Pressure Sensors Market Size and Forecast 2025 to 2034

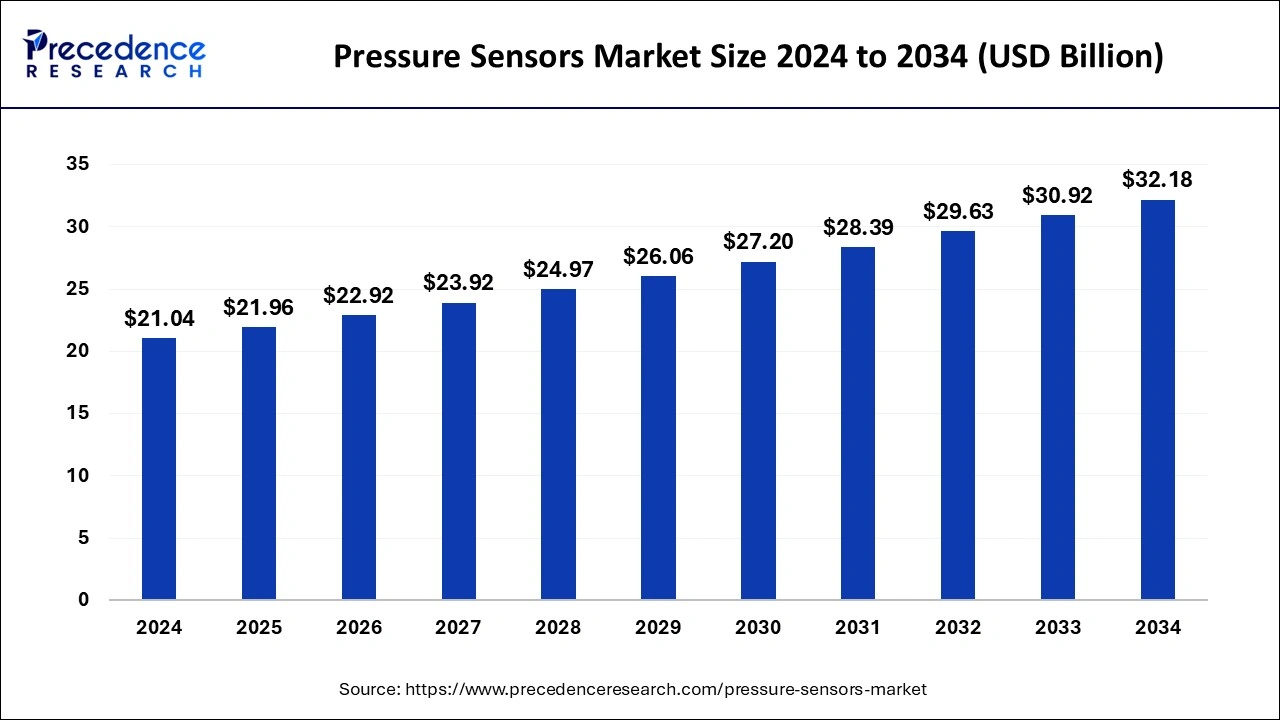

The global pressure sensors market size was estimated at USD 21.04 billion in 2024 and is predicted to increase from USD 21.96 billion in 2025 to approximately USD 32.18 billion by 2034, expanding at a CAGR of 4.34% from 2025 to 2034.

Pressure Sensors Market Key Takeaways

- In terms of revenue, the global pressure sensors market was valued at USD 21.04 billion in 2024.

- It is projected to reach USD 32.18billion by 2034.

- The market is expected to grow at a CAGR of 4.34% from 2025 to 2034.

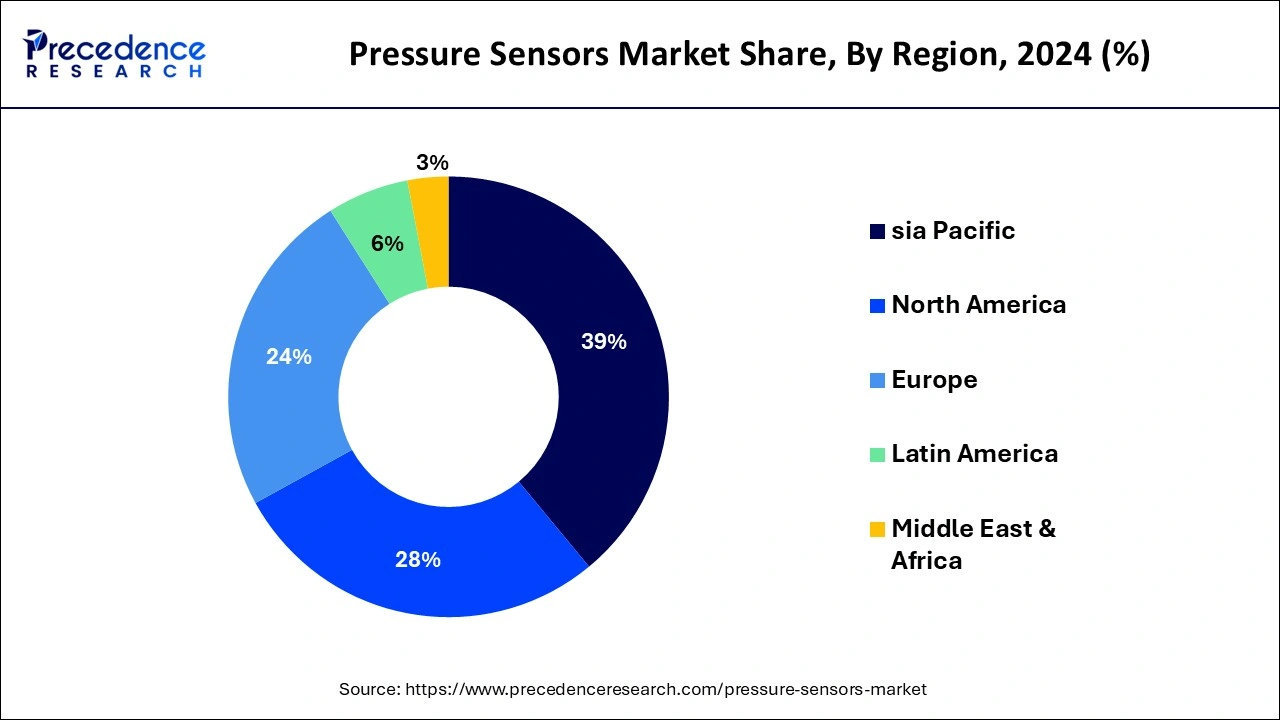

- Asia Pacific dominated the market with the largest share of 39% in 2024.

- North America is expected to witness the fastest rate of growth in the pressure sensors market during the forecast period.

- By product, the absolute pressure sensor segment held the largest share of 44% in 2024.

- By product, the differential pressure sensor segment is expected to grow at a significant rate during the forecast period.

- By type, the wired segment held the largest market share of 86% in 2024.

- By type, the wireless segment is expected to grow at a notable rate.

- By technology, the piezoresistive segment led the market with the largest share of 27% in 2024.

- By technology, the electromagnetic segment is expected to grow at a notable rate.

- By application, the automotive segment held the maximum market share of 26% in 2024.

- By application, the industrial segment is expected to grow at a notable rate.

Asia Pacific Pressure Sensors Market Size and Growth 2025 to 2034

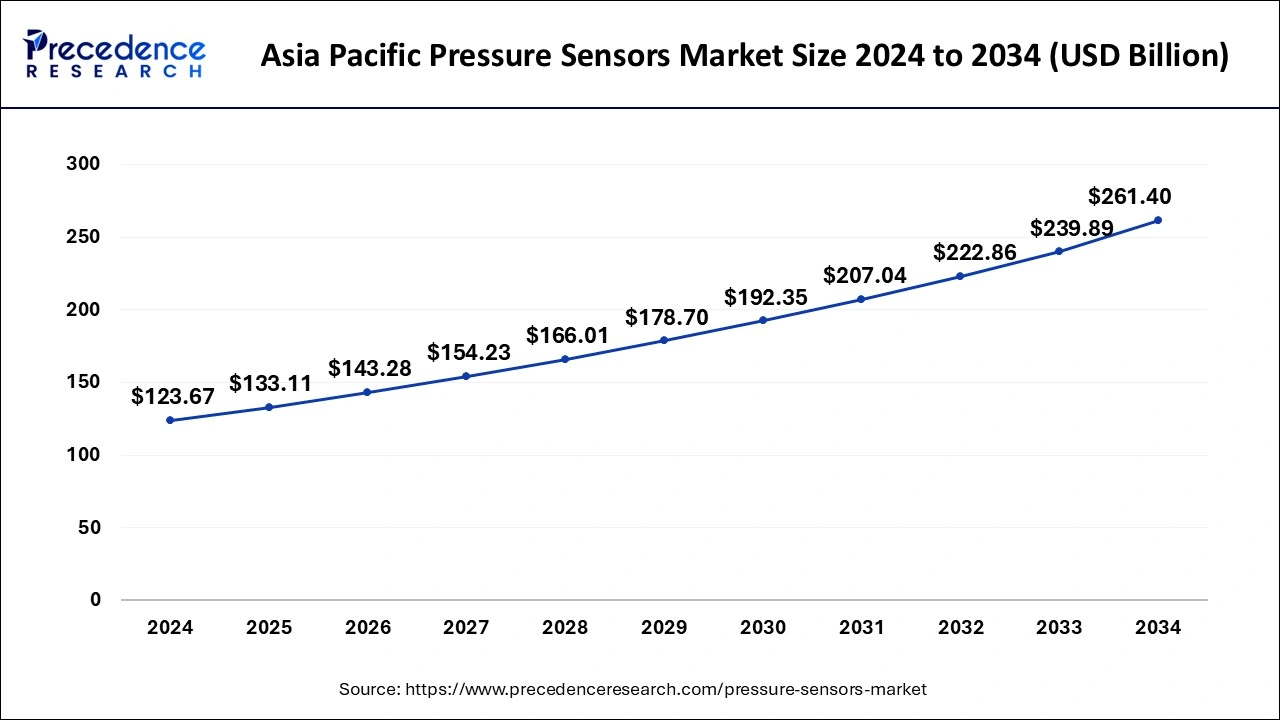

The Asia Pacific pressure sensors market size was valued at USD 8.21 billion in 2024 and is expected to reach around USD 12.71 billion by 2034, expanding at a CAGR of 4.47% from 2025 to 2034.

Asia-Pacific dominated the pressure sensors market with the largest market share of 39% in 2024, driven by industrialization, technological advancements, and the expansion of key industries across countries in the region. APAC is home to some of the world's largest manufacturing hubs, automotive markets, and emerging economies, contributing to the increasing demand for pressure sensors.

- In October 2023, IIT-Delhi researchers announced that it has developed a wearable and scalable pressure sensor that can potentially provide a low-cost & easy alternative to costly surgeries, posture correction accessories and footwear modifications.

Additionally, increasing healthcare expenditures and technological advancements in countries such as Japan and India contribute to the demand for pressure sensors in medical devices such as blood pressure monitors and respiratory equipment.

North America is poised for rapid growth in the pressure sensors market driven by the presence of various industries such as automotive, oil and gas, healthcare, and manufacturing. The region's advanced technological infrastructure, stringent regulatory standards, and the continuous demand for innovative sensing solutions contribute to the growth of the pressure sensors market. Moreover, the automotive industry in North America is a major consumer of pressure sensors, employing them in various applications such as tire pressure monitoring systems (TPMS), engine management, and safety systems.

Meanwhile, Europe is growing at a notable rate in the pressure sensors market. The adoption of Industry 4.0 practices and the emphasis on industrial automation contribute to the demand for pressure sensors in manufacturing, process control, and other industrial applications. The region's focus on environmental sustainability and regulations drives the use of pressure sensors in applications related to weather forecasting, air quality monitoring, and water management.

Market Overview

The pressure sensors market offers devices designed to measure and monitor the pressure of gases or liquids in various applications. These sensors play a crucial role in a wide range of industries, including automotive, healthcare, aerospace, industrial manufacturing, and consumer electronics. It is utilized to detect changes in pressure and convert this information into electrical signals. This data is then used for control and monitoring purposes in different systems. For instance, in the automotive industry, pressure sensors are integral to the functioning of the vehicle's airbag system, engine management, and tire pressure monitoring.

In healthcare, these sensors are employed in medical devices such as ventilators, blood pressure monitors, and infusion pumps. The market has witnessed significant growth driven by advancements in sensor technologies, increasing automation across industries, and the rising demand for accurate and real-time pressure measurements. Miniaturization of sensors, improvements in sensor accuracy, and the integration of pressure sensing capabilities into smart devices have further fueled market expansion.

Pressure Sensors Market Data and Statistics

- According to the St. Louis's Federal Reserve Bank statistics, USD 82.74 billion were expended on household appliances in 2022 compared to previous year that is USD 70.43 billion in the United States alone. Therefore, these increasing sales may further help in growth of the market.

Pressure Sensors Market Growth Factors

- The automotive sector is a major driver for the pressure sensors market. Pressure sensors are essential components in modern vehicles, used in applications such as tire pressure monitoring, engine control systems, and airbag deployment. The increasing integration of advanced driver-assistance systems (ADAS) and electric vehicles (EVs) further boosts the demand for pressure sensors.

- Growing adoption of industrial automation across various sectors, including manufacturing, oil and gas, and process industries, is a significant growth factor. Pressure sensors play a crucial role in these automated systems for monitoring and controlling processes, ensuring operational efficiency, and enhancing safety.

- The proliferation of smartphones, wearables, and other consumer electronic devices with embedded pressure sensors contributes to market growth. These sensors are used in applications such as altitude sensing, barometric pressure measurement, and touch sensitivity, enhancing the functionality of electronic devices.

- In the healthcare sector, pressure sensors are utilized in medical devices like blood pressure monitors, respiratory devices, and infusion pumps. The increasing focus on remote patient monitoring and healthcare digitization drives the demand for pressure sensors in the medical field.

- The rise of IoT technologies has led to increased connectivity and smart device integration. Pressure sensors are crucial components in IoT-enabled systems, facilitating real-time monitoring and control. This trend is particularly evident in smart homes, smart cities, and industrial IoT applications.

- Ongoing advancements in sensor technologies, including the development of Micro-Electro-Mechanical Systems pressure sensors, contribute to market growth. These advancements lead to smaller, more energy-efficient sensors with improved accuracy and reliability.

- The implementation of stringent safety and quality standards across industries, such as automotive and healthcare, drives the adoption of high-performance pressure sensors. Compliance with regulatory requirements fuels the demand for sensors that meet specific industry standards.

- The increasing popularity of wearable devices, including fitness trackers and smartwatches, contributes to the demand for miniaturized and efficient pressure sensors. These sensors enable features such as altimeter functions and enhance the overall capabilities of wearables.

- Pressure sensors are utilized in environmental monitoring applications, including weather forecasting, air quality monitoring, and water management. As environmental awareness and regulatory requirements increase, the demand for pressure sensors in these applications grows.

- Pressure sensors find applications in the energy sector, including oil and gas exploration and production. The need for efficient and reliable pressure monitoring in these critical operations supports market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 32.18 Billion |

| Market Size in 2024 | USD 21.04 Billion |

| Market Size in 2025 | USD 21.96 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.94% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pressure Sensors Market Dynamics

Driver

Advancement in the automotive industry

The rapid advancement of the automotive industry is a significant driver for the burgeoning demand in the pressure sensors market. As the automotive sector undergoes a transformative shift towards electric vehicles (EVs), autonomous driving, and advanced driver-assistance systems (ADAS), the role of pressure sensors becomes increasingly pivotal. Pressure sensors are integral components in ensuring the efficient and safe operation of various automotive systems. In EVs, pressure sensors are utilized for monitoring battery systems, optimizing energy efficiency, and ensuring thermal management. Moreover, in the realm of autonomous vehicles and ADAS, these sensors contribute to functions like adaptive cruise control, tire pressure monitoring, and airbag deployment systems, enhancing overall safety and performance. The industry's emphasis on reducing emissions and enhancing fuel efficiency further propels the demand for pressure sensors, as they play a crucial role in optimizing combustion processes. As automakers continue to prioritize innovation and technological integration, the pressure sensors market is poised to experience sustained growth, driven by the evolving needs of the automotive landscape.

Restraint

Limited Accuracy in Harsh Environments

The limited accuracy of pressure sensors in harsh environments poses a significant restraint on the demand for these sensing devices. In industries such as aerospace, oil and gas, and manufacturing, where extreme conditions are prevalent, the performance of pressure sensors becomes crucial for maintaining operational efficiency and safety. Harsh environments characterized by high temperatures, corrosive substances, or intense vibrations can compromise the accuracy and reliability of pressure sensors over time. These challenges hinder the widespread adoption of pressure sensors in critical applications where precision is paramount. For instance, in oil and gas exploration, where sensors are exposed to rugged conditions, the risk of inaccuracies in pressure measurements may impact the effectiveness of operations and compromise safety protocols.

Addressing these limitations requires substantial advancements in sensor technologies, materials, and protective enclosures. Additionally, industries operating in harsh environments may incur higher costs to implement specialized sensors that can withstand these conditions. As a result, the limited accuracy of pressure sensors in challenging settings acts as a deterrent, impacting their potential deployment across sectors that require robust and precise monitoring capabilities. Efforts to enhance the durability and resilience of pressure sensors in extreme conditions remain crucial to unlocking their full potential across diverse industries.

Opportunity

Industry 4.0 and Industrial Automation

- In January 2024, Sensata Technologies launched digital water pressure sensor, 129CP Series. It will offer improved smart pressure monitoring abilities to water utilities and drive waste lessening.

The advent of Industry 4.0 and the rapid evolution of industrial automation present compelling opportunities for the pressure sensors market. In Industry 4.0, the integration of digital technologies and smart manufacturing processes, pressure sensors play a pivotal role in optimizing industrial operations. These sensors are instrumental in monitoring and controlling pressure-sensitive processes across manufacturing units, ensuring precision and efficiency. As industries embrace automation to enhance productivity and reduce operational costs, the demand for pressure sensors escalates, given their critical role in maintaining and regulating various parameters.

Whether in hydraulic systems, pneumatic machinery, or fluid handling processes, pressure sensors contribute to real-time data acquisition, enabling quick responses to fluctuations and ensuring the seamless functioning of automated systems. Moreover, pressure sensors facilitate predictive maintenance strategies by providing insights into equipment health, minimizing downtime, and improving overall operational reliability. As smart factories become the norm, the pressure sensors market is poised to capitalize on the growing need for advanced sensing technologies, establishing itself as an indispensable component in the landscape of Industry 4.0 and industrial automation.

Product Insights

The absolute pressure sensor segment dominated the pressure sensors market in 2024.the segment is observed to continue the trend throughout the forecast period. Absolute pressure sensors measure pressure relative to a perfect vacuum. They provide absolute pressure at a specific location without referencing it to atmospheric pressure. Commonly used in applications where the reference point is a vacuum, such as altitude measurement, weather forecasting, and high-altitude laboratories.

- In July 2023, STMicroelectronics launched its new ILPS28QSW MEMS water/liquid-proof absolute pressure sensor for the industrial IoT applications.

The differential pressure sensor is expected to grow at a significant rate throughout the forecast period. Differential pressure sensors measure the difference in pressure between two points. They provide data on the pressure variance between two locations or across a system. Widely utilized in HVAC systems for airflow control, liquid level measurement, filter monitoring, and industrial processes where pressure differentials are critical.

Type Insights

The wired segment held the largest share of the pressure sensors market in 2024. Wired pressure sensors utilize physical connections, such as cables or wires, for data transmission. These sensors are directly connected to the monitoring or control system using a wired interface. It generally offer a stable and reliable communication method. They are suitable for applications where consistent and real-time data transmission is critical.

On the other hand, the wireless segment is expected to generate a notable revenue share in the market. Wireless pressure sensors transmit data without the need for physical connections. They use wireless communication protocols such as Wi-Fi, Bluetooth, Zigbee, or other radio frequency technologies to send pressure readings to a central monitoring system. It provide flexibility and ease of installation, particularly in applications where running wires is impractical or costly. They are often used in remote or difficult-to-access locations.

Technology Insights

The piezoresistive segment held the dominating share of the pressure sensors market in 2024. Piezoresistive pressure sensors operate on the principle of the piezoresistive effect, where the electrical resistance of a material changes in response to applied mechanical stress. Commonly used in automotive applications, industrial processes, and medical devices due to their accuracy and reliability.

On the other hand, the electromagnetic segment is expected to generate a notable revenue share in the market. Electromagnetic pressure sensors measure pressure by utilizing changes in the magnetic field caused by the movement of a diaphragm or other pressure-sensitive elements. It is used in various industrial and automotive applications where resistance to harsh environments and high accuracy are essential.

Application Insights

The automotive segment held the largest share of the pressure sensors market in 2024. Pressure sensors play a crucial role in the automotive industry for applications such as tire pressure monitoring systems (TPMS), engine control systems, brake systems, airbag deployment, and fuel systems.

- In September 2023, Infineon Technologies launched Xensiv SP49 intelligent tyre pressure monitoring sensor. It is designed for various smart tyre functions such as tyre blowout, inflation assistance, on-tyre auto-position sensing, and load detection.

On the other hand, the industrial segment is expected to generate a notable revenue share in the market. In industrial settings, pressure sensors are used for various applications, including process control, hydraulic systems, HVAC systems, pneumatic systems, and general pressure monitoring in manufacturing processes.

Pressure Sensors Market Companies

- AlphaSense

- City Technology Ltd.

- Dynament Ltd.

- Figaro Engineering Inc.

- Membrapor

- Nemoto Kyorindo co., Ltd.

- Robert Bosch GmbH

- ABB Ltd.

- Siemens

- GfG Europe Ltd.

Recent Development

- In January 2024, Melexis launched its Triphibian MEMS pressure sensor in Belgium. It offers gas and liquid media measurement from 2 to 70 bar in a 16pin SO16 package.

- In October 2023, element14 partners with Superior Sensor Technology to launch innovative pressure sensors that offers higher accuracy and fully integrated solution for pressure sensing.

- In September 2023, Baker Hughes launched its Druck hydrogen-rated pressure sensors that withstand harsh environments and provide extended term stability. The hydrogen pressure sensors used in a variety of applications such as hydrogen filling stations, gas turbines, and hydrogen production electrolysis.

Segments Covered in the Report

By Product

- Absolute Pressure Sensors

- Differential Pressure Sensors

- Gauge Pressure Sensors

By Type

- Wired

- Wireless

By Technology

- Piezoresistive

- Electromagnetic

- Capacitive

- Resonant Solid-State

- Optical

- Others

By Application

- Automotive

- Oil & Gas

- Consumer Electronics

- Medical

- Industrial

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content