Human Augmentation Market Size and Forecast 2025 to 2034

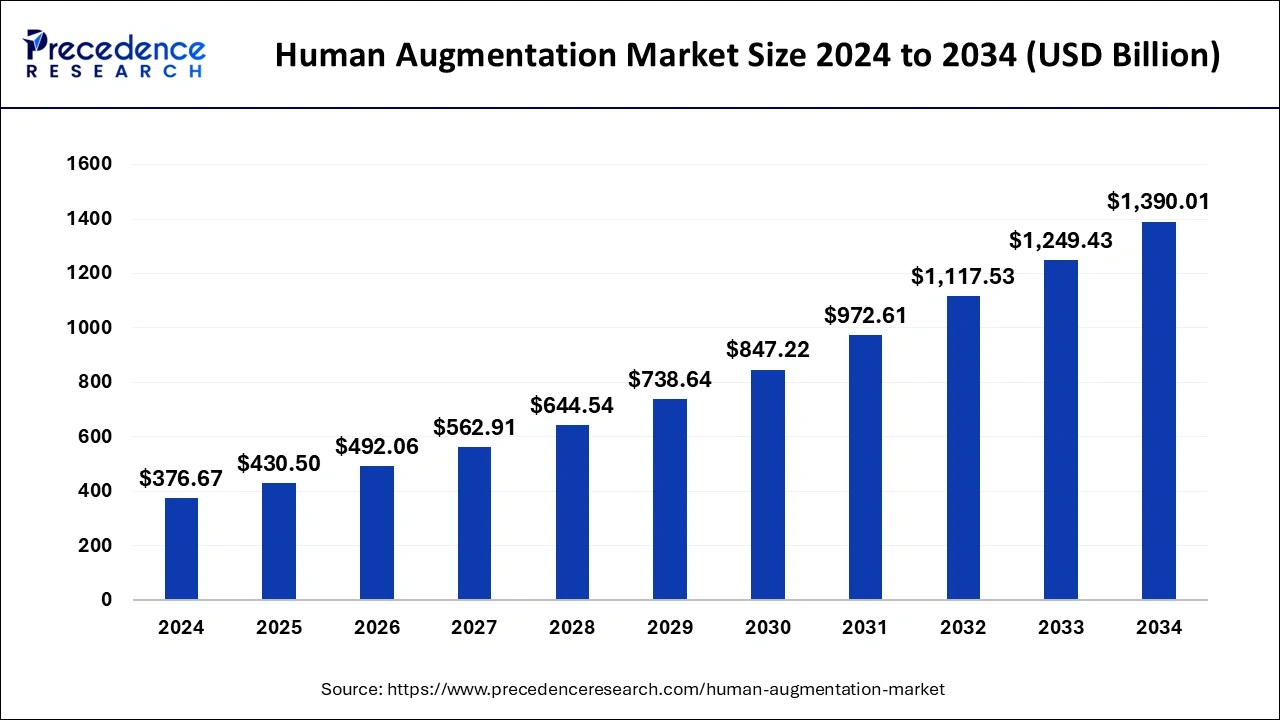

The global human augmentation market size was calculated at USD 376.67 billion in 2024 and is predicted to reach around USD 1,390.01 billion by 2034, expanding at a CAGR of 13.95% from 2025 to 2034. The market growth is attributed to the increasing integration of advanced technologies such as AI, AR, and VR in applications ranging from healthcare to defense and entertainment.

Human Augmentation Market Key Takeaways

- The global human augmentation market was valued at USD 376.67 billion in 2024.

- It is projected to reach USD 1,390.01 billion by 2034.

- The human augmentation market is expected to grow at a CAGR of 13.95% from 2025 to 2034.

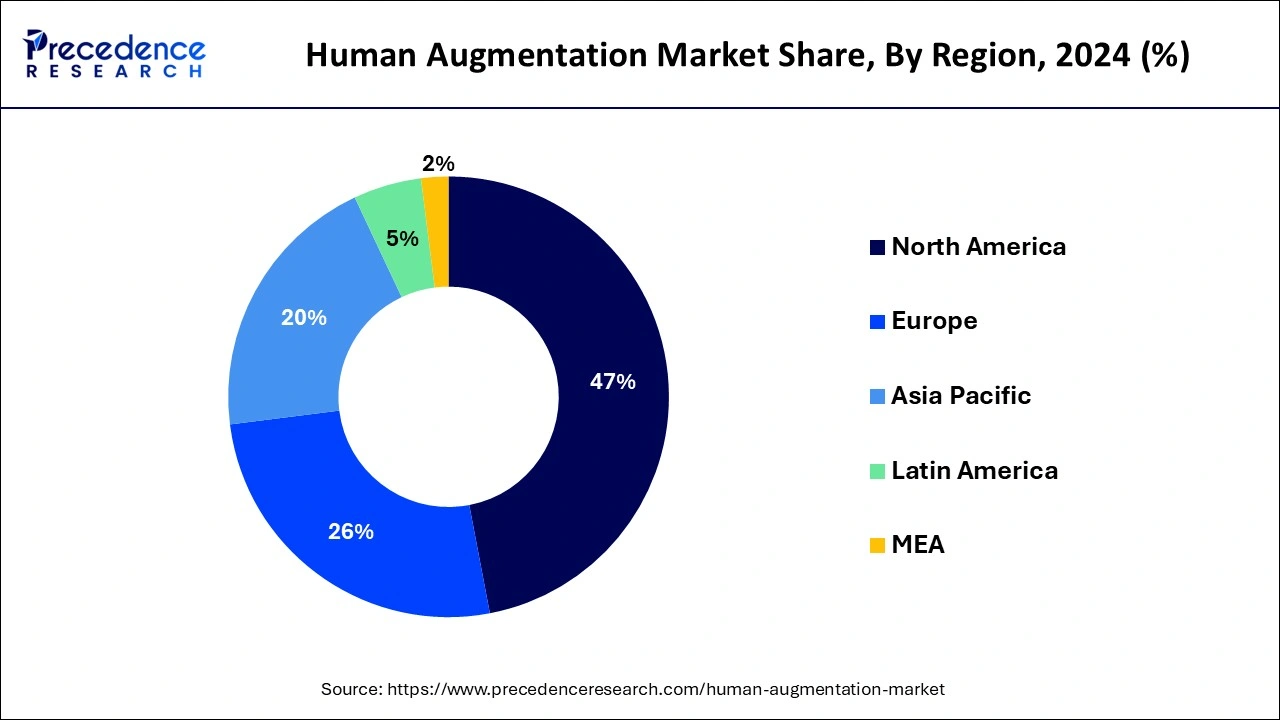

- North America contributed more than 46.14% of the market share in 2024.

- Asia-Pacific is estimated to witness the fastest CAGR between 2024 and 2034.

- By type, the wearable segment has held the largest market share of 61% in 2024.

- By type, the In-built segment is anticipated to grow at a remarkable CAGR of 15.1% between 2025 and 2034.

- By product, the body worn segment generated over 58% of the market share in 2024.

- By product, the non-body worn segment is expected to expand at the fastest CAGR over the projected period.

- By technology, the wearable segment generated over 46% of market share in 2024.

- By technology, the virtual reality segment is expected to expand at the fastest CAGR over the projected period.

- By end-user, the consumer segment had the largest market share of 32% in 2024.

- By end-user, the medical segment is expected to expand at the fastest CAGR over the projected period.

Impact of Artificial Intelligence on the Human Augmentation Market

Artificial intelligence is revolutionizing human augmentation in the form of innovative and technological wearable computing, augmented reality systems, and the brain-computer interface. Machine learning tools add to the augmentation solutions, making them more functional by collecting data and making decisions on use and operation, making the user experiences and operations more efficient. Wearables in health are seeing growing popularity, and AI algorithms are often used to analyze the wearer's vital signs and suggest possible health problems to solve. Furthermore, with the advancing technologies and AI central to driving adaptive, customized, and optimized augmentation solutions, the future of human capabilities is being written.

U.S. Human Augmentation Market Size and Growth 2025 to 2034

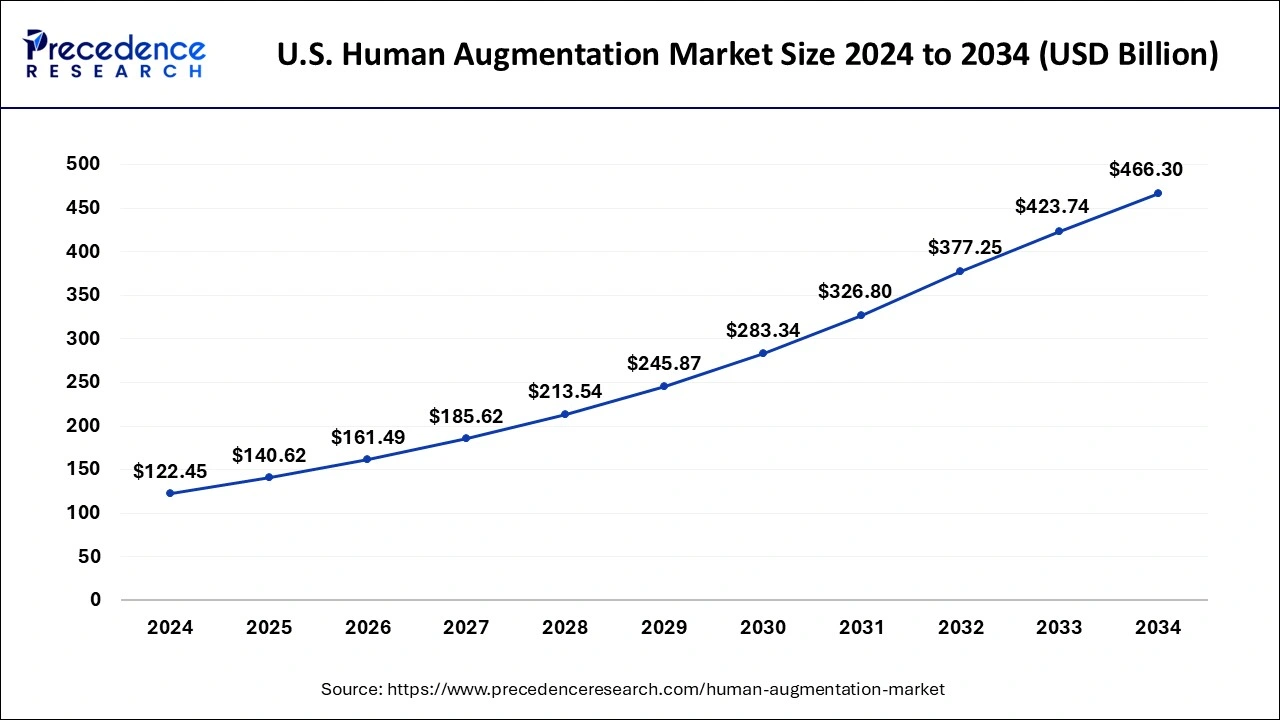

The U.S. human augmentation market size was exhibited at USD 122.45 billion in 2024 and is projected to be worth around USD 466.30 billion by 2034, growing at a CAGR of 14.31% from 2025 to 2034.

North America has held the largest revenue share 46.14% in 2024. In North America, the human augmentation market is witnessing robust growth driven by increased investments in technological advancements. The region's focus on innovation in healthcare applications, including prosthetics and neuroprosthetic devices, contributes to market expansion. Moreover, collaborations between technology companies and healthcare providers are accelerating the adoption of human augmentation, creating a dynamic landscape that responds to the rising demand for enhanced capabilities in various industries.

Asia-Pacific is estimated to observe the fastest expansion.Asia-Pacific human augmentation market is undergoing substantial growth, driven by swift industrialization and widespread technological uptake. Significant investments in research and development, notably in Japan and South Korea, are propelling innovations in robotics, exoskeletons, and wearable technologies. The region's proactive stance in integrating human augmentation across healthcare and military domains further fuels market expansion. This positions Asia-Pacific as a pivotal player in advancing the realm of human augmentation technologies, showcasing its commitment to pushing the boundaries of innovation in this transformative and dynamic field.

In Europe, the human augmentation market is marked by a burgeoning interest in ethical and regulatory considerations. The region embraces advancements in technologies like augmented reality and neuroprosthetics, with a focus on maintaining a balance between innovation and ethical standards. Collaborations between tech firms and healthcare institutions drive progress, positioning Europe as a hub for responsible innovation in human augmentation, and addressing societal and ethical concerns.

Market Overview

The human augmentation market involves the integration of advanced technologies to enhance human capabilities, both physically and cognitively. This includes using devices, implants, or wearable technologies to augment sensory perceptions, improve physical abilities, or enhance cognitive functions. Key technologies include augmented reality (AR), virtual reality (VR), robotics, and bioelectronic implants. Applications span healthcare, manufacturing, and military industries, aiming to improve efficiency, safety, and overall human performance. The market reflects the ongoing intersection of technology and humanity, seeking to push the boundaries of what individuals can achieve through symbiotic collaboration with advanced technological systems.

The pursuit of improved productivity, safety, and quality of life drives the human augmentation market. It encompasses technologies like exoskeletons for physical strength augmentation, brain-computer interfaces for cognitive enhancement, and implantable devices for medical applications. As ethical and regulatory considerations evolve, the market continues to expand, presenting opportunities for innovation and transformative advancements.

Human Augmentation Market Growth Factors

- Ongoing innovations in AR, VR, robotics, and bioelectronics drive the human augmentation market, offering new and refined solutions for physical and cognitive enhancement.

- The market sees substantial growth in healthcare, with applications ranging from prosthetics and exoskeletons to brain-computer interfaces, enhancing mobility and aiding rehabilitation.

- Human augmentation technologies are increasingly adopted in industrial settings to improve worker productivity, safety, and efficiency, presenting significant business opportunities for providers.

- The military sector embraces human augmentation for enhanced soldier performance, creating avenues for business expansion and technological advancement.

- Advancements in brain-computer interfaces and neurotechnology present opportunities for improving memory, focus, and overall cognitive abilities, impacting industries such as education and professional training.

- As the industry matures, navigating ethical considerations and evolving regulatory landscapes becomes crucial, influencing market dynamics and shaping the direction of innovation.

- The integration of human augmentation features in consumer electronics and wearables, such as smart glasses and health monitoring devices, opens up new business opportunities in the consumer market.

- Human augmentation finds crucial applications in rehabilitation and assistive technologies, benefiting individuals with disabilities. Innovations in prosthetics, exoskeletons, and periprosthetic devices contribute to the market's growth, offering improved quality of life for users.

- With the rise of remote work, the human augmentation market explores opportunities in telepresence solutions. Augmented reality tools and robotics enable enhanced remote collaboration, addressing the evolving needs of the global workforce and creating avenues for market expansion.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 13.95% |

| Market Size in 2025 | USD 430.50 Billion |

| Market Size by 2034 | USD 1,390.01 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, Technology, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Technological advancements, military and defense investments

Technological advancements and military and defense investments synergistically propel the demand for the human augmentation market. Breakthroughs in augmented reality (AR), virtual reality (VR), artificial intelligence (AI), and robotics are transforming human augmentation, offering cutting-edge solutions that enhance physical and cognitive capabilities. These advancements drive the market's growth by continually expanding the scope and effectiveness of augmentation technologies.

In the military and defense sector, substantial investments in human augmentation technologies are steering innovation. Governments and defense organizations worldwide are integrating exoskeletons, cognitive enhancement tools, and other advanced technologies to enhance soldiers' performance and survivability. The need for enhanced situational awareness, improved communication, and heightened physical capabilities on the battlefield amplifies the demand for human augmentation solutions, fostering collaboration between technology developers and defense entities and further accelerating market growth.

Restraint

Regulatory challenges and high development costs

Regulatory challenges pose a significant restraint on the human augmentation market. As technological advancements rapidly outpace regulatory frameworks, there is uncertainty and ambiguity surrounding the ethical and legal aspects of human augmentation. Governments and international bodies are grappling with defining clear guidelines for ethical use, safety standards, and potential societal impacts of these technologies. This regulatory lag can deter investment and adoption, as businesses and consumers hesitate due to concerns about compliance, liability, and ethical considerations. Striking a balance between encouraging innovation and ensuring responsible use is essential for overcoming these regulatory hurdles and fostering market growth.

The high costs associated with the development and deployment of human augmentation technologies act as a formidable constraint on market demand. Research, design, and testing of advanced technologies demand substantial financial investment. Additionally, complying with evolving regulatory standards further amplifies development costs. These financial barriers limit the number of companies entering the market and can result in elevated prices for end-users, hindering widespread adoption. Overcoming this challenge requires strategic collaborations, increased research funding, and a more streamlined regulatory environment to encourage innovation while mitigating the financial burden on developers and, ultimately, end-users.

Opportunity

Consumer electronics integration and healthcare innovation

Consumer electronics integration plays a pivotal role in surging demand for the human augmentation market as technology seamlessly intertwines with daily life. The integration of human augmentation features into consumer electronics, such as smart glasses, fitness trackers, and health monitoring devices, enhances user experiences. These technologies not only contribute to lifestyle improvements but also introduce individuals to the benefits of augmented capabilities, fostering a broader acceptance and utilization of human augmentation in various aspects of life.

Simultaneously, healthcare Innovation is a key driver, propelling demand for human augmentation technologies to new heights. The healthcare sector's increasing adoption of these technologies reflects a commitment to improving patient outcomes and quality of life, creating a significant market demand for innovative human augmentation solutions that positively impact both healthcare professionals and patients alike. The intersection of consumer electronics and healthcare innovation expands the market reach, making human augmentation an integral part of improving overall well-being and performance.

Type Insights

According to the type, the wearables segment held a 61.30% revenue share in 2024. Wearable human augmentation involves devices worn externally, like smart glasses and exoskeletons, enhancing physical capabilities. Trends highlight the integration of augmented reality (AR) in wearables for immersive experiences and the development of lightweight exoskeletons for industrial and healthcare applications, driving market growth.

The in-built segment is anticipated to expand at a significant CAGR of 15.1% during the projected period. In-built human augmentation refers to the integration of advanced technologies directly into the human body, including implants and bioelectronic devices. Trends indicate a rising focus on neuroprosthetics, enhancing cognitive functions, and implantable medical devices. The market sees continuous innovation in bio-hacking technologies for improved health monitoring and performance enhancement.

Product Insights

The body worn segment held the largest market share of 58% in 2024. Body worn human augmentation involves devices directly worn or attached to the user's body. This includes exoskeletons, smart clothing, and wearable gadgets. The market trend indicates a surge in demand for lightweight and ergonomic designs, emphasizing user comfort. Advancements include enhanced sensor technologies for precise data capture and improved integration with augmented reality, making body-worn devices more versatile for various applications in healthcare, industrial settings, and everyday life.

The non-body worn segment is projected to grow at the fastest rate over the projected period. Non-body worn human augmentation refers to technologies that do not require direct attachment to the body. Examples include neuroprosthetics, brain-computer interfaces, and implantable devices. The market trends highlight a focus on miniaturization and improved biocompatibility, aiming for seamless integration with the human body. Advancements in non-body worn technologies prioritize user safety, efficiency, and the ability to address specific medical conditions, expanding applications in healthcare and cognitive enhancement.

Technology Insights

The wearable segment held the largest market share of 46% in 2024. Wearable technology in the human augmentation market refers to devices seamlessly integrated into daily life, enhancing human capabilities. These include smart glasses, fitness trackers, and health monitoring devices. Trends focus on miniaturization, improved biometric sensing, and extended functionalities, offering users real-time data for health and performance. The market sees a rising demand for wearables that seamlessly merge with lifestyle, promoting accessibility and continuous monitoring for personalized augmentation experiences.

The virtual reality segment is projected to grow at the fastest rate over the projected period. Virtual reality in the human augmentation market immerses users in computer-generated environments, amplifying experiences. VR trends emphasize enhanced realism, improved interaction, and applications in training and rehabilitation. The market explores VR's potential for cognitive augmentation, offering immersive solutions for mental health, education, and skill development. As VR technology advances, its integration into human augmentation continues to reshape industries, fostering innovation and transformative experiences.

End-user Insights

The consumer segment held the highest market share of 32% in 2024. The consumer end user segment in the human augmentation market encompasses the integration of augmented capabilities into everyday life. Trends include the incorporation of human augmentation features in wearables and smart devices, enhancing user experiences. This segment is witnessing a surge in demand as consumers increasingly seek technology-driven improvements in lifestyle, entertainment, and personal productivity.

The medical segment is anticipated to expand at the fastest rate over the projected period. The medical end user segment focuses on healthcare applications, with trends emphasizing innovations in prosthetics, exoskeletons, and neuroprosthetic devices. Human augmentation technologies in the medical field aim to enhance patient rehabilitation, mobility, and overall quality of life, reflecting a growing trend toward adopting advanced solutions for improved healthcare outcomes.

Human Augmentation Market Companies

- Ekso Bionics Holdings, Inc.

- ReWalk Robotics Ltd.

- Cyberdyne Inc.

- Touch Bionics Inc. (Össur)

- B-Temia Inc.

- Wandercraft

- Rex Bionics Ltd.

- Wearable Robotics SRL

- Hocoma AG (DIH Technologies)

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- Google LLC (Alphabet Inc.)

- Facebook Reality Labs (Meta Platforms, Inc.)

- Sony Corporation

- Microsoft Corporation

Recent Developments

- In December 2024, several prominent organizations, including H2L, Inc., NTT DOCOMO, Inc., TOPPAN Inc., Toyota Motor Corporation Frontier Research Center, Mizuno Corporation, and Mitsubishi Research Institute, Inc., joined the "Human Augmentation Consortium" on December 17, 2024. This collaboration aims to leverage human augmentation technologies that enhance sensory and motor capabilities through advanced network systems across various sectors, addressing critical societal challenges.

- In May 2024, German Bionic introduced its comprehensive 360° Human Augmentation Platform at VivaTech, held from May 22 to 25 in Paris. This integrated ecosystem combines the latest Apogee series e-exoskeletons with the German Bionic OS, the first proprietary operating system for exoskeletons, and the German Bionic IO data platform. Additionally, the platform showcased two innovative human-machine interfaces, making their public debut. Designed to improve health and productivity, this user-centered platform reflects German Bionic's dedication to delivering accessible, empowering, and easy-to-use technology solutions. Visitors could explore these advancements at Hall 1, Stand J40-003.

Latest Announcements by Industry Leaders

- August 2024 – National Science Foundation (NSF)

- Northwestern Vice President for Research – Eric Perreault

- Announcement - A multi-institutional collaboration led by Northwestern University has secured $26 million in funding from the National Science Foundation (NSF) to establish a groundbreaking Engineering Research Center (ERC) focused on enhancing robotic capabilities to augment human labor. Eric Perreault, Northwestern's vice president for research, described the NSF award as a historic achievement that builds on the university's renowned expertise in robotics and human-machine systems. The HAND initiative, described as bold and visionary, aims to drive transformative advancements in manufacturing, food processing, healthcare, and other sectors that require precise and dexterous manipulation. Ed Colgate, Kevin Lynch, and a team of distinguished industrial and academic partners have collaborated to ensure the research delivers practical and impactful solutions. This initiative is expected to leave a lasting, positive impact across diverse industries.

Segments Covered in the Report

By Type

- In-Built

- Wearable

By Product

- Body Worn

- Non-body Worn

By Technology

- Wearable

- Virtual Reality

- Augmented Reality

- Exoskeleton

- Intelligent Virtual Assistants

By End User

- Consumer

- Commercial

- Medical

- Defense

- Industrial

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting