What is the Interventional Cardiology Devices Market Size?

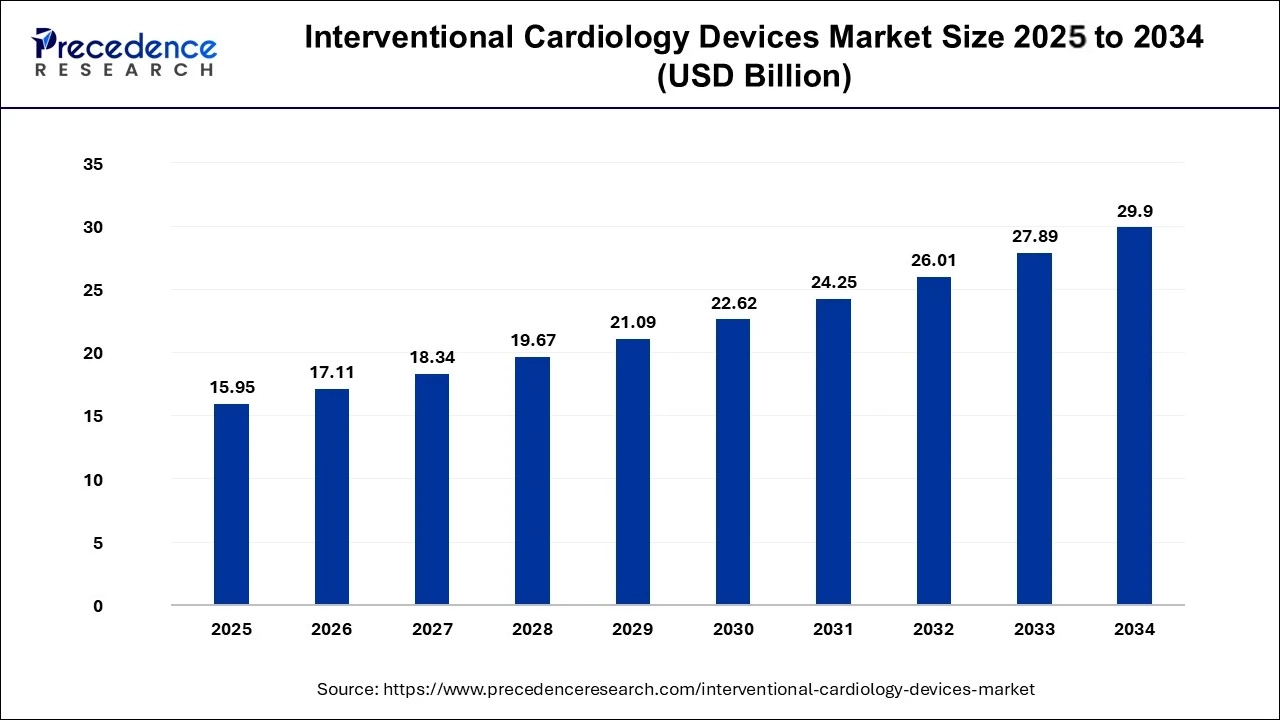

The global interventional cardiology devices market size is accounted at USD 15.95 billion in 2025 and predicted to increase from USD 17.11 billion in 2026 to approximately USD 29.9 billion by 2034, expanding at a CAGR of 7.24% from 2025 to 2034.

Interventional Cardiology Devices Market Key Takeaways

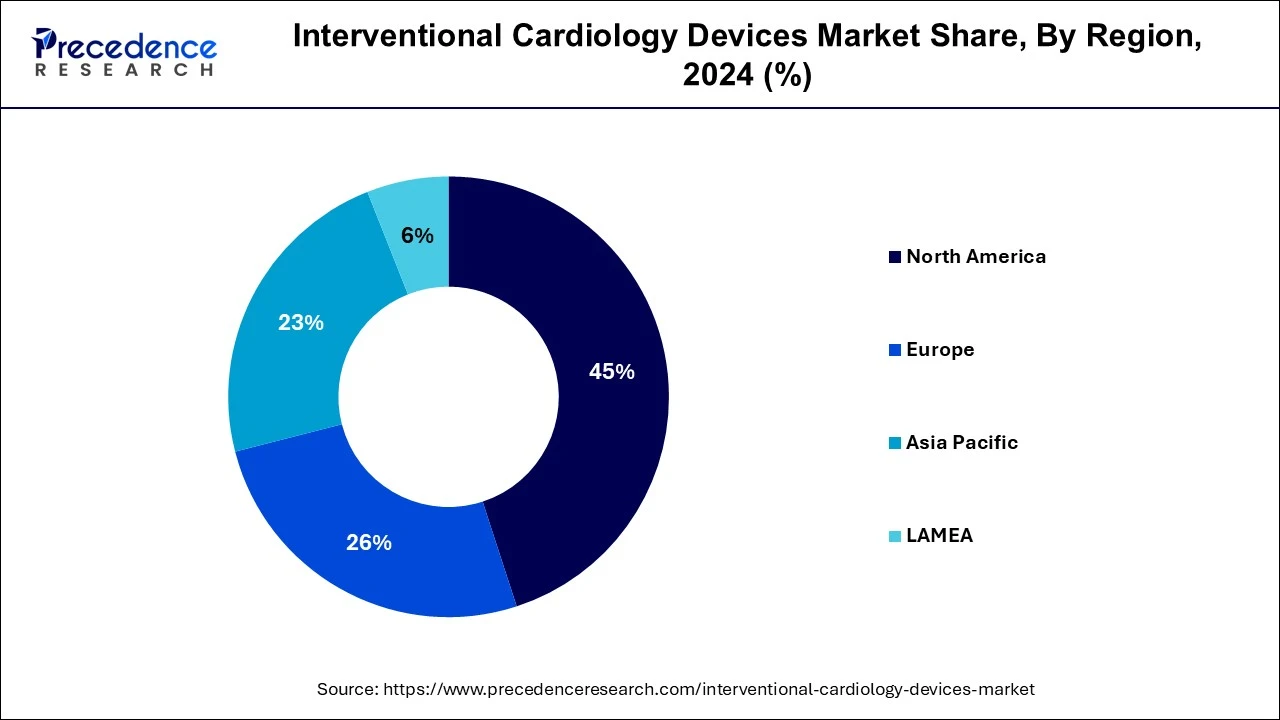

- North America dominated the global market with the largest market share of 45% in 2024.

- Europe is expected to grow with the highest CAGR during the forecast period.

- By product, the coronary stents segment captured the largest market share in 2024.

- By product, the intravascular imaging catheters and pressure guidewires segment is projected to witness the fastest CAGR during the forecast period.

What is the Role of AI in Interventional Cardiology Devices?

The advancements in AI technology has drastically the changed the overall healthcare sector. AI has been integrated in most of the medical fields for enhancing medical procedures and lowering the mistakes of healthcare professionals. Nowadays, the cardiology devices manufacturers have started adopting AI in their factories for enhancing the manufacturing process. AI can help in interventional cardiology by analyzing angiography images for transcatheter aortic valve implantation and valve placement. Moreover, AI helps in detecting the presence of heart diseases along with providing suitable methodologies for getting cured.

- In September 2024, Viz.ai partnered with Cleerly. This partnership is done for developing an AI-based platform for diagnosing heart diseases.

Market Overview

Interventional cardiology is a subspecialty of cardiology. Interventional cardiologists are cardiovascular diseases specialists who have completed training. They focus on the use of catheters, which are thin, flexible tubes used to execute procedures. Angioplasty and stenting, for example, are accomplished by directing equipment through the body's arteries. These minimally invasive interventional techniques are an excellent alternative to open surgery for many individuals.

Interventional cardiology is concerned with the use of catheters to treat heart problems. The process entails inserting a device such as balloon, stent, catheter, or other device into femoral artery or any other big peripheral artery or vein, and then cannulating the heart under X-ray guidance. Furthermore, a variety of interventional cardiology devices are utilized to treat peripheral vascular problems that impact the circulatory system and can lead to plaque build-up in limb arteries. The catheters, balloons, stents, and filters are some of the interventional cardiology devices on the market.

Interventional Cardiology Devices Market Growth Factors

- The development of minimally invasive coronary stents.

- A large number of patients suffering from coronary heart diseases.

- The rapidly growing elderly population.

- Increased patient awareness of cardiovascular diseases.

- The increasing need to monitor and treat patients.

- The development of more advanced and innovative cardiovascular devices.

- Numerous government programs to increase the accessibility of IC treatments.

- Technological advancements in cardiology devices industry.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 17.11 Billion |

| Market Size in 2025 | USD 15.95 Billion |

| Market Size in 2034 | USD 29.90 Billion |

| Growth Rate From 2025 to 2034 | 7.24% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising Incidences of Ischemic Heart Disease

The prevalence of ischemic heart disease has grown significantly in several countries such as the U.S., India, China and some others. It is usually caused by joining of fatty material and plaque inside the coronary arteries through a process called atherosclerosis. These diseases are caused by several factors such as smoking tobacco, obesity, high cholesterol, old-age, diabetes and some others. The interventional devices including angioplasty balloons, angioplasty stents, angioplasty catheters are found effective for treating this heart disease. Thus, the growing prevalence of coronary artery disease (CAD) has increased the demand for interventional cardiology devices, thereby boosting the industrial expansion.

According to American College of Cardiology, in 2023, ischemic heart disease was the leading cause of death with an age-standardized rate per 100,000 of 108.8 deaths.

Restraint

Presence of Alternatives

The interventional cardiology devices industry experiences several problems. Firstly, there are several alternative techniques such as lipid-lowering drugs and anticoagulants that are highly effective for treating heart diseases, that in turn hampers the industry. Secondly, various market players have recalled their products due to their negative impact in the human body, thereby restraining the growth of the interventional cardiology devices market.

Opportunity

Adoption of Biosensors in Cardiology

The application of biosensors has increased rapidly in the cardiology sector. In cardiology, these sensors are used for detecting cardiac biomarkers and measuring blood pressure. It also finds application in clinical analysis and diagnosis of several cardiac disorders. Also, the wearable biosensors are used for continuously monitor vital signs such as heart rate and pulse. Moreover, these sensors are capable of measuring pulse wave velocity for detecting the stiffness of arterial walls. Thus, the growing use of biosensors in cardiology is anticipated to create growth opportunities in the upcoming days.

Product Insights

The coronary stents segment held the largest share of the market. The rising demand for preventing heart attacks and strokes has driven the market growth. Also, these stents helps in curing problems such as chest pain and shortness of breath that is crucial for the industrial expansion. Moreover, the capacity of stents to improve blood flow and reduce the risk of re-narrowing along with the rapid adoption of minimally invasive surgical procedures has boosted the market growth.

- In May 2024, Abott launched XIENCE Sierra. XIENCE Sierra is an eluting coronary stent system that helps in curing patients suffering from blocked coronary arteries.

The intravascular imaging catheters and pressure guidewires segment is projected to witness the fastest CAGR during the forecast period. The growing demand for intravascular imaging catheters for diagnosing and treating heart conditions by delivering cross-sectional images of the heart and blood vessels has boosted the market growth. Also, the rising application of pressure guidewires in measuring blood pressure gradient and calculating fractional flow reserve (FFR) is driving the industrial expansion. Moreover, the rise in number of patients suffering from epicardial disease and coronary microvascular dysfunction has increased the demand for these devices, thereby driving the growth of the interventional cardiology devices market.

- In March 2024, Boston Scientific Corporation launched iCross. iCross is an imaging catheter that can provide detailed images of the heart and coronary arteries.

Regional Insights

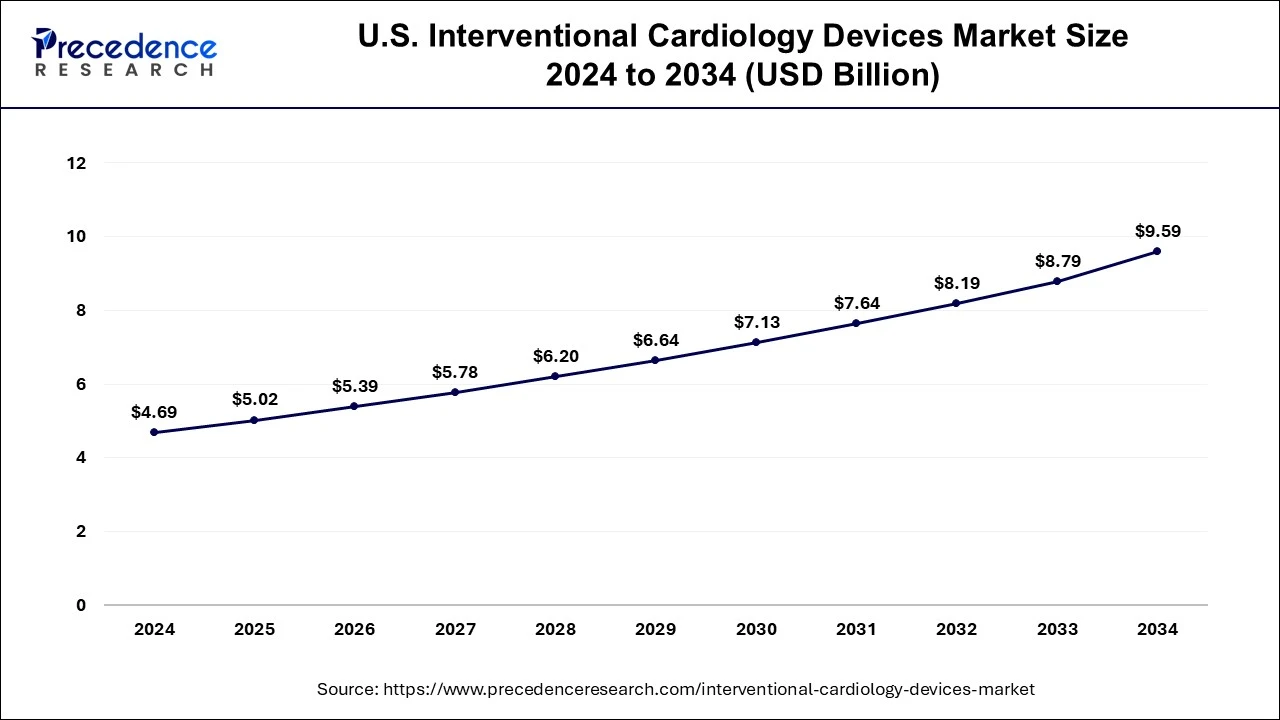

U.S. Interventional Cardiology Devices Market Size and Growth 2025 to 2034

The U.S. interventional cardiology devices market size was evaluated at USD 5.02 billion in 2025 and is predicted to be worth around USD 9.59 billion by 2034, rising at a CAGR of 7.41% from 2025 to 2034.

North America dominated the global market with the largest market share of 45% in 2024. The presence of advanced healthcare infrastructure, favorable government product development initiatives, and high patient awareness levels, combined with relatively high healthcare expenses in the region, are some of the major drivers for the interventional cardiology devices market to grow. In North America, the U.S. is a major contributor of the market with presence of several market players such as Boston Scientific, Abbott Laboratories, Cardinal Health and some others. These market players are adopting several strategies such as product launches, acquisitions, partnerships and some others to maintain their dominance in the industry.

- In October 2024, Boston Scientific Corporation announced that the FDA had approved FARAWAV NAV Ablation Catheter. This catheter is used for the treatment of paroxysmal atrial fibrillation.

Europe is expected to grow with the highest CAGR during the forecast period. Europe has a high rate of premium-priced interventional cardiology devices consumption, and it is the region that can accommodate a high rate of medical device innovation, thereby dominating the interventional cardiology devices market. Also, the cases of peripheral artery disease has increased rapidly in Germany and France that in turn increases the demand for cardiology devices, thereby boosting the market growth. Moreover, several government initiatives aimed at advancing the cardiology department along with technological advancement in healthcare sector has boosted the growth of the interventional cardiology devices market in this region.

How is North America leading in the Interventional Cardiology Devices Market?

North America takes the lead in the interventional cardiology devices market, and that is because of its developed healthcare systems and a huge commitment to the use of less invasive methods. The ongoing innovations, the presence of highly skilled cardiologists, and the existing favorable reimbursement policies are all contributing factors to growth in the region. The diagnosis of diseases at an early stage, the adoption of the latest technologies in the hospitals, and the modernization of the clinical settings all play a vital role in the region's demand for the next-generation devices, thereby increasing the efficiency of the procedures.

What are the driving factors of the Interventional Cardiology Devices Market in Europe?

Europe is expected to grow with the highest CAGR during the forecast period. Europe stands to gain a lot from the interventional cardiology devices market, not only because of its excellent healthcare infrastructure but also because of the high demand for heart treatments in structural diseases. The investment in innovation and R&D is highlighting the clinical outcomes. On the downside, the strict regulatory standards can be a reason that new products take longer to get approved. However, the increasing focus on precision medicine, the aging of the population, and digital health solution integration keep major European countries like Germany, France, and the United Kingdom running at steady growth rates in the interventional cardiology devices market.

How is Asia-Pacific performing in the Interventional Cardiology Devices Market?

The interventional cardiology devices market in the Asia-Pacific region is growing at a very fast pace, as a result, among other reasons, of the increasing awareness and the expanding healthcare infrastructure. The demand is coming from the growing use of less invasive treatments, government support in the form of initiatives, and the increasing health expenditure. China, Japan, and India are countries that are rapidly becoming leading players in this market due to the technological progress and local manufacturing that make cardiac care more accessible and affordable.

United States Interventional Cardiology Devices Market Analysis

The U.S. market for interventional cardiology devices can achieve this where R&D, technology, and the supply chain are all closely linked, and where a large number of patients are subjected to these treatments. The high physician skill ratio, good reimbursement policies, and the trend towards sharp interventions have not merely led to market dominance but also to the opening of new opportunities in both hospital and ambulatory care settings.

China Interventional Cardiology Devices Market Trends:

The rapid growth of interventional cardiology device sales in China is mainly driven by the worldwide ruling to be more healthcare efficient and by the local market. The population is growing, and so are the heart problems, which in turn call for more cardiac devices. On one hand, technological progress is attracting alliances with foreign and local companies, and is creating competitiveness on the other. The combination of countries' affordability, infrastructure expansion, and the adoption of advanced imaging and interventional technologies creates a win-win situation for the market.

Germany Interventional Cardiology Devices Market Trends:

Germany is the number one in Europe concerning the sales of interventional cardiology devices, which is definitely helped by high-tech medical equipment and the strong position of the country in research. The good hospital network, the existence of highly trained medical practitioners, and the German government's support for innovations to drive new device adoption are factors riding on. Increased interest in individual cardiac care and the infusion of digital health technologies into traditional cardiology are some of the factors that are finally leading to better procedures. With its stringent quality standards and efficient healthcare infrastructure, Germany is playing an increasingly important role in the market share and the progression of the market.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting different marketing strategies, such as new product launch, investments, partnerships, and mergers & acquisitions. The companies are also spending on the development of improved products. Moreover, they are also focusing on competitive pricing.

The various developmental strategies such as acquisition, business expansion, investments, new product launches, partnerships,joint venture, and mergers fosters market growth and offers lucrative growth opportunities to the market players.

Interventional Cardiology Devices Market Companies

- Boston Scientific Corporation

- Medtronic

- Edward Lifesciences Corporation

- Abbott

- BIOTRONIK SE & Co. KG

- iVascular

- Terumo Corporation

- B. BarunMelsungen

- Biosensors International Group

- Cardinal Health

Recent Developments

- In September 2024, Argon Medical Devices launched CLEANER Vac. It is a thrombectomy system used to remove blood clot from the peripheral venous vasculature.

- In June 2024, Medtronic launched Steerant Aortic Guidewire. This device is used for facilitating catheter placement during interventional procedures in the aorta.

- In February 2024, BIOTRONIK joined hands with IMDS. This joint venture is done for launching micro Rx catheter used for interventional cardiac applications.

Value Chain Analysis

- R&D: Developing advanced interventional cardiology devices with improved safety and performance through an emphasis on innovation, engineering, and design optimization.

Key players: Medtronic, Boston Scientific, Abbott Laboratories, Koninklijke Philips N.V. - Clinical Trials and Regulatory Approvals: compliance, efficacy, and safety validation, and fast-tracking of regulatory approvals for timely market entry are all done by the department.

Key Players: Abbott Laboratories, Medtronic, Boston Scientific, Terumo Corporation - Formulation and Final Dosage Preparation: This is the production and assembly of devices in accordance with very rigorous quality and design standards to ensure accuracy and dependability.

Key players: Medtronic, Abbott Laboratories, Boston Scientific - Packaging and Serialization: The distribution process entails the use of protective packaging, labeling, and serialization for the purpose of maintaining product integrity, traceability, and compliance.

Key players: Praxis Packaging Solutions, Medtronic, Boston Scientific - Distribution to Hospitals, Pharmacies: Logistics are strengthened to ensure that the medical devices are delivered to health care providers and that there is proper control of the inventory, and safe transport.

Key players: Cardinal Health, Medtronic, Boston Scientific, Abbott Laboratories - Patient Support and Services: Installation, user training, technical support, and maintenance services are all provided to increase customer satisfaction and device performance.

Key Players: Medtronic, Abbott Laboratories, Boston Scientific

Segments Covered in the Report

By Product

- Coronary Stents

- DES

- BMS

- BRS

- PTCA Balloon Catheters

- Normal

- Specialty (Includes cutting, scoring, and lithotripsy balloons)

- DCB

- Accessory Devices

- PTCA Guidewires (Workhorse, Specialty)

- Diagnostic Catheters

- PTCA Guiding Catheters

- Introducer Sheaths

- Intravascular Imaging Catheters and Pressure Guidewires (IVUS Catheters, OCT Catheters, FFR Guidewires)

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- MEA

- Rest of the World

Get a Sample

Get a Sample

Table Of Content

Table Of Content