What is the Intrusion Detection and Prevention Systems (IDPS) Market Size?

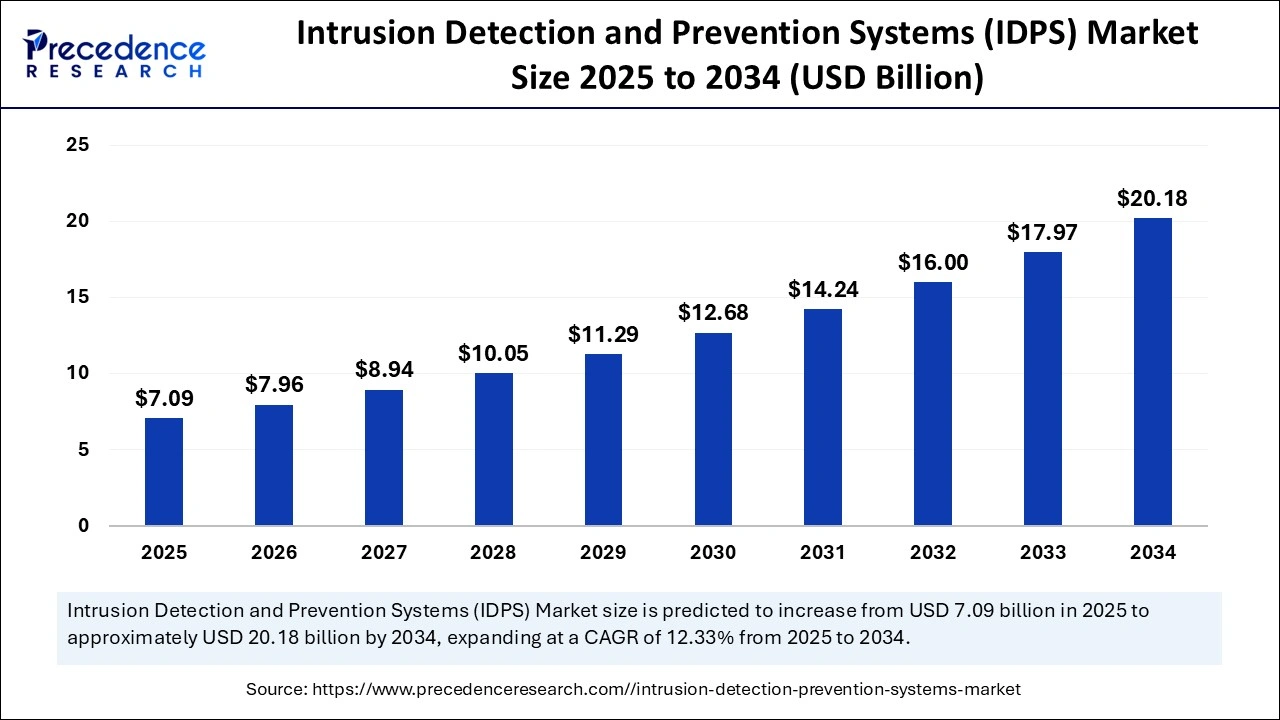

The global intrusion detection and prevention systems (IDPS) market size was calculated at USD 7.09 billion in 2025 and is predicted to increase from USD 7.96 billion in 2026 to approximately USD 22.23 billion by 2035, expanding at a CAGR of 12.11% from 2026 to 2035. The demand for enhanced security measures is driving the global intrusion detection and prevention systems (IDPS) market. Rapid digital transformation and several cyberattacks are fueling the adoption of intrusion detection and prevention systems, fostering market growth.

Intrusion Detection and Prevention Systems (IDPS) Market Key Takeaways

- In terms of revenue, the intrusion detection and prevention system (IDPS) market is valued at $7.09 billion in 2025.

- It is projected to reach $22.23billion by 2035.

- The market is expected to grow at a CAGR of 12.11% from 2026 to 2035.

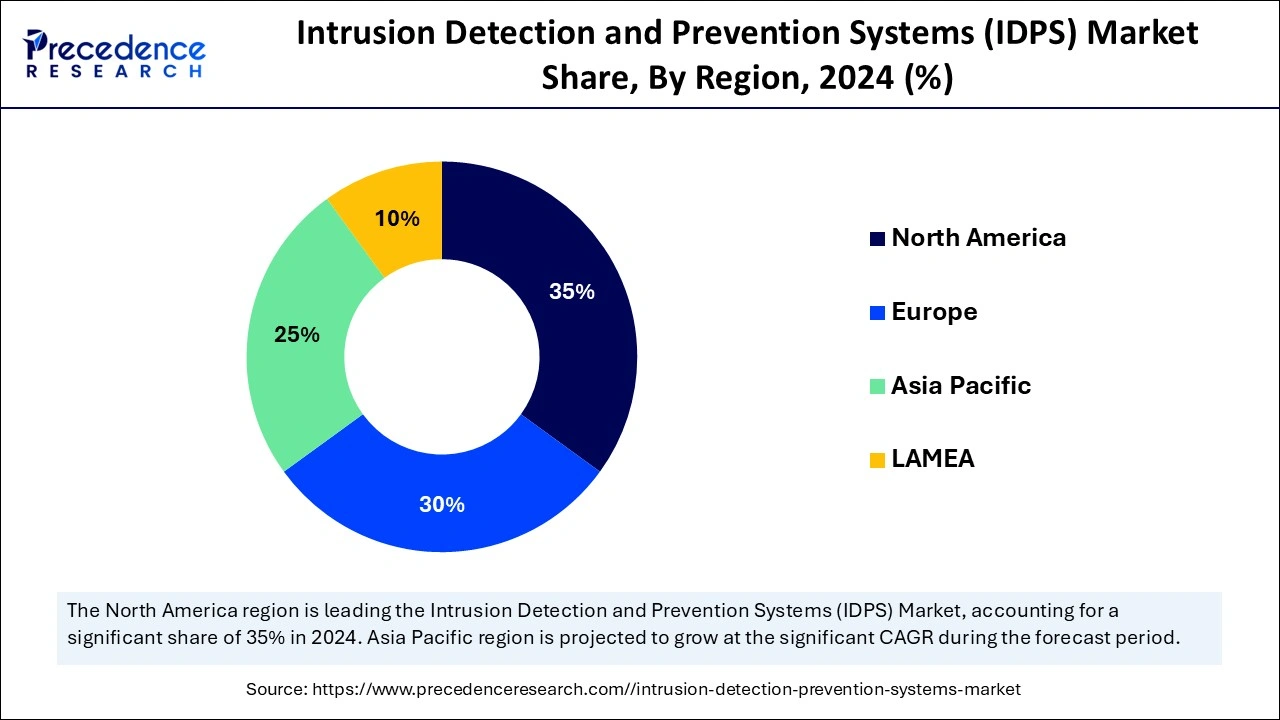

- North America dominated the global market with the largest revenue share of 35% in 2025.

- Asia Pacific intrusion detection and prevention systems market is expected to grow at the fastest CAGR of 14% during the forecast period.

- Europe is growing at a notable CAGR of 13.2% during the forecast period.

- By type, the network-based segment contributed the highest market share in 2025.

- By type, the network behavior analysis segment is expected to witness the fastest growth during the predicted timeframe.

