What is Drug Screening Market Size?

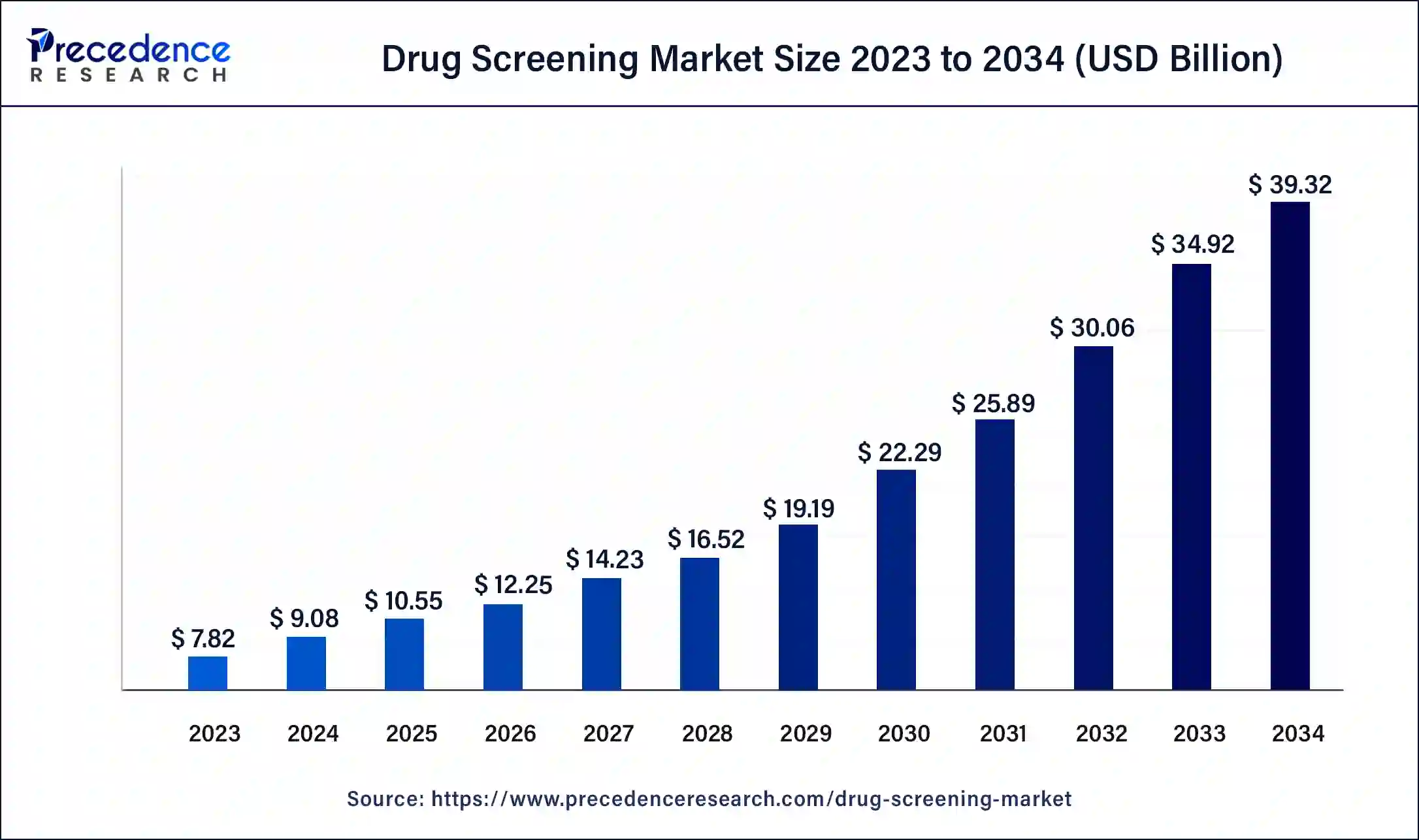

The global drug screening market size is estimated at USD 10.55 billion in 2025 and is anticipated to reach around USD 39.32 billion by 2034, growing at a CAGR of 15.79% from 2025 to 2034. The rising prevalence of drug abuse worldwide. Substance abuse has become a major public health concern, leading to increased demand for drug screening tests across various sectors.

Market Highlights

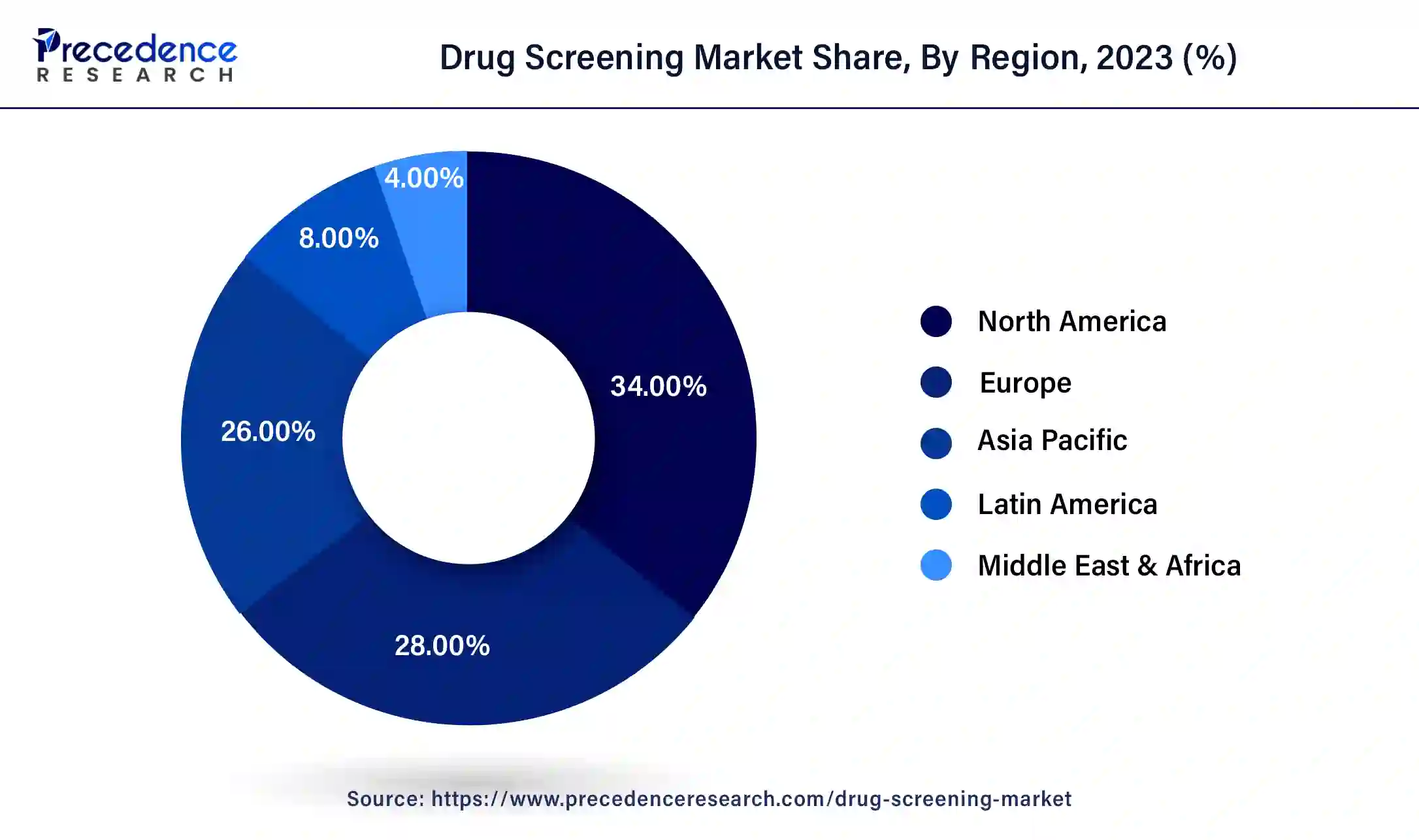

- North America led the market in 2024. The region is observed to sustain the position throughout the forecast period.

- Asia Pacific is observed to be the fastest growing segment during the forecast period.

- Based on products and services, the drug screening market is dominated by the rapid testing devices segment.

- Based on sample type, the market was dominated by oral fluid samples segment in 2024.

- Based on end user, the segment of drug testing laboratories held the largest share of the market in 2024.

What is the use of drug screening?

The drug screening market is experiencing significant growth, driven by several factors, including increasing drug abuse, strict regulations, and technological advancements. The market is expected to grow substantially by the end of 2033. Technological advancements in drug screening methods are also contributing to market growth.

The development of innovative testing techniques such as rapid screening devices, advanced laboratory-based tests, and point-of-care testing solutions is enhancing drug screening procedures' efficiency, accuracy, and speed. Additionally, advancements in data analytics and artificial intelligence are facilitating the interpretation of test results, further driving market growth.

One of the primary drivers of this growth is the rising prevalence of drug abuse worldwide. Substance abuse has become a major public health concern, leading to increased demand for drug screening tests across various sectors. That includes workplaces, healthcare, and other agencies. Moreover, strict government regulations about drug testing in workplaces and other settings are further fuelling market expansion. Employers are increasingly adopting drug screening programs to ensure a safe and productive work environment, driving the demand for drug screening products and services.

Drug Screening Market Growth Factors

- Innovations in screening methods and automation have accelerated the drug screening process, allowing for testing larger compound sectors in shorter time frames.

- Growing interest from both the public and private sectors has led to greater funding for drug screening initiatives, fostering the development of new technologies and approaches.

- The rise in the shift towards personalized healthcare has driven the need for more efficient and tailored drug screening methods, spurring growth in the market.

- Regulatory agencies have implemented policies encouraging drug screening for rare diseases and unmet medical needs, providing opportunities for the market to grow globally.

- The increasing burden of chronic diseases worldwide has fuelled demand for novel therapeutics, driving growth in the drug screening market.

- Expansion into emerging markets, particularly in Asia-Pacific and North America, has presented new opportunities for growth in the drug screening market, driven by factors such as increasing healthcare expenditures and rising disease prevalence.

Why is AI playing a prominent role in drug screening industry?

The drug screening market is rapidly changing with the introduction of sophisticated technologies, such as high-throughput screening, AI-driven predictive analytics, and microfluidics, all of which are improving precision and timelines. More recent innovations involve the use of biosensors and lab-on-a-chip that will allow quicker, cheaper, and on-site drug screening. For example, AI algorithms can now provide real-time analysis of data, increasing the chances of detecting more complex drugs and their metabolites. These inventions should lead to advancements in workplace safety, clinical testing, and forensic settings, which, in turn, will help propel the market while also providing reliability.

Drug screening Market Outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the numerous government initiatives aimed at lowering the drug addicts coupled with technological advancements in the drug screening solutions.

- Major Investors: Numerous market players are actively entering this market, drawn by product launches, joint ventures, R&D and some others. Various drug screening such as Agilent Technologies, Inc., Siemens Healthineers, Bio-Rad Laboratories, Inc., LabCorp, and some others have started investing rapidly for developing advanced drug screening solutions across the world.

- Startup Ecosystem: Various startup companies are engaged in developing advanced drug screening solutions. The prominent startup brands dealing in drug screening consists of Relay Therapeutics, Xaira Therapeutics, Inc., Pardes Biosci and some others.

Drug Screening Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.55 Billion |

| Market Size in 2026 | USD 12.25 Billion |

| Market Size by 2034 | USD 39.32 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 15.79% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product And Service, Sample Type, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Requirement of early detection

Healthcare providers are integrating drug screening protocols into routine medical care to identify individuals struggling with substance abuse disorders and provide them with appropriate interventions and treatment pathways. Early detection through drug screening can facilitate timely intervention, which in turn prevents the progression of substance abuse disorders, mainly found in teenagers to adults. It helps in reducing associated health issues.

The growing awareness of the adverse health and societal consequences of drug and alcohol abuse, coupled with regulatory acts, is driving the adoption of drug screening across various sectors, including healthcare, law enforcement, transportation, and sports. As a result, the demand for drug screening products and services is poised for sustained growth. It will offer significant opportunities for market expansion and innovation in the coming years.

Restraint

Privacy concerns and ethical considerations

The significant restraint of the drug screening market is the potential for privacy concerns and ethical considerations. As drug screening becomes more widespread across various sectors, including employment, healthcare, and criminal justice, there is a growing debate on individual privacy rights and the ethical implications of invasive testing practices. Moreover, false positives and false negatives in drug screening tests can lead to inaccurate results, potentially causing unwanted consequences such as wrongful termination or legal action. This highlights the importance of ensuring the reliability and accuracy of drug screening methodologies and results within the appropriate context.

Additionally, the cost associated with implementing drug screening programs, including equipment, personnel training, and ongoing testing, can become a hurdle for organizations. particularly small businesses and healthcare facilities. Economic factors, regulatory complexities, and societal consequences towards drug testing also contribute to the challenges facing the drug screening market.

Opportunity

Demand for rapid and accurate testing solutions

The major opportunity in the drug screening market is the growing demand for rapid and accurate testing solutions. With increasing awareness about substance abuse and stringent regulations in various industries such as healthcare, transportation, and sports, there is a growing need for efficient drug screening methods. Companies that can offer innovative, cost-effective, and non-invasive testing technologies can capitalize on this opportunity.

- For instance, there is a rising interest in portable and point-of-care testing devices that can deliver quick results without the need for laboratory equipment. Additionally, advancements in biotechnology and analytical chemistry are enabling the development of more sensitive and specific testing methods. These methods allow for detecting a wider range of drug abuses with higher accuracy. Companies that can address these market needs by providing convenient, reliable, and regulatory-compliant drug screening solutions will have a tremendous opportunity for growth and expansion in the drug screening market globally.

Segment Insights

Product and Services Insights

The drug screening market is dominated by the segment rapid testing devices. This segment has gained importance due to its instant, feasible, and accurate results. The products and services for the market are divided into drug screening products, drug screening services, rapid testing devices, and consumables. Among these analytical instruments are immunoassay analysers, breathalysers, and chromatography instruments.

The segment of rapid testing devices is expected to grow exponentially and will overtake the market globally in the forecast period. The rapid testing segment has proliferated due to the rise in alcohol and substance abuse in the masses, and it is the major driving factor of the drug screening market.

- For instance, according to the report published by UNODC- United Nations Office on Drugs and Crime in 2022, drug use and other substance abuse increased by the rate 22% globally. Around 200 million people are smoking cannabis to get high. Also, as per the global information system on alcohol and health, the total worldwide consumption of alcohol was 6.2 litres per person.

Sample Type Insights

The oral fluid sample held the largest share of the drug screening market. By sample type, the market is further classified into breath, oral, urine fluids, hair samples, and other sample types. This segment is showing the fastest growth owing to the fact that to detect a drug influence, the oral fluid sample is mainly used by professionals due to its easy method and less time-consuming techniques with it. Oral fluid samples are easier to collect and provide rapid detection of any drug substance in the human system. Also, oral fluid samples are preferred over urine tests as they maintain a dignity of individuals with less invasiveness.

In addition, the key factors attributing to the growth of the market within this segment are the enforcement of stringent laws and regulations for drug screening methods and alcohol testing by authorities. Most countries declare it a serious offense, boosting the market's growth.

End-User Insights

The drug screening market is dominated by the segment of drug testing laboratories, and it is expected to thrive in the upcoming years. In developed countries, well-trained lab assistants are available to test the samples, which gives utmost accuracy as they are tested by skilled ones with manual intervention. For instance, US infirmary health companies and LabCorp are ready to offer laboratory testing services in the eastern Gulf Coast countries.

Due to their accuracy concerns, drug testing laboratories are gaining traction and showing wide acceptance in the global market. Also, laboratory testing can detect even a smaller foreign particle in human sample which could be of drug abuse unlike rapid testing. Rapid testing may sometimes show wrong results due to many reasons. Hence, the probability of wrong results is almost eliminated in laboratory testing; this gives the segment a robust platform to grow globally with the rising consumption of drugs by individuals, which is a severe concern to look after by every authority in the respective countries.

Regionl Insights

U.S. Drug Screening Market Size and Growth 2025 to 2034

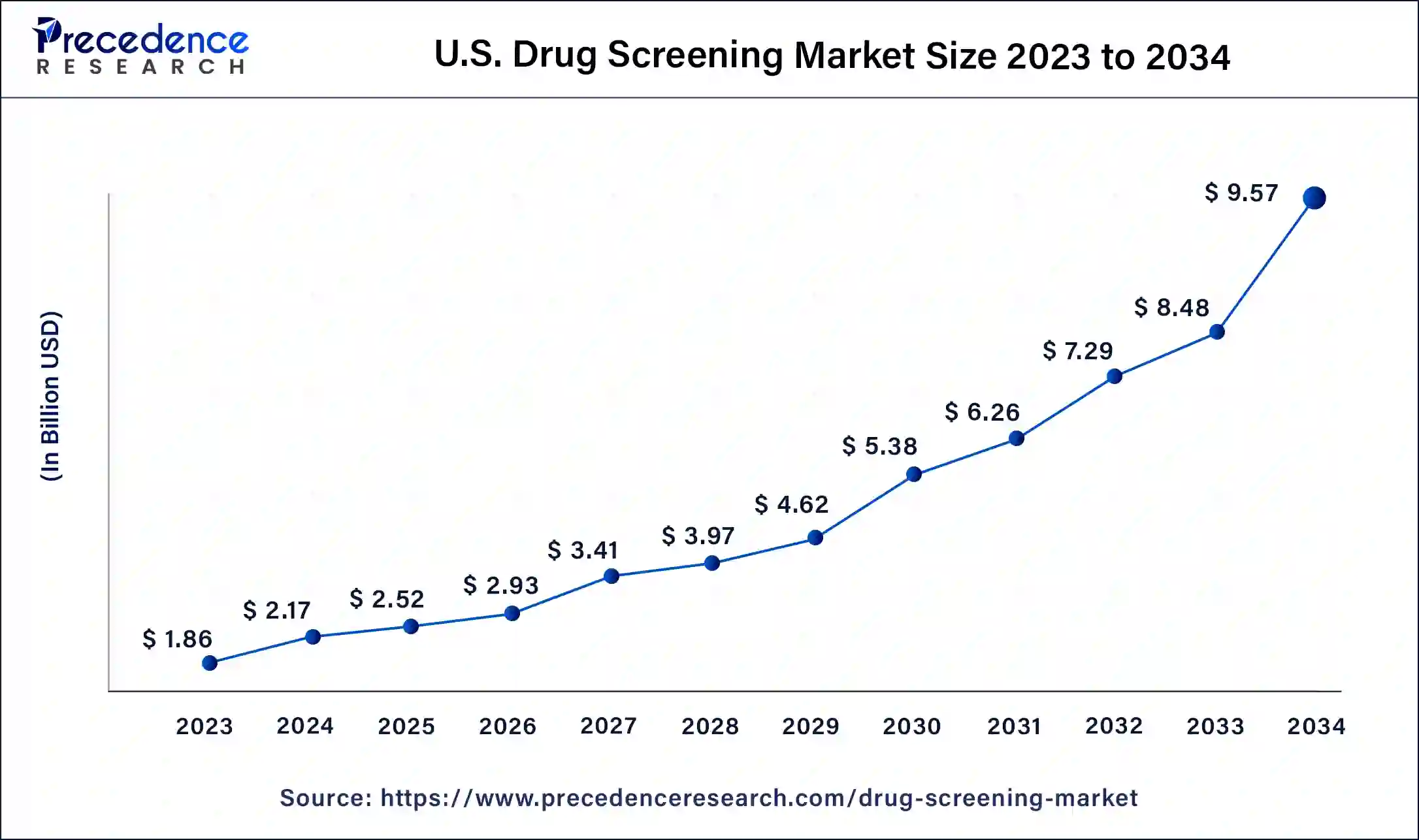

The U.S. drug screening market size reached USD 2.52 billion in 2025 and is expected to be worth around USD 9.57 billion by 2034 at a CAGR of 16% from 2025 to 2034.

North America was the largest shareholder of the drug screening market and dominated the market globally. The key factor attributed to the growth of the market is the growing consumption of forbidden drugs. The availability of government funding to prohibit drug abuse and laws supporting drug screening. The increasing incidences of accidents that involve heavy consumption of alcohol by individuals and the presence of key players in the North American region are the major key factors that help boost the growth of the market.

- For instance, in April 2022, an American clinical laboratory, Quest Diagnostics had, performed a drug test on random samples of unidentifiable urine, hair, and oral fluid collected that was of around 11 million. The laboratory released data in March 2022 after testing such a huge collection of samples.

Asia Pacific is observed to be the fastest-growing region in the drug screening market and is anticipated to thrive at a higher pace in the forecast period. This growth is attributed to the presence of major key players in the Asian Pacific and strict regulations against the consumption of illicit drugs. In China, the market is expected to proliferate with opportunities in the workplace, such as drug treatment centres, schools and colleges, law enforcement agencies, and drug testing laboratories. Moreover, fingerprint-based testing is an innovative method that is trending in China in the market.

In addition, India is thriving in the drug screening market due to the rising awareness of substance use and strict implementation of drug screening regulations within workplaces. Several public and private authorities are aiming to make India drug-free and reduce substance abuse.

What led Europe to hold a significant share of the drug screening market?

Europe held a significant share of the market. The rising adoption of drug screening products by workplaces in numerous countries such as Germany, UK, France, Italy and some others has driven the market expansion. Additionally, the presence of various market players such as Siemens Healthineers, Drägerwerk AG & Co. KGaA, SYNLAB and some others is expected to propel the growth of the drug screening market in this region.

Why Latin America held a considerable share of the drug screening market?

Latin America held a considerable share of the industry. The rise in number of criminal justice and law enforcements agencies and drug treatment center in several nations including Argentina, Brazil, Peru and some others has boosted the market growth. Also, numerous government initiatives aimed at lowering the number of drug addicts is expected to foster the growth of the drug screening market in this region.

How is Middle East & Africa contributing to the drug screening market?

The Middle East & Africa held a notable share of the market. The growing emphasis of pain management center to adopt rapid testing devices for testing drugs in people across numerous countries such as UAE, Saudi Arabia, Qatar, South Africa and some others has boosted the industrial expansion. Also, rapid investment by government for strengthening the drug treatment centers is expected to drive the growth of the drug screening market in this region.

Key Players in Drug Screening Market and Their offerings

- Quidel Corporation: Quidel Corporation is a leading company in diagnostic solutions, formed by the merger of Quidel Corporation and Ortho Clinical Diagnostics. It specializes in in vitro diagnostics, developing and manufacturing a wide range of testing products for use in hospitals, clinics, and at-home settings.

- F. Hoffmann-La Roche: F. Hoffmann-La Roche AG, or Roche, is a Swiss multinational healthcare company headquartered in Basel that operates in two divisions such as pharmaceuticals and diagnostics. It is the world's largest biotechnology company and a global leader in in-vitro diagnostics, focusing on developing and manufacturing medicines and diagnostic tests to prevent, diagnose, and treat major diseases, particularly in oncology and other areas like immunology, ophthalmology, and infectious diseases.

- Thermo Fisher Scientific, Inc.: Thermo Fisher Scientific, Inc. is an American company that is a world leader in serving science, with a mission to make the world healthier, cleaner, and safer. It provides a wide range of products and services to the life sciences, analytical challenges, and laboratory productivity sectors, including analytical instruments, specialty diagnostics, pharmaceutical services, and lab supplies.

- Siemens Healthineers: Siemens Healthineers is a leading global medtech company with a history of over 125 years that pioneers breakthroughs in healthcare, providing a comprehensive portfolio of diagnostic and therapeutic products, services, and digital solutions. The company offers digital and enterprise services, and its products are used by a wide range of customers, including hospitals, laboratories, and pharmaceutical companies.

- Bio-Rad Laboratories, Inc.: Bio-Rad Laboratories, Inc. is an American company that develops, manufactures, and markets products for the life science research and clinical diagnostics markets. This company provides instruments, software, and consumables for scientific discovery, drug development, and biopharmaceutical production. Its products are used by a range of customers, including universities, research institutions, hospitals, and biopharmaceutical companies.

- Agilent Technologies, Inc.: Agilent Technologies, Inc. is a global leader in life sciences, diagnostics, and applied chemical markets, providing instruments, software, services, and expertise to laboratories worldwide. Its solutions are used in diverse fields such as pharmaceutical, clinical diagnostics, environmental testing, and food safety.

- LabCorp: Labcorp is a global life sciences and healthcare company that provides comprehensive laboratory services to help with medical diagnostics and drug development. This company serves doctors, hospitals, pharmaceutical companies, and patients, offering a wide range of tests from common health checks to advanced disease diagnostics.

Recent Developments

- In July 2025, Intelligent Bio Solutions launched SmarTest Patch. SmarTest Patch is a non-invasive drug testing solution designed for the consumers of the U.S.

(Source: https://www.theglobeandmail.com) - In April 2025, Test Your Poison launched next-gen drug testing kits. These kits are designed to combat the rise in contaminated street drugs.

(Source: https://biopharmaboardroom.com) - In April 2025, VivoSim Labs launched an AI-based drug testing model. This drug testing model is designed for the laboratories of North America.

(Source: https://www.stocktitan.net) - In January 2025, ThinkCyte, a biotechnology company pioneering novel artificial intelligence (AI)-based cell analysis and sorting instruments, announced that it will begin the pre-commercial launch of its new cell analysis platform, VisionCyte™. The VisionCyte platform leverages high-resolution morphological profiling, high-throughput capabilities, and advanced AI analysis to uncover novel biomarkers and facilitate the discovery of new and diversified hits and targets for drug discovery. (Source: prnewswire.com )

- In April 2025, CytoTronics, Inc., a pioneer of semiconductor-based platforms for discovery in cell biology, launched its neural application for Pixel systems today. This innovation for neurodegenerative disease and neurotoxicity research, the application enables high-throughput screening for drug discovery at an unprecedented scale. (Source: businesswire.com )

- In December 2024, Beckman Coulter Life Sciences, a global leader in laboratory automation and innovation, and a company of Danaher Corporation, launched the Cydem VT Automated Clone Screening System, a revolutionary high-throughput microbioreactor platform for automated top clone screening. The all-in-one high-throughput screening platform is ideal for cell line development of Chinese Hamster Ovary (CHO) cell lines producing monoclonal antibodies (mAbs). (Source: news-medical.net )

- In April 2022,Saladex, Biomedical, Inc. received a patent portfolio for antipsychotic drug testing from Janssen Pharmaceutical NV. This portfolio includes intellectual property (IP) from 17 patent families. This move by the company helps strengthen its position in the antipsychotic drug testing field.

Segments Covered in the Report

By Product And Service

- Drug Screening Product

- Analytical Instruments

- Rapid Testing Devices

- Oral Fluid Testing Devices

- Consumables

- Drug Screening Service

By Sample Type

- Urine Sample

- Breath Sample

- Oral Fluid Sample

- Hair Sample

- Others Sample

By End-user

- Drug Testing Labs

- Workplaces

- Criminal Justice and Law Enforcements Agencies

- Hospitals

- Drug Treatment Centre

- Individual Users

- Pain Management Centre

- Schools And Colleges

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting