What is the Life Science Tools Market Size?

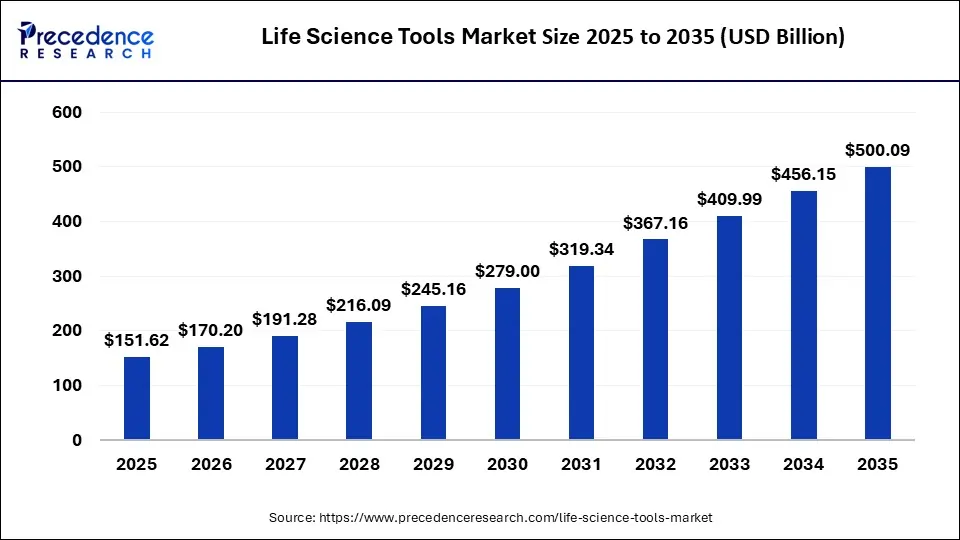

The global life science tools market size is valued at USD 151.62 billion in 2025 and is predicted to increase from USD 170.20 billion in 2026 to approximately USD 500.09 billion by 2035, expanding at a CAGR of 12.68% from 2026 to 2035. The increasing adoption of inorganic growth strategies such as acquisition by the key players in the market is expected to drive market growth over the forecast period.

Life Science Tools Market Key Takeaways

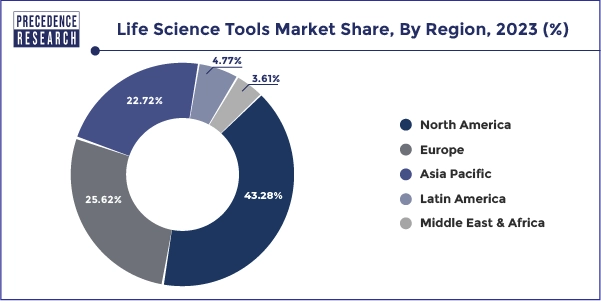

- North America is estimated to account for of the share 43.28% in 2025.

- Europe is estimated to account for the share of 25.62% in 2025.

- The Asia Pacific region is growing at the highest CAGR 15% over the projected period.

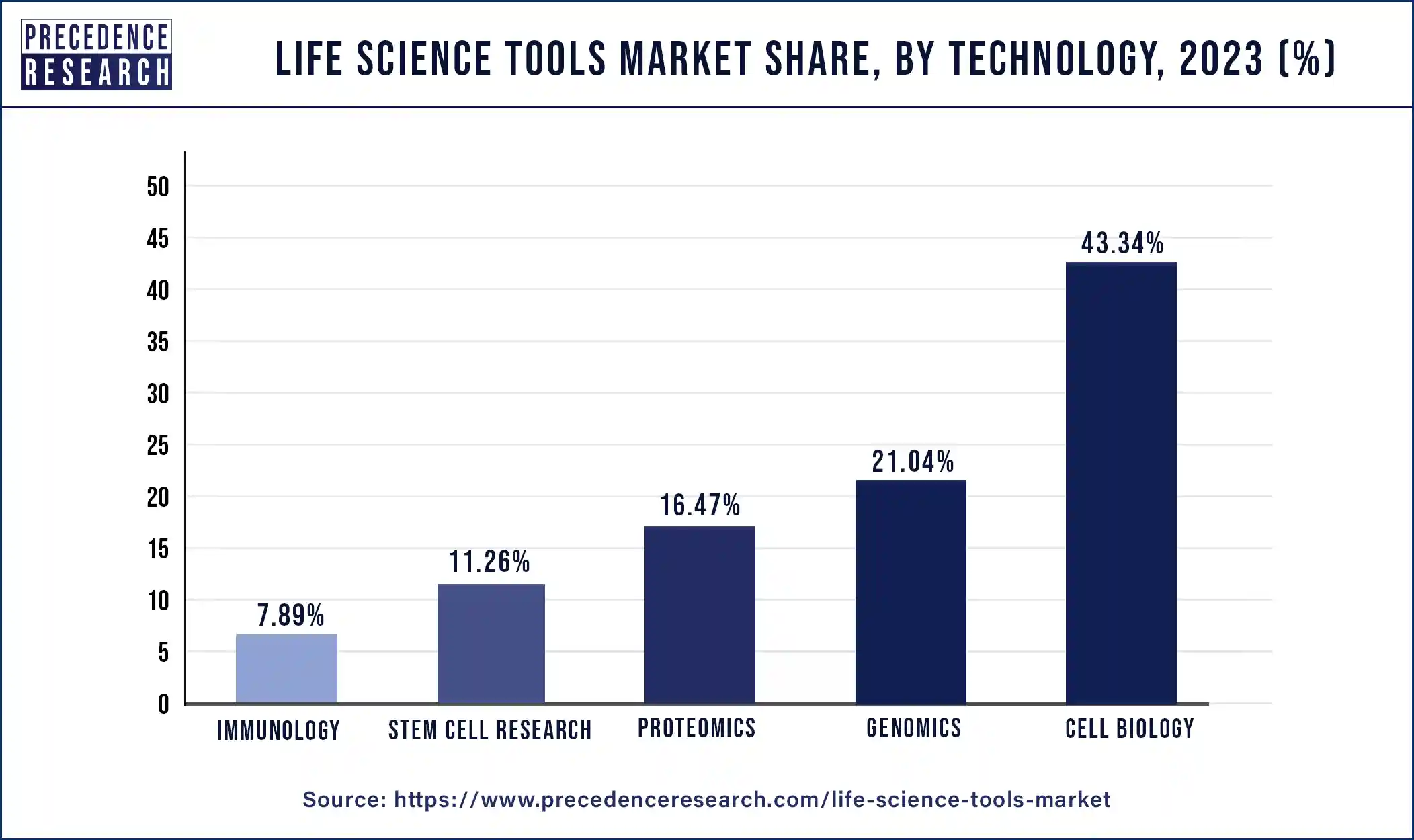

- By technology, in 2025, cell biology technology has captured a revenue share of 43.34%.

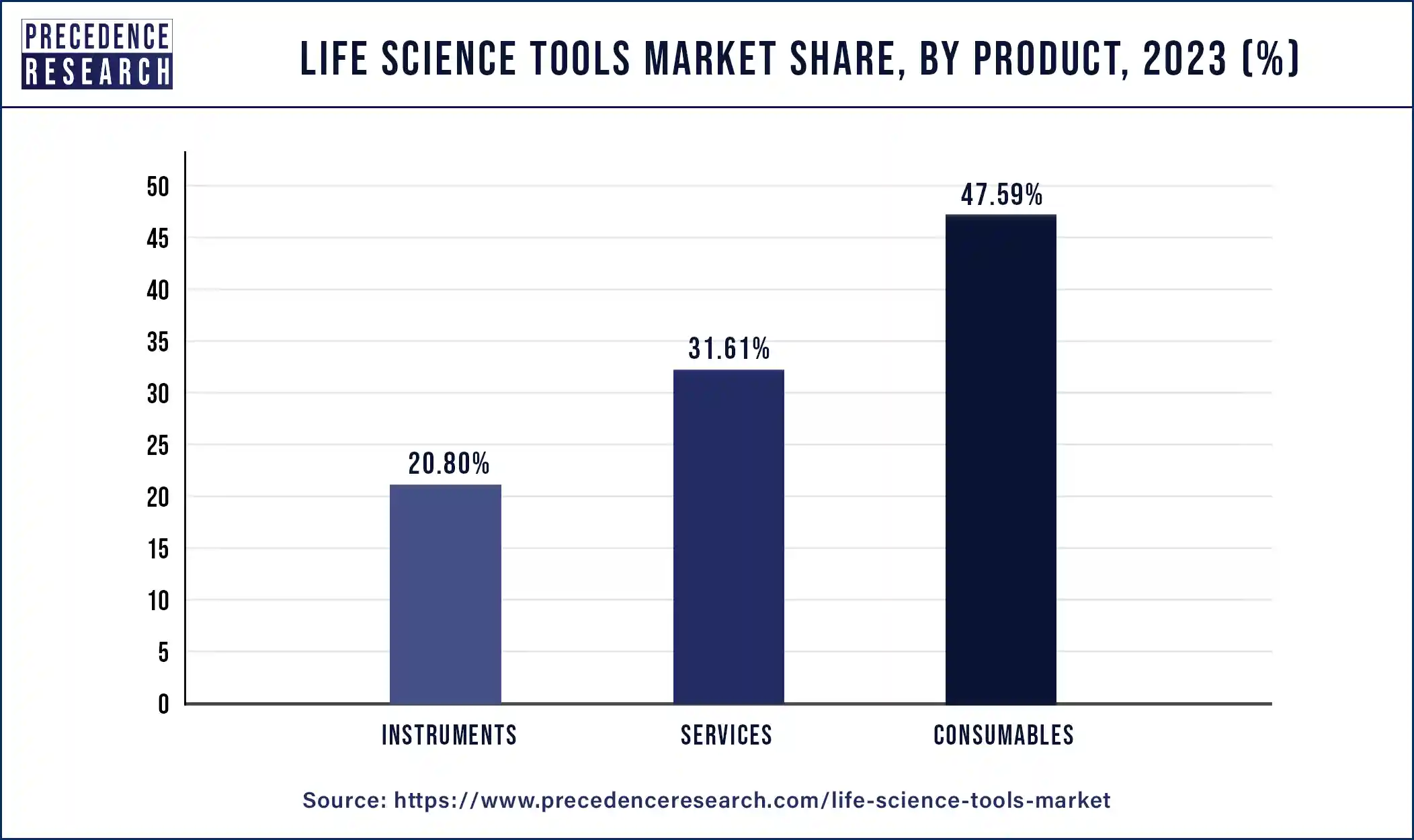

- By product, in 2025, consumable segment have captured a revenue share of 47.59%.

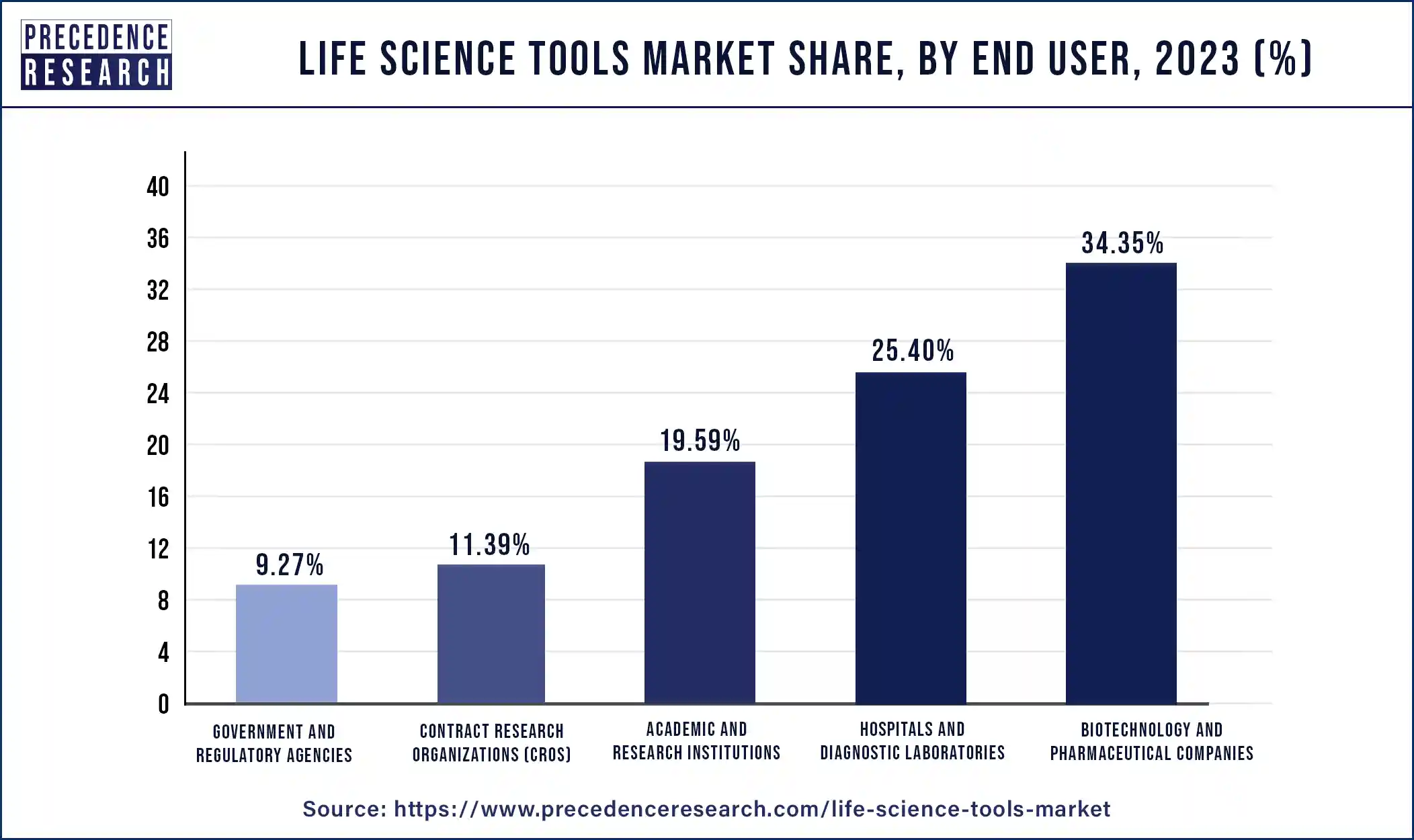

- By end-use, the biotechnology and pharmaceutical companies segment has generated a revenue share of around 34.35% in 2025.

- By application, the drug discovery and development segment has generated the highest revenue share of 31.69% in 2025.

What are life science tools?

The life science tools market is generally driven by the increasing demand for advanced tools from the healthcare sector coupled with technological advancements in the medical devices. The life science tools are the equipment, software, and consumables used in fields such as biology, medicine, and chemistry to conduct experiments, analyze data, and develop new technologies.

Life science tools market outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the growing demand for advanced medicinal instruments coupled with technological advancements in stem cell therapies.

- Major Investors: Several market players and strategic investors are actively entering this market, drawn by partnerships, R&D and product launches. Numerous life science tool brands such as Hoffmann-La Roche Ltd., Bio-Rad Laboratories, Inc., Bruker Corporation, Danaher Corporation and some others have started investing rapidly for developing high-quality life science tools to cater the needs of the healthcare sector.

- Startup Ecosystem:Various startup brands are engaged in developing high-quality life science tools. The crucial startup companies dealing in life science tools consists of LegWorks, ComeBack Mobility, Proov, Senzo and some others.

Life Science Tools Market Growth Factors

Rapid technological advancements adopted by the companies operating in the life science tools market in the field of sequencing technologies, mass spectrometry, NMR, chromatography methods, and other products significantly drives the market growth. Further, market players invest significantly towards research & development related to life science tools and services along with increase in the developments and number of strategic deals predicted to fuel the market growth prominently.

The field of life sciences and biopharma witnessed large number of acquisitions in the year 2018 that paved a way for flourishing industry growth in 2019 and in the coming years. Initially, only few industry participants were having infrastructure to deal with the entire value chain of biological production. This has dramatically changed in the recent past, presently there are several firms operating in the market and are involved in the development of biologics. The aforementioned factor significantly drives the market growth.

Advancing Laboratory Innovation: Life Science Tools in Action

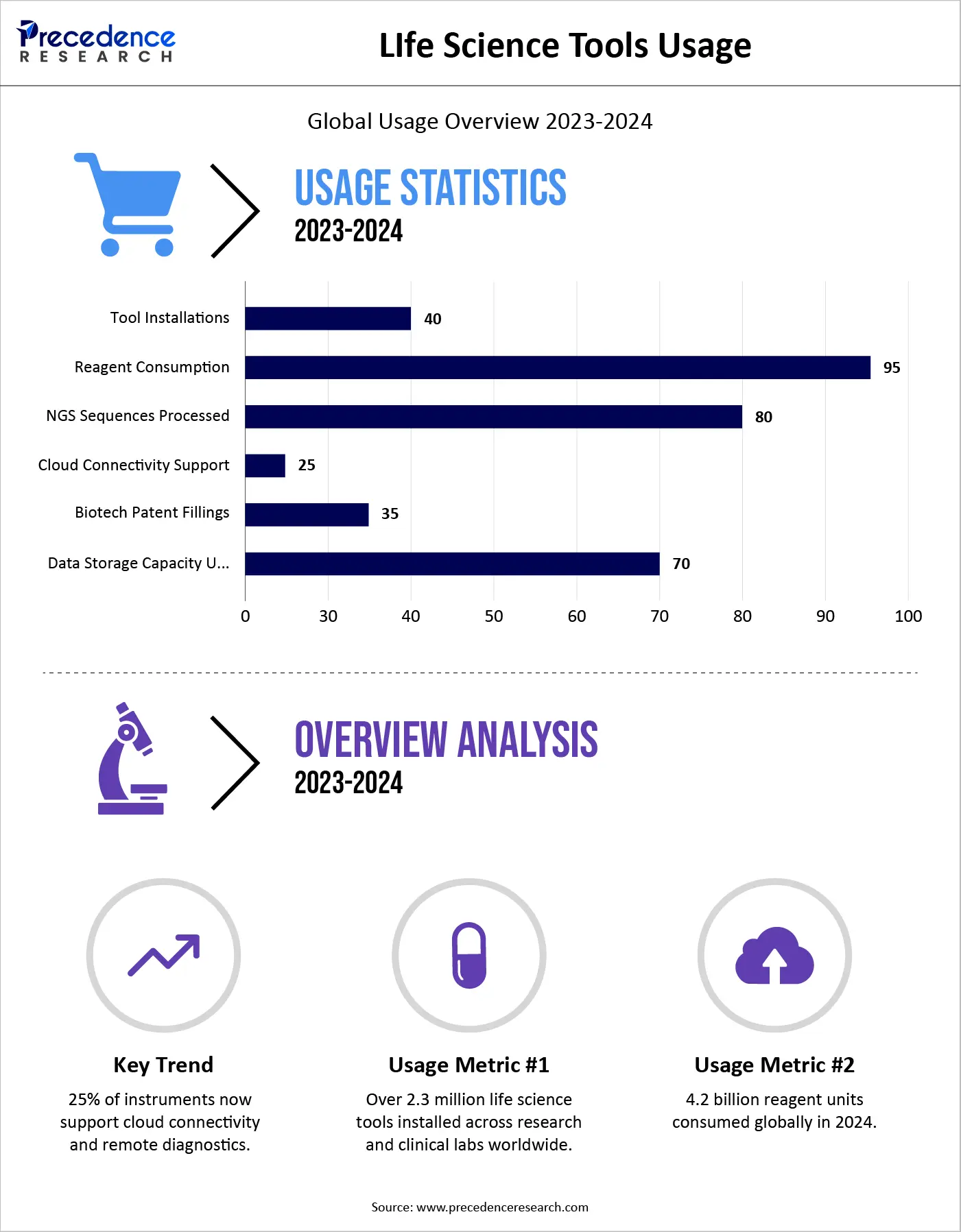

The life science tools industry is experiencing rapid operational expansion, driven by rising research intensity and laboratory modernization. More than 2.3 million life science instruments are currently installed across research and clinical laboratories worldwide, reflecting strong global infrastructure growth. In 2024 alone, approximately 4.2 billion reagent units were consumed, underscoring the recurring demand that sustains laboratory workflows. Technological progress is equally evident, with over 3,600 new lab instruments launched in 2023, a 41% increase over the previous year. Automation adoption has reached nearly 60% of research labs, while 25% of instruments now offer cloud connectivity. These trends highlight the market's significance in accelerating scientific discovery, diagnostics, and biopharmaceutical innovation globally.

MarketScope

| Report Highlights | Details |

| Market Size in 2025 | USD 151.62 Billion |

| Market Size in 2026 | USD 170.20 Billion |

| Market Size by 2035 | USD 500.09 Billion |

| Growth Rate From 2026 To 2036 | CAGR of 12.68% |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Product, Application, End User, Region |

| Companies Mentioned | Agilent Technologies, Becton, Dickinson and Company, F. Hoffmann-La Roche Ltd., Bio-Rad Laboratories, Inc., Bruker Corporation, Danaher Corporation, GE Healthcare, Hitachi, Ltd., Illumina, Inc., Merck KGaA, Oxford Instruments plc, Qiagen N.V. |

MarketDynamics

Market Drivers

Increasing Demand for Biopharmaceuticals:

Rising demand for biologics frequently utilizing recombinant DNA technology is projected to drive the market expansion of life science tools. In order to increase the production of biological treatments and keep up with the rising demand, the life science industry is currently concentrating on cutting-edge innovations like predictive analytics. With the help of significant improvements in technology, laboratories, strategy, and operations, these goods, which make up about 20% of the global pharmaceutical market, may end up serving as the foundation of the pharmaceutical industry during the course of the projection period. Demand has grown as a result of biopharmaceutical products' greater safety, effectiveness, and capacity to cure medical illnesses that were previously incurable.

Market Opportunities

Advancements in Technology:

The adoption rate of tools, including next sequencers, PCR and qPCR, flow cytometers, spectrometers, microscopes, chromatography columns, nucleic acid processing equipment, and cell biology instruments, is increasing in technological developments. The introduction of DNA assay in clinical settings has been impacted by improvements in molecular diagnostic methods such as digital droplet PCR, Next-Generation Sequencing (NGS), and genome-wide sequencing concerning accuracy, timescale, and reproducibility. The optimal use of circulating nucleic acids in therapeutic applications depends on an efficient extraction process.

By Product

In terms of cost-effectiveness, unparalleled sequencing speed, high resolution, and accuracy in genomic analysis, next-generation sequencing (NGS) technologies are advancing. Next-generation sequencing technology includes de novo assembly sequencing, whole genome sequencing, transcriptome sequencing, and resequencing at the DNA or RNA level. The market is projected to develop due to factors such as the rise in the use of next-generation sequencing technology in clinical diagnostics and the speed, affordability, and accuracy of this sequencing approach. For instance, next-generation sequencing has several benefits over conventional sequencing techniques, according to an article published by PubMed Central in January 2021. These benefits include faster turnaround times for large sample numbers, lower cost, and improved sensitivity in detecting low-frequency variations. Sample multiplexing also increases throughput.

Owing to its importance in researching tumor heterogeneity, discovering new genes linked to cancer, and identifying changes associated with carcinogenesis, next-generation sequencing is expected to grow dramatically. For instance, the clinical study of cancer with an unknown origin and the assessment of prospective treatments were done using a sequencing-based method by the Genomic Medicine Service of the National Health Service in the United Kingdom.

Technology Insights

Cell biology technology dominated the global life science tools market in 2025 and followed by genomics technology. Traditional genome editing technologies have limited capacity to maintain pace with rapidly growing genome modification era as these technologies require time, are inefficient, and also require in-depth work. The introduction of CRISPR/Cas9 nuclease and ZFN provides precise and easy genome editing. Presently, the genomic industry has witnessed substantial growth in the number of advancements and prominent expansion in the application gene editing tools to treat genetic disease. The aforementioned factor prominently drives the market growth for cell biology in the forthcoming years.

The cell biology technology segment is expanding due to the increased funding by the National Institutes of Health for cell biology and the application of cell biology technology in drug discovery. Also, the use of cell-based assays for drug discovery has increased as a result of advancements in liquid handling and flow cytometry.

Cell biology remains to be impacted by further advancements in AI tools. For instance, the cell morphology atlas maintained by the life science business Deepcell, founded by Stanford University, just reached one billion photos. The atlas was created as part of the company's effort to enhance AI models for cell characterization and isolation in order to uncover patterns that humans are not capable of seeing. Identification of cell types based on morphology will benefit from expanding the volumes of these datasets.

Also, major industrial companies' increasing research practices propel the demand for tools and equipment. For instance, Haihe and EdiGene Laboratory declared a strategic partnership to create platform technologies and stem regenerative cell treatments in January 2022. The cooperation intends to investigate cutting-edge biomarkers to improve stem cell production quality control. Owing to these strategies, the demand for life science tools has proliferated.

Besides this, proteomics application segment projected to register the highest growth over the forecast period. This is attributed to complete illustration provided by the proteome analysis related to structural and functional information of the cell as well as their response mechanisms against drugs and other outside factors. Mass spectrometry is the key technology used during proteomic analysis. Technological advancements in the field of mass spectrometry expected to drive the capabilities of proteomic analysis.

End-use Insights

The healthcare segment occupied maximum market value share in 2025 and expected to witness substantial growth over the forecast period. The segment comprises of clinics, hospitals, community centers, diagnostic laboratories, and physician offices. Rising adoption of proteomic and genomic workflow in hospitals to treat and diagnose various clinical abnormalities analyzed to fuel the market growth. In addition, efforts taken by the clinics and hospitals to expand their research gateway in the field of genomics also projected as the major factor to propel the market growth of life science tools.

Due to hospitals' high usage and consumption rates of tissue diagnostic solutions, the healthcare sector is anticipated to expand. With greater frequency, clinicians are using tissue-based diagnostic testing procedures instead of more conventional testing approaches. This is because tissue diagnostic tests are quicker than more traditional methods.

It is anticipated that genomic sequencing in a hospital or clinical setting would enhance patient care while bringing down medical expenses. As a result, the healthcare sector is expected to grow at the fastest rate going forward.

Also, a number of innovations in tools and equipment have increased the accuracy of very complex procedures in hospitals. The laboratory tools used to conduct the analysis are predominantly responsible for the accuracy of medical diagnostic outcomes, and this primarily has a favorable impact on the market expansion.

However, biopharmaceutical companies expected to grow at a lucrative CAGR during the forecast period. These companies have initiated large number of genome sequencing projects by collaborating with academic medical centers and community health systems. For instance, Grail, Inc. has conducted studies for detecting genomic fingerprints from tumors using blood sample, with an intention to identify cancer at their early stage. Regeneron collaborated with Geisinger Health System, a Pennsylvania-based company to enroll patients in the study. Therefore, increasing interest of biopharmaceutical companies in genomics predicted to trigger the market growth.

Regional Analysis

U.S. Life Science Tools Market Size and Growth 2026 to 2035

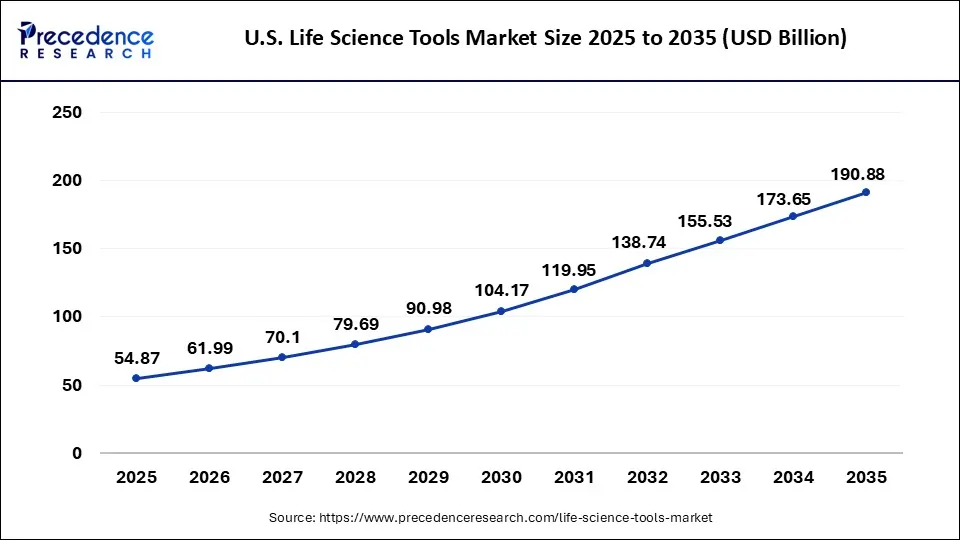

The U.S. life science tools market size is evaluated at USD 54.87 billion in 2025 and is expected to reach USD 190.88 billion by 2035, poised to grow at a CAGR of 13.28% from 2026 to 2035.

In terms of revenue, North America accounted for the maximum revenue share in 2025 due to local presence of major market leaders such as Thermo Fisher Scientific. Reputable informatics network along with well-regulated framework for approval and usage of genomic tests in the region again propel the growth of market. In addition, significant rise in the number of genomic procedures for clinical and academic application in the United States expected to fuel the North America market throughout the forecast period.

The North American region is predicted to dominate the life science tools industry. The biopharmaceutical business in the United States has grown dramatically with the introduction of novel product categories such as immunotherapeutic, nanoantibodies, synthetic vaccines, and others. The market is anticipated to be driven by the pharmaceutical and biopharmaceutical industry' increased R&D investments in life science tools, academics, and research.

For instance, the US biopharmaceutical industry has emerged as the global leader in the discovery of new drugs, according to the Pharmaceutical Research and Manufacturers of America. The total amount of funds spent on research and development by the pharmaceutical and biopharmaceutical industries was anticipated to be USD 91.1 billion in 2021, up from roughly USD 83 billion in 2020.

Furthermore, the use of human tissue in the creation of novel assays is crucial to personalized therapy. Tissue diagnostics are increasingly used due to the expansion of customized medicine brought about by the increased use of healthcare IT systems and sequencing technologies in the clinical workflow. The sector for tailored treatment is growing owing to the United States Precision Medicine Program. Therefore, the aforementioned instances in the North American region are projected to boost global market growth.

Asia Pacific poised to witness the fastest growth during the analysis period. This is attributed to the increasing penetration of leading market players in emerging Asian countries and rising investments for design of advanced diagnostic methods.

Why Europe held a significant share of the industry?

Europe held a significant share of the market. The rising demand for advanced healthcare facilities in numerous countries including Germany, Italy, France, UK and some others has boosted the market growth. Additionally, numerous government initiatives aimed at developing the healthcare infrastructure is expected to drive the growth of the life science tools market in this region.

What made Latin America to hold a considerable share of the market?

Latin America held a considerable share of the industry. The growing demand for high-quality medicinal equipment in several countries such as Brazil, Argentina, Venezuela and some others has driven the market expansion. Also, rapid investment by market players for opening up new manufacturing centers is expected to propel the growth of the life science tools market in this region.

How did Middle East and Africa held a notable share of the industry?

Middle East and Africa held a notable share of the market. The growing cases of surgical procedures in numerous countries such as UAE, Saudi Arabia, Qatar, South Africa and some others has boosted the market expansion. Also, the presence of numerous healthcare companies and medical device manufacturers is expected to boost the growth of the life science tools market in this region.

Value-Chain Analysis

- Raw Material Procurement

The raw materials used in the production of life science tools stainless steel and titanium, polymers such as polypropylene and polyethylene, ceramics and others.

Key Companies: CeramTec GmbH, CoorsTek Inc, Elan Technology and some others. - Production Methodology

The production of healthcare tools is a highly regulated and multi-phase process that moves from initial concept to mass production and post-market monitoring, with rigorous testing and documentation at every stage.

Key Companies: Merck KGaA, Oxford Instruments plc, Qiagen N.V., Shimadzu Corporation and others. - Distribution Channel

The distribution of life science tools involves a multi-tiered and highly specialized network for transporting several products from manufacturers to end-users such as research laboratories, hospitals, and diagnostic centers. The primary channels include direct sales, wholesalers and distributors, and increasingly, online platforms.

Key Companies: Hoffmann-La Roche Ltd., Bio-Rad Laboratories, Inc., Bruker Corporation and others.

Key Companies & Market Share Insights

The global life science tools market is highly competitive due to rapid advancements and on-going technological development in the life sciences tools. In addition, the market players adopt collaboration, merger, partnership, and other inorganic growth strategies to offer wide range of innovative and attractive solutions to their customers. Market leader are significantly investing in genomic research to provide early diagnosis solutions for major diseases such as cancer.

Key Players in Life Science Tools Market & Their Offerings

- Agilent Technologies: Agilent Technologies is a global company focused on life sciences, diagnostics, and applied chemical markets. Its products are used in research, clinical diagnostics, food and environmental testing, and chemical analysis.

- Becton, Dickinson and Company: Becton, Dickinson and Company (BD) is a global medical technology company that develops and manufactures medical devices, instrument systems, and reagents for healthcare, life sciences, diagnostics and some others.

- F. Hoffmann-La Roche Ltd.: F. Hoffmann-La Roche Ltd., commonly known as Roche, is a Swiss multinational healthcare company that specializes in pharmaceuticals and diagnostics. It is one of the world's largest biotech companies, a leading provider of cancer treatments and in-vitro diagnostics.

- Bio-Rad Laboratories, Inc.:Bio-Rad Laboratories, Inc. is a global company that develops, manufactures, and markets products for the life science research and clinical diagnostics markets. This company is investing heavily to advance scientific discovery, drug development, and disease diagnostics.

- Bruker Corporation:Bruker Corporation is a global company based in Billerica, Massachusetts, that manufactures high-performance scientific instruments and diagnostic solutions for research, industrial, and applied markets. It enables scientists to explore life and materials at microscopic, molecular, and cellular levels through its advanced technologies.

- Danaher Corporation:Danaher Corporation is a global science and technology company headquartered in Washington, D.C., that creates products for the life sciences, diagnostics, and biotechnology sectors. This company provides a wide range of products and services, such as diagnostic instruments, life science research tools, and bioprocessing equipment, serving customers in healthcare, research institutions, and other industries worldwide.

Other Companies

- GE Healthcare

- Hitachi, Ltd.

- Illumina, Inc.

- Merck KGaA

- Oxford Instruments plc

- Qiagen N.V.

- Shimadzu Corporation

- Thermo Fisher Scientific, Inc.

- ZEISS International

Recent Developments

- In October 2025, Medtronic launched a new range of electrosurgical devices in India. This new range of devices are integrated with TissueFect sensing technology.

(Source: health.economictimes.indiatimes.com) - In September 2025,OpZira launched ophthalmic device portfolio. These devices are designed for enhancing the capabilities of ophthalmologists.

(Source: businesswire.com) - In September 2025, Syensqo launched Amodel PPA for medical devices. Amodel PPA delivers high heat resistance, electrically insulative properties, biocompatibility and some others for advanced single-use medical instruments and assemblies

(Source: indianpharmapost.com)

Segments Covered in the Report

By Technology

- Genomics

- Cell Biology

- Proteomics

- Stem Cell Research

- Immunology

By Product

- Consumables

- Instruments

- Services

By Application

- Drug Discovery and Development

- Clinical Diagnostics

- Genomic and Proteomic Research

- Cell Biology Research

- Others

By End-User

- Academic and Research Institutions

- Biotechnology and Pharmaceutical Companies

- Hospitals and Diagnostic Laboratories

- Contract Research Organizations (CROs)

- Government and Regulatory Agencies

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting