What is the Infertility Drugs Market Size?

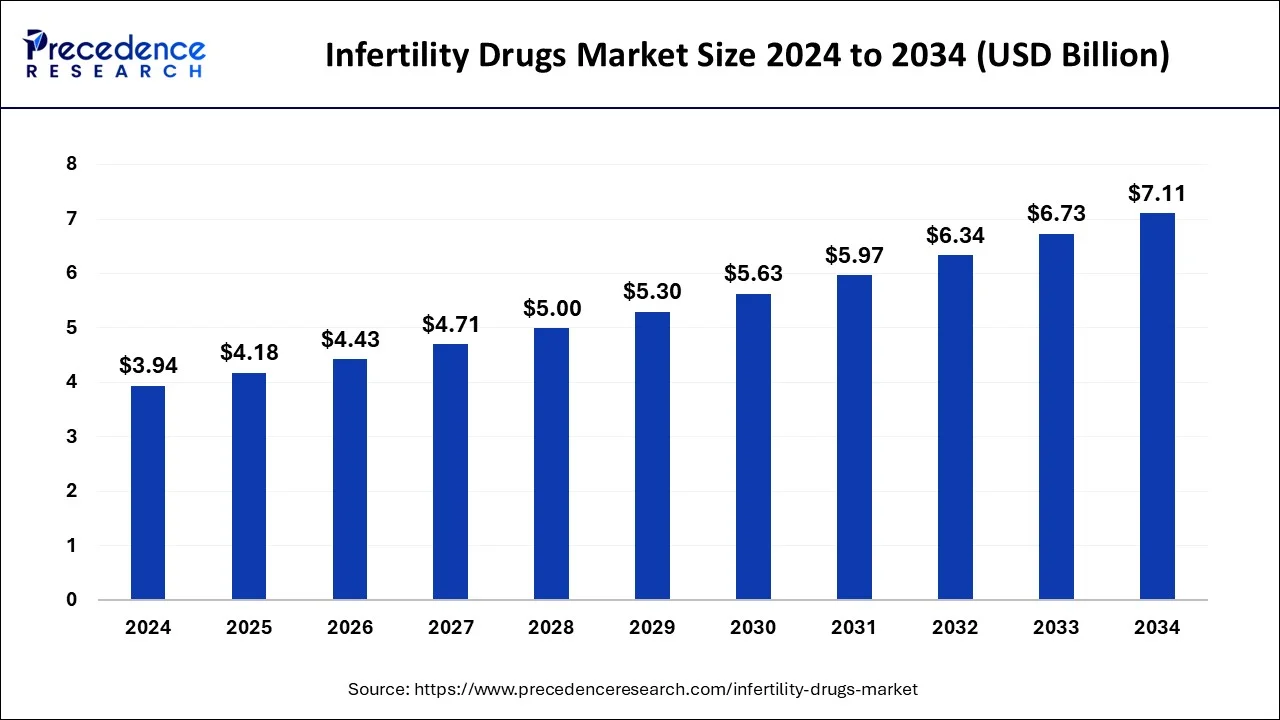

The global infertility drugs market size was estimated at USD 4.18billion in 2025 and is predicted to increase from USD 4.43 billion in 2026 to approximately USD 7.50 billion by 2035, expanding at a CAGR of 6.02% from 2026 to 2035. The primary reasons behind the growth of this market are developments in healthcare facilities and a desire for parenthood among married couples.

Infertility Drugs Market Key Takeaways

- The global infertility drugs market was valued at USD 4.18billion in 2025.

- It is projected to reach USD 7.50billion by 2035.

- The market is expected to grow at a CAGR of 6.02% from 2026 to 2035.

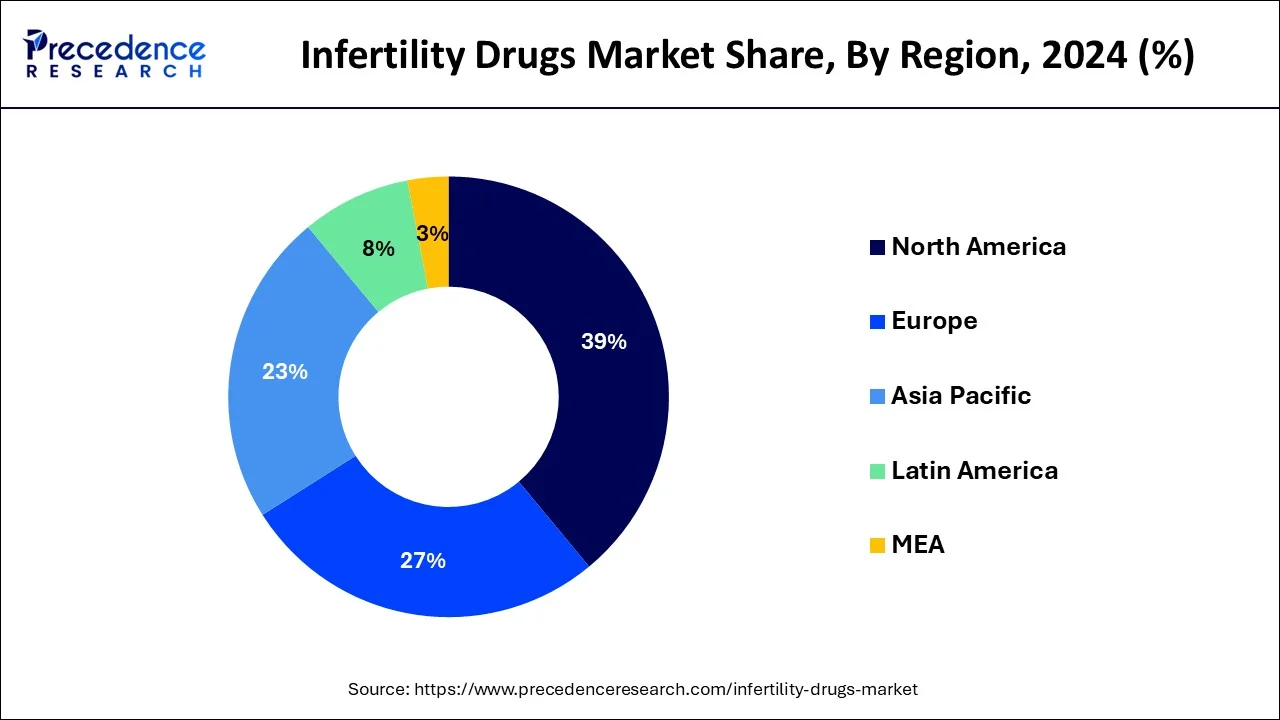

- North America dominated the market with the largest market share of 39% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR of 6.93% during the forecast period.

- By drug class, the gonadotropins segment has contributed more than 41% of market share in 2025.

- By the drug class, the selective estrogen receptor modulators segment is predicted to show rapid growth in the market.

- By the distribution channel, the hospital pharmacy segment has generated more than 55% of market share in 2025.

- By distribution channel, the online pharmacy segment is expected to grow at a high rate over the forecast period.

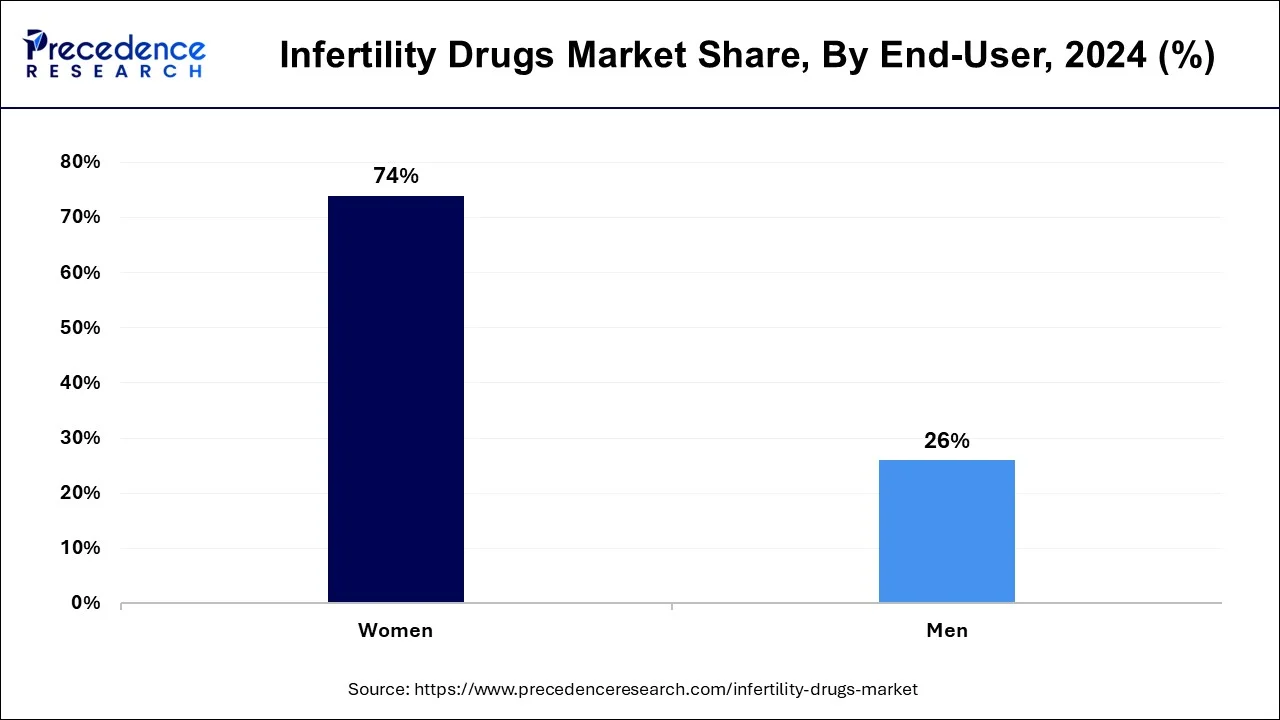

- By end-user, the women segment has contributed more than 74% of market share in 2025.

- By end-user, the men segment will be the fastest-growing segment during the forecast period.

What is the Infertility Drug?

Infertility is a condition of not being able to achieve pregnancy after 12 months or more of regular unprotected sex. Infertility is divided into primary and secondary infertility. Primary infertility is when parents are unable to conceive for the first child, and secondary infertility is when parents are unable to conceive for the second child. Infertility issues can be in men and women as well. Sometimes, there can be an issue with both partners and sometimes, it can be totally unexplained. There are many reasons behind infertility, and it mainly depends upon the lifestyle of both partners. If the partners have addictions like smoking, drinking, or obesity due to bad food habits, this can affect reproductive fitness adversely and can lead to impotence in males and the inability to conceive in females.

How is AI contributing to the Infertility Drugs Industry?

AI customizes the therapy of infertility drugs based on the patient's hormones, history, and response to the cycles. It streamlines stimulation regimens, dynamically arranges dosages, forecasts treatment outcomes, enhances gametogenesis, lowers morbidity, and assists clinicians in delivering safer and more productive assisted reproductive therapy.

Infertility Drugs Market Growth Factors

- Bad lifestyle, including habits like smoking, drinking, unhealthy sleep schedules, excess junk food consumption, etc.

- Sedentary work and lack of exercise

- People marrying late in their life

- Marijuana use

- Being overweight or being underweight.

Market Outlook

- Industry Growth Overview: The increase in infertility levels, postponed parenthood, and broader assisted reproduction adoption are expected to spur the continued growth of the infertility drugs market.

- Global Expansion: Asia-Pacific speeds up with medical tourism, North America is on the route of adoption, and Europe increases funding availability.

- Major Investors: Investments are pushed by Merck KGaA, Ferring Pharmaceuticals, Organon, Bayer, Pfizer, Novartis, Teva, Mankind Pharma, and Sanofi.

- Startup Ecosystem: New startups are developing AI-powered IVF labs and new fertility medication to enhance treatment precision.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 6.02% |

| Market Size in 2025 | USD 4.18 Billion |

| Market Size by 2035 | USD 7.50Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Drug Class, By Distribution Channel, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Bad lifestyle

Due to bad habits and addictions, an increasing population is getting infertile. Smoking has become a new trend. Many corporate employees and students catch a habit of smoking in their life at some stage and become addicted to it. However, smoking and alcoholism can have severe effects on the reproductive system of males as well as females. In males, such bad habits can lead to impotence or erectile dysfunction, and in females, it can lead to an inability to conceive. Awareness is being spread regarding infertility issues through advertisements and even movies that talk about infertility.

Restraint

Awareness issues and side effects

Infertility is a subject that is thought to be taboo and shameful in many villages. It is thought to be shameful not being able to conceive. In many Indian villages, due to a lack of education, women are thought to be solely responsible for not being able to conceive. There is an importance of awareness in these areas. Infertility drugs of high quality should be made aware in government hospitals, and awareness should be spread, too. Infertility drugs, however, are expensive and are not affordable for many people. There is also a stigma in society when someone consumes such drugs, and people are hesitant when it comes to getting treatment for infertility. Infertility drugs need proper testing and approval processes, which can take a long time. Also, testing them on subjects can cause problems with their health. Infertility drugs can have potential side effects, too; for example, the child might have poor immunity and health issues in the future.

Opportunities

Another reproductive health market

The infertility drugs market will open opportunities for several other markets like childcare, IVF, etc. There will be a growth in healthcare infrastructure, and more awareness about infertility will spread. Due to more advancements in technology, people can produce healthy babies. The infertility drugs market will also boost the surrogacy market and infertility tourism. Parents can travel to different countries to get effective treatments for infertility. More awareness about infertility in rural areas as well as urban areas will help fight the stigma that people have regarding infertility.

Segment Insights

Drug Class Insights

According to the drug class, the gonadotropins segment dominated the infertility drugs market in 2025 and is expected to continue this dominance throughout the forecast period. It will achieve the highest growth during the forecast period. Gonadotropins are high in cost and are used widely. Gonadotropins are naturally produced by the pituitary glands and stimulate the ovaries to produce a ‘follicle' containing an egg, which then releases the egg from the ovary. For those who are not able to ovulate, gonadotropins are given to stimulate ovulation. Gonadotropin helps those who are ovulating but are facing problems in conceiving. Gonadotropins for medical purposes are produced in the laboratory and injected under the skin to be effective. It is generally given to women who do not have regular menstrual periods and have very low levels of LH and FSH hormones.

According to the drug class, the selective estrogen receptor modulators segment is predicted to show rapid growth in the infertility drugs market. SERMs are used for indcing ovulation in women having ovulation disorders. SERMs can stimulate ovulation and hence improve the chances of getting pregnant. Some SERMs also find uses in breast cancer treatment, and this, too, helps grow the market. For example, tamoxifen is a drug that can induce ovulation and can also stop the activity of estrogen in the breasts.

Distribution Channel Insights

According to the distribution channel, the hospital pharmacy segment dominated the infertility drugs market in 2025. This is because people prefer to have a proper consultation and treatment with highly qualified professional doctors and then take the medicines. This channel is more popular because patients can get physically diagnosed by the doctors and continue the consultation, visit clinics for regular checkups, and there is a sense of assurance and security in a couple's mind.

In the infertility drugs market, the online pharmacy segment is expected to grow at a high rate over the forecast period. Ordering online is accessible and convenient. Online medicine delivery has become convenient, and people who don't have access to shops nearby or live in remote areas can consult doctors online and order medicines. Privacy is assured when ordering online, as many people find it to be embarrassing due to social pressures and stigma. There is also a wider variety of medications available online. Online websites also provide discounts. People can get effective customer support when ordering online.

End-user Insights

By end-user, the women segment dominated the infertility drugs market in 2025. It has been found that women show higher depression levels than men when it comes to infertility. This is mainly because of the social stigma and a lack of knowledge in the orthodox families. Studies have also shown that a failure in one treatment shows a higher level of distress in women when taking treatment next time. In some societies, women are considered to be solely responsible for the infertility issues. Infertility issues in women can be complex. There can be issues with ovulation, blockages in the fallopian tubes, or other abnormalities in the uterus. Women are also more aware of their reproductive health.

In the infertility drugs market, the men segment will be the fastest-growing segment during the forecast period. There is a growing awareness of male infertility. Many males are working professionals and catch bad habits and addictions like smoking or drinking. This often leads to a low sperm count, a fall in sperm motility, sperm deformation, or impotence. Men also take infertility treatment to accompany their spouses, as couples have become aware that the problem might lie with either of them. Regular checkups are done in order to check if there are any other health issues like genetic factors or hormonal issues.

Regional Insights

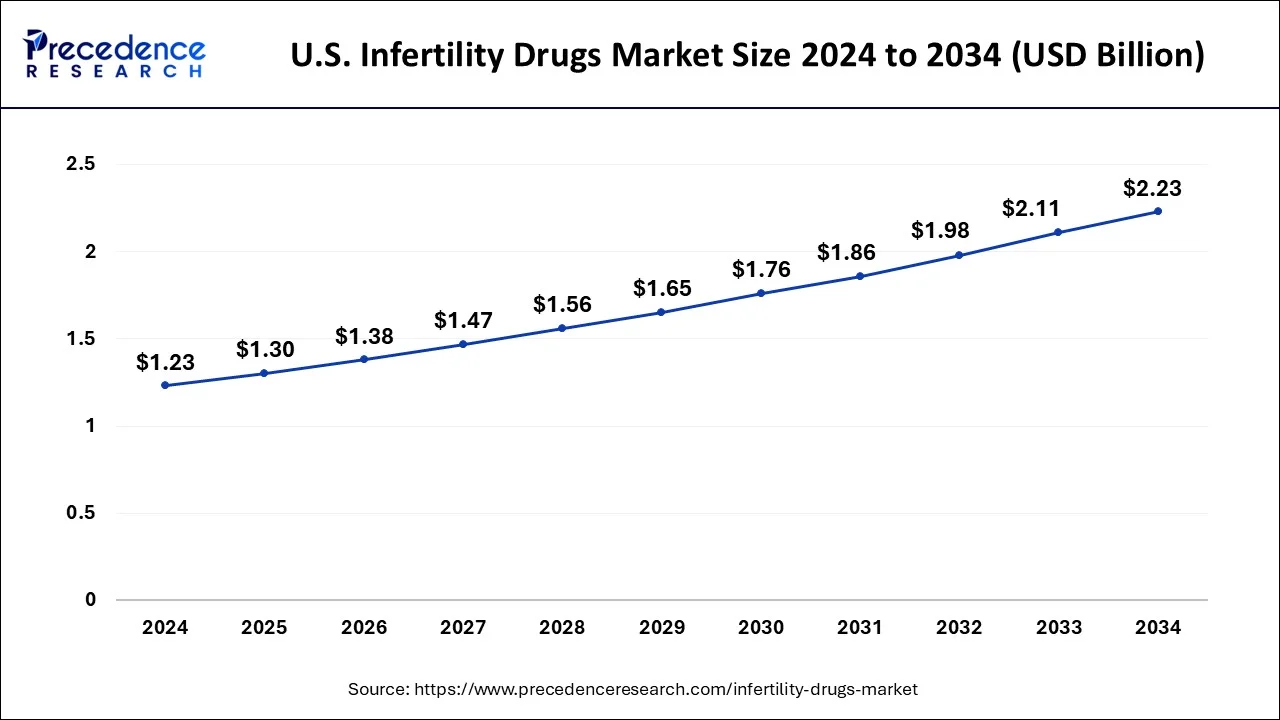

What is the U.S. Infertility Drugs Market Size?

The U.S. infertility drugs market size reached USD 1.30 billion in 2025 and is predicted to be worth around USD 2.36 billion by 2035, at a CAGR of 6.14% from 2026 to 2035.

North America dominated the infertility drugs market in 2025. The biggest reason why we see a large sale of infertility drugs in North America is that the lifestyle followed by North American people is extremely unhealthy. Due to a high amount of sugary and salty foods, there is a rise in obesity and eating disorders, which hampers sperm quality or leads to poor reproductive health in females. Another main issue is the habit of smoking. Recent reports say that one in five deaths in the U.S. happens because of smoking. Smoking can hamper sperm quality, making them weak and reducing their mobility.

U.S. Infertility Drugs Market Trends

The U.S. is the leader with high levels of assisted reproductive care and high usage of high-quality fertility drugs. Increasing the insurance requirements, specialty pharmacy network, and fast AI implementation enhances personal dosing plans, enhances patient compliance, and helps complex and high-intensity treatment plans in the country.

- According to the Journal of Nutrition published in 2022, adults in the U.S. consume about 4.8 junk food items daily.

Asia Pacific will have the fastest growth rate in the global infertility drugs market during the forecast period. Infertility is rising in Asia Pacific because of several factors. People are choosing to marry late while focusing on their careers in countries like India. A trend has been seen that people with higher education levels and late marriages show primary infertility. Apart from this, smoking, tobacco consumption, obesity, and other diseases show their link with secondary infertility. Several awareness programs have been conducted, and people have become alert about their reproductive health because of this.

China Infertility Drugs Market Trends

The momentum displayed by the government-supported fertility programs and the accelerated clinic growth in China is very robust. The injections of the long-acting hormones, the increasing access to urbanization, and the increased acceptance of treatment all raise the volume of drugs, but the domestic and imported versions of the therapy compete in the changing and demanding reproductive medical environment.

What Are the Driving Factors of the Infertility Drugs Market in Europe?

Europe is expected to grow at a significant rate during the forecast period. Europe enjoys a wide coverage of treatment systems. Infertility drugs continue to be widely used in the public and private reproductive care provider environments due to the existence of clinical standardization, established fertility centers, and a stable inflow of patients.

Germany Infertility Drugs Market Trends

Germany is a developed infertility drug market defined by the adoption of biosimilars and dependency on private financing. Increasing sensitivity of costs to patients evokes demand to substitute, as more attention to male infertility increases the scope of therapeutic application beyond conventional hormone-based therapies in specialized fertility centers.

Value Chain Analysis of the Infertility Drugs Market

- R&D: Research and discovery of new infertility compounds, such as hormone therapy and ovulation stimulators.

Key Players: Merck KGaA, Ferring Pharmaceuticals, Organon, Bayer AG, ReproNovo, Gameto - Clinical Trials and Regulatory Approvals: Human testing to prove the safety and effectiveness of the drugs, and to obtain regulatory approval to market the drug.

Key Players: IQVIA, Medpace, Charles River Laboratories, Covance - Formulation and Final Dosage Preparation: Preparation of APIs into stable injections, pills, or gels with a consistent therapeutic performance.

Key Players: Merck KGaA, Ferring, Pfizer, Teva Pharmaceuticals, Cipla - Packaging and Serialization: Bottling, blister packing, and coding products to make sure that they are safe, compliant, and to prevent counterfeiting.

Key Players: PCI Pharma Services, Vetter Pharma, West Pharmaceutical Services, Schott - Distribution to Hospitals, Pharmacies of Infertility Drugs: Supply chain distribution to infertility clinics, hospitals, and retail pharmacies.

Key Players: AmerisourceBergen, Cardinal Health, McKesson, Janwa Medical

Infertility Drugs Market Companies

- Merck & Co., Inc.: Provides biologic fertility treatments such as human chorionic gonadotropin products used to enhance ovulation induction and assisted reproductive treatment all over the world.

- Ferring B.V.: Focuses on reproductive medicine, and a wide range of fertility-related drugs are used as part of the stimulation, ovulation, and family-building process.

- Organon Group of Companies: Specializes in women's health, providing infertility drugs that are aimed at assisted reproductive therapy and hormonal balance.

Other Major Key Players

- Abbott

- Novartis AG

- Bayer AG

- Pfizer Inc.

- Mankind Pharma

- Teva Pharmaceutical Industries LTD.

- Sanofi

Recent Developments

- In December 2025, Intas Pharmaceuticals Limited partnered exclusively with IntegriMedical to provide IVF and gynecology therapies using needle-free injections in India. This system uses high-pressure jets for medication delivery, minimizing tissue trauma and the risk of cross-contamination effectively.

(Source: https://pharma.economictimes.indiatimes.com ) - In February 2025, Motherhood Hospitals launched the Motherhood Fertility & IVF Centre in Kharghar to tackle infertility issues among couples. The center offers advanced reproductive care, diagnostics, and holistic treatment solutions, addressing the impact of stress, lifestyle changes, and delayed family planning on fertility rates.

(Source: https://www.healthcareexecutive.in ) - In February 2024, Lupin, a major global pharma company, launched Ganirelix Acetate Injection. It is a single-dose prefilled syringe indicated for inhibiting premature luteinizing hormone (LH) surges in women who undergo ovarian hyperstimulation.

- In March 2024, Future Generali India Insurance launched ‘Health PowHER', a product designed exclusively for women healthcare at various stages of their lives. There will be varios treatments offered by the product, and one of the treatments will be infertility treatment. This will include oocyte cryopreservation, stem cell storage, wellness programme, insurance for newborn defects, nursing care, and many more benefits.

Segments Covered in the Report

By Drug Class

- Gonadotropins

- Aromatase Inhibitors

- Selective Estrogen Receptor Modulators (SERMs)

- Dopamine Agonists

- Others

By Distribution Channel

- Hospital Pharmacy

- Specialty & Retail Pharmacy

- Online Pharmacy

By End-user

- Men

- Women

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting