Human Capital Management Market Size and Forecast 2025 to 2034

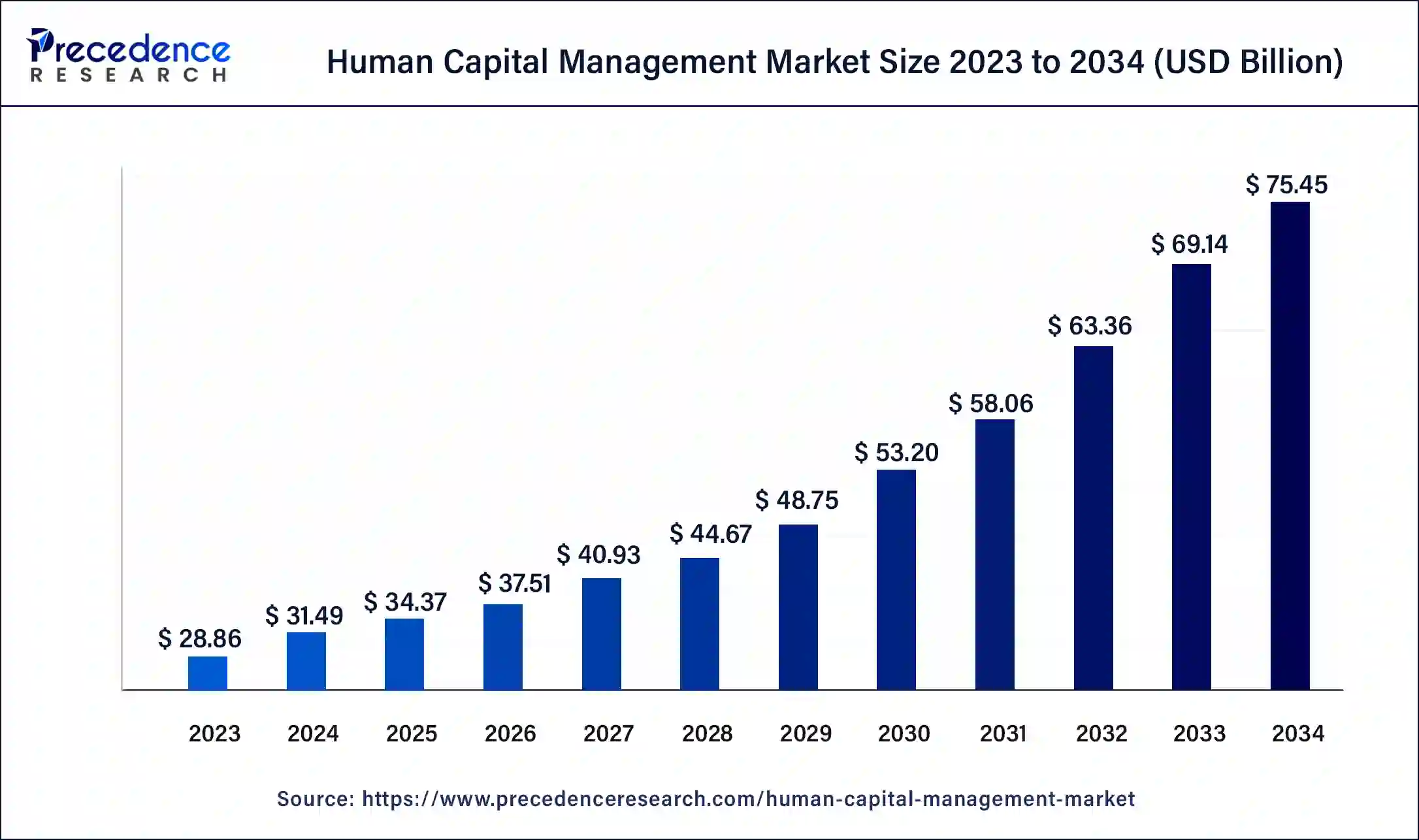

The global human capital management market size was estimated at USD 31.49 billion in 2024 and is predicted to increase from USD 34.37 billion in 2025 to approximately USD 75.45 billion by 2034, expanding at a CAGR of 9.13% from 2025 to 2034.The rising demand for unified HR solutions across the world is driving the growth of the human capital management market.

Human Capital Management Key Takeaways

- In terms of revenue, the human capital management market is valued at $34.37 billion in 2025.

- It is projected to reach $75.45 billion by 2034.

- The human capital management market is expected to grow at a CAGR of 9.13% from 2025 to 2034.

- North America led the human capital management market with the highest share in 2024.

- By component, the software segment led the market with a major market share of 67.20% in 2024.

- By component, the services segment is expected to grow at a significant CAGR of 10.30% over the projected period.

- By deployment mode, the cloud-based segment led with 73.60% and is expected to continue its growth during the forecast period with a CAGR of 9.90%.

- By organization size, the large enterprises segment dominated the market with the largest share of 57.50% in 2024.

- By organization size, the small enterprise segment is expected to grow at a significant CAGR of 10.80% from 2025 to 2034.

- By end user industry, the it and telecom held the biggest market share of 19.40% in 2024.

- By end user industry, the healthcare segment is expanding at a significant CAGR of 10.90% from 2025 to 2034.

- By functionality, the core HR segment led with a market share of 26.10% in 2024.

- By functionality, the talent acquisition segment is expected to grow at a significant CAGR of 11.20% over the projected period.

- By user type, the hr managers segment dominated with a market share of 33.80% in 2024.

- By user type, the C-level executive segment is expected to grow at a significant CAGR of 9.80% from 2025 to 2034.

How is AI shaping the Human Capital Management Industry?

The advancements in AI play a crucial role in the growth of the IT industry. Nowadays, HCM-developing companies have started integrating AI into their software to enhance HR-related operations. AI can automate several HR tasks, such as decision-making and employee development. AI-enabled HCM software ensures that all the functions of any organization operate properly and comply with government compliances and labor laws. Moreover, the applications of AI in HCM solutions can result in cost savings and provide enhanced data analytics to enhance scalability and flexibility in organizations. Thus, the integration of AI in the HCM industry is expected to shape industrial growth in a positive way.

- In October 2023, IBM announced a partnership with EY. This partnership is done to launch EY.ai Workforce that uses AI technology for automating several HR-related tasks in large businesses.

U.S. Human Capital Management Market Size and Growth 2024 to 2034

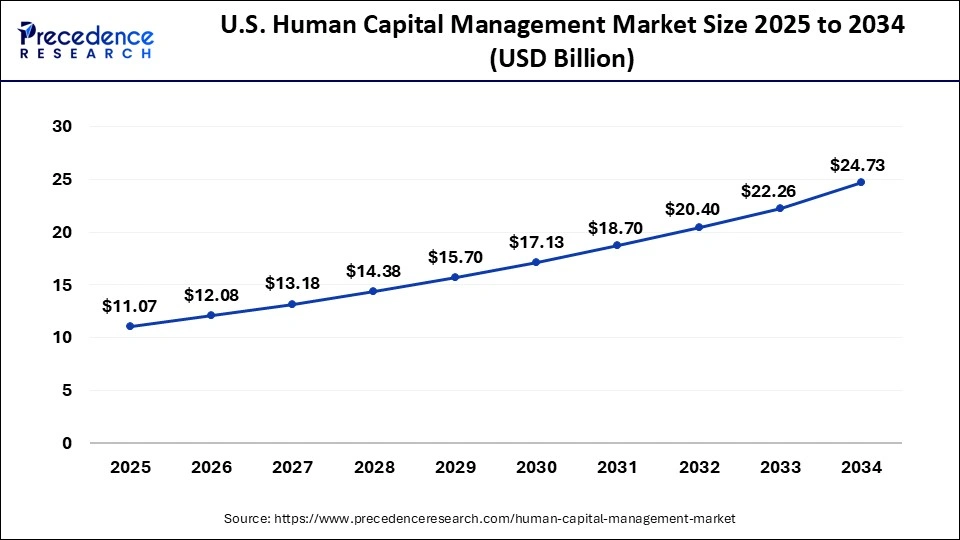

The U.S. human capital management market size was exhibited at USD 10.14 billion in 2024 and is projected to be worth around USD 24.73 billion by 2034, poised to grow at a CAGR of 9.32% from 2025 to 2034.

North America held the largest share of the human capital management market in 2024. The growth of the market in this region is mainly driven by the rising advancements in the IT sector along with increasing investment by government in countries such as the U.S and Canada for developing the AI sector.

- In April 2024, the government of the U.S. announced an investment of around US$ 30 million under the CHIPS and Science Act & Inflation Reduction Act for developing the IT industry across the country.

- The Canadian Government announced that it would make an investment of US$ 2 billion in 2024 under the AI Compute Access Fund and a Canadian AI Sovereign Compute Strategy to develop the AI sector across the region.

The growing developments in the BFSI sector along with the rise in number of business enterprises has driven the market growth. Also, the rising development in telecom sector in the U.S and Canada has increased the demand for HCM solutions, thereby driving the market growth to some extent.

Moreover, the presence of several local market players of human capital management such as Oracle, Microsoft Corporation, Ceridian HCM Inc and some others are constantly engaged in development of high-quality HCM tools and adopting several strategies such as partnerships, acquisitions, collaborations, launches and business expansions, which in turn drives the growth of the human capital management market in this region.

- In May 2024, Oracle launched Oracle Glow. Oracle Glow is an advanced HCM solution that is used for employee development and strengthening business agility by allowing companies to develop quickly, upskill, and empowering their teams for achieving better business outcomes.

Asia Pacific is expected to be the fastest growing region during the forecast period. The rising development in the human capital management industry by private and public entities along with the growing investment by government for developing the telecom sector in countries such as India, China, Japan, South Korea, Singapore and some others is expected to drive the market growth to some extent.

- The International Trade Administration in January 2024 announced that the government of Singapore will invest around US$ 7.5 billion for developing the telecommunication industry across the country.

Moreover, the increasing development in the BFSI and healthcare sector has increased the demand for advanced HCM solutions, thereby driving market growth. Additionally, the rise in the number of SMEs in China, Japan, India, South Korea, Singapore, and some others is likely to boost the market growth to some extent.

Furthermore, the presence of various local companies of human capital management such as Zoho, GreytHR, ZingHr, Beisen and some others are developing advanced HCM solutions and software across the Asia Pacific region, that in turn is expected to drive the growth of the human capital management market in this region.

- In February 2024, GreytHR launched a new brand identity in India. This launch is done with an aim to streamline HR-related operations across various industries in the country.

Market Overview

The human capital management market is a prominent industry in the technology & IT sector. This industry deals in the development and distribution of various HCM software and services across the world. This industry comprises several offerings that mainly include software and services. This software and services are mainly deployed through cloud and on-premises to perform HR-related applications in several industries such as BFSI, retail, government & public sector, transportation & logistics, manufacturing, healthcare, education, and others. The HCM solutions are mainly used in large enterprises & small and medium enterprises for managing payroll, talent acquisition, employee engagement, and some others. This industry is likely to grow significantly with the growth of the IT and software industries.

- According to the official website of Bamboo HR, the integration of several HCM tools of the company in various organisations helps in saving around $40000 every year and reducing HR cost by 40%.

Top 10 HCM Tools

- Workday

- BambooHR

- UKG

- Oracle HCM Cloud

- SAP Success Factor

- ADP Workforce Now

- PeopleSoft

- Zoho People

- Paycor

- Vantage HCM

Human Capital Management Market Growth Factors

- Rising developments related to the IT industry have led to human capital management market growth.

- There is a rise in the number of government initiatives related to the development of the IT industry across the globe.

- The trend of integrating advanced HCM controls and business performance management in HCM software.

- Rising use of HCM solutions for talent management and data protection of employees.

- The growing investments from public and private sector entities for developing the human capital management market.

- Advancements in technologies related to HCM services positively impact industrial growth.

- The growing focus on digitalization across the world has accelerated the market in a positive way.

- The increasing adoption of HCM solutions for optimizing workforce management among companies.

- There is a growing demand for smartphone-based HCM applications that are available in Play Store and App Store.

- The increasing demand for streamlining various HR operations boosts the market growth.

- The growing application of HCM tools in the BFSI sector around the world has driven the growth of the human capital management market.

Key Factors Influencing Future Market Trends

- Adoption of cloud-based HCM solutions: The increased use of cloud-based HCM is attributed to technology that is scalable, cheaper, and easily integrates with other systems. It is real-time data and improved collaboration that render these tools essential in driving HR agility, with cloud platforms coming as key in defining the HCM growth trajectory.

- Employee experience and engagement:Firms are investing in boosting employee satisfaction, wellness, and career development to increase the retention rate and, in turn, increase overall productivity. There is a keen market interest in HCM techniques and solutions supporting Individualized learning and Performance feedback, as well as flexible models for working out, highlighting a tendency to employee experience and workplace humanization.

- Demand for data-driven decision making:The organizations are improving workforce planning, performance monitoring, and HR strategy development. Companies are using a data-driven approach to optimize recruitment, advancement, and employee growth, furthering the market for HCM platforms that come with advanced analytics.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 75.45 Billion |

| Market Size in 2025 | USD 34.37 Billion |

| Market Size in 2024 | USD 31.49 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.13% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Deployment, Organization Size, End-Use Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing application of HCM solutions in construction industries

The use of advanced HCM solutions is increasing rapidly in numerous industries across the world. The application of HCM solutions in construction sectors has increased in managing the payroll and attendance of labor, along with providing mobile phone access from any location. Also, the use of HCM solutions to enhance the learning and development of laborers in the construction industry is crucial for industrial growth. Thus, the rising application of HCM solutions in the construction industry is likely to drive the growth of the human capital management market during the forecast period.

- In October 2023, ADP launched ADP Workforce Now. ADP Workforce Now is a comprehensive HCM solution that finds several HR-related operations in the construction industry.

Restraint

Security issues, along with a lack of skilled workforce

The human capital management industry has gained traction due to the growing usage of HCM tools around the world. Although there are numerous applications of HCM solutions, there are several problems in this industry. Firstly, the documents of employees saved in HCM software might be misused by hackers, which causes a major security concern. Secondly, the number of skilled professionals with expertise in HCM analytics is very low. Thus, security concerns, along with a shortage of trained workforce, are likely to restrain the growth of the human capital management market during the forecast period.

Opportunity

Advancements in blockchain technology to change the future

Several developments are taking place in the technological sectors associated with HR processes. Nowadays, software developers have started integrating blockchain technology in HCM solutions tools for safeguarding employee data. By using blockchain technology, the HCM software can enhance security and credibility of HR processes. Thus, advancements in blockchain technology associated with HCM solutions is expected to create ample growth opportunities for the market players in the years to come.

- In April 2023, CSM Tech launched CSM ProofChain. CSM ProofChain is blockchain service that can enhance the hiring process in businesses.

Technological Advancements

The sector of human capital management is being transformed by innovative technology as it improves HR's effectiveness, accuracy, and contribution to the strategic objectives of the organization. Advanced artificial intelligence applications make the talent recruitment process faster by automating processes, like resume screening, candidate matching, and scheduling of interviews. Automating payroll, benefits, and compliance helps HR personnel be attentive to critical strategic initiatives with a greater resource allocation. Further, automated systems also enhance the employee experience through personalisation of training, provision of feedback channels, and the ability for employees to self-manage their requirements via the internet.

Functionality Insights

The core HR segment dominated the global market in 2024, largely due to its foundational role in managing essential employee data and processes. Core HR systems centralize employee records, payroll, benefits, and performance management, streamlining HR operations and providing a comprehensive view of workforce data. This centralization facilitates informed decision-making and strategic planning, while automating routine tasks reduces administrative burdens and enhances efficiency. Furthermore, automating processes such as onboarding, leave management, and performance reviews minimizes errors and allows HR professionals to focus on strategic initiatives.

The talent acquisition segment is also witnessing rapid growth in the market. This trend is driven by organizations operating in a highly competitive and evolving job market, alongside advancements in technology. Organizations are increasingly utilizing technologies like AI and machine learning to streamline recruitment processes, automate tasks such as resume screening and candidate matching, and derive valuable insights through data analytics to improve hiring decisions. Additionally, the shift toward remote and hybrid work models has necessitated effective management of a geographically dispersed workforce, incorporating features for virtual collaboration, performance tracking, and employee engagement.

User Type Insights

The HR managers segment secured a dominant position in the market in 2024. This dominance is primarily attributable to improvements in efficiency and strategic initiatives. HR managers are key stakeholders, as human capital management (HCM) software automates routine tasks, offers data-driven insights for better decision-making, and supports strategic talent development. Furthermore, HCM systems provide powerful reporting and analytics tools, enabling HR managers to gain deeper insights into workforce trends and make informed strategic decisions. HCM platforms deliver integrated tools for the entire employee lifecycle, from recruitment and onboarding to training, development, and performance management, covering all areas of direct HR responsibility.

The C-level executive segment is projected to experience the fastest growth in the market. This is because top leaders increasingly recognize that managing human capital effectively is essential for achieving strategic business objectives, rather than merely being an HR function. This shift is influenced by the importance of attracting and retaining top talent, the need for data-driven decision-making, the imperative of navigating digital transformation and evolving work models, and the growing recognition of the strategic significance of Diversity, Equity, and Inclusion (DEI). Consequently, C-suite executives are actively driving investments in HCM technologies, such as AI-powered analytics and skills platforms, to enhance workforce management, employee engagement, and overall organizational success.

Component Insights

The software segment dominated the human capital management market in 2024, due to its ability to provide comprehensive digital solutions that automate HR functions, streamline talent management processes, offer centralized data and analytics for informed decision-making, and enhance employee engagement through self-service portals. The increasing demand for automation to simplify HR functions, the need for better employee experiences, and the recurring revenue model of subscription-based software appeal particularly to businesses of all sizes, especially smaller ones with fluctuating needs. By streamlining processes and offering improved tools for communication and development, HCM software boosts employee satisfaction and productivity.

The services segment is experiencing the fastest growth during the forecast period, driven by businesses' need for specialized expertise to implement, manage, and leverage complex HCM technologies such as AI and ML. Companies seek ongoing support and talent management services to achieve better workforce outcomes. While organizations are adopting automation for repetitive HR tasks, they require services to help implement and customize these solutions, allowing HR professionals to focus on more strategic initiatives. The rising demand for automation, advanced analytics, and strategic talent management emphasizes the need for professional services to ensure optimal adoption and maximize return on investment from HCM solutions.

Offering Insights

The software segment dominated the market in 2024. The growing application of core HR, talent management, and workforce management software has driven the market growth. Also, the increasing use of HCM software for streamlining HR operations is likely to boost market growth to some extent. Moreover, the upsurge in demand for HCM software for recruitment and human resource development is expected to propel the growth of the human capital management market during the forecast period.

- In April 2023, Paycom Software launched Global HCM. Global HCM is a cloud-based human capital management software that is available in 180+ countries, has 15 languages, and has the ability to cater to the needs of HR.

The solutions segment is estimated to exhibit the fastest growth rate during the forecast period. The rising trend of HCM solutions in various industries for increasing hiring speed along with developing an organization's human capital has driven market growth. Also, the increasing usage of human capital management solutions in healthcare organizations to optimize a healthcare organization's entire workforce is likely to boost market growth to some extent. Moreover, the growing demand for HCM solutions in large enterprises to increase the productivity of workers is expected to foster the growth of the human capital management market during the forecast period.

- In October 2023, Empeon launched the Scheduling Solution. This is a comprehensive HCM solution that finds various applications in the healthcare sector.

Deployment Insights

The cloud-based segment led the market in 2024 and is expected to continue its growth during the forecast period. This growth is primarily due to its inherent flexibility, scalability, cost-effectiveness, remote access capabilities, and faster integration with other systems, all of which are essential in today's dynamic business environments. Cloud platforms enable access from anywhere on any device, facilitating collaboration and efficient management for remote and global teams. Additionally, by minimizing the need for significant on-premises infrastructure and utilizing shared resources, cloud-based HCM reduces both capital and operational expenditures. It also enhances employee experience by making HR functions and information accessible to both employees and HR managers at any time and from any location.

Organization Size Insights

The large enterprises segment led the market in 2024. This is because of their extensive workforce, complex operational structures, and demand for robust, scalable solutions. These organizations require sophisticated tools to manage recruitment, performance, payroll, and compliance across diverse regions and regulations. HCM solutions enable large enterprises to optimize their HR processes, reduce administrative overhead, and improve overall operational efficiency, resulting in significant cost savings. Typically, large enterprises have the financial resources to invest in advanced HCM technologies and the skilled personnel to implement and manage these systems, ensuring compliance and mitigating legal risks.

The small enterprise segment is expected to experience the fastest growth during the predicted timeframe. This is largely due to the increasing adoption of cloud-based and AI-powered solutions that improve efficiency, manage remote workforces, and enhance employee engagement, all at a cost-effective price. Small and medium-sized enterprises are utilizing HCM tools to streamline administrative burdens, automate core HR functions, and gain a competitive advantage by making better use of their limited resources. They recognize the importance of managing and retaining talent, which is critical in improving recruitment, fostering a positive employee experience, and investing in upskilling and reskilling initiatives.

End-Use Insights

The IT and telecom segment led the market in 2024, driven by the high demand for skilled talent, rapid adoption of new technologies, and the increasing need for efficient remote and hybrid workforce management solutions. Companies in these sectors are early adopters of advanced HCM systems that leverage AI and automation to enhance employee experiences and streamline HR functions. The widespread implementation of remote and hybrid work models in IT necessitates sophisticated HCM solutions for managing distributed teams, improving collaboration, and ensuring seamless communication and connectivity.

The healthcare segment is expected to experience the fastest growth in the market. This growth is primarily driven by increasing complexity, a demand for specialized skills, and the need to manage large, diverse workforces amidst ongoing technological advancements, such as AI, as well as a growing demand for predictive and personalized patient care. The healthcare industry is complex and rapidly evolving, necessitating specialized skills and knowledge to manage its diverse workforce, which includes doctors, nurses, technicians, and administrators. Additionally, healthcare organizations face significant challenges in workforce planning and staffing, highlighting the importance of effective human capital management.

Human Capital Management Markets Top 14 Companies

- SAP SE

- Automatic Data Processing

- Oracle Corporation

- Microsoft Corporation

- Cornerstone OnDemand, Inc.

- Ceridian HCM, Inc.

- Infor, Inc.

- Ramco Systems Ltd.

- Workday, Inc.

- Paycom Software, Inc.

- UKG Inc

- Cegid

- Bamboo HR LLC

- Sumtotal Systems, LLC

Recent Developments

- In October 2024, ADP announced its acquisition of WorkForce Software, a global, large corporation-focused workforce management solutions company. The acquisition is meant to expand ADP's global portfolio of workforce management solutions and ultimately enable further innovations in the space.

- In September 2024, ADP announced the launch of ADP Lyric HCM. ADP Lyric HCM was developed as part of ADP's strategy of keeping pace with workforce trends as they continue to evolve, with services developing as a global HR, payroll, and service function. With Lyric, ADP combines GenAI capabilities with a comprehensive dataset into flexible, smart, and people-centric HCM.

- In March 2024, Cornerstone OnDemand announced the acquisition of Talespin, a company very focused on spatial, extended reality (XR) learning. The XR learning technology will complement Cornerstone's rich capabilities across content subscriptions, curation, creation, and analytics to give a holistic learning content solution to support the future of work.

- In January 2024, PwC announced a partnership with Darwinbox. This partnership is done with the aim of delivering Darwinbox's human capital management (HCM) platform to clients in the Middle East.

- In October 2023, Oracle launched Oracle HCM. Oracle HCM is a HCM solution that can perform various HR-related operation in medium-size companies with less than 15000 employees.

- In September 2023, PDS launched Vista. Vista is an advanced HCM tool that finds various HR-related applications, such as employee engagement, payroll management, and employee attendance.

- In June 2023, TeamLease HR Tech launched Paylief. Paylief is a HCM platform that can handle several functions such as talent acquisition, employee benefits, workforce management, and legal compliances.

- In April 2023, Pocket HRMS launched mission Bharat 2.0. This mission is launched with an aim to digitalize payroll system, HRMS, and other compliances with advanced and easy-to-use HR software in regional languages.

Segments Covered in the Report

By Component

- Software

- Core HR

- Talent Management

- Workforce Management

- Payroll Management

- Learning Management

- Performance Management

- Applicant Tracking System (ATS)

- Benefits Administration

- Time & Attendance

- Succession Planning

- Services

- Implementation & Integration

- Support & Maintenance

- Consulting & Training

- Managed Services

By Deployment Mode

- On-Premise

- Cloud-Based

By Organization Size

- Small Enterprises (1–99 employees)

- Medium Enterprises (100–999 employees)

- Large Enterprises (1,000+ employees)

By End User Industry

- IT & Telecom

- Banking, Financial Services & Insurance (BFSI)

- Healthcare

- Retail & E-commerce

- Manufacturing

- Government & Public Sector

- Education

- Travel & Hospitality

- Energy & Utilities

- Construction

- Transportation & Logistics

- Others (e.g., Media, Entertainment)

By Functionality

- Core HR (Personnel Administration, Org Management)

- Talent Acquisition

- Onboarding

- Employee Engagement

- Learning & Development

- Compensation Management

- Workforce Planning & Analytics

- Employee Self-Service (ESS) & Manager Self-Service (MSS)

By User Type

- HR Managers

- Recruiters

- Employees

- C-level Executives

- Payroll/Finance Professionals

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting