What is the Fire Fighting Foam Market Size?

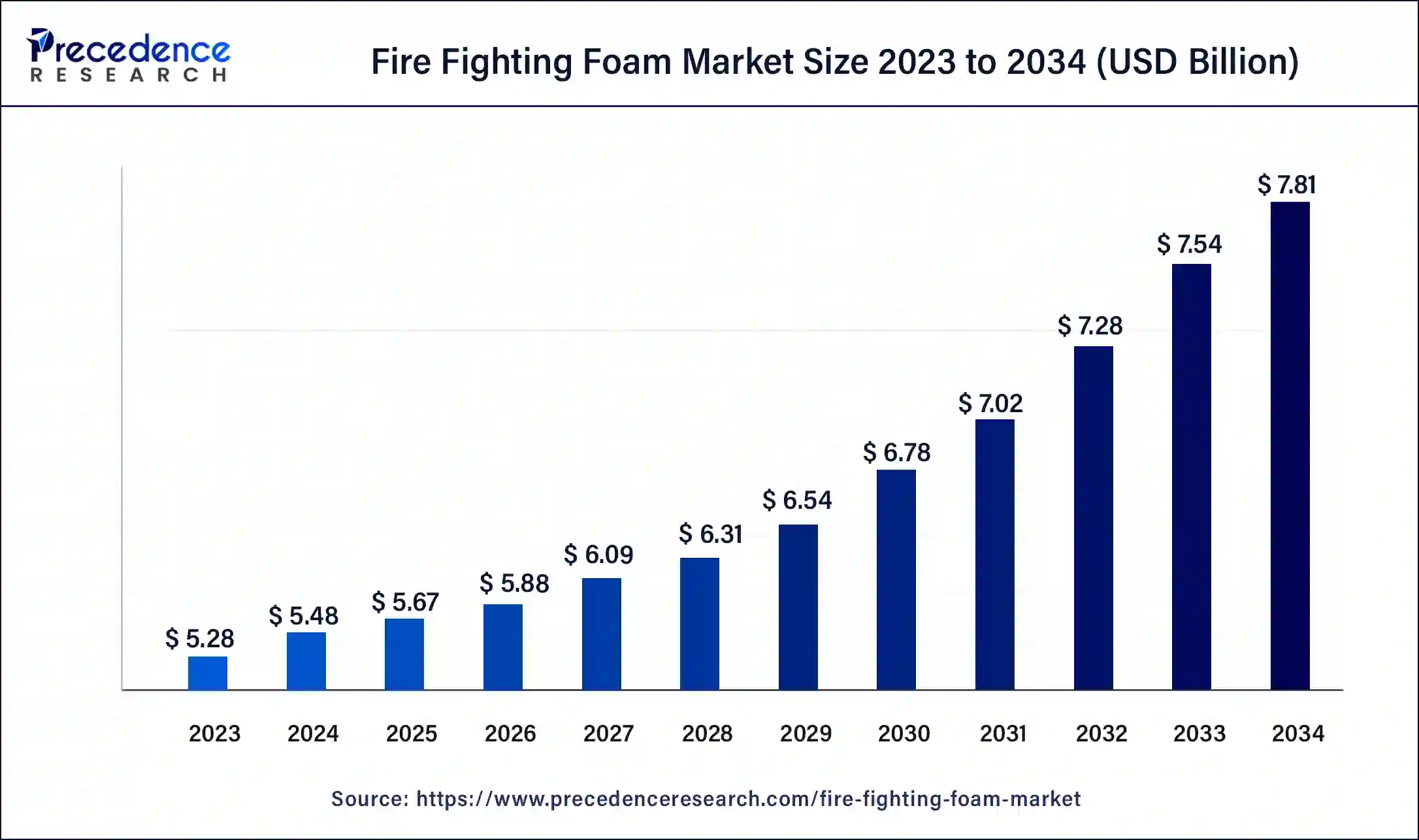

The global fire fighting foam market size was valued at USD 5.67 billion in 2025, and is anticipated to hit around USD 5.88 billion by 2026, and is expected to reach USD 7.81 billion by 2034, at a CAGR of 3.62% from 2025 to 2034. The benefits of fire fighting foam include providing a short-term fire barrier, reducing the amount of water required to fight fires, cooling surface temperatures, etc. These factors help to the growth of the market.

Fire Fighting Foam Market Key Takeaways

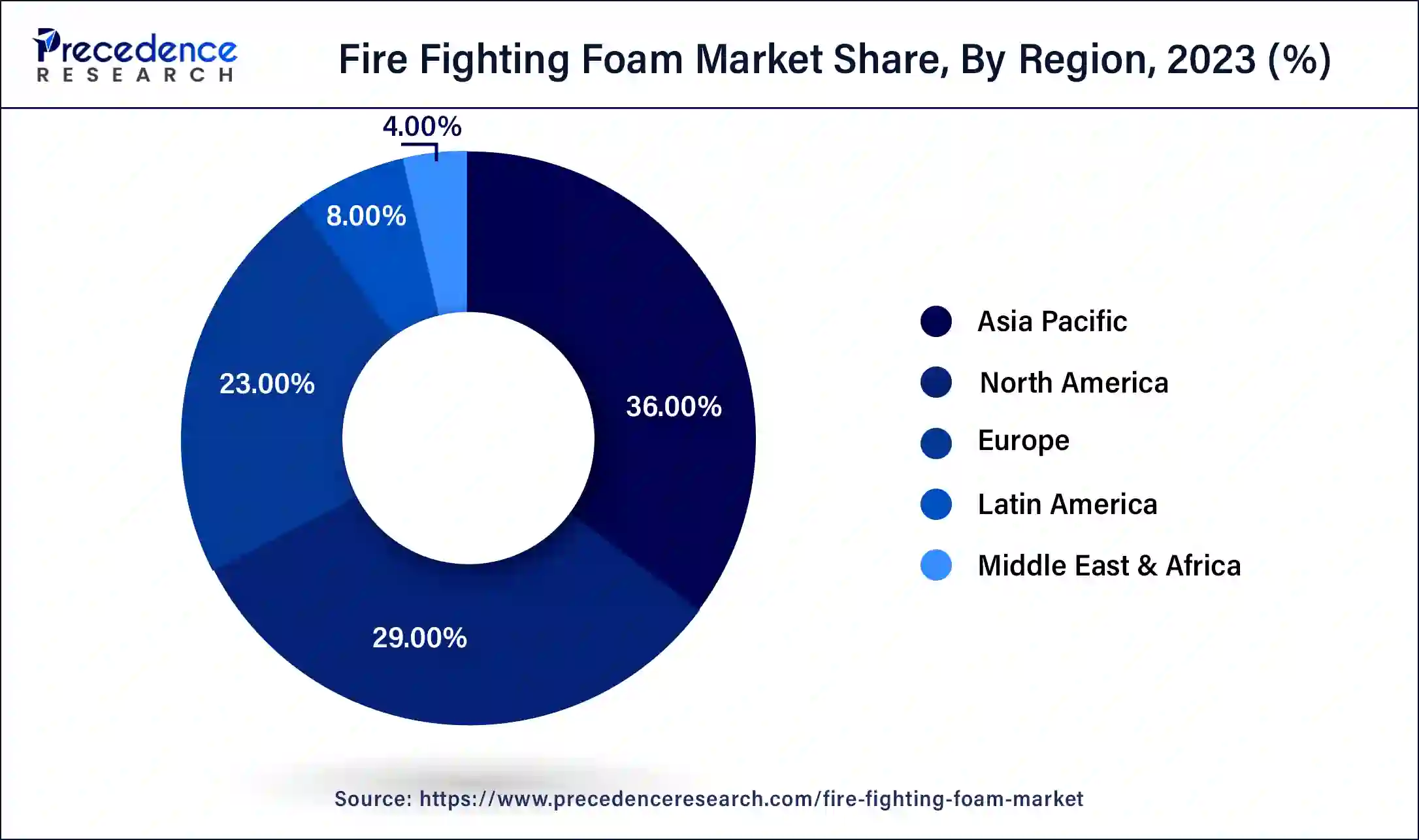

- Asia Pacific dominated the fire fighting foam market with the largest market share of 36% in 2024.

- North America is estimated to be the fastest-growing during the forecast period of 2025 to 2034.

- By foam type, the Aqueous Film Forming Foam (AFFF) segment dominated the market in 2024.

- By foam, the Alcohol Resistant Aqueous Film Forming Foam (AR-AFFF) segment is expected to be the fastest-growing during the forecast period.

- By fire type, the Class A fire-type segment has contributed more than 43% of market share in 2024.

- By fire, the class B segment is estimated to be the fastest-growing during the forecast period.

- By end-use, the oil & gas segment accounted for the biggest market share of 23% in 2024.

- By end-use, the chemicals segment is anticipated to be the fastest-growing during the forecast period.

What is the role of AI in the Fire Fighting Foam?

The application of AI in firefighting brings many benefits, including improved resource allocation, enhanced risk assessment accuracy, and reduced response time. The use of AI also minimizes the firefighter's exposure to dangerous situations through the use of robotics, which helps the growth of the market. AI is changing and improving the way firefighters respond to emergencies. Artificial Intelligence AI implementation can help improve the way fire professionals fight and prepare for emergency situations. These factors help the growth of the fire fighting foam market.

- In August 2020, EHung launched autonomous firefighters for high-rise buildings in Yunfa, China. The 216F demonstrated putting out a fire in a high-rise building. It can carry six fire extinguisher bombs in a single trip and up to 150 liters of firefighting foam and has a maximum flight altitude of 600 meters.

What is Fire Fighting Foam?

The fire fighting foam market refers to the global industry responsible for producing and selling foam-based products that are useful during fire fighting activities. The foam has been highly used as a fire extinguishing medium for combustible and flammable liquids, different from other extinguishing agents like CO2, dry chemicals, water, etc. Firefighting foam is simply a stable mass of small air-filled bubbles with a lower density than water, gasoline, or oil. At the time of these events, foam-based products were used to extinguish fires, especially in cases when they were caused by flammable liquids or gases. These factors help to the growth of the market.

- According to WHO, an estimated 1,80,000 deaths are caused by burns every year, and it occurs in low and middle-income countries. Burns occur mainly in the workplace and at home. In India, over 1 million people are severely or moderately burnt every year. About 1,73,000 Bangladeshi children are severely or moderately burnt every year. In Colombia, Bangladesh, Pakistan, and Egypt, 18% of children with burns have a permanent disability, and 17% have a temporary disability.

What are the Growth Factors of the Fire Fighting Foam?

- The benefits of fire-fighting foam include minimal environmental impact, such as the use of biodegradable foaming agents, which helps the growth of the market.

- Fast extinguishes flammable liquid spill fires, minimizing pollution, and saving lives that help the growth of the market.

- Improved effectiveness of water, reduced rekindling, and cooling surface temperatures help the growth of the market.

- Liquid fire extinguishes in three stages including removal of fuel source, cooling, and smothering help the growth of the market.

- It also includes creating a barrier to reduce vapor release, reduce heat, remove oxygen, and smother the fire, helping the growth of the fire fighting foam market.

Fire Fighting Foam Market Outlook:

- Industry Growth Overview: The fire fighting foam market will continue to grow steadily between 2025 and 2030, as various industries will be making a shift towards the use of high-performance foam systems that can respond quickly to fires. There will be a general rise in demand across oil & gas, aviation, and industrial facilities, especially in the Asia-Pacific region and North America, primarily due to evolving fire-safety regulations and expanding infrastructure.

- Global Expansion: Key Manufacturers are expanding manufacturing facilities and distribution channels across Southeast Asia, the Middle East, and LATAM to remain close to their industrial customers and comply with new regulations. Several manufacturers are scaling their production capabilities to produce fluorine-free foams to follow the growing demand in fast-growing economies.

- Major Investors: Private equity and strategic investors are making their way into the fire safety chemicals market thanks to strong long-term demand, regulatory tailwinds, and high technical barriers. Investment activity has accelerated in companies developing next-generation foam concentrates and environmentally responsible alternatives for suppression solutions.

- Startup Ecosystem: The startup ecosystem is evolving rapidly, with many developing PFAS-free foams, bio-based surfactants, and more efficient suppression technologies. These companies are attracting significant financial commitments by providing sustainable and performance-driven alternatives to comply with global fire-safety trends and ESG values.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 7.81 Billion |

| Market Size in 2025 | USD 5.67 Billion |

| Market Size in 2026 | USD 5.88 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.62% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Foam Type, Fire Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising industrial fire incidences and oil & gas industry expansion

The rising industrial fire incidences and oil & gas industry expansion contribute to the growth of the market. The most common causes of industrial fire incidents include intentional fire, heating equipment, electrical distribution, and lighting equipment. Expansion and evolution of the oil and gas industry contribute to the growth of the market. These factors drive the growth of the fire fighting foam market.

Industrial Fire Threats and Oil & Gas Expansion Fuel Push for Firefighting Systems

The rise in the number of industrial fires is raising concerns globally about safety. In 2023, 110,000 nonresidential fires were reported in the U.S., killing 130 people, with total property loss that is immeasurable. Additionally, oil and gas exploration and development are expanding rapidly in 2024. Both of these trends are markedly increasing the demand for modern fire protection infrastructure worldwide, particularly in the high-risk facilities of refineries, warehouses, and processing/chemical plants, where, in many cases, rapid response systems may well prove to be the difference between life and death.

Restraint

Substitute availability and environmental concerns

Substitute availability and environmental concerns can restrict the growth of the market. There are many different types of firefighting foam, such as Class A type foam and Class B type foam. Class A type foam includes foam solution, compressed air foam, aspirated medium expansion foam, and system aspirated low expansion foam. Class B-type foam includes Aqueous Film Forming Foam (AFFF) and Alcohol Resistant-Aqueous Film Forming Foam (AR-AFFF). The environmental concerns include a negative impact on the environment from the discharge of foam solutions. These factors can hamper the growth of the fire fighting foam market.

Opportunity

Environmental protection

The use of available replacements for fighting foams to sand and water. These alternatives are environmentally friendly and less expensive, which leads to environmental protection. To overcome environmental concerns like negative impact on the environment from discharge of foam solutions. The use of environmentally friendly fire fighting foams including fluorine-free foams (FFF), green fire fighting foams (GFFF), and others. These factors help to the growth of the fire fighting foam market.

Foam Type Insights

The aqueous film forming foam (AFFF) segment dominated the fire fighting foam market in 2024. The water film formed by aqueous film forming foam (AF) offers many benefits, including enabling flames to be extinguished quickly and the foam to reach even in a very large fire and more distant areas. It spreads very fast and allows the foam floating on it to spread fast. Imposing a barrier to mass transfer limits fuel evaporation. It is a highly effective Firefighting product used for highly hazardous, flammable liquid firefighting. It is a fluorine-containing fire-fighting foam primarily used to extinguish flammable liquids like petrol. These factors help the growth of the aqueous film forming foam (AFFF) segment and contribute to the growth of the market.

The alcohol resistant aqueous film forming foam (AR-AFFF) segment is expected to be the fastest-growing during the forecast period. The benefits of Alcohol Resistant Aqueous Film Forming Foam (AR-AFFF) include providing effective fire suppression and extinguishing liquid class B fires, which contain polar solvents and hydrocarbons. These types of foams are required when the fuels are water miscible, such as acetone and alcohol.

The alcohol resistant aqueous film forming foam (AR-AFFF) may be required in high-risk facilities, including the chemical and oil and gas industries, such as pharmaceutical plants and process areas, tank farms, ships, and refineries. AR-AFFFs are acceptable for the fast extinguishment of high-scale class-B fires. AR-AFFF contains polymers that form a protective film between the foam blanket and the burning surface. These factors help the growth of the Alcohol Resistant Aqueous Film film-forming foam (AR-AFFF) segment and contribute to the growth of the fire fighting foam market.

Fire Type Insights

The Class A fire-type segment dominated the fire fighting foam market in 2024. Class A fire type involves regular combustible substances like plastic, paper, wood, rubber, cloth, and fabric. This occurs when a heat source comes in contact with these types of materials, which can cause damage to property and pose a threat to human life. Class A fires with a steady flame that produces a specific amount of ash and smoke. These fires may spread fast if not addressed instantly, which makes it necessary to act fast and use the proper fire extinguisher to prevent potential harm and damage.

The best fire extinguishers for class A fire include multipurpose dry chemical powder extinguishers, foam extinguishers, and water extinguishers. These factors help the growth of the Class A fire-type segment and contribute to the growth of the market.

The class B segment is estimated to be the fastest-growing during the forecast period. A class B fire is a fire in flammable gases like propane and butane or flammable liquids, alcohols, lacquers, solvents, oil-based paints, oils, tars, or petroleum greases. It is caused by leaks of flammable liquids or accidental spills, improper storage or use of flammable materials in industrial facilities, lithium-ion batteries, careless handling of flammable substances like smoking near fuel storage areas, and faulty electrical equipment or wiring. These factors can lead to class B-type fire. These factors can lead to the growth of the class B fire type segment and contribute to the growth of the fire fighting foam market.

End-use Insights

The oil & gas segment dominated the fire fighting foam market in 2024. The oil & gas are flammable materials, and any accidental release and leaks can lead to firing. In the oil & gas industry, the principal cause of the fire is the ignition of flammable vapors from auxiliary motors & mobile engines and improper hot work practices. It also includes fire and hazardous explosion factors like chemical storage, poor ventilation, static electricity, storage tank overfills, natural disasters, human error, etc. This leads to rising demand for firefighting foam. These factors help the growth of the oil & gas segment and contribute to the growth of the market.

The chemicals segment is anticipated to be the fastest-growing during the forecast period. When reaction conditions are met, oxidizers strip electrons from the fuel; oxidizers are highly electronegative and may be gases, liquids, or solids. Oxygen is the most problematic in industries due to its reactive concentrations in the atmosphere, which leads to high damage and loss. These factors can lead to the growth of the chemicals segment and contribute to the growth of the fire fighting foam market.

Regional Insights

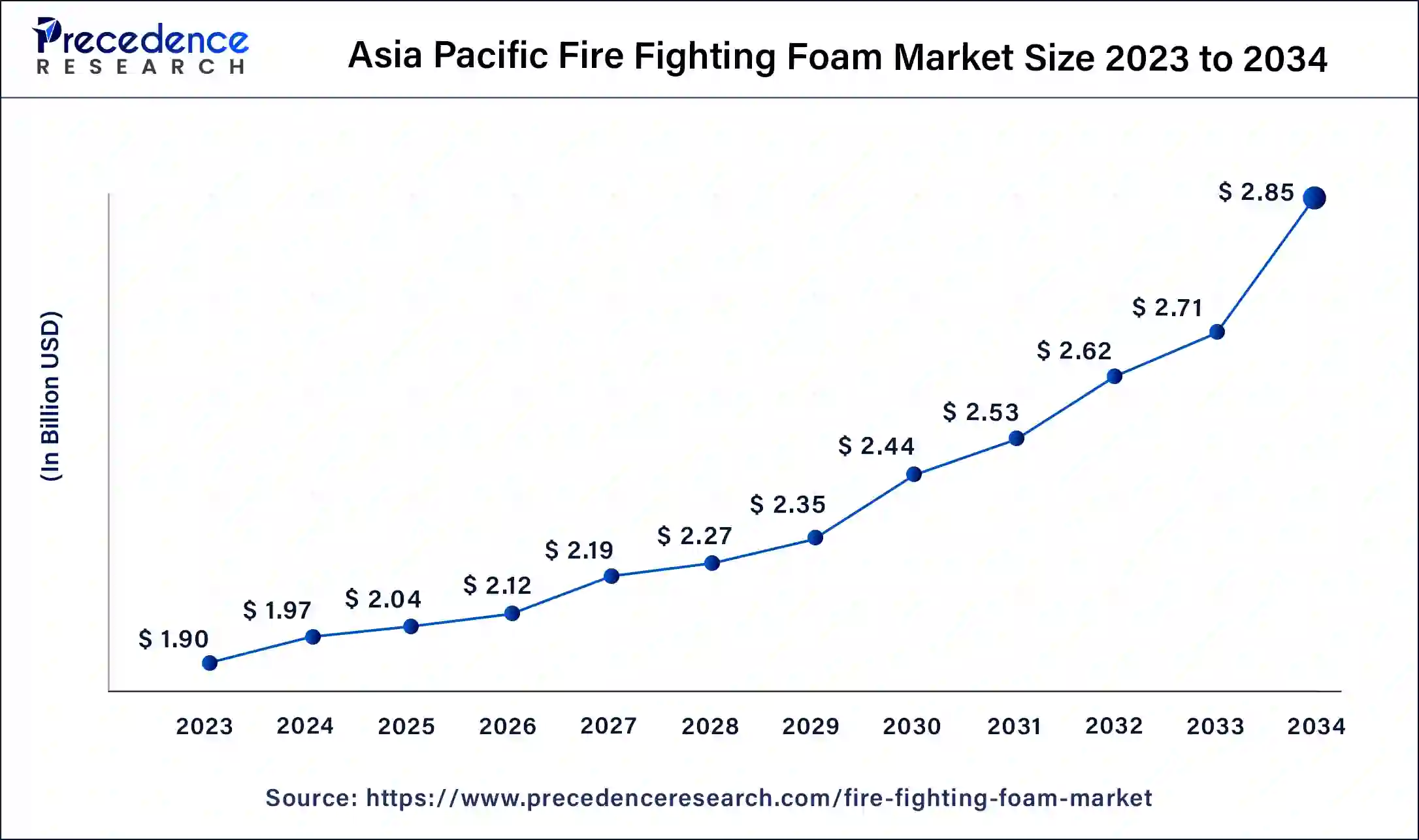

Asia Pacific Fire Fighting Foam Market Size and Growth 2025 to 2034

The Asia Pacific fire fighting foam market size is exhibited at USD 2.04 billion in 2025 and is projected to be worth around USD 2.85 billion by 2034, poised to grow at a CAGR of 3.75% from 2025 to 2034.

Asia Pacific dominated the fire fighting foam market in 2024. The lack of proper industrial safety, increased fire accidents, a major share of chemical production worldwide, and dry atmospheric conditions in many countries in the Asia Pacific region lead to the growth of the market. In India and China, rapidly growing industries like aviation, automation, marine, chemical, and others contribute to the growth of the market in the Asia Pacific region.

- In September 2023, Swadeshi Empresa developed firefighting robots for the Indian Navy. Trials of firefighting robots under the SPRINT initiative were undertaken onboard the aircraft carrier INS Vikrant. It detects the fire and extinguishes it using a spray/water/foam jet and keeps people away from danger.

North America is estimated to be the fastest-growing during the forecast period of 2025-2034. Stringent regularities related to fire safety drive the growth of the fire fighting foam market in the North American region. The presence of a high number of users like oil & gas, manufacturing, and other industries in the North American region. Rising wildfires and fire-related accidents in the United States due to human negligence and atmospheric changes have led to the growth of the market.

- In March 2024, in Columbia, the new Aqueous Film Forming Foam (AFFF) Takeback Program to collect and destroy PFAS-laden fighting foam was launched by Ohio. The first of its kind in the country, operating this program in collaboration between the Ohio EPA (Environmental Protection Agency), the State Fire Marshal's Office, and the science & technology Company Battelle.

Asia Pacific: China Fire Fighting Foam Market Trends

China's market is witnessing steady growth, driven by industrial expansion and increasing urban infrastructure development, particularly in high-risk sectors like oil, gas, and chemicals. Aqueous Film Forming Foam (AFFF) continues to dominate the market due to its effectiveness in large-scale industrial fires. Growing environmental concerns and regulatory restrictions on PFAS-based foams are pushing manufacturers to adopt fluorine-free, eco-friendly alternatives.

North America: U.S. Fire Fighting Foam Market Trends

The U.S. market is growing moderately, due to stringent environmental regulations and litigation around PFAS (“forever chemicals”) are driving a shift toward fluorine free, eco friendly foams. The U.S. Department of Defense is leading a major replacement program, allocating over US$ 850 million to retire legacy AFFF stocks.

Why did Europe Experience Rapid Growth in the Fire Fighting Foam Market?

Europe experienced robust growth as constraints surrounding fire regulations, modernization of facilities, and airport growth have led to increased demand for advanced foams. The shift quickly towards PFAS bans has resulted in the rapid adoption of fluorine-free options. The region also provided opportunities for suppliers in energy facilities, chemical facilities, and higher-risk storage, fueling organic growth in these sectors.

Investments in emergency response training, cross-border safety training, and upgrading transportation centers for emergencies all supported the long-term growth of suppliers as they transitioned, alongside their customers and the public, to compliant, high-performance foam solutions.

Germany Fire Fighting Foam Market Trends

Germany experienced steady growth with its strong industrial base, limited use of non-traditional fire laws, and advanced airports, all requiring high-quality foam systems. Chemical plants and automotive factories began to increase spending on safety, resulting in higher demand for PFAS-free products. Upgraded terminals, warehouses, and energy facilities were constructed to comply with new standards as well.

Local producers, in reference to Teutonic Certainty, began to explore more efficient and green solutions to meet stricter regulatory and consumer demands for foam and fire-related solutions, leading to significant growth opportunities in both the public and private sectors, particularly in safety.

Why Did Latin America Experience Considerable Growth in the Fire Fighting Foam Market?

Latin America experienced considerable growth as foam demand was driven by increased industrial activity, expanded airports, and enhanced safety inspections. Oil and gas energy projects in Brazil and Mexico created momentum for market adoption. Many countries began actualizing the switch to PFAS-free products, creating more opportunities for suppliers. Investing in ports, logistics hubs, and first responders supported continual growth as governments pushed for safer fire response systems.

Brazil Fire Fighting Foam Market Trends

Brazil led the region because of the requirements for demonstrably strong fire protection systems for oil fields, refineries, and significant airports. New industrial projects and regulatory pressures led to increased demand for dependable foams. Brazil began implementing fluoride-free options, opening new doors for suppliers. Growth continued by adding warehousing, ports, and public safety programs to aid in growth. Local industries sought higher standards, which helped spur upgrades among critical facilities even faster.

Why did the Middle East & Africa Region Grow Steadily in the Fire Fighting Foam Market?

The Middle East and Africa continued to grow steadily as oil and gas locations, airports, and large-scale industrial projects all required robust fire protection systems. Many countries invested in modernizing emergency response systems, and many also invested in solutions utilizing modern foam innovations. Industries began the transition to safer, PFAS-free foam products slowly, but this trend began to create new market opportunities. The importance of expanding logistics hubs, construction projects, and safety programs in the emerging economies drove continued demand for modern firefighting foam products.

The UAE Fire Fighting Foam Market Trends

The UAE led the Middle East & African region due to its advanced airports, industrial zones, and energy, which took an interest in the modern options for fire protection systems. With the region developing strict regulations to enforce programs to improve safety, industries were obligated to develop new solutions for foam. More investment in fluorine-free technologies and the development of larger training facilities further promoted adoption in the market. Expanding ports, logistics, and high-risk facilities all provided long-term demand for new solutions.

Fire Fighting Foam Markets Companies

- SFFECO GLOBAL

- Kerr Fire

- Fabrik Chemischer Praparate von Dr. Richard Sthamber GmbH & Co. KG

- Dafo Fomtec AB

- Johnson Controls International PLC

- DIC Corporation

- Perimeter Solution

- National Foam

- ANGUS FIRE

- BIO EX S.A.S

- Kidde-Fenwal Inc.

- Eau & Feu

- ICL Group

- Buckeye Fire Equipment

- Chemguard

- Tyco Fire Products LP

- 3M

- Dr. Sthamer

- The Solberg Company (a division of Amerex Corporation)

- KV Fire Chemicals

- Auxquimia

Recent Developments

- In August 2024, National Foam announced the launch of AvioF3 Green Mil 3% Fluorine Free Foam (F3) Concentrate, designed for crash rescue operations at both military land-based and civilian aviation facilities. Innovatively formulated, AvioF3 Green Mil 3% concentrate is specifically engineered for use on Aviation Rescue Fire Fighting vehicles (ARFF).

- In April 2025, Perimeter Solutions announced the release of its new SOLBERG SPARTAN 1% Fluorine-Free Class A/B Foam Concentrate at FDIC 2025 in the United States. The company reported that the foam is designed to give firefighters more control in various fire scenarios, including structure, wildland, vehicle, gasoline, and dumpster fires.

- In March 2025, Hempel A/S announced the launch of Hempafire Extreme 550, its latest PFP solution. This state-of-the-art epoxy PFP coating provides up to four hours of fire protection while delivering exceptional durability and application efficiency. Formulated especially for cellulosic fires, this PFP coating sets new benchmarks for fire safety in commercial and industrial projects.

- In June 2023, Johnson Controls, the global leader for smart, healthy, and sustainable buildings, launched the new NFF-331 3% x3 % Non-Fluorinated Firefighting Foam Concentrate under its ANSUL, CHEMGUARD, and SKUM brands. NFF-331 3% x 3% Non-Fluorinated Firefighting Foam Concentrate is tested and approved for use on a wide range of Class B, hydrocarbon, and polar solvent and fuels.

- In May 2023, the new NFF-331 3%×3% Non-Fluorinated Firefighting Concentrate under its SKUM, ANSUL, and CHEMGUARD brands was launched by the global leader for smart, healthy, and sustainable buildings, Johnson Controls.

- In February 2024, an innovative product, the eco-friendly ‘enviroFoam' fire extinguisher range, was launched by a trade-only fire safety supplier, CheckFire Ltd. This new product helps to provide fire safety solutions to class B flammable liquid fires as well as environmentally responsible.

Segments Covered in the Report

By Foam Type

- Aqueous Film Forming Foam (AFFF)

- Alcohol Resistant Aqueous Film Forming Foam (AR-AFFF)

- Protein Foam

- Synthetic Detergent Foam

By Fire Type

- Class A

- Class B

- Class C

By End-use

- Oil & Gas

- Automotive

- Chemical

- Aviation

- Marine

- Mining

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting