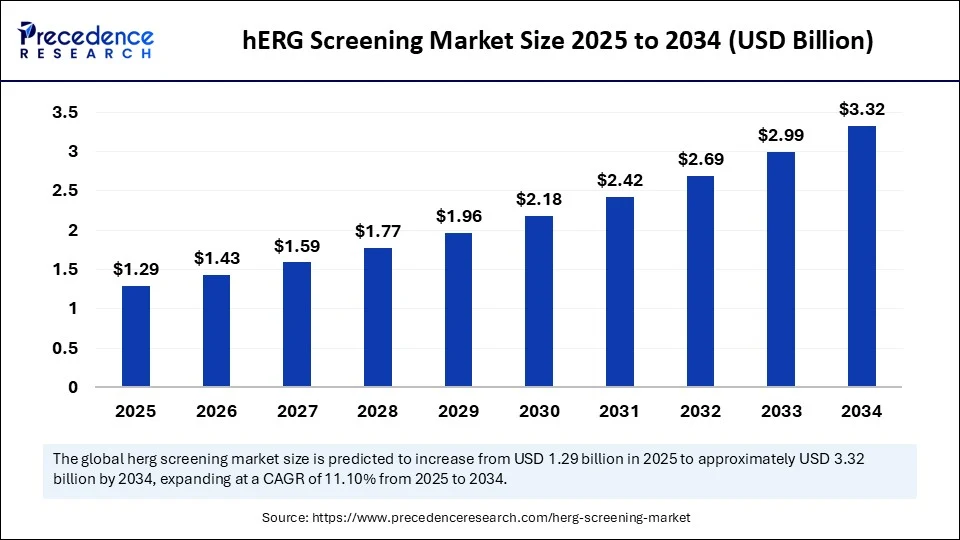

The global hERG screening market size accounted for USD 1.29 billion in 2025 and is predicted to increase from USD 1.43 billion in 2026 to approximately USD 3.63 billion by 2035, expanding at a CAGR of 10.90% from 2026 to 2035. The rising development of innovative drug formulations is driving the global hERG screening market.

hERG Screening MarketKey Takeaways

- In terms of revenue, the global hERG screening market was valued at USD 1.90billion in 2025.

- It is projected to reach USD 3.63billion by 2035.

- The market is expected to grow at a CAGR of 10.90% from 2026 to 2035.

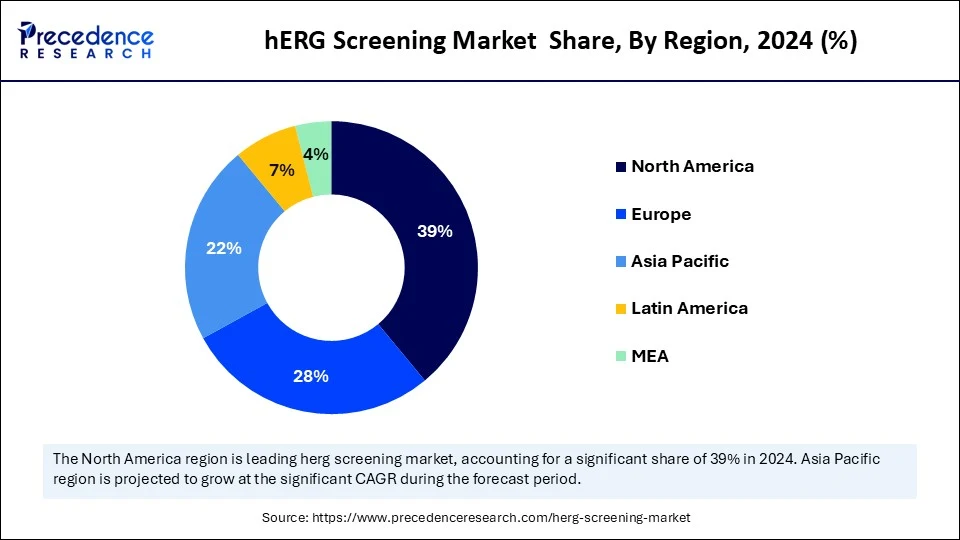

- North America dominated the hERG screening market with the largest share of 39% in 2025.

- Asia Pacific is expected to grow at a significant CAGR from 2026 to 2035.

- By assay type, the functional assays segment led the market in 2025.

- By technology, the automated electrophysiology platforms captured the biggest market share of 36% in 2025.

- By technology, the high-throughput screening (HTS) segment will grow at the fastest CAGR between 2026 and 2035.

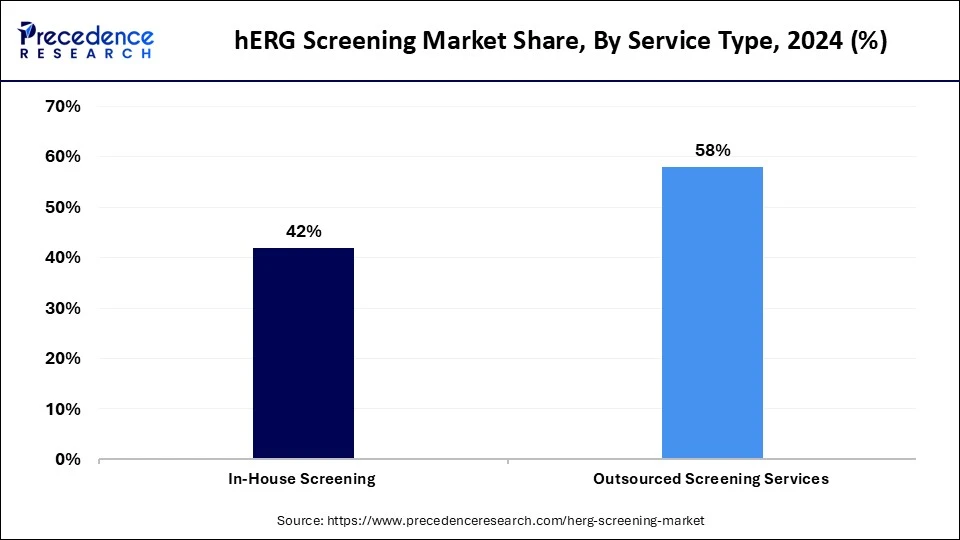

- By service type, the outsourced screening services segment captured the highest market share of 58% in 2025 and is expected to grow at the fastest rate over the forecast

- period.

- By service type, the in-house screening segment is expected to grow at a notable CAGR between 2025 and 2035.

- By end-user, the pharmaceutical & biotechnology companies segment held the highest market share of 61% in 2025.

- By end-user, the contract research organizations (CROs) segment will grow at a significant CAGR between 2026 and 2035.

- By application, the preclinical safety & toxicology segment contributed the largest market share of 47% in 2025.

- By application, the regulatory submission studies segment will expand at a significant CAGR between 2026 and 2035.

- By scale of operation, the preclinical-scale screening segment generated the major market share of 40% in 2025.

- By scale of operation, the high-throughput screening scale segment will expand at a significant CAGR between 2025 and 2035.

Market Overview

The hERG screening market refers to the global industry involved in testing drug candidates for their potential to block the human ether-a-go-go-related gene (hERG) potassium channel. This ion channel, encoded by the KCNH2 gene, plays a crucial role in regulating cardiac repolarization. Inhibition of hERG channels by certain compounds can lead to QT interval prolongation and life-threatening arrhythmias such as Torsades de Pointes (TdP). Hence, hERG screening is a crucial component of preclinical cardiac safety pharmacology, mandated by regulatory agencies such as the FDA, EMA, and ICH (specifically under ICH S7B/E14 guidelines). The expanding research & development infrastructure, government support, investments in R&D activities, and companies' collaborative approaches for novel drug formulations and technological advancements are improving the efficiency and accuracy of the hERG screening process to treat rising heart disease.

How is AI Revolutionizing hERG Screening?

Artificial Intelligence is enhancing the capabilities of hERG screening technologies by enabling more accurate and high-speed predictions of hERG channel inhibitions. AI's role in analyzing vast datasets and detecting complex patterns enables more efficiency in the hERG screening technology. The growing emphasis on in silico modeling is driving the integration of AI with hERG screening services. Additionally, the ongoing FDA guidelines for AI credibility in drug submissions increased AI acceptance in the life science industry. Companies are focusing on adopting hybrid models to combine silico and in vivo approaches, making significant opportunities for AI entry in hERG screening research and development.

What are the Key Trends in the hERG Screening Market?

- Increased Prevalence of Heart Disease: With the rising number of cases of cardiovascular disease and heart conditions worldwide, the demand for novel, safe, and innovative drugs is rising, driving the need for hERG screening to ensure the safety of novel drugs and medication.

- Rising Awareness: The awareness about drug-induced cardiac arrhythmias and the benefits of hERG screening in drug safety practices has increased, contributing to market growth.

- Growing R&D Activities: The rising research and development activities in new drug developments and growing approvals for novel formulations are supporting increased adoption of the hERG screening process.

- Regulatory Requirements: The increased demand for personalized medicines and companies mandating compliance with strict regulatory requirements are driving demand for hERG screening.

- Drug Formulation Demand: The demand for novel drug formulation and development has increased, driven by the need for new treatments, which in turn increases the need for the hERG screening process.

Market Outlook of the hERG Screening Market:

- Industry Growth Overview: The hERG screening market will continue to experience steady growth due to the strict regulations regarding cardiac safety, increased support for drug development, and the importance of reducing expensive failures during late-stage clinical trials.

- Sustainability Trends: Efforts to become sustainable include decreasing reagent wastage, using reusable microfluidic platforms, and using in silico screens for less laboratory testing and reduced energy consumption.

- Global Expansion: Growing support for innovation in pharmaceuticals, clinical research facilities, and international partnerships related to preclinical safety testing will accelerate hERG screening market growth in both the Asia Pacific and Latin America.

- Start-up Ecosystem: Innovative companies creating artificial intelligence-driven tools to predict cardiotoxicity, compact patch clamp devices, and economical assay formats will attract financial investment from pharmaceutical partnerships and venture capital.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 3.63 Billion |

| Market Size in 2025 | USD 1.29 Billion |

| Market Size in 2026 | USD 1.43 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.90% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Assay Type, Technology, Service Type, End User,Application, Scale of Operation, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Number of Drug Candidates Entering Clinical Trials

The increased number of drug candidates entering clinical trials is the major factor driving the growth of the market. The need for the hERG screening process has been increasing to assess cardiac safety and potential cardiotoxic effects. The growing demand for cardiac safety assessments is driving the need for early-stage drug discovery to identify potential components that lead to adverse cardiac effects. The research initiatives have increased the adoption of hERG screening technologies for drug development to assess cardiac safety and meet regulatory requirements. The increased prevalence of heart disease has boosted the number of clinical trials, driving the expansion of hERG screening services.

Restraint

High Cost

The high costs associated with installing and maintaining comprehensive screening equipment like automated patch-clamp systems are major challenges for the adoption of hERG screening technologies in smaller pharmaceutical and biotechnology companies. This equipment is expensive, making it challenging for budget-limited companies. The products used in hERG screening, like precision recombinant hERG potassium ion channel members, are also expensive, making it difficult for the adopt and use of hERG screening products. Additionally, this system needs specialized expertise, further adding to the hERG screening cost.

Opportunity

Technological Advancements

Technological advancements like high-throughput screening and automated patch assay techniques are enabling faster and more efficient hERG screening of components. The cutting-edge technologies, like automated patching, are offering more accurate results and reducing false negatives. These technologies are enabling better decision-making in drug development, enhancing productivity, and reducing costs. The increased adoption of automated patch clamp systems and high-throughput screening is becoming prior in various pharmaceutical companies. Companies are focusing on providing novel products and services, such as GLP-certified hERG screening services and automated hERG screening suites.

Segment Insights

Assay Type Insights

What Made Functional Assays the Dominant Segment in the hERG Screening Market in 2025?

The functional assays segment dominated the market in 2025. The dominance of functional assays stems from their crucial role in early-stage drug development and reducing late-stage attrition by cardiac toxicity. Functional assays assess the drug candidates on the hERG potassium channel. The hERG potassium channels are crucial for cardiac repolarization and arrhythmia prevention. The utilization of advanced functional assays that have been developed with automated patch-clamp technology has increased to enhance throughput and reduce costs.

- The ICH S7B Guidelines Q&As offer the best practice recommendations for patch-clamp assays, including assays involving the hERG channel.

Technology Insights

Which Technology Dominate the hERG Screening Market in 2025?

The automated electrophysiology platforms segment dominated the market in 2025 due to their vital role in offering stable and high-quality recordings at physiological tempers, providing sophisticated alternatives for conventional manual path-clamp technologies. Automated electrophysiology platforms increase throughput and allow early identification of potential drug liabilities. Technological advancements like third-generation automated patch-clamp systems are offering a high success rate of hERG screening services, supporting segmental growth.

The high-throughput screening (HTS) segment is expected to grow at the fastest rate over the forecast period due to the high acceptance of HTS in drug development. It accelerates the identification of drug candidates and enhances drug discovery. High-throughput screening (HTS) technologies evaluate large compound libraries for potential hERG channel interactions. This technology enhances the accuracy, efficiency, and reliability of hERG assays, which makes them more accessible and affordable.

Service Type Insights

Why Did the Outsourced Screening Services Lead the hERG Screening Market in 2025?

The outsourced screening services segment led the market in 2025 and is likely to sustain its growth trajectory in the coming years. This is mainly due to the increased need for outsourcing high-volume structure-activity screens in pharmaceutical and biotechnology companies. Pharmaceutical companies are rapidly adopting outsourced screening services while integrating the expertise and specialized infrastructure of CROs for hERG screening. Leveraging outsourced screening services with contract research organizations (CROs) enables companies to reduce the cost of maintaining and purchasing advanced hERG screening technologies like automated patch-clamp systems.

The in-house screening segment is expected to expand at a notable growth rate throughout the forecast period due to the increasing demand for high-throughput screening and automated patch-clamp system technologies. Pharmaceutical companies are investing heavily in research and development, driving the need for in-house screening capabilities. The in-house screening allows pharmaceutical and biotechnology companies to perform efficient and sophisticated drug safety testing, helping to reduce costs associated with expertise and equipment.

End-User Insights

How Does the Pharmaceutical & Biotechnology Companies Segment Dominate the hERG Screening Market?

The pharmaceutical & biotechnology companies segment dominated the market in 2024 due to increased adoption of hERG screening services among these companies. These companies integrated the hERG screening technologies into their drug development pipelines to assess the potential cardiotoxicity of new drug candidates. The pharmaceutical & biotechnology companies are investing in research & development activities, driving the need for comprehensive hERG screening technologies.

The contract research organizations (CROs) segment is expected to grow at the fastest rate in the upcoming period, driven by increased demand for outsourced screening services from pharmaceutical & biotechnology companies. Contract research organizations (CROs) provide capacity, specialized expertise, and affordable solutions for hERG screening. The increased need for outsourced hERG screening services is contributing to the segment's growth.

Application Insights

Why Did the Preclinical Safety & Toxicology Segment Dominate the hERG Screening Market in 2025?

The preclinical safety & toxicology segment dominated the market in 2025 due to the increased utilization of hERG screening technologies in the preclinical safety & toxicology process. The toxicology testing is essential in preclinical research, helping to assess candidate safety profiles and make better decisions. The hERG screening enables pharmaceutical & biotechnology companies to detect potential safety risks early and reduce adverse reaction risks.

The regulatory submission studies segment is expected to expand at the highest CAGR over the projection period, driven by the increased demand for hERG screening services. These services play a crucial role in assessing cardiac safety and are mandated by several regulations, like the FDA and EMA. Regulatory strict guidelines on cardiotoxicity and growing pharmaceutical pipelines have increased the adoption of the hERG screening services. The adoption of the comprehensive in vitro proarrhythmia assay (CiPA) is high in regulatory submission studies.

Scale of Operation Insights

How Does the Preclinical-Scale Screening Segment Dominate the hERG Screening Market in 2025?

The preclinical-scale screening segment dominated the market in 2024 due to the crucial role of hERG screening services in the early detection of potential cardiac risk in the drug development process. Pharmaceutical companies are prioritizing the use of the hERG channel in preclinical studies to reduce the risk of drug-induced cardiac arrhythmias, reduce failures, and delay later in drug development.

The high-throughput screening scale segment is expected to expand at a significant CAGR in the market over the forecast period. The growth of the segment is attributed to the increasing demand for affordable and rapid screening solutions. The high-throughput screening scale enables rapid assessment of large chemical libraries from biological targets and allows the primary screening process. Technological advancements like ultra-high-throughput screening (uHTS) scales are gaining traction for screening millions of components rapidly, supporting segmental growth.

Regional Insights

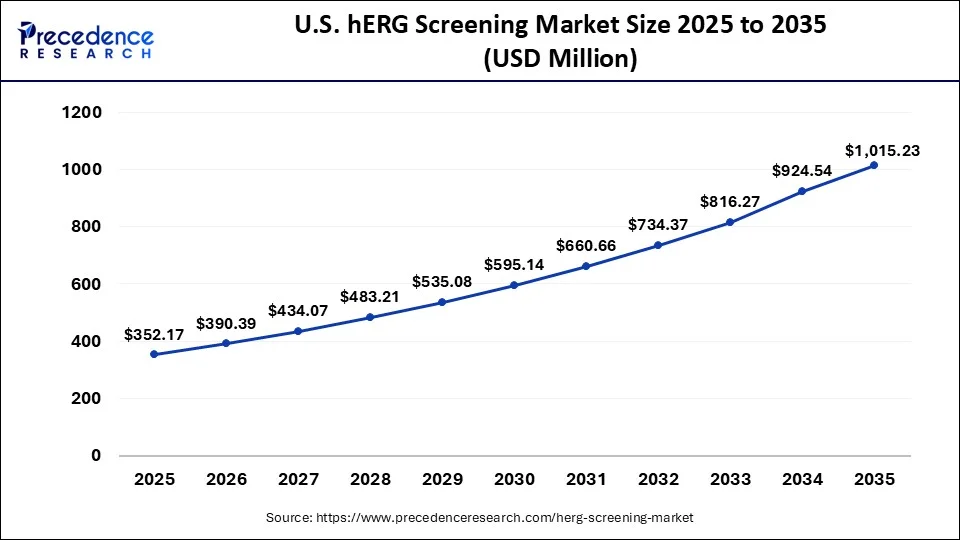

What is the U.S. hERG Screening Market Size?

The U.S. hERG screening market size is exhibited at USD 352.17 million in 2025 and is projected to be worth around USD 1,015.23 million by 2035, growing at a CAGR of 11.17% from 2026 to 2035.

What Made North America the Dominant Region in the hERG Screening Market in 2025?

North America dominated the global hERG screening market by capturing the largest share in 2025. This is mainly due to its well-established research infrastructure and the presence of leading pharmaceutical and biotechnology companies. North America has experienced rapid growth in drug development activities due to the increased prevalence of cardiovascular disease and heart conditions. North America has been investing heavily in research & development, fueling research activities and the formulation of novel products. Stringent regulations like the FDA and EMA have mandated the use of hERG screening technologies in a critical step in drug approvals. Additionally, the ongoing emphasis on technological advancements is further adding to the market growth.

The U.S. is a major contributor to regional market growth due to the increased prevalence of cardiovascular disease in the country and demand for new drug formulation. The U.S. is a hub for advanced research institutions and pharmaceutical companies. Robust innovations in R&D, focus on technological advancements, and growing integration of hERG screening technologies with broader safety pharmacology panels are driving the market.

Asia Pacific hERG Screening Market Trends

Asia Pacific is expected to grow at the fastest CAGR over the forecast period, driven by the increasing number of cases of chronic heart conditions and inflammatory disorders. There is a strong focus on technological advancements and the integration of cutting-edge technologies like AI and ML in drug discovery, which is likely to fuel the market growth. Additionally, the outsourcing of the drug discovery and development process by North American and European pharmaceutical companies is increasing the adoption of hERG screening technologies.

China is a major player in the market, contributing to growth due to the ongoing advances in pharmaceutical and research & development infrastructure. Government investments and funding for local research institutions are fostering the adoption of advanced technologies and services, including hERG screening.

India is emerging as a significant player due to its expanding pharmaceutical manufacturing sector. The increasing investments and funding for research & development, as well as collaboration between research institutions, academic institutions, and pharmaceutical & biotechnology companies, are contributing to the market growth.

Europe hERG Screening Market Trends

Europe is expected to experience notable growth in the market, driven by its increased drug development activities and stringent regulatory requirements. Factors like increased prevalence of cardiovascular disease and ongoing emphasis on technological advancements are further contributing to the market growth. Counties like Germany and the UK are leading the market due to the presence of some of the well-known pharmaceutical and biotechnology companies and robust R&D infrastructure. Additionally, strict regulations regarding drug safety are driving the adoption of hERG screening technologies in drug development.

- In August 2023, the specialist ion channel contract research and drug discovery company, Metrion Biosciences Limited (Metrion), became a member of the UK GLP (Good Laboratory Practices) Compliance Monitoring Program, under the UK's Medicines and Healthcare products Regulatory Agency (MHRA) notice. The company provides GLP-compliant hERG ion channel testing services for the world's life sciences community. (Source: https://metrionbiosciences.com)

Germany hERG Screening Market Trends

Germany's market is experiencing notable growth as stringent regulatory requirements for cardiac safety in drug development drive widespread adoption of hERG assays in preclinical testing. Expanding pharmaceutical and biotechnology R&D activity, particularly in cardiovascular and central nervous system drug discovery, is increasing demand for reliable early-stage cardiotoxicity screening.

Value Chain Analysis of the hERG Screening Market:

- Raw Materials and Technology Suppliers: This step consists of chemical testing machines, laboratory testing kits, and accuracy monitoring devices to ensure effective screening for hERG potency in medications.

Key Players: Merck KGaA, Charles River Laboratories, and Thermo Fisher Scientific. - Device Manufacturers and Testing Method Developers: This part incorporates automatic sampling systems (APC) and data collection software applications in addition to developing and maintaining methods used to comply with regulatory standards while allowing for successful replication of screening results.

Key Players: Sophion Bioscience, Molecule Devices, and Nanion Technologies. - Consumers and Service Providers: Some companies that manufacture or provide drugs and materials related to drugs have also established programs to eliminate potential liabilities associated with drug development by offering a third-party basis for hERG analysis.

Key Players: Eurofins Scientific, Evotec, and Labcorp Drug Development.

hERG Screening Market Companies

- Charles River Laboratories

- Eurofins Scientific

- Cyprotex (Evotec SE)

- Thermo Fisher Scientific

- Metrion Biosciences

- Aurora Biomed

- QPatch (Sophion Bioscience)

- Nanion Technologies

- Axol Bioscience

- B'SYS GmbH

- Multispan Inc.

- ChanTest (now part of Charles River)

- Bioneer Corporation

- Cellectricon

- Corning Inc.

- Physiologically Relevant

- BioAxis Research

- ChemPartner

- Eurofins Discovery

- NEXEL Co., Ltd.

Recent Developments

- In May 2025, the Integrated Similarity Evaluation (ISE) map was developed by the research team at the National Institute of Health (NIH) for assessing the reliability of hERG prediction models, especially for detecting potential false negatives. (Source: https://pmc.ncbi.nlm.nih.gov)

- In January 2025, hERGAT, a novel learning model to combine a graph attention mechanism and a gated recurrent unit, was developed by Lee and Yoo. The models provide the importance of various molecular structures by capturing complex interactions at the molecular and atomic levels, to offer features contributing to hERG inhibition.

(Source: https://pmc.ncbi.nlm.nih.gov) - In January 2024, according to the new ICH S7B Guideline Q&As, the novel Best Practice hERG assay was introduced by Mediford to comply with GLP (Good Laboratory Practice) to provide Mediford as part of their drug development support services. (Source: https://www.mediford.com)

Segment Covered in the Report

By Assay Type

- Binding Assays

- Radioligand Binding Assays

- Fluorescence-Based Binding Assays

- Functional Assays

- Patch Clamp Assays

- Manual Patch Clamp

- Automated Patch Clamp

- Voltage-Sensitive Dye Assays

- Ion Flux Assays

- Other Functional Assays

By Technology

- Manual Electrophysiology

- Automated Electrophysiology Platforms

- High-Throughput Screening (HTS)

- Cell-Based Assays

- Fluorescence Imaging Plate Reader (FLIPR)

- Other Technologies

By Service Type

- In-House Screening

- Outsourced Screening Services

By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutions

- Contract Research Organizations (CROs)

- Others (Regulatory Bodies, Government Labs, Non-Profits)

By Application

- Lead Optimization

- Preclinical Safety & Toxicology

- Regulatory Submission Studies

- Drug Repositioning Studies

- Others

By Scale of Operation

- Research-Scale Screening

- Preclinical-Scale Screening

- High-Throughput Screening Scale

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting