What is the Distributed Temperature Sensing Market Size?

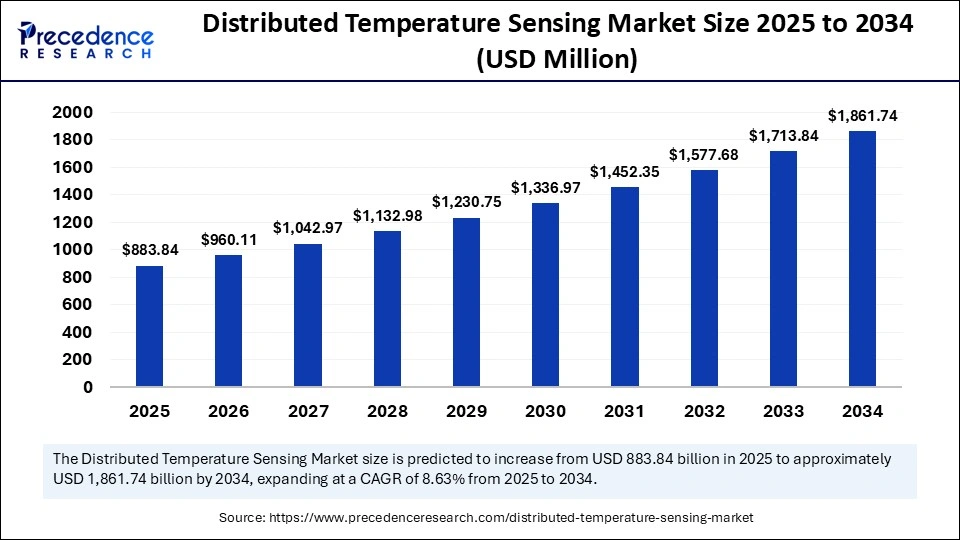

The global distributed temperature sensing market size is accounted at USD 883.84 million in 2024 and is predicted to increase from USD 960.11 million in 2026 to approximately USD 1861.74 million by 2034, expanding at a CAGR of 8.63% from 2025 to 2034. Increasing demand for safety measures to avoid potential accidents is driving the growth of the distributed temperature sensing market.

Distributed Temperature Sensing MarketKey Takeaways

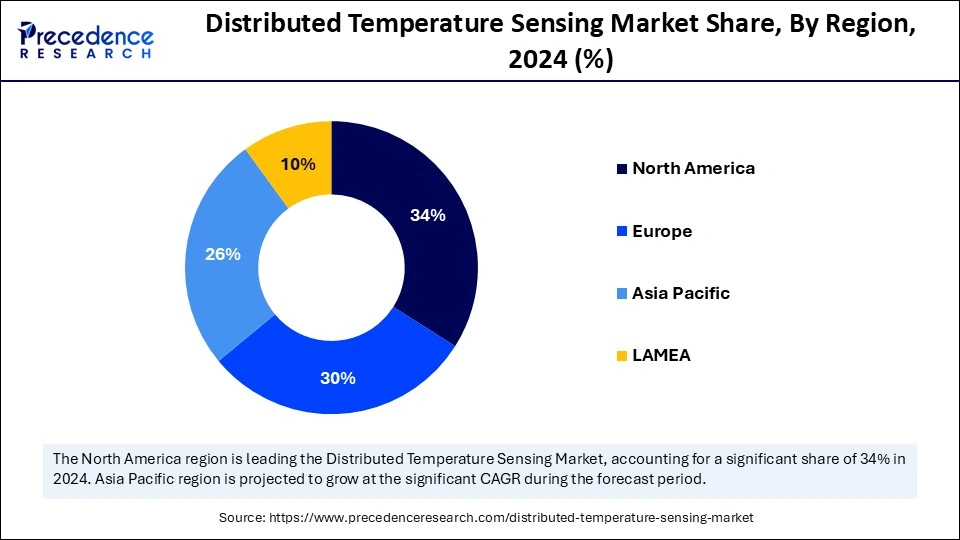

- North America accounted for the largest revenue share of 34% in 2024.

- Asia-Pacific is expected to grow at the fastest CAGR of 12.2% from 2025 to 2034.

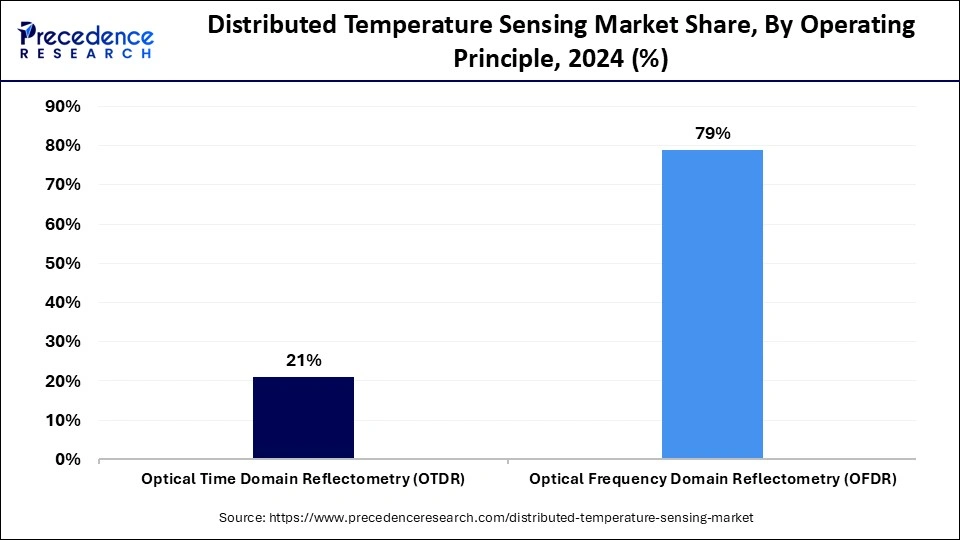

- By operating principle, the optical frequency domain reflectometry (OFDR) segment held the highest revenue share of 79% in 2024.

- By operating principle, the optical time domain reflectometry (OTDR) segment is growing at a notable CAGR of 10.3% from 2025 to 2034.

- By fiber type, the single-mode fiber segment dominated the market with the largest share in 2024.

- By fiber type, the multi-mode fiber segment is expected to expand at the fastest rate in the upcoming period.

- By application, oil and gas dominated the market in 2024.

- By application, the process & pipeline monitoring segment is expected to expand at a significant CAGR during the forecast period.

Distributed Temperature Sensing: Enabling Precision Monitoring at Scale

Distributed temperature sensing (DTS) systems are crucial in oil and gas plants, power stations, buildings, and industrial infrastructure like gigafactories to ensure safety, security, and environmental protection from disasters like oil or gas leaks. They detect slight changes in temperature, preventing major damages to equipment and surroundings. The distributed temperature sensing market is expanding rapidly due to stringent regulations regarding workforce and equipment safety. The shift toward proactive measures to prevent disasters is fueling market growth, protecting assets and ensuring smooth operations.

The rising need for data-based analysis supports market expansion. DTS systems offer accurate temperature measurement, making them ideal for applications requiring precise monitoring. Moreover, continuous technological advancements are boosting the market. Innovations in robust optical fibers are improving the viability of these systems. New plastic optic fiber cables are more durable, cost-effective, and efficient, creating new market opportunities.

Impact of AI on the Distributed Temperature Sensing Market

Aartificial intelligence is significantly revolutionizing the market for distributed temperature sensing. AI algorithms can process vast amounts of temperature data generated by DTS systems to identify small temperature variations, patterns, or anomalies that are unable to be detected by people or older methods. Using past data, AI can predict equipment failures based on temperature changes. This enables proactive maintenance, prevent breakdowns and reducing downtime. AI algorithms can also spot potential hotspots or issues by finding thermal imbalances, preventing disasters. In addition, AI enables real-time monitoring of temperature data, allowing for swift action in case of anomalies or faults.

Distributed Temperature Sensing MarketGrowth Factors

- Growing concerns about security propels the growth of the market. Distributed temperature sensing systems are crucial for early fire detection in buildings, tunnels, oil & gas pipelines, and power cables, enhancing safety and security.

- The rising need for real-time monitoring to detect leakages in oil & gas pipelines is expected to boost the growth of the market.

- Distributed temperature sensing systems gather essential data of various systems to analyze and bring valuable insights, which is driving their adoption in applications requiring data-driven analysis.

- Technology improvements in the distributed temperature sensing systems, such as in optical fiber technologies, are contributing to market expansion.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1861.74 Million |

| Market Size in 2025 | USD 960.11 Million |

| Market Size in 2025 | USD 883.84 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.63% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Operating Principle, Fiber Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Need for Safety and Security in Many Industries

The increasing concerns about safety in various industries is a major factor driving the growth of the temperature distributed sensing market. Distributed temperature systems offer real-time temperature monitoring, enabling system administrators to identify potential hazards and threats, including fire, overheating, and leaks. Integrating these systems is crucial for ensuring the safety and operational efficiency of various industrial plants, buildings, natural gas and oil pipelines, and other critical assets. Access to real-time information on power cables, pipelines, and buildings allows incident prevention teams to implement necessary safety measures to prevent fires, gas or oil leaks, and other accidents, empowering safety teams to take proactive steps rather than solely focusing on disaster recovery. This proactive approach leads to the protection of costly systems and assets.

Restraint

High Initial Investment

The high cost of distributed temperature sensing systems stems from the need for specialized equipment and complex installation. Optical glass fibers, crucial for the system, are fragile and sensitive to temperature, pressure, and strain variations, which can impact signal transmission. Effective protection, precise calibration, and timely maintenance are essential for seamless operation, ensuring accurate data.

These systems use specialized equipment like optical interrogators and signal processing units, which are expensive due to their manufacturing and maintenance requirements. Installation requires highly skilled personnel, and challenging environments, such as pipelines and geothermal wells, further complicate the process and impact the accuracy of readings.

Opportunity

Various Government Norms and Regulations Regarding Safety and Security

Governments worldwide are significantly increasing their focus on safety and security standards, leading to the implementation of various security measures. One notable example is the deployment of distributed temperature sensing systems within critical establishments. This proactive approach is particularly crucial in high-risk environments such as oil and natural gas plants, power plants, and industrial manufacturing units. The high efficiency of distributed temperature sensing systems, which offer live monitoring of temperature variations, is crucial in these establishment. This real-time capability allows for immediate responses during system failures or any unlikely event occurrences, thereby enhancing the capacity to avert potential disasters. Stringent environmental regulations are encouraging these establishments to prevent events such as gas or oil leakage into natural bodies, which can result in an enormous amount of air, water, and land pollution, causing almost irreversible damage to the environment.

Segment Insight

Operating Principle Insights

Why did the Optical Frequency Domain Reflectometry (OFDR) Segment Dominate the Market in 2024?

The optical frequency domain reflectometry (OFDR) segment dominated the market with the largest revenue share of 79% in 2024. This dominance is driven by the enhanced capability of optical frequency domain reflectometry in integrating with distributed temperature sensing. This integration enhances spatial resolution, enables precise temperature measurement, and allows for the comprehensive analysis of gathered data with live monitoring capabilities. These features make OFDR DTSs one of the most efficient systems. These systems are well-suited for applications such as oil and gas operations, power utilities, and environmental monitoring. It offers real-time data gathering and analysis with a high degree of accuracy and precision.

The optical time domain reflectometry (OTDR) segment is projected to grow at the fastest CAGR of 10.3% in the coming years. The growth of the segment is attributed to the high accuracy and reliability of temperature monitoring provided by this system over long distances. With the help of laser pulse transmission from fibre optic cables, OTDR analyzes the backscattered light to detect temperature variations. Oil & gas, power, and infrastructure applications are highly benefited by this method due to its high suitability in these particular applications to acquire, monitor, and analyse live data about the systems.

Fiber Type Insights

What Made Single-Mode Fiber the Dominant Segment in 2024?

The single-mode fiber segment dominated the distributed temperature sensing market with the major revenue share in 2024. This segment's dominance is mainly attributed to its high effectiveness in long-distance and high-precision temperature monitoring. Its small core diameter and reduced model dispersion enable the transmission of signals over long distances without losing signals. This makes it highly suitable for applications such as pipeline monitoring, power utilities, and industrial sectors. The accuracy of data provided by single-mode fibre type is higher, providing superior resolution and precision compared to other modes, such as multi-mode fibre.

The multi-mode fiber segment is expected to grow at the fastest rate during the forecast period. The growth of the segment is attributed to the rising usage of multi-mode fibres in various applications, including oil and gas production and leakage detection. Multi-mode fibers, with their larger core diameter, offer the advantage of higher optical power. This is crucial in distributed temperature sensing systems, which depend on backscattered light. Additionally, multi-mode fibers are generally more cost-effective and simpler to install and maintain, making them a popular choice. They are particularly well-suited for short-distance applications where high-resolution data is not the primary requirement.

Application Insights

How Does the Oil and Gas Segment Dominate the Market in 2024?

The oil and gas segment dominated the distributed temperature sensing market with the highest revenue share in 2024. This is mainly due to the increased need for highly advanced distributed temperature sensing and monitoring systems for exploration, production, and transportation. Distributed temperature sensing offers real-time monitoring of the temperature in pipelines, wellbores, and other critical infrastructure. The integration of this technology has significantly enhanced safety, efficiency, and real-time leakage detection during various critical operations within the sector.

The process and pipeline monitoring segment is expected to grow at a significant CAGR in the coming years. The segment's growth is largely attributed to the increasing need for real-time monitoring and leakage detection in industries such as oil and gas, chemical processing, and power generation. The need for improved process control, asset protection, and thermal regulation also drives the deployment of distributed temperature sensing systems. The availability of accurate, precise temperature data at affordable price is a key advantage offered by the distributed temperature sensing market, which is a significant factor in its growth.

Regional Insights

U.S. Distributed Temperature Sensing Market Size and Growth 2025 to 2034

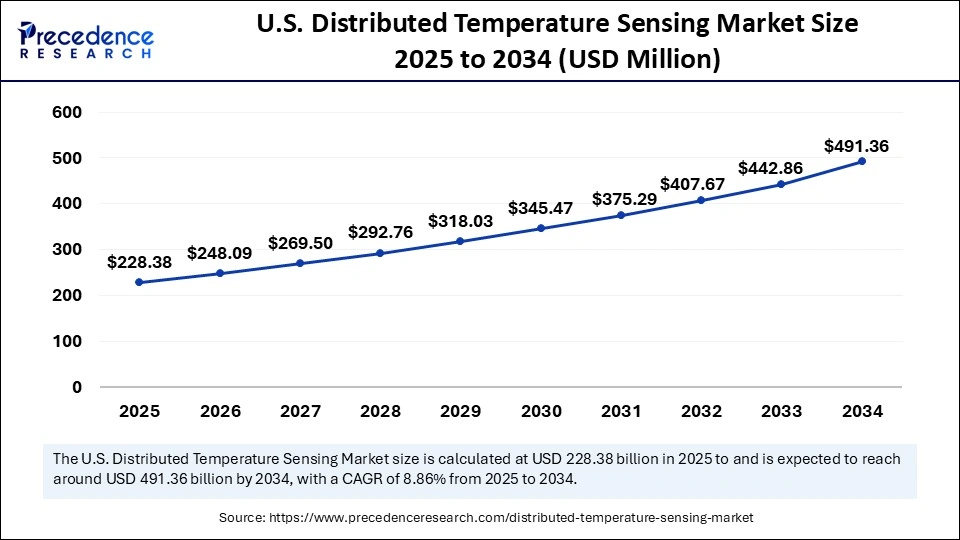

The U.S. distributed temperature sensing market size is exhibited at USD 228.38 million in 2025 and is projected to be worth around USD 491.36 million by 2034, growing at a CAGR of 8.86% from 2025 to 2034.

What Factors Contribute to North America's Market Dominance in 2024?

North America registered dominance in the distributed temperature sensing market by holding the largest revenue share of 34% in 2024. The region boasts well-established oil & gas industry and power utilities, boosting the demand for DTS systems. The presence of major market players in the region, such as Schlumberger Limited, Halliburton Company, and OFS Fitel, significantly contributes to market growth. The continuous assessment of infrastructure and buildings in countries like the U.S. and Canada further fuels the demand for distributed temperature sensing solutions. Moreover, stringent environmental regulations contribute to market expansion.

U.S. Distributed Temperature Sensing Market Trend

The market for DTS in the U.S. is driven by extensive adoption of DTS into oil & gas wells, modernization of smart grid systems, and infrastructure projects and reinvestment. Increasing emphasis on safety and leak detection and optimizing operations all drive usage in energy transmission systems and other industrial facilities. Growth in data centers and wildfire monitoring also help drive demand for distributed temperature sensing to obtain monitoring thermal mapping and mitigate risk in real-time.

Asia Pacific is expected to expand at the highest CAGR of 12.2% during the forecast period. The growth of the market in the region is driven by rapid industrialization, particularly in countries like China and India. China is one of the major manufacturing hubs, creating the need for DTS systems in various industrial applications. India is a major player in the distributed temperature sensing market within Asia Pacific. The rapid expansion of the oil & gas industry in the country is driving the growth of the market. Stringent regulations regarding emission control and leakage detection drive demand for DTS systems. In addition, increasing focus on sustainable solutions and environmental protection support regional market growth.

China Distributed Temperature Sensing Market Trend

China's growth for DTS is productive with increasing power transmission networks, infrastructure expansion of urban areas, and investment into energy and petrochemical projects. The push for intelligent monitoring systems in oilfields, metros and industrial plants further drives adoption of DTS. Infrastructure expansion of utility tunnels and large-scale high-voltage lines also drives reliance on tracking temperature and operational safety through robust fiber-optic sensing procedures.

Europe is considered to be a significantly growing area. The growth of the distributed temperature sensing market within Europe is driven by stringent regulations regarding labor safety. Increased environmental awareness further boosted the adoption of DTS systems in the oil & gas and energy sector to detect leakages. Many industries are facing challenges in temperature monitoring, analysis, and real-time monitoring, necessitating proactive measures. This is driving the demand for effective distributed temperature sensing solutions in Europe. Germany, with its significant chemical industry presence, is a leading market. Distributed temperature sensing solutions are particularly in demand in the oil and gas sector, which is fueling market growth.

Germany Distributed Temperature Sensing Market Trend

Germany demonstrates strong signs of DTS adoption based on its established industrial base, stringent safety guidelines, and demand for continuous monitoring in energy and manufacturing facilities. The development of renewable energy infrastructure, including wind and underground grid systems, are reasons for the reliance on fiber-optic sensing. Ongoing industrial automation combined with strict compliance for safety in all facility production also continue to drive demand for DTS across chemical, utility, and pipeline systems networks.

Middle East & Africa: Growth in Digital Trade Corridor

Cross-border e-commerce is experiencing notable growth in the Middle East and Africa, driven by increased smartphone accessibility and digital payment systems, as well as logistics modernization led by governments. Import demand in Gulf countries has helped to drive growth, while African countries have capitalized on the emergence of online marketplaces and trade facilitation at the regional level. The development of customs electronic systems and wider fintech adoption continue to promote the facilitation of international purchases seamlessly.

UAE Distributed Temperature Sensing Market Trend

The UAE continues to see rising use of DTS spurred by modernization in the oil & gas sector, its pipeline safety initiatives, and growing smart infrastructure projects. The need for thermal monitoring is large, particularly in support of higher adoption across wells, refineries, and district cooling systems. Additionally, the UAE government is digitally transforming utilities to promote its smart infrastructure projects, and is growing networks for power to support "remote" temperature sensing technologies in extreme desert conditions in an accurate manner.

Distributed Temperature Sensing Market Companies

- AP Sensing

- Bandweaver

- HALLIBURTON

- NKT Photonics A/S

- OFS Fitel, LLC

- OPTROMIX

- SLB

- Silixa Ltd

- Yokogawa Electric Corporation

- Sumitomo Electric Industries, Ltd.

Recent Developments

- In February 2025, Scientists have innovated an advanced type of optical fibre made from plastic known as POFs. This approach is expected to enhance the spatial resolution significantly. This approach is expected to reduce the noise inferences produced in the traditional systems. The new approach is using the perfluorinated graded-index POFs, which provide high accuracy even in high temperature and low strain conditions.

(Source: https://techxplore.com) - In July 2024, VIAVI solutions has introduced Optic Cables and Fiber-Enabled Critical Infrastructure, an integrated real-time monitoring and analytics solution for oil, gas, and water pipelines to electrical power transmission Infrastructures. The damage to asset can be a critical obstacle and dent in the initial capital invested in the project, which makes the detection and prevention of any threat is a crucial task which is driving the requirement for an effective solution.

(Source: https://www.viavisolutions.com)

Segments covered in the report

By Operating Principle

- Optical Time Domain Reflectometry (OTDR)

- Optical Frequency Domain Reflectometry (OFDR)

By Fiber Type

- Single-mode Fiber

- Multi-mode Fiber

By Application

- Oil and Gas

- Power Cable Monitoring

- Fire Detection

- Process & Pipeline Monitoring

- Environmental Monitoring

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content