What is Isobutene Market Size?

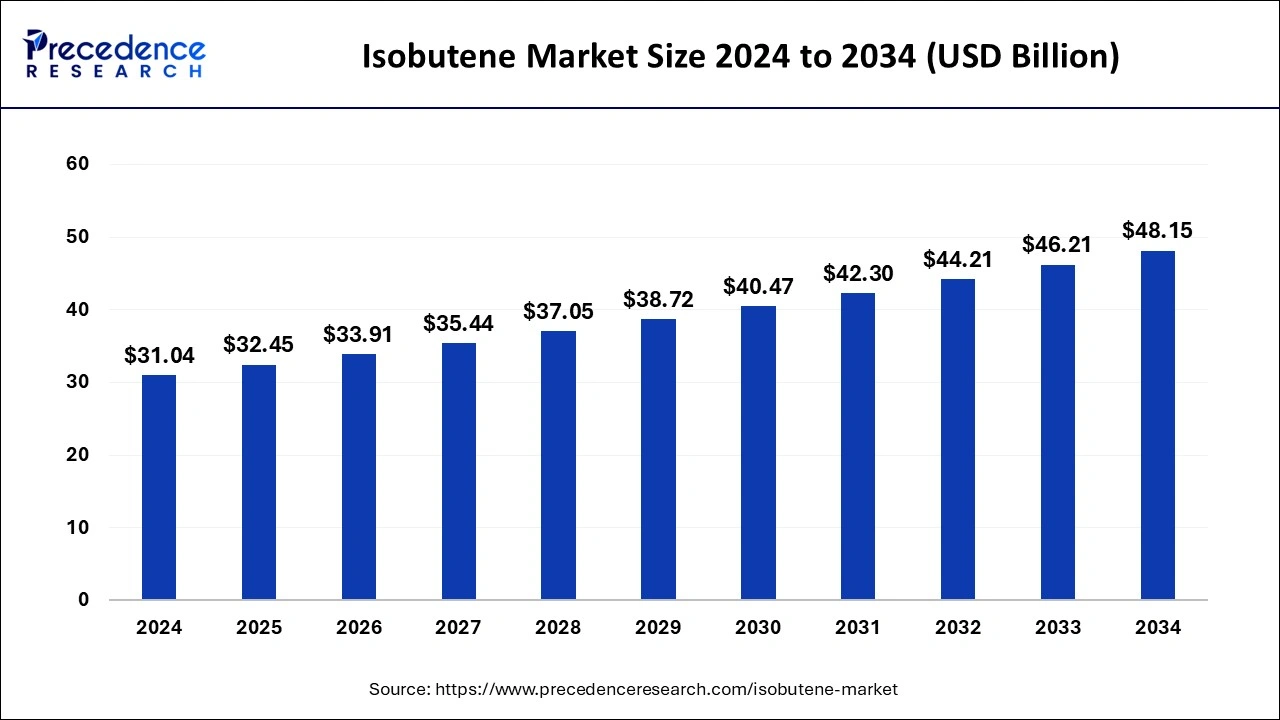

The global isobutene market size is estimated at USD 32.45 billion in 2025 and is predicted to increase from USD 33.91 billion in 2026 to approximately USD 50.13 billion by 2035, expanding at a CAGR of 4.45% from 2026 to 2035

Market Highlights

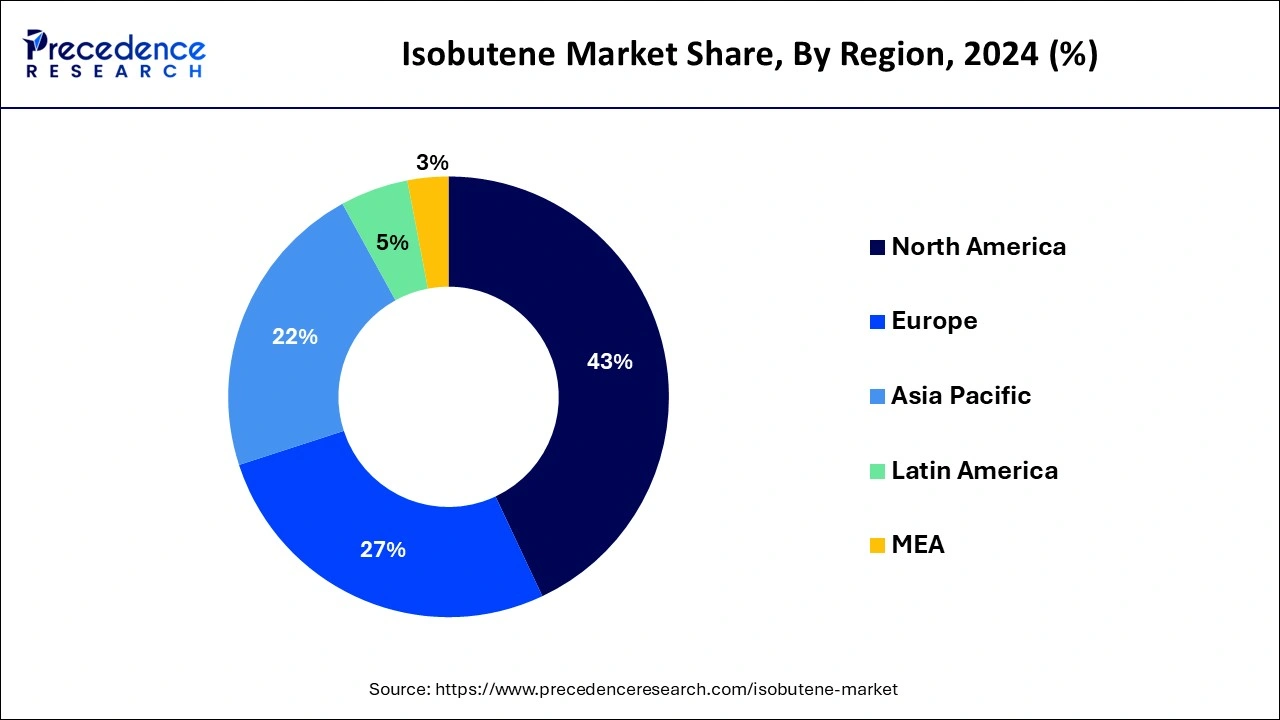

- North America dominated the market with the largest share of 43% in 2025.

- Asia Pacific is expected to witness the fastest CAGR of 5.29% during the forecast period.

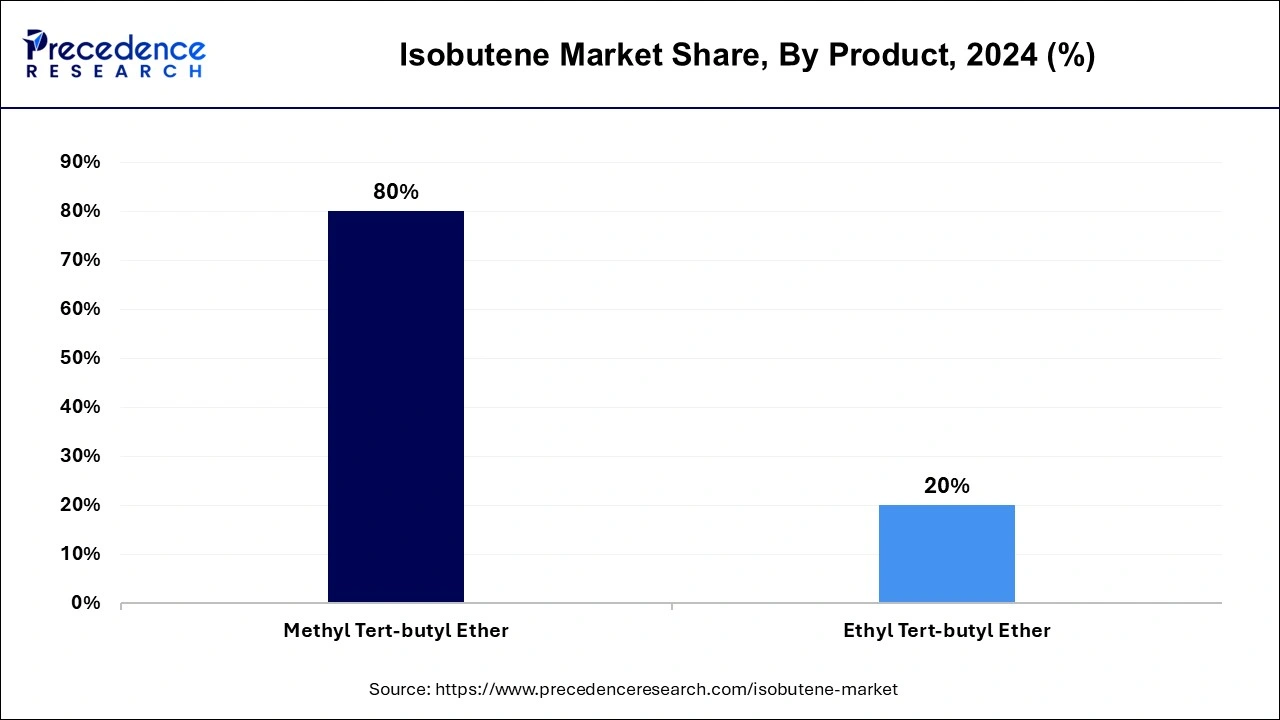

- By product, the Methyl tert-butyl ether (MTBE) segment held the largest segment of 80% in 2025.

- By application, the automotive segment held the biggest market share of 34% in 2025.

- By application, the aerospace segment is expected to grow at a notable CAGR of 4.71% between 2026 to 2035

Market Overview

The isobutene is also known as isobutylene, it is a hydrocarbon with the molecular formula C4H8. It is an important chemical compound used in various industrial applications. Isobutene is primarily utilized in the production of synthetic rubber, particularly in the manufacturing of butyl rubber, which has diverse applications such as tire inner tubes, inner liners, adhesives and sealants. Additionally, isobutene is employed in the production of methyl tert-butyl ether (MTBE), a fuel additive, and in the creation of various chemicals, including antioxidants, lubricant additives, and plasticizers. The demand for isobutene is influenced by factors such as the automotive industry, petrochemical industry, and overall economic trends. The isobutene market is subject to fluctuations in supply and demand, changes in raw material prices, and regulatory developments affecting its various applications.

Isobutene Market Data and Statistics

- In October 2023, The French government announced that it has given Global Bioenergies EUR 16.4 million to support fund construction of the world's 1st bio-sourced isobutene plant. The new plant will be capable of generating 10,000 tonnes of isobutene and derivatives per year which is due to begin operating in 2027.

Isobutene Market Growth Factors

- Isobutene is a crucial component in the production of butyl rubber, which is widely used in the manufacturing of tires for automobiles. The growth of the automotive industry, driven by increasing vehicle production and demand, contributes to the demand for isobutene.

- Butyl rubber, a major derivative of isobutene, is utilized in the production of various rubber products such as tires, automotive parts, and industrial goods. The growth in these industries directly impacts the demand for isobutene.

- Isobutene is a key raw material in the production of methyl tert-butyl ether (MTBE), which is used as a fuel additive to enhance the octane rating of gasoline. The demand for fuel additives and their role in optimizing engine performance can drive the growth of the isobutene market.

- Isobutene is used in the synthesis of various chemicals, including antioxidants, lubricant additives, and plasticizers. The growth of the chemical industry, particularly in applications where isobutene-derived products are essential, contributes to the overall market expansion.

- Overall economic growth and industrial development play a significant role in driving the demand for isobutene. As economies expand, there is often an increased need for rubber-based products, chemicals, and other materials that rely on isobutene.

- Advances in production technologies, such as improved catalytic processes and production efficiency, can positively impact the isobutene market by making production more cost-effective and environmentally friendly.

- Changes in environmental regulations and standards, particularly those related to fuel composition and emissions, can influence the demand for isobutene-based products. For example, regulations promoting cleaner fuels may drive the use of fuel additives such as MTBE.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 32.45 Billion |

| Market Size in 2026 | USD 33.91 Billion |

| Market Size by 2035 | USD 50.13 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.45% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Isobutene Market Dynamics

Drivers

Automotive industry growth

The continuous growth of the automotive industry serves as a significant driver for the demand in the isobutene market. As the automotive sector expands globally, the need for isobutene-derived products, particularly butyl rubber, intensifies. Butyl rubber is a vital component in tire manufacturing, and with the escalating demand for vehicles, there is a proportional increase in the consumption of tires, reinforcing the demand for isobutene. Tires, being a critical component in the automotive supply chain, are not only essential for original equipment manufacturers (OEMs) but also contribute to the replacement market, further sustaining the demand for isobutene.

Moreover, the automotive industry's pursuit of innovation and advancements, including the development of high-performance and fuel-efficient vehicles, accentuates the role of isobutene-derived chemicals. Fuel additives like methyl tert-butyl ether (MTBE), produced from isobutene, contribute to achieving higher octane ratings and cleaner-burning fuels, aligning with the automotive industry's objectives for enhanced environmental performance. Therefore, the growth trajectory of the automotive industry acts as a pivotal force propelling the demand for isobutene and its derivatives, fostering a symbiotic relationship between the two sectors.

Restraint

Environmental concern

Environmental concerns pose a potential restraint on the demand for the isobutene market. The use of isobutene-derived products, notably methyl tert-butyl ether (MTBE) as a fuel additive, has raised ecological issues due to its potential impact on water quality and groundwater contamination. MTBE is known for its solubility in water, making it persistent and challenging to remediate once released into the environment. In response to these concerns, regulatory bodies have implemented stringent guidelines or bans on the use of MTBE in certain regions, influencing the demand for isobutene in this application.

In addition, as global attention increasingly shifts towards sustainable and eco-friendly practices, there is a growing preference for bio-based alternatives to traditional petrochemical-derived products. The environmental footprint associated with the production and utilization of isobutene may drive industries and consumers toward exploring greener alternatives, thus limiting the growth prospects for isobutene in specific applications. To mitigate these challenges, the isobutene industry may need to invest in research and development initiatives focused on developing environmentally friendly production processes or alternative applications for isobutene-derived chemicals. Addressing environmental concerns is crucial for the long-term viability of the isobutene market in a world increasingly prioritizing sustainable practices.

Opportunity

Growing demand for synthetic rubber in various applications

- In June 2022, Global Bioenergies (GBE) announced that it had received its 1st order from Shell to conduct bio-isobutene derivatives tests. It is used in various applications such as cosmetics and fine chemicals to commodities and fuels.

The escalating demand for synthetic rubber across diverse applications presents a significant opportunity for the isobutene market. Synthetic rubber, particularly butyl rubber derived from isobutene, is a versatile material with widespread applications beyond tire manufacturing. Industries such as automotive, construction, and manufacturing increasingly rely on synthetic rubber for its unique properties, including impermeability to gases and resistance to heat and aging.

In the automotive sector, synthetic rubber finds application in the production of various components such as hoses, gaskets, and seals, contributing to improved durability and performance. Moreover, the construction industry utilizes synthetic rubber-based materials for sealants and adhesives due to their adhesive and waterproofing properties. The medical and consumer goods sectors also leverage synthetic rubber in the production of gloves, gaskets, and seals. Thus, as the demand for synthetic rubber continues to surge, propelled by the growth in these diverse industries, the isobutene market stands to benefit significantly.

Segment Insights

Product Insights

The Methyl tert-butyl ether (MTBE) segment dominated the isobutene market share of 80% in 2025. the segment is observed to continue the trend throughout the forecast period and is expected to grow at a significant rate throughout the forecast period.

MTBE is primarily used as a fuel additive, specifically in gasoline, to enhance octane levels and reduce engine knocking. It improves combustion efficiency and reduces air pollution by lowering emissions of harmful pollutants. It is also utilized in the petrochemical industry as a chemical intermediate for the production of isobutene-based chemicals, including high-octane aviation fuels.

Application Insights

The automotive segment dominated the isobutene market in 2025. Isobutene plays a crucial role in the automotive industry, particularly in the production of butyl rubber used for tire manufacturing. Butyl rubber's impermeability to gases makes it a preferred material for tire inner tubes, inner liners, and other automotive components.

On the other hand, the aerospace segment is expected to generate a notable revenue share in the market. Isobutene-derived products, such as specialty chemicals and elastomers, find applications in the aerospace sector. These materials may be used in the production of seals, gaskets, and other components that require high-performance properties.

Regional Insights

U.S. Isobutene Market Size and Forecast 2026 to 2035

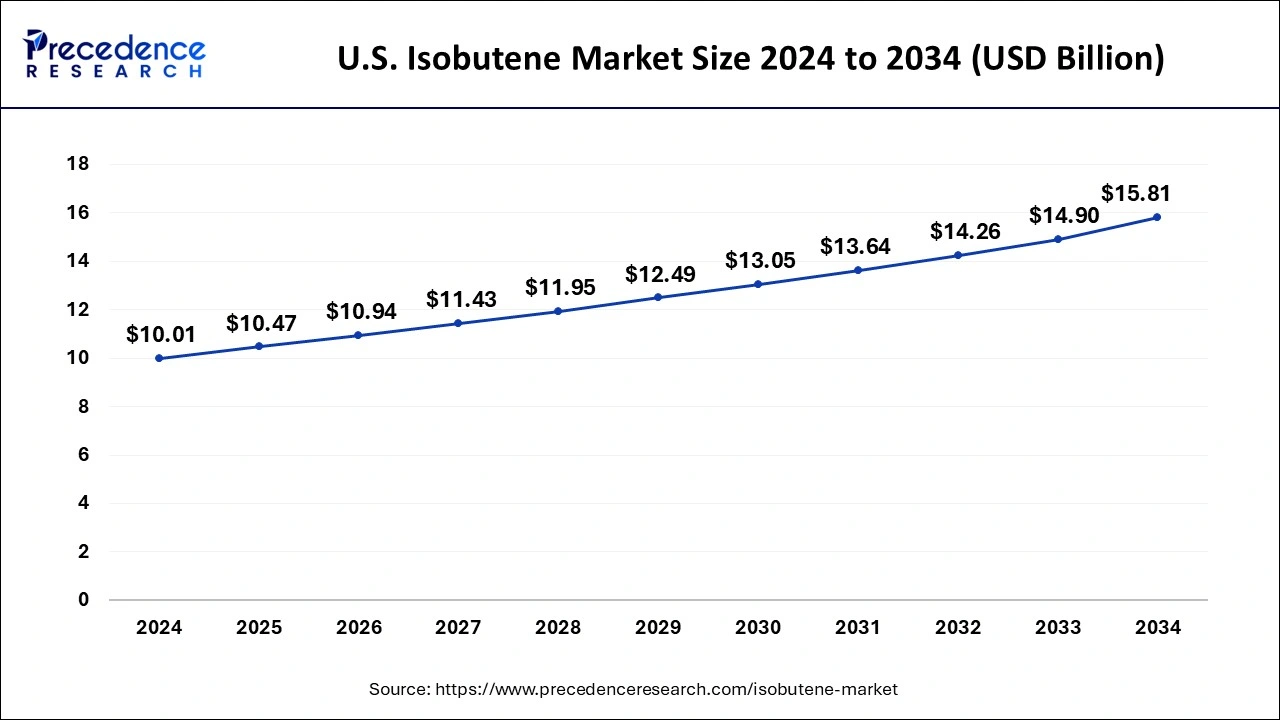

The U.S. isobutene market size is valued at USD 10.47 billion in 2025 and is expected to be worth around USD 16.54 billion by 2035, rising at a CAGR of 4.68% from 2026 to 2035.

U.S. Isobutene Market Analysis

The market in the U.S. is expanding due to rising demand for fuel additives, particularly MTBE, driven by regulations promoting cleaner-burning fuels. Growth in the automotive and petrochemical sectors, coupled with abundant shale gas providing cost-effective feedstock, supports increased production. Additionally, the demand for synthetic rubber in tires, adhesives, and sealants further propels the market, while ongoing investments in chemical manufacturing infrastructure enhance overall market capacity and efficiency.

North America dominated the isobutene market in 2025 the largest market share of 43% in 2025 due to the demand for fuel additives, particularly oxygenates like MTBE, in North America being influenced by regulatory requirements and the need for cleaner-burning fuels. Isobutene is involved in the production of these fuel additives, impacting its market dynamics in the region. Moreover, North America has witnessed a surge in shale gas production, providing a source of feedstock for the petrochemical industry. The availability of raw materials influences the production of isobutene and its derivatives in the region.

Additionally, the automotive industry in North America is a major consumer of isobutene-derived products, particularly in the production of synthetic rubber for tires. The growth or contraction of the automotive sector directly impacts the demand for isobutene in the region.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia-Pacific is poised for rapid growth in the isobutene market due to the rapid industrialization and urbanization in countries like China, India, and other emerging economies in the Asia-Pacific region contribute to the increased demand for isobutene-derived products. This includes the automotive industry, construction sector, and various manufacturing activities. The Asia-Pacific region is a major hub for the automotive industry, and the increasing production and sales of vehicles drive the demand for isobutene-based products, especially in the production of synthetic rubber for tires.

- In July 2023, Exxon Mobil Corporation acquired Denbury Inc., the acquisition will provide ExxonMobil to operate the biggest C02 (carbon dioxide) pipeline network in the U.S.

India Isobutene Market Analysis

The Indian market is growing due to rapid industrialization, increasing automotive production, and rising demand for synthetic rubber used in tires, adhesives, and sealants. Expanding chemical manufacturing facilities and urbanization-driven construction activities further boost consumption. Additionally, government initiatives supporting industrial growth and the growing petrochemical sector provide a stable feedstock supply, making isobutene a key raw material for fuel additives and various downstream chemical products in India.

How is the Opportunistic Rise of Europe in the Market?

Europe is growing at a notable rate in the isobutene market. The market is driven by various factors such as the automotive sector, the chemical industry, and regulatory initiatives promoting cleaner fuels. European regulations addressing air quality and emissions standards play a role in driving the demand for fuel additives. Isobutene is involved in the production of fuel additives, and its usage aligns with regulatory requirements for cleaner-burning fuels. Europe has shown a growing interest in bio-based and sustainable practices. This trend may influence the demand for bio-based isobutene or isobutene-derived products as industries explore environmentally friendly alternatives.

UK Isobutene Market Analysis

In the UK, the market is expanding due to growing demand for fuel additives, driven by stringent environmental regulations targeting cleaner-burning fuels and reduced emissions. The automotive and chemical industries further contribute to market growth, with isobutene used in synthetic rubber, adhesives, and specialty chemicals. Investments in advanced petrochemical production and the shift toward sustainable and bio-based alternatives are also supporting increased adoption and production of isobutene-derived products in the UK.

Value Chain Analysis

- Chemical Synthesis and Processing

Isobutene (2-methylpropene) is produced via petrochemical routes, such as MTBE cracking, and bio-based methods using isobutanol dehydration.

Key players: ExxonMobil, BASF, LyondellBasell, Dow Chemical, SABIC - Waste Management and Recycling

Isobutene and isobutane waste are managed through recovery, purification, and reuse in refineries and chemical plants, promoting a circular economy.

Key players: Shell, Chevron, TotalEnergies, Linde, Air Liquide

Top Companies Operating in the Market & Their Offerings

- BASF – Produces isobutene and derivatives for synthetic rubber, fuel additives, and specialty chemicals, with expertise in petrochemical processes and innovative catalytic technologies.

- Evonik – Focuses on high-purity isobutene production, specialty polymers, and chemical intermediates, supporting automotive, construction, and industrial applications.

- ExxonMobil – Supplies isobutene via petrochemical routes, offering raw materials for MTBE, synthetic rubber, lubricants, and fuel additives, leveraging global refining and chemical infrastructure.

- ABI Chemicals – Provides isobutene and isobutane products for industrial applications, including fuel additives, polymers, and chemical intermediates, with customized solutions for manufacturers.

- Global Bioenergies – Develops bio-based isobutene through fermentation of renewable feedstocks, producing sustainable fuels, chemicals, and synthetic rubber precursors.

- Praxair – Supplies industrial gases and purification technologies for isobutene processing, enabling high-purity production and efficient chemical manufacturing.

- SynGip BV – Offers isobutene production and recovery solutions, specializing in petrochemical and bio-based routes for industrial and specialty chemical applications.

Recent Developments

- In April 2023, Global Bioenergies (Evry, France) launched its Isonaturane 16, 2nd cosmetic ingredient. It is a natural version of isododecane, a twelve-carbon molecule attained by assembling 3 naturally sourced isobutene.

- In March 2021, BASF SE announced it has successfully collaborated with OMV AG have to start-up of isobutene plant using novel direct-production technology for high-purity isobutene at the Burghausen site.

- In January 2021, Global Bioenergies, French biotech company, announced that they have launched their 1st batch of cosmetic-grade renewable plant-based isododecane.

Segments Covered in the Report

By Product

- Methyl tert-butyl ether (MTBE)

- Ethyl tert-butyl ether (ETBE)

By Application

- Automotive

- Aerospace

- Antioxidants

- Pharmaceuticals

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting