What is Temperature Sensors Market Size?

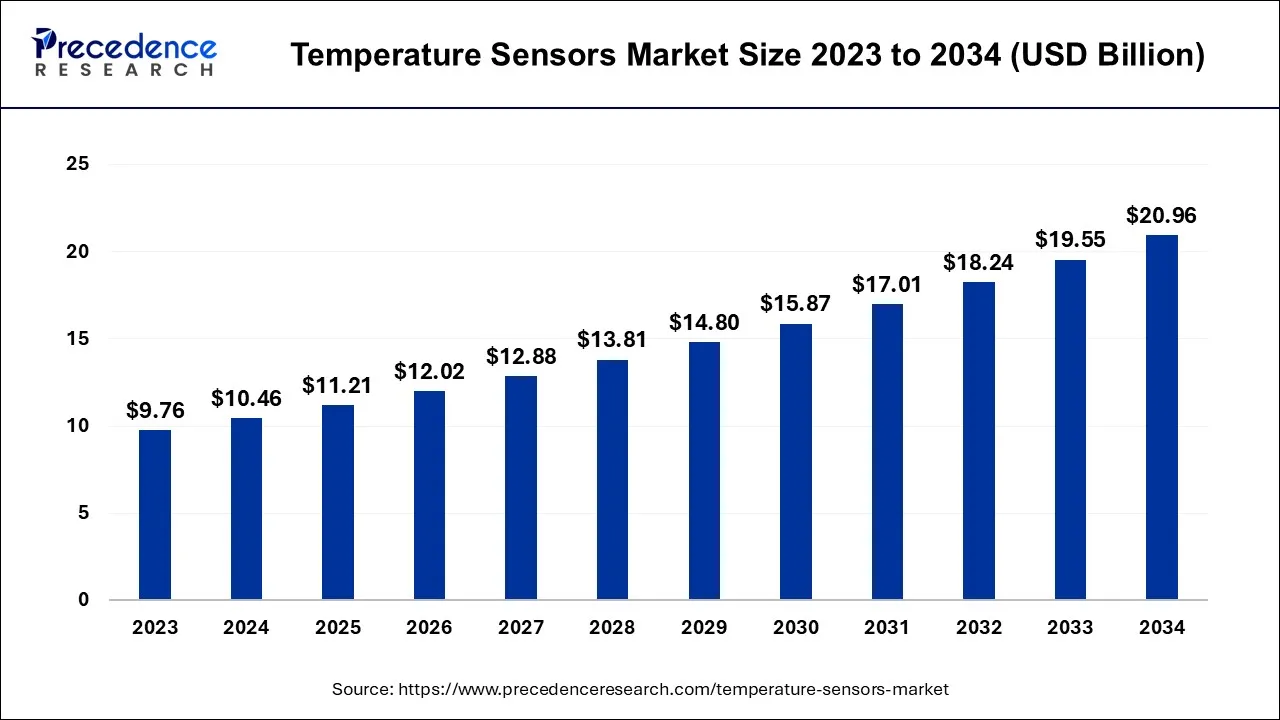

The global temperature sensors market size is valued at USD 11.21 billion in 2025 and is anticipated to reach around USD 20.96 billion by 2034, expanding at a CAGR of 7.20% over the forecast period 2025 to 2034.

Market Highlights

- In terms of revenue, the temperature sensors market is valued at $11.21 billion in 2025.

- It is projected to reach $20.96 billion by 2034.

- The temperature sensors market is expected to grow at a CAGR of 7.20% from 2025 to 2034.

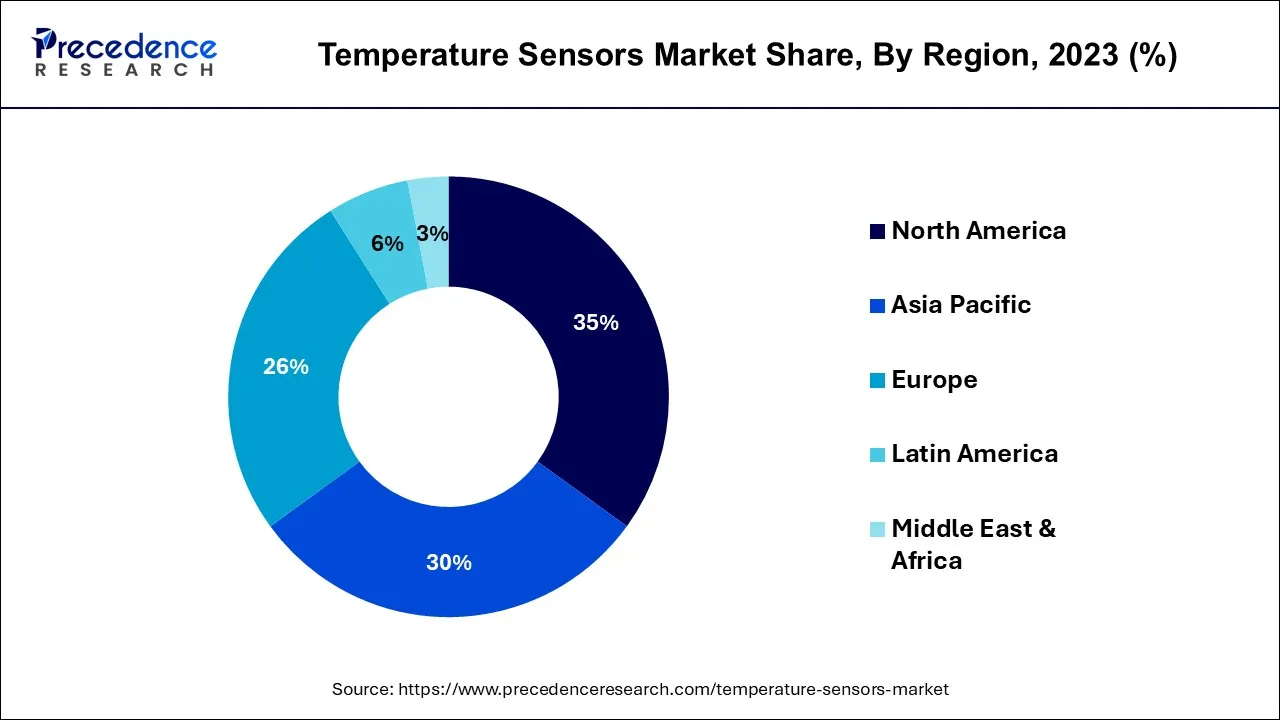

- North America contributed more than 35% of revenue share in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

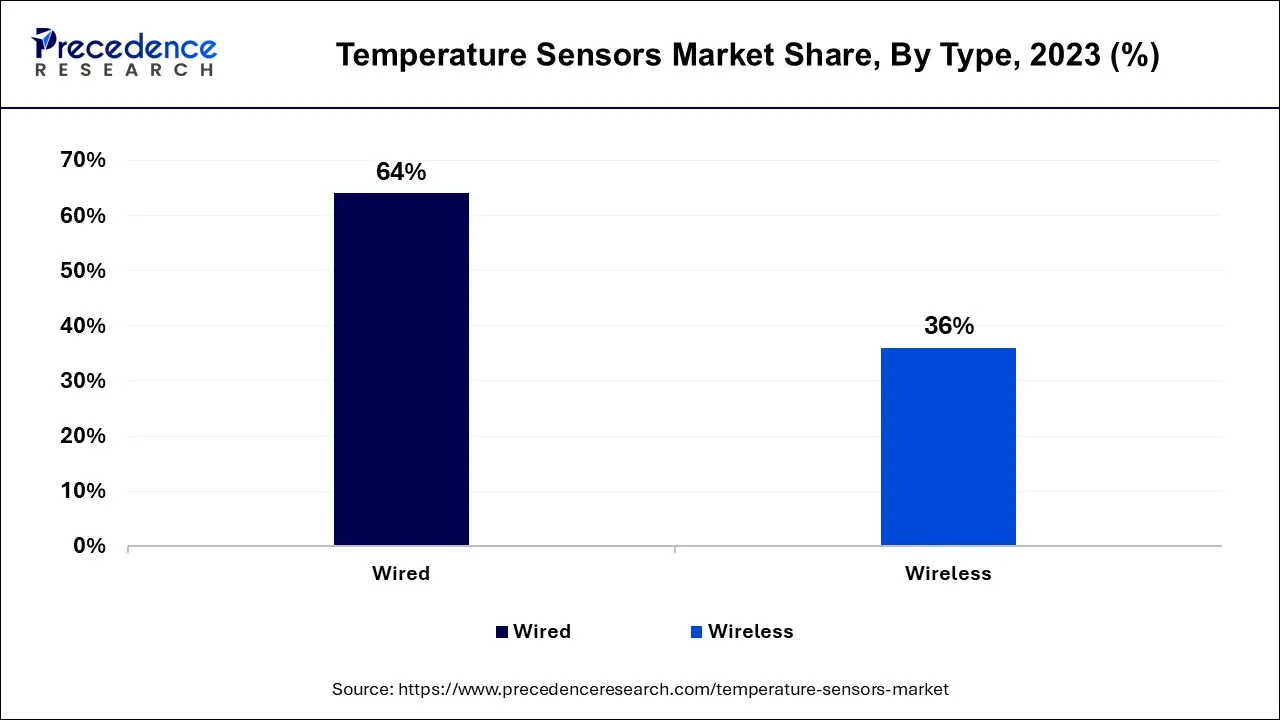

- By Type, the wired segment has held the largest market share of 64% in 2024.

- By Type, the wireless segment is anticipated to grow at a remarkable CAGR of 10.8% between 2025 and 2034.

- By Technology, the resistance temperature detectors segment generated over 31% of the revenue share in 2024.

- By Technology, the thermistor segment is expected to expand at the fastest CAGR over the projected period.

- By End-user Industry, the chemical and petrochemical segment had the largest market share of 35% in 2024.

- By End-user Industry, the oil and gas segment is expected to expand at the fastest CAGR over the projected period.

How are the Empowering Aspects of the Temperature Sensors?

The temperature sensors market comprises a diverse range of devices designed to measure temperature accurately in various applications. These sensors are integral components in industries like manufacturing, automotive, healthcare, and consumer electronics. The market exhibits dynamic growth driven by technological advancements, increasing demand for IoT-enabled sensors, and their crucial role in ensuring product quality, safety, and efficiency. Temperature sensors can be contact-based (thermocouples, RTDs) or non-contact (infrared sensors) and play a vital role in monitoring and controlling temperature in a wide array of processes and products.

Temperature Sensors Market Growth Factors

- The temperature sensors market is a vital component of modern industries, facilitating accurate temperature monitoring across diverse applications. It encompasses various sensor types, including contact-based thermocouples and RTDs, as well as non-contact infrared sensors.

- The market is propelled by technological advancements and the growing adoption of IoT-enabled sensors for quality control and process optimization. Manufacturing, automotive, and healthcare industries rely on these sensors to ensure product quality, safety, and efficiency.

- Major factors that surge the market growth include the demand for temperature-sensitive applications and the integration of sensors into smart devices. The trend towards miniaturization and wireless communication further fuels market expansion. Challenges include calibration issues and sensor drift, requiring ongoing maintenance.

- However, the market offers opportunities in emerging sectors like healthcare and the automotive industry, where temperature sensors are essential for advanced diagnostics, thermal management, and autonomous vehicle technology. The Temperature Sensors Market continues to evolve as a critical component of modern industrial processes, ensuring precision and reliability in temperature monitoring and control.

Temperature Sensors Market Outlook

- Global Expansion: A rise in demand from industrial automation, consumer electronics, and healthcare sectors, driven by IoT integration and advancements in miniaturization and accuracy, is supporting future developments.

- Major Investors: The market has large, global asset management companies, including Vanguard Group, BlackRock, and those that handle the portfolios of the major manufacturing companies.

- Startup Ecosystem: Like Therma and Calumino, are emphasising temperature and humidity monitoring and thermal imaging sensors, respectively.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.21 Billion |

| Market Size in 2026 | USD 12.02 Billion |

| Market Size by 2034 | USD 20.96 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.2% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Technology, and By End-user Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing industrial automation, IoT and connectivity

The temperature sensors market experiences significant growth driven by two interrelated factors, the expansion of industrial automation and the increasing integration of temperature sensors into IoT ecosystems. Industrial automation has become a cornerstone of modern manufacturing and process industries, relying heavily on precise temperature monitoring for quality control and process optimization. Temperature sensors play a pivotal role in this automation, ensuring that machinery and processes operate within specified temperature ranges. As industries continue to embrace automation for efficiency and precision, the demand for temperature sensors remains robust.

Simultaneously, the rise of internet of things (IoT) technology has revolutionized temperature sensing by enabling remote monitoring and control. IoT devices, often equipped with temperature sensors, collect and transmit real-time data to centralized systems or cloud platforms. This connectivity empowers industries to remotely monitor and manage temperature-sensitive assets and environments, making predictive maintenance and rapid responses to temperature fluctuations possible. Consequently, the synergy between industrial automation and IoT connectivity propels the demand for temperature sensors, as they serve as critical components in the digital transformation of various sectors, including manufacturing, logistics, healthcare, and agriculture. As industries continue to advance and embrace smart technologies, the temperature sensors market is poised for sustained growth.

Restraint

Technical challenges

Technical challenges and compatibility issues pose significant restraints on the temperature sensors market. One key challenge is accuracy. Temperature sensors must provide precise readings to ensure the safety and reliability of critical systems, but factors like electromagnetic interference, self-heating, and sensor drift can affect accuracy. Another challenge is calibration and maintenance. Temperature sensors require regular calibration to maintain accuracy, which can be costly and time-consuming, especially when dealing with a large number of sensors in industrial settings.

Compatibility issues arise when integrating temperature sensors with existing systems and devices. Ensuring seamless communication and data exchange between sensors and control systems is crucial. Mismatched protocols, data formats, or interfaces can hinder integration efforts. Furthermore, issues related to power consumption and sensor size may limit their applicability in compact or battery-powered devices. These challenges necessitate ongoing research and development efforts to overcome technical limitations and improve sensor performance, reliability, and compatibility, thus unlocking the full potential of temperature sensors across various industries.

Opportunity

IoT integration and demand from automotive industry

The temperature sensors market is experiencing significant growth, driven in large part by the integration of IoT technology and heightened demand from the automotive industry. IoT integration has revolutionized temperature sensing by enabling real-time data collection and remote monitoring across various applications. Industries such as manufacturing, logistics, and healthcare now rely on IoT-connected temperature sensors to ensure precision, compliance, and operational efficiency. For instance, in the pharmaceutical sector, IoT-enabled temperature sensors monitor the storage and transportation of sensitive vaccines and medicines, ensuring they remain within specified temperature ranges, thus maintaining their efficacy.

The automotive industry is another key driver, with the growing popularity of electric vehicles (EVs) and advanced driver-assistance systems. Temperature sensors play a crucial role in EVs by monitoring battery temperature for safety and performance optimization. Additionally, ADAS systems rely on temperature data for accurate decision-making, enhancing vehicle safety. As automakers continue to invest in these technologies, the demand for temperature sensors is set to rise further, solidifying their position as a cornerstone of the modern automotive and IoT landscape.

Segment Insights

Technological Advancement

Technological advancements in the temperature sensors market feature digital sensors, fiber optic sensors, wearable devices, and smart temperature sensors. Digital sensors are a popular advancement in remote applications, featuring non-volatile memory and range-bound alert indications. Fiber optic sensors with the traction gains advantage and provide immunity to electromagnetic interference. Smart temperature sensors help in remote monitoring and data collection. Another technology is the IoT system, which integrates into the IoT system, helps to control temperature in industries.

Wearable devices are used in smartwatches and fitness trackers. The device supports health and safety. A Temperature sensor in industrial automation measures the appropriate temperature in a complex process. The most recent technology used in the temperature sensors market is the resistive temperature device (RTD), thermocouple, and thermistor. This technology helps the market to sustain itself in the long run.

Type Insights

According to the type, the wired segment has held a 64% revenue share in 2024. The temperature sensors market offers both wired and wireless sensor solutions to meet diverse industry needs. Wired temperature sensors, characterized by their robustness and reliability, are preferred in critical applications such as industrial manufacturing and laboratory environments, where uninterrupted, real-time temperature monitoring is essential. These sensors are trending toward improved accuracy, durability, and compatibility with industrial automation systems.

The wireless segment is anticipated to expand at a significant CAGR of 10.8% during the projected period. Wireless temperature sensors have gained traction, owing to the growing demand for remote monitoring and IoT integration. These sensors offer flexibility and ease of installation, making them suitable for applications like smart homes, healthcare, and logistics. A trend in this segment is the development of low-power, long-range wireless sensors, enhancing their efficiency and extending their applicability in various industries. Both wired and wireless temperature sensors play pivotal roles in modern temperature monitoring solutions, catering to diverse requirements across industries.

Technology Insights

Based on the technology, the Resistance Temperature Detectors (RTDs) segment is anticipated to hold the largest market share of 31% in 2024. Resistance temperature detectors (RTDs) and thermistors are two prevalent technologies in the temperature sensors market. RTDs are known for their high accuracy and stability, making them ideal for applications demanding precision, such as scientific research and industrial process control. They exhibit linear resistance-temperature relationships and are typically made of platinum, nickel, or copper. Industry trends show an increasing demand for RTDs due to their reliability and compatibility with IoT systems for real-time temperature monitoring.

On the other hand, the thermistors segment is projected to grow at the fastest rate over the projected period. Thermistors, known for their affordability and sensitivity, find applications in consumer electronics, automotive, and medical devices. These semiconductor-basedsensors offer a non-linear resistance-temperature characteristic, making them suitable for temperature-compensation circuits. Trends indicate a growing market for thermistors, particularly in the automotive sector, where temperature-sensitive components require accurate thermal management for enhanced performance and efficiency.

End-user Industry Insights

In2024, the chemical and petrochemical segment had the highest market share of 35% on the basis of the end user. In the chemical and petrochemical industry, temperature sensors play a critical role in ensuring the safe and efficient operation of processes. The trend in this sector is a growing emphasis on accuracy and reliability in temperature measurement. As chemical reactions are highly sensitive to temperature variations, precise monitoring is essential to prevent accidents and optimize production. Temperature sensors with advanced features like remote monitoring and self-diagnosis capabilities are gaining traction, enabling real-time data analysis and proactive maintenance.

The oil and gas segment is anticipated to expand at the fastest rate over the projected period. In the oil and gas industry, temperature sensors are utilized in various applications, including upstream drilling, refining, and transportation. The trend here is towards rugged and durable sensors that can withstand harsh environmental conditions, such as extreme temperatures and corrosive substances. Additionally, the industry is witnessing a shift towards wireless and IoT-enabled temperature sensors for remote monitoring of pipelines, storage tanks, and equipment, enhancing operational efficiency and safety while reducing maintenance costs.

Regional Insights

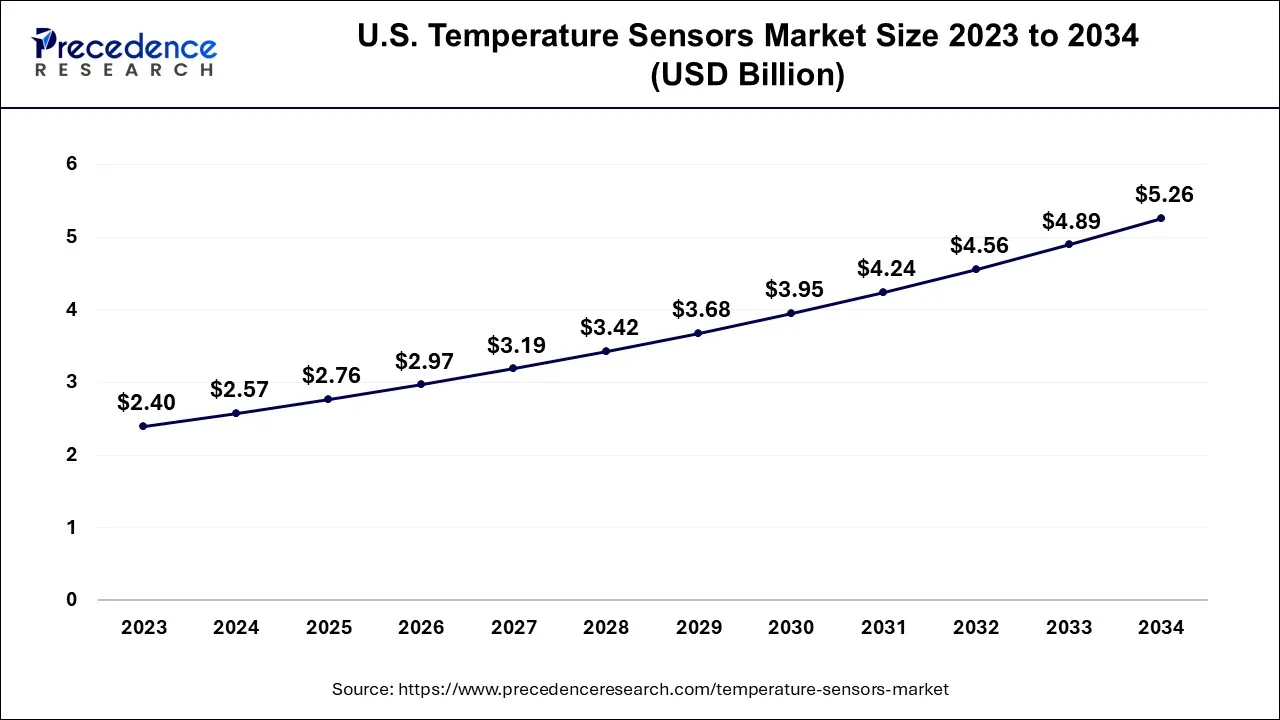

U.S. Temperature Sensors Market Size and Growth 2025 to 2034

The U.S. temperature sensors market size is calculated at USD 2.76 billion in 2025 and is projected to be worth around USD 5.26 billion by 2034, poised to grow at a CAGR of 7.43% from 2025 to 2034.

Leveraging Miniaturization and MEMS: Bolster the U.S. Market

The leading U.S. companies are encouraging the application of Micro-Electro-Mechanical Systems (MEMS) technology, which offers sensors smaller, more energy-efficient, and favourable for integration into compact devices, such as wearables and portable medical equipment.

Why did North America hold the Largest Share of the Market in 2024?

North America held the largest revenue share over 35% in 2024.In North America, the temperature sensors market has witnessed a growing demand for sensors in the healthcare sector, particularly for temperature monitoring during the COVID-19 pandemic. Additionally, the automotive industry in the region is embracing temperature sensors to enhance vehicle safety and performance. The trend toward electric vehicles has further fueled the adoption of temperature sensors for battery management.

Asia Pacific is estimated to observe the fastest expansion. In the region, the increasing industrialization and expansion of manufacturing facilities have driven the demand for temperature sensors to ensure efficient and safe production processes. Additionally, the region's focus on environmental monitoring and energy conservation has led to the adoption of temperature sensors in HVAC systems, further boosting market growth. The rise in smart manufacturing practices, coupled with government initiatives promoting energy efficiency, has contributed to the expanding role of temperature sensors in the Asia Pacific. Factors influencing the growth, such as increased production and solution of the temperature sensor in several industries. Other emerging markets like electronics, energy, and automotive within the region boost the temperature sensor companies.

Progressive Ultra-Accurate Active Temperature Sensor: Elevates the Japan Market

The prospective growth of the Japanese market will be fueled by notable efforts in novel temperature sensors, such as SEMITEC Corporation, in collaboration with Hirosaki University and National Institute of Technology Hachinohe College, established a unique sensor. This is 15 times more precise and has a 10 times faster thermal response than their previous high-performance sensors.

Reedy Sensors for Automotive E-motors is Driving Europe

An impactful ongoing advancement in sensor technology by European companies is further supporting the overall market expansion. Whereas, Switzerland-based TE Connectivity designed e-motor temperature sensors available in NTC and Pt designs, sealed with fluoroplastics for added protection. These robust solutions can be used in tight spaces in electric vehicles (EVs) and battery systems, with a wide operating range of -40°C to 200°C and high voltage insulation.

Exploration of Edge AI and Multi-Sensor Platforms: Expands the German Market

Nowadays, many German startups are evolving advanced platforms, particularly Sensry's Kallisto Platform, an ultra-small multi-sensor module. This usually combines temperature sensing with up to 20 other measurands and features unified edge AI and diverse wireless connectivity options (Wi-Fi, BLE, etc.) for industrial IoT applications.

Temperature Sensors Market: Value Chain Analysis

- Raw Material Procurement

Numerous robust firms are sourcing specialized materials, like platinum for RTDs, different metal alloys for thermocouples, and specific metal oxides.

Key Players: TE Connectivity, Omega Engineering, Inc., Hayashi Denko, etc. - Assembly and Packaging

The assembly includes the protection of the sensor element and creating an assembly with a connection head for wiring, while packaging leverages hermetic sealing for harsh or sensitive applications.

Key Players: Heatcon Sensors, Thermonic Sensor and Control, and Arcotherm. - Lifecycle Support and Recycling

It mainly focuses on preventive maintenance to escalate lifespan, whereas recycling comprises specialized e-waste processes.

Key Players: Sensitech, ABB, Keysight, etc.

Key Players inTemperature Sensors Market and their Offerings

- Texas Instruments Incorporated- A major company offers both local and remote temperature sensing capabilities, with alternatives for ultra-high accuracy, low power consumption.

- Honeywell International Inc.- They provide various probes, Resistance Temperature Detectors (RTDs), thermostats, thermistors, and humidity/temperature sensors.

- Panasonic Corporation- It explored NTC thermistors for automotive and industrial applications, and Grid-EYE infrared array sensors for non-contact thermal detection.

- Siemens AG- A leader facilitates a comprehensive portfolio for numerous applications in process instrumentation (SITRANS T series) and HVAC/building automation (Q-series and Symaro sensors).

- STMicroelectronics N.V.- They usually offer a portfolio of digital and analog temperature sensors developed for numerous applications.

Other Temperature Sensors Market Companies

- NXP Semiconductors N.V.

- Analog Devices, Inc.

- Infineon Technologies AG

- Maxim Integrated Products, Inc.

- TE Connectivity Ltd.

- ON Semiconductor Corporation

- Microchip Technology Inc.

- Sensirion AG

- Amphenol Corporation

- Emerson Electric Co.

Recent Developments

- In May 2025, Linux 6.16 introduced sensor monitoring for the ASUS ROG MAXIMUS Z690 Formula. This initiative aims to enhance the company's value and is expected to boost global shopping rates.

- In February 2025, IFM launched new innovative temperature sensors. IFM is popular for its sensor technology and automation solutions and has announced two innovative products known as TP2 temperature plug and TSM clamp. Further added to the temperature sensor module.

- In January 2025, Apple revealed an all-new temperature sensor that could be used with Apple Watch, AirPods, and more. To better the customer experience, Apple has adopted an innovative idea. This will help users to check the ambient temperature in the device's environment.

- In 2022,OMEGA Engineering launched the latest version of its HANI Clamp-On Temperature Sensor: the HANI Clamp Sensor is explicitly designed for plastic pipe applications. This Sensor precisely measures the temperature of media inside a pipe in seconds without ever breaching the pipe.

- In 2022, Honor launched Earbuds 3 Pro which is integrated with temperature monitoring technology. Honor's buds include a temperature sensor combined with an AI temperature algorithm that can measure with approximately 80% chance of achieving approximately ±0.3 degrees Celsius or less error.

Segments Covered in the Report

By Type

- Wired

- Wireless

By Technology

- Infrared

- Thermocouple

- Resistance Temperature Detectors

- Thermistor

- Temperature Transmitters

- Integrated Circuit

- Fiber optics

- Others

By End-user Industry

- Chemical and Petrochemical

- Oil and Gas

- Metal and Mining

- Power Generation

- Food and Beverage

- Automotive

- Medical

- Consumer Electronics

- Aerospace and Military

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting