What is Artificial Intelligence Software Platform Market Size?

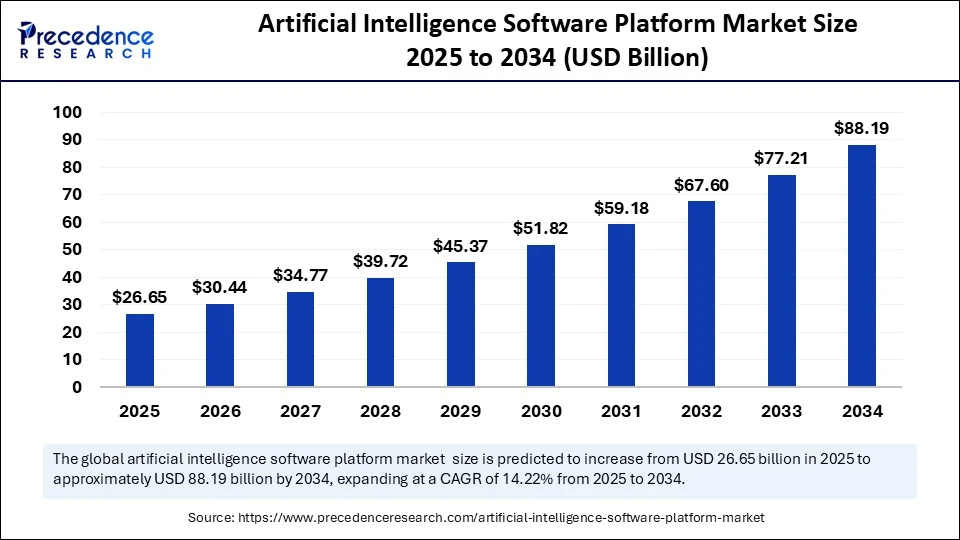

The global artificial intelligence (AI) software platform market size is estimated at USD 26.65 billion in 2025 and is predicted to increase from USD 30.44 billion in 2026 to approximately USD 88.19 billion by 2034, expanding at a CAGR of 14.22% from 2025 to 2034. The growth of the market is driven by the rising demand for enterprise automation solutions, exponential growth in data volumes, and increased demand for industry-specific solutions.

Market Highlights

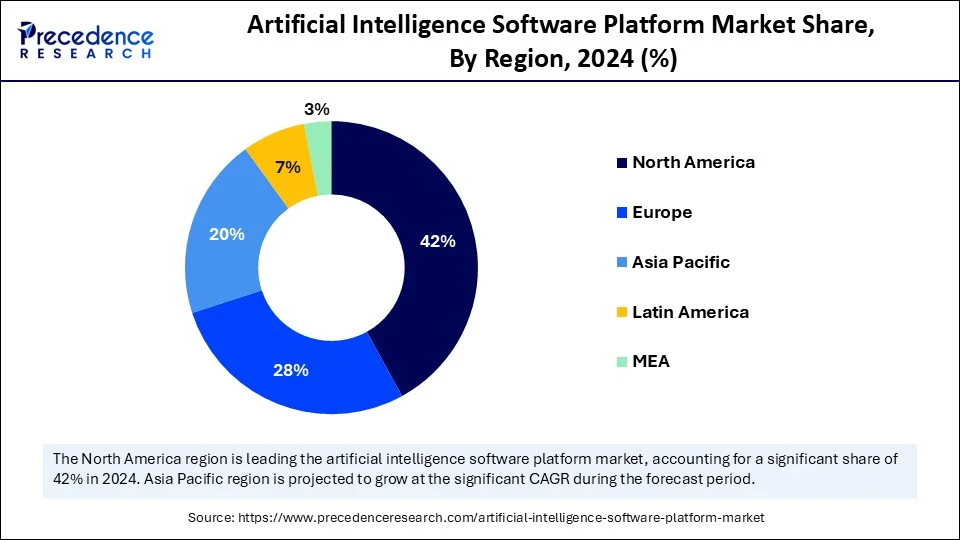

- North America dominated the artificial intelligence (AI) software platform market with the largest share of 42% in 2024.

- Asia Pacific is expected to grow at a CAGR of approximately 30% from 2025 to 2034.

- By technology, the machine learning platforms segment captured the biggest market share of 38% in 2024.

- By technology, the computer vision segment is expected to grow at a CAGR of 34% from 2025 to 2034.

- By deployment mode, the cloud-based segment contributed the highest market share of 66% in 2024.

- By deployment mode, the hybrid segment is expected to grow at a CAGR of 28% from 2025 to 2034.

- By component, the software tools & SDKs segment held the biggest market share of 52% in 2024.

- By component, the APIs segment is expected to grow at a CAGR of 27% from 2025 to 2034.

- By functionality, the model development segment generated the market share of 40% in 2024.

- By functionality, the autoML / no-code AI builders segment is expected to grow at a CAGR of 33% from 2025 to 2034.

- By application, the predictive analytics segment accounted for the significant market share of 30% in 2024.

- By application, the image/video analysis segment is expected to grow at a CAGR of 36% from 2025 to 2034.

- By end-use industry, the BFSI segment held the remarkable market share of 22% in 2024.

- By end use industry, the healthcare & life sciences segment is expected to grow at a CAGR of 31% from 2025 to 2034.

- By enterprise size, the large enterprises segment captured the largest market share of 61% in 2024.

- By enterprise size, the SMEs segment is expected to grow at a CAGR of 29% from 2025 to 2034.

Market Overview

The artificial intelligence software platform market refers to the ecosystem of pre-built and customizable software solutions designed to facilitate the development, deployment, and management of AI applications. These platforms typically include tools for data preparation, model training, model deployment, algorithm selection, workflow orchestration, integration with other software environments, and support for machine learning (ML), deep learning (DL), and natural language processing (NLP). AI software platforms are critical enablers for organizations aiming to embed AI capabilities in applications across industries such as healthcare, finance, retail, manufacturing, and logistics.

AI software platforms can be cloud-based, on-premise, or hybrid, and they serve enterprises, developers, and data scientists in building scalable and production-grade AI solutions. These platforms also provide pre-trained models, AI-as-a-Service (AIaaS) offerings, and APIs to accelerate time to value. The rising adoption of AI in the banking sector is expected to boost the growth of the artificial intelligence (AI) software platform market. Financial institutions are increasingly using AI systems to automate processes, personalize customer experiences, and improve risk management. These solutions boost productivity, reduce costs, enhance customer interactions, and mitigate risks.

What Factors are Fueling the Growth of the Artificial Intelligence (AI) Software Platform Market?

- Focus on Industrial Automation: Industries are investing in AI platforms to automate routine tasks, streamline processes, and boost efficiency. This intelligent automation streamlines manual tasks, reduces costs, and enables human resources to focus on more critical areas, thereby enhancing overall business productivity.

- Shift Toward Cloud Environment: Cloud computing enables companies to adopt AI platforms without major software investments. Cloud-based AI platforms are scalable, flexible, and easily integrated with existing IT systems.

- Increasing Investment & Sector-wise Adaptation: The rising demand for industry-specific solutions boosts the growth of the market. Both private and public sectors are heavily investing in AI platforms, driving innovation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 26.65 Billion |

| Market Size in 2026 | USD 30.44 Billion |

| Market Size by 2034 | USD 88.19 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.22% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology,Deployment Mode, Component, Functionality, Application, End Use Industry, Enterprise Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Advancements in Computing Power

The rapid advancement of computing power, including powerful GPUs, TPUs, and AI accelerators, is a key driver in the artificial intelligence (AI) software platform market. Enterprises are increasingly adopting GPU-as-a-service and cloud-based AI infrastructure to access high-performance computing without major capital investment, making AI more affordable and accessible. This increased capacity enables the training of more complex models, real-time inference, and resource-intensive applications across various sectors, including finance and healthcare. The combination of enhanced computational capabilities and increased data accessibility is a primary driver of demand for scalable, feature-rich, AI-based software platforms that can support ambitious AI tasks.

Rising Adoption in Various Industries

There is high adoptions of AI technologies in the health, financial institutions, and manufacturing sectors that drive market growth. The AI tool is becoming instrumental in helping organizations overcome inefficiencies brought about by manual tasks, enhance diagnostic and financial risk decision-making, and the management of intelligent production processes with a wide range that includes predictive maintenance, intelligent quality control, and monitoring of regulatory compliance.

Financial institutions are using AI systems to automate fraud detection, underwriting, risk scoring, continuous auditing, and customer engagement, thereby increasing reliability and scalability. In the healthcare industry, AI aids in clinical documentation, imaging, diagnostics, and personalized patient workflows, thereby freeing up skilled professionals and leading to improved outcomes.

AI tools are becoming instrumental in helping organizations overcome inefficiencies caused by manual tasks, improve diagnostic and financial risk decision-making, and manage intelligent production processes. Financial institutions leverage AI for fraud detection, underwriting, risk scoring, and customer engagement, enhancing reliability and scalability. In healthcare, AI supports clinical documentation, imaging, diagnostics, and personalized patient workflows, improving outcomes and freeing up professionals. The widespread adoption of AI in these sectors drives the demand for sophisticated AI software platforms.

Restraint

High Infrastructure Costs and Resource Bottlenecks

The substantial upfront investments required for advanced AI hardware, such as GPUs and TPUs, create a barrier to entry for smaller businesses and startups. Limited access to these essential resources, due to global shortages and supply chain issues, further exacerbates the problem, delaying project timelines and hindering innovation. The energy-intensive nature of AI model training and operation leads to increased operational costs, which can strain budgets and limit scalability. Moreover, the need for specialized expertise in AI development and deployment adds to the overall expenses, making it difficult for companies to fully leverage AI capabilities.

Opportunity

Rising Focus on Industrial Automation

There is a strong focus on industrial automation, which creates immense opportunities in the artificial intelligence (AI) software platform market. Businesses across various industries are increasingly adopting AI to automate processes, improve decision-making, and enhance customer experiences. This trend is driven by the need for increased productivity, improved quality control, and enhanced safety in manufacturing and other industrial sectors. The integration of AI facilitates the development of smart factories, where machines can communicate and make decisions autonomously. Consequently, the demand for AI software platforms that support these advanced automation capabilities continues to surge.

Segment Insights

Technology Insights

Why Did the Machine Learning Platforms Segment Contribute the Most Revenue in 2024?

The machine learning platforms segment led the artificial intelligence (AI) software platform market while holding a 38% share in 2024. These platforms provide full infrastructure, data incorporation for model training and versioning, deployment, and monitoring, offering enterprises scalable AI solutions. As organizations transition from pilot programs to production-level tools, there is a growing demand for platforms that facilitate MLOps processes and automate model management. The use of predictive analytics and operational intelligence across financial, healthcare, retail, and manufacturing sectors supports segment growth.

The computer vision segment is expected to grow at a significant CAGR over the forecast period, owing to the rapid integration of computer vision in healthcare imaging, autonomous driving, retail analytics, manufacturing, and security systems. Machine learning algorithms, particularly those based on deep learning and convolutional neural networks, are at the forefront of computer vision technologies, enabling image classification, object localization, and face identification. Several industries commonly utilize this technology in predictive maintenance and automated quality control, resulting in reduced downtime and increased product reliability.

Deployment Mode Insights

Why Did the Cloud-Based Segment Dominate the Artificial Intelligence (AI) Software Platform Market in 2024?

The cloud-based segment held a 66% share of the market in 2024. Organizations are increasingly shifting toward cloud-native solutions that combine AI and machine learning with managed services from public clouds like AWS, Microsoft Azure, and Google Cloud, enabling them to implement AI projects more quickly without significant infrastructure investments. This deployment enables organizations to utilize vast amounts of data for training and deploying models, and to leverage capabilities such as automated MLOps, real-time analytics, and generative AI workflows. The widespread adoption of cloud-based platforms by industries like finance, healthcare, and retail has solidified their role as a cornerstone of digital transformation, contributing to segmental dominance.

The hybrid segment is expected to grow at the fastest CAGR in the upcoming period. Hybrid models are gaining popularity, offering a strategic middle ground between cloud flexibility and on-premise control, especially in industries with stringent data privacy, compliance, and latency requirements, such as finance, healthcare, and government. Organizations can utilize hybrid architectures to host confidential workloads and regulated data in-house, while shifting compute-intensive workloads, such as model training and inference, to the public cloud. This approach enables a balance between data control and scalability, thereby meeting regulatory requirements.

Component Insights

How Does the Software Tools & SDKs Segment Contribute the Most Revenue in 2024?

The software tools & SDKs segment led the artificial intelligence (AI) software platform market while holding a 52% share in 2024, driven by high demand for development frameworks, integrated development environments, and AI-based tooling ecosystems. These tools offer vital infrastructure for developers, including code recommendations, troubleshooting, test automation, and model integration, serving as the backbone of commercial AI initiatives. The rise of AI-aided code systems, such as GitHub Copilot and Microsoft IntelliCode, has increased productivity and reduced developer errors, rapidly gaining widespread adoption across organizations. SDKs, particularly those supporting machine learning frameworks and cloud services, have seen explosive growth, enabling developers to integrate AI features into various applications quickly.

The application programming interfaces (APIs) segment is expected to grow at a significant CAGR over the forecast period. The proliferation of microservices and hybrid deployment architecture has increased the preference for APIs as a way to gain modular access to AI functionalities. Developers can leverage predictive analytics, NLP, computer vision, and generative models without the complexities of integrating extensive frameworks. This modular approach makes APIs particularly appealing for developing feature-rich applications across cloud, mobile, and edge environments. The availability of standardized AI APIs from major cloud providers, including image recognition and code generation, has lowered technical barriers and enhanced deployment speed. With the increasing adoption of composable architectures and developer-centric integration methods, API adoption is poised for exponential growth, thereby accelerating AI-driven innovations across various industries.

Functionality Insights

Why Did the Model Development Segment Lead the Artificial Intelligence (AI) Software Platform Market in 2024?

The model development segment held a 40% share of the market in 2024. Development platforms, based on modern AI/ML, offer comprehensive environments that streamline data intake, model experimentation, hyperparameter tuning, and scalable training. There's a high demand for platforms equipped with distributed training, experiment tracking, and governance capabilities, as organizations transition from experimentation to production phases. This infrastructure is essential for developing reliable, reproducible models across enterprises. The need for rapid deployment of effective predictive models, combined with a shortage of data scientists, is driving organizations to adopt ML platforms with automation and collaboration features. These features enhance output rates and minimize errors.

The autoML / no-code AI segment is expected to grow at the highest CAGR in the market during the projection period. AutoML tools utilize automation to streamline model building by automating feature engineering, model selection, and hyperparameter tuning. This makes advanced AI accessible to business analysts, domain experts, and SMEs, even without extensive ML expertise. As enterprises increasingly adopt automation and shorter deployment lifecycles, these no-code environments enable model-building for a broader range of users, thereby reducing reliance on specialized teams.

Application Insights

What Made Predictive Analytics the Dominant Segment in the Market in 2024?

The predictive analytics segment dominated the artificial intelligence (AI) software platform while holding a 30% share in 2024. This is mainly due to the increased need for predictive analytics across major industries, including banking, retail, healthcare, and supply chain management, for demand forecasting, fraud detection, marketing optimization, and threat identification. AI platforms provide functionalities such as time-series forecasting, regression, classification, and clustering, which are essential for operational planning and risk minimization. The enhanced accuracy and reliability of predictive analytics tools, achieved through integrated machine learning algorithms, have significantly improved their effectiveness and actionability.

The image/video analysis segment is expected to grow at the fastest rate in the coming years, driven by its adoption across various applications, including surveillance, automotive, augmented reality, virtual reality, and industrial sectors. Visual AI solutions enable real-time object recognition, anomaly detection, behavioral analytics, gesture recognition, and environment mapping, which are crucial in smart city implementations, retail security, autonomous driving, and immersive AR/VR experiences. With the growing need for safety and monitoring globally, businesses and governments are increasingly adopting advanced video surveillance systems that utilize AI for automatic event detection and alert generation.

End Use Industry Insights

Why Did the BFSI Segment Contribute the Most Revenue in 2024?

The BFSI segment led the market while holding a 22% share in 2024, driven by the industry's commitment to digital transformation. This transformation involves modernizing core banking systems, implementing advanced data analytics platforms, and automating support functions, such as contact centers. Banks and financial institutions are leveraging AI to improve operational efficiency, enhance customer experiences, and ensure regulatory compliance. Moreover, significant investments in cutting-edge technologies are fueling this growth, enabling BFSI companies to stay competitive. The increasing adoption of AI in this sector reflects a strategic shift towards data-driven decision-making and innovative service delivery.

The healthcare & life sciences segment is likely to experience rapid growth over the forecast period due to several key factors. The development of advanced diagnostic services is driving the need for sophisticated AI solutions to improve accuracy and efficiency. Drug discovery processes are also benefiting from AI, accelerating research and development efforts. Automation of various operations within healthcare facilities is another major driver, streamlining processes and reducing manual errors. Furthermore, the increasing demand for precise diagnoses, coupled with broader access to healthcare services, is boosting the adoption of AI-powered tools. Healthcare providers are leveraging AI to analyze vast amounts of data, leading to better patient outcomes and more personalized care. Ultimately, the integration of AI is transforming the healthcare landscape, making it more efficient, accurate, and patient-focused.

Enterprise Size Insights

How Does the Large Enterprises Segment Lead the Artificial Intelligence (AI) Software Platform Market in 2024?

The large enterprises segment led the market with a 61% share in 2024. These organizations possess substantial financial resources, enabling them to invest heavily in AI infrastructure and solutions. Their complex systems and vast datasets create a strong demand for AI-driven predictive analytics, automation, and risk management tools. Large enterprises can deploy AI across various departments, including marketing, customer service, and logistics, maximizing their return on investment. The ability to integrate AI into existing IT environments, often through hybrid or on-premise solutions, allows for greater data control and compliance. Moreover, these companies have the in-house expertise and dedicated IT budgets necessary to successfully implement and manage sophisticated AI platforms. Consequently, large enterprises are well-positioned to leverage AI for enhanced operational efficiency and strategic decision-making.

The SMEs segment is expected to grow at the fastest rate in the coming years. Cloud-based solutions offer cost-effective access to AI tools, reducing the need for SMEs for significant upfront investment in hardware and infrastructure. SaaS applications further simplify implementation, minimizing the technical expertise required to deploy and manage AI systems. SMEs are recognizing the potential of AI to enhance efficiency and gain a competitive advantage in their respective industries. The availability of user-friendly platforms and pre-packaged models enables SMEs to automate various operational areas, such as customer service and marketing analytics. This eliminates the need to hire specialized IT professionals, making AI adoption more accessible and manageable for smaller businesses.

Regional Insights

U.S. Artificial Intelligence Software Platform Market Size and Growth 2025 to 2034

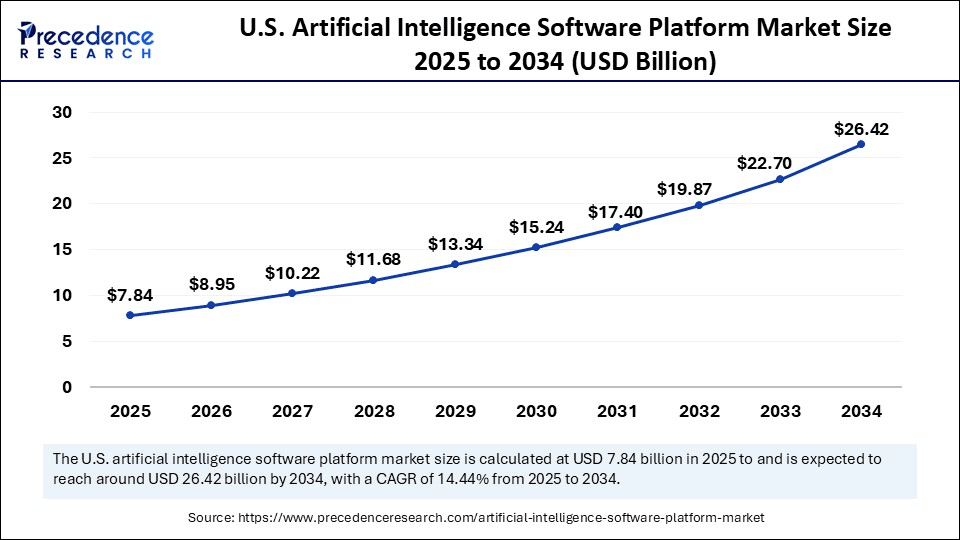

The U.S. artificial intelligence (AI) software platform market size is evaluated at USD 7.84 billion in 2025 and is projected to be worth around USD 26.42 billion by 2034, growing at a CAGR of 14.44% from 2025 to 2034.

What Made North America the Dominant Region in the Artificial Intelligence (AI) Software Platform Market in 2024?

North America led the global market with the highest market share of 42% in 2024 due to its advanced technological infrastructure. The region boasts powerful cloud computing services, high-speed networks, and robust data centers, which are essential for AI development and deployment. Major players like Amazon Web Services, Google Cloud, and Microsoft Azure provide the necessary platforms and resources. Beneficial regulatory policies and strong private sector involvement further contribute to the region's growth. These factors enable the widespread adoption of AI across various sectors, driving innovation and market expansion in North America.

The U.S. is a major contributor to the market in North America due to its substantial investments in AI research & development. This has enabled leading universities and businesses to develop world-class AI frameworks and tools. Tech giants like Google, Nvidia, OpenAI, AWS, and Microsoft are aggressively expanding their AI platforms. These companies are investing heavily in cloud data centers and other essential infrastructure. This strategic focus keeps the U.S. at the forefront of AI development, driving innovation and market expansion.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to experience the fastest growth during the forecast period. This is mainly due to the increasing investments in digital infrastructure, including data centers and high-speed connectivity. Governments across the region are actively creating and funding large-scale AI programs. Rapid economic growth in countries like India and Vietnam fuels the demand for automation and data-driven decision-making. This creates a favorable environment for AI adoption across various industries. Moreover, the increasing availability of skilled labor and a focus on technological advancements further contribute to the market's expansion.

China's substantial investments in AI and robotics are a major driver of the AI boom in the Asia-Pacific region. The country supports smart manufacturing, healthcare automation, and service systems, with Chinese companies leading in cloud services and hardware innovations. Local companies are developing strong AI tools and models, competing with global standards. This is supported by China's excellent infrastructure, industrial policy, and a highly competitive technology ecosystem. These factors position China as a key player in the global AI landscape.

What Factors are Influencing the Growth of the European Artificial Intelligence (AI) Software Platform Market?

The market in Europe is expected to grow at a notable rate during the forecast period, as enterprises across finance, healthcare, and manufacturing sectors are increasingly investing in AI solutions to support automation and predictive analytics. The implementation of the EU AI Act promotes transparency, safety, and ethical use of AI platforms. Businesses are embracing these practices to comply with the act. Furthermore, funding programs and policy support for indigenous innovation are driving the adoption of AI platforms. These trends are making European enterprises more reliant on AI, contributing to market expansion.

Germany is a key player in the European market, driven by its strong industrial base and research institutions. There is a growing number of AI startups in the country. German companies in the manufacturing and automotive sectors are using AI platform tools to improve decision-making, automation, and data integration. Significant investments and national programs are fostering the development of AI-ready infrastructure that supports data control and compliance requirements, supporting market growth.

How is the Opportunistic Rise of Latin America in the Artificial Intelligence Software Platform Market?

Latin America is experiencing an opportunistic rise in the market, driven by surging AI adoption across businesses. Nearly half of Latin American companies have already integrated AI into their operations, driven by the momentum of digital transformation. Governments across Latin America launched AI initiatives and national plans in 2024 and 2025 to promote AI use for digital transformation. Venture capital and private equity investments into AI startups are increasing, especially in generative AI and ML, reflecting growing confidence in local innovation.

Brazil leads the Latin American market, driven by the government's commitment to AI through its national AI plan (PBIA). In July 2024, the Ministry of Science, Technology, and Innovation of Brazil launched the Brazilian Artificial Intelligence Plan 2024-2028, which aims to position Brazil as a global leader in AI by advancing sustainable and socially responsible technologies across various sectors. Also in July 2024, Brazil introduced a USD 4 billion plan to support AI development through a global initiative. By 2027, Brazil is training about 5 million individuals to work with artificial intelligence.

What Factors Drive the Growth of the Middle East and Africa Artificial Intelligence Software Platform Market?

The market in the Middle East and Africa (MEA) is expected to grow at a lucrative rate in the coming years due to government-led AI strategies. Saudi Arabia, the UAE, and Qatar are making significant investments to advance technology and infrastructure. The rapid transformation of Persian Gulf states into global hubs for AI investment and innovation is a key driver of growth in the Middle East and Africa artificial intelligence software platform market. There is strong cloud adoption, smart city investments, and digital modernization across MEA, pushing businesses to use AI for automation, data-driven decision-making, and improved efficiency.

Saudi Arabia is likely to maintain dominance in the market in the MEA. The joint AI innovation center in Saudi Arabia, a partnership between SenseTime and King Saud University, aims to integrate AI into research and everyday life across various sectors.

In September 2024, the Ministry of Human Resources and Social Development launched the ‘One Million Saudis in AI' initiative to empower one million Saudis in artificial intelligence. Moreover, Saudi firms are collaborating with international tech giants (e.g., Microsoft, Google) to build cloud & AI infrastructure, boosting knowledge transfer and platform capabilities.

Artificial Intelligence (AI) Software Platform Market Companies

- Adobe Inc.

- Amazon Web Services (AWS)

- Baidu Inc.

- C3.ai

- DataRobot

- Google LLC (Google Cloud AI Platform)

- H2O.ai

- Hewlett-Packard Enterprise (HPE)

- IBM Corporation (Watson Studio)

- Intel Corporation

- Microsoft Corporation (Azure AI)

- NVIDIA Corporation

- Oracle Corporation

- Palantir Technologies

- Salesforce Inc. (Einstein Platform)

- SAP SE

- SAS Institute Inc.

- TIBCO Software

- Veritone Inc.

- Zoho Corporation (Zia AI Platform)

Recent Developments

- In July 2025, Atos MMA announced the availability of the Atos Polaris AI Platform, a complete system of autonomous AI agents, to coordinate and manage complex business processes. The platform can also enable customers to approach digital transformation at an accelerated rate by resulting in the general automation of business procedures.(Source: https://atos.net)

- In March 2024, Microsoft collaborated with NVIDIA to drive transformation in AI in the healthcare and life sciences space. The partnership leverages the core strengths of each company: the cloud and computational power of Microsoft Azure on the one hand, and the cloud infrastructure and AI-enabled capabilities of NVIDIA DGX Cloud and Clara. It aims at speeding innovation and better patient care with a development in segments such as clinical research and drug discovery.(Source: https://news.microsoft.com)

- In March 2024, NVIDIA introduced new Generative AI Microservices to push medical technology (MedTech), drug discovery, and digital health. These microservices use artificial intelligence (AI) to be potentially more effective in the sphere of healthcare technologies.(Source: https://en.eeworld.com.cn)

Segment Covered in the Report

By Technology

- Machine Learning Platforms

- Natural Language Processing (NLP)

- Computer Vision

- Speech Recognition & Voice Processing

- Deep Learning Platforms

- Reinforcement Learning

- Others

By Deployment Mode

- Cloud-Based

- On-Premise

- Hybrid

- Others

By Component

- Software Tools & SDKs

- Application Programming Interfaces (APIs)

- Model Training & Deployment Infrastructure

- Data Preparation & Annotation Tools

- Others

By Functionality

- Model Development (Training & Validation)

- Model Deployment & Inference

- Data Engineering & ETL

- Model Monitoring & Governance

- AutoML / No-code AI Builders

- Others

By Application

- Predictive Analytics

- Natural Language Understanding (Chatbots, Virtual Assistants)

- Image/Video Analysis

- Speech Analytics

- Fraud Detection

- Recommendation Engines

- Others

By End Use Industry

- Healthcare & Life Sciences

- Banking, Financial Services & Insurance (BFSI)

- Retail & E-Commerce

- Manufacturing

- Transportation & Logistics

- IT & Telecom

- Media & Entertainment

- Energy & Utilities

- Government & Defense

- Others

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

- Startups

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content