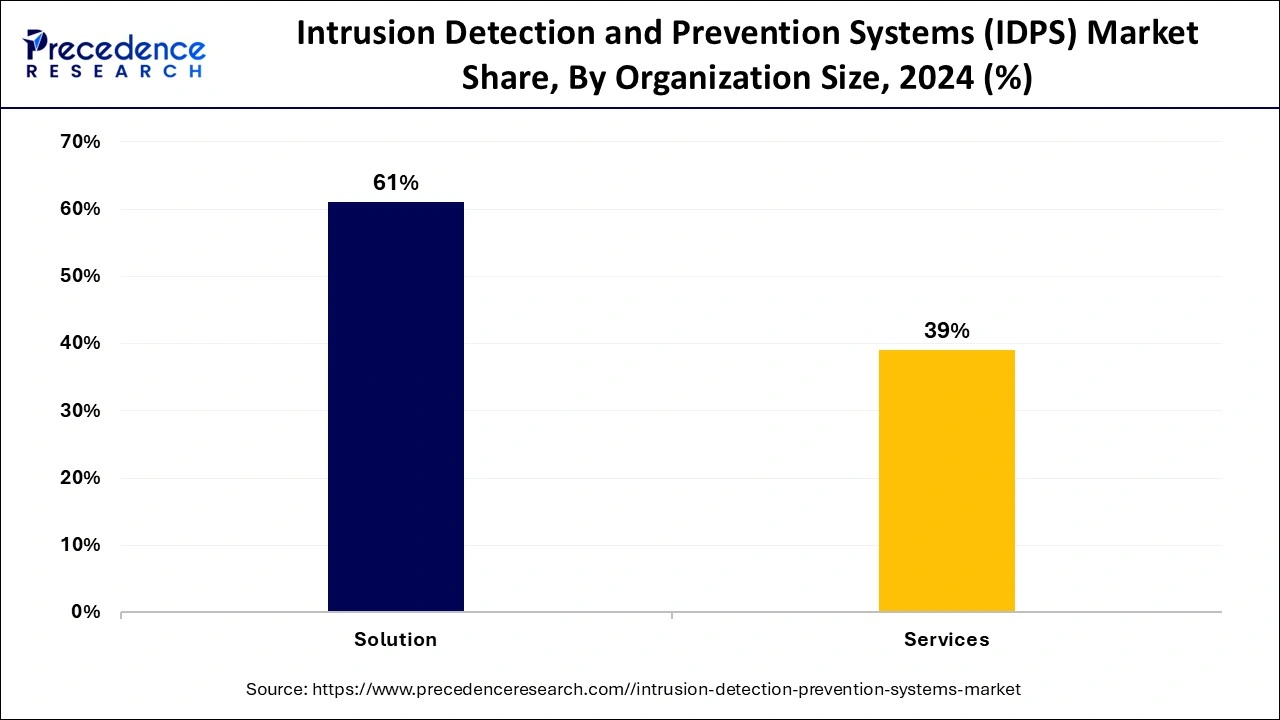

- By component, the solution segment captured the highest market share of 61% in 2025.

- By component, the services segment will expand rapidly in the coming years.

- By technology, the network intrusion detection system (NIDS) segment contributed the highest market share in 2025.

- By technology, the hybrid IDS segment is expected to grow fastest during the predicted timeframe.

- By deployment, the on-premises segment captured the biggest market share in 2025.

- By deployment, the cloud segment will expand rapidly in the coming years.

- By organization size, the large enterprises segment held the largest market share in 2025.

- By organization size, the small and medium-sized enterprises (SMEs) segment is projected to grow with the fastest CAGR during the forecast period.

- By vertical, the banking, financial services, and Insurance (BFSI) segment held the largest market share in 2025.

- By vertical, the government & defense segment is projected to grow with the fastest CAGR during the forecast period.

Market Overview

The intrusion detection and prevention systems (IDPS) market has witnessed significant growth due to the rapid proliferation of digital infrastructure and expansion of IT infrastructure, and the wide adoption of cloud computing. Organizations are adopting cloud computing for its flexibility and cost reduction. However, the digital revolution is coming along with security vulnerabilities. The increased number of cyberthreats and data breaches has driven the necessity of robust intrusion detection and prevention solutions. Along with IT industries, military & defense, and other government organizations are the biggest victims of cyberattacks, requiring advanced security measures. Additionally, the requirement to comply with security regulations and compliance plays a vital role in the increased adoption of intrusion detection and prevention systems (IDPS) globally.

Perimeter, Cisco, Palo Alto Networks, Fortinet, Symantec, Trend Micro, McAfee, IBM Security, and Sophos Darktrace were the 10 best network security providers for government in 2024. (Source: https://cybersecuritynews.com)

Is AI able to boost areas of Intrusion Detection and Prevention Systems (IDPS)?

Yes, Artificial Intelligence is rapidly revolutionizing all areas and aspects of intrusion detection and prevention systems. Compared to the traditional intrusion detection and prevention systems (IDPS), which used to face challenges face sophisticated cyber threats such as advanced persistent threats (APTs), zero-day exploits, and industry inside attacks, the advanced AI-enable intrusion detection and prevention systems (IDPS) has come with cutting-edge features of real-time threat detection, automated response mechanisms, as well as adaptive anomaly recognition. The systems are ensuring high accuracy and reducing false positives. Major industries are AI with intrusion detection and prevention systems (IDPS), to enhance the dynamics of cyber threat detection and prevention measurements.

- For instance, in April 2025, Cisco Systems Inc. launched a new security innovation at the annual RSAC Conference 2025 in San Francisco, with a focus on helping enterprises navigate AI threats and scale up AI adoption security. According to the soon-to-be-published report from Cisco, 86% of organizations worldwide have AI-related security incidents in the FY 2024.(Source:https://siliconangle.com)

Top Breakthrough by the General Dynamics Information Technology - 2025

General Dynamics Information Technology (GDIT), a business unit of General Dynamics, is one of the largest cloud services providers to the U.S. government, and operates hundreds of active cloud programs across government agencies.

- In March 2025, General Dynamics Information Technology (GDIT) unvield its new Strategic Collaboration Agreement to boost digital modernization, deliver efficiencies, and advance government missions, and expanded its partnership with Amazon Web Services (AWS). The companies are collaborating for the development of advanced cybersecurity, AI, and cloud migration and modernization solutions to accelerate the digital transformation for defense, intelligence, and civilian agencies in the U.S.

David Appel, vice president of U.S. Federal at AWS, announced that “the collaboration between GDIT and AWS will boost the modernization and efficiency of our U.S. Federal customers at a critical time of government digital transformation!”

Which Growth Factors Fuel Intrusion Detection and Prevention Systems (IDPS) Market?

- Rising Security Breaches and Cyberattacks: The increased number of security breaches and cyberattacks has driven industries to invest in advanced security solutions to protect their sensitive data and maintain operational integrity, driving innovations and adoption of intrusion detection and prevention systems.

- Trend of BYOD and CYOD Culture: The rising trend of bring your own device BIYOG and choose your own device CYOD culture, fueling the need for advanced security majors with remote access, driving market growth.

- Cloud-based Organization and Growth: The strategic growth in cloud-based organizations for scalability and cost-effectiveness, driving adoption of advanced security measures, including intrusion detection and prevention systems (IDPS).

- Focus on Zero Trust Security: Industries are driving demand for zero trust security technologies to reduce the risk of cyberthreats and security breaches, which requires verification and authentication of every user and device, fueling adoption of intrusion detection and prevention systems (IDPS).

Market Outlook

- Industry Growth Overview: The intrusion detection and prevention systems (IDPS) market has experienced steady growth as a result of increasing multi-cloud usage, intrinsic issues related to visibility of encrypted traffic, and additional regulations placed on the financial, health, and critical infrastructure sectors globally.

- Sustainable Trends: Organizations are focusing on sustainable, energy-efficient cybersecurity infrastructure through shared use of IDPS systems with unified threat management platforms; reducing the redundancy of hardware, optimizing the amount of power used in a data centre, and using virtualized deployments to reduce carbon footprints.

- Global Expansion: Cross-border digital trade, hybrid workforces, and the rapid digitalization of government services are the driving forces for implementing IDPS in developing countries, particularly in those that have enacted data localization regulations and established sovereign cybersecurity policies that require in-country threat detection capabilities.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 22.23Billion |

| Market Size in 2025 | USD 7.09 Billion |

| Market Size in 2026 | USD 7.96 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 12.11% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Component, Technology,Organization Size, Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Data Security Regulations

Global regulatory frameworks are implementing strict data security regulations to protect the sensitive data of citizens. Stringent regulations, including General Data Protection Regulation (GDPR), Health Insurance Portability and Accountability Act (HIPAA), and Payment Card Industry Data Security Standard (PCI-DSS) comply with the protection of personal data, sensitive data of patient health, and maintain standards for security credit card data, respectively, drives need for advanced intrusion detection and prevention systems (IDPS). The organization needs to comply with these regulations to avoid fines, legal consequences, and maintain its reputation, driving a surge in the integration of advanced security solutions with existing systems to eliminate the risk of regulatory compliance, including intrusion detection and prevention systems.

Restraint

Complexity of Implementation and Management

The implementation and management complexity of intrusion detection and prevention systems (IDPS) is the major restraint for global market growth. These systems are complex to implement and integrate with existing security systems, creating challenges of time consumption. The system requires complex configuration for effective detection and prevention of threats, which requires specialized expertise and can be time-consuming. The requirement of management and maintenance to ensure its effectiveness hampers its adoption rate.

Opportunity

The Development of Advanced Threat Intelligence

Ongoing development of advanced threat intelligence is a significant factor holding growth opportunities to shape the continuous market in the future. The advanced threat intelligence offers an intrusion detection and prevention system with advanced real-time detection and actions in emerging threats, to improve the efficiency of detection and prevention. The system can integrate with threat intelligence for better understanding of past threats, detect anomalies, and adapt to novel cyber threats, helping to prevent challenges before event it occur. Development of advanced threat intelligence and making intrusion detection and prevention systems more proactive and reactive to potential intrusions, helping to attract potential organizations for adoption.

Segment Insights

Type Insights

In 2025, the network-based segment dominated the market due to increased reliability of organizations on the network. Network-based intrusion detection and prevention systems help organizations to enhance their security principles by detecting and preventing network-based attacks. The solutions help to reduce the risk of security breaches and data loss by blocking and identifying potential threats.

- In March 2025, Suricata announced the launch of Suricata 7.0.10. to address a critical issue in 7.0.9 affecting AF_PACKET users. Suricata 7.0.10 is a high-performance Network Threat Detection, Intrusion Prevention System (IPS), Intrusion Detection System (IDS), and Network Security Monitoring engine, designed to support various protocols, provide flexible rule configuration, and integrate with other security solutions. Source: https://x.com)

The network behavior analysis segment is anticipated to witness the fastest growth over the forecast period. The network behavior analysis solutions can detect advanced threats by analyzing network traffic and identifying anomalies. The ability of network behavior analysis solutions to provide real-time network traffic monitoring and advanced incident response enhances detection and response to security threats, enhances security, and reduces false positives.

Component Insights

The solution segment accounted largest market share in 2025 due to the ability of solutions to provide comprehensive security capabilities like detection, prevention, and response. The intrusion detection and prevention solution integrates with advanced technologies, including behavioral analysis, AI, and ML. The demand for AI-powered and cloud-based intrusion detection and prevention solutions is high. Organizations are adapting key solutions like network-based and host-based intrusion detection and prevention solutions.

The services segment is the second-largest segment, leading the market due to increased demand for specialized security services. The intrusion detection and prevention system services provide implementation, management, and maintenance of intrusion detection and prevention system solutions. The services also provide support and maintenance to ensure solution effectiveness. Key service providers, including consulting, managed, implementation, and training security service providers, are contributing to segment growth.

Technology Insights

In 2025, the network intrusion detection system (NIDS) segment dominated the market. The segment growth is attributed to increased need for comprehensive threat detection in network traffic, advanced threat protection to prevent sophisticated cyber threats, and real-time monitoring of network traffic and allowing swift detection and response to security threats. The increased adoption of advanced technologies in organizations, increased the necessity of advanced and real-time detection and incident response capabilities for network traffic. The organization had increased adoption of network intrusion detection systems (NIDS) with AI-enabled analytics and behavioral analysis.

The hybrid IDS segment has witnessed significant growth, driven by the ability of hybrid Intrusion Detection Systems (IDS) to offer comprehensive and robust security solutions. The hybrid IDS, leveraging both network-based and host-based detection capabilities, allows for more robust security measures. The hybrid IDS is flexible and scalable, making it ideal for complex and dynamic IT environments.

Deployment Insights

In 2025, the on-premises segment dominated the market due to the requirement for full control over security infrastructure. Industries require on-premises solutions to meet strict data security and privacy regulations. The on-premises solution is crucial for key industries like finance, banking, government, and healthcare, as they handle sensitive data. These organizations prefer on-premises solutions for greater control and data sovereignty. The on-premises solutions enable customization, as they offer specific industrial needs, prevention capabilities, and advanced threat detection capabilities.

However, the cloud segment is expected to lead the market in the forecast period. The rapid use of cloud computing in organizations is driving demand for cloud-based intrusion detection and prevention system solutions for protection from security risks. Cloud-based solutions are scalable, affordable, and easy to use, making them suitable for organizations.

- On May 6, 2025, the NEOX PacketOwl and PacketOwlVirtual Series Security Appliances, the next-generation, hybrid-cloud-ready Network Security Solutions, were launched by NEOX Networks, Inc., a leader in IT and OT Observability and Security solutions. This solution supports up to 100 Gbps and offers high performance as the industry's only Suricata-based Network Intrusion Detection System (NIDS), Network Security Monitoring (NSM), and Network Detection and Response (NDR).(Source: https://fox59.com)

Organization Size Insights

The large enterprises segment held the largest market share in 2025. The adoption of intrusion detection and prevention systems solutions and services is high across large enterprises. High cybersecurity threats necessitate robust security solutions in large enterprises. The complex networks and diverse IT environments of these enterprises make them more vulnerable to cyber threats and in need of robust intrusion detection and prevention systems. The requirement of enterprises to comply with regulatory compliance mandates leverages advanced security measures, including intrusion detection and prevention systems.

By organization size, the small and medium-sized enterprises (SMEs) segment held a significant market share in 2024, due to rising cyber threats in small and medium-sized enterprises (SMEs), driven by increased adoption of cloud-based solutions, fueling the necessity of advanced security practices. However, the limited security budget makes these enterprises invest in advanced intrusion detection and prevention system solutions. The rising need for cost-effective solutions is contributing to novel innovation and the development of intrusion detection and prevention systems.

Vertical Insights

In 2025, the banking, financial services, and Insurance (BFSI) segment held the largest market share due to rapid digital transformation in the sector. the banking, financial services, and Insurance (BFSI) sector is facing challenges of cyber threats like data breaches, ransomware attacks, and phishing, driving significant demand for advanced intrusion detection and prevention systems. The increased use of online banking, mobile payments, and e-commerce is driving the necessity of advanced security measures, driving the adoption of intrusion detection and prevention systems.

The government & defense segment is projected to witness significant growth in the forecast period. Government & defense organizations handle sensitive data and critical infrastructure, driving the need for advanced security solutions, including intrusion detection and prevention systems. The high-stakes security requirements in this organization contribute to segment growth. Additionally, government & defense agencies require compliance with stringent regulations and standards to ensure the security of sensitive data.

Regional Insights

What is the U.S. Intrusion Detection and Prevention Systems (IDPS) Market Size?

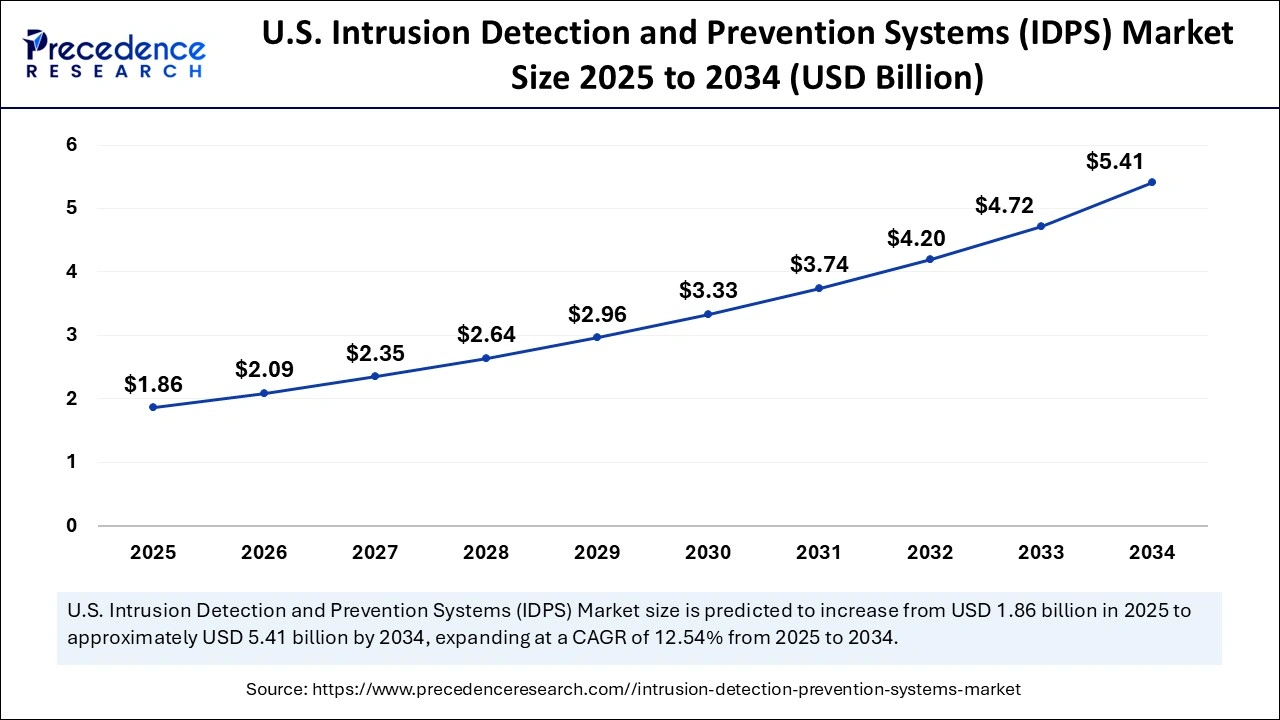

The U.S. intrusion detection and prevention systems (IDPS) market size was exhibited at USD 1.66 billion in 2025 and is projected to be worth around USD 5.41 billion by 2035, growing at a CAGR of 12.54% from 2026 to 2035.

Robust Investment in Research and Development: Fueling the North American Market

North America dominates the global intrusion detection and prevention system market due to increased cases of cybercrime, data spamming, theft, and phishing in regional industries. North America has a robust economy and strong investments in research and development activities. Additionally, the presence of key market players contributes to market growth. The demand for cloud-based intrusion detection and prevention systems is high in North America.

The U.S. Major player in the regional market, driven by to large IT industry of the country. The US has a robust IT infrastructure that drives demand for significant and advanced intrusion detection and prevention systems. The rise in cybersecurity concerns among the military and defence sector is a significant factor leading countries to invest in cybersecurity innovations. The Government of the U.S. is focusing on investing in cybersecurity initiatives, like providing funding for R&D for innovation and development of novel technologies, and supporting industry standards and best practices. Ongoing collaboration between the government and industries for the establishment and adherence of cybersecurity standards, like ISO/SAE 21434 fueling the market growth.

Trend of the Asia Pacific Intrusion Detection and Prevention System (IDPS) Market

Asia Pacific is anticipated to witness the fastest growth over the forecast period due to rapid digitalization, increased use of cloud computing, rising cyber threats, and increased government initiatives in cybersecurity. Asia has witnessed a significant rise in the BYOD (Bring Your Own Device) trend. The rising requirement of secure remote access, driven by the extreme adoption of remote working culture, is fueling demand for intrusion detection and prevention systems (IDPS) in Asia.

Which countries are leading the Asian Intrusion Detection and Prevention System (IDPS) Market?

Countries like South Korea, China, Japan, and India are major players in the Asian intrusion detection and prevention (IDPS) market, driven by their robust IT infrastructure and spending, rapid digital transformation, increased cyber threats, and regulatory compliance.

China is leading the market due to the country's high investment in technological advancements and government support for cybersecurity solutions. The Government of China has implemented various policies to promote domestic solutions, driving market growth.

South Korea stands out in the regional market due to the country's robust cybersecurity ecosystem, including legal bodies and high investments in the IT infrastructure. The increased adoption of cloud computing, IoT devices, and stricter government data security requirements is driving investments in intrusion detection and prevention systems (IDPS).

India is a significant player in contributing to regional market growth, due to the country's rapid digital transformation and government initiatives in providing proactive security measures. For instance, in March 2025, the Defence Research and Development Organisation (DRDO) Collaboration Conference-Cum-Exhibition on ‘Advanced Technologies for Internal Security and Disaster Relief Operations' was held by Raksha Mantri Shri Rajnath Singh inaugurated the Ministry of Home Affairs (MHA) at DRDO Bhawan, New Delhi. The conference focuses on equipping Central Armed Police Forces (CAPFs) officers with recent innovations in security technologies. (Source:https://www.pib.gov.in)

Europe Intrusion Detection and Prevention System (IDPS) Market & Trends

Europe is a significant player in the global intrusion detection and prevention system (IDPS) market, growth driven by the increased number of security breaches and cyberattacks. European industries have developed a specialized culture of Bring Your Own Device (BYOD) and Choose Your Own Device (CYOD) models. Stringent security regulations like GDPR, HIPAA, and PCI-DSS are imposing requirements, driving the adoption of intrusion detection and prevention systems.

The UK is leading the regional market due to countries' advanced cybersecurity frameworks, proactive regulatory posture, and innovative technologies like AI-driven threat detection, threat intelligence integration, and behavioral analytics. The UK's focus on zero-trust security is fueling the adoption of intrusion detection and prevention systems. The UK integration of this system with Security Information and Event Management Platforms (SIEM)and Security Orchestration, Automation, and Response (SOAR) technologies to improve the country's security.

Modernization of Cybersecurity in Latin America Digital Economies

Latin America is realizing considerable growth in IDPS adoption as financial institutions and telecommunications companies continue to address increasing phishing and DDoS threats. Governments are modernizing digital identity systems and critical infrastructure protection frameworks, which increases the need for real-time network traffic monitoring and anomaly detection. Cloud-first policies in Brazil and Mexico continue to encourage the integration of scalable virtual IDPS solutions.

Brazil Intrusion Detection and Prevention Systems (IDPS) Market Trends

Brazil is at the forefront of IDPS adoption, driven by the digital transformation of its banking sector and rigorous data protection legislation (LGPD). Large enterprises in Brazil are focused on advanced visibility into their networks and integrating threat intelligence into their security programs.

MEA's Cybersecurity and Infrastructure Projects are Growing

The Middle East and Africa's (MEA) intrusion detection and prevention system (IDPS) marketplace is strengthening with the growing demand for more advanced levels of cyber protection for oil, gas, smart cities, and national digital transformation programs.

The increase in state-sponsored attacks, along with regulatory reform in the Gulf countries have helped to create a strong need for enterprise-class IDPS investments. The expansion of telecommunications within Africa is adding to this requirement as well as expanding the need for scalable, carrier-grade security monitoring systems.

UAE Intrusion Detection and Prevention Systems (IDPS) Market Trends

The UAE market is expanding swiftly as organizations in sectors like finance, oil & gas, and government invest in advanced cybersecurity to counter rising threats. The market is projected to grow at a double-digit annual rate through the late 2020s, with solutions and services both seeing strong uptake.

Intrusion Detection and Prevention Systems (IDPS) Market Companies

- AT&T

- Check Point Software Technologies

- IBM Corporation

- Allegion plc

- ASSA ABLOY

- Juniper Networks

- BAE Systems

- Cisco Systems, Inc.

- Fortinet, Inc

- Palo Alto Networks

- Robert Bosch GmbH

- Sophos Ltd

Recent Developments

- In April 2025, Darktrace / OT announced that it has been named as a Market Leader in Omdia's 2025 Market Radar for OT Cybersecurity Platforms, for its unique capabilities in the OT security market. (Source: https://www.darktrace.com)

- In April 2025, Suricata introduced its beta version of Suricata 8.0, designed to improve detection capabilities, like transactional rules and "Txbits" for per-transaction bit support, and matching on the absence of buffers using the keyword "absent". (Source: https://forum.suricata.io)

- In January 2025, Palo Alto Networks introduced its Next-Generation IDPS (Intrusion Detection and Prevention System), which includes novel features and capabilities, particularly within its AI Access Security platform. (source: https://docs.paloaltonetworks.com)

Segment Covered in the Report

By Type

- Network-based

- Network Behavior Analysis

- Wireless-based

- Host-based

By Component

- Solution

- Services

By Technology

- Network Intrusion Detection System (NIDS)

- Host Intrusion Detection System (HIDS)

- Network Intrusion Prevention System (NIPS)

- Hybrid IDS

- Host Intrusion Prevention System (HIPS)

- Others

By Deployment

- On-premises

- Cloud

By Organization Size

- SMEs

- Large enterprises

By Vertical

- BFSI

- Manufacturing

- IT & Telecom

- Healthcare

- Retail & E-commerce

- Government & Defense

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting