What is the Interventional Radiology Market Size?

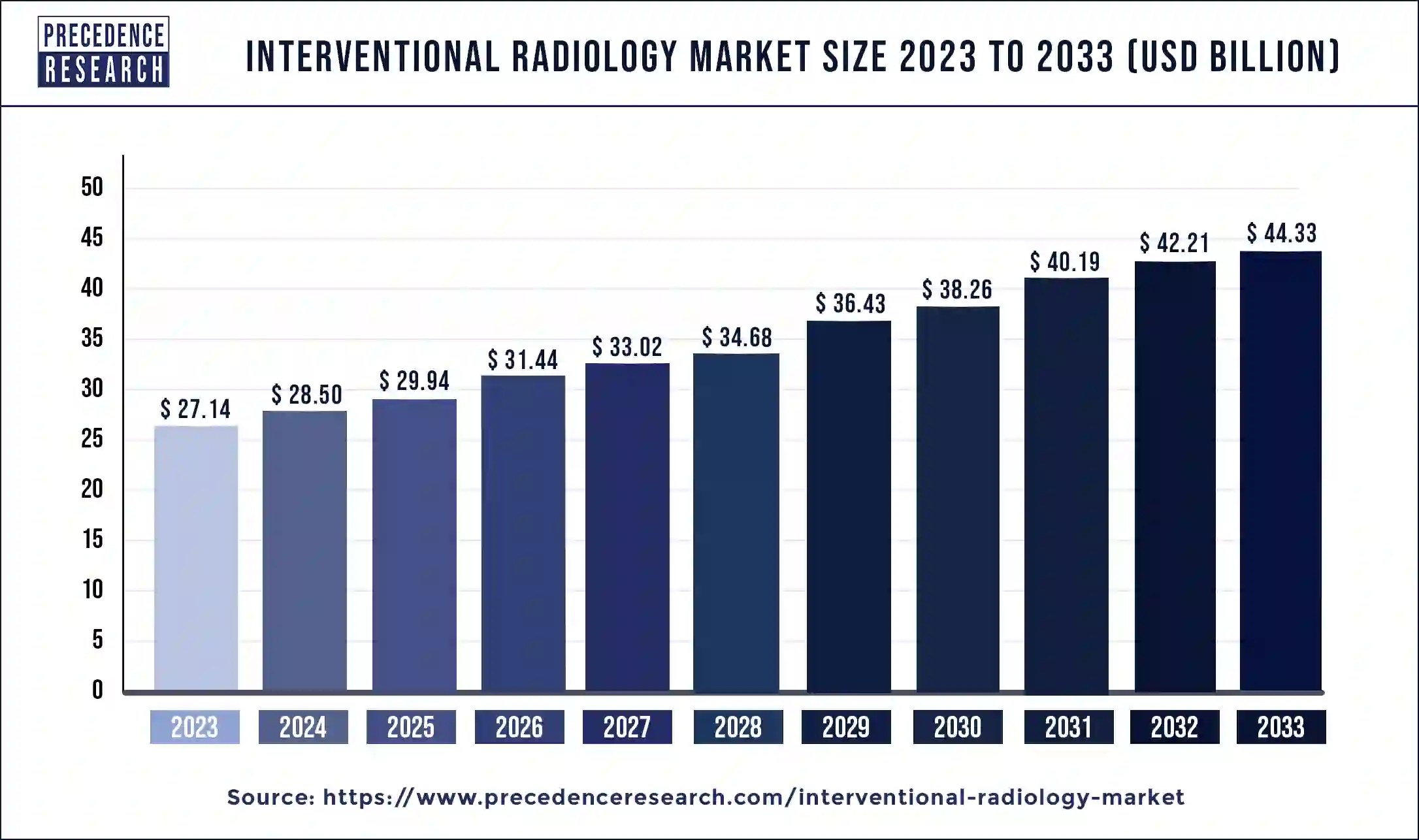

The global interventional radiology market size is estimated at USD29.94 billion in 2025 and is predicted to increase from USD 31.44 billion in 2026 to approximately USD 46.38 billion by 2034, expanding at a CAGR of 4.99% from 2025 to 2034. The rising prevalence of chronic illness among the population drives the growth of the market.

Market Highlights

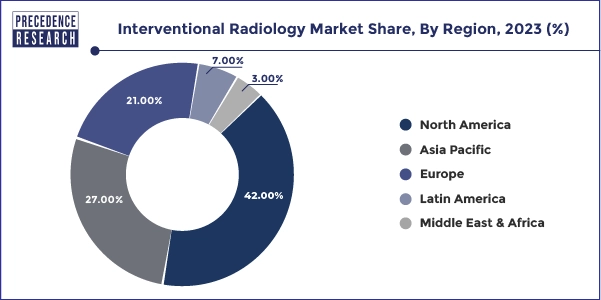

- North America dominated the interventional radiology market, with the largest market share of 42% in 2024.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

- By product, the ultrasound imaging systems segment led the market in 2024

- By application, the cardiology segment captured the biggest market share in 2024.

- By application, the oncology segment is expected to grow at the fastest rate during the forecast period.

Market Overview

Interventional radiology is a specialized field of radiology procedures. Physicians use interventional radiology for imaging to guide the minimally invasive surgical procedures for the treatment, diagnosis, and detection of several chronic diseases. Interventional radiology is highly efficient in treatment, cost, and pain relieving, reduces recovery time, and reduces the risk of the patients by traditional open surgery. Interventional radiology includes imaging techniques like MRI scanners, CT scanners, angiography systems, and ultrasound, which are widely used in procedures. The rising prevalence of chronic illness and the demand for effective treatment procedures drive the expansion of the interventional radiology market.

Interventional Radiology Market Growth Factors

- The increasing healthcare infrastructure and the rising demand for technological advancements in the minimal treatment of diseases drive the expansion of the interventional radiology market.

- The growing prevalence of chronic diseases such as cardiovascular, oncology, gastroenterology, etc., is driving the demand for minimally invasive treatment or surgeries, which drives the demand for the interventional radiology market.

- The rising investments in the technological development of healthcare equipment and devices drive the growth of the market.

- The rising population and the increasing prevalence of unhealthy lifestyles cause severe issues in the people that drive the growth of the market.

- The rising prevalence of cancer and other chronic diseases that need to be detected and diagnosed early has led to a higher demand for the interventional radiology market.

Interventional Radiology Market Outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the rising government initiatives aimed at strengthening the healthcare sector coupled with rapid incidences of heart diseases around the globe.

- Major Investors: Numerous market players are actively entering this market, drawn by collaborations, R&D and business expansions. Various healthcare companies such as Koninklijke Philips, GE Healthcare, Siemens Healthineers, Fujifilm Healthcare and some others have started investing rapidly for developing advanced radiology solutions to cater the needs of the medicals.

- Startup Ecosystem: Various startup brands are engaged in developing radiology systems. The prominent startup brands dealing in interventional radiology comprises of Subtle Medical, Aidoc, Deeptek and some others.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 29.94 Billion |

| Market Size in 2026 | USD 31.44 Billion |

| Market Size by 2034 | USD 46.38 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.99% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising prevalence of chronic diseases

The rising global population, geriatric population, rising healthcare infrastructure, and the prevalence of chronic diseases such as cancer, cardiovascular diseases, and other severe diseases demand early detection and diagnosis with minimally invasive treatment that drives the demand for the interventional radiology market. The rising number of cancer diseases globally is positively influencing the demand for interventional radiology. It helps in the treatment of cancer in several ways. It directly treats the disease by preventing bleeding during surgeries, providing pain relief, and reducing the side effects of cancer treatment. Interventional radiology is directly used in cancer cells and in cancer-killing therapies like chemotherapy and radioactive medicine in tumors and cancer cells. Thus, the rising cases of cancer and the demand for effective and minimal treatment procedures have contributed to the growth of the interventional radiology market.

- According to the World Health Organization, chronic diseases are responsible for 41 million deaths every year, which is equivalent to 74% of all deaths that occur worldwide. Among all the chronic diseases, cardiovascular diseases kill 17.9 million people, followed by 9.3 million deaths due to cancer, 4.1 million deaths due to chronic respiratory diseases, and 2.0 million deaths due to diabetes. Out of all deaths, 77% occur in low and middle-income countries.

Restraint

High cost

The increased cost associated with the products due to the integration of smart technologies is limiting the expansion of the interventional radiology market. The high cost of radiology is due to various reasons, including the use of advanced systems like CT and MRI machines. Radiology reading services, insurer reimbursement rules, healthcare system costs, and the type of patient care determine the further costs associated with interventional radiology. Cost reduction from the hospital end can be done by purchasing alternative equipment at low prices, purchasing in bulk, reducing the use of films, and altering the patterns of some supplies. This will help in reducing the charges applied to patients.

Opportunity

Technological advancements

The evaluation of the technologies associated with the healthcare industry and the increasing adoption of the technologies for detection and diagnosis with minimal treatment drive the expansion of the market. Technological innovations in interventional radiology include multimodality image fusion guided procedures, cone-beam computed tomography (CBCT), and preoperative imaging to improve the efficiency of the procedures. The rising investment in the technologies of interventional radiology by the major market players and the rising participation of new start-ups for technological evaluation drive the growth of the interventional radiology market. The integration of technologies such as augmented reality and virtual reality in the treatment is further propelling the growth of the market in the forecast period.

- For instance, in April 2024, Bayer, a healthcare company, asked Google to collaborate to incorporate AI and cloud capabilities for building new tech products that will provide assistance to radiologists. Bayer will use its clinical data handling expertise, radiology, healthcare regulator, and other expertise in this collaboration.

Segment Insights

Product Insights

The ultrasound imaging systems segment dominated the market with the highest market growth in 2024. The rising adoption of ultrasound interventional radiology by major healthcare facilities for the treatment and detection of several diseases is driving the demand for ultrasound imaging systems. The ultrasound imaging system is one of the important parts in the interventional radiology procedures. The ultrasound imaging system includes procedures like thoracentesis (fluid drainage around the lungs), drainage of Baker's cysts and abscesses, paracentesis (fluid drainage from the abdominal cavity), and the placement of PICC lines. It is also used in procedures like hysterosonography and amniocentesis. Ultrasound imaging system is a cost-effective alternative to MRI magnetic resonance imaging with accurate guidance. It does not involve radiation exposure, which is safer for patients. Thus, all these properties are propelling the demand for the ultrasound imaging system.

- For instance, in February 2024, FUJIFILM India launched the ALOKA ARIETTA 850, the most advanced Endoscopic Ultrasound Machine. The machine can develop superior-quality images and provide a better user interface than conventional machines.

Application Insights

The cardiology segment dominated the interventional radiology market in 2024. Cardiovascular diseases (CVDs) are the most common diseases that occur, and they are responsible for the highest number of deaths. Physical inactivity, tobacco consumption, alcohol consumption, unhealthy diet, occupational hazards, and pollution are the major causes of CVDs. Heart diseases, heart attacks, heart failure, arrhythmia, stroke, and heart valve problems are all CVDs that need radiology for monitoring.

- According to research, the number of 17.9 million deaths annually will rise to 24 million by 2030. Globally, the financial expense of CVDs was around US$ 863 billion in 2010, which will rise by 22% by 2030, which is equivalent to US$ 1044 billion.

The oncology segment is estimated to grow at the fastest CAGR during the forecast period. The rising prevalence of cancer globally drives the demand for oncology interventional radiology treatment. Interventional radiology in cancer treatment is also known as interventional oncology. In interventional oncology, the radiologist uses imaging like computed tomography (CT), fluoroscopy, and ultrasound to deliver cancer therapies directly to the cancer cells or tumors that are leaving the healthy, untouched tissues. Interventional oncology involved no anesthesia, faster recovery, and minimal discomfort. Oncology intervention is a treatment with higher efficiency that can kill cancer tumors, relieve the pain of the treatment, and extend the life of the patients. Thus, the higher prevalence of cancer globally drives the demand for the interventional oncology segment.

Regional Insights

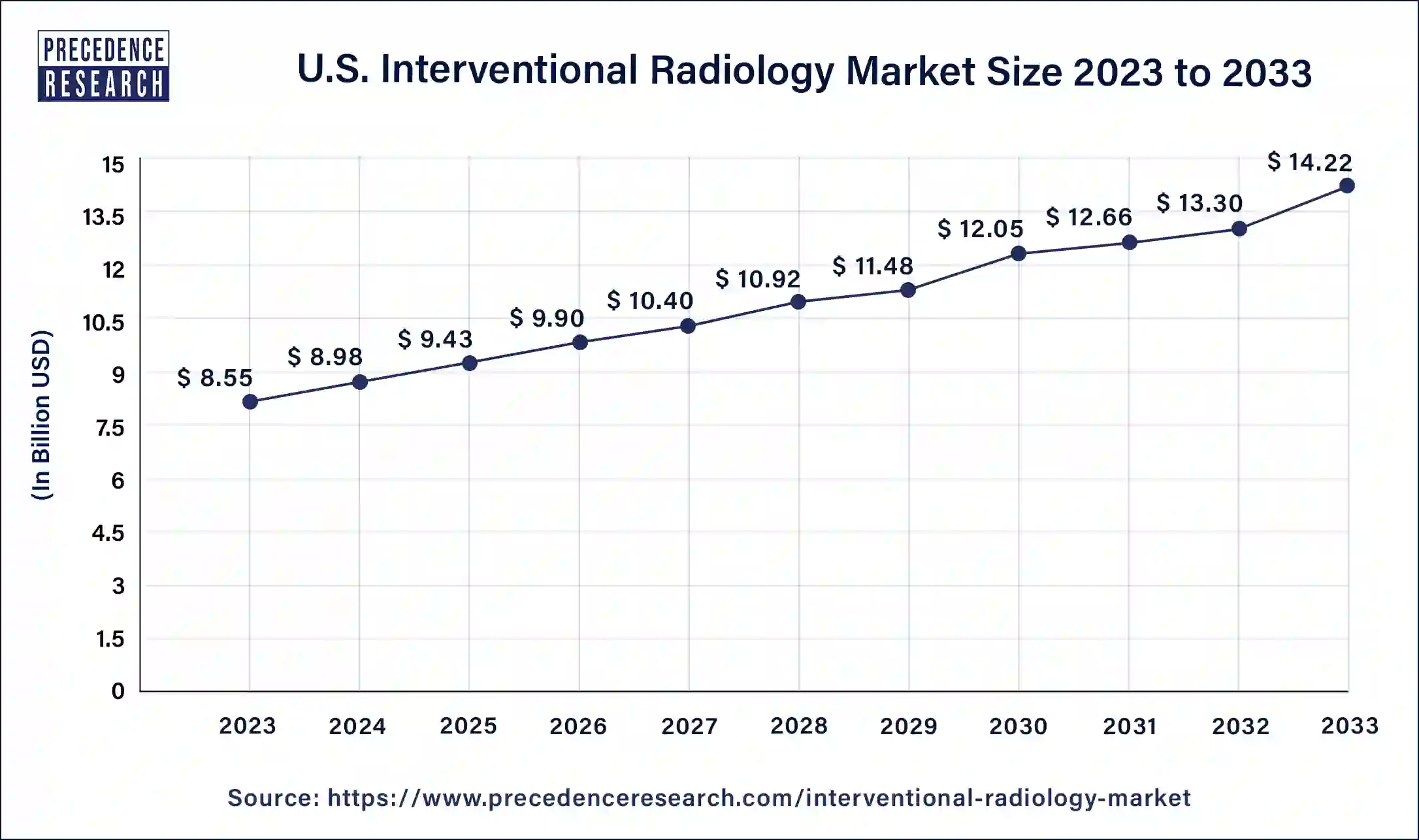

U.S. Interventional Radiology Market Size and Growth 2025 to 2034

The U.S. interventional radiology market size is estimated at USD9.43 billion in 2025 and is predicted to be worth around USD 14.95 billion by 2034, at a CAGR of 5.23% from 2025 to 2034.

North America led the interventional radiology market with the largest market share in 2024. The growth of the market in the region is increasing due to the higher number of chronic diseases such as cancer due to the unhealthy lifestyle that drives the demand for the market. The rising healthcare infrastructure and the technological adoption in the treatment of most chronic diseases have expanded the demand for the interventional radiology market. The rising participation and the presence of the major healthcare and pharmaceutical facilities in the region are contributing to the growth of the market. Additionally, investments in research and development activities in the expansion of the technologies that drives the growth of the market in the region.

- For instance, there are 2,001,140 new cancer cases and 611,720 cancer deaths estimated in the U.S. in 2024.

Asia Pacific is estimated to grow at the fastest rate during the forecast period. Asia and Europe are among the top regions that face the highest levels of deaths associated with CVDs. When it comes to diabetes, which uses radiology to diagnose complications associated with diabetes, China (174.4 million patients till 2045) has the highest number of diabetic patients, followed by India (124.9 million patients till 2045) and Pakistan (62.2 million patients till 2045). The countries are going to rank in the top three until 2045.

- According to the International Diabetes Federation, India spent US$ 8.5 billion on diabetes in 2021 and the amount is expected to rise up to US$ 10.3 billion by 2030.

According to research published in September 2024 in Radiation Medicine and Protection Journal, in the past 20 years, the radiology equipment per million population in China has increased significantly. Dental radiology equipment has increased ninefold, followed by CT scanners with a fivefold increase.

Europe also has a significant share of the interventional radiology market. The growth of the market is expected to increase due to the rising healthcare infrastructure and the improvement in the development of technological evolution in modern devices and equipment, driven by the rising number of geriatric patients who are more prone to chronic illness. Thus, all these factors contribute to the expansion of the interventional radiology market in the region.

Why Latin America held a considerable share of the interventional radiology market?

atin America held a considerable share of the industry. The increasing number of government hospitals in numerous countries such as Brazil, Argentina, Peru, Venezuela and some others has boosted the market expansion. Also, the presence of various market players coupled with technological advancements in the healthcare sector is expected to drive the growth of the interventional radiology market in this region.

How is Middle East & Africa contributing to the interventional radiology market?

The Middle East & Africa held a notable share of the market. The rise in number of diagnostics centers in various nations including UAE, Saudi Arabia, South Africa and some others has driven the market growth. Additionally, numerous government initiatives aimed at strengthening the healthcare infrastructure is expected to boost the growth of the interventional radiology market in this region.

Interventional Radiology Market Companies

- Koninklijke Philips: Koninklijke Philips is a Dutch multinational health technology company that focuses on improving people's health through innovation in areas like diagnosis, treatment, and home care. The company offers professional healthcare solutions, such as diagnostic imaging and patient monitoring along with personal health products including toothbrushes and breast pumps.

- GE Healthcare: GE HealthCare is a global medical technology and digital solutions company that provides products and services for patient diagnosis, treatment, and monitoring. Its offerings include diagnostic imaging systems (like X-ray and MRI), ultrasound, patient care solutions (such as monitoring and anesthesia equipment), and pharmaceutical diagnostics (including contrast agents).

- Siemens Healthineers: Siemens Healthineers is a leading global medical technology company with over 125 years of experience, headquartered in Erlangen, Germany. This company provides a wide range of products and services for diagnostic and therapeutic imaging, laboratory diagnostics, and advanced therapies.

- Fujifilm Healthcare: Fujifilm Healthcare is a division of the global company Fujifilm Holdings that provides medical and diagnostic solutions. It offers a wide range of products and services, including diagnostic imaging (like X-ray, CT, MRI, and ultrasound), enterprise imaging and IT solutions, endoscopy, and in-vitro diagnostics.

- Canon Medical Systems Corporation: Canon Medical Systems Corporation is a Japanese medical imaging company that provides diagnostic systems including computed tomography (CT), magnetic resonance (MR), X-ray, and ultrasound systems.

- Toshiba Medical Systems: Toshiba Medical Systems was a global provider of diagnostic medical imaging solutions, including CT, X-ray, and MRI systems. The company's product lines include a wide range of medical imaging and information systems, such as CT, MRI, X-ray, and ultrasound systems.

Recent Developments

- In March 2024, Kauvery Hospitals in Chennai proudly announced the launch of its new quaternary facility at Arcot Road, Vadapalani. The facility has the highest level of specialized medical care, with advancements in the treatments and innovative procedures for overcoming critical health issues with compassion and precision.

- In March 2024, GE HealthCare is introducing the latest technologies in surgery, image guiding solutions, ultrasound, and CT navigation at the Society of Interventional Radiology (SIR) Annual Scientific Meeting that will be held on March 23-28 in Salt Lake City, UT.

- In October 2025, Terumo launched FineCross M3. FineCross M3 is an interventional cardiology solution designed for treating patients suffering from coronary artery diseases.(Source: https://www.biospectrumindia.com)

- In August 2025, Esaote Group launched a comprehensive portfolio of cardiovascular imaging technologies. These technologies are designed to enhance diagnostic precision, streamline workflows, and support clinical decision-making across the world.(Source: https://healthcare-in-europe.com)

- In March 2025, Ge Healthcare launched a new range of invasive cardiology product offerings. This new range of products are designed for the healthcare sector globally.(Source: https://www.dicardiology.com)

Segments Covered in the Report

By Product

- Ultrasound imaging systems

- MRI systems

- CT scanners

- Angiography systems

By Application

- Oncology

- Cardiology

- Urology

- Gastroenterology

- Gynecology

- Obstetrics

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting