What is Hypersonic Flight Market Size?

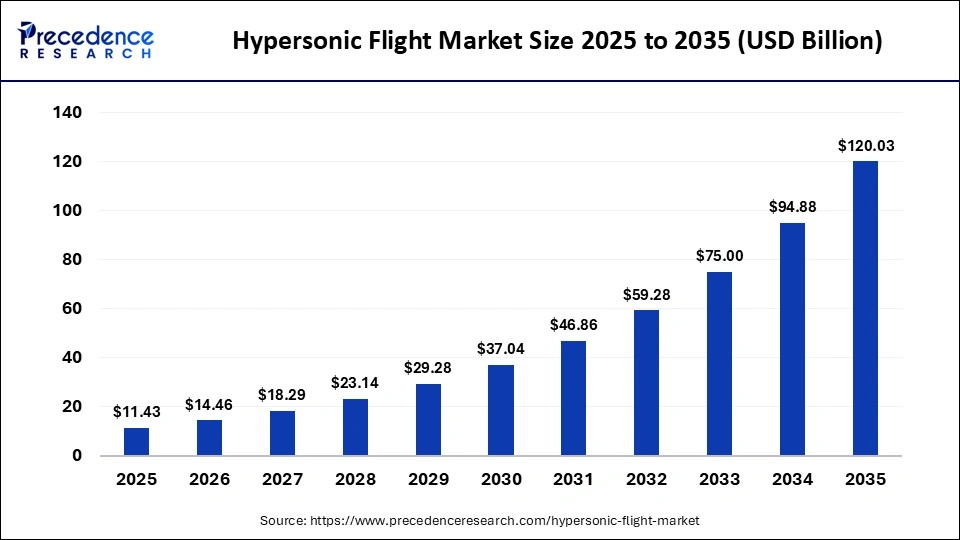

The global hypersonic flight market size was calculated at USD 11.43 billion in 2025 and is predicted to increase from USD 14.46 billion in 2026 to approximately USD 120.03 billion by 2035, expanding at a CAGR of 26.51% from 2026 to 2035. The surging demand for superfast planes from the military sector to invade warfare areas and ongoing technological advancements in the aerospace industry are playing a prominent role in shaping the industrial landscape.

Market Highlights

- North America led the market with a major share of 45% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR during the forecast period.

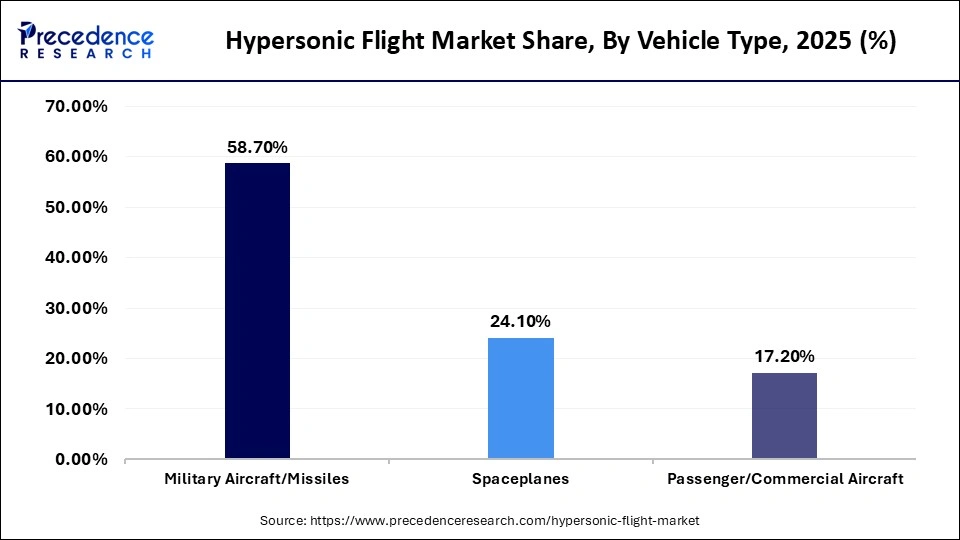

- By vehicle type, the military aircraft/missiles segment held the largest market share of 58.7% in 2025.

- By vehicle type, the spaceplanes segment is expected to expand at the fastest CAGR during the forecast period.

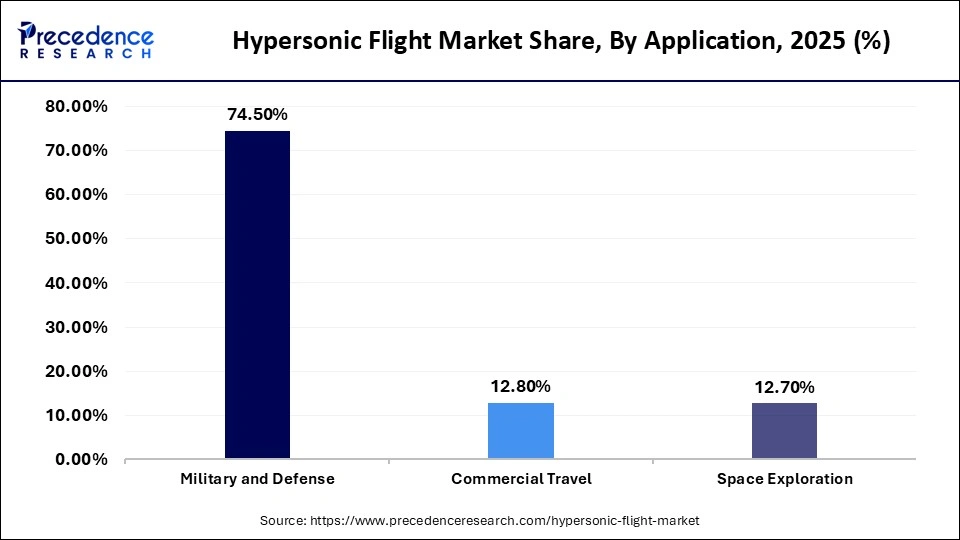

- By application, the military & defense segment held the largest market share of 74.5% in 2025.

- By application, the commercial travel segment is expected to grow at the fastest CAGR between 2026 and 2035.

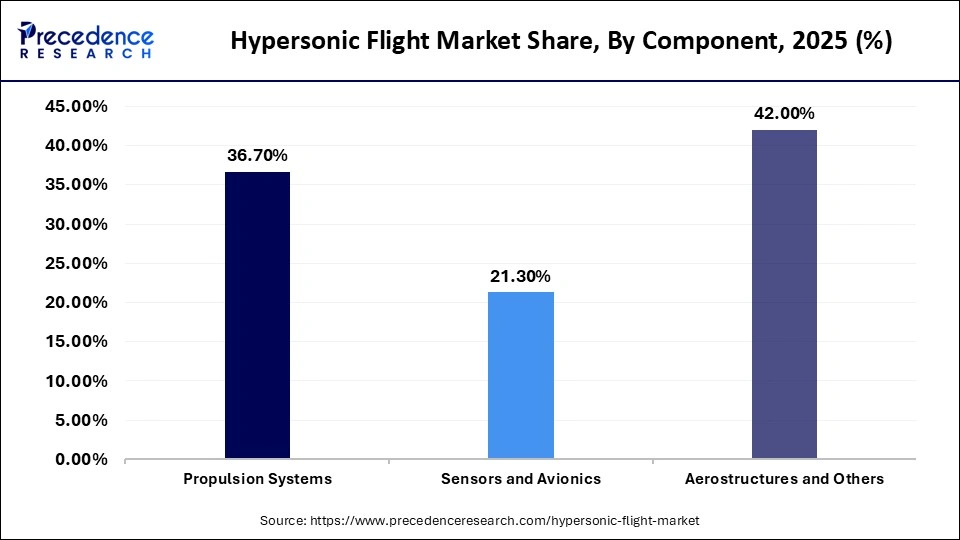

- By component, the propulsion systems segment held a major market share of 36.7% in 2025.

- By component, the sensors & avionics segment is expected to grow at a significant CAGR during the forecast period.

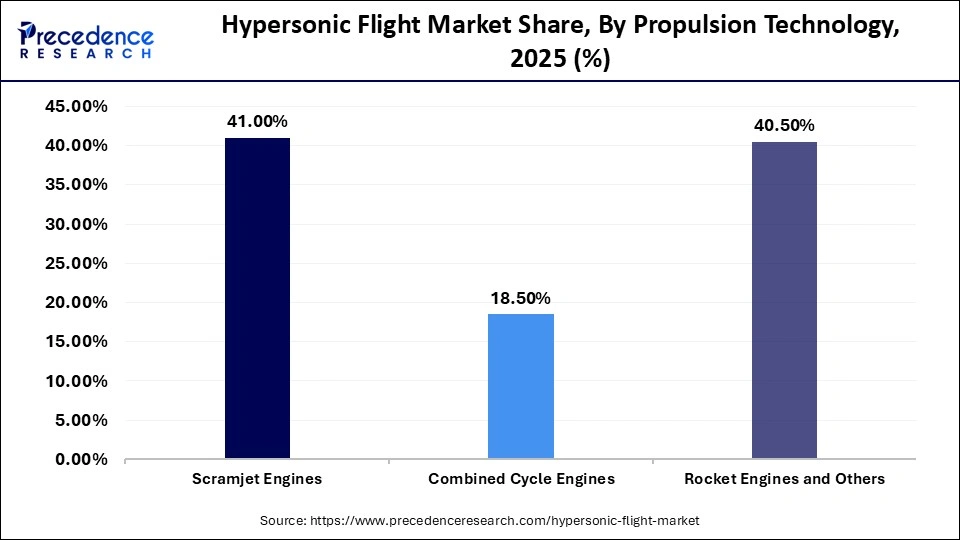

- By propulsion technology, the scramjet engines segment dominated the market with a share of 41% in 2025.

- By propulsion technology, the combined cycle engines segment is expected to expand with the highest CAGR during the forecast period.

Market Overview

The hypersonic flight market is a crucial segment of the aerospace sector. This market deals with the production and distribution of hypersonic flights across the world. It integrates cutting-edge propulsion systems, including scramjets, with advanced thermal protection materials to enable rapid intercontinental travel, next-generation military strikes, and enhanced space access. The growing emphasis of aerospace companies on developing cargo aircraft, along with the rapid investment by market players in opening new production centers, is expected to accelerate market expansion. Moreover, growing defense expenditure is expected to contribute to the market.

Hypersonic Flight Market Trends

- Increasing R&D in Hypersonic Propulsion Technologies: Research into scramjet engines, dual‑mode ramjets, and advanced rocket propulsion systems is accelerating to enable sustained hypersonic cruise capability, improve fuel efficiency, and reduce thermal stresses at extreme speeds.

- Partnerships: Various aircraft companies are partnering with aerospace organizations to test supersonic flights. For instance, in March 2025, Boom Supersonic partnered with NASA. This partnership aims at advancing supersonic flight tests of its aircraft, XB-1.

- Business Expansions: Several market players are investing rapidly in opening new manufacturing plants to enhance the development of aerospace components. For instance, in November 2025, Collins Aerospace opened a manufacturing hub in Bengaluru, India. This production unit is inaugurated to manufacture advanced aerospace products for global markets.

- Government Investments: The governments of several countries, such as the U.S., China, the UAE, and France, are investing rapidly in strengthening the defense sector. For instance, in November 2025, the government of Germany announced an investment of 35 billion. This investment is aimed at advancing military space capability.

- AI and Autonomous Flight Integration: Artificial intelligence and advanced autonomy systems are being integrated into hypersonic vehicles for real‑time control, navigation, and adaptive flight management in complex, high‑speed environments where human reaction time is insufficient.

How is AI Influencing the Hypersonic Flight Industry?

Ongoing advancements in Artificial intelligence are reshaping the landscape of the aerospace industry. In the aerospace sector, AI drives safety, efficiency, and innovation by analyzing massive datasets and enabling autonomous systems, along with optimizing maintenance operations. Nowadays, the hypersonic jet companies are integrating AI in their production centers to enhance design optimization, scramjet engine management, predictive maintenance, and hypersonic trajectory, navigation, and guidance. Additionally, AI assists in real-time monitoring, adaptive trajectory management, and threat assessment for both defense and commercial hypersonic applications, improving overall mission reliability and safety.

- In July 2025, Luminary Cloud launched Shift-Wing. Shift-Wing is an AI-based platform that helps in designing and developing aircraft components.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.43 Billion |

| Market Size in 2026 | USD 14.46 Billion |

| Market Size by 2035 | USD 120.03 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 26.51% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component,Application, Deployment,Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Analysis

Vehicle Type Insights

Why Did the Military Aircraft/Missiles Segment Dominate the Hypersonic Flight Market?

The military aircraft/missiles segment dominated the market, accounting for 58.7% share in 2025. This is because defense applications remain the primary driver of hypersonic technology development. Governments and defense agencies prioritize hypersonic weapons and aircraft for their ability to travel at speeds exceeding Mach 5, evade traditional missile defenses, and enhance strategic strike capabilities. High investments in research, testing, and deployment of hypersonic missiles and military aircraft ensure sustained demand, making this segment the largest contributor to the market.

The spaceplanes segment is expected to expand at the fastest CAGR during the forecast period. This is due to the rising application of ramjet engines in spaceplanes to enhance their operational efficiency. Also, the surging use of these planes for transporting cargo and crews to orbit, deploying or repairing satellites, conducting scientific research, and executing military reconnaissance or logistics missions is expected to boost segmental growth.

Application Insights

What Made Military & Defense the Leading Segment in the Hypersonic Flight Market?

The military & defense segment led the hypersonic flight market with the largest share of 74.5% in 2025. This is due to the growing adoption of advanced aircraft by the military and defense organizations. Additionally, the rapid investment by the government in strengthening the defense sector and partnerships among aerospace brands and defense organizations to develop aerial military vehicles bolstered segmental growth. The focus on strengthening national security, combined with continuous research and testing programs, makes military and defense the leading segment in the market.

The commercial travel segment is expected to grow at a significant CAGR between 2026 and 2035. This is due to the surging emphasis of aviation companies on deploying hypersonic flights to revolutionize long-haul journeys by reducing travel time. Additionally, the rapid investment by the aircraft manufacturers in developing high-quality engines for commercial aircraft is expected to foster segmental growth.

Component Insights

Why Did the Propulsion Systems Segment Dominate the Hypersonic Flight Market?

The propulsion systems segment dominated the hypersonic flight market, accounting for a major share of 36.7% in 2025. This is due to the growing use of propulsion systems in hypersonic flights for enabling rapid, long-range, and maneuverable flight. Also, the rising application of propulsion systems in hypersonic flights to generate high thrust and manage extreme aerodynamic heat is positively contributing to the segmental expansion. Additionally, the rapid investment by the aerospace brands in developing scramjet engines for hypersonic flights is expected to sustain the dominance of the segment in the near future.

The sensors & avionics segment is expected to expand at the highest CAGR during the forecast period. This is due to the surging application of high-temperature pressure sensors and heat flux sensors in hypersonic flights. Rapid investment by semiconductor companies in opening new sensor manufacturing units, as well as the growing use of inertial sensors in spaceplanes, is playing a prominent role in driving segment growth. Moreover, the increasing application of avionics in hypersonic flights to manage extreme thermal loads and maintain stability in high-altitude trajectories is expected to propel segmental growth.

Propulsion Technology Insights

Why Did the Scramjet Engines Segment Dominate the Hypersonic Flight Market?

The scramjet engines segment dominated the market while holding a 41% share in 2025. This is due to the increased use of scramjet engines in hypersonic flights to deliver a high speed of Mach 5+. Also, the rapid investment by the aerospace companies in developing advanced scramjet engines, along with technological advancements in scramjet engines, bolstered the segment. Moreover, numerous advantages of scramjet engines, including high speed, weight reduction, superior defense capabilities, and improved thermal management, are driving its adoption.

- In February 2025, Hyprix launched Tezz. Tezz is a supersonic ramjet engine designed for the defense sector in India.

The combined cycle engines segment is expected to grow at the highest CAGR during the forecast period. This is due to the fact that combined cycle engines are essential for hypersonic flight to provide expanded operational range, thereby driving segmental growth. Also, the surging investment by the aerospace companies in developing advanced combined cycle engines, along with technological advancements in CCEs, is playing a prominent role in shaping segmental development. Moreover, numerous advantages of combined cycle engines, including high efficiency, low fuel consumption, and reduced emission is expected to propel segmental expansion.

Regional Insights

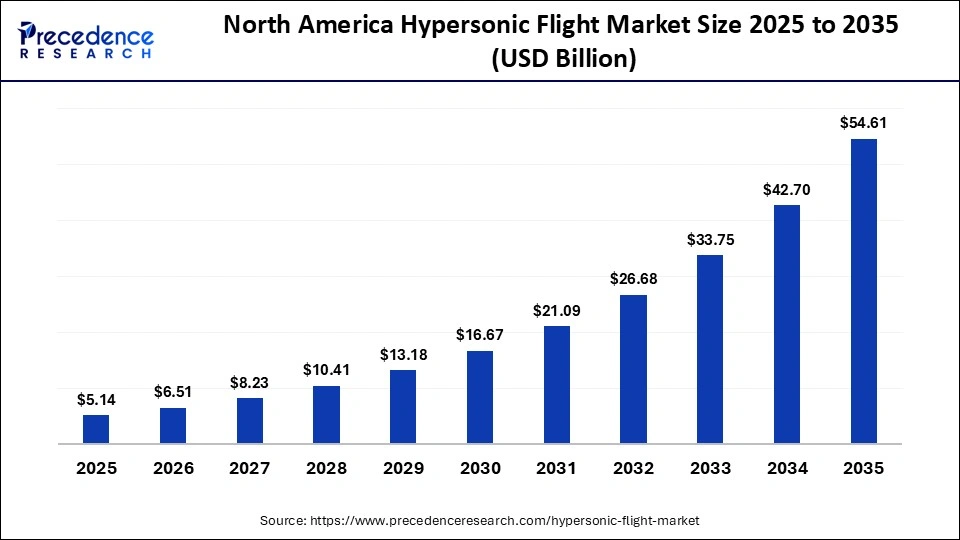

How Big is the North America Hypersonic Flight Market Size?

The North America hypersonic flight market size is estimated at USD 5.14 billion in 2025 and is projected to reach approximately USD 54.61 billion by 2035, with a 26.66% CAGR from 2026 to 2035.

North America registered dominance in the hypersonic flight market by capturing a major share of 45% in 2025. This is primarily due to the rapid expansion of the aerospace sector in the U.S., Canada, and Mexico. Also, the surging investment by the flight manufacturers in opening new production centers, along with numerous government initiatives aimed at strengthening the defense sector, reinforced the region's leading position in the market. Moreover, the presence of several market players, including Lockheed Martin, Northrop Grumman, Boeing, and Raytheon Technologies, is expected to sustain the dominance of the region in the coming years.

- In October 2025, Lockheed Martin partnered with Venus Aerospace. This partnership aims to accelerate innovations in next-generation propulsion systems in the U.S.

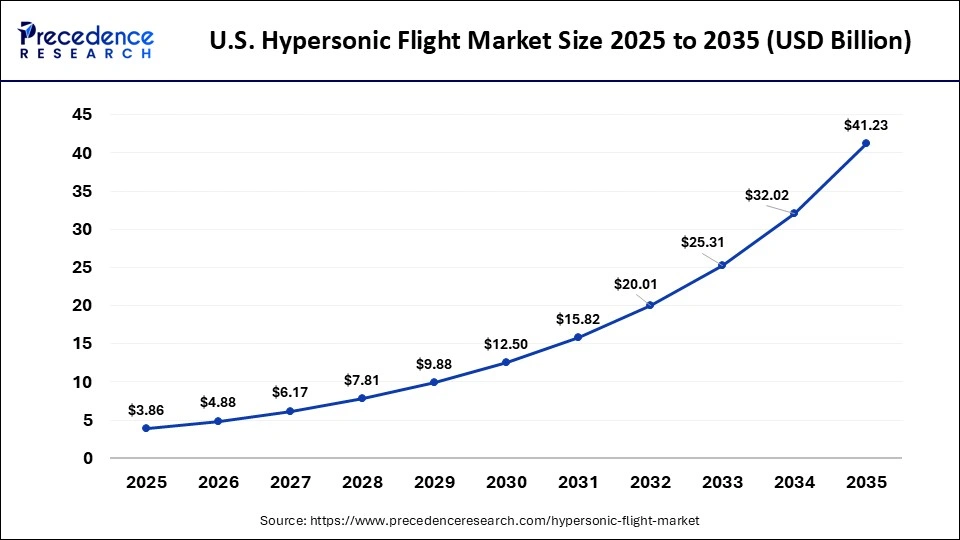

What is the Size of the U.S. Hypersonic Flight Market?

The U.S. hypersonic flight market size is calculated at USD 3.86 billion in 2025 and is expected to reach nearly USD 41.23 billion in 2035, accelerating at a strong CAGR of 26.73% between 2026 to 2035.

What Made North America the Dominant Region in the Hypersonic Flight Market?

North America registered dominance in the hypersonic flight market by capturing a major share of 45% in 2025. This is primarily due to the rapid expansion of the aerospace sector in the U.S., Canada, and Mexico. Also, the surging investment by the flight manufacturers in opening new production centers, along with numerous government initiatives aimed at strengthening the defense sector, reinforced the region's leading position in the market. Moreover, the presence of several market players, including Lockheed Martin, Northrop Grumman, Boeing, and Raytheon Technologies, is expected to sustain the dominance of the region in the coming years.

In October 2025, Lockheed Martin partnered with Venus Aerospace. This partnership aims to accelerate innovations in next-generation propulsion systems in the U.S.

Canada Hypersonic Flight Market Trends

The market in Canada is growing due to the increasing demand for cargo aircraft from the logistics sector, as well as the rapid investments in the aerospace industry by the government. Additionally, the surging emphasis of flight companies on advanced research and development of hypersonic flights, along with partnerships among aerospace companies and advanced materials brands to manufacture high-quality components for hypersonic flights, is accelerating market growth.

In February 2025, the government of Canada invested US$ 1.3 million. This investment is made to develop the aerospace sector in this country.

Why is Asia Pacific Expanding with the Fastest CAGR in the Market?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The surging demand for hypersonic passenger aircraft in several nations, including China, India, Japan, and South Korea, is driving the market growth. Additionally, the rise in the number of aerospace startups, coupled with the rapid investment by the government in space exploration activities, is positively contributing to the market. Moreover, the presence of various aerospace companies, including Mitsubishi Heavy Industries, Hanwha, AVIC, and Hindustan Aeronautics Limited (HAL), is expected to foster the growth of the hypersonic flight market in this region.

In June 2025, Hanwha Aerospace announced to invest around US$ 459.3 million. This investment is made to develop next-generation KF-21 supersonic fighter jets.

China Hypersonic Flight Market Analysis

- The market in China is expanding as a result of rising investment by the China Aerospace Science and Technology Corporation to enhance space exploration activities, as well as the surging focus of the aerospace companies on developing scramjet engines. Additionally, the growing emphasis of the government on deploying advanced fighter jets in the military and defense sector to improve the air force capabilities is positively contributing to the market.

- In December 2024, Space Transportation launched the JinDou 400 ramjet engine in China. JinDou 400 ramjet engine is designed for the Yunxing supersonic passenger aircraft.

Value Chain Analysis

- Raw Materials Sourcing

Raw materials used in the production of hypersonic flights comprise refractory metals, advanced ceramics, and specialized carbon-based composites.

Key Companies: GE Aerospace, Rolls-Royce, and CoorsTek. - Testing and Certification

Testing and certification of hypersonic flight (speeds of Mach 5 or higher) is a rigorous, multi-stage process combining advanced ground-based simulations and high-cadence flight tests.

Key Companies: Hermeus, Stratolaunch, and Destinus. - Maintenance, Repair & Overhaul (MRO)

Maintenance, Repair, and Overhaul (MRO) of hypersonic flight vehicles is an advanced, high-precision process centered on structural integrity under high pressure, managing extreme aerodynamic heating, and the degradation of specialized materials.

Key Companies: Lufthansa Technik AG, Rolls-Royce, and Safran SA.

Who are the major players in the global hypersonic flight market?

The major players in the hypersonic flight market include Lockheed Martin (US), Northrop Grumman (US), Boeing (US), Raytheon Technologies (US), Airbus (FR), General Dynamics (US), Thales Group (FR), Korea Aerospace Industries (KR), Aerojet Rocketdyne (US), SpaceX (US), and Leidos (US)

Recent Developments

- In January 2026, Lockheed Martin partnered with GE Aerospace. This partnership aims at developing a liquid-fueled rotating detonation ramjet engine for hypersonic flights.

(Source: https://defensescoop.com - In January 2026, Polaris Spaceplanes announced the launch of a hypersonic aircraft in Germany. This hypersonic aircraft is developed in a partnership of Polaris Spaceplanes with BAAINBw.

(Source: https://turdef.com) - In November 2025, Rocket Lab launched a hypersonic test flight. This hypersonic test flight is designed for the U.S. military.

(Source: https://www.space.com)

Segments Covered in the Report

By Vehicle Type

- Military Aircraft/Missiles

- Spaceplanes

- Passenger/Commercial Aircraft

By Application

- Military & Defense

- Commercial Travel

- Space Exploration

By Component

- Propulsion Systems

- Sensors & Avionics

- Aerostructures & Others

By Propulsion Technology

- Scramjet Engines

- Combined Cycle Engines

- Rocket Engines & Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting