What is the Fiber Optic Sensing System Market Size?

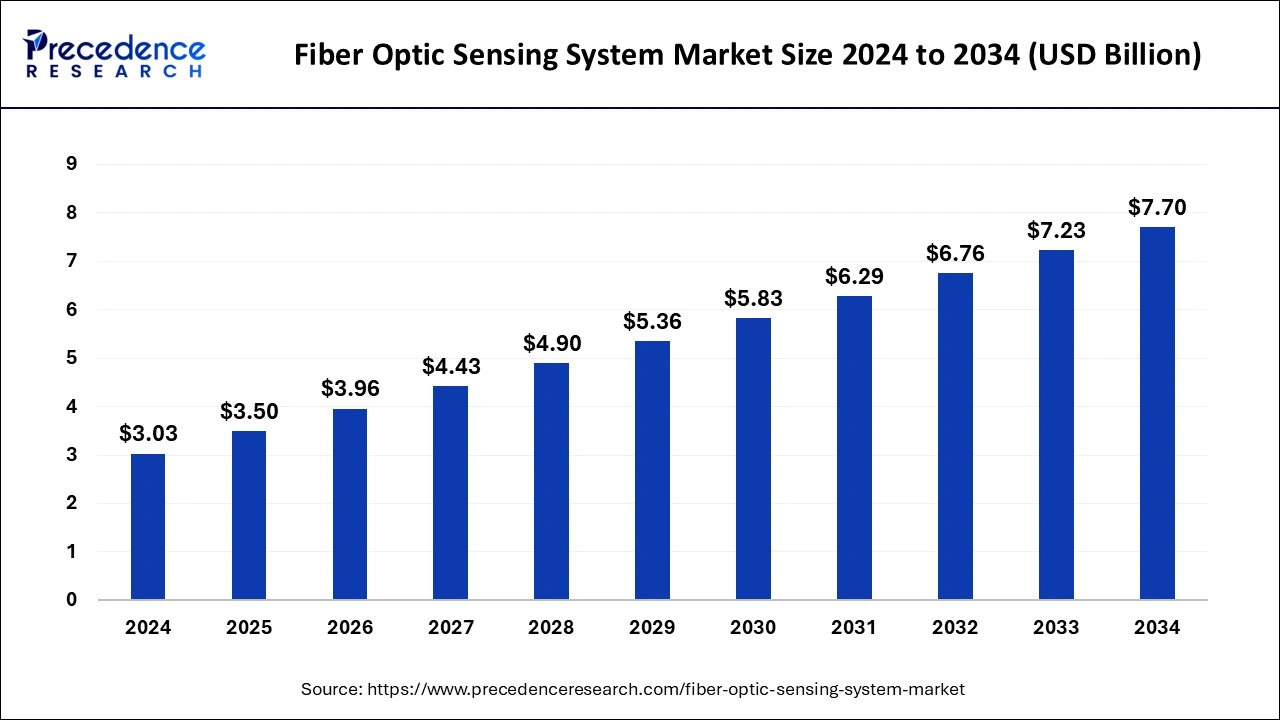

The global fiber optic sensing system market size is estimated at USD 3.50 billion in 2025 and is predicted to increase from USD 3.96 billion in 2026 to approximately USD 7.70 billion by 2034, expanding at a CAGR of 9.78% from 2025 to 2034.

Fiber Optic Sensing System MarketKey Takeaways

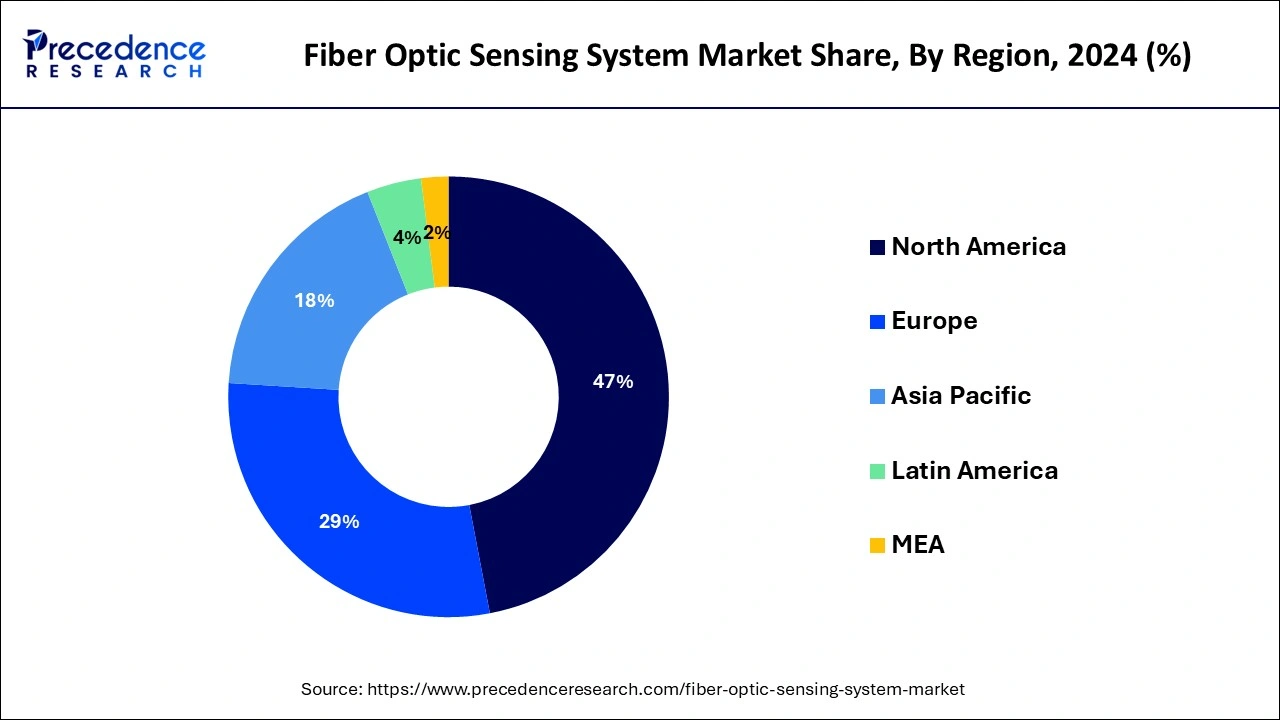

- North America held the largest share of 47% in 2024.

- Europe is forecasted to be a significantly growing region of the market.

- By type, the Fiber Bragg Grating optic sensors segment held the largest share of 45% of the fiber optic sensing system market in 2024.

- By type, the phase-modulated fiber optic sensors segment is expected to witness rapid growth over the forecast period.

- By end user, the transportation and automotive segment held the largest share of 27% in 2024.

- By end user, the oil and gas segment is expected to witness significant growth during the forecast period.

Market Overview

The fiber optic sensing system market encompasses the industry involved in the design, production, distribution, and utilization of sensing systems based on fiber optic technology. These systems utilize optical fibers as the sensing element to detect and measure various physical parameters such as temperature, strain, pressure, vibration, and acoustic signals. Fiber optic sensing systems offer several advantages over traditional sensing technologies, including high sensitivity, immunity to electromagnetic interference, ability to cover large areas over long distances, and suitability for harsh environments. They find applications in diverse industries such as oil and gas, civil engineering, aerospace, healthcare, automotive, and security.

The market includes a wide range of products and solutions, including distributed fiber optic sensing systems, point-based fiber optic sensors, interrogators, signal processing software, and related components.

Companies involved in this market include manufacturers of fiber optic components, sensing systems integrators, technology developers, system integrators, and service providers. The growth of the fiber optic sensing system market is driven by increasing demand for real-time monitoring and diagnostics in critical infrastructure, growing adoption of smart structures and IoT applications, rising investments in oil and gas exploration and production activities, and expanding applications in industries such as aerospace, automotive, and healthcare. Additionally, advancements in fiber optic technology and the development of innovative sensing techniques contribute to market expansion and technological evolution.

Fiber Optic Sensing System Market Data and Statistics

- In April 2023, Researchers at the Missouri University of Science and Technology (Missouri S&T) received funding exceeding US$ 14 million to pioneer the development of fiber optic sensors engineered to withstand harsh and extreme environmental conditions. These cutting-edge sensors are anticipated not only to endure severe conditions but also hold promise in detecting the presence of nearby explosive materials.

- In April 2023, Schlumberger and Sintela entered into a collaborative agreement to jointly develop innovative fiber-optic solutions across various industrial sectors. Under the agreement, Schlumberger will spearhead the market and delivery of these solutions in industries such as energy with carbon capture and storage (CCS), as well as geothermal sectors.

- Meanwhile, Sintela will focus on delivering integrated solutions for other industrial requirements. The collaboration aims to merge Sintela's distributed fiber-optic sensing (DFOS) portfolio with Schlumberger's fiber-optic solutions intellectual property (IP). This integration is expected to streamline fiber-optic interrogator deployments and introduce new digital workflow capabilities, ultimately enhancing operational performance for Schlumberger's clientele.

Market Outlook

- Industry Growth Overview: The market for fiber optic sensing systems is expanding steadily due to the need for real-time monitoring in sectors like infrastructure, power, and oil and gas. Adoption is growing thanks to improvements in fiber optic technologies and more funding for smart infrastructure. The market is expanding more quickly due to the trend toward safety monitoring and predictive maintenance.

- Sustainability Trends:These systems support sustainability by enabling long-distance, non-intrusive monitoring, reducing the need for multiple sensors, and helping prevent leaks or structural failures. This improves efficiency, reduces waste, and extends asset life. They also help companies meet environmental regulations and sustainability targets more effectively.

- Global Expansion: Asia Pacific is the fastest-growing region due to rapid industrialization and infrastructure projects, while North America leads the market because of strong industrial adoption. Businesses are growing globally to cater to both developed and developing markets. More international investments are being driven by the growing demand for smart and connected monitoring solutions worldwide.

Fiber Optic Sensing System MarketGrowth Factors

- The increasing demand for real-time and accurate monitoring solutions across various industries such as oil and gas, infrastructure, and healthcare is driving the adoption of fiber optic sensing systems. These systems offer high sensitivity and reliability, making them ideal for applications where precise data is crucial for decision-making and safety.

- Advancements in fiber optic technology have led to the development of sophisticated sensing systems that can detect changes in temperature, strain, pressure, and other environmental variables along the length of the fiber optic cable. This capability enables continuous monitoring of assets, structures, and environments in both terrestrial and harsh conditions.

- The expanding adoption of fiber optic sensing systems in applications such as perimeter security, structural health monitoring, and smart oilfield management is fueling market growth. These systems provide cost-effective and scalable solutions compared to traditional sensing technologies, driving their widespread deployment across various industries.

- Government initiatives and investments in infrastructure development, especially in emerging economies, are creating opportunities for the deployment of fiber optic sensing systems. These systems play a crucial role in enhancing the efficiency, safety, and sustainability of critical infrastructure projects such as bridges, pipelines, and railways.

Recent Trends

- Infrastructure and Critical Asset Monitoring: Fiber-optic sensing systems are increasingly used to monitor bridges, tunnels, pipelines, and other large-scale infrastructure in real-time, improving safety and maintenance efficiency.

- Integration with AI and IoT: These systems are being combined with AI, cloud/edge analytics, and distributed sensing technologies to detect issues early, predict failures, and provide actionable insights

- Miniaturization and Multi-Parameter Sensing:Sensors are becoming smaller and capable of measuring multiple parameters like strain, temperature, vibration, and acoustics, expanding their range of applications.

- Deployment in Challenging Environments:Fiber-optic sensing is being applied in harsh environments such as oil & gas, aerospace, and smart grids due to its precision, durability, and reliability.

- Growth in Emerging Markets and Smart Infrastructure:Demand is rising in regions like Asia-Pacific as urbanization, digitalization, and smart city projects drive the adoption of advanced sensing solutions.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.78% |

| Market Size in 2025 | USD 3.50 Billion |

| Market Size in 2026 | USD 3.96 Billion |

| Market Size by 2034 | USD 7.70 Billion |

| Dominated Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Types, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing demand in the automotive industry

The demand for fiber optic sensing systems is on the rise in the automotive industry, driven by their highly desirable features such as high heat resistance, noise immunity, and flexible light transmission. These technologies are anticipated to be integrated into various electronic control systems in vehicles to measure movement and direction accurately. Temperature management is crucial in the development and testing of electric and hybrid vehicles, as the performance and aging of key components rely heavily on temperature distribution and the prevention of internal hot spots. Thus, there is a growing need for faster and more accurate temperature measurement throughout the electric vehicle product development stages.

Fiber optic sensing system technologies are gaining momentum in electric and hybrid vehicle testing due to their electromagnetic field immunity, rapid response, durability, compact size, high precision, and safety features, while promoting the growth of the fiber optic sensing system market.

- According to the India Brand Equity Foundation (IBEF), the electric vehicle market in India is projected to reach US$ 7.09 billion by 2025.

Additionally, the Indian automotive industry aims to increase vehicle exports by five times. This trajectory is expected to have a positive impact on the fiber optic sensing system market in the coming years.

Restraint

High cost associated with this technology

Fiber optic sensing systems play a critical role for companies in monitoring challenging work environments and obtaining real-time data with high accuracy. The market for these systems is expanding due to their numerous advantages, including their precision and reliability in data collection. However, one major hurdle hindering broader adoption is the high cost associated with this technology, making it inaccessible for many companies seeking real-time monitoring and sensing solutions. Moreover, the installation and maintenance expenses of fiber optic sensing systems are considerable, further complicating their implementation. Consequently, the elevated cost of these systems presents a significant restraint to fiber optic sensing system market growth.

Opportunity

Growing demand for wireless technology

The increasing reliance on wireless technology stems from its ability to facilitate seamless communication and connectivity across various environments. In today's dynamic work landscape, where remote work and flexible arrangements are becoming more common, wireless technology serves as the backbone for enabling remote collaboration, data sharing, and real-time communication. This trend is particularly evident in the fiber optic sensing systems market, where the demand for wireless solutions is driven by the need for flexibility, scalability, and mobility.

Wireless technology enables employees to stay connected and productive regardless of their physical location. With the proliferation of mobile devices and the ubiquity of Wi-Fi networks, individuals can access critical data, applications, and resources from virtually anywhere. This level of flexibility not only enhances workforce efficiency but also fosters innovation and collaboration across teams and organizations.

Moreover, wireless technology extends beyond traditional office settings to encompass various aspects of daily life. From smart homes and IoT devices to public spaces and transportation systems, wireless connectivity enables seamless integration and communication between diverse systems and devices. This interconnected ecosystem presents numerous opportunities for fiber optic sensing systems to enhance monitoring, surveillance, and data collection across different environments. However, while the demand for wireless technology continues to grow, challenges such as security concerns, bandwidth limitations, and infrastructure requirements remain. Addressing these challenges is essential to unlocking the full potential of wireless technology and ensuring its seamless integration into everyday life and business operations. As technology evolves and connectivity becomes more pervasive, the role of wireless solutions in driving innovation and efficiency across industries, including the fiber optic sensing system market, will continue to expand.

Segment Insight

Type Insights

The fiber bragg grating optic sensors segment dominated the fiber optic sensing system market, accounting for 45% of the market share in 2024. The fiber bragg grating (FBG) optic sensors segment is driven by offering high sensitivity and accuracy for measuring parameters like strain, temperature, pressure, and vibration. FBG sensors are immune to electromagnetic interference (EMI) and can multiplex multiple sensors along a single optical fiber, enabling distributed sensing over long distances. They are reliable and durable, with minimal drift and long-term stability, making them suitable for harsh environments. Ongoing advancements in FBG sensor technology, coupled with industry standards mandating reliable sensing solutions, contribute to their widespread adoption across industries, driving market growth.

The phase modulated fiber optic sensors segment is projected to witness a rapid CAGR during the forecast period due to their unique capabilities and advantages. PM-FOS offer high sensitivity and accuracy in measuring various parameters such as temperature, strain, pressure, and acoustic signals. One of the key advantages of PM-FOS is their ability to achieve distributed sensing over long distances with minimal signal degradation. They utilize phase modulation techniques to encode information, enabling precise measurements even in challenging environments with high noise levels or electromagnetic interference.

Additionally, PM-FOS exhibit excellent immunity to environmental factors like temperature variations and mechanical stress, ensuring reliable and consistent performance over time. As industries increasingly demand robust and accurate sensing solutions for critical applications, the versatility and reliability of PM-FOS make them a preferred choice, driving their adoption and contributing to the overall growth of the fiber optic sensing system market.

End User Insights

The transportation and automotive segment dominated the market with 27% market share in 2024, due to their growing demand for advanced monitoring and sensing technologies. In these industries, fiber optic sensing systems play a crucial role in ensuring the safety, efficiency, and reliability of various operations and components. In transportation, including railways, bridges, tunnels, and pipelines, fiber optic sensors are utilized to monitor structural health, detect potential defects or damages, and assess environmental conditions such as temperature and strain. Likewise, in the automotive sector, fiber optic sensing systems are integrated into vehicles to enable real-time monitoring of critical parameters like temperature, pressure, and vibration, enhancing vehicle performance, safety, and durability.

The increasing emphasis on smart transportation infrastructure, intelligent vehicles, and autonomous driving further drives the adoption of fiber optic sensing systems in the transportation and automotive sectors. As these industries continue to prioritize innovation and efficiency, the demand for advanced sensing solutions is expected to rise, thereby fueling the growth of the fiber optic sensing system market.

The oil and gas segment is poised to experience the fastest CAGR during the forecast period. The oil and gas industry is driven by leveraging these systems for enhanced operational efficiency, safety, and production optimization. Fiber optic sensors are widely used for monitoring pipelines, wellbores, and other critical infrastructure, providing real-time data on factors like temperature, pressure, and strain. This proactive monitoring helps in early detection of potential issues, minimizing risks and preventing downtime. The adoption of fiber optic sensing systems is also driven by the industry's focus on optimizing production processes, complying with regulatory requirements, and ensuring environmental sustainability. Therefore, the oil and gas segment's commitment to operational safety and efficiency contributes significantly to the growth of the fiber optic sensing system market.

Regional Insights

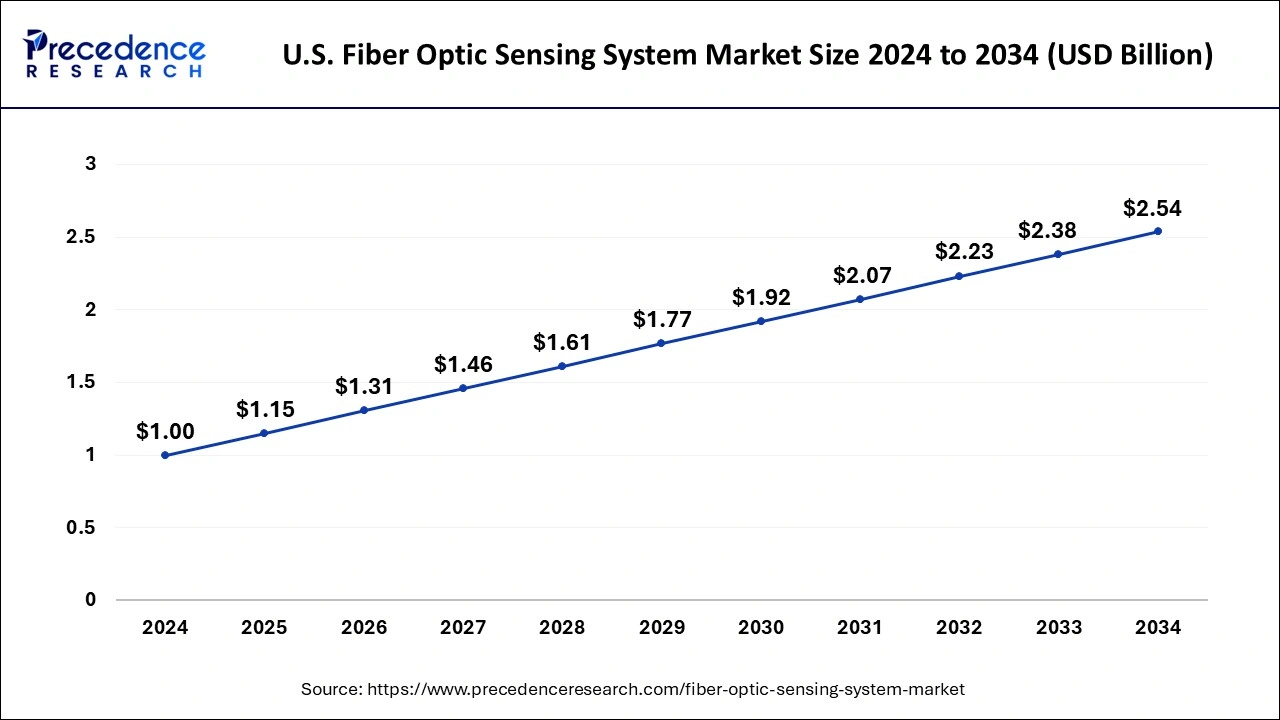

U.S.Fiber Optic Sensing System Market Size and Forecast 2025 to 2034

The U.S. fiber optic sensing system market size is estimated at USD 1.15 billion in 2025 and is anticipated to reach around USD 2.54 billion by 2034, growing at a CAGR of 9.81% from 2025 to 2034.

North America held the largest share of 47% in the fiber optic sensing system market in 2024, primarily due to the development of technologically advanced fiber-optic sensors in sectors like healthcare and automotive. Leading manufacturers in the region are also focusing on expanding their distribution networks, which is expected to further drive market growth.

Europe is expected to experience consistent growth in CAGR, fueled by the sustained demand for precise fiber optic temperature sensors in various industrial applications. The presence of established manufacturers like Calex Electronics Limited, Proximion AB, Scaime, Althen sensors & control, among others, contributes to the steady growth trajectory across European nations.

Value Chain Analysis

- Raw Material Procurement: Fiber optic sensing systems depend on specific optical fibers, coatings, electronics, and sensors. Purchasing concentrates on robust high quality parts to guarantee precision and dependability in demanding settings. To maintain a steady supply while lessening their impact on the environment, manufacturers are also giving priority to sustainable sourcing and supplier partnerships.

- Distribution to OEMs and integrators:After production, fiber optic sensing systems are supplied to OEMs and system integrators who incorporate them into applications like industrial automation, infrastructure monitoring, and oil and gas pipelines. Timely delivery and effective logistics are essential for maintaining system performance and installation schedules.

- Lifecycle Support and recycling:To guarantee long-term performance, lifecycle support includes installation instructions, calibration, upkeep, and software updates. O lessen the impact on the environment and promote circular economy initiatives in the market, recycling and proper disposal of optical fibers and electronic components are becoming increasingly crucial.

Fiber Optic Sensing System Market Companies

- TE Connectivity (Switzerland)

- Corning Incorporated (U.S.)

- Molex (U.S.)

- Amphenol Corporation (U.S.)

- Infinite Electronics International, Inc. (U.S.)

- Hitachi Information & Telecommunication Engineering, Ltd (Japan)

- Radiall (France)

- Delaire USA (U.S.)

- Belden Inc. (U.S.)

- Panduit (U.S.)

- HIROSE ELECTRIC CO., LTD. (Japan)

- Ratioplast-Electronics (Germany)

- RS COMPONENTS PTE LTD (U.K.)

- 3M (U.S.)

- Nexans (France)

- LEONI AG (Germany)

- Glenair, Inc. (U.S.)

- Extron (U.S.)

- CommScope (U.S.)

Recent Developments

- In July 2024, VIAVI Solutions announced the launch of NITRO Fiber Sensing, an integrated real‑time asset monitoring and analytics solution for critical infrastructure (pipelines, power cables, perimeters). The system uses distributed temperature/strain and acoustic sensing to locate threats and prevent downtime across large assets.

(Source: viavisolutions.com) - In June 2025, Optics11 launched OptiFender, a high‑precision partial‑discharge monitoring platform for electrical infrastructure (transformers, cable accessories, GIS). It enables "install‑and‑forget" fiber‑optic sensors with ML analytics to reduce unplanned outages and extend asset life.

(Source: optics11.com) - 28 November 2023, HAWK Measurement Systems launched its new "HawkFiber.com" website showcasing a modular fiber‑optic sensing system capable of monitoring assets over long distances (10 km-150 km) with 24/7 real‑time data. The system supports distributed acoustic, temperature, and strain sensing for pipelines, conveyors, and perimeters.

(Source: hawkmeasurement.com) - In March 2023, Yokogawa Electric and Otsuka Chemical unveiled the establishment of Syncrest Inc., marking a joint venture aimed at researching, developing, and manufacturing middle molecular pharmaceuticals. Syncrest Inc. operates as a contract research, development, and manufacturing organization, focusing on advancing pharmaceutical innovation and production.

- In May 2021, AP Sensing introduced its 5th-Generation Distributed Acoustic Sensing (DAS) system, a significant advancement in asset monitoring technology. Unlike conventional point sensors, this new DAS system from AP Sensing enables seamless and continuous monitoring of critical infrastructures such as pipelines, power cables, and railways. This innovation represents a leap forward in enhancing the reliability and safety of infrastructure monitoring and management.

- In June 2021, NEC Corporation unveiled its optical fiber sensing solution empowered by artificial intelligence (AI). This innovative solution harnesses AI technology to analyze vibrations detected in optical fibers, enabling the early detection of anomalies such as fiber damage. By identifying these issues promptly, the solution aids in preventing potential damage, ultimately contributing to the maintenance and resilience of critical infrastructure networks.

Segments Covered in the Report

By Types

- Fiber Bragg Grating Optic Sensors

- Intensity Modulated Fiber Optic Sensors

- Phase Modulated Fiber Optic Sensors

- Others

By End User

- IT and Telecom

- Transportation and Automotive

- Medical

- Defense

- Industrial

- Oil and Gas

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting