What is the Aerospace Parts Manufacturing Market Size?

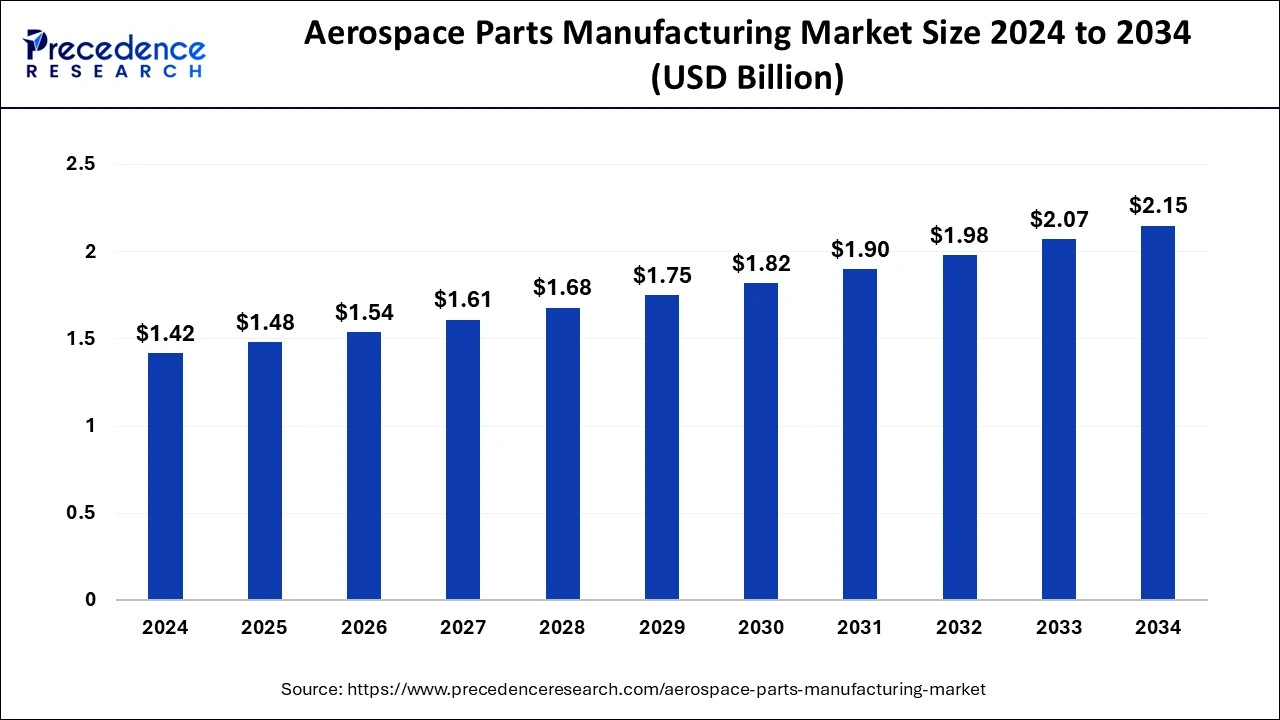

The global aerospace parts manufacturing market size is estimated at USD 1.48 billion in 2025 and is predicted to increase from USD 1.54 billion in 2026 to approximately USD 2.15 billion by 2034, expanding at a CAGR of 4.24% from 2025 to 2034.

Aerospace Parts Manufacturing MarketKey Takeaways

- In terms of revenue, the global aerospace parts manufacturing market was valued at USD 1.42 billion in 2024.

- It is projected to reach USD 2.15 billion by 2034.

- The market is expected to grow at a CAGR of 4.24% from 2025 to 2034.

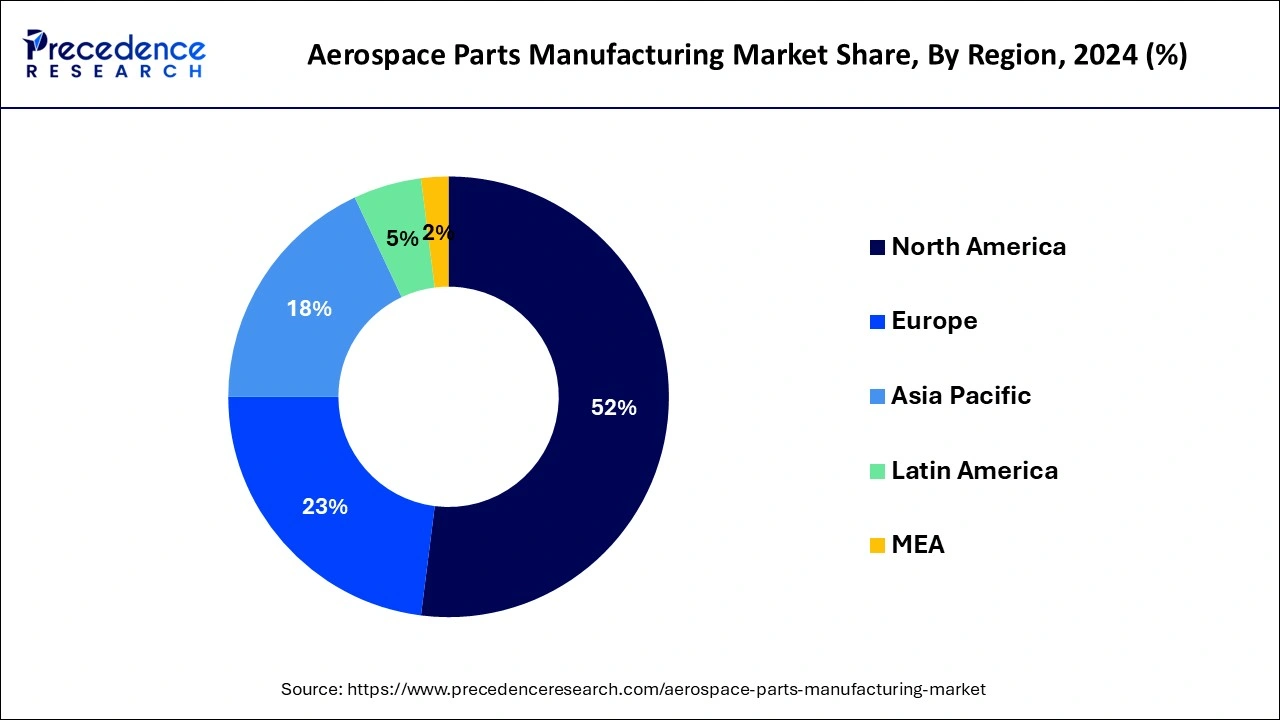

- North America dominated the aerospace parts manufacturing market with the largest market share of 52% in 2024.

- Asia-Pacific is estimated to expand at the fastest CAGR between 2025 and 2034.

- By product, the aircraft manufacturing segment held the largest market share of 52% in 2024.

- By product, the avionics segment is anticipated to grow at a remarkable CAGR during the forecast period.

- By end-use, the commercial segment generated the largest share of 51% in 2024.

- By end-use, the business segment is expected to expand at the fastest CAGR over the projected period.

Aerospace Parts Manufacturing Market Overview: Exploring the Market Trends

The aerospace parts manufacturing market involves the production of components and equipment for aircraft and spacecraft. This complex process encompasses designing, fabricating, and assembling various parts that make up the structure and systems of airplanes, helicopters, and spacecraft. From engine components to navigation systems, aerospace manufacturers play a crucial role in ensuring the safety and functionality of aerospace vehicles. These manufacturers employ advanced technologies and materials to meet stringent industry standards. Precision and quality are paramount in aerospace parts manufacturing, as even the smallest component must adhere to strict specifications to guarantee the reliability and efficiency of the overall aerospace system. The industry is characterized by innovation, with continuous advancements in materials and manufacturing techniques driving progress in aviation and space exploration.

Aerospace Parts Manufacturing Market Data and Statistics

- According to the International Air Transport Association (IATA), global air passenger numbers are expected to double by 2037.

- Global military spending reached a record high in recent years, with several countries investing in modernizing their defense capabilities.

- In April 2021, Jamco Corporation, in partnership with ANA, introduced the aviation industry's inaugural hands-free lavatory doors on aircraft, unveiling the groundbreaking project known as Blue Sky Vol.5.

- In December 2021, Intrex Aerospace forged a strategic alliance with Eaton and UTC Aerospace, unveiling a novel business approach aimed at strengthening their presence and influence in the aerospace parts market.

Aerospace Parts Manufacturing MarketGrowth Factors

- The aerospace parts manufacturing market is driven by the growing demand for commercial aircraft. As global air travel continues to rise, manufacturers experience heightened demand for components and systems to build new airplanes, contributing to the industry's growth.

- Advances in aerospace technologies, materials, and manufacturing processes propel market growth. Continuous innovation leads to the development of lighter, more durable, and efficient components, meeting the evolving needs of the aviation and aerospace sectors.

- The expanding interest and investments in space exploration drive growth in aerospace parts manufacturing. Components for satellites, rockets, and space exploration vehicles are in demand as both government agencies and private companies focus on exploring outer space.

- Aerospace manufacturers increasingly engage in global supply chain networks. This integration optimizes costs, enhances efficiency, and allows companies to leverage expertise and resources from different regions, fostering market expansion.

- The aerospace parts manufacturing market benefits from increased defense spending globally. Governments invest in military aircraft and related systems, stimulating demand for specialized components, such as avionics and defense systems.

- Stringent environmental regulations push the aerospace industry to develop more fuel-efficient and environmentally friendly aircraft. This focus on sustainability leads to the manufacturing of advanced components that contribute to reduced fuel consumption and lower carbon emissions, aligning with industry and regulatory trends.

Aerospace Parts Manufacturing Market Outlook: Forecasting the Innovations

- Industry Growth Overview: Increasing passengers and cargo traffic, adoption of advanced technologies, and modernization of commercial and military fleets are responsible for industry growth.

- Major Investors: Large institutional asset managers and specialized private equity firms are the major investors in the market.

- Startup Ecosystem: Startup ecosystems are utilizing advanced technologies to enhance efficiency, operational agility, and minimize costs.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.48 Billion |

| Market Size in 2026 | USD 1.54 Billion |

| Market Size by 2034 | USD 2.15 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.24% |

| Dominated Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Noise-induced hearing loss (NIHL)

- According to the International Air Transport Association (IATA), the global air travel demand is projected to double by 2037, creating a substantial need for new aircraft and replacement parts.

The surge in global air travel significantly boosts the demand for aerospace parts manufacturing. As more people choose air transportation, airlines around the world seek to expand their fleets to meet the rising passenger numbers. This increased demand for new aircraft creates a domino effect on the aerospace parts market, as manufacturers must produce a wide range of components to build and maintain these airplanes. Airlines require various parts, from engines to avionics and structural components, to ensure the safety and efficiency of their fleets. This heightened demand not only benefits established aerospace companies but also encourages innovation and competition within the industry. The growth in global air travel acts as a catalyst, driving the production of advanced, reliable, and fuel-efficient aerospace parts to meet the evolving needs of the aviation sector and contribute to the overall expansion of the aerospace parts manufacturing market.

Restraint

Cyclical nature of the industry

The cyclical nature of the aerospace industry introduces challenges for the aerospace parts manufacturing market, influencing market demand. This cyclicality is closely linked to economic conditions and impacts the overall health of the aviation sector. During economic downturns or crises, airlines may experience financial constraints, leading to deferred or canceled orders for new aircraft and associated components. The result is a fluctuating demand for aerospace parts, affecting manufacturers' production levels and revenue streams. The industry's reliance on a stable economy underscores the vulnerability of aerospace parts manufacturing to economic downturns. Consequently, companies in this market need to implement robust strategies for navigating through economic cycles, including diversification, cost management, and flexibility in production capacity to withstand the impact of fluctuations in demand and ensure long-term sustainability.

Opportunity

Rising demand for lightweight materials

The surging demand for lightweight materials in the aerospace industry presents significant opportunities for aerospace parts manufacturing. As airlines and aircraft manufacturers increasingly prioritize fuel efficiency and environmental sustainability, there is a growing need for advanced lightweight materials. This trend creates a distinct market opportunity for aerospace parts manufacturers to innovate and develop cutting-edge components using materials such as advanced composites and alloys. These lightweight materials not only contribute to fuel savings but also enhance overall aircraft performance, leading to increased demand for components that meet the industry's evolving standards.

Manufacturers can capitalize on this opportunity by investing in research and development to create materials that are not only lightweight but also durable and cost-effective. Companies that can successfully integrate these materials into their aerospace components stand to gain a competitive edge in the aerospace parts manufacturing market, as airlines seek to modernize their fleets with more fuel-efficient and environmentally friendly aircraft. As the industry continues to prioritize weight reduction, aerospace parts manufacturers have the chance to play a pivotal role in shaping the future of aviation through the production of advanced lightweight components.

Product Insights

The aircraft manufacturing segment held the highest market share based on the product in 2024. The aircraft manufacturing segment in the aerospace parts manufacturing market involves the production of entire aircraft, encompassing airframes, wings, engines, and other integral components. A significant trend in this segment is the increasing adoption of advanced materials like composites for constructing aircraft structures, aiming to reduce weight and enhance fuel efficiency. As the aviation industry emphasizes modernization and sustainability, aircraft manufacturers seek innovative solutions within this segment, driving the evolution of materials and manufacturing processes for more efficient and environmentally friendly air travel.

The avionics segment is anticipated to witness rapid growth at a significant CAGR during the projected period. Avionics is a critical segment in aerospace parts manufacturing that encompasses electronic systems used in aircraft for communication, navigation, monitoring, and control. Avionics components include instruments, displays, radar systems, and communication equipment. A significant trend in the aerospace industry is the rapid advancement of avionics technology. Manufacturers are developing more sophisticated and integrated avionics systems, incorporating features like digital communication, automation, and enhanced navigation capabilities. This trend responds to the industry's demand for safer, more efficient, and technologically advanced aircraft, driving innovation in avionics products.

End-use Insights

According to the end-use, the commercial segment held the largest share in the aerospace parts manufacturing market in 2024. The commercial segment in aerospace parts manufacturing refers to the production of components specifically designed for commercial aircraft. This includes manufacturing parts for passenger planes, cargo planes, and other aircraft used in commercial air travel. In recent trends, the commercial aerospace segment has witnessed a surge in demand for lightweight materials, fuel-efficient components, and advanced avionics. Airlines and aircraft manufacturers are increasingly focusing on upgrading and modernizing their fleets, driving the need for innovative and technologically advanced aerospace parts tailored to commercial aviation requirements.

The business segment is anticipated to witness rapid growth over the projected period. The business segment in aerospace parts manufacturing refers to the various end-use categories for the components produced. This includes commercial aviation, defense, and space exploration. In recent trends, the commercial aviation segment has seen substantial growth due to increased air travel demand. The defense sector remains a crucial end-use, driven by military modernization initiatives globally. Additionally, the rising interest in space exploration has opened new opportunities, with companies contributing components for satellite launches and other space-related applications, diversifying the aerospace parts manufacturing market.

Regional Insights

U.S.Aerospace Parts Manufacturing Market Size and Growth 2025 To 2034

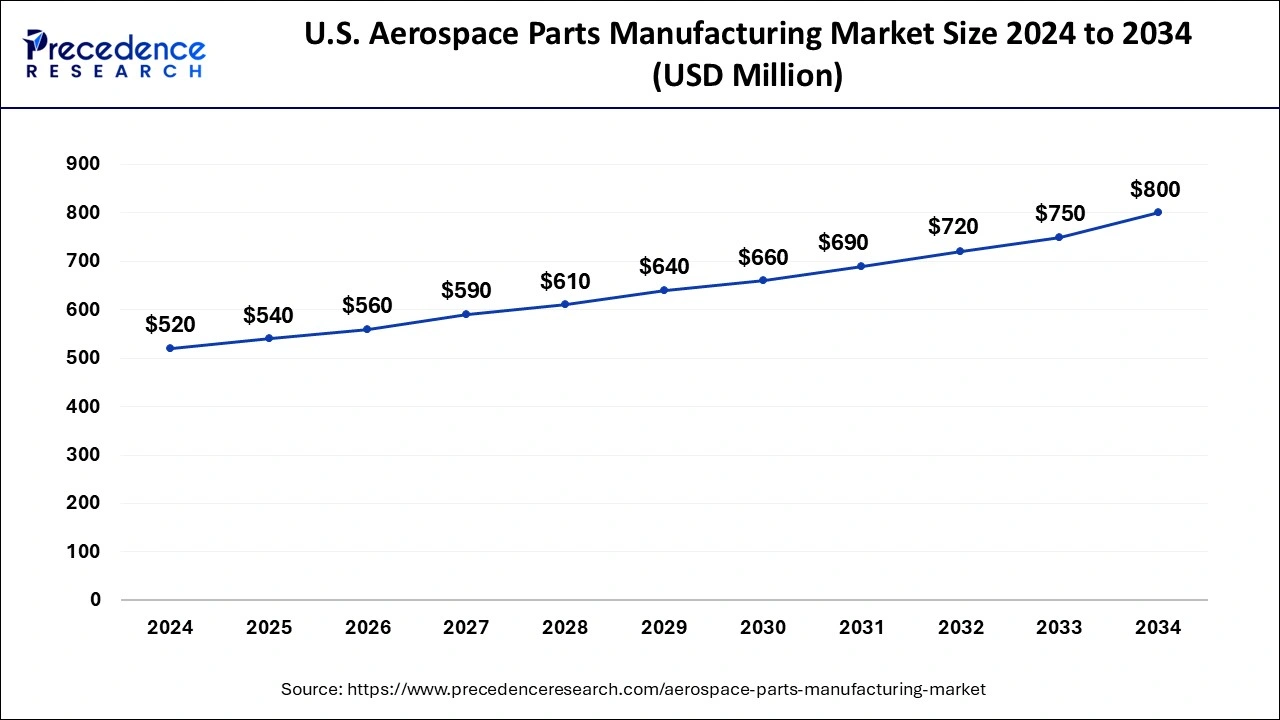

The U.S. aerospace parts manufacturing market size is valued at USD 540 million in 2025 and is projected to reach USD 800 million by 2034 with a CAGR of 4.40% from 2025 to 2034.

Robust Aviation Industry Drives North America

North America led the market with the biggest market share of 52% in 2024 due to a robust aviation industry, comprising leading companies like Boeing and Lockheed Martin. The region benefits from substantial defense spending, driving demand for military aircraft components. Additionally, advanced technology adoption and a strong focus on research and development contribute to North America's dominance. The presence of key aerospace manufacturers, strategic collaborations, and a well-established supply chain further solidify the region's position as a major contributor to the global aerospace parts manufacturing market.

The well-established aerospace industry and well-developed supply chains for aerospace parts help in the market growth. The strong investment in aerospace research & development and advancements in manufacturing processes, materials science, and propulsion systems drive the market growth. The highly skilled workforce for aerospace parts manufacturing and the availability of advanced manufacturing technologies like Internet of Things, automation, and AI increase demand for aerospace parts manufacturing. The growing demand for aerospace parts for space exploration, commercial aviation, and defense helps in the market growth. The key exporter of aerospace parts and a favorable regulatory environment drive market growth. The presence of major manufacturers like United Technologies, Boeing, and Lockheed Martin contributes to the overall market growth.

The Expanding Aviation Industry Boosts the Asia Pacific

Asia-Pacific is poised for rapid growth in the aerospace parts manufacturing market due to the expanding aviation industry, rising air travel demand, and increasing defense spending. Countries like China and India are investing significantly in aerospace infrastructure and technology. As global aircraft production shifts towards Asia-Pacific, the region becomes a key hub for manufacturing components. Moreover, the growing interest in space exploration and satellite launches further contributes to the region's prominence in the aerospace sector, fostering economic development and technological advancements.

China aerospace parts manufacturing market trends

The government initiatives, like Made in China 2025, aiming to build advanced manufacturing capabilities and strong investment in local production and infrastructure, help the market growth. The growing air travel demand and increasing demand for defense & commercial aircraft increases demand for aerospace parts manufacturing. The robust manufacturing facilities and lower labor costs drive the market growth. The strategic partnerships with international aerospace companies and foreign investments increase demand for aerospace parts manufacturing. The growing technological advancements in aircraft technologies and diversified supply chains drive the overall growth of the market.

India aerospace parts manufacturing market trends

India is significantly growing in the aerospace parts manufacturing market. The growing civil aviation and rising emphasis in the defense sector increase demand for aerospace parts manufacturing. The low labor cost, low production cost, and availability of a skilled workforce help in the market growth. The growing focus on domestic manufacturing and government support to improve manufacturing hubs drives the overall market growth.

Europe Driven by Established Aerospace Companies

Meanwhile, Europe is experiencing notable growth in the aerospace parts manufacturing market due to several factors. The region boasts established aerospace companies, leading in technological innovation and production efficiency. Increasing demand for commercial aircraft, military modernization, and a growing emphasis on sustainable aviation contribute to this growth. Moreover, collaborations and partnerships between European manufacturers and global aerospace players further enhance the competitiveness of the European aerospace parts manufacturing sector, solidifying its position as a key player in the global aerospace industry.

Strong Aerospace Industry Simulates U.S.

Due to the presence of a strong aerospace industry, the aerospace parts manufacturing in the U.S. is increasing. Additionally, the growing investment in the defence sector is also increasing its manufacturing and R&D. Moreover, the development of next-generation aerospace parts is also driving their exportations.

Government Support Uplift UK

The growing government support is expanding the aerospace industry, which is contributing to the increased development of aerospace parts manufacturing. Moreover, the presence of advanced materials and technologies, along with skilled personnel, is enhancing their R&D, driving innovations.

Growing Innovations Accelerate South America

South America is expected to grow significantly in the aerospace parts manufacturing market during the forecast period, due to growing innovations. This is increasing the use of lightweight and high-performance materials for the development of aerospace parts. The expanding defence and specialized aviation sector is also increasing its demand, which in turn, is promoting the market growth.

Expanding Aerospace Industry Propels Brazil

The expanding aerospace industry in Brazil is increasing the demand for aerospace parts manufacturing. They are also investing in advanced alloys and are encouraging the use of 3D printing techniques. Additionally, the growing collaborations are also driving their manufacturing.

Value Chain Analysis: Understanding the Product Lifecycle

- Raw Material Sourcing

Raw material sourcing for aerospace parts manufacturing involves procuring high-performance materials and advanced composites from specialized global suppliers.

Key players: Alcoca Corporation, Hexcel Corporation. - Testing and Certification

Rigorous quality control and adherence to regulatory standards are involved in the testing and certification of aerospace parts manufacturing.

Key players: SGS SA, Applus+. - Aftermarket Services and Upgrades

Activities like inspections, avionics modernization, engine overhauls, and structural modifications are involved in the aftermarket services and upgrades of the aerospace parts manufacturing.

Key players: Boeing, Airbus, Rolls-Royce Holdings.

Key Players' Offering

- Boeing: The company manufactures complete commercial airlines and military aircraft.

- Lockheed Martin: Advanced military aircraft are manufactured by the company.

- Northrop Grumman: The company produces defence and aerospace technologies.

- Rolls-Royce Holdings: Power systems and aircraft engines are developed by the company.

- Bombardier Aerospace: The company manufactures private and business jets.

Aerospace Parts Manufacturing Market Companies

- Boeing

- Airbus

- General Electric (GE Aviation)

- Lockheed Martin

- United Technologies Corporation (UTC Aerospace Systems)

- Honeywell Aerospace

- Safran

- Northrop Grumman

- Raytheon Technologies

- BAE Systems

- Rolls-Royce Holdings

- Thales Group

- Spirit AeroSystems

- Bombardier Aerospace

- Leonardo S.p.A.

Recent Developments

- In April 2025, Cambium launched a high-temperature resin system, ApexShield, for aerospace manufacturers. The system increases the production speed of carbon-carbon parts for rocket nozzle extension and hypersonic glide bodies. The company utilizes AI-driven material discovery in partnership with the US Department of Defense laboratories. It lowers production time from 6 to 9 months to 1 to 2 months and minimizes hypersonic parts fabrication by 70-80 %.

- In February 2025, Qatar Airways Cargo launched Aerospace products. The product is designed to meet the needs of partners working with commercial airlines, freight forwarders, and manufacturers. This provides transportation for critical aerospace parts & components, aircraft engines, and spares .

- In August 2022, Safran Data Systems, a division of Safran Electronics & Defense, successfully acquired Captronic Systems, a local Indian firm. This strategic move positions Safran Data Systems as a key player in the space industry, bolstering its international operations and expanding its product portfolio. The acquisition enhances Safran Data Systems' capabilities in providing instrumentation for testing, telemetry, and communications with satellites, launch vehicles, and various remote platforms.

- In May 2022, JAMCO Corporation announced the formalization of a Supporter Agreement with SkyDrive Inc., a pioneering company in the development of flying cars. Under this collaboration, JAMCO will contribute to SkyDrive's efforts by lending its expertise through Aircraft Interiors development professionals. This partnership signifies a significant step for JAMCO in futuristic transportation solutions.

Segments Covered in the Report

By Product

- Engines

- Aerostructure

- Cabin Interiors

- Equipment, System, and Support

- Avionics

- Insulation Components

By End-use

- Commercial Aircraft

- Business Aircraft

- Military Aircraft

- Other

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting