Consumer Foam Market Size and Forecast 2025 to 2034

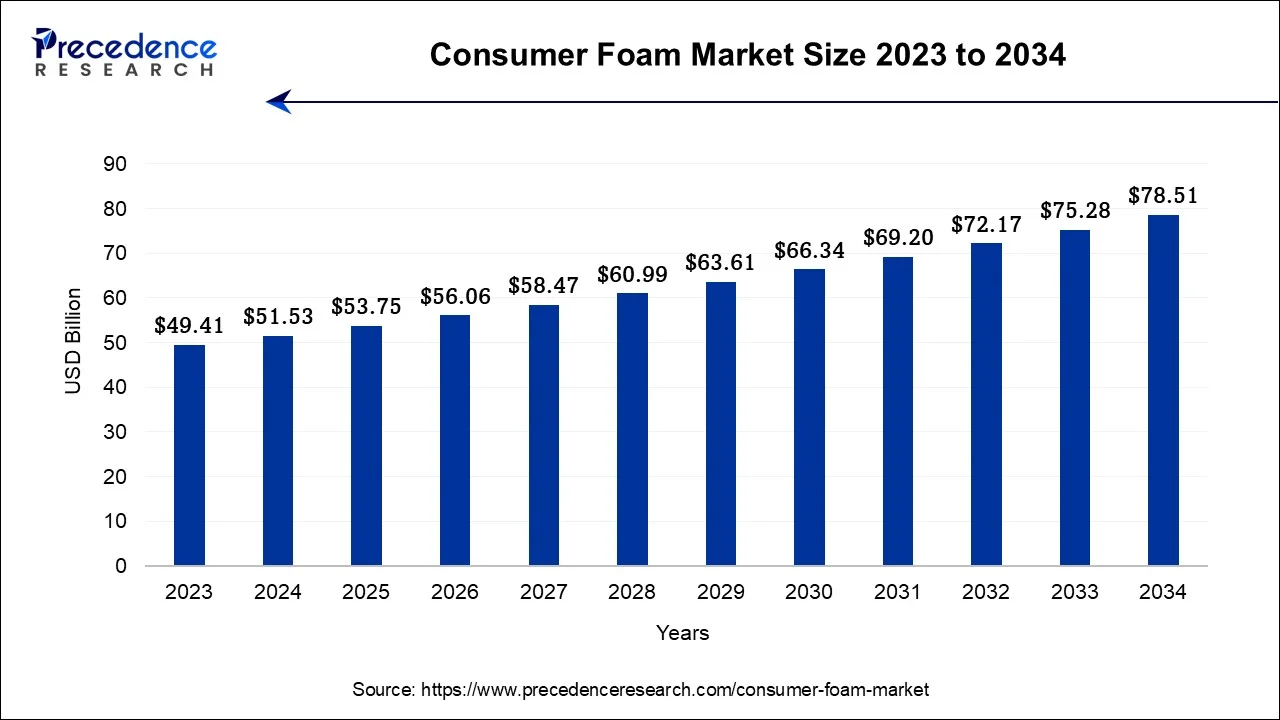

The global consumer foam market size accounted for USD 51.53 billion in 2024 and is predicted to increase from USD 53.75 billion in 2025 to approximately USD 78.51 billion by 2034, at a CAGR of 4.30% between 2024 and 2034.

Consumer Foam Market Key Takeaways

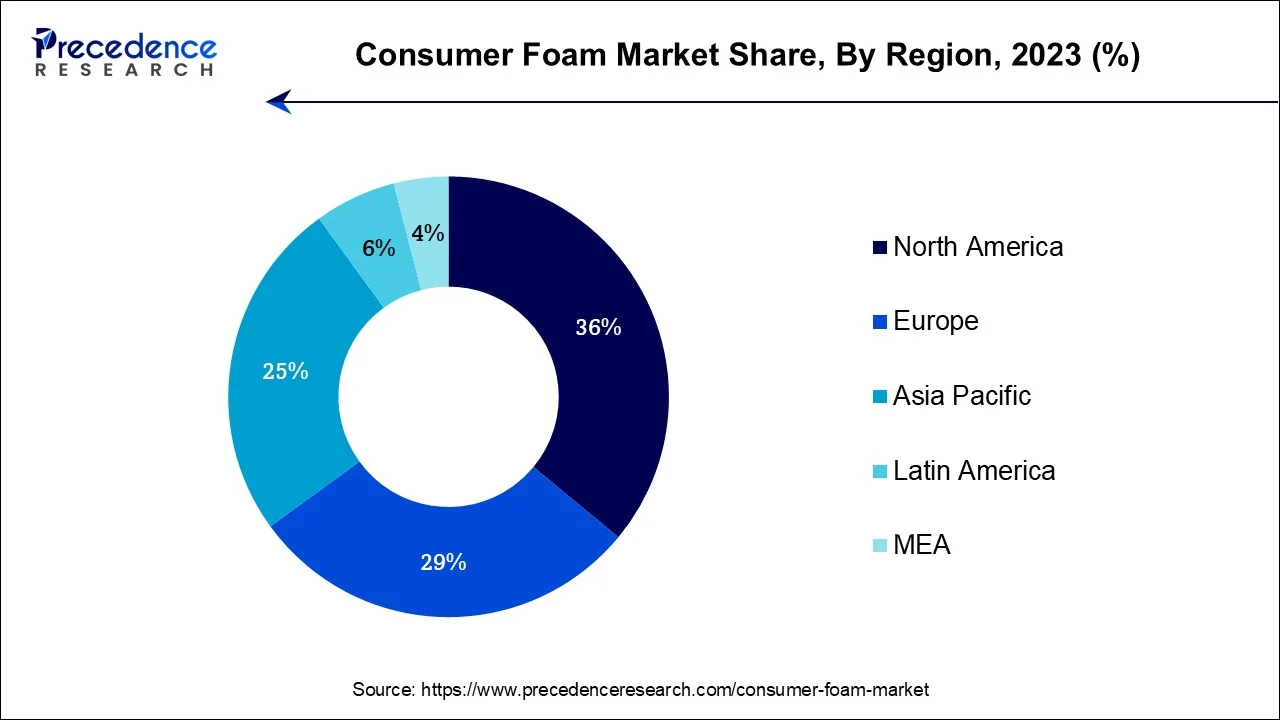

- North America contributed the largest market share of 36% in 2024.

- Asia-Pacific region is expected to expand at the fastest CAGR during the forecast period.

- By Resin Type, the polyurethane segment has held the highest market share of 38% in 2024.

- By Resin Type, the polyolefins segment is anticipated to grow at a significant CAGR of 6.2% between 2024 and 2034.

- By End Use, the bedding and furniture segment contributed the major market share of 34.5% in 2024.

- By End Use, the automotive segment is expected to grow at the fastest CAGR over the projected period.

U.S.Consumer Foam Market Size and Growth2025 to 2034

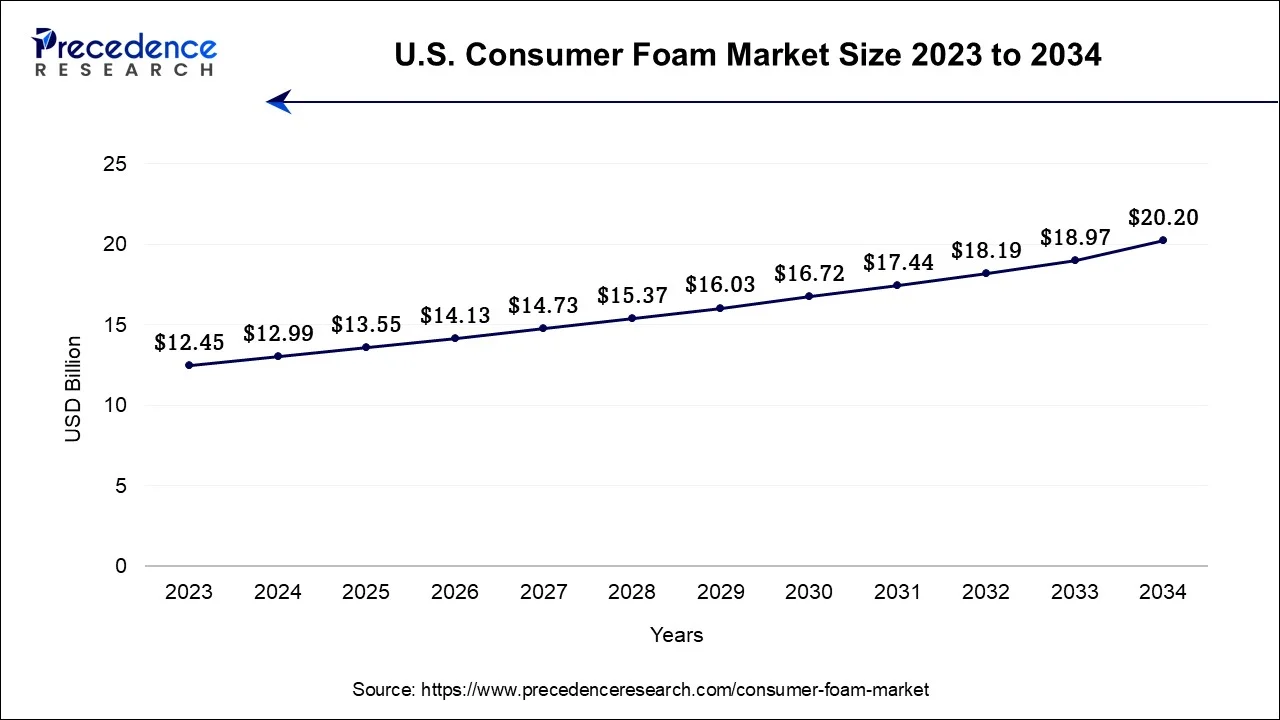

The U.S. consumer foam market size accounted for USD 12.99 billion in 2024 and is expected to be worth around USD 20.20 billion by 2034, at a CAGR of 4.51% from 2025 to 2034

North America held the largest revenue share of 36% in 2024. In North America, the consumer foam market is witnessing notable trends. There's a growing emphasis on eco-friendly foam materials as consumers increasingly prioritize sustainability. Customization is gaining traction, with consumers seeking tailored foam products like mattresses and pillows for individual comfort needs. Additionally, e-commerce is reshaping the retail landscape, with online sales channels offering convenience and a wide range of foam-based options. The health and wellness sector's growth is driving demand for foam-based products designed to address sleep and orthopedic concerns. These trends collectively reflect consumers' evolving preferences for comfort, sustainability, and personalized experiences in foam products.

In Europe, the consumer foam market is witnessing notable trends. A growing emphasis on sustainability is leading to increased demand for eco-friendly foam products. Customization options are gaining popularity, with consumers seeking bespoke foam solutions for enhanced comfort. Technological innovations are driving product quality, with a focus on durability and performance. The expansion of e-commerce is revolutionizing the way consumers shop for foam-based products, providing convenience and a wider range of choices. Overall, Europe's foam market is evolving to meet consumer demands for sustainability, customization, and superior quality in foam-based items like mattresses, pillows, and furniture cushions.

Market Overview

- The consumer foam market encompasses the production and distribution of diverse foam-based products catering to consumer needs. Consumer foam market comprises flexible materials like polyurethane, latex, or memory foam, widely applied in diverse areas. These include mattresses, pillows, furniture cushions, packaging materials, and automotive seating. Consumer preferences for comfort, support, and sustainability drive the market.

- The market is driven by consumers' demand for comfort, support, and durability in everyday products. Innovations in foam technology, eco-friendly materials, and customization options are shaping this market, reflecting a growing awareness of both performance and environmental factors among consumers seeking high-quality foam-based solutions for various lifestyle and comfort needs.

Consumer Foam Market Growth Factors

- The consumer foam market is marked by several prominent trends and growth drivers. There's a growing emphasis on sustainability. As environmental consciousness rises, consumers are increasingly seeking foam products made from eco-friendly materials and manufacturing processes. Customization is gaining traction, with consumers seeking personalized foam solutions that cater to their unique comfort and support needs.

- Third, technological advancements in foam formulations are enhancing product performance, durability, and temperature regulation, aligning with consumers' demands for superior quality. Moreover, the ever-expanding e-commerce landscape is revolutionizing the way consumers shop for foam-based products, with online retail channels offering convenience and a vast array of options.

- Several factors contribute to the growth of the consumer foam market. The demand for foam products is underpinned by the burgeoning bedding and furniture industries, which continually seek innovative and comfortable solutions. Moreover, the automotive sector's reliance on foam for seating and interior components propels market expansion. Additionally, the packaging industry's need for protective and cushioning materials bolsters demand. The aging population's increased focus on health and wellness further drives demand for foam-based items, such as mattresses designed for superior spinal support and pressure relief.

- While the consumer foam market presents numerous opportunities, it also faces challenges. The industry must address concerns related to environmental sustainability and the disposal of foam waste, driving the need for more eco-friendly practices. Regulatory compliance and adherence to safety standards are paramount challenges, necessitating robust quality control measures. However, these challenges also translate into business opportunities. Companies investing in research and development to create sustainable foam solutions can carve a niche in the market.

- Furthermore, collaborations between foam manufacturers and other industries, like healthcare or automotive, can lead to innovative applications and expand market reach. The rise of e-commerce presents an opportunity for businesses to reach a global consumer base, provided they can effectively leverage online sales channels and digital marketing strategies.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 51.53 Billion |

| Market Size in 2025 | USD 53.75 Billion |

| Market Size by 2034 | USD 78.51 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.30% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | End-Use, Resin Type and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Innovations in foam technology, comfort and support demand

Innovations in foam technology significantly drive market demand for the consumer foam industry. Advancements in foam formulations and manufacturing processes have led to the creation of products with enhanced performance, durability, and temperature regulation. These innovations resonate with consumers seeking superior quality and comfort in mattresses, pillows, furniture cushions, and other foam-based items. As manufacturers continue to push the boundaries of foam technology, consumers are drawn to these cutting-edge solutions, fueling market growth and cementing foam's position as a preferred material for comfort and support. Moreover, innovations that enhance comfort and support in foam-based products are driving market demand in the consumer foam market.

Consumers increasingly seek superior quality items like mattresses and furniture cushions that provide enhanced comfort and support, promoting better sleep and overall well-being. Continuous advancements in foam technology and formulations, including memory foam and specialized contouring, offer innovative solutions that cater to these needs. As consumers prioritize comfort in their lifestyles, the market responds with innovative foam products, boosting demand for these higher-performing and customized offerings.

Restraints

Environmental concerns and regulatory compliance

Environmental concerns pose a restraint on the consumer foam market by pressuring manufacturers to address sustainability issues. Foam products, particularly those made from non-biodegradable materials, contribute to waste and pollution concerns. Compliance with stringent environmental regulations, including restrictions on certain foam types and disposal practices, can increase production costs. Consumers, increasingly eco-conscious, may opt for alternative materials perceived as more sustainable, impacting the demand for foam products.

Balancing the performance benefits of foam with environmental responsibility is a challenge the industry must navigate to meet evolving consumer expectations. Moreover, Regulatory compliance poses a restraint on the consumer foam market by imposing strict standards and safety requirements.

Manufacturers must invest in research, testing, and certification processes to ensure their foam products meet these regulations, increasing production costs. These added expenses can be passed on to consumers, affecting pricing and market affordability. Additionally, the need to adhere to different regulations across regions and countries can create logistical challenges for manufacturers, hindering market expansion and potentially limiting consumer choices due to compliance-related constraints.

Opportunities

Sustainable materials and customization

Sustainable materials are driving market demand in the consumer foam market as consumers increasingly prioritize eco-friendly choices. Products made from biodegradable and recyclable foam materials resonate with environmentally conscious consumers seeking sustainable options. This surge in demand reflects a growing awareness of the environmental impact of foam products and a desire to reduce carbon footprints. Manufacturers that invest in sustainable materials not only meet this consumer demand but also position themselves as environmentally responsible brands, thus experiencing heightened market appeal and growth. Moreover, Customization surges market demand in the consumer foam market by catering to individual preferences for comfort and support.

Consumers seek personalized foam solutions tailored to their unique needs, whether it's a mattress with specific firmness levels or a pillow designed to relieve pressure points. Offering customizable options allows manufacturers to address these diverse requirements, enhancing consumer satisfaction and loyalty. This focus on individualized comfort experiences drives consumers to invest in foam products that align precisely with their expectations, boosting market demand for such tailored solutions.

Resin Type Insights

According to the resin type, Polyurethane has held 38% revenue share in 2024.. Polyurethane, a versatile foam resin, is a key player in the consumer foam industry. Polyurethane, a versatile foam resin, is highly regarded for its exceptional comfort and support attributes. This makes it the top choice for crafting mattresses, pillows, and furniture cushions in the market. Trends show a growing demand for eco-friendly, low-VOC (volatile organic compound) polyurethane foam materials. As sustainability gains importance, manufacturers are exploring bio-based and recycled polyurethane options. Additionally, innovations in memory foam and high-resilience foam formulations continue to enhance consumer comfort experiences.

The polyolefins segment is anticipated to expand at a significant CAGR of 6.2% during the projected period. The polyolefins, a type of polymer derived from olefin monomers, play a significant role in the consumer foam market. Current trends involve the development of sustainable polyolefin foams, utilizing recyclable and biodegradable variants. Additionally, advanced manufacturing techniques are enhancing the performance of polyolefin-based foams, leading to increased demand for applications in mattresses, packaging, and furniture cushions.

End Use Insights

The bedding and furniture segment held the largest market share of 34.5% in 2024. In the consumer foam market, bedding and furniture are end-use segments encompassing foam applications. Bedding includes mattresses and pillows, with trends favoring memory foam for better sleep quality. Furniture, including sofas and chairs, utilizes foam cushions for enhanced comfort. Eco-friendly and sustainable foam materials are increasingly sought after in both segments, reflecting a growing awareness of environmental concerns. Customization options for mattresses and furniture cushions are also on the rise, catering to individual comfort preferences.

On the other hand, the automotive segment is projected to grow at the fastest rate over the projected period. In the consumer foam market, the automotive sector is a significant end-use segment that utilizes foam materials for various applications. These include seating, interior components, and sound insulation. Current trends in this sector involve an increased focus on lightweight and sustainable materials to enhance fuel efficiency and reduce the carbon footprint of vehicles. Foam innovations that offer both comfort and environmental benefits are thus gaining prominence in response to these automotive industry trends.

Consumer Foam Market Companies

- Tempur Sealy International, Inc.

- Serta Simmons Bedding, LLC.

- Sleep Number Corporation

- Leggett & Platt, Incorporated

- Carpenter Co.

- Foamex Innovations

- Future Foam, Inc.

- Innocor, Inc.

- Vita Group

- Recticel NV

- Hilding Anders Group

- Zinus Inc.

- Sinomax Group Limited

- Brentwood Home

- Select Comfort Corporation

Technological Advancement

Technological advancements in the consumer foam market feature polyurethane (PU) advancement, ergonomic applications and smart foams, and automotive applications. Ergonomic applications and smart foams technology are subdivided into digital integration and EPP foam. EPP foam is popular for its durable and lightweight properties, while digital integration encourages digital technology to provide a personalized experience and ergonomic benefits.

Automakers are also actively participating in the consumer foam market. With the new foam technologies, vehicle performance has been improved and enhanced. Technology is the main reason for the environmental changes, and the accurate utilization of resources and machines. The production process has been highly advantaged and upskilled with the various technologies. The contribution to the future market with the help of technology has smoothed the operations and quality process.

Recent Developments

- In July 2023, FXI and Innocor combined to create one of the most innovative foam solutions providers. The two leading producers of polyurethane foam products signed a definitive merger agreement to add creativity in the consumer foam market.

- In February 2023, Cruz Foam redefined consumer packaging, solving the customer's need for high performance with exceptional sustainability. Cruz foam, a specialist material company well known for its eco-friendly solutions, is putting efforts into contributing to the environment globally.

- In 2023, Tempur Sealy International, Inc. and Mattress Firm Group Inc. ("Mattress Firm") have entered a definitive agreement for Tempur Sealy to acquire Mattress Firm. This acquisition is set to reshape the bedding industry landscape, creating new opportunities and synergies for both companies.

- In 2020, Tempur Sealy acquired Sherwood Bedding, a mattress manufacturer, to expand its product portfolio and distribution network. This acquisition allowed Tempur Sealy to reach a broader customer base.

- In 2018,Serta Simmons Bedding, one of the largest mattress manufacturers, partnered with Tuft & Needle, an online mattress startup. This alliance allowed Serta Simmons to tap into the growing online mattress market and offer innovative, direct-to-consumer solutions.

- In 2018, Leggett & Platt, a diversified manufacturer, acquired Elite Comfort Solutions, a foam solutions provider. This acquisition bolstered Leggett & Platt's presence in the foam market and expanded its product offerings.

Segments Covered in the Report

By End-Use

- Bedding and Furniture

- Automotive

- Consumer Electronics

- Footwear

- Others

By Resin Type

- Polyurethane

- Polystyrene

- Polyolefins

- Phenolic

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting