Optical Sensor Market Size and Forecast 2025 to 2034

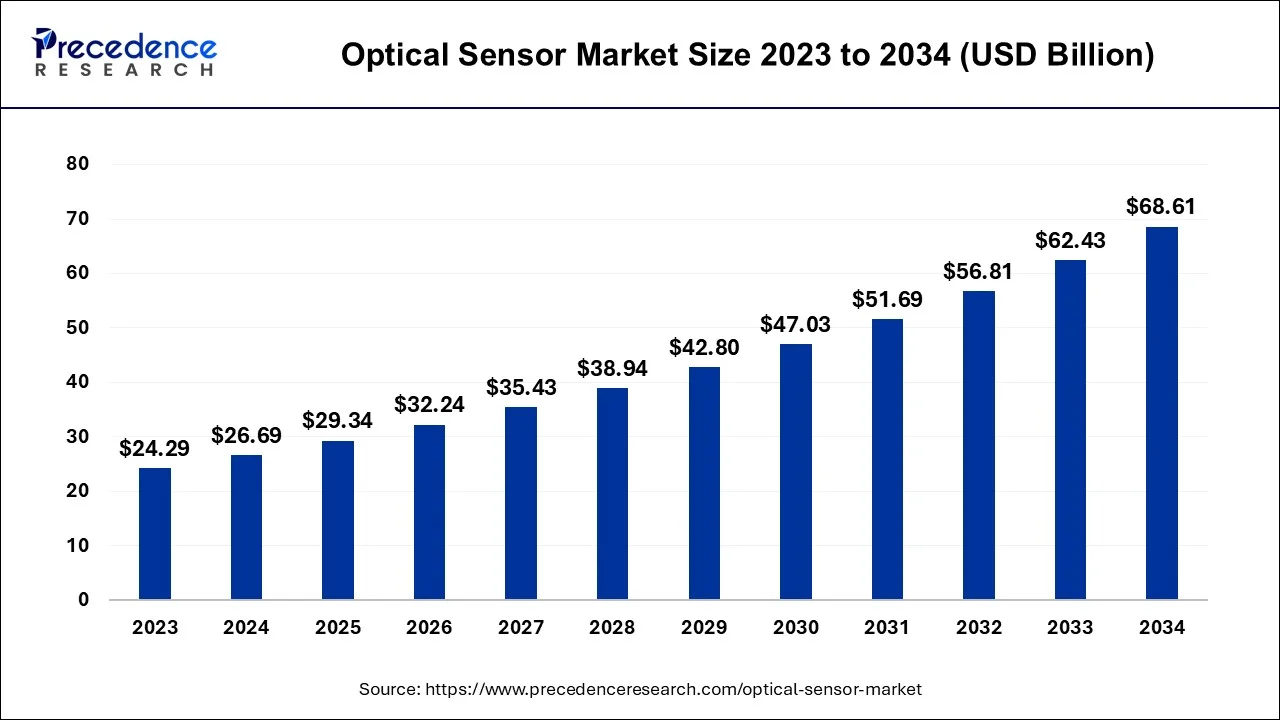

The global optical sensor market size accounted at USD 26.69 billion in 2024 and is anticipated to reach around USD 68.61 billion by 2034, expanding at a notable CAGR of 9.90% between 2025 and 2034.

Optical Sensor Market Key Takeaways

- In terms of revenue, the optical sensor market is valued at $29.34 billion in 2025.

- It is projected to reach $68.61 billion by 2034.

- The optical sensor market is expected to grow at a CAGR of 9.90% from 2025 to 2034.

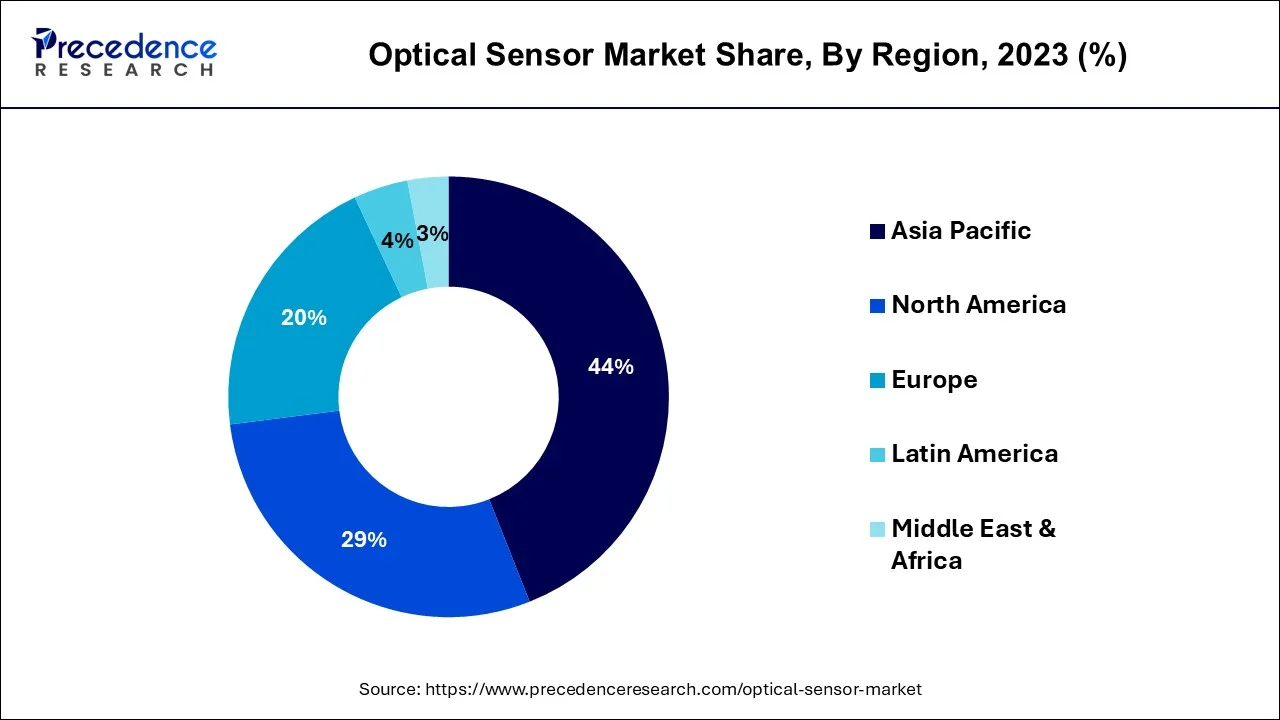

- Asia Pacific contributed more than 44% of revenue share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

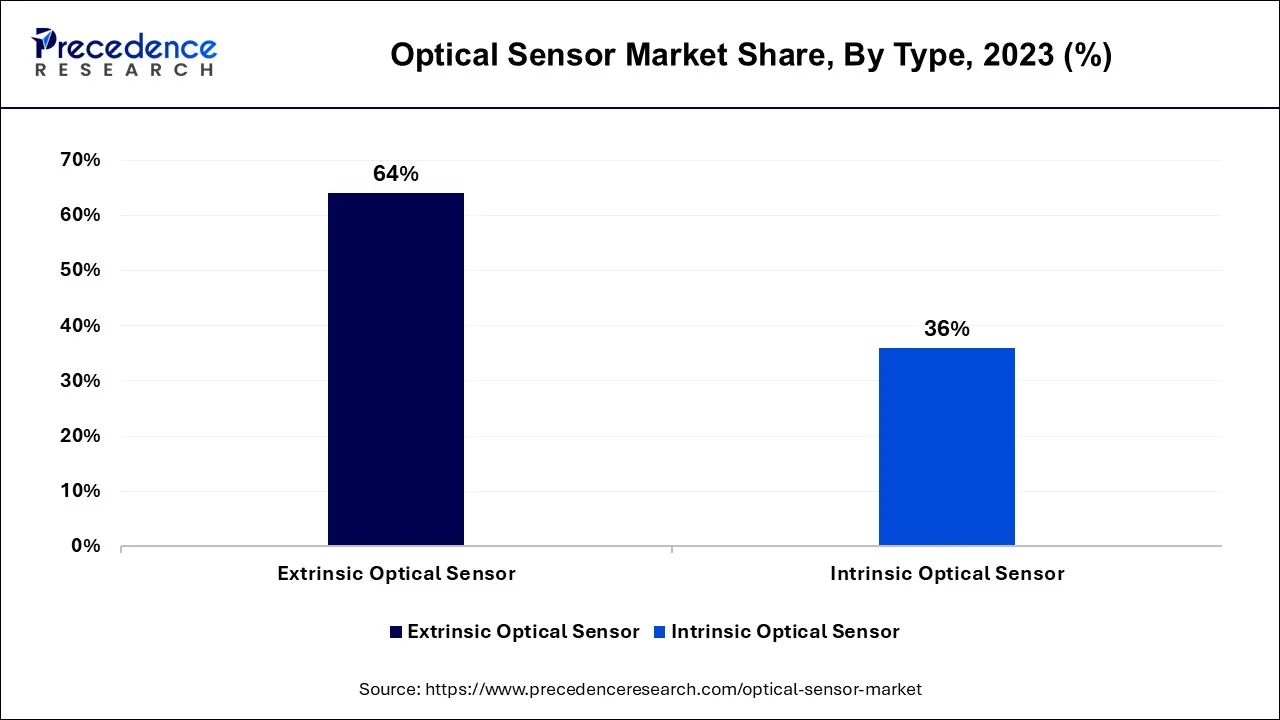

- By Type, the extrinsic optical sensor segment has held the largest market share of 64% in 2024.

- By Type, the intrinsic optical sensor segment is anticipated to grow at a remarkable CAGR of 10.8% between 2025 and 2034.

- By Sensor Type, the image sensor segment generated over 35% of revenue share in 2024.

- By Sensor Type, the ambient light and proximity sensor segment is expected to expand at the fastest CAGR over the projected period.

- By Application, the consumer electronics segment had the largest market share of 32% in 2024.

- By Application, the medical segment is expected to expand at the fastest CAGR over the projected period.

Asia Pacific Optical Sensor Market Size and Growth 2025 To 2034

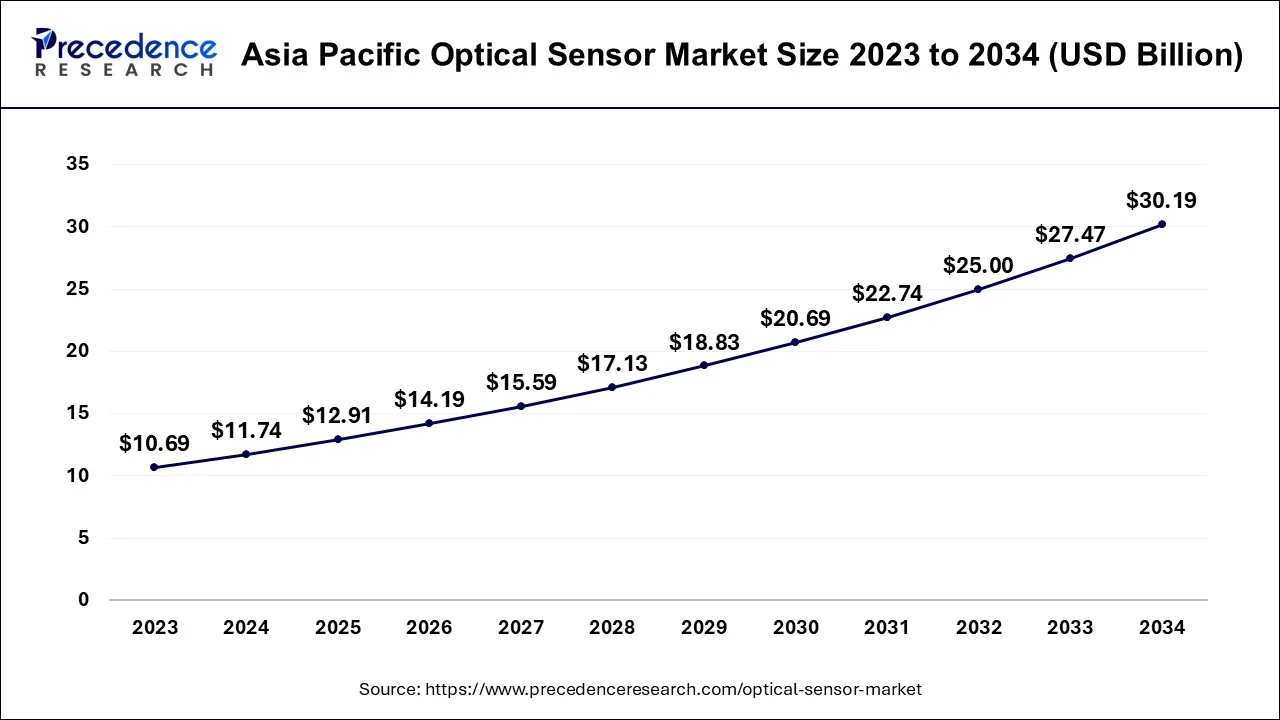

The Asia Pacific optical sensor market size was estimated at USD 11.74 billion in 2024 and is expected to be worth around USD 30.19 billion by 2034, rising at a CAGR of 9.91% from 2025 to 2034.

Asia Pacific held the largest revenue share of 44% in 2024. Asia Pacific dominates the optical sensor market due to several key factors. The region is a global hub for electronics manufacturing, with countries like China, Japan, South Korea, and Taiwan leading in production. The presence of major consumer electronics manufacturers, automotive companies, and an expanding healthcare sector drives demand for optical sensors. Additionally, the region experiences rapid industrial automation and smart city development, increasing the need for optical sensor applications. Government initiatives, technological advancements, and a large customer base further solidify Asia-Pacific's leading position in the optical sensor market.

Asia Pacific is dominating the optical sensor market. The rapid growth in the smartphone and automotive industry is highly empowered by advanced technologies. The advanced driver-assistance system in automotive and facial recognition, and other features in the smartphone industry, are approaching the optical sensor industry. Industrial goods and consumer electronics are focusing on advancement by utilizing optical sensors in their products and applications.

North America is estimated to observe the fastest expansion. North America commands a major growth in the optical sensor market due to several factors. The region boasts a strong presence of key industry players and leading technological innovators. Additionally, North America's advanced healthcare and automotive sectors drive the demand for optical sensors in applications like medical devices and autonomous vehicles. Robust investments in research and development, along with a focus on emerging technologies, have propelled market growth. Moreover, favorable government regulations and initiatives supporting the adoption of optical sensors, particularly in healthcare and aerospace, contribute to North America's prominent position in the global optical sensor market.

Market Overview

The opticalsensor marketfocuses on the production and commercialization of optical sensors, which are specialized devices engineered for the detection and precise measurement of light and various electromagnetic radiation forms. These sensors serve numerous applications, spanningconsumer electronics, automotive technology, industrial automation, healthcare, and diverse industries. The market has witnessed substantial growth, primarily driven by technological advancements like CMOS image sensors, LiDAR systems, and optical fingerprint recognition, alongside the escalating demand resulting from the widespread adoption of smart devices, automation, andthe expansive Internet of Things(IoT) landscape.

Optical Sensor Market Growth Factors

- Continuous innovations in optical sensor technology drive market growth. As the Internet of Things expands, the demand for optical sensors in connected devices rises.

- The proliferation of smartphones, tablets, and wearables fuels the demand for optical sensors. Optical sensors are integral to advanced driver assistance systems (ADAS) and autonomous vehicles.

- The manufacturing sector relies on optical sensors for quality control and automation. Optical sensors are used in medical devices for diagnostics and monitoring.

- Optical sensors aid in monitoring air and water quality, supporting environmental initiatives.

- Demand for optical sensors in security cameras and systems is increasing. Optical sensors enable touchless interfaces, enhancing user experiences.

- These technologies depend on optical sensors for motion tracking and immersion.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.90% |

| Market Size in 2024 | USD 26.69 Billion |

| Market Size in 2025 | USD 29.34 Billion |

| Market Size by 2034 | USD 68.61 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Sensor Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing demand in consumer electronics

The optical sensor market is experiencing robust growth, primarily propelled by the increasing appetite for consumer electronics. Everyday devices such as smartphones, tablets, and smartwatches have become indispensable in people's daily lives, and optical sensors are integral to these gadgets. They empower features like automatic screen brightness adjustment based on surrounding light conditions, secure fingerprint recognition, and sophisticated camera functionalities. Consumers' desire for more versatile, secure, and advanced electronic devices is a significant catalyst for this market's expansion.

Furthermore, emerging technologies like augmented reality and virtual reality heavily rely on optical sensors for precise motion tracking and immersive user experiences. In summary, the soaring demand for feature-rich consumer electronics is a central driver behind the optical sensor market's growth, fostering continual technological advancements and expanding opportunities for the industry.

Restraint

Limited range and line-of-sight requirement

The constraint of limited range and the requirement for a direct line of sight are significant challenges that hinder the growth of the optical sensor market. Optical sensors, although highly precise and versatile, typically have restricted detection ranges and rely on unobstructed lines of sight between the sensor and the target. This limitation curtails their utility in various scenarios. In applications where extended sensing distances are imperative, such as long-range surveillance or monitoring, optical sensors often fall short, necessitating the deployment of alternative technologies like radar or LiDAR.

Moreover, in cluttered or obstructed environments, the need for a clear line of sight makes optical sensors impractical, further limiting their applicability. This constraint is especially pronounced in autonomous vehicles, drones, and robotics, where navigating complex and unpredictable environments is a paramount requirement. Addressing the challenge of range and line-of-sight restrictions is a critical focus area for the optical sensor market to broaden its scope and impact in a wider array of industries and applications.

Opportunity

Healthcare innovations

The realm of healthcare innovations has unlocked promising prospects within the optical sensor market. Optical sensors are emerging as pivotal instruments in the ever-evolving healthcare landscape, with multifaceted applications that serve as potent drivers of market expansion. Foremost, optical sensors constitute the backbone of wearable health devices, offering continuous monitoring of vital signs such as heart rate, blood oxygen levels, and blood pressure. The rising need for remote patient monitoring, particularly in chronic disease management, elder care, and post-operative recovery, underscores the growing demand for these sensors.

Additionally, non-invasive diagnostic tools, such as pulse oximeters and glucose monitors, depend on optical sensors to deliver swift and painless measurements. As these technologies advance in precision and user-friendliness, their adoption is poised for substantial growth, particularly in the context of home-based healthcare.

Furthermore, the landscape of telemedicine and telehealth applications reaps the benefits of optical sensors, facilitating remote patient consultations and diagnoses. This trend is expected to persist and expand, especially in the aftermath of the healthcare transformations precipitated by the pandemic. In a healthcare arena that prioritizes precision and minimally invasive solutions, optical sensors emerge as indispensable instruments for enhancing patient care, monitoring, and diagnostic capabilities, thereby offering an abundance of opportunities for both market expansion and technological evolution.

Technological Advancement

Technological advancements in the optical sensor market feature wireless sensors, smart technology, LIDAR, and miniaturization. Wireless sensor technology provides flexibility and smooth installation. It applies to applications such as industrial monitoring and home automation. The miniaturization is convenient because of its small, compact size. It's used in various applications and devices, most probably in medical devices and consumer electronics. Smart technology consists of machine learning and AI. The quick response and advanced features incorporate reliable data. LIDAR advancement is a component of the autonomous driving system and ADAS, used in optical detection. These technologies are a contribution to several sectors, including the optical sensor market. It encourages pace for innovation and development in the market.

Impact of COVID-19

- COVID-19 disrupted global supply chains, causing shortages in electronic components and raw materials required for optical sensor manufacturing. Factory closures, logistics interruptions, and increased lead times affected the production and delivery of optical sensors, leading to delays and increased costs. Manufacturers faced challenges in sourcing critical components, including semiconductors and specialty glass, which are vital for optical sensor production. This impacted on the overall supply chain efficiency and caused temporary shortages.

- The pandemic accelerated the adoption of remote working and telehealth solutions, creating increased demand for webcams, biometric sensors, and optical components for medical devices. On the other hand, the demand for optical sensors in industries such as automotive and manufacturing slowed down due to production shutdowns and reduced consumer spending. As a result, optical sensor manufacturers had to adapt to shifting demand patterns and adjust their production accordingly.

- COVID-19 highlighted the importance of hygiene and touchless interactions. This increased R&D efforts in developing optical sensors for touchless interfaces, gesture recognition, and biometric applications to reduce physical contact points and improve overall safety. Research and development initiatives focused on enhancing sensor accuracy and expanding applications in areas such as healthcare, security, and smart home devices, reflecting the evolving needs in a post-pandemic world.

- The pandemic emphasized the importance of remote patient monitoring and telemedicine. Optical sensors, particularly those used in pulse oximeters and diagnostic equipment, became critical in providing accurate and real-time health data for remote consultations. The healthcare sector saw increased investments in optical sensor technologies to support telehealth services, enabling healthcare providers to remotely monitor patients and make timely assessments. This shift may have long-term implications for the adoption of optical sensors in the healthcare industry.

Type Insights

According to the type, the extrinsic optical sensor segment has held 64% revenue share in 2024. The extrinsic optical sensor segment commands a significant share in the optical sensor market due to its versatility and wide-ranging applications. These sensors, which rely on external factors to modify their optical properties, offer flexibility in measuring various parameters such as temperature, pressure, and strain. They find extensive use in industries like aerospace, automotive, and healthcare for their precision and reliability.

Additionally, their compatibility with optical fiber technology contributes to the market share, as optical fiber systems gain prominence in sectors like telecommunications and data transmission, further cementing the extrinsic optical sensor's leading position in the market.

The intrinsic optical sensor segment is anticipated to expand at a significant CAGR of 10.8% during the projected period. The commanding growth of the intrinsic optical sensor segment within the optical sensor market can be attributed to its innate qualities of exactitude, steadfastness, and adaptability. Intrinsic optical sensors are supported by the elemental principles of light manipulation, endowing them with unparalleled precision across a wide spectrum of applications. They exhibit exceptional prowess in gauging an array of physical and chemical attributes, spanning temperature, pressure, and refractive indices, rendering them indispensable in industries such as healthcare, aerospace, and telecommunications.

Moreover, they carve a distinct niche in the realms of scientific exploration and laboratory environments. Their esteemed repute for robustness, coupled with their capability to function seamlessly in the most demanding conditions, contributes significantly to their substantial market growth. This is especially evident in mission-critical applications where precision is the ultimate benchmark.

Sensor Type Insights

Based on the sensor type image sensor segment is anticipated to hold the largest market share of 35% in 2022. The Image Sensor segment holds a major share in the optical sensor market primarily due to its widespread applications in consumer electronics, such as smartphones and digital cameras. Image sensors are fundamental for capturing high-quality photographs and videos, driving the demand for advanced image sensor technology.

Additionally, the growing popularity of applications like facial recognition, gesture control, and augmented reality heavily relies on image sensors. These sensors offer superior performance in terms of resolution, color accuracy, and low-light sensitivity, making them indispensable in modern imaging and visual applications, thus contributing significantly to their market dominance.

On the other hand, the ambient light and proximity sensor segment is projected to grow at the fastest rate over the projected period. The ambient light and proximity sensor segment holds a significant share in the optical sensor market due to its wide-ranging applications in consumer electronics, especially smartphones and tablets. Ambient light sensors adjust screen brightness, enhancing user experience and conserving power. Proximity sensors enable features like touchless gestures and call handling.

Additionally, the emphasis on energy efficiency and the growing demand for touchless interfaces in the wake of the COVID-19 pandemic have further boosted the adoption of these sensors. Their ability to improve user convenience, device efficiency, and hygiene underscores their substantial market presence and growth.

Application Insights

In 2024, the consumer electronics segment had the highest market share of 32% on the basis of the application. The paramount position of the consumer electronics segment in the optical sensor market can be ascribed to its pervasive assimilation of optical sensors across a spectrum of devices, ranging from smartphones and tablets to laptops and wearables. These sensors are the keystones, enabling vital functionalities such as facial recognition, adaptive luminance control, contactless gesturing, and high-definition imaging.

With consumers' ceaseless demand for progressively advanced and multifaceted devices, the consumer electronics industry sustains its role as the foremost driving force in expanding the optical sensor market. Furthermore, the ascent of emerging technologies like augmented reality (AR) and virtual reality (VR) underscores the pivotal status of optical sensors, solidifying their vanguard position within the intricate domain of consumer electronics.

The medical segment is anticipated to expand at the fastest rate over the projected period. The medical segment commands a significant share in the optical sensor market due to the critical role optical sensors play in healthcare applications. They are widely used in medical devices for non-invasive monitoring of vital signs, such as pulse oximeters and glucose monitors. With the increasing focus on remote patient monitoring and telemedicine, optical sensors have gained prominence in delivering accurate health data for remote consultations. Their precision, reliability, and ability to enhance patient care have positioned them as indispensable tools in the healthcare sector, driving a substantial market share in this application domain.

Optical Sensor Market Companies

- Hamamatsu Photonics

- ON Semiconductor

- ams AG

- Teledyne Technologies

- Vishay Intertechnology

- STMicroelectronics

- First Sensor AG

- Sony Corporation

- Texas Instruments

- Avago Technologies (Broadcom)

- Balluff

- Sick AG

- Analog Devices

- Rockwell Automation

- Keyence Corporation

Recent Developments

- In April 2025, Indian scientists developed an eco-friendly silk-based optical sensor for early cholesterol detection. A new optical sensor platform is based on silk fibre functionalized using phosphorene quantum dots. Source: zeenews.india.com

- In May 2025, the DLR established a new Institute of Space Research to advance optical sensor technologies and planetary science. A huge contribution to medical science is engaging new future professionals in the optical sensor market. Source: spacedaily.com

- In November 2024, an optical sensor manufactured by ABB was deployed with the successful launch of the satellite Hugo from GHGSat, the emerging leader in greenhouse gas sensing services in space. Source: envirotech-online.com

- In October 2022, Lumotive and Gpixel joined forces to introduce an innovative reference design platform. This platform combines advanced 3D lidar and CMOS image sensors, making it easier for companies to embrace cutting-edge 3D lidar technology, especially in mobility and industrial applications like autonomous navigation of robots in logistics settings. The collaboration leverages Gpixel's remarkable GTOF0503 indirect time-of-flight image sensor, which, when paired with Lumotive's LM10 beam steering chip, offers a compelling solution for medium to long-range 3D applications. This partnership underscores the exceptional precision and versatility inherent in Gpixel's sensor technology.

- In July 2022,Sony Corporation made an exciting announcement regarding the impending launch of the IMX675. This state-of-the-art 1/3-type CMOS image sensor is designed for security cameras and boasts an impressive 5.12-megapixel resolution. What sets it apart is its ability to simultaneously provide a full-pixel output of the captured image and rapid production of areas of interest, catering to the evolving needs of security camera applications.

Segments Covered in the Report

By Type

- Extrinsic Optical Sensor

- Intrinsic Optical Sensor

By Sensor Type

- Fiber Optic Sensor

- Image Sensor

- Photoelectric Sensor

- Ambient Light and Proximity

By Application

- Industrial

- Medical

- Biometric

- Automotive

- Consumer Electronics

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting