What is the Micro-Electro-Mechanical System Market Size?

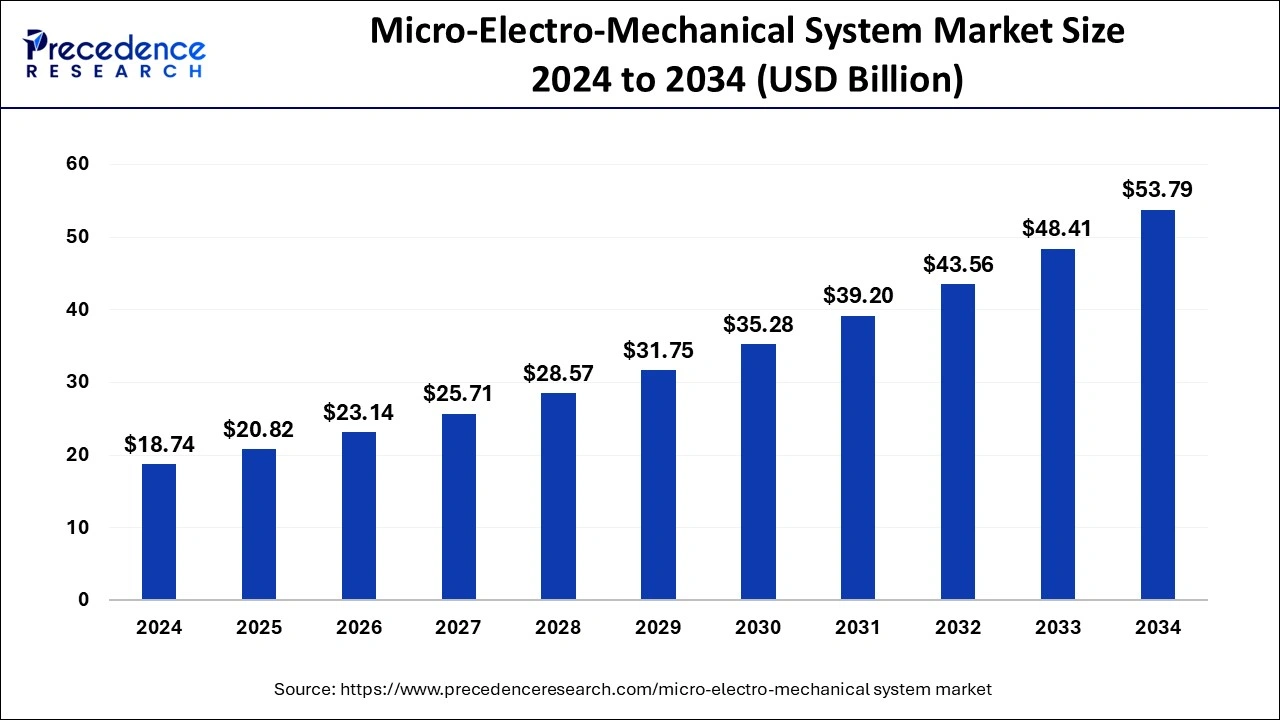

The global micro-electro-mechanical system market size is valued at USD 20.82 billion in 2025 and is predicted to increase from USD 23.14 billion in 2026 to approximately USD 58.82 billion by 2035, expanding at a CAGR of 10.94% from 2026 to 2035. The micro-electro-mechanical system market growth is attributed to the increasing demand for miniaturized, energy-efficient sensors and actuators across various industries.

Micro-Electro-Mechanical System Market Key Takeaways

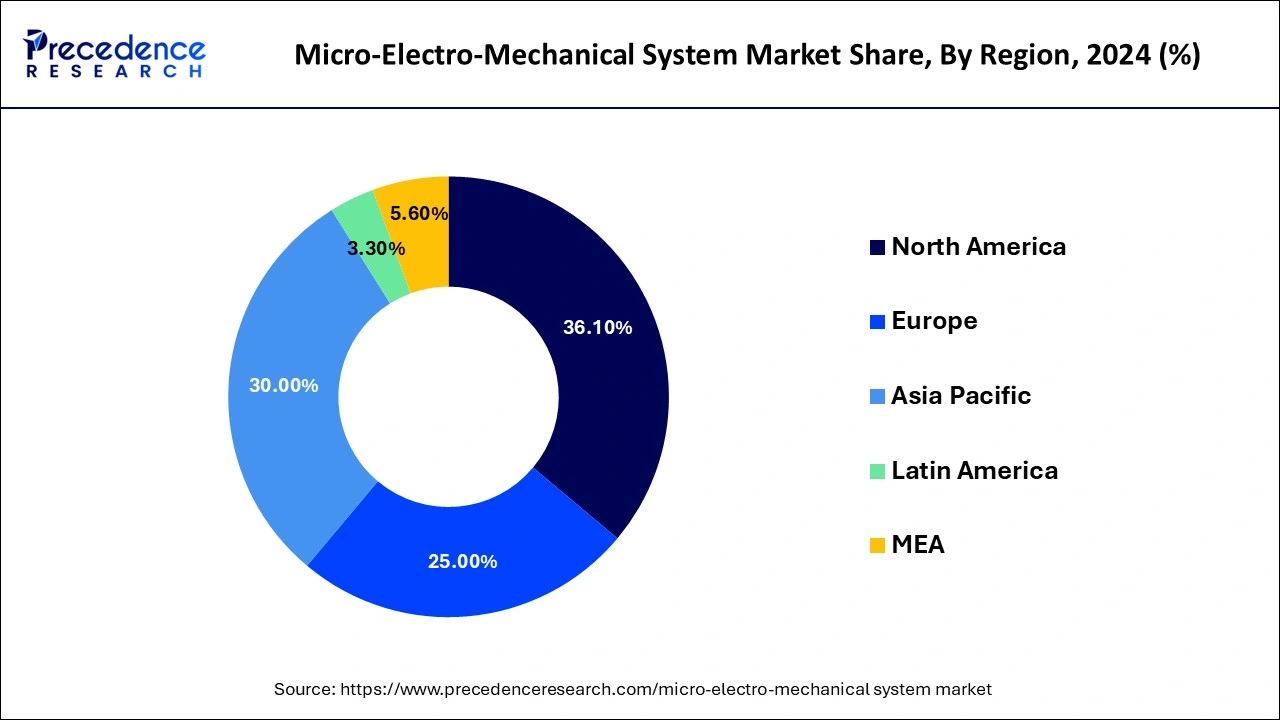

- North America dominated the micro-electro-mechanical system market with the largest market share of 36.1% in 2025.

- Asia Pacific is projected to host the fastest-growing market in the coming years.

- By sensor type, the inertial sensors segment has held a major market share of 25% in 2025.

- By sensor type, the optical sensors segment is expected to grow at the fastest CAGR during the forecast period.

- By actuator type, the optical segment accounted for a considerable share of the market in 2025.

- By actuator type, the radio frequency segment is anticipated to grow with the highest CAGR during the studied years.

- By vertical, the automotive segment led the global market in 2025.

- By vertical, the healthcare segment is projected to expand rapidly in the coming years.

Impact of Artificial Intelligence on the Micro-Electro-Mechanical System Market

Artificial intelligence in data analysis improves precision and increases the efficiency of operations. The micro-electro-mechanical system market has improved by using AI in various manufacturing industries, such as the healthcare industry, automotive manufacturing industry, and consumer electronics manufacturing industries, due to their important role in using sensors and actuators. In healthcare, they improve MEMS-based diagnosing instruments, making the diagnoses more accurate and faster. MEMS sensors are used in real-time tracking of various patients' conditions, hence enhancing diagnostic results. Moreover, AI integrates MEMS devices with automotive systems, which helps reduce risks and achieve better and more efficient autonomous driving assistance technologies.

Market Overview

The micro-electro-mechanical system market is fuelled by the rising usage of IoT devices in various fields. Micro-electro-mechanical system (MEMS) technology combines mechanical and electrical structures, transducers, control circuitry, and actuators on a silicon base, providing solutions for miniaturized, reliable, and low-cost devices. This integration is very important for many IoT applications since the cost of space and power is always a major issue for designers. MEMS sensors have proven to expand the safety aspects of automobiles, optimize energy efficiency, and drive the advancement of ADAS and self-driving technologies. Furthermore, the accelerometers and gyroscopes made using MEMS technology are widely used in ADAS to provide information on the stabilities of the cars and the control systems in operation.

Micro-Electro-Mechanical System Market Growth Factors

- Surging demand for IoT-connected devices across industries is expected to drive MEMS sensor adoption.

- Increasing focus on miniaturization in consumer electronics is anticipated to accelerate the micro-electro-mechanical system market growth.

- Advancements in automotive technologies, such as autonomous vehicles and electric vehicles, are likely to fuel demand for MEMS components.

- Rising emphasis on environmental sustainability is expected to boost MEMS applications in energy-efficient solutions.

- Growing adoption of wearable medical devices is projected to increase the need for MEMS sensors in healthcare.

- The expansion of 5G networks is anticipated to accelerate the demand for MEMS in communication devices and infrastructure.

- Government investments in smart city initiatives are expected to contribute to the rising demand for MEMS technology in urban development.

Market Scope

| Report Coverage | Details |

| Market Size by 2026 | USD 23.14 Billion |

| Market Size in 2025 | USD 20.82 Billion |

| Market Size in 2035 | USD 58.82 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.94% |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Sensor, Actuator, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising adoption in automotive applications

The growing adoption of the micro-electro-mechanical system market in the automotive sector is anticipated to boost the market in the coming years. MEMS technology, widely adopted in the automotive industry, is the key concern in improving the safety, performance, and connectivity capabilities of vehicles. Micro-electro-mechanical system sensors, comprising accelerometers, gyroscopes, and pressure sensors, are critical components of modern ADAS and autonomous vehicles, providing instant data on the vehicle and driving environment. Such features include, but are not limited to, a collision sensor, adaptive cruise control, and lane-keeping assistance. Automotive applications are also benefiting from stiff safety standards being set by governments across the world.

- According to the 2023 WHO report, approximately 1.19 million fatalities occur annually due to road traffic crashes, driving the adoption of this technology.

Restraint

High manufacturing costs

High manufacturing costs of MEMS devices are expected to impede the growth of the micro-electro-mechanical system market. MEMS technology incorporates photolithography, micro-machining, and etching cost factors and adds to the general cost of production. These processes are not easy and simple, and since they require special materials and are processed in clean rooms, the cost of the MEMS components is relatively high. These high manufacturing costs are expected to inhibit the use of MEMS technology, especially in price-sensitive markets and applications in which price is a major factor in end-product selections.

Opportunity

Demand for MEMS in Internet of Things (IoT) applications

High demand for MEMS in Internet of Things (IoT) applications represents a significant opportunity for the micro-electro-mechanical system market. MEMS sensors are essential in IoT gadgets, enabling action, such as movement sensing, climatic sensing, and measurement. This expansion highlights the increasing demand for low-power MEMS sensors and drivers for IoT systems enabling across various networks.

As the IoT environment broadens, especially in the scope of smart homes, smart cities, and industry, the need for MEMS solutions is likely to increase in various segments. Moreover, improvements in MEMS fabrication processes, such as soft lithography, transfer printing, and 3D integration packaging, have also helped bring MEMS devices to the commercial markets and have also contributed to the increasing stability of these devices, making them viable for use in IoT applications.

- According to the National Institute of Standards and Technology, it is estimated that over 75 billion IoT devices will be in use by 2025.

Sensor Type Insights

The micromachined inertial sensors segment dominated the micro-electro-mechanical system market during the forecasting period due to their application in automobiles, portable electronics, consumer electronics, and industrial uses. These sorts of sensors are used for sensing motion, acceleration, and orientation and are thus must-have components in devices, including smartphones, game consoles, and advanced driver-assistance systems (ADAS). The growth in demand for wearable devices with the additional fitness tracking and navigation capability has increased the demand for inertial sensors.

- According to a 2023 report published by the NIH, adults aged 18-49 are more likely to use wearable devices, particularly those with higher household incomes and college education.

The optical sensors segment is projected to lead the market in the future years, owing to the increasing usage in telecommunication, medical-related, and environmental fields. These sensors are used mostly in optical communication technology, fiber optic technology, and medical imaging devices for their high accuracy characteristics. Growing concerns about the environment have also made it possible for optical sensors to track the quality of air and features of pollution. Additionally, these sensors are useful in the development of more sophisticated health diagnostic instruments and noninvasive health instruments.

Actuator Type Insights

The optical segment held the largest revenue share in the micro-electro-mechanical system market during the forecasting period. Optical microelectromechanical systems are mostly used in optical switches and tunable filters and are vital in telecommunication or data centers as well as most networking equipment. They allow the design of high-speed integrated optical devices that offer superior performance and low energy consumption due to well-defined light signal control. Pursuing the adoption of 5G systems and fiber optic communication systems increases the need for enhanced optical solutions in the form of optical MEMS.

Radiofrequency sub-segment is projected to lead the market in the coming years. Low power consumption, high performance, and size compatibility also make the RF MEMS suitable for integration into portable devices. The progressive developments in wireless communication technology, especially with the growth of 5G, clearly place RF MEMS on the trajectory of growth due to the increasing demands for high-speed frequency systems.

- The U.S. Federal Communications Commission (FCC) published in 2024 that the application of 5G technologies will be very fast, and this creates the need for the development of new RF components in the market, such as RF MEMS.

Vertical Insights

The automotive segment dominated the micro-electro-mechanical system market due to the rising use of MEMS sensors in automobiles. Small, lightweight, low-power MEMS devices, including accelerometers, gyroscopes, and pressure sensors, are used to monitor the vehicle dynamics to help safety features, including collision detection, adaptive cruise control, and lane departure systems. EVs and autonomous driving technologies require high-quality MEMS sensors to meet all the requirements of highly sophisticated systems. Furthermore, the increased spending on improving the vehicle's performance, safety, and integrated communication systems further facilitates the market.

- According to the International Energy Agency, nearly one in five cars sold in 2023 was electric, with sales approaching 14 million. Notably, 95% of these sales occurred in China, Europe, and the United States.

The healthcare sub-segment is projected to lead the micro-electro-mechanical system market in the coming years, owing to the growing need for tiny, precise medical instruments. MEMS sensors are finding their application in medical diagnostics, patient monitoring systems, drug delivery systems, and wearable health care devices. These sensors guarantee non-invasive methods, great accuracy, and continuous measurement, which are essential in today's health care. Moreover, membrane electronics and Nanogap technology have raised the demand for MEMS in healthcare sectors due to increased chronic disease cases, the aging population, and the increased use of personalized medicine.

- According to the NIH survey carried out in the year 2024, MEMS is rapidly transforming the medical arena, including the use of implantable devices and point-of-care diagnostic tools, because they are cheaper and more accurate than their counterparts.

Regional Insights

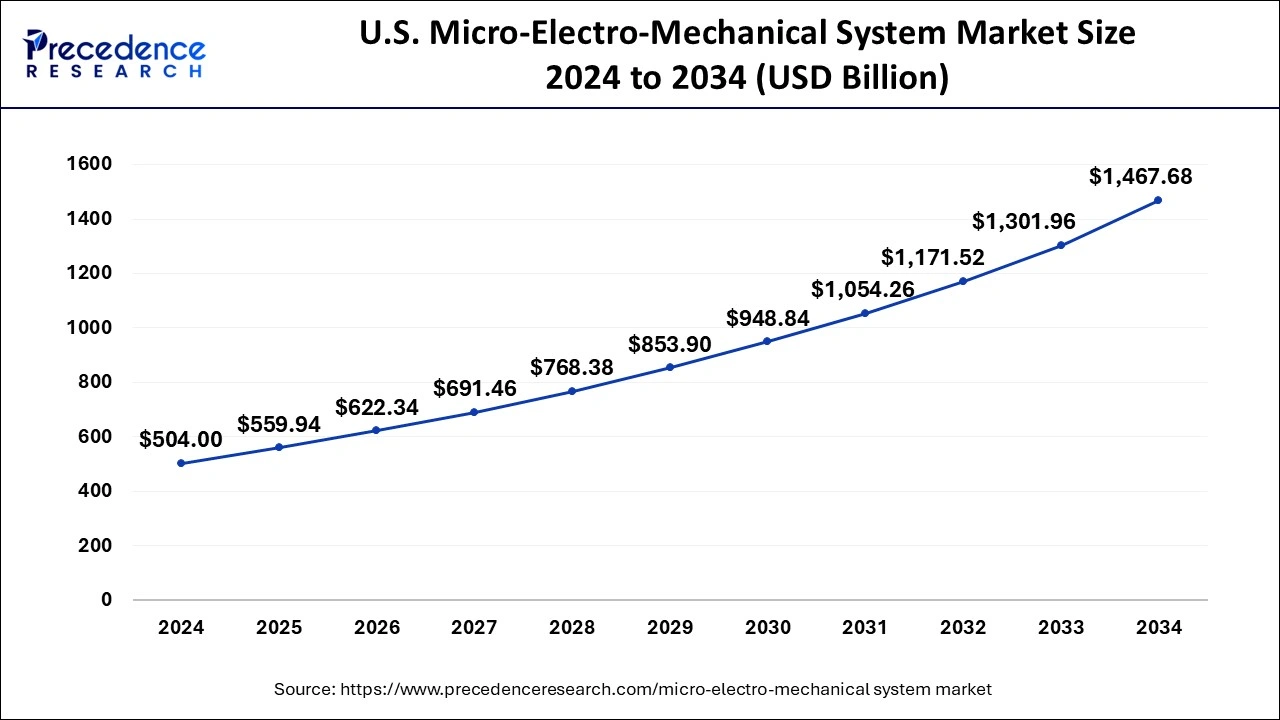

U.S. Micro-Electro-Mechanical System Market Size and Growth 2026 to 2035

The U.S. micro-electro-mechanical system market size is exhibited at USD 559.94 billion in 2025 and is expected to be worth around USD 1,633.40 billion by 2035, growing at a CAGR of 11.3% from 2026 to 2035.

North America dominated the micro-electro-mechanical system market in 2025 due to the advancement of technologies in automotive, healthcare, and telecommunication. Its high concentration in automotive applications, especially in the U.S. and Mexico, is supposed to boost MEMS sensor consumption owing to its importance in self-driving cars and electric cars. Furthermore, the leadership of the North American market, especially in the healthcare and telecommunications sectors.

Asia Pacific is projected to host the fastest-growing micro-electro-mechanical system market in the coming years, owing to the industrialization and new technology networks from countries including China, Japan, and South Korea. It has established itself as one of the leading regions of electronics manufacturing globally, with a special focus on consumer electronics, automobile, and telecommunication industries, where MEMS devices are vital. China's commitment to moving up the technology value chain and developing advanced semiconductor and MEMS industries, the demand for MEMS sensors and actuators has significantly increased across production sectors.

- Based on the projection of the Asian Development Bank in 2024, the automotive industry in the region is projected to expand at a compounded rate as they look for MEMS parts that enable the safety, performance, and networking of automobiles.

What are the Advancements in the Micro-Electro-Mechanical System Market in Europe?

Europe is witnessing significant growth in the market. This growth is due to advancements in IoT and wearable technology, automotive safety regulations, and consumer electronics innovation. Furthermore, Europe hosts several leading pure-play MEMS firms supplying custom inertial, optical, and microfluidic sensors to clients worldwide.

Germany Micro-Electro-Mechanical System Market Trends: The Germany MEMS market is experiencing robust growth, driven by advancements in automotive, healthcare, and consumer electronics sectors. The country is seeing high demand for precision sensors in autonomous vehicles and industrial automation, which is fueling market expansion even more.

What are the key trends in the Micro-Electro-Mechanical System Market in Latin America?

Latin America is set to experience substantial growth throughout the forecast years. This growth is due to various factors such as the proliferation of Internet of Things (IoT) devices, smart sensors in automotive applications, and the expanding healthcare sector requiring miniaturized diagnostic and monitoring devices. Additionally, the region is witnessing rising investments in research and development, propelling the market even market.

Brazil Micro-Electro-Mechanical System Market Trends: Brazil is witnessing rapid growth and development, driven by advancing manufacturing ecosystems and growing consumer bases. Other growth factors include rapid technological advancements and increasing adoption across various sectors such as consumer electronics, automotive, healthcare, and industrial automation.

How is the Middle East and Africa growing in the Micro-Electro-Mechanical System Market?

The Middle East and Africa market is witnessing steady growth in the market and is expected to maintain this growth trajectory throughout the forecast years. Growth is further supported by expanding IoT deployments across smart cities, utilities, and industrial operations. The region is also witnessing advancements in consumer electronics, including wearables and smartphones, which continue to drive demand for compact and high-performance sensors.

Saudi Arabia Micro-Electro-Mechanical System Market Trends: Rising adoption of micro-electro-mechanical system (MEMS) technology into smartphones and other portable electronics, and rising application of compact micro-electro-mechanical system (MEMS) technology by different industrial sectors such as aerospace, automobile, consumer electronics, defence, and many more, may drive the growth.

Micro-Electro-Mechanical System Market Companies

- Texas Instruments Incorporated

- TDK Corporation

- STMicroelectronics

- Robert Bosch GmbH

- Qualcomm Technologies, Inc.

- Panasonic Corporation

- NXP Semiconductors

- Knowles Electronics, LLC

- Infineon Technologies AG

- HP Development Company, L.P.

- Honeywell International Inc.

- Goertek

- DENSO CORPORATION

- Broadcom

- Analog Devices, Inc.

Latest Announcements by Industry Leaders

- January 18, 2024 – Melexis

- Product Manager Pressure Sensors – Karel Claesen

- Announcement- Melexis has unveiled the MLX90830, its first pressure sensor featuring the innovative patented Triphibian™ technology. This miniaturized MEMS pressure sensor is designed for robust measurement of gas and liquid media across a range of 2 to 70 bar. The factory-calibrated sensor measures absolute pressure and provides a proportional analog output signal, enabling cost-effective integration into advanced electric vehicle (EV) thermal management systems. “Access to miniaturized and accurate factory-calibrated MEMS pressure sensors based on Triphibian™ technology allows for centralized thermal management in EVs, enhancing system reliability while reducing size,” said Karel Claesen, Product Manager for Pressure Sensors. The MLX90830 offers versatile integration, functioning as a standalone device or embedded within broader systems.

Recent Developments

- In January 2024, Sumitomo Precision Products Co., Ltd. (SPP), a prominent manufacturer of high-precision industrial products, expanded its presence in the microelectromechanical systems (MEMS) manufacturing sector with the launch of MEMS Infinity. This 150 mm and 200 mm wafer foundry is designed to address growing customer demand, offering services ranging from concept design and evaluation to prototyping and mass production.

- In September 2024, Menlo Micro solidified its position as a key innovator in the microelectronics industry with its groundbreaking Ideal Switch technology. This innovation, resulting from extensive research and development, enhances performance, reliability, and scalability in electronic systems across sectors such as telecommunications, industrial automation, and defense. The company also announced advancements in its technology and unveiled a strategic partnership to bolster defense capabilities.

Segments Covered in the Report

By Sensor

- Pressure Sensor

- Optical Sensor

- Microspeaker

- Microphone

- Inertial Sensor

- Environmental Sensor

- Others

By Actuator

- RF MEMS

- Optical MEMS

- Microfluidics

- Inkjet Print Heads

- Others

By Vertical

- Telecommunication

- Others

- Industrial

- Healthcare

- Consumer Electronics

- Automotive

- Aerospace and Defense

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content