What is Industrial Sensors MarketSize?

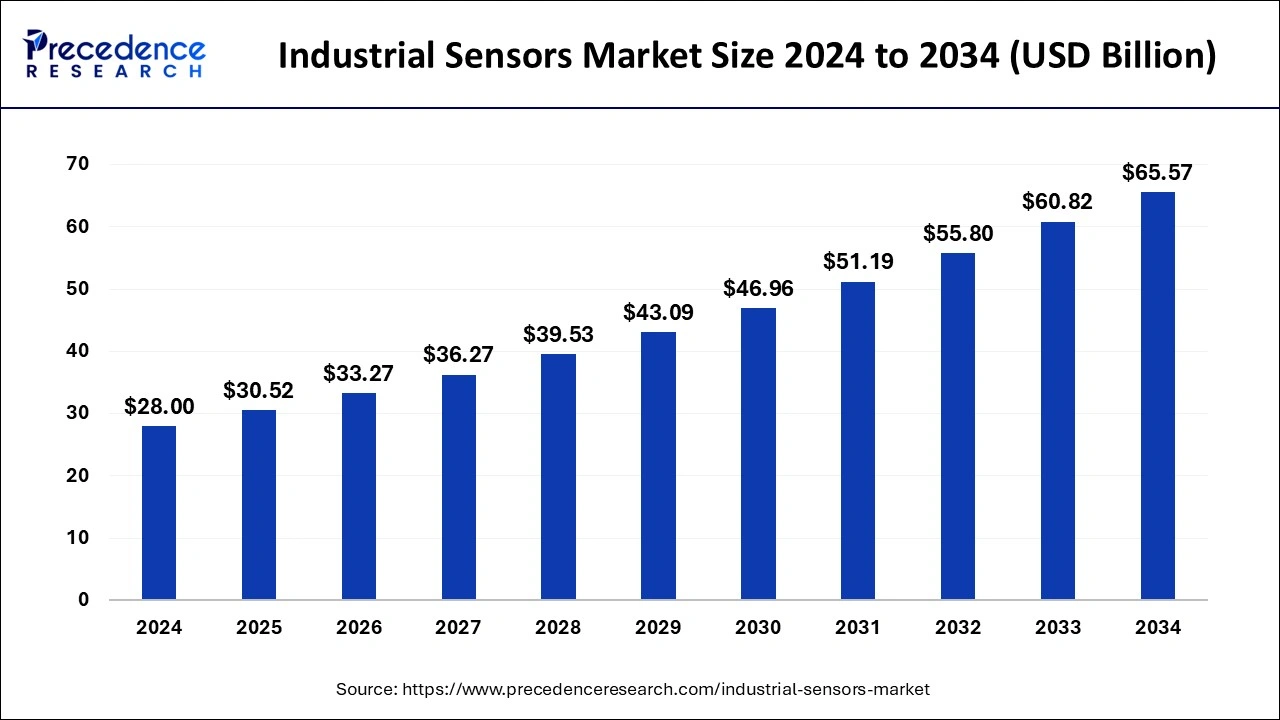

The global industrial sensors market size accounted for USD 30.52 billion in 2025 and is expected to exceed USD 70.5 billion by 2035, growing at a CAGR of 8.73% from 2026 to 2035

Industrial Sensors Market Key Takeaways

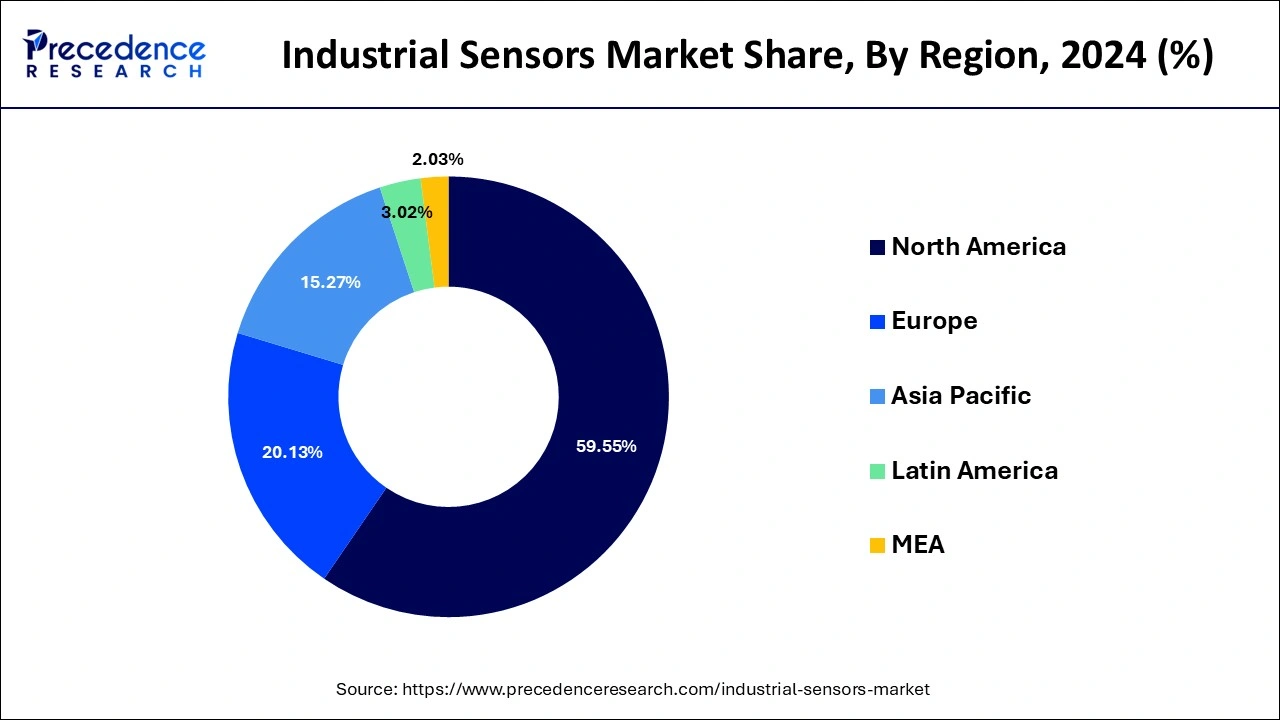

- Asia Pacific led the global market with the highest market share of 59.55% in 2025

- The industry sensor market of sensor technology is anticipated to develop at the greatest CAGR from 2026 to 2035

- The non-contact commercial sensor market is anticipated to expand at the greatest CAGR from 2026 to 2035

- The automobile segment is anticipated to develop at the greatest CAGR from 2026 to 2035

- Particularly the industrial sensing market is anticipated to occupy the second-largest market from 2026 to 2035

Market Overview

An industry sensor is a tool that detects environmental events or changes and then produces related output. These sensors are crucial to Industry 4.0 and manufacturing automation. Equipment condition is checked using motion detectors and monitoring devices for linear or rotational positioning, leveling, tilt detection, and shocks or accident detection. They react by producing output on a display or sending the information and data for further processing when they detect physical input including temperature, motion, light, wetness, tension, or other entity. These give an overview of the primary uses for artificial illumination energy conservation, environmental control, and hardware fault diagnosis. For almost any industrial need, a wide range of sensors is readily available. Commercial sensors can improve operations for mission-critical commercial processes and offer unrivaled asset protection. Sensor technology and its many uses are always changing to meet new technical developments and commercial demands. Sensors pick up on a variety of physical characteristics, including heat, pressure, and distance. Industrial sensors can also be used to precisely and repeatedly measure a variety of chemical, mechanical, and biological parameters. Because of their dependability, they are widely used in the manufacturing, construction, and healthcare sectors. The Internet of Things, which makes extensive usage sensors, also connects network infrastructure including smart grids, home automation, water-efficient systems, and navigation systems.

Industrial Sensors Market Growth Factors

Industrial sensors are tools that may identify environmental changes and produce additional signals or outputs as a result. They are able to detect inputs including light, temperature, pressure, heat, voltage, humidity, and motion, and produce outputs on a display screen for sending data for additional processing. Proximity, velocity, capacitive, inductive, photoelectric, and magnetic ultrasonic sensors are a few of the frequently utilized industrial sensors.

They are crucial for machine automation since they help to ensure precise alignment of mechanical parts and give information about how well they are working. As a result, such sensors are widely used in many different industries, including mining for chemicals, petroleum & gas, manufacturing, healthcare, power generation, and water and sewage treatment. One of the main factors boosting the market is the increased digitization and demand for factory automation.

In keeping with this, the widespread use of wireless technology and the expanding desire for increased productivity at industrial facilities have led to an increase in the use of industrial sensors. Such sensors are also being used by businesses to increase productivity, keep an eye on plant assets, diagnose equipment problems, and boost worker safety. Additionally, a large-scale industrial sensing deployment to track flood and sea levels, ecological factors, and energy usage is promoting market expansion. Other growth-promoting elements are being acted upon by numerous technological developments, including the introduction of automation and a Network of Things-enabled sensing devices. These sensors have the ultimate decision, processing software, and on-chip processing capacity, which help to enhance a variety of industrial operations. Additional reasons, such as the growth of Industry 4.0 and intensive research and development programs, are predicted to fuel the market even more.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 30.52 Billion |

| Market Size in 2026 | USD 30.52 Billion |

| Market Size by 2035 | USD 70.5 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.73% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Sensor Type, Type, and End-User Industry, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

- Industrial sensors continue to progress technologically - Micro-Electro-Mechanical Systems are one of the cutting-edge technologies used in industrial sensing applications. MEMS is a system that, in its broadest sense, can be characterized as miniature mechanical and electromechanical components (i.e., structures and devices) created by the process of microfabrication. The crucial measurements of Microelectronic devices can range from far below one micrometer on the low end to many millimeters on the high end. MEMS technology in sensing devices is enabling the production of an increase in the number of microscopic-sized sensors. In most instances, it is worth considering as it is far faster and more sensitive than larger-scale sensors.

- Increasing industry 4.0 & IOT penetration in production - The need for industrial sensors is anticipated to increase as the Internet of Things usage spread throughout manufacturing sectors. Significant market demand has been created by the expanding integration of IoT across numerous industries, including industrial, health, and many others. In addition, it is projected that the burgeoning Industry 4.0 revolution will drive demand for the market for industrial sensors. The industry 4.0 transformation is being fuelled by an increase in technological adoption and digitalization as a result of the expanding development of more efficient & cost-effective production across a variety of industries. The manufacturers have been able to boost production, efficiency, and revenue thanks to the increased integration of IoT and the Industrial Internet in manufacturing. The market for sensing devices has now grown as a result of the industries' increasing demand for greater performances.

Key Market Challenges

- Specific performance standards for upcoming sophisticated sensors - According to end-user applications, the detecting capacity of the sensor varies, which causes erroneous measurements and detecting performance. The functional requirement of sensors becomes crucial for advanced applications because, for instance, flow, temperature, pressure, and particular input characteristics in the automobile end-user sector differ from others in the oil and gas finished sector.

- High ownership costs - A variety of parts, including position magnetic, sensor rods, electronic housing fittings, diagnostics light-emitting diode, and connections, are used in the manufacturing and assembly of an industrial sensor. The cost and availability of ingredients and raw materials, along with the length of time it takes to introduce the finished product to the market, are the main factors that affect profitability. The main obstacles facing businesses in this sector are raising their manufacturing capabilities, delivering goods of higher quality, and lowering overall costs of production. The real cost of using the control technique is included in the ownership cost, which must take into account installation expenses, operational costs throughout the course of its use, upkeep and reappraisal costs, operation, and potential replacement costs. The market for sensing devices is expected to experience growth challenges due to the rising overall cost of ownership.

Key Market Opportunities

- Predictive maintenance will present industry participants with profitable opportunities - A branch of monitoring systems called "predictive maintenance" is concerned with figuring out when commercial machinery and equipment require maintenance. It ensures production facilities are operational and permits ongoing product design to confirm satisfied customers and profitability. Collecting sensor data, simplifying data transfers, and creating predictions are the three fundamental improvements of predictive maintenance above conventional maintenance schedules. One of the key components of proactive maintenance systems is sensors. Market expansion prospects for sensor devices are anticipated to be excellent in the foreseeable future. Industry and IoT are being adopted more frequently in production, wearable devices with smart sensors are in high demand, and industrial sensors are advancing technologically, all of which are contributing to this market's growth. Additional aspects that are anticipated to provide substantial potential for the expansion of this market include the use of sensing devices for preventive analytics and the rising adoption of smart sensors in the automotive sector.

Segment Insights

Sensor Type Insights

During the anticipated period, the industry sensor market of sensor technology is anticipated to develop at the greatest CAGR. Machine vision applications are what are essentially driving the market expansion for industrial sensor technology. Image sensors are also predicted to play a crucial role in new areas like the Internet of Things, system infrastructure, smart cities, smart manufacturing, smart cars, and intelligent medical devices. Additionally, more and more important biometric techniques�like fingerprint and iris scanning�are using picture sensors. Manufacturing, oil & gas, pharmaceutical, chemical, and energy & electricity are a few sectors that use sensor technology.

Type Insights

The non-contact commercial sensor market is anticipated to expand at the greatest CAGR during the anticipated period. Due to the several benefits, non-contact sensors provide over contact devices, including spontaneity, dependability, lifespan, and performance uniformity, this market is expected to increase. Non-contact sensors are employed in a variety of operations, including process control, engineering, automation, manufacturing, and others, which is fuelling the expansion of this market. The best option for maintaining corrosive media is generally thought to be the non-contact approach. The technique utilized determines the type of sensor. For example, the most popular non-contact level detection systems include ultrasonic, optical, microwave/radar, laser, nuclear, MEMS, capacitance, conductivity, and loading cells. Non-contact thermocouples track temperature changes by using the principles of radiation and convection. They pick up infrared radiation, which is the heat radiation emitted by an object. Infrared and fiber optics thermocouples are examples of non-contact temperature measurements.

End-User Industry Insights

During the projection period, the automobile segment is anticipated to develop at the greatest CAGR. This market's expansion is driven by the growing adoption of IoT technology in processing and manufacturing facilities. Additionally, IoT-based automated production sensors enable firms to remotely monitor plant locations, enhance worker & asset security, and maximize operational effectiveness. By accomplishing early fault detection, incorporating these industry sensors into production services helps reduce maintenance expenses.

- In March 2025, IN-SPACe proposed the formation of a technology consortium aimed at integrating ISRO's advanced sensor technologies into the automotive sector. This initiative seeks to leverage ISRO's high-end sensor technology, which is currently at Technology Readiness Level (TRL-9), to enhance the automotive industry's sensor capabilities, which are currently at TRL-3.

Regional Insights

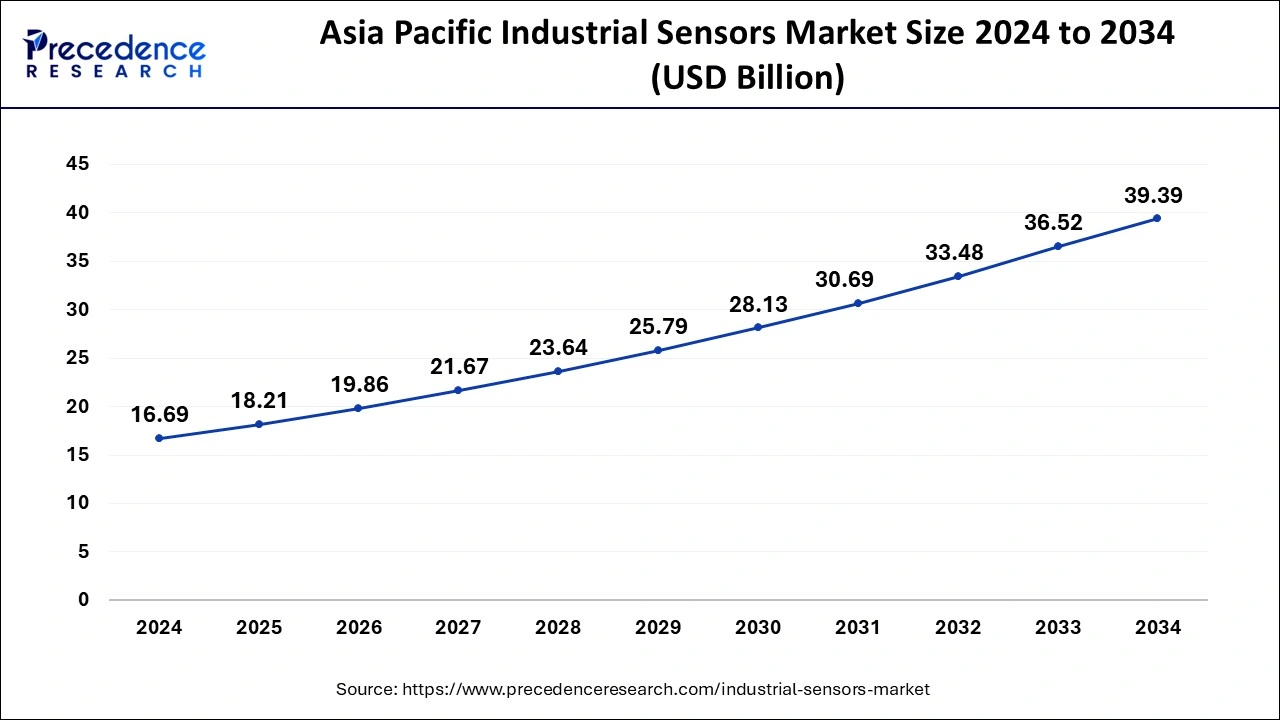

Asia Pacific Industrial Sensors Market Size and Growth 2026 to 2035

The Asia Pacific industrial sensors market size was exhibited at USD 18.21 billion in 2025 and is projected to be worth around USD 42.37 billion by 2035, growing at a CAGR of 8.81% from 2026 to 2035

During the anticipated period, particularly in the industrial sensing market is anticipated to occupy the second-largest market. Due to the widespread adoption of Industry 4.0 and the Industrial Web of Things in manufacturing facilities, as well as the existence of sensor producers in the region, particularly in the US, North America is predicted to hold the second-largest market for sensing devices. The US government is implementing several initiatives to advance Industry 4.0 across the nation.

The Nationwide Network for Industrial Innovation is one such initiative. The nation is creating the NNMI as part of this program, which will be made up of regional centers that will hasten the acceptance of slashing production technology for the production of novel products that are competitive on a worldwide scale.

Asia Pacific Industrial Sensors Market: Industry 4.0 Adoption and Demand Dynamics

Asia Pacific dominated the industrial sensors market in 2025. It is driven by the increasing need for sensors with real-time monitoring, data analytics, and automation features is boosted by the adoption of Industry 4.0 along with the Industrial Internet of Things (IIoT). Substantial boosts in sales and revenue are driving robust expansion in the Asia Pacific industrial sensors market in the Asia Pacific region.

China Industrial Sensors Market Trends

China's market focuses on the production, development, and deployment of sensors used to monitor, control, and automate numerous processes within industrial environments. Industrial sensors play a vital role in optimizing operational efficiency, guaranteeing safety, and enhancing productivity across a broad range of industries such as manufacturing, automotive, chemicals, oil & gas, energy, and more.

The rising adoption of AI-based sensors in the industrial sector, particularly in predictive maintenance and smart manufacturing. These AI sensors are used to monitor machinery conditions in real time. These sensors can predict equipment failures before they occur, reducing downtime and maintenance costs. For instance, in February 2024, Amazon announced its plan to invest in start-ups that combine AI with robotics. The Amazon Industrial Innovation Fund has made 12 investments in total, including in Mantis Robotics, which is developing a robotic arm that uses sensors to work alongside humans.

Evolution of the Industrial Sensors Market in North America

North America is the fastest-growing market during the forecast period. It is driven by advancements in technology and the rising need across various sectors. The integration of sensors into everyday apparatus is becoming more prevalent, improving functionalities in industries such as automotive, healthcare, and manufacturing. This trend is likely to continue as companies seek to enhance efficiency and gather data for better decision-making.

U.S. Industrial Sensors Market Trends

The U.S. market is driven by technology evolution, together with the ongoing automation wave across manufacturing and even process industries. Import trends indicate a rising reliance on advanced sensor components such as IoT-enabled, smart, and multifunctional devices, reflecting a change in procurement patterns toward high-precision, energy-efficient solutions.

Value Chain Analysis for the Industrial Sensors Market

- Raw Material Procurement

It requires high precision, durability, and compliance with stringent environmental standards, making the procurement of raw materials a vital, quality-driven operation.

Key Players: STMicroelectronics, NXP Semiconductors, Infineon Technologies

- Wafer Fabrication

It works by changing high-purity silicon into greatly specialized, miniature sensing components, usually utilizing Micro-Electro-Mechanical Systems (MEMS) technology.

Key Players: GlobalFoundries Inc., X-FAB Semiconductor Foundries AG, Tower Semiconductor Ltd

- Photolithography and Etching

It depends heavily on photolithography as well as etching processes to fabricate Micro-Electro-Mechanical Systems (MEMS), accelerometers, pressure sensors, and optical components.

Key Players: ASML Holding N.V., Nikon Corporation, Canon Inc.

Industrial Sensors Market Companies

- ABB LTD. (Switzerland)

- Amphenol Corporation (US)

- AMS AG (Austria)

- Analog Devices, Inc. (U.S.)

- Bosch Sensortec (Germany)

- Corporation (Japan)

- Dwyer Instruments (US)

- Endress+Hauser

- Figaro Engineering Inc. (Osaka, Japan)

- First Sensor AG

- Honeywell International (US)

- Infineon Technologies AG (Germany)

- Integrated Device Technology (United States)

- Microchip Technology (United States)

- NXP Semiconductors N.V. (Netherlands)

- Omega Engineering (Switzerland)

- Omron Corporation

- Panasonic Corporation (Japan)

- PCB Piezotronics, Inc. (United States)

- Renesas Electronics Corporation

- Rockwell Automation (US)

- Safran Colibrys SA (Switzerland)

- Sensirion AG (Switzerland)

- Siemens AG (Germany)

- STMicroelectronics International N.V. (Switzerland)

- TE Connectivity (Switzerland)

- Teledyne Technologies Incorporated (United States)

- Texas Instruments (US)

Recent Developments

- In September 2023, Cognex announced the launch of a New Industrial Vision Sensor, the In-Sight SnAPP vision sensor. The In-Sight SnAPP sensor is designed for quality control applications such as presence or absence inspections, assembly verification, defect detection, and other automated inspection tasks.

- In May 2025, Teledyne Technologies Incorporated unveiled three new variants of industrial CMOS image sensors, offering resolutions from 1.3 megapixels to 67 megapixels. These sensors were developed using a delta space qualification methodology combined with extensive radiation testing, positioning them for a wide range of space-based applications.

- In December 2024, Electronics City Industries Association (ELCIA) and India Electronics & Semiconductor Association (IESA) joined forces to establish a sensor technology hub. India's electronics and semiconductor sectors have signed an MoU on a partnership that aims to foster India's ambition to become a global leader in ESDM.

- Honeywell was designated the recipient of 11 product development awards in May 2022, such as the Red Dot and also if Design Awards, two of the most prominent and well-recognized award schemes in the sector. By displaying innovation, practicality, and design longevity, those product-specific awards recognize Honeywell's ongoing dedication to providing a superior user experience that promotes workplace and employee safety.

- In April 2022, Build- bought 17 businesses and made investments in another two. The transactions cost the company almost $ 3.08 billion. TE Connectivity has made investments in a variety of fields, including sensors, cardiovascular and arterial diseases, micro-electro-mechanical systems, and others.

- In April 2022, Spectris Plc & venture capital company Arcline Capital Management reached an agreement to sell Omega Engineering's industrial control and measurement equipment in the United States for $525 million cash. According to a statement published by Spectris on Tuesday, Omega Engineers is valued at roughly 20.4 times its normalized profits before interests, taxation, amortization, and amortized for 2021. The announcement claims that Arcline will combine Omega Engineering with the sensor maker Dwyer Group, which it acquired last year.

- Plants and electric cars in March 2022 at APEC 2022. New technology, examples, and business presentation will be helpful to power designers in reducing EMI and sound while also boosting energy capacity or reliability.

- Texas Instruments unveiled the 3D Auditorium control technique in October 2021. Engineers can obtain improperly calibrated ultra-high accuracy with the TMAG5170 at rates up to 20 kSPS for quicker and more precise real-time control in motor-drive and industrial automation and control systems.

- Rockwell Automation introduced LifecycleIQ Services as a brand name in June 2021. With the help of Rockwell Automated systems and extremely skilled personnel, customers may now interact with the company in new and innovative ways that will help them perform better and rethink what's possible for their industrial manufacturing value chain.

- In May 2021, Honeywell reported that dnata US has implemented its Honeywell Thermo Rebellion temperature measurement technology at Boston Airport International Airport to assist both domestic and foreign travelers.

Segments Covered in the Report

By Sensor Type

- Pressure Sensors

- Position Sensors

- Level Sensors

- Gas Sensors

- Temperature Sensors

- Image Sensors

- Humidity & Moisture Sensors

- Flow Sensors

- Force Sensors

By Type

- Contact

- Non-Contact

By End-User Industry

- Oil & Gas

- Pharmaceuticals

- Chemicals

- Automotive

- Manufacturing

- Mining

- Energy & Power

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting