What is the Position Sensor Market Size?

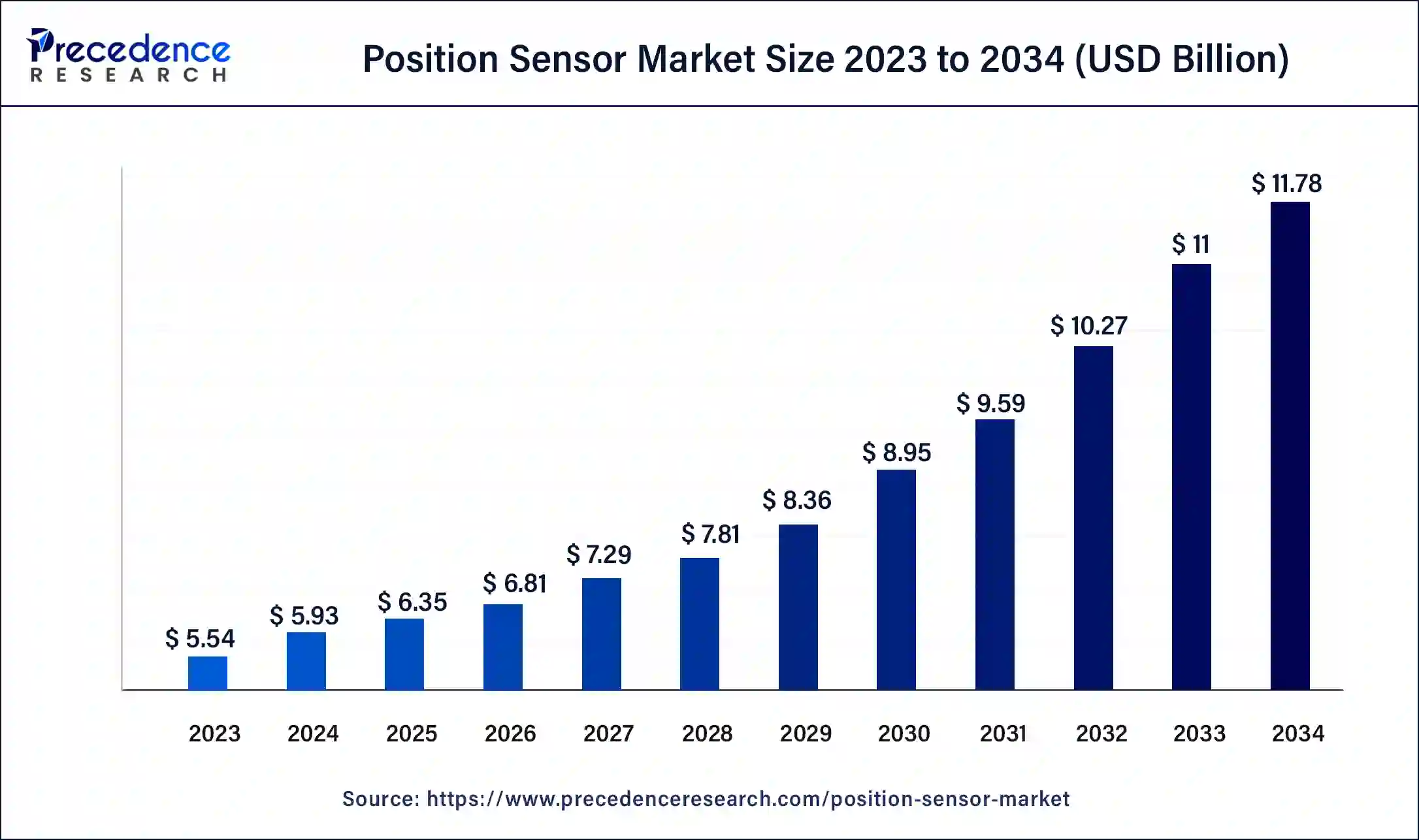

The global position sensor market size is calculated at USD 6.35 billion in 2025 and is predicted to increase from USD 6.81 billion in 2026 to approximately USD 12.53 billion by 2035, expanding at a CAGR of 7.03% from 2026 to 2035. Rising trends towards automation in industries like automotive, packaging, military & aerospace, etc., contribute to the market's growth.

Position Sensor Market Key Takeaways

- The global position sensor market was valued at USD 6.35 billion in 2025.

- It is projected to reach USD 12.53 billion by 2035.

- The position sensor market is expected to grow at a CAGR of 7.03% from 2026 to 2035.

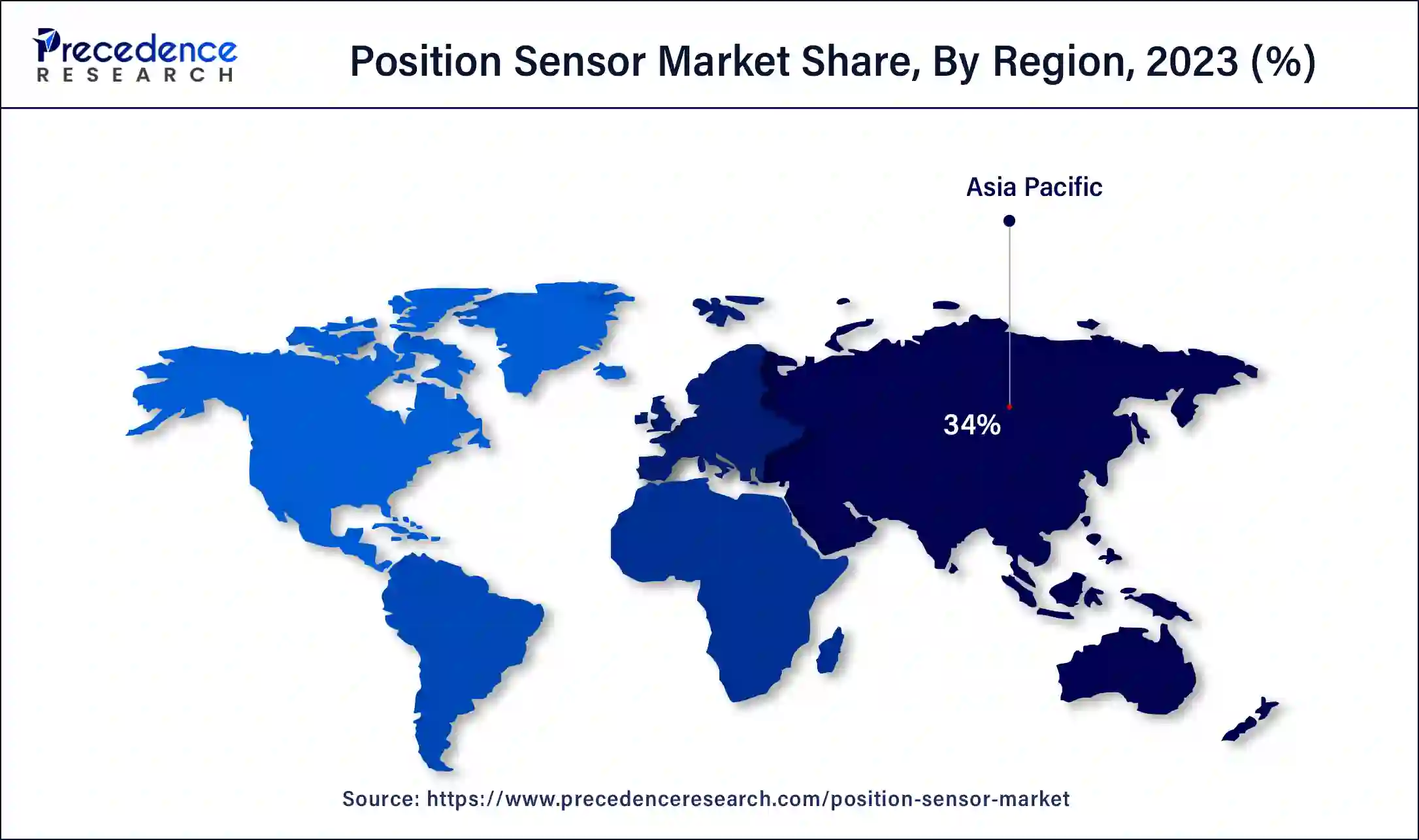

- Asia Pacific dominated the position sensor market with the largest market share of 34% in 2025.

- North America is estimated to be the fastest-growing during the forecast period of 2026 to 2035.

- By technology, the proximity sensors segment dominated the market in 2025.

- By technology, the photoelectric sensors segment is expected to be the fastest-growing during the forecast period.

- By application, the automotive segment dominated the position sensor market in 2025.

- By application, the automotive, electronics & semiconductors sectors segment is anticipated to be the fastest-growing during the forecast period.

Position Sensors Enhanced with Artificial Intelligence Modify Accuracy and Awareness

Artificial intelligence is a transformative force in the position-sensor market. STMicro has earlier this year made headlines by expanding its MEMs sensor portfolio, in a common sign of consolidation on AI-enabled edge sensing.; Bosch showed off a few demos of AI-powered sensors at CES, and committed to additional billion-dollar investments to build intelligent processing on the devices.

Multi-sensor fusion enables repeatable accuracy in automotive and industrial localization, and vendors are embedding neural processing for anomaly detection and adaptive calibration at the front-end. These developments and the accession of edge-AI toolkits and faster silicon enables production, smarter, safer, enhanced speed and speed of deployments today.

What is the Position Sensor?

The position sensor market refers to a position sensor service provider, which is an electrical device that measures position, distance, length, or displacement to monitor, test, or automate processes. A position sensor is a device that measures mechanical position. It may indicate the absolute location (position) or relative displacement (position) in terms of three-dimensional, linear travel, or rotational angle. The common types of position sensors include sensors that can detect the absence or presence of an object, proximity-type position sensors, and contact-type position sensors. These factors help to the growth of the market.

Position Sensor Market Growth Factors

- The benefits of position sensors include the capability to detect both the speed and position of the crankshaft, high stability, and precision over a high range of temperatures that contribute to market growth.

- It also includes it provides a digital signal which makes it easier to interface with modern ECU (electronic control unit).

- The applications of position sensors include home appliances, gaming, aerospace applications, robotics, research, testing, and lab applications that help the position sensor market grow.

- It also includes handling and lift systems, medical equipment, in-vehicle testing, machinery, and measurement and automation applications.

Trade Analysis of Position Sensor Market

- During the TTM period, India imported a total of 2,482 shipments of Position Sensor.

- The shipments were from foreign exporters to 65 Indian buyers.

- Position Sensors are mainly imported by India from Japan, the US, and Brazil.

- On the world market, the largest importers are India, Mexico, and Vietnam, with 2,480 shipments. India is the world's largest import market.

- Mexico comes in second place with 2,368 shipments.

- Third place is occupied by Vietnam with 2,301 shipments.

Market Outlook

- Industry Growth Overview: The continuous expansion of automation in the sectors of automotive, robotics, and industrial systems guarantees a high demand.

- Sustainability Trends: The sensors integrated with IoT help in making energy consumption more efficient and in achieving more eco-friendly manufacturing processes.

- Global Expansion: Asia Pacific is the fastest adopter, while growth in Europe and North America is gradual but continuous.

- Major Investors: Europas, NSF, Plug and Play, and EIC Fund provide financial support for the development of new technologies.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 12.53 Billion |

| Market Size in 2025 | USD 6.35 Billion |

| Market Size in 2026 | USD 6.81 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.03% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand for the automotive industry and the trend towards automation for production process

The rising demand for the automotive industry and the trend towards automation for production processes are driving the growth of the position sensor market. In the automotive industry, market benefits include high durability, precision, reliability, and non-contact measurement. They perform vehicle efficiency, performance, and safety by providing precision provisional data. Position sensors are essential components designed to measure the angles of engines, monitor the position of the motor, measure seat position, record clutch position, etc., contributing to the growth of the market.

- In April 2024, the sensor company SICK grew and expanded its AI-sensor solutions, and its sales increased by 5.4% to 2.3 million euros. Additionally, the company may record the above 70 patent applications for AI-based automation and software solutions.

Restraint

Limitations of position sensors

The limitations of the position sensors can hamper the growth of the position sensor market. It includes limitations of high expenses for high precision and accuracy requirements, sensitivity to extreme temperatures, dust, and wear & tear, physical size limitations, less sensing angle, wear out because of moving parts, low repeatability, limited frequency, and low accuracy. The output signal created by the position sensor may be interrupted by magnetic and electrical materials.

Opportunity

Opportunities in the sensor technologies

The opportunities in the military & aerospace, and automotive industries contribute to the growth of the position sensor market. Sensor technologies are driving the future of electronics. The 5G-enabled sensors enhance data transmission, augmented reality sensors improve the user experience, biometric sensors improve authentication and security, AI-enabled sensors contribute to new opportunities, wearable sensors allow healthier lives, smart sensors generate new applications, and IoT-enabled sensors demand continues to rise.

- In July 2024, in India, the Moto G85 5G smartphone was launched by Motorola. The smartphone features include a Sony Lytia sensor for the main camera and Gorilla Glass 5 protection the 3D curved display at the front.

Segment Insights

Technology Insights

The proximity sensors segment dominated the position sensor market in 2024. Proximity sensors are highly used in manufacturing and industrial applications, mainly in the areas of safety and stock management. It is used for object placement, inspection, counting, and identification in an automated production line. These are also used for consumer electronics. The features of only metal detection are short sensing range, long life, short response time, high precision, usability in severe environments, and non-contact detection.

The proximity sensor advantages include being helpful in many security problems; in terms of power usage, a capacitive sensor is helpful, has power consumption and low cost, operates in critical environmental conditions, has a high switching rate and high speed, has good stability, and also it can detect metals and also non-metals. Applications of proximity sensors include agriculture food manufacturing and processing, level detection, process control, quality assurance and inspection, transportation, logistics, supply chain, and standard object position detection.

- In April 2024, OSLO Norway, Xiaomi's latest smartphone, the Redmi Turbo 3 smartphone, was launched by a global AI software company and the world leader in AI Virtual Smart Sensors, Elliptic Labs.

The photoelectric sensors segment is expected to be the fastest-growing during the forecast period. The photoelectric sensor emits light from the transmitter, which consists of light-emitting elements.

The types of photoelectric sensors include diffusive sensors, retro-reflective sensors, and through-beam sensors. The photoelectric sensor features include simple optical axis adjustment and wiring. It is not affected by object inclination, color, or gloss and is easy to adjust. The long life of sensors and no contact with objects reduces chances of physical damage, has a high resolution, has a fast response time, and can detect any object, including liquid, wood, plastic, or glass, and long sensing distance.

- In June 2024, in India, Hikrobot launched the new Machine Vision Photoelectric Sensors for different distance detection applications. These photoelectric sensors were launched to allow a high range of applications across the verticals.

Application Insights

The automotive segment dominated the position sensor market in 2024. The position sensors are important components designed to measure the angle of the engines, monitor the motor position, measure seat position, record clutch position, select the gear position, the pedal position of the accelerometer and brakes, track the steering wheel angle, and check the level of fuel. It is used for steering angle detection, brushless motor control, fuel injection, ignition timing, low noise measurement, resilience to shock and vibration, high linearity, and no hysteresis, measuring motor position, seat position, clutch position, gear position, brake pedal position, steering wheel angle, fuel level, and throttle angle.

- In June 2024, Vitesco Technologies reevaluated the new product offering, the Rotor Lock Actuator for EV safety, which is focused on the EV market. The functions of the Rotor Lock Actuator include cutting costs, simplifying system designs, rotor position sensing, and park locking.

The automotive, electronics & semiconductors sectors segment is anticipated to be the fastest-growing during the forecast period. Position sensors in automotive, electronics & semiconductors sectors applications offer many benefits, including use for steering angle detection, brushless motor control, fuel injection, ignition timing, etc. In electronics, position sensors are used to provide counting, motion control, and encoding tasks by determining the absence or presence of a target or by detecting its distance, motion, speed, or direction. It also includes the benefits of the potentiometric sensors being highly accurate and inexpensive; optical sensors have high resolution and are highly accurate, which helps to position sensor market growth.

Regional Insights

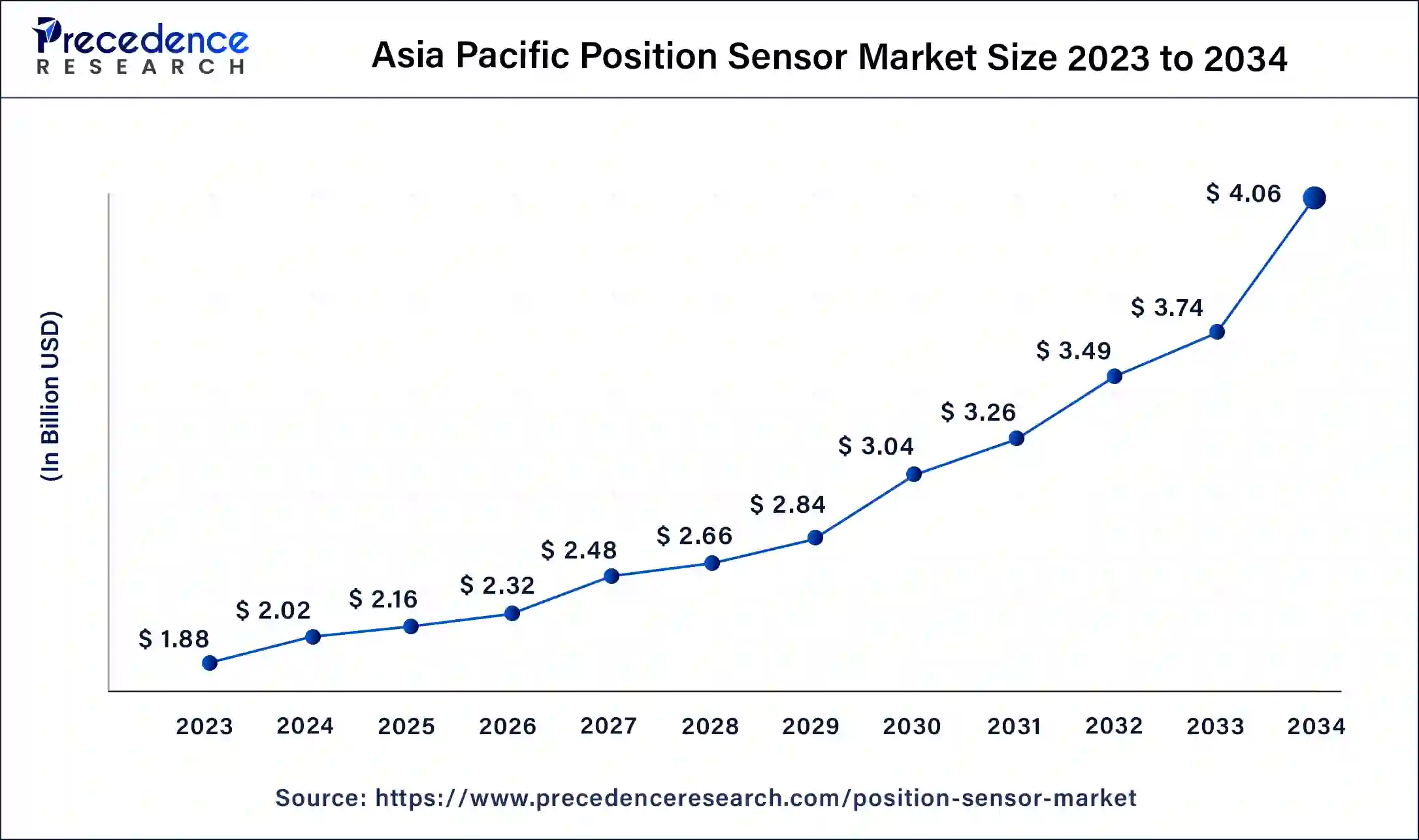

What is the Asia Pacific Position Sensor Market Size?

The Asia Pacific position sensor market size is exhibited at USD 2.16 billion in 2025 and is projected to be worth around USD 4.33 billion by 2035, poised to grow at a CAGR of 7.20% from 2026 to 2035.

Asia Pacific dominated the position sensor market in 2024. Increasing industrial manufacturing and increasing industries for consumer electronics devices like laptops and smartphones in the Asia Pacific region are leading the market's growth. Low cost of manufacturing, high quality, accuracy sensors, and equipment contribute to the growth of the market in the Asia Pacific region.

The position sensor market in China is being driven by increasing electric vehicle production, major pre-investments in industrial automation, and the rapid development of robotics for manufacturing, and logistics applications. Overall demand is growing largely because of smart factory deployments that are being driven by national initiatives to digitize industry. Additionally, strong local manufacturing capabilities and increased development of semiconductors will further enhance China's position as a major volume, fast-growing market for position sensors.

- In May 2024, in India, smartphones were launched by Realme, Motorola, Oppo, and others, including Realme Narzo 70 Series, Moto Edge 50Pro, G64, Nord CE 4, and more.

North America is estimated to be the fastest-growing during the forecast period of 2025-2034. There is increasing competition in the North American region as many key players are consistently coming up with cutting-edge products to develop industrial needs. The increasing trend towards wireless sensor technology adoption helps to the growth of the position sensor market.

- In August 2024, in the United States, the patented Alfred ML2 Smart Mortise Lock with Z-wave long range was launched by the smart and connected lock subsidiary of GHT Door Hardware, Alfred International. The ML2 comes standard with a door position sensor, which improves security and allows smart auto-relock capabilities.

The United States remains a significant market for position sensors, driven by its strong automotive manufacturing and increasing robotics adoption, and rapid advancements of automation within industry settings. Demand for accurate motion control in aerospace, semiconductor production and advanced medical equipment will also continue to support upward deployment numbers. Research and development activity in support of new sensor technologies and the presence of position sensor companies further encourage innovation and commercial acceptance.

Is the Europe's Strong Industrial Automation driving the Market?

Europe's position sensor market benefits greatly advanced manufacturing ecosystems, increasingly higher adoption of robots, and high automotive safety standards. Focused investments in Industry 4.0, factory digitalization, and precision engineering are creating significant growth in sensor use across machinery, consumer electronics, and healthcare devices. Rapid electric vehicle (EV) production growth and supportive regulations for motion-control technologies continue to deepen adoption across Germany, France, and Italy. The region also has very strong semiconductor capabilities, enabling greater reliability and innovation in sensor use.

Germany's overall European leadership is due to the robust automotive manufacturing base, large use of robotics, and early adoption of Industry 4.0 technologies. The high demand for precision motion-control component in machinery, EV production, and automation equipment will continue to support Germany's accelerated use of position sensors.

How Middle East & Africa is Prospects for Industrial Modernization?

Due to ongoing industrial modernization activities, increasing adoption of automation in oil & gas facilities and additional spending on smart infrastructure, the Middle East & Africa region is developing into an emerging market. GCC countries are prioritizing digital transformation to facilitate greater deployment of motion-sensing technologies to utilities, transportation, and industrial equipment. In Africa, manufacturing expansion and greater electronics assembly capabilities are starting to create opportunities for growing sensor adoption.

United Arab Emirates

The United Arab Emirates is taking the lead across the region with its strong emphasis on smart city development, utility automation, and modernization of transportation systems. Ongoing industrial diversification efforts and technology-resilient policies are continuing to drive demand for position sensor technology across infrastructure and industrial applications, regardless of which companies actually implement them first.

Value Chain Analysis of the Position Sensor Market

- Raw Material Procurement: Obtaining silicon wafers and specialized chemicals, which are indispensable for the manufacture of position sensors with high reliability.

Key players: Dow, Shin-Etsu - Wafer Fabrication: The process of creating electrical circuits on semiconductor wafers under thoroughly clean and controlled manufacturing environments.

Key players: TSMC, Intel - Photolithography and Etching: The procedure of circuit pattern transfer and layer removal that leads to the creation of the sensor structure.

Key players: ASML, Applied Materials - Doping and Layering Processes: The techniques of modifying semiconductor traits and depositing layers to make possible the electrical connections.

Key players: Lam Research, KLA Corporation - Assembly and Position Sensor Packaging: Trimming dies, sensor housing, functionality testing, and even the readiness of integration into the system.

Key players: ASE Group, Amkor Technology

Position Sensor Market Companies

- Vishay Intertechnology, INC.: Offers mainline electronic materials comprising resistors and strain gages, which are essential for the high precision positioning and measurement sensors.

- Siemens AG: Provides automation platforms along with industrial sensors as part of its global engineering portfolio.

- Sick AG: The company produces various types of industrial sensors, encoders, and lasers for factory and logistics automation.

Other Major Key Players

- Sensata Technologies

- Schneider Electric SA

- Optek Technology

- Leuze Electronics GmbH + Co. KG

- Keyenence Corporation

- iFM Efector, Inc.

- Honeywell International, Inc.

- Heidenheim

- CTS Corporation

- Bourns, Inc.

- Banner Engineering

- Balluff GmbH

Recent Developments

- In October 2025, Renesas Electronics Corporation launched a new family of magnet-free Inductive Position Sensor integrated circuits: RAA2P3226, RAA2P3200, and RAA2P4200. These ICs offer high resolution and robust performance, along with a web-based design tool for customizing sensing elements. (Source: https://www.bisinfotech.com )

- In July 2025, STMicroelectronics plans to acquire NXP Semiconductors' MEMS sensors business, enhancing its global sensors capabilities, particularly for automotive safety and industrial applications, while expanding its MEMS technology and product portfolio.

(Source: https://www.globenewswire.com ) - In February 2023, Continental launched the new E-motor Rotor Position Sensor. The new E-motor Rotor Position Sensor is more efficient and smoother operations for electric vehicles.

- In October 2023, an IPS (inductive position sensor) technology was developed by Renesas Electronics Corp. for highly precision motor position sensor ICs for medical, robotics, and industrial applications. The use of position-sensing technology and non-contact coil sensors can replace costly optical and magnetic encoders, generally used in motor control systems that need absolute position sensing, high reliability, speed, and accuracy.

Segments Covered in the Report

By Technology

- Photoelectric

- Linear

- Proximity

- Rotary

- Others

By Application

- Automotive

- Military & Aerospace

- Electronics & Semiconductors

- Packaging

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content