What is the Interventional Oncology Market Size in 2026?

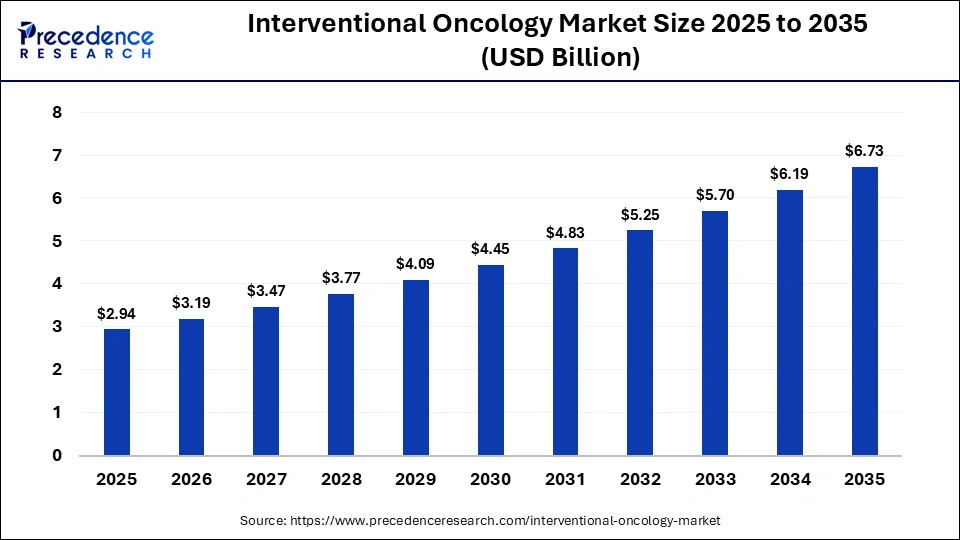

The global interventional oncology market size was calculated at USD 2.94 billion in 2025 and is predicted to increase from USD 3.19 billion in 2026 to approximately USD 6.73 billion by 2035, expanding at a CAGR of 8.63% from 2026 to 2035. The market is driven by rising cancer cases and growing demand for minimally invasive treatments.

Key Takeaways

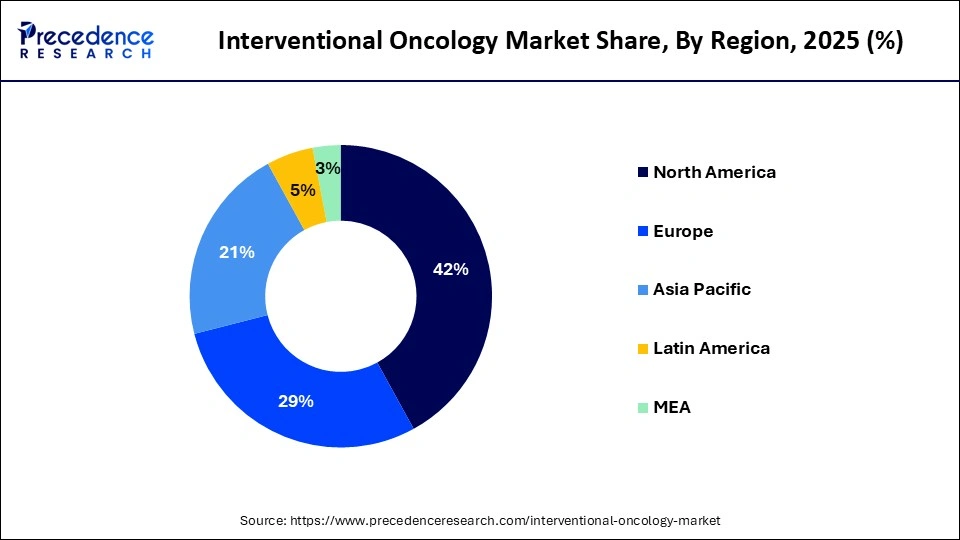

- By region, North America accounted for the largest share of the market in 2025.

- By region, Asia Pacific is expected to witness the fastest growth during the forecasted years.

- By technique, the ablation therapies segment led the market in 2025.

- By technique, the embolization therapies segment is expected to grow at the fastest rate in the market over the forecast period.

- By procedures, the vascular interventions segment held a significant share of the market in 2025.

- By procedures, the tumor ablation segment is expected to grow at the fastest CAGR in the market over the forecast period.

- By application, the liver cancer segment held the largest market share in 2025.

- By application, the lung cancer segment is expected to show considerable growth in the market over the forecast period.

- By end-user, the hospitals segment held a significant share of the market in 2025.

- By end-user, the specialty clinics segment is expected to show the fastest growth in the market over the forecast period.

Market Overview

Interventional oncology is a fast-growing subspecialty that deals with the diagnosis, treatment, and palliation of cancer with minimally invasive, image-guided procedures, including ablation, embolization, and targeted therapies to tumors. These methods allow the accurate targeting of the cancerous tissues and minimization of the surrounding healthy structures, which leads to fewer complications, shorter hospitalizations, and rapid recovery of the patient relative to the traditional methods involving surgery. The market is growing because of the increase in cancer incidences worldwide and the growing burden on healthcare systems across the world. The increasing popularity of minimally invasive treatment among patients, the enhancement of the reimbursement policies, and the increase in the number of investments in oncological research.

How is AI Integration Influencing the Interventional Oncology Market?

Artificial intelligence is making a significant impact on the interventional oncology market by improving accuracy, efficiency, and clinical outcomes. Imaging analytics powered by AI help clinicians recognize, segment, and characterize tumors more accurately, and thus enable optimized treatment planning. AI also helps in patient risk assessment, predicts treatment responses, and facilitates personalized therapy design. Combined with robotic-assisted systems, AI improves procedural consistency and reduces variability, while AI-driven data platforms allow large-scale analysis of clinical data to advance research, innovation, and evidence-based decision-making.

Interventional Oncology Market Trends

- The rising demand for less invasive cancer treatments is boosting the introduction of image-guided ablation and embolization techniques, offering patients fewer hospitalizations, fewer complications, and faster recovery.

- There is a growing utilization of interventional oncology in conjunction with chemotherapy, immunotherapy, and radiation therapy, helping to enhance the treatment outcomes, supporting personalized cancer care, and expanding clinical applications across tumor types.

- The shift toward outpatient and ambulatory surgery centers for interventional oncology procedures is reducing healthcare costs, improving access, and increasing patient throughput in both developed and emerging markets.

- Growing demand for individualized therapies is fostering the development of targeted embolic agents, drug-loaded beads, and precision devices tailored to tumor behavior and patient phenotypes.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.94 Billion |

| Market Size in 2026 | USD 3.19 Billion |

| Market Size by 2035 | USD 6.73 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.63% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Techniques, Procedure, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Technique Insights

Why Does the Ablation Therapies Segment Lead the Interventional Oncology Market?

The ablation therapies segment led the market, accounting for the largest revenue share in 2025. This is due to their minimally invasive nature, high precision, and widespread clinical usage. Radiofrequency ablation, microwave ablation, cryoablation, and laser ablation are some of the widely used therapies in treating solid tumors of the liver, kidney, lung, and bone. RFA is the most established modality among them, given its safe profile over time, cost-effectiveness, and image guidance compatibility. The significant increase in the number of cancer cases in the world and the growing popularity of outpatient-based treatments have dramatically increased the volume of ablation procedures, reinforcing the segment's leading position.

The embolization therapies segment is expected to grow at the fastest CAGR during the forecast period due to the growing need for specific organ-sparing cancer therapies. Liver cancer is especially sensitive to the procedures of transarterial chemoembolization and transarterial radioembolization. The selectivity of embolization techniques in blocking blood flow to tumors and enabling localized delivery of chemotherapy or radiation has advanced significantly. This approach enhances therapeutic effectiveness while minimizing systemic toxicity. Additionally, these procedures are performed in minimally invasive settings, which reduces hospitalization time and overall health care costs.

Procedures Insights

Why Did the Vascular Interventions Contribute the Most Revenue in the Interventional Oncology Market?

The vascular interventions segment held the largest share of the market in 2025, as the use of catheter-based cancer therapies grew, and the number of liver malignancies attained high levels. Transarterial chemoembolization, transarterial radioembolization, and percutaneous transhepatic biliary drainage have become indispensable as a means of management in the treatment of hepatocellular carcinoma and metastatic liver disease. Improved imaging technologies, more precise catheterization, and better embolic materials, which enables directed delivery of drugs straight into tumors, have contributed to the dominance of the segment.

The tumor ablation segment is expected to grow at a significant rate in the market, owing to the growing cases of tumors and advancements in ablation technologies. Techniques such as radiofrequency ablation, microwave ablation, cryoablation, and laser ablation have become popular in the treatment of early-stage tumors and inoperable tumors. Since minimally invasive surgeries promote faster healing and lower the risk of complications compared to open surgery, they have contributed to the growing demand for such procedures. Furthermore, increasing research on combination therapies, such as ablation paired with immunotherapy, has strengthened clinicians' confidence in these procedures.

Application Insights

Why Did the Liver Cancer Segment Lead the Interventional Oncology Market?

The liver cancer segment led the market while holding the largest revenue share in 2025, owing to the high prevalence of hepatocellular carcinoma in the world, as well as the growing rates of metastatic liver tumors. Liver cancer is one of the major causes of mortality in the world. With the increased prevalence of hepatitis B and C, which are the causes of liver cancer, the demand for ablation procedures has increased significantly. TACE, TARE, and ablation procedures are interventional forms of oncology treatment that are being used extensively in liver malignancies that cannot be treated with a surgical procedure. The liver's dual blood supply makes it an ideal target for vascular interventions, making it particularly well-suited for embolization-based therapies.

The lung cancer segment is expected to grow at a significant CAGR over the forecast period. This is mainly due to the increasing number of cases of lung malignancies around the world. Lung cancer is still one of the most widely diagnosed types of cancer, creating pressure to find an effective localized treatment. The processes of interventional oncology, like microwave ablation and radiofrequency ablation, are progressively applied to early-stage lung tumors and patients who are not eligible for surgery. Improved imaging modalities, such as CT-guided interventions, are driving growth by enhancing the accuracy and safety of these procedures.

End-User Insights

How Did Hospitals Contribute the Most Revenue in the Interventional Oncology Market?

The hospitals segment held the highest share of the market in 2025 due to their developed infrastructure, skilled specialists, and comprehensive cancer care facilities. Hospitals are equipped with advanced imaging services, hybrid operating rooms, and high-end interventional radiology suites required for complex procedures such as embolization and ablation. Multidisciplinary oncology teams provide coordinated treatment planning, improving patient outcomes. Additionally, favorable reimbursement policies in many regions support interventional oncology procedures performed in hospitals, further contributing to higher procedure volumes.

The specialty clinics segment is expected to grow at the fastest rate in the upcoming period because of the rising demand for personalized care. Interventional oncology specialty centers offer focused services, shorter appointment wait times, and streamlined care. The growth of the segment is further fueled by increasing patient preference for outpatient procedures, which reduce hospital stays and associated costs. These clinics typically provide highly specialized expertise, with dedicated interventional radiology teams, enhancing both treatment efficiency and patient satisfaction.

Regional Insights

North Ameirca Interventional Oncology Market Size and Growth 2026 to 2035

The North America interventional oncology market size is estimated at USD1.23 billion in 2025 and is projected to reach approximately USD2.86 billion by 2035, with a 8.80% CAGR from 2026 to 2035.

Why Did North America Lead the Global Interventional Oncology Market?

North America led the interventional oncology market by holding the largest share in 2025 due to the presence of major medical equipment manufacturers, well-developed healthcare infrastructure, and high healthcare spending. The region has a high prevalence of cancer, creating the need for ablation procedures. Well-established screening programs and advanced diagnostic capabilities, along with a strong demand for image-guided and minimally invasive cancer treatments, also bolstered the market. Favorable regulatory frameworks and established reimbursement policies further encourage the adoption of advanced embolization devices and ablation systems. Additionally, the high concentration of specialized cancer centers and qualified interventional radiologists in the U.S. and Canada contributes to increased procedure volumes.

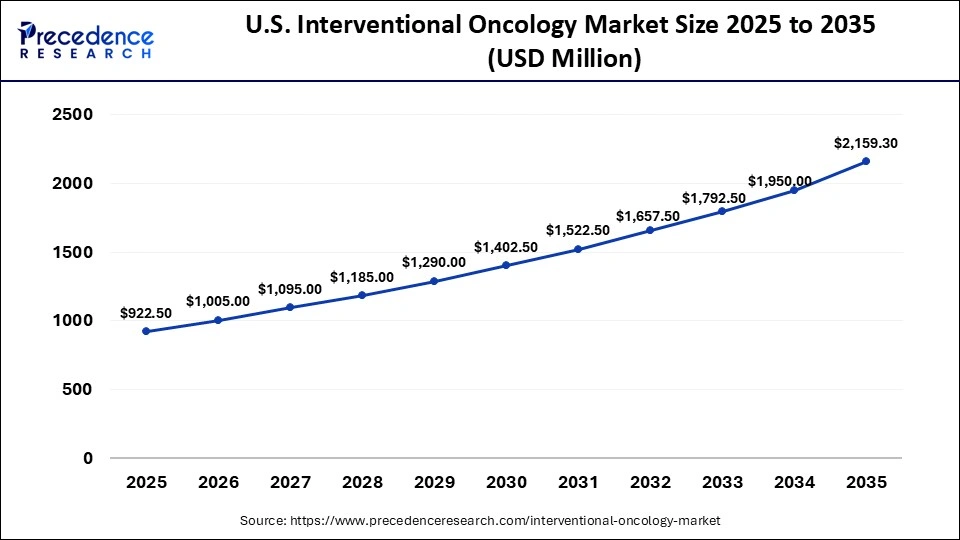

U.S. Interventional Oncology Market Size and Growth 2026 to 2035

The U.S. interventional oncology market size is calculated at USD 922.50 million in 2025 and is expected to reach nearly USD2159.30 million in 2035, accelerating at a strong CAGR of 8.88% between 2026 and 2035.

U.S. Market Analysis

The interventional oncology market in the U.S. is growing due to the high prevalence of cancer, advanced screening programs, and increasing demand for minimally invasive, image-guided treatments. Additionally, patient preference for outpatient procedures that reduce hospital stays and costs is driving wider adoption of these therapies.

Why is Asia Pacific Undergoing the Fastest Growth in the Interventional Oncology Market?

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing cancer burden, growing healthcare infrastructure, and growing healthcare investments. The region has a high proportion of cancer patient population, especially in China, India, and Japan, which drives the demand for advanced treatments. Minimally invasive procedures are gaining more traction in the region. Growing medical tourism, growing disposable incomes, and a growing number of private healthcare facilities are also contributing to the market. Also, market penetration is increasing due to the increased introduction of cost-effective ablation equipment and embolization equipment by international and local manufacturers.

Why is the European Interventional Oncology Market Gaining Momentum?

The European interventional oncology market is expected to grow at a notable CAGR in the upcoming period, driven by the rising incidence of cancer, an aging population, and increasing patient preference for minimally invasive treatments. Steady growth in lung, liver, and colorectal cancer cases is fueling demand for advanced interventional oncology procedures. Strong government support for early cancer detection programs, favorable reimbursement policies, the expansion of specialized oncology centers, and investment in modern imaging technologies are further enhancing procedural efficiency and patient outcomes.

Interventional Oncology Market Companies

- Medtronic plc

- Boston Scientific Corporation

- Johnson & Johnson (Ethicon)

- Teleflex Incorporated

- Cook Medical

- AngioDynamics Inc.

- Stryker Corporation

- Profound Medical

- Terumo Corporation

- Siemens Healthineers

Recent Developments

- In December 2024, AngioDynamics received FDA 510(k) approval of its NanoKnife System to be used to ablate prostate tissue. This non-thermal, radiation-free technology offers a less invasive methodology for treating prostate cancer among patients.(Source: https://investors.angiodynamics.com)

- In February 2024, Profound Medical Corp. entered a non-exclusive collaboration with Siemens Healthineers to offer a complete therapeutic solution combining Profound's TULSA-PRO system with Siemens' MAGNETOM Free.Max MR scanner. Profound will market the integrated solution through its own sales force while continuing to offer TULSA-PRO as a stand-alone system for flexible MR hardware use.(Source: https://www.surgicalroboticstechnology.com)

- In September 2024, Stryker Corporation acquired care.ai to make its healthcare IT and connected medical device portfolio stronger. The acquisition improved Stryker's AI-assisted virtual workflow of care, smart room technology, and real-time clinical decision support.(Source: https://www.stryker.com)

Segments Covered in the Report

By Techniques

- Ablation Therapies

- Radiofrequency Ablation (RFA)

- Microwave Ablation (MWA)

- Cryoablation

- Laser Ablation

- Irreversible Electroporation (IRE)

- Embolization Therapies

- Transarterial Chemoembolization (TACE)

- Transarterial Radioembolization (TARE)

- Biopsy Techniques

- Core Needle Biopsy

- Fine Needle Aspiration (FNA)

- Targeted Therapy Delivery Systems

- Drug-Eluting Beads

- Radioembolization

- Drug-Eluting Stents

- Injectable Hydrogels and Nanoparticles

- Other Targeted Therapy Systems

- Image-Guided Procedures

- Ultrasound Guidance

- CT Scan Guidance

- MRI Guidance

- Fluoroscopy Guidance

By Procedure

- Tumor Ablation

- Tumor Biopsy

- Vascular Interventions

- Palliative Care

By Application

- Liver Cancer

- Lung Cancer

- Kidney Cancer

- Prostate Cancer

- Breast Cancer

- Other Cancer

By End-user

- Hospitals

- Specialty Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting