Human Resource Professional Service Market Size and Forecast 2025 to 2034

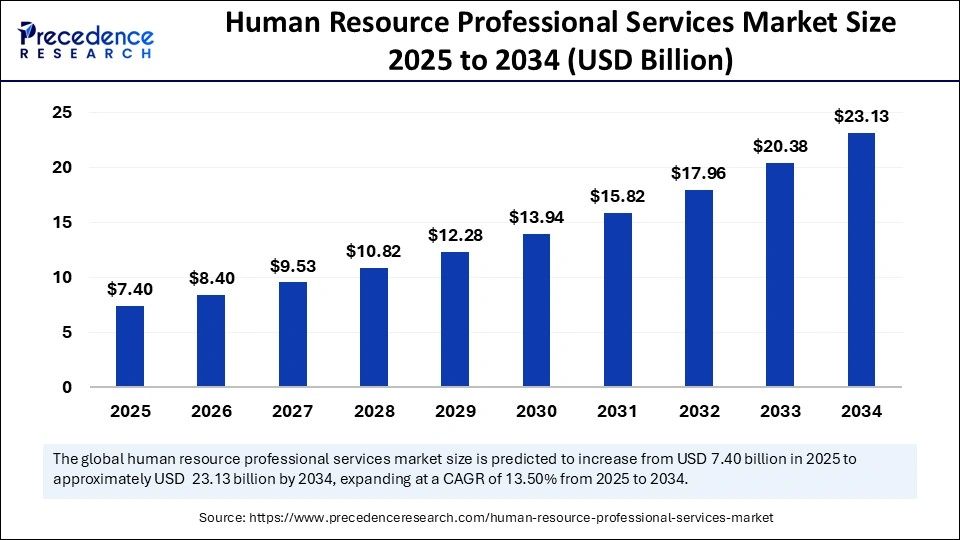

The global human resource professional service market size accounted for USD 6.52 billion in 2024 and is predicted to increase from USD 7.40 billion in 2025 to approximately USD 23.13 billion by 2034, expanding at a CAGR of 13.50% from 2025 to 2034. The rising diversity of human resources is the key factor driving the growth of the market. Also, the increasing shift towards automating human resources (HR), coupled with the technological advancements in the sector, can fuel market growth further.

Human Resource Professional Services Market Key Takeaways

- In terms of revenue, the human resource professional service market is valued at $7.40 billion in 2025.

- It is projected to reach $23.13 billion by 2034.

- The market is expected to grow at a CAGR of 13.50% from 2025 to 2034.

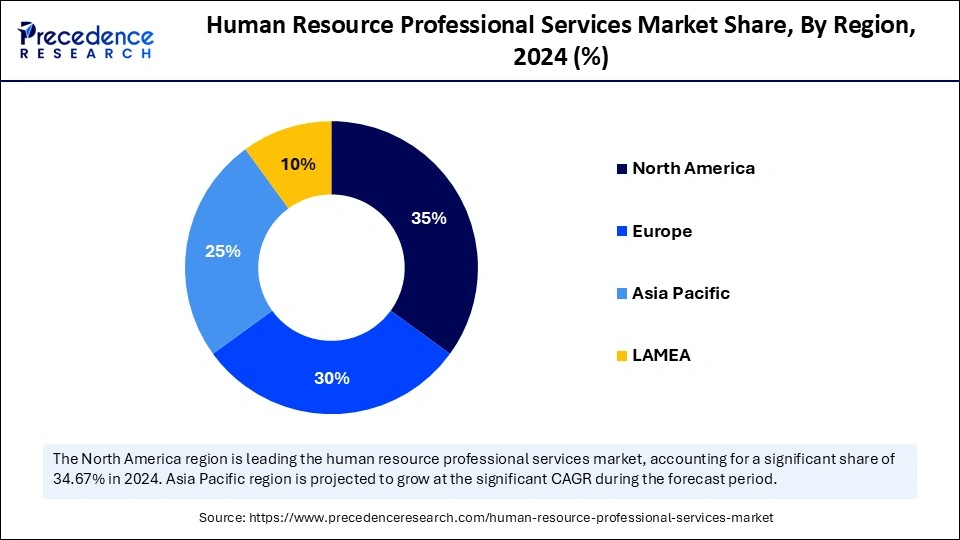

- North America dominated the market by holding more than 35% of the market share in 2024.

- Asia Pacific is expected to grow at a notable CAGR of 15.5% over the forecast period.

- By service, the core HR services segment held the major market share of 34% in 2024.

- By service, the talent management segment is projected to grow at a CAGR of 16.2% over the forecast period.

- By deployment, the on-premises deployment segment dominated the market in 2024.

- By deployment, the hosted deployment segment is anticipated to grow at the fastest rate over the forecast period.

By enterprise size, the large enterprise segment led the market in 2024. - By enterprise size, the small and medium enterprises (SMEs) segment is estimated to grow at the fastest rate over the projected period.

- By end use, in 2024, the IT and telecom sector segment dominated the market by holding the largest share.

- By end use, the retail sector is projected to grow at the fastest rate during the forecast period.

Artificial Intelligence-Based Technologies Improving Employee Experience

Artificial intelligence (AI) can customize the onboarding process, offering new employees specialized resources and information, which leads to higher retention rates. AI-driven chatbots can offer employees quick access to HR support and information, fostering a sense of belonging and engagement. In the human resource professional services market, AI can help HR managers identify the weaknesses and strengths of employees and create personalized development plans.

- In March 2025, Phenom, an applied AI company specializing in HR, announced major innovations during its product keynote at IAMPHENOM: X+ Ontologies, X+ Agent Studio, and a new range of verticalized X+ Agents. These enhancements expand on Phenom's award-winning X+ generative AI capabilities by providing HR's first hyper-relevant agents built for specific industry needs, job roles, and use cases.

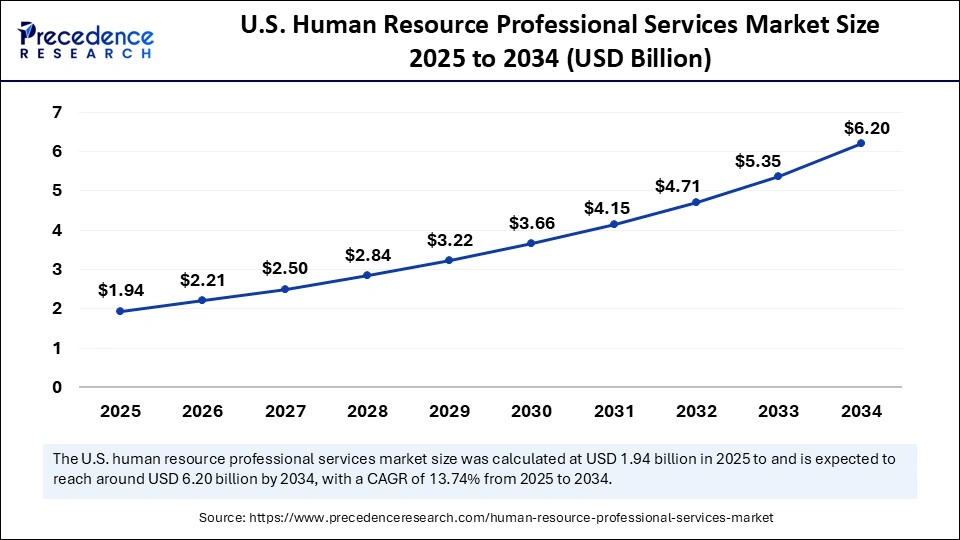

U.S. Human Resource Professional Service Market Size and Growth 2025 to 2034

The U.S. human resource professional service market size was exhibited at USD 1.71 billion in 2024 and is projected to be worth around USD 6.20 billion by 2034, growing at a CAGR of 13.74% from 2025 to 2034.

North America dominated the human resource professional services market in 2024. The dominance of the region can be attributed to the strong presence of various large enterprises operating in many sectors, such as automotive, IT and telecom, mining, manufacturing, military, and defense. Furthermore, the increasing availability of innovative technology tools can impact positive regional growth. In North America, the U.S. led the market owing to the emergence of the e-commerce industry along with the robust IT and telecom industry in the country. The country is also investing heavily in human resources, which can help to optimize the market reach in the country further.

- In February 2024, Workday, Inc. and Insperity, a prominent HR solutions provider in the U.S., joined forces to develop and deliver new full-range HR solutions designed for small and medium-scale businesses.

Asia Pacific is expected to grow at the fastest rate in the human resource professional services market over the forecast period. The growth of the region can be credited to the increase in the need for technology services like cloud-based recruitment platforms and the growing adoption of innovative HR solutions that enhance recruiting efficiency and onboarding. Moreover, organizations are emphasizing employee well-being, driving market expansion further.

In Asia Pacific, Japan is showing significant growth due to the companies in the country focusing on the well-being of employees and trying to stick to the compliance requirements, which benefits from the automation of HR functions. The major market players in the country are increasingly incorporating innovations such as AI and big data analytics.

Market Overview

In recent years, companies have been increasingly focusing on employee wellness programs as they positively affect both work satisfaction and work productivity. The dilemma around HR management is being addressed from a more versatile standpoint, which is inclusive of employee engagement and employee culture. The constantly changing scenarios for HR practitioners create huge opportunities in the market to modify and conceive their service offerings globally.

Human Resource Professional Services Market Growth Factors

- The growing demand for flexibility in accessing attendance, leaves, and work schedules is expected to boost the human resource professional services market growth soon.

- The increasing focus on efficiency and cost reduction can propel market growth shortly.

- The rising complexity of HR regulations and compliance will likely contribute to market expansion.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 23.13 Billion |

| Market Size in 2025 | USD 7.40 Billion |

| Market Size in 2024 | USD 6.52 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.50% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Enterprise Size, Deployment, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing demand for workforce optimization

The human resource professional services market is witnessing a growth in demand for workforce optimization services as companies increasingly strive to improve productivity and efficiency. This is fueled by the need to adapt to shifting economic conditions, changing dynamics of the labor market, and technological advancements. In addition, improved technology solutions like workforce planning tools and HR analytics can optimize the whole process efficiently.

- In October 2024, Crowe LLP, a public accounting and consulting firm, announced the launch of the firm's human capital consulting practice, led by seasoned industry specialist Joy Duce. The new service offering provides organizations of all sizes across industries with tailored solutions to manage the employee life cycle, from policies and processes to due diligence, regulatory obligations, and more.

Restraint

Challenges in retaining talent

The talent pool is shifting, which makes it difficult to seek and hire qualified candidates. High turnover costs organizations money and disturbs operations. Many employees globally are leaving their jobs to find good opportunities or work-life balance. Moreover, labor regulations and laws are constantly changing, which makes it challenging for HR professionals to stay compliant.

Opportunity

Increasing risk management and compliance

The growing complexity of labor regulations and laws across different regions has made compliance a key concern for organizations. The human resource professional services market is boosted by the need for expert support and advice in navigating this landscape. Furthermore, market players are aware that non-compliance can pose substantial reputational damage and financial penalties. Hence, the need for HR services to help keep compliance is increasing, creating future opportunities for the market.

Service Insights

The core HR services segment held the largest human resource professional services market share in 2024. The dominance of the segment can be attributed to the increasing need for companies to automate business operations associated with human resource functions. Additionally, these services encompass basic HR functions such as recruitment, onboarding, training, compensation, performance management, etc., to ensure the organization's efficient and smooth operations.

- In August 2024, Deloitte announced the launch of its HR Cloud Operate services, designed to empower organizations to maximize the value of their Cloud HCM platforms and enhance their HR delivery. The launch comes at a time when businesses are grappling with a gap in technology and process skills within HR teams, which can pose significant challenges.

The talent management segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be linked to the organizations that are increasingly focused on employing professional services to detect potential gaps between real and desired performances and to attract the cream of individuals to improve the company's overall performance.

Deployment Insights

The on-premises deployment segment dominated the human resource professional services market in 2024. The dominance of the segment can be credited to the overall cost efficiency and cost ownership offered by this segment. Also, this method enables more widespread customization of services and products while maintaining flexibility. Organizations are choosing this deployment method due to enhanced data security and personalized services.

The hosted deployment segment is anticipated to grow at a faster rate over the forecast period. The growth of the segment can be driven by the increasing speed of digital transformations along with the growing need for cloud-based services, associated with many benefits such as cost savings, flexibility, scalability, etc. The most substantial benefit of this method is that companies utilizing hosted services do not need any upgrades.

- In July 2024, Omilia, a market leader in enterprise Conversational Artificial Intelligence (CAI), announced the launch of Pathfinder, a tool that significantly reduces CAI application design and development time to accelerate and improve customer deployments.

Enterprise Size Insights

The large enterprise segment led the human resource professional services market in 2024. The dominance of the segment is owing to the increasing emphasis on the inclusion of advanced technologies, coupled with the rising reliance on up-to-date strategic decisions. Moreover, major market players are focusing on automating the HR processes, which provide innovation-based convenience.

The small and medium enterprises (SMEs) segment is estimated to grow at the fastest rate over the projected period. The growth of the segment is due to the surge in the expansion of SMEs in emerging economies such as India, China, and Japan. Furthermore, ongoing government initiatives globally are driving innovation in the sector, impacting positive market growth.

End-Use Insights

In 2024, the IT and telecom sector segment dominated the human resource professional services market by holding the largest share. The dominance of the segment is because of a surge in the efficiency of HRM abilities of companies across the globe. In addition, the increasing inclusion of advanced technologies offers accessibility and availability of high-speed internet services, which is influencing the global business scenario.

The retail sector is projected to grow at the fastest rate during the forecast period. The growth of the segment can be linked to the surge in the growth of the retail market, which has resulted in extensive hiring of employees, which also generates employee retention concerns. Also, the adoption of these services enables retailers to emphasize more on their core tasks while deploying enhanced HRM techniques.

Human Resource Professional Services Market Companies

- Accenture

- ADP, Inc.

- Cezanne HR Limited

- Ernst and Young Global Limited

- IBM

- Mercer LLC

- Oracle

- PwC

- SAP SE

- Workday, Inc.

Latest Announcements by Market Leaders

- In January 2025, Telstra and Accenture announced a proposed joint venture (JV) to accelerate Telstra's data and AI roadmap rapidly to further extend its network leadership, improve customer experience, and help its teams operate more efficiently and effectively.

- In August 2024, IBM and Intel announced a collaboration to deploy Intel Gaudi 3 AI accelerators as a service on IBM Cloud. This offering, which is expected to be available in early 2025, aims to help more cost-effectively scale enterprise AI and drive innovation underpinned by security and resiliency. This collaboration will also enable support for Gaudi 3 within IBM's Watson AI and data platform.

Recent Developments

- In May 2024, Accenture, a major market participant in the technology and innovation sector, was named the Official Business and Technology Consulting Partner for the National Football League (NFL). The newly formed partnership for five years aims to utilize the company's advanced technology to shape a better future for the game.

- In June 2024, Colorado State University, a prominent educational industry participant in the U.S., selected Workday Inc., a major human resource services provider, as the university's new human capital management system facilitator.

- In September 2023, HiBob collaborated with Papaya Global, a payroll platform provider, to help multinational employers meet the need for compliant HR-integrated payroll solutions. Through the collaboration, HiBob integrated its HR data into Papaya's platform, allowing employers to integrate PTO, HR, and compensation information with real-time data synchronization and optimize payroll processes.

Segments Covered in the Report

By Service

- Core HR

- Employee Collaboration and Engagement

- Recruiting

- Talent Management

- Workforce Planning and Analytics

- Others

By Enterprise Size

- Large Enterprise

- SMEs

By Deployment

- Hosted

- On-premise

By End Use

- Academia

- BFSI

- Government

- Healthcare

- IT and Telecom

- Manufacturing

- Retail

- Others

By Region

- North America

- Europe

- Asia-Pacific,

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting