What is the Radiology AI Market Size?

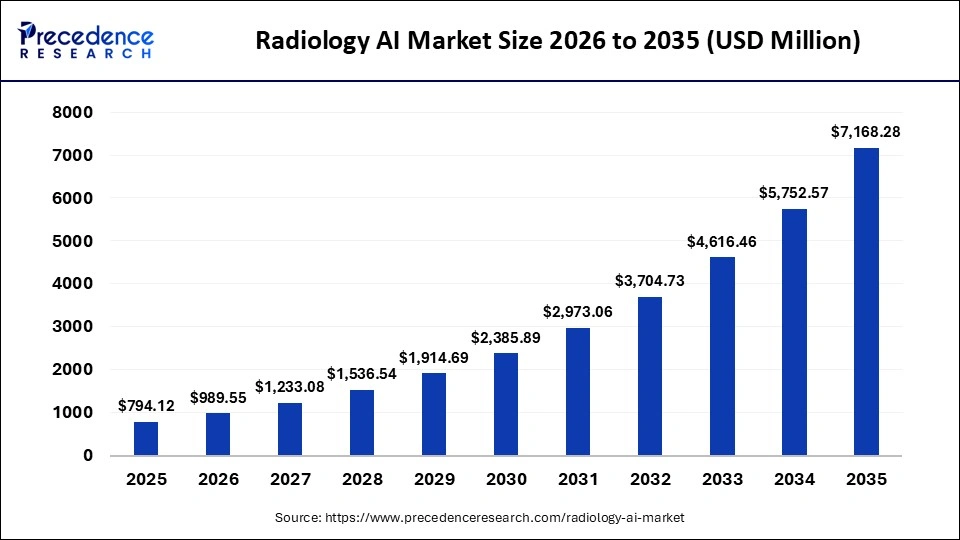

The global radiology AI market size accounted for USD 794.12 million in 2025 and is predicted to increase from USD 989.55 million in 2026 to approximately USD 7,168.28 million by 2035, expanding at a CAGR of 24.61% from 2026 to 2035. The market for radiology AI is experiencing unprecedented growth, driven by the increasing demand for early detection of chronic diseases.

Market Highlights

- North America dominated the market, holding the largest market share in 2025.

- The Asia-Pacific is expected to expand at the fastest CAGR between 2026 and 2035.

- By offering, the software/SaaS segment generated the biggest market share in 2025.

- By offering, the on-device software segment is growing at the highest CAGR between 2026 and 2035.

- By function, the diagnostic imaging & interpretation segment held the major market share in 2025.

- By function, the treatment planning & intervention support segment is growing at a healthy CAGR between 2026 and 2035.

- By modality, the computed tomography (CT) segment captured the highest market share in 2024.

- By modality, the magnetic resonance imaging (MRI) segment is expected to expand at a strong CAGR between 2026 and 2035.

- By indication, the oncology segment recorded the largest market share in 2025.

- By indication, the cardiology segment is expected to grow at a remarkable CAGR between 2026 and 2035.

- By end user, the hospitals segment accounted for the biggest market share in 2025.

- By end user, the diagnostic imaging centers segment is expected to grow at a significant CAGR between 2026 and 2035.

Radiology AI Market Overview: Adoption, Clinical Workflows, and Emerging Use Cases

As AI technology continues to evolve, radiologists, researchers, and technologists are continuously innovating to improve patient outcomes. According to the American College of Radiology, 30 percent of radiologists use AI in their clinical practices. Radiology AI uses artificial intelligence algorithms, including deep learning and machine learning (ML), to detect and characterize abnormalities in medical images, such as MRIs, X-rays, mammograms, and CT scans, which assist in timely diagnostics and the planning of personalized treatment strategies. Radiology AI solutions efficiently address the global radiologist shortage and improve diagnostic quality. Advanced AI tools help radiologists by automating repetitive tasks, generating critical findings, and providing quantitative analysis, ultimately improving patient care.

What Has Been the Impact of Technological Changes on the Radiology AI Market?

Technological advancements have significantly accelerated the growth of the radiology AI market by improving diagnostic accuracy, workflow efficiency and clinical decision support. The introduction of deep-learning imaging models, high-performance GPUs, and cloud-enabled processing has enabled faster, more precise interpretation of X-rays, CT scans, MRIs, and mammograms. Modern radiology AI tools now support automatic lesion detection, organ segmentation, triage prioritization, and structured reporting, reducing radiologists workload while improving patient throughput.

Integration with PACS, EMR systems, and real-time analytics platforms has further enhanced adoption, allowing hospitals and imaging centers to incorporate AI into daily clinical workflows. These technological changes create a strong foundation for scalable, high-quality radiology services across global healthcare systems.

Radiology AI Market Outlook

Between 2025 and 2030, the industry is expected to grow rapidly. The market is driven by the rising global incidence of cancer, the growing volume of medical imaging, and the trend towards integrating AI platforms. The global shortage of radiologists, increasing demand for early and accurate disease detection, and the continuous advancements in AI and computational capabilities.

Several leading players in the radiology AI market are actively expanding their geographic presence, particularly in high-growth regions such as Asia-Pacific, North America, and Europe. For instance, in September 2024, deepc, the leading radiology AI platform company, announced a strategic partnership with IST Medical, a prominent healthcare solutions provider operating in Germany, Spain, and Portugal. This collaboration will significantly enhance access to deepcs platform, deepcOS, across these key strategic European markets.

Major investments in the radiology AI market are driven by increased funding from venture capital firms, large healthcare systems, and tech firms. These investments are likely to accelerate the adoption of radiology AI solutions, enhancing diagnostic accuracy and efficiency in detecting abnormalities across imaging modalities.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 794.12 Million |

| Market Size in 2026 | USD 989.55 Million |

| Market Size by 2035 | USD 7,168.28 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 24.61% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Offering, Function, Modality, Indication, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Radiology AI Market Segmental Insights

Offering Insights

Software/SaaS: The segment held the largest share of the AI radiology market in 2024, driven by key benefits such as scalability, cost-effectiveness, and seamless integration with healthcare IT infrastructure. Radiology AI software or SaaS platforms enable hospitals to deploy advanced imaging algorithms without large upfront hardware investments, making adoption easier for facilities of all sizes. These cloud-based solutions support a broad range of clinical functions, including diagnostic imaging and interpretation, automated reporting and documentation, image acquisition enhancement and workflow optimization for modalities such as MRI, CT, ultrasound and mammography.

Continuous updates through the cloud also ensure that radiologists have access to the latest model improvements, regulatory-approved features and security patches, which strengthen long-term adoption across large health networks and imaging centers.

On-device Software: On the other hand, the on-device software segment is expected to grow at a remarkable CAGR over 2026-2035. On-device software is a significant segment of the radiology AI market, driven by increasing demand for speed, data privacy, and reliable performance within existing clinical infrastructure. Running inference directly on imaging equipment or local hospital servers reduces latency and improves real-time decision support during imaging procedures.

It also ensures full compliance with data protection requirements by keeping sensitive medical images within the healthcare facilitys network. As edge AI chips are increasingly integrated into scanners and PACS systems, on-device radiology AI will continue to expand, particularly in regions with strict data governance rules or limited cloud connectivity.

Function Insights

Diagnostic Imaging & Interpretation: The segment contributed the highest revenue share. Artificial intelligence can significantly enhance diagnostic accuracy, reduce interpretation time and manage the increasing volume of medical images across modalities, including MRI, CT scans, and X-rays. AI models are being trained on large, diverse datasets to detect subtle abnormalities, quantify disease progression, and highlight regions of interest, supporting radiologists in complex cases. These capabilities help reduce diagnostic variability and accelerate the time to incorporation of imaging findings into clinical decision-making.

Treatment Planning & Intervention Support: The segment is expected to grow at the fastest CAGR, driven by increasing focus on personalizing therapeutic procedures to transform patient outcomes. AI assists in predicting how an individual patient responds to specific treatments, such as chemotherapy, radiotherapy, targeted therapy, and others. This allows clinicians to tailor personalized treatment strategies to enhance treatment outcomes and reduce adverse effects. AI-driven planning tools also support precise radiation dose mapping, tumor contouring and surgical navigation, improving the overall safety and accuracy of interventional procedures.

Screening & Triage: The segment is anticipated to grow at a notable rate. AI-powered solutions are designed to optimize radiology workflows, ensure timely diagnosis of critical health conditions, and support early disease detection. AI tools function as intelligent assistants to radiologists, performing repetitive tasks with high consistency and speed, allowing human experts to focus on more complex cases and the decision-making process. Screening algorithms for diseases such as lung cancer, breast cancer and cardiovascular disorders help flag high-risk cases, prioritize urgent studies, and reduce backlogs in high-volume imaging departments.

Modality Insights

Computed Tomography (CT): The CT segment held the largest market share in 2024. The segments growth is supported by increasing innovation aimed at making diagnostics faster, safer, more accurate, and more efficient. Moreover, the high volume of CT procedures and the diverse applications of AI within CT workflows are anticipated to drive the segments growth during the forecast period.

Magnetic Resonance Imaging (MRI): This segment is expected to grow rapidly between 2026 and 2035, driven by the shift toward integrated AI platforms and cloud-based solutions. The rising global burden of chronic disorders such as cancers, cardiovascular diseases, and other diseases increases the need for highly detailed imaging for early detection and monitoring, fueling the demand for AI-enhanced MRI.

X-Ray: This segment is anticipated to grow at a significant CAGR, driven by the rapid adoption of AI in X-ray imaging and the increasing integration of AI software into existing digital X-ray infrastructure. AI algorithms rapidly analyze chest X-rays to detect critical health conditions such as pneumonia, tuberculosis, and fractures, and others.

Indication Insights

Oncology: The segment accounted for the majority of the market share in 2024. Radiology AI is significantly transforming the oncology field by enhancing every stage of patient care, from early detection and diagnosis to personalized treatment planning and monitoring. AI algorithms can efficiently and accurately analyze medical images such as CT scans, mammograms, and MRIs to detect subtle, early signs of cancer that are often overlooked by the human eye, thereby improving survival rates. AI-powered tools also streamline radiologists workflows by automating repetitive tasks and ensuring timely care for urgent conditions.

According to the data released by the International Agency for Research on Cancer (IARC) in February 2024, there were around 20 million new cases of cancer and approximately 9.7 million deaths in 2022. It is reported that about one in five people will develop cancer during970,000 their lifetime. Lung cancer was the most commonly occurring cancer worldwide, with 2.5 million new cases accounting for 12.4% of the total new cases. Over 35 million new cancer cases are predicted in 2050, a 77% increase from the estimated 20 million cases in 2022.

Cardiology: The cardiology segment is expected to grow at a remarkable CAGR between 2026 and 2035. The integration of radiology AI into cardiology is significantly improving the diagnostic capabilities, reducing human workload, and shifting the field toward more personalized patient care. AI substantially enhances the interpretation of cardiac imaging modalities, including coronary artery disease (CAD) detection, functional analysis, and tissue characterization. Radiology AI assists cardiologists by automating complex analyses and detecting subtle patterns that are often difficult for humans to detect.

According to the Centers for Disease Control and Prevention, Heart disease is one of the leading causes of death in the United States, with one person dying every 33 seconds from cardiovascular disease. Approximately 695,000 people in the United States died from heart disease in 2021, which is 1 in every five deaths. It is estimated that 805,000 people suffer from heart attacks in the United States every year.

Neurology: This segment is poised for rapid expansion and significant growth. In neurology, Radiology AI serves as a powerful set of tools that enhance the accuracy, speed, and efficiency of diagnosing, treating, and monitoring various neurological disorders. It manages the vast amount of complex imaging data and provides valuable quantitative insights. AI aids in the diagnosis and management of chronic neurological diseases such as neurodegenerative diseases (Alzheimers and Parkinsons), multiple sclerosis (MS), and brain tumors. Additionally, AI optimizes the entire imaging process through automated reporting, worklist prioritization, and reconstructs high-quality MR images from accelerated or low-dose acquisition data.

End Users Insights

Hospitals: The hospitals segment is dominating the radiology AI market. Hospitals are the major end users in the market, owing to high patient volumes, well-established imaging infrastructure, and an increasing focus on operational efficiency. Hospitals typically have advanced digital infrastructure to effectively manage a vast majority of complex imaging workloads, especially for modalities like MRIs, X-rays, and CT scans, creating a need for AI tools to enable earlier disease detection by highlighting subtle abnormalities that are often missed during manual review.

Diagnostic Imaging Centers: The segment is rapidly growing. Diagnostic imaging centers are a significant end user in the radiology AI market. The rising focus on outpatient care and the increasing need for specialized AI-powered services in standalone facilities primarily drive the segments growth. In diagnostic imaging centers, AI algorithms are highly effective at interpreting and analyzing medical imaging data, including CT, MRI, and digital pathology. These factors are expected to drive segment growth during the forecast period.

Radiology AI Market Regional Insights

North America dominates the radiology AI market, holding the majority of the market share, since the region benefits from a highly developed and advanced healthcare infrastructure, including state-of-the-art hospitals and diagnostic imaging centers that are increasingly offering AI-powered radiology solutions to improve diagnostic accuracy significantly, streamline clinical workflows, and ultimately lead to better patient population outcomes. Medical facilities, especially in the United States and Canada, widely deploy AI tools for CT, MRI, X-ray, and mammography interpretation, enabling faster triage, earlier disease detection, and reduced radiologist workload.

Moreover, significant investment in cutting-edge technology, a supportive government framework, and increasing incidences of chronic diseases are anticipated to drive the regions growth during the forecast period. Federal initiatives that support AI adoption, expanding reimbursement structures for digital diagnostics, and the active involvement of major technology companies further accelerate innovation. Rising cases of cancer, cardiovascular diseases, and respiratory disorders continue to fuel demand for AI-enhanced imaging tools, positioning North America as the largest and most technologically mature market for radiology AI.

The United States radiology AI market is the major contributor to the growth of the North American region. The country has a well-established, sophisticated healthcare system with high healthcare expenditure, enabling significant investment in cutting-edge technology. The presence of several leading global AI and healthcare technology companies, such as GE HealthCare, Microsoft, Nvidia, and others driving an innovation-driven ecosystem. The favorable regulatory environment of the U.S. Food and Drug Administration (FDA) has accelerated the clearance process for AI-powered diagnostic tools, reducing time-to-market and encouraging technology adoption.

Asia Pacific is the fastest-growing region in the radiology AI market. The growth of the area is primarily supported by developing healthcare infrastructure, an aging population, rising healthcare expenditure, the integration of AI into medical imaging, the rising demand for efficient and accurate diagnostics, and the need to address the shortage of radiologists. Countries like India, China, and Japan are at the forefront of accelerating the expansion of the radiology AI market in the region, owing to improved diagnostic capabilities that lead to earlier detection of chronic diseases and higher treatment rates.

How is China transforming the radiology AI market?

The country is experiencing significant growth. The established presence of key players, a large patient population, growing healthcare infrastructure, considerable investment in R&D, and increasing access to high-quality diagnostic facilities support the radiology AI market. Several companies and investors are increasingly investing to drive innovation and adoption of AI-driven radiology in the country. Moreover, the adoption of artificial intelligence in radiology is accelerating due to the urgent need to reduce diagnostic turnaround times and alleviate radiologist workload amid growing imaging complexity. These factors are expected to fuel the expansion of the radiology AI market in the country.

The Europe region holds a substantial market share in the radiology AI market. The area has a sophisticated healthcare system that facilitates the diagnosis and treatment of a wide range of chronic diseases. The European Medicines Agency (EMA)s favorable regulatory environment has accelerated the regulatory clearance of AI-powered diagnostic tools. The rising incidence of chronic diseases such as cancer, cardiovascular conditions, and neurodegenerative diseases has increased the need for accurate diagnostic tools to manage high imaging volumes and address radiologist shortages. The adoption of AI-driven solutions helps automate tasks and improve workflow efficiency.

Germany Radiology AI Market Trends

The German radiology AI market is experiencing significant growth. The market is driven by increasing demand for efficient diagnostics, a surge in the geriatric population, growing need for early disease detection, and a supportive regulatory framework. Germany has one of the largest imaging volumes in Europe, creating strong demand for AI tools that reduce reporting time, improve diagnostic accuracy, and manage rising workloads across CT, MRI, and X-ray modalities. Hospitals and radiology centers are adopting AI-powered workflow solutions to support clinical decision-making in oncology, neurology, and cardiology, where early detection is critical for improving outcomes.

The continuous advancement in artificial intelligence and computational capabilities is expected to drive the growth of the radiology AI market significantly. Research institutions and technology developers in Germany are actively refining algorithms for precision imaging, automated triage, quantitative analysis, and structured reporting. Government-funded digital health initiatives and national strategies for AI adoption further accelerate deployment across both public and private healthcare networks.

Radiology AI Market Companies

Develops AI-enhanced radiology platforms for CT, MRI, X-ray, and ultrasound, integrating automated image analysis and workflow orchestration. Its AI-RAD Companion suite supports multi-organ detection and clinical decision support.

Provides AI cloud infrastructure through Azure Health, enabling radiology AI model development, deployment, and clinical integration. Offers imaging analytics tools and partnerships that embed AI into diagnostic workflows.

Offers AI-powered radiology solutions integrated into CT, MRI, and enterprise imaging systems. Focuses on workflow acceleration, automated triage, and precision diagnosis through its IntelliSpace and Radiology Workspace platforms.

Provides AI-driven imaging platforms and Edison AI services that enhance image reconstruction, detection, and reporting. Strong footprint across CT, MRI, and ultrasound with embedded real-time analytics.

Supplies AI-integrated diagnostic imaging and PACS solutions through its Synapse platform. Focus areas include automated lesion detection, workflow efficiency, and advanced visualization.

Delivers AI-based imaging solutions under its Altivity platform, enhancing reconstruction quality, dose reduction, and automated measurements across CT, MRI, and ultrasound systems.

A leading radiology AI company offering cancer detection and triage systems for X-ray, CT, and mammography. Deploys AI-assisted interpretation tools widely across hospitals and screening programs.

Specializes in AI applications for breast imaging, including advanced mammography and tomosynthesis analysis. Supports radiologists by enhancing cancer detection and automating workflows.

Integrates AI with high-end imaging modalities and digital platforms. Strong presence in AI-enabled CT, MR, and unified diagnostic ecosystems across hospitals.

Focuses on AI-enhanced womens health imaging, particularly mammography and breast tomosynthesis. Provides diagnostic platforms with automated detection and improved clinician workflows.

Recent Developments

- In November 2025, Oxipit, a leading provider of AI-driven medical imaging solutions, announced that Diagnostikum Group, one of Austrias foremost diagnostic providers, had chosen the Oxipit CXR Suite to enhance chest X-ray workflows across its network. The implementation will be carried out through Oxipits partner, Deepc, ensuring seamless integration into Diagnostikums existing clinical environment.(Source:https://oxipit.ai)

- In May 2025, Lunit, a leading provider of AI for cancer diagnostics and therapeutics, announced a strategic partnership with Starvision Service GmbH, Germanys largest private radiology network. Through a newly signed framework agreement, Lunits AI imaging solutions will be deployed across Starvisions expansive network of radiological practices. Under the agreement, Starvision will adopt several of Lunits AI solutions, including Lunit INSIGHT CXR, Lunit INSIGHT MMG, Lunit INSIGHT DBT, and RBfracture.(Source: https://www.prnewswire.com)

Radiology AI MarketSegments Covered in the Report

By Offering

- On-Devices Software

- Software/SaaS

By Function

- Screening & Triage

- Diagnostic Imaging & Interpretation

- Treatment Planning & Intervention Support

- Monitoring & Follow-Up

- Report & Documentation

- Workflow Optimization

- Research & Clinical Development

- Other Functions

By Modality

- Computer Tomography (CT)

- Magnetic Resonance Imaging (MRI)

- X-Ray

- Ultrasound

- Mammography

- Other Modalities

By Indication

- Oncology

- Cardiology

- Neurology

- Pulmonology/Respiratory Diseases

- Orthopedics

- Others

By End User

- Hospitals

- Diagnostic imaging centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting