Inboard Engines Market Size and Forecast 2025 to 2034

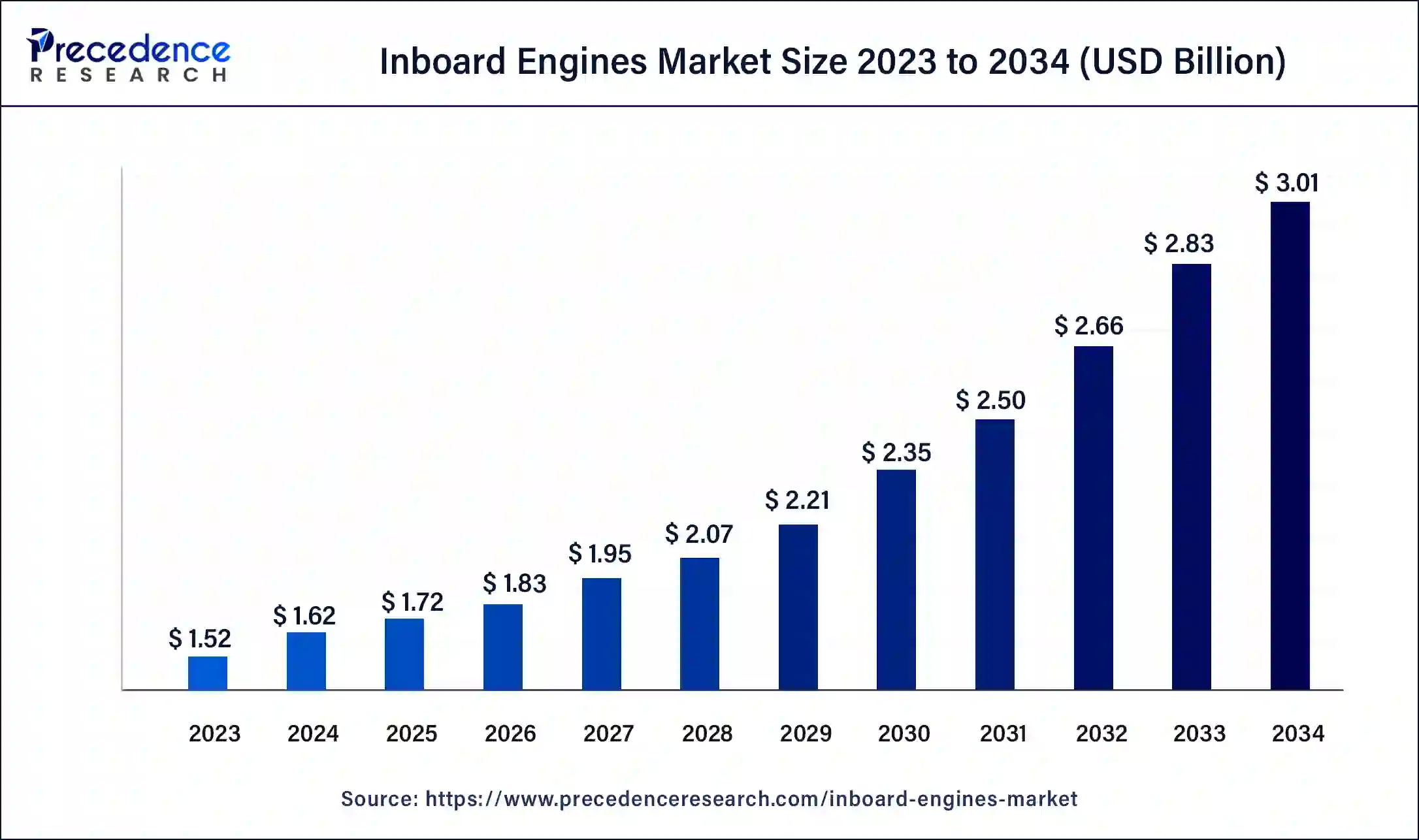

The global inboard engines market size is projected to be worth around USD 3.01 billion by 2034 from USD 1.62 billion in 2024, at a CAGR of 6.39% from 2025 to 2034. Increasing demand due to technological developments, increasing environmental regulations, economic growth, and growing recreational boating are the key drivers of the inboard engines market.

Inboard Engines Market Key Takeaways

- Asia Pacific led the global inboard engines market with the largest market share in 2024.

- North America is anticipated to grow notably in the market during the forecast period.

- By product type, the diesel segment accounted for the biggest share of the market in 2024.

- By product type, the gasoline segment is expected to witness significant growth in the market during the forecast period.

- By power, the medium segment is expected to grow significantly in the market during the forecast period.

- By ignition, the electric segment holds the largest share of the market in 2024.

- By engine, the IC engine segment dominated the global market in 2024.

- By application, the recreational boats segment generated more than 67% of market share in 2024.

- By application, the commercial boats segment is set to show notable growth in the market during the forecast period.

Market Overview

Inboard engines are internal engines mounted in the center of the boat. In general, inboard engines are four-stroke engines similar to automobile engines. Inboards are preferred when it comes to sailboats, motorboats, commercial boat workboats, and marine boats for tours since they are usually of higher displacement and offer a broader power range. Inboard engines are very popular with boaters who enjoy water sports. It must be said that they give great wake for water skiing and wakeboarding.

How is AI Changing the Inboard Engines Market?

The use of artificial intelligence (AI) is making significant advancements in the inboard engines market. The ship engine is a crucial and intricate part of a ship's engineering system, integrated into various systems and auxiliary subsystems. AI has the capability to predict when ships and equipment will require maintenance, which can reduce downtime and cut costs. By analyzing sensor data from ship engines, AI can detect patterns that indicate when maintenance is necessary, enabling proactive repairs that prevent unexpected breakdowns.

Traditional maintenance methods have led to longer turnaround times for repairing or replacing engine components and restoring normal operations. An AI-based condition monitoring system can continuously monitor engine health and help estimate maintenance timing, ultimately reducing maintenance costs and enhancing ship safety.

Inboard Engines Market Growth Factors

- Technological advancements in the inboard engine, like efficiency, reduced emission, and better performance, enable the markets to meet customer needs, hence the growth in the inboard engines market.

- More developed maritime facilities and an enlarged commercial boating market, including recreational and industrial ones, lead to a higher demand for inboard engines.

- An increase in activities in commercial marine vessels, particularly in fishing and carrying of cargo.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.01 Billion |

| Market Size in 2025 | USD 1.52 Billion |

| Market Size in 2024 | USD 1.62 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.42% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Power, Ignition, Engine, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increasing trend towards recreational water sport activities

Increasing demand for recreational water sports activities is expected to drive growth in the inboard engines market. Some water recreational activities include Jet skiing, rowing, rafting, kayaking, canoeing, sailing, power boating, yachting, boat racing, and many more. Recreation boating facilities are being developed all over the world due to increased concern about water sports and the fact that more people are using water sports.

- According to the Observatory of Economic Complexity (OEC) World, in 2022, Recreational Boats were the world's 255th most traded product, with a total trade of USD 16.7 billion. Trade in Recreational Boats represents 0.07% of total world trade.

Restraint

Environmental issues & rising legal requirements

People spend increasing amounts of time and effort studying the issue of environmental pollution, and the demands on the ecological environment are rising. This affects the dynamics of the inboard engines market. The demands for controlling the harmful gas emissions of engines are growing higher and higher, and each country has set a set of measures for emission control of transportation tools, and emissions standards are becoming higher and higher.

As for the advancement of the shipping business, the emissions of exhaust power on ships have been very detrimental to the quality of the atmosphere for a long time. A medium-speed, high-power diesel engine operates 4000 hours yearly, and it emits approximately 1500 tonnes of NOx. People around the globe have paid much attention to the emission of marine engine exhaust gas, and the dangers of marine diesel engine exhaust emissions to the atmosphere have been considered serious by most government bodies in different countries.

International Maritime Organisation (IMO) is one of the affiliated firms of the United Nations which has been established to enhance maritime safety.

Opportunity

Marine tourism

The maritime tourism market is expected to expand due to the increasing government support for the tourism industry. An increase in the number of travelers and tourists, favorable legislation performing a push factor for leisure travels, and increased investment in tourism coupled with growth in infrastructure development can promote the inboard engines market. Social media appeal by Gen-Z and millennials is supplementing leisure travel since the market has expanded its penetrations. However, knowledge and understanding of the culture of the other destinations continue to play a significant role while selecting the destination.

- In April 2022, the Vacation rental platform Vacasa surveyed consumers on future travel intentions, 38% of travelers plan to book a vacation rental in summer, up from 32% in the summer of 2022 with 76% choosing a vacation rental for private and recreational amenities.

Product Type Insights

The diesel segment accounted for the biggest share of the inboard engines market in 2024. This is because diesel engines provide better power, torque, acceleration, towing, and also hauling capacity than gasoline engines. In a diesel engine, the air is compressed at a faster rate to deliver higher power for doing work. They also tend to have higher durability and may also last longer than gas engines. Furthermore, diesel fuel can be easily acquired at most marinas and ports, hence providing convenience for boat owners and operators alike. They are also preferred in marine applications since they are more reliable and durable and thus do not need frequent replacements within their life cycle.

The gasoline segment is expected to witness significant growth in the inboard engines market during the forecast period. Gasomatic engines are relatively cheaper than diesel ones, and they emit less. These are also more flexible, efficient in terms of refueling, and less noisy and vibrative than those of diesel power. The use of gasoline engines easily starts in cold weather because these fuels are more volatile as compared to diesel.

Power Insights

The medium segment is expected to grow significantly in the inboard engines market during the forecast period. Medium-speed engines operate at speeds that lie between 300 and 900 rpm. It is most common in small boats and power stations driving electrical generators. Medium-speed engines are the most common type of engine. These high revolutions, for instance, buses, yachts, and other powerful means of transport require such high revolutions.

Ignition Insights

The electric segment holds the largest share of the inboard engines market in 2024. The electric inboard boat motors are ideal for new boats and e.g., retrofitting of existing boats. The electric sailboat motors remain center stage and the most popular products in the seaborne market. These motors run very quietly, which enriches the sailing experience.

- In November 2023, Evoy released a new electric inboard engine.

Engine Insights

The IC engine segment dominated the global inboard engines market in 2024. An I.C. engine, also known as a combustion engine, is defined as an internal combustion heat engine that makes use of energy in the fuels, such as gasoline, through the process of combustion to generate mechanical energy. It is widely employed in automobiles, power generators, and numerous other similar industrial uses. IC engines vary from one another by their kind, for example, gasoline or diesel engines, which occur due to differences in combustion methods employed in them.

Application Insights

The recreational boats segment dominated the inboard engines market in 2024. Recreational boat means any vessel manufactured or used for recreational and not commercial purposes or a vessel that is being leased, rented, or chartered to another for recreational and not commercial purposes. Boating is a recreational activity whereby an individual travels or has an enjoyable time using a boat, power boat, sailing boat, rowing boat, or paddling boat. The factors that have led to the growth of this market include rising tourism, economic development, demands for boating, development of boat engines, and increased disposable income. Also, rising water sports events and rising import of boats in emerging regional markets.

- In December 2023, Blue Innovations Group's first electric recreational boat.

The commercial boats segment is set to show notable growth in the inboard engines market during the forecast period. The growth in international trade and sea transportation is creating more opportunities in the market for commercial ships, which necessarily incorporate inboard engines. Innovations in engine technologies, such as better fuel economy and less pollution, are making these engines more suitable for commercial applications. The general capacity and reliability of the inboard engine also play a part in the applicability of inboard systems to the commercial business. With the increase in sectors like tourism, fisheries, cargo transport, etc., the demand for improved models of inboard engines in commercial boats is believed to increase greatly.

Regional Insights

Asia Pacific led the global inboard engines market in 2024. The revolution of various countries such as China, India, and Japan, with fast and growing industrialization and economic growth, increased the demand for inboard engines. Further, the commercial and recreational boating industry in the region is experiencing growth, and massive investment in the maritime industry is increasing the demand for energy-effective and highly-performing inboard propulsion.

North America is anticipated to grow notably in the inboard engines market during the forecast period. The developed maritime structures and strong markets for commercial boating, including fishing, cargo transport, and commercial leisure boating, in turn, affect the demand for inboard engines.

The North American inboard engines market is characterized by relatively higher levels of technological advancement and high requirements of engine performance and efficiency. North America is one of the major drivers of the inboard engine industry due to the technological development, favorable regulations, and high demand in this region.

Inboard Engines Market Companies

- Caterpillar Inc.

- Crusader Engine

- Cummins Inc.

- Ilmor Engineering, Inc.

- Indmar Marine Engine

- MAN Energy Solutions

- Mercury Marine

- MTU Friedrichshafen GmbH

- Nanni Industries

- PCM (Pleasurecraft Marine Engine Co.

- Scania AB

- Suzuki Motor Corporation

- Volvo Penta

- Yamaha Motor Co., Ltd.

- Yanmar Co., Ltd.

Recent Developments

- In November 2022, Correct Craft, an electric boat manufacturing company from the U.S., completed the purchase of an Indmar Marine engine for an undisclosed amount.

- In February 2023, Volvo Penta teamed up with Maine's Southport Boats to release a new version of the Southport 30 FE with Volvo Penta's pleasure landing system. This is an automatic drivetrain that focuses on versatility to meet the flow needs of everyone on board.

- In August 2022, Cummins Inc. the acquisition of Meritor, which accelerated the development of energy-efficient solutions. Meritor also provides synergies with our core businesses by expanding our product offerings, sales and service networks, and customer relationships.

Segments Covered in the Report

By Product Type

- Diesel

- Gasoline

- Electric

- Others

By Power

- Low

- Medium

- High

By Ignition

- Electric

- Manual

By Engine

- IC engine

- Two-stroke

- Four-stroke

- Electric Engine

By Application

- Recreational Boats

- Commercial Boats

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting