The global medical devices market size was valued at USD 600.21 billion in 2023 and is envisioned to hit around USD 996.93 billion by 2032, at a CAGR of 5.8% from 2023 to 2032.

The global medical devices industry includes medical equipment or devices and related services provided used in the treatment, diagnosis, and monitoring of medical conditions. The range of medical devices comprises of in-vitro diagnostic devices, dental equipment and supplies, tongue depressors and bandages, ophthalmic devices, diagnostic imaging equipment, irradiation apparatuses, hospital supplies, cardiovascular devices, surgical implants and instruments, and other medical devices. In this captivating exploration, this study delves deep into the intricate web of technologies, regulations, and market dynamics driving the evolution of medical devices.

Medical technology companies around the globe are working on development of new and technologically advanced medical devices. Also, they are seeking easier approval for medical devices by the regulatory authorities fueling the market’s growth over the upcoming years. Medical devices sector is extremely capital intensive and necessitates constant training of the healthcare system providers to adapt to modern technologies. The large multinational corporations operating in the market are expanding their geographical presence to boost their revenues and extend their product portfolios.

- For instance, in November 2022, Medtronic, the medical devices industry player introduced its third manufacturing module in Costa Rica. The company is expected to consolidate its manufacturing operations in the country with an expected investment of around $65 million dollars. This expansion process of the medical device manufacturing facility was started in 2020 and is projected to continue until 2024.

The analysis, which was released in advance of Universal Health Coverage (UHC) Day, shows that, in 2021, health spending worldwide hit a record high of US$ 9.8 trillion, or 10.3% of the world's gross domestic product (GDP). However, the increasing government spending on healthcare was the main driver of the overall health spending from 2019 to 2021.

As per the above mentioned source, spending on outpatient care, inpatient care, and medical goods accounted for over 60% of health spending in 2019 across all the income groups of the world.

Rapid Growth in Elderly Population Contributes to the Market Growth:

- An increasing life expectancy around the globe has pushed the medical devices manufacturing companies to address the growing needs of an elderly population. Growth in elderly population created demand for medical devices such as assistive devices, home care devices, and wearable medical devices.

- According to the WHO, the world's population of elderly people aged 60 years and older is anticipated to double (2.1 billion) by 2050.

- The number of people aged more than 60 years outnumbered the children younger than 5 years in 2020.

- Healthcare spending associated with the COVID-19 accounted for an average of around 8% of total health spending from government in 2020.

- The elderly population accounts for about one third of total healthcare consumption.

Value Chain Analysis of Medical Devices Market

| Research & Development | Manufacturing and Assembly | Distribution, Marketing, and Sales | End Users |

| In2Bones Global, Inc. | Medtronic plc | Mckesson Medical-Surgical | Hospital |

| Johnson and Johnson | Fresenius Medical Care | NovoMed | Scientists |

| Abbott Laboratories | GE Healthcare | Local/International Distributors, wholesalers, and dealers across the global | Other healthcare professionals |

| striker corporation | Abbott | ||

| Johnson and Johnson | |||

| Siemens Healthineers |

Medical device companies primarily delivers value through manufacturing and selling their products. The global medical devices market comprises of research and development, manufacturing, distribution, and end users.

- Research & Development: R&D is one of the highest value segment of global value chain for medical devices industry and accounts for a significant share of the final cost of medical device production. This section of the value chain includes product design and efforts for obtaining regulatory approval for the sale in particular markets.

- Manufacturing: Manufacturing and assembly represents is the lower value adding stage of the medical device. Medical device manufacturing processes are generally automated and involves higher degree of advanced engineering and technology. Medical equipment and device manufacturing industry designs and manufactures an extensive range of medical products that monitor, diagnose, and treat diseases and conditions affecting humans.

- Distribution, Marketing, and Sales: Distributors and marketers helps in connecting the manufacturers with end users. On the other hand, the marketing in the medical device value chain is one of the critical components to the success of medical devices business and it helps in finding and identifying ideal customers.

- End Users: End users such as clinics, hospitals, the offices of dentists and doctors, medical laboratories, and outpatient treatment centers among other end users adds value to the global medical devices market supply chain.

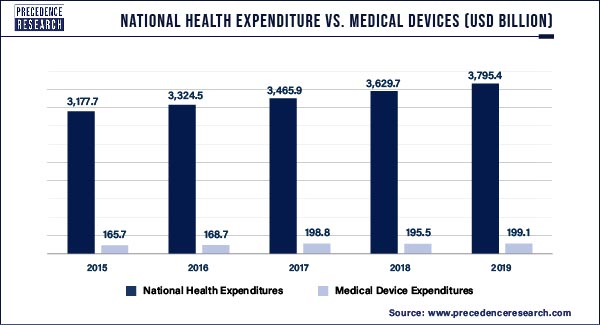

The spending on medical devices such as instrument, apparatus, appliance, implant, implement, and machine is continuously growing at a rapid pace. However, the U.S. is the largest medical device market worldwide, comprising of more than 40% share in global medical devices market.

The following chart shows national health expenditure and medical devices expenditure in the U.S. over the past years:

Medical Devices Market: Key Market Drivers

- Increasing number of medical facilities: Healthcare institutions or hospitals offers treatment for patients and are the most important cornerstones of modern healthcare system. A growing middle class, population demographics, rising incomes, and growing better health awareness is contributing to the increased number of medical facilities. For instance, according to the AHA Hospital Statistics (2022), the number of hospitals are growing across the U.S. The growing number of hospitals creates demand for medical devices.

Following chart shows a total number of hospitals in the U.S.:

| Number of U.S. Community1 Hospitals | 5,139 |

| Number of Federal Government Hospitals | 207 |

| Number of Nonfederal Psychiatric Hospitals | 635 |

| Other Hospitals | 112 |

| Total Number of All U.S. Hospitals | 6,093 |

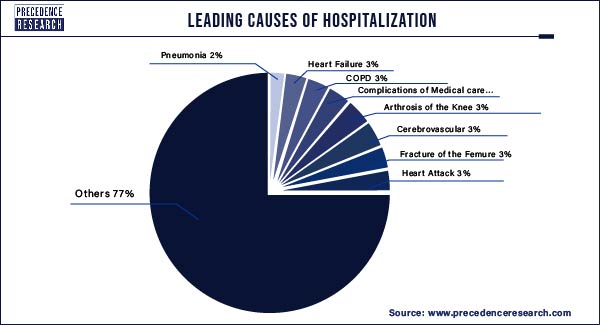

Growing Health Issues: Lack of physical activities, unhealthy eating habits, lack of sleep, and consumption of alcohol is leading to increased health issues and hospitalization. In addition, the urban population around the globe is seeing a rise in overweight and obese citizens. This has further boosted the prevalence of high blood pressure, high cholesterol, and diabetes. The growing hospitalization due to the aforementioned reasons has further driven the growth of the global medical devices market. The following figure shows major reasons for hospitalization:

Medical Devices Market Investment Opportunities, Potential and Promising Outlook

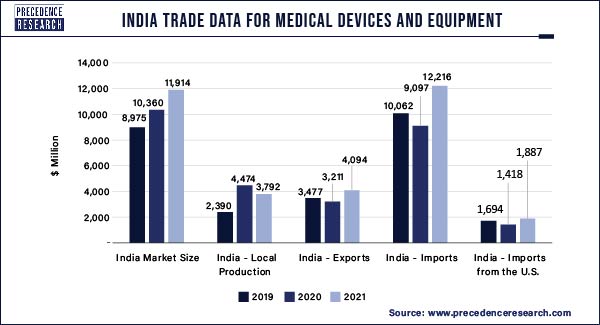

- Demand from developing countries: The developing countries including China, India, Mexico, and others are seeing huge demand for medical device products. Globalization of medical supplies and devices in past decades, increase in incomes, and growing urbanization in the developing countries is creating opportunities for growth of the medical devices market. The growing focus on health and wellness in developing countries is further contributing to the demand for medical devices. The following figure shows historic trade data for medical devices and equipment.

Government Support: Governments across the globe are focusing on providing maximum support to the medical device industry by providing financial incentives to encourage the production of high-end medical devices. On the other hand, governments are also working towards introducing a lucrative fiscal measures to promote research, manufacturing, development, and import of medical devices. Further, the governments in countries such as India and China are focusing on the development of medical devices on a domestic level.

For instance, the Indian government recently introduced a Production Linked Incentive (PLI) Scheme to support domestic medical device manufacturing. Additionally, Government of India launched a number of programs to strengthen the medical devices sector, with a focus on R&D and 100% FDI for medical devices.

- Growing Medical Devices Manufacturing and Innovation in the U.S.: Medical devices is one of the strongest and fastest-growing manufacturing sectors in the U.S. The country is actively working on developing advanced medical devices and diagnostics to enable people to live longer, more productive, healthier, and independent lives. Also, the country is home to over 6,500 medtech companies, which are mostly small and medium sized enterprises (SMEs). The continuous research and innovation in the U.S. medical devices industry is aimed at developing cutting-edge technologies.

- Increased Demand for Innovative Medical Devices: the demand for innovative medical device is growing at rapid pace across the globe. These innovations include devices like wearable and services like health data. Wearable devices is one of the latest innovations in healthcare industry designed to collect users' personal health data, and send a patient's health information to a healthcare professional or doctor in real-time.

The medical devices industry is highly competitive and subject to rapid transformations or changes due to supply chain disruptions, which can pose risks to investors. It is important for investors to conduct thorough research and analysis before making any investment decisions. The top medical devices manufacturing companies across the globe includes Abbott Laboratories Inc., Koninklinje Philips NV, GE Healthcare (General Electric Company), Johnson & Johnson, Medtronic PLC, DePuy Synthes, Ethicon LLC, Siemens Healthineers, Stryker, Cardinal Health, BD, Boston Scientific, and Baxter International Inc. and many more.

The medical devices market is highly fragmented due to the presence of huge number of market players. These players are constantly engaged in research & development, acquisitions & mergers, new product launches, and partnerships to gain competitive edge over others and exploit the prevailing market opportunities. For instance, in August 2022, Medtronic plc, a healthcare technology company acquired Affera, Inc. This acquisition is expected to expand the cardiac ablation portfolio of Medtronic.

SWOT Analysis of Medical Devices Market

Strengths

- Aging population: The population over the age of 65 years is increasing rapidly and is projected to double (2.1 billion) by year 2050. Typically, the elderly population uses more health resources as compared with the younger counterparts. The health issues such as heart disease, diabetes, chronic constipation, dehydration, conditions related to mental health, and bone & joint related disorders are common in elderly population. Growing aging population impacts positively on medical devices industry.

- Government support: The Indian government is introducing financial incentives to boost domestic medical device manufacturing and attract investment in medical devices. On the other hand, the Japanese government actively working towards increasing the accessibility and availability of foreign technologies and products through initiatives such as a new Pharmaceutical and Medical Device Law (PMDL).

- Strong financial performance of key players: The companies including Medtronic, Johnson & Johnson, GE Healthcare, Siemens Healthineers, and Abbott representing a stronger financial performance in past few years.

- Key player strategies to enhance geographical presence: The number of distributors and dealers of medical devices is increasing across the globe along with growing healthcare industry. In addition, the leading market players are focusing on expanding their distributor networks by using partnership and collaboration strategies. For instance, in August 2022, Medtronic partnered with BioIntelliSense for distribution of multi-parameter wearable in the U.S. for continuous remote patient.

Weaknesses

- Tough regulatory environment: Increased regulatory scrutiny by the United States Food and Drug Administration (FDA) resulted into the surge in costs for development of new medical device products. In addition, the factors such as challenging regulatory procedures and shifting reimbursement policies are hampering the global medical devices market. The medical device manufacturers are also concerned about foreign regulations that favors domestic manufacturing.

- The global supply chains of medical devices can be disrupted due to various factors such as the COVID-19 pandemic, trade wars, natural disasters, and logistics delays and failures. This leads to the increased prices of products.

- Shrinking profit margins due to high competitive pricing in the global medical devices industry is one of the market weaknesses. The medical device industry revenue mainly depends on product prices; however, companies needs to lower the price of their offerings in order to remain competitive in the global market. This results into the shrinking profit margins and impacts negatively on the market.

- Lack of venture capital for startups: Due to the stringent FDA regulations, early-stage medical device companies or startups seeing hard time attracting venture capital.

Opportunities

- Growing economies in Asia and Africa: Countries including China, India, Brazil, Mexico, and South Africa are projected to see rapid growth in gross domestic product in upcoming years. The growing income levels of the population leads to the increased healthcare spending, impacting positively on the global medical devices market.

- Globalization: This trend drives medical access for countries and people that may not be able to afford or may not have access to care.

Threats

- Global economic uncertainty and volatility, which can impact consumer spending and demand for medical devices.

- Medical device tax: Some countries poses sales tax on medical devices, which leads to the reduced R&D investment and need for companies to lower the price of their products to remain competitive in the market.

- Cybersecurity threats: In past few years, cybersecurity threats have become a significant concern with several hacking attempts intended at medical device companies. Connected medical devices industry is facing threats such as ransomware attacks and malware.

Major Breakthroughs to Propel the Growth of Medical Devices Market

The medical devices market has witnessed several major innovations in recent years, revolutionizing healthcare delivery and patient care. Some of the notable innovations include:innovations in medical devices industry that are being developed by various companies. Here are some examples:

- 3D Printing Technology: Global medical industry is seeing rapid adoption of 3D printing technology due to its unique possibilities. 3D printing technology helps in develop tools for surgical procedures, create custom orthodontics, and create patient-specific surgical models for training. This technology is also helping the medical device manufacturers to create prototypes that helps in quick manufacturing of custom medical devices, by reducing the demand-supply gap.

- Medical Robots: The use of medical robots is emerging trend in the global healthcare industry. Nowadays, robotic-assisted surgeries are ensuring that patients have reduced blood loss, receive smaller incisions, and recover faster as compared to the traditional surgery.

- Wearables: The continuous advances in technology is boosting the manufacturing of wearable medical devices for various applications including blood pressure monitoring, ECG monitoring, biosensors, tracking stress levels, and track sleeping.

- Connected Health: Becton Dickinson, an American multinational medical technology company partnered with Microsoft Azure, a cloud computing platform to build physical products that help patients, provides insights into healthcare delivery, and improve safety.

- Point-of-Care (POC) Solutions: Thermo Fisher Scientific, an American supplier of scientific products collaborated with Samsung to jointly develope new POC solutions in areas such as cardiac problems, detection of sepsis, and women’s health conditions, as well as therapeutic drug monitoring.

As the demand for innovative medical devices rises, so too does the importance of regulatory compliance, patient safety, and ethical considerations. Stakeholders across the healthcare ecosystem must collaborate to ensure that new technologies are rigorously tested, properly regulated, and effectively integrated into clinical practice. Looking ahead, the medical devices market holds immense potential to transform healthcare delivery, enhance accessibility, and address global health challenges. By harnessing the power of innovation, collaboration, and patient-centered design, the future of medical devices promises to revolutionize healthcare and improve lives worldwide.

Get Full Access of this Report@ https://www.precedenceresearch.com/checkout/1129

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

About the Authors

Aditi Shivarkar

Aditi, Vice President at Precedence Research, brings over 15 years of expertise at the intersection of technology, innovation, and strategic market intelligence. A visionary leader, she excels in transforming complex data into actionable insights that empower businesses to thrive in dynamic markets. Her leadership combines analytical precision with forward-thinking strategy, driving measurable growth, competitive advantage, and lasting impact across industries.

Aman Singh

Aman Singh with over 13 years of progressive expertise at the intersection of technology, innovation, and strategic market intelligence, Aman Singh stands as a leading authority in global research and consulting. Renowned for his ability to decode complex technological transformations, he provides forward-looking insights that drive strategic decision-making. At Precedence Research, Aman leads a global team of analysts, fostering a culture of research excellence, analytical precision, and visionary thinking.

Piyush Pawar

Piyush Pawar brings over a decade of experience as Senior Manager, Sales & Business Growth, acting as the essential liaison between clients and our research authors. He translates sophisticated insights into practical strategies, ensuring client objectives are met with precision. Piyush’s expertise in market dynamics, relationship management, and strategic execution enables organizations to leverage intelligence effectively, achieving operational excellence, innovation, and sustained growth.

Request Consultation

Request Consultation