HVAC Equipment Market Size and Forecast 2025 to 2034

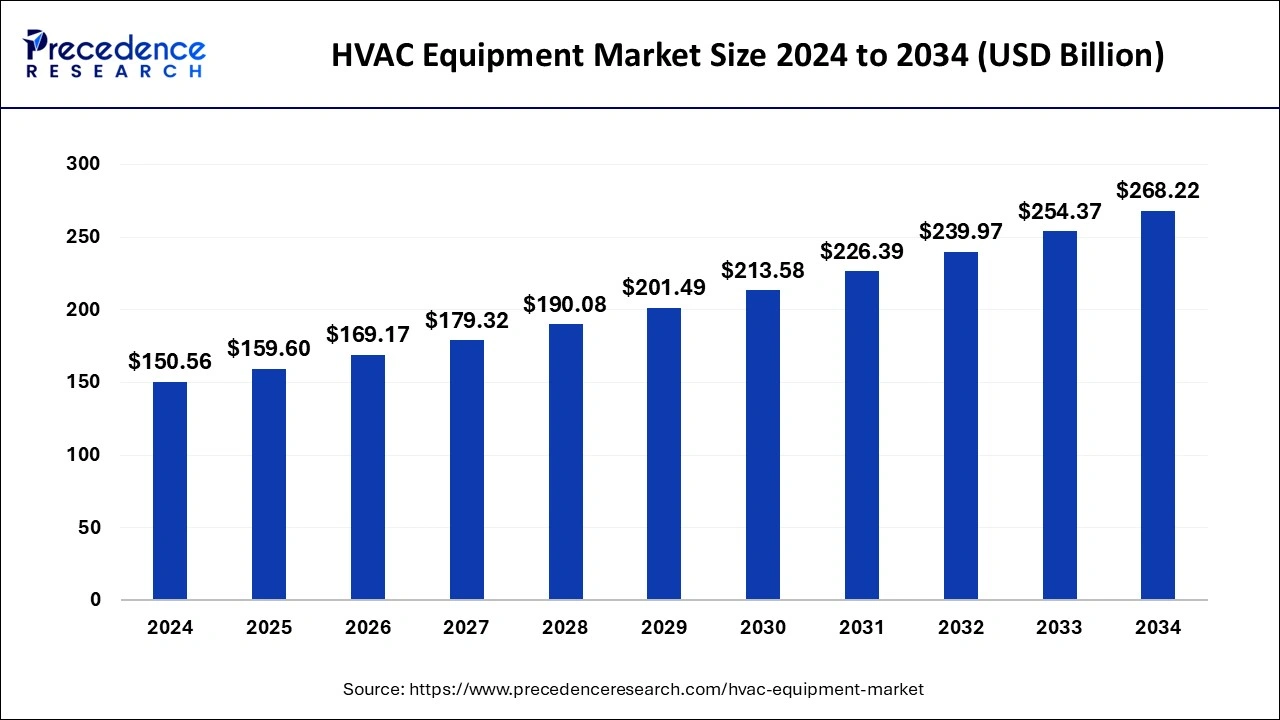

The global HVAC equipment market accounted for USD 150.56 billion in 2024 and is anticipated to reach around USD 268.22 billion by 2034, expanding at a CAGR of 5.94% from 2025 to 2034. The rising demand for the HVAC equipment market is due to the increasing need to maintain good indoor air quality through proper ventilation with filtration and provide thermal comfort.

HVAC Equipment Market Key Takeaway

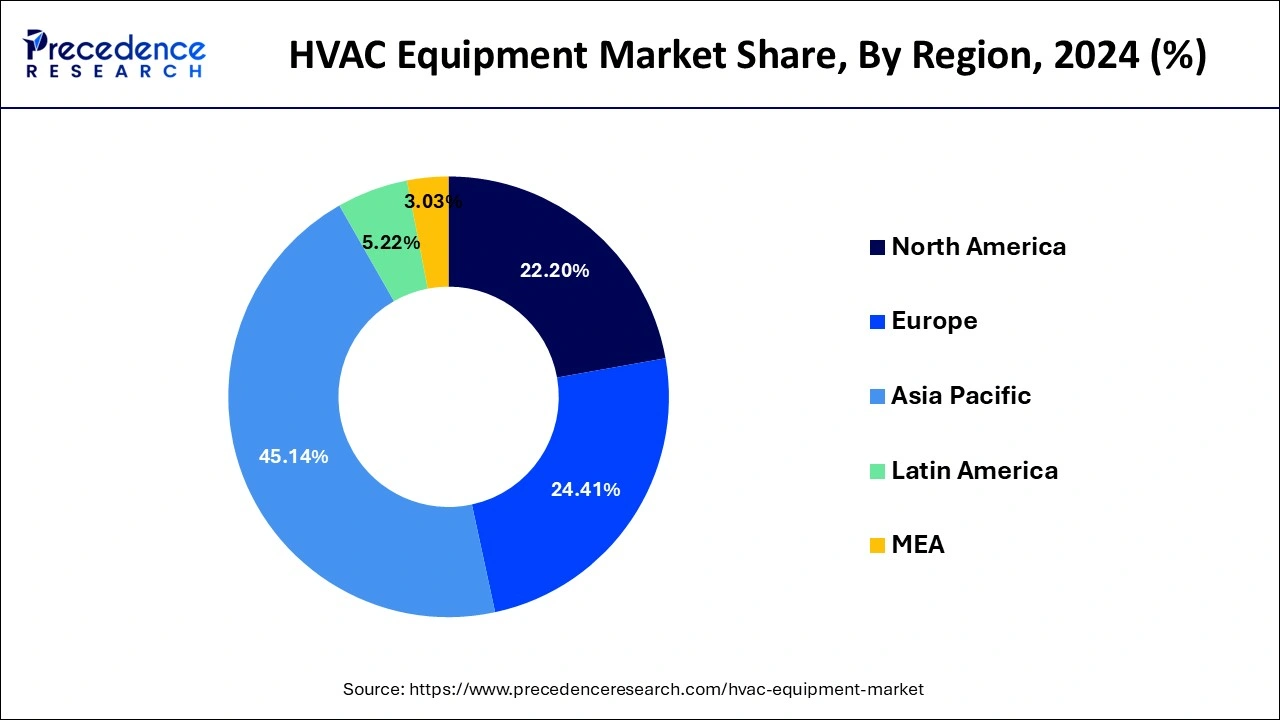

- Asia Pacific dominated the global market with the largest market share of 45.14% in 2024.

- North America is projected to expand at the fastest CAGR during the forecast period.

- By product, the cooling product segment contributed the highest market share in 2024.

- By end-use, the residential segment captured the biggest market share in 2024.

How is Artificial Intelligence (AI) Changing the HVAC Equipment Industry?

The integration of artificial intelligence in HVAC has the potential to benefit the industry by improving system efficiency. Ai utilizes real-time data to adjust the heating and cooling system automatically which results in reducing energy wastage and lowering utility bills. AI-powered tools are built in with a predictive maintenance feature which is commonly applied in Building Management systems (BMS) which detects the presence of any abnormalities or inefficiency in the system, and sends an alert before a minor issue becomes a major problem. Additionally, AI has the ability to analyse HVAC system data from various sensors and maintain the optimal indoor atmosphere, adjusting to temperature, humidity and airflow in real-time.

- In September 2024, Monaire, a Boston USA based company has developed HVAC systems with AI-powered solutions. This technology is embedded with algorithms and machine learning to thoroughly evaluated real-time data from wireless sensors installed on HVAC equipment to create an ideal performance.

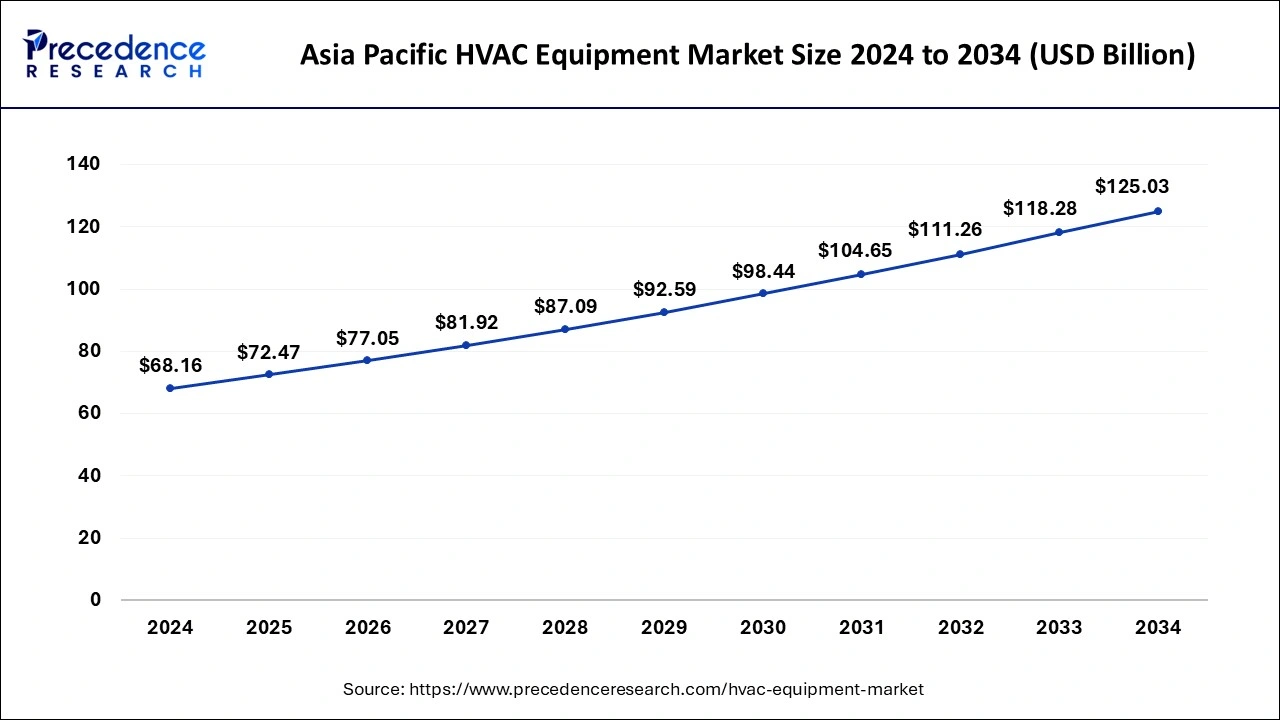

Asia Pacific HVAC Equipment Market Size and Growth 2025 to 2034

The Asia Pacific HVAC equipment market size was estimated at USD 68.16 billion in 2024 and is predicted to be worth around USD 125.03 billion by 2034, at a CAGR of 6.25% from 2025 to 2034.

The HVAC equipment market in China dominated the Asia Pacific region in 2024. The dominance of this country is due to the increasing consumer demand for energy-efficient, smart home technology which is extensively being adopted by homeowners. China has set ambitious climate goals, to reduce carbon emissions by incorporating HVAC systems. The primary driver of this market in China is the increasing building construction and strict regulation regarding energy efficiency. The Chinese HVAC equipments are generally affordable compared to the global market due to lower manufacturing costs and economies of scale.

North America contributed significantly amounting for the second-highest revenue share in 2024 and is expected to grow remarkably over the forecast period owing to the promotions by the Government in this region for the use of energy-efficient systems by providing subsidies and tax benefits. For instance, On 22nd September 2021, In North America, Carrier Corporation has introduced a new Toshiba Carrier touch screen controller for variable refrigerant flow (VRF) systems that can connect up to 128 indoor units to one simple interface. This controller enables building managers to access their complete VRF system from a single location, removing the need to monitor individual units. The European region is also estimated to grow significantly owing to the growing tourism sector and real estate industry in the region.

United States

The United States held a substantial HVAC equipment market share in 2024. The HVAC industry in the United States is currently facing a significant shortage of HVAC engineers and technicians. This shortage concerns the consumers and increases the demand for energy-efficient and sustainable HVAC solutions. According to a survey, in 2023, there were approximately 145,142 HVAC companies in the United States and 659,906 HVAC professionals employed in the HVAC industry.

HVAC Equipment Market Growth Factors

- Rising global climatic changes and increasing global warming are driving the need for efficient HVAC systems.

- Increased adoption of air purifying and cooling systems due to rising disposable incomes.

- Technological advancements in developing energy efficient and cost-effective air purifying equipments.

- Growing support from government bodies for developing energy efficient and sustainable HVAC equipments.

- Rising investments and fundings by various industries and organizations.

- Increasing demand for safe and potent HVAC systems in various settings as healthcare, pharmaceutical and equipment manufacturing industries.

- Integration of smart and AI-driven technologies in HVAC equipments improving the reliability, safety and accuracy.

Market Scope

| Report Coverage | Details |

| HVAC Equipment Market Size in 2025 | USD 159.6 Billion |

| HVAC Equipment Market Size by 2034 | USD 268.22 Billion |

| Growth Rate From 2024 to 2033 | CAGR 5.94% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, and By End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Global climatic changes leading to health risks

The global increase in greenhouse gas emissions and rising health concerns due to higher air quality indexes (AQIs) is creating the demand for efficient and clean air providing solutions such as advanced HVAC in both commercial and residential sectors. Furthermore, the rising disposable incomes are promoting the adoption of HVAC systems in various settings such as homes, offices and public places to maintain indoor air quality and safety.

Restraint

High installation and maintenance costs

Although HVAC systems prove to be a potent solution for rising air pollution levels, the installation and maintenance costs associated with HVAC equipments is restraining their market growth. Furthermore, the complex process for installation needing expert technicians and requirement of large spaces with time-to-time maintenance of these systems can pose challenges for the adoption of HVAC systems ultimately impacting the market stability.

Opportunity

Technological advancements in developing energy efficient HVAC systems

The rising government support, increasing investments and technological advancements in developing energy efficient solutions and sustainable equipments for HVAC systems is creating opportunities for market growth. Moreover, the increased focus on automation of systems across multiple industries serves a potential to boost the integration of advanced technologies in the industry.

Product Type Insights

The ventilation equipment segment dominated the market with the largest share in 2024. Advancements in HVAC ventilation equipment such as multi-stage filtration with enhanced air purification for improved air quality, energy-efficient smart ventilation systems and integration with automation systems in buildings are increasing their demand in the market. Furthermore, rapid urbanization, expansion of industrial areas, extreme weather events across the globe, rising pollution rates, growing awareness among the population about the importance of indoor air quality (IAQ) and the increased use of HEPA (High-EfficiencyParticulate Air) filters are the factors driving the market growth of this segment.

The cooling equipment segment is anticipated to witness lucrative growth over the forecast period. The market growth of this segment is driven by the surging global temperatures, variations in climate, increased construction activities, rising disposable incomes, favourable government policies and initiatives as well as integration of smart technologies such as Internet of Things (IoT) and motion-activated air conditioning.

Moreover, the utilization of variable refrigerant flow (VRF) systems offering precise temperature control and zoning capabilities, optimization of energy consumption with smart thermostats which automatically adjust temperature settings by learning user preferences, implementation of DeVAP (Desiccant Enhanced Evaporative) systems for absorbing humidity from cooled air and the use of bipolar ionization technology for neutralizing harmful contaminants from the air are the factors expected to fuel the growth of HVAC cooling equipment in the upcoming years.

System Type Insights

The centralized HVAC systems segment accounted for the largest market share in 2024. Centralized HVAC systems are focused on enhancing the energy conservation with smart technologies and deployment of sustainable practices such as implementation of demand-controlled ventilation (DCV) systems for optimizing supply of fresh air with minimal energy consumption, use of eco-friendly refrigerants like R-454B and R-32 for lowering global warming effects, integration of artificial intelligence algorithms for optimizing performance and predictive maintenance through machine learning and data analytics further extending the life span of the equipment which ultimately drives their demand across various industries around the globe.

The hybrid systems segment is expected to grow at the fastest rate during the forecast period. Hybrid HVAC systems focus on combining various energy sources or use of dual-fuel systems such as electricity, gas and renewable energy for optimizing their performance and energy efficiency while reducing carbon emissions making them a popular option. Implementation of innovative solutions like solar power integration offering an alternative approach to fossil fuels, combination of geothermal heat pumps with hybrid systems, ductless mini-split systems offering personalized comfort and quiet operation, on-demand hot water recirculator reducing wastage of energy and sensor-enhanced ventilation for improving indoor air quality are driving the adoption of hybrid systems.

Furthermore, increased use in commercial sectors like airports, malls, hotels and offices as well as in the residential sector with changing lifestyles and rising disposable incomes is fuelling the market growth of this segment.

Service Type Insights

The installation segment held the largest market share in 2024. The rising demand for HVAC systems for various applications across several sectors, growth in construction activities, increased emphasis on energy efficiency and comfort, government initiatives like LEED (Leadership in Energy and Environmental Design) certification for promoting sustainability and development of green buildings are the factors driving the growth of installation segment. Moreover, increased focus on systems with high Seasonal Energy Efficiency Ratio (SEER) and Heating Season Performance Factor (HSPF) ratings, increased, availability of renewable energy options, integration of UV-C lights for killing bacteria and viruses in the air as well as development of advanced ventilation systems is significantly boosting installation rates of HVAC systems creating a demand for HVAC equipment.

The upgrades & replacements segment is predicted to grow at the fastest rate in the predicted timeframe. The market growth of this segment can be linked to the rising demand for energy saving systems, growing awareness on improving indoor air quality among the population, ongoing technological advancements in HVAC equipment, increasing disposable incomes, rapid urbanization and industrialization initiatives by emerging economies, and the need for modernizing existing infrastructure with aging HVAC systems for meeting the current regulations and standards.

Additionally, high-quality services and offer incentives like discounts and financing options among others by manufacturers and service providers is fostering upgrades and replacements leading to strong customer relationships. For instance, in March 2025, American Residential Services (ARS/ Rescue Rooter), the largest provider of air conditioning, plumbing heating and electrical services in U.S. announced a strategic alliance with Bluon, a leading HVAC data and AI technology company for transforming HVAC service by leveraging OCR (Optical Character Recognition) technology, equipment documentation and AI-powered technical support.

Application Insights

The commercial segment held a dominant presence in the market in 2024. HVAC systems are a growing necessity in commercial spaces such as malls, retailers, office buildings, schools, storage facilities as well as manufacturing and distribution companies to promote customer satisfaction and employee well-being. Regulating the internal building environment not only contributes to overall productivity but also helps prevent damage to building materials and its structural integrity by controlling humidity. The rising demand for data centers due to significant growth in cloud computing and artificial intelligence applications is also driving demand in the segment. Data centers require large amounts of cooling to keep the servers running smoothly, making HVAC systems indispensable.

The industrial segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Due to rising global temperatures, the adoption of industrial HVAC systems is increasing drastically, allowing manufacturers to maintain the right environment for production processes. This is crucial in maintaining product quality and consistency. A lack of proper HVAC systems can also lead to safety hazards, especially in industries such as chemical, pharmaceutical, and food & beverage manufacturing, where maintaining certain environmental conditions is essential for ensuring product integrity. HVAC systems are also important in high-temperature manufacturing settings for metals, semiconductors and other similar industries where worker and machine safety would otherwise be compromised.

Distribution Channel Insights

The direct sales (OEMs & manufacturers) segment held the largest market share in 2024. OEM (Original Equipment Manufacturer) sales channel are boosting the sales of HVAC equipment by tailoring HVAC systems to specific demand of several commercial buildings and need of clients ensuring dependability and optimal performance. Increased accessibility of manufacturers to specialized components and advanced technologies enables delivery of cutting-edge and energy efficient solutions. Moreover, use of software solutions like CPQ (Configure, Price, Quote) software for streamlining sales cycle with reduced errors, Field Service Management (FSM) Software integrated with Customer Relationship Management (CRM) systems ensuring customer satisfaction, online project management tools like Google Suites and Trello as well as mobile applications are assisting in improving customer experience with enhanced operational productivity.

The HVAC contractors & system integrators segment is anticipated to grow rapidly during the forecast period. HVAC contractors are responsible for installing and maintaining HVAC systems and also provide expert repair and maintenance services further ensuring the optimal performance and system operation with efficiency and longevity. System integrators specialize in integrating and coordinating different HVAC components and technologies such as in smart building automation systems which includes HVAC controls, creating extensive and structured climate control solutions.

Increased for expert personnel trained on smart systems and novel technologies, use of Virtual Reality and Augmented Reality (VR/AR) for training and maintenance purposes by service providers and manufacturers, development of new service models creating opportunities for remote monitoring and utilization of Software as a Service (SaaS) by manufacturers for managing HVAC systems are the factors driving the market growth of this segment.

HVAC Equipment Market: Trends, Investments and Initiatives

- In January 2025, Carrier Global Corporation, a global leader in intelligent climate and energy solutions announced to donate about $2.5 million in indoor air purifiers for improving air quality for the communities affected by the recently ongoing and historic wildfires in Los Angeles and surrounding areas.

- In January 2025, at the Consumer Electronics Show 2025, Panasonic launched their novel energy efficient approach for HVAC which uses less energy than the conventional technologies called as OASYS, a home comforting sustainable technology for modern, high-performance homes.

HVAC Equipment Market Companies

- Carrier Corporation

- Daikin Industries Ltd.

- Ingersoll Rand

- Johnson Controls

- Trane Technologies

- LG Electronics

- Hitachi Ltd.

- United Technologies,

- Electrolux, Emerson Electric Co.

- Honeywell International Inc

- Lennox International Inc.

- Mitsubishi Electric

Latest Announcements by Industry Leaders

- In June 2024, Mead Rusert, Carrier's vice president for building technologies, and commercial HVAC said, “With contracts that cover heating and cooling performance, energy usage, sustainability, and infrastructure, customers can count on Carrier's expertise to provide optimized building system performance and support to meet the needs of your business.”

Recent Developments

- In July 2024, Air Scientist Solutions Inc., a company specialising in indoor air quality, Heating, Ventilation, and Air Conditioning (HVAC) solutions, unveiled a Wi-Fi Smart Air Unit retrofit which is embedded with technology that provides energy savings, optimizes installation, and improved comfort and safety for residential and commercial spaces across the United States.

Segments Covered in the Report

By Product Type

- Heating Equipment

- Furnaces

- Gas

- Electric

- Oil

- Heat Pumps

- Air Source

- Ground Source

- Hybrid

- Boilers

- Unit Heaters

- Other (Infrared Radiant Heaters, etc.)

- Furnaces

- Ventilation Equipment

- Air Handling Units (AHU)

- Energy Recovery Ventilators (ERV) & Heat Recovery Ventilators (HRV)

- Ventilation Fans

- Variable Air Volume (VAV) & Constant Air Volume (CAV) Systems

- Fan Wall Unit (FWU)

- BMS

- Others (Ducts & Dampers, etc.)

- Cooling Equipment

- Air Conditioners

- Split

- Window

- Packaged

- Ductless

- Rooftop

- Chillers

- Air Cooled

- Water Cooled

- Cooling Towers

- Open-Circuit

- Closed-Circuit

- Hybrid

- CRAC (Computer Room Air Conditioning)

- CRAH (Computer Room Air Handler)

- In-Row Cooling

- CDU (Coolant Distribution Unit)

- D2C (Direct-to-Chip Cooling)

- Rear Door Heat Exchanger (RDHX)

- Fan Coil Unit (FCU)

- Chilled Beam

- Others (Immersion Cooling, etc.)

- Air Conditioners

By System Type

- Centralized HVAC Systems

- Decentralized HVAC Systems

- Hybrid Systems

By Service Type

- Installation

- Maintenance & Repair

- Upgrades & Replacements

- Consulting & Engineering Services

By Application

- Residential

- Apartments

- Villas

- Condominiums

- Commercial

- Retail Stores

- Shopping Malls

- Hotels

- Hospitals

- Data Centers

- Others (Educational Institutes, etc.)

- Industrial

- Manufacturing Plants

- Food Processing & Cold Storage

- Clean Rooms & Controlled Environments

By Distribution Channel

- Direct Sales (OEMs & Manufacturers)

- Wholesalers & Distributors

- Retail Sales

- HVAC Contractors & System Integrators

By Geography

- North America

- Europe

- Asia Pacific

- LAMEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting