What is the Life Science Reagents Market Size?

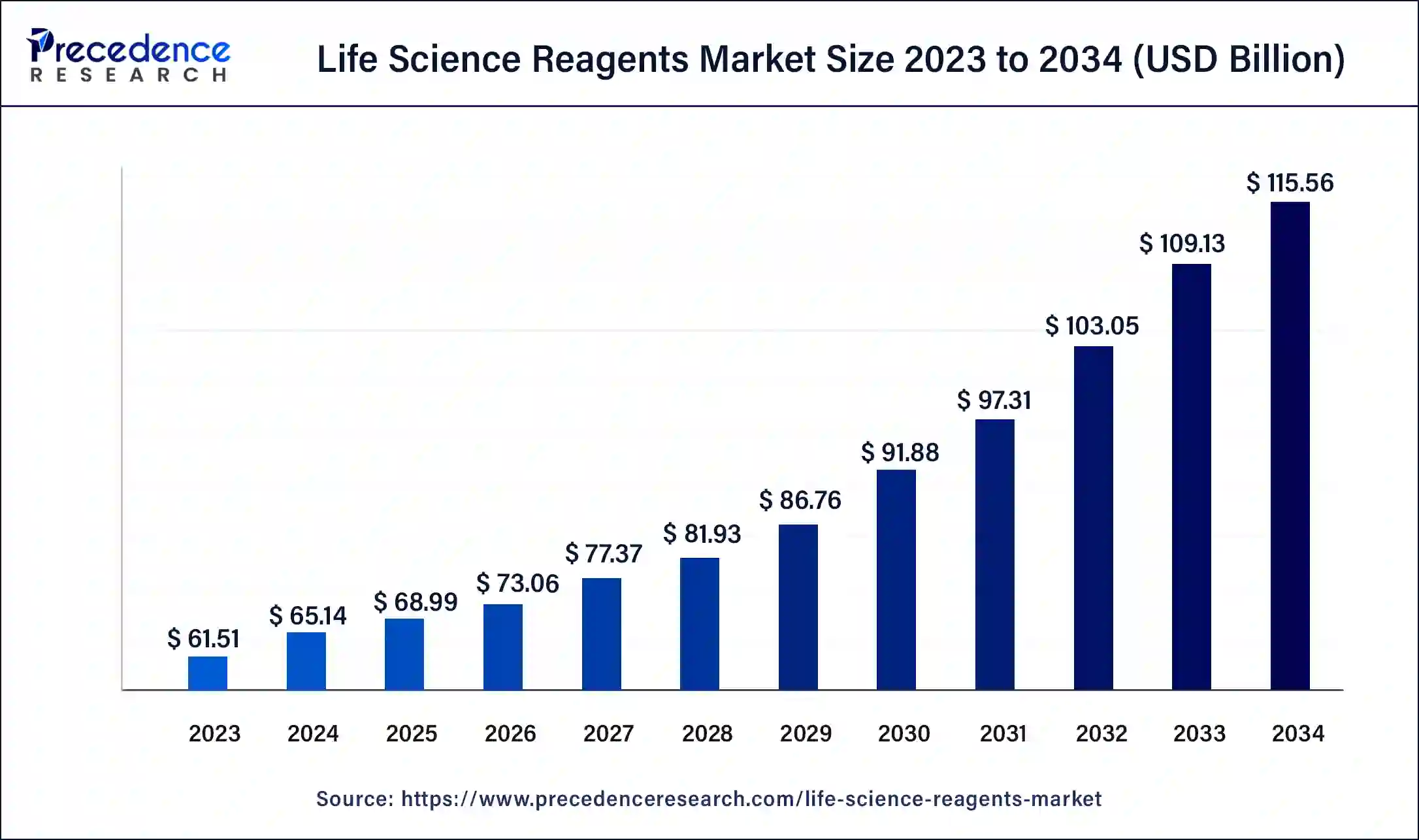

The global life science reagents market size accounted for USD 68.99 billion in 2025 and is predicted to increase from USD 73.06 billion in 2026 to approximately USD 121.76 billion by 2035, at a CAGR of 5.85% from 2026 to 2035. The North America life science reagents market size reached USD 21.53 billion in 2025.

Life Science Reagents Market Key Takeaways

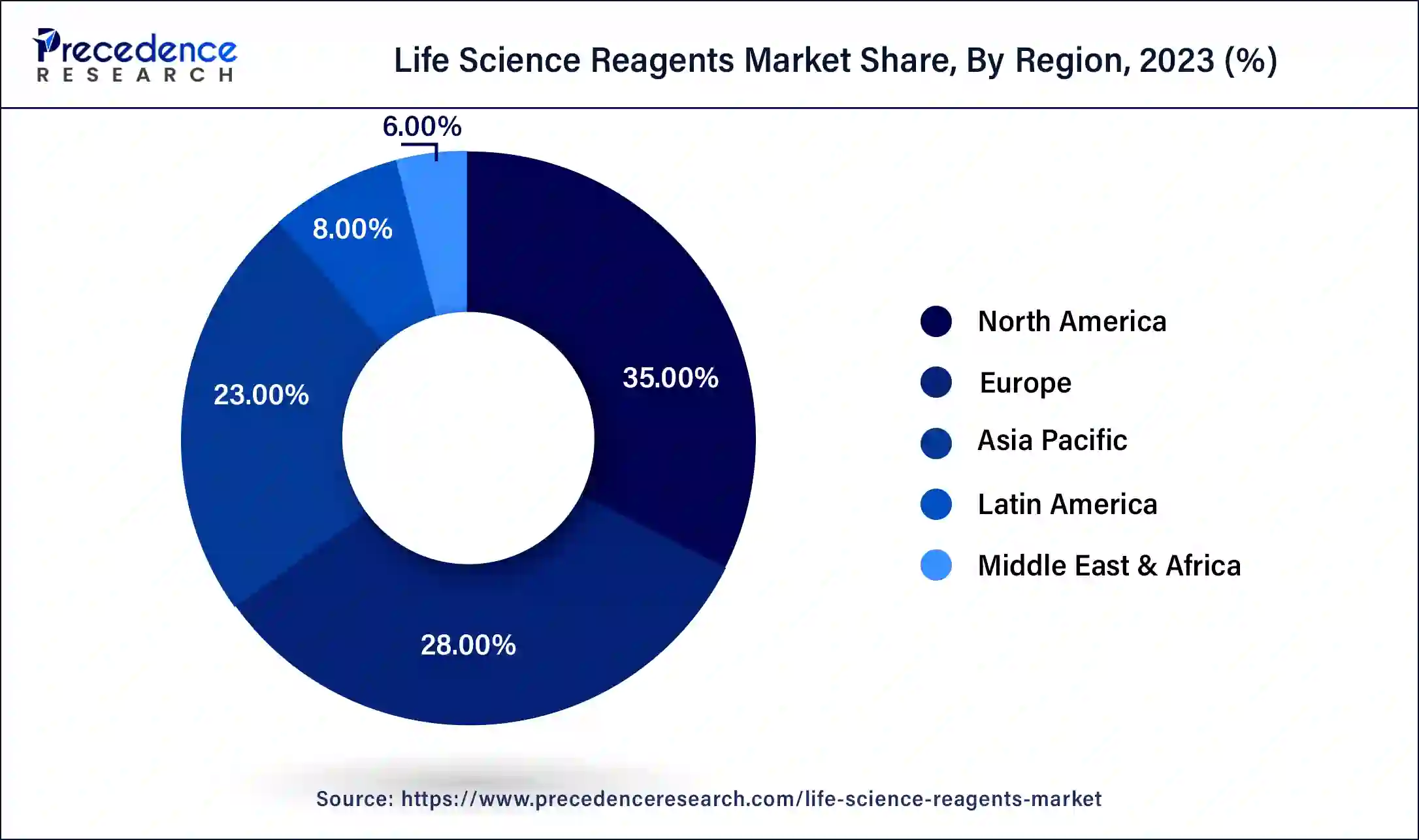

- North America led the global market with the highest market share of 35% in 2025.

- By product, the immunoassay segment has held the largest market share in 2025.

- By application, the hospitals & diagnostic labs segment captured the biggest revenue share in 2025.

Growth Factors

The global life science reagents market is primarily driven by various factors such as rising prevalence of infectious diseases, rising investments in the research & development by the biotechnology company, rapidly growing biotechnology industry, technological upgradations in the life science filed, and rapidly growing biopharmaceutical industry across the globe. Micro-organisms such as bacteria, virus, and parasites may result in the infectious diseases. This type of diseases can be easily transmitted to others. The rising prevalence of various infectious diseases such as Hepatitis A virus, HIV, Zika, and Dengue has resulted in the increased demand for the life science reagents. According to the Journal of Infectious Diseases and Therapy 2019, around 1.5 million clinical cases of Hepatitis A Virus is reported across the globe each year. Zika Virus was declared an endemic in Africa. According to the World Health Organization, more than 31,000 confirmed cases of Zika Virus had been reported in Americas in 2018. Further, dengue is the most critical mosquito-borne disease, which is spreading rapidly across the globe. As per the WHO, the cases of dengue fever increased rapidly from 505,430 cases in 2000 to 4.2 million in 2019, all over the globe. Therefore, the rapidly rising prevalence of various infectious diseases among the global population is the most important driver of the life science reagents market.

The outbreak of the COVID-19 pandemic had a positive effect on the market and it spiked the demand for the life science reagents across the globe. The demand for the life science among the diagnostic centers and hospital rapidly surged for the growing need for testing the patients. Furthermore, all the research organizations became active and demanded the life science reagents to conduct their study on the new COVID-19 virus that became a pandemic all over the globe. Thus, the COVID-19 positively impacted the market growth in 2020.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 68.99 Billion |

| Market Size in 2026 | USD 73.06 Billion |

| Market Size by 2035 | USD 121.76 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.85% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Segment Insights

Product Insights

Based on product, the immunoassay segment accounted largest revenue share in 2023 and is projected to sustain its dominance during the forecast period. This can be attributed to the increased demand for the immunoassay reagents among the diagnostic labs and the hospitals. Moreover, the biotechnology and the pharmaceutical industries are the major consumers of the immunoassay reagents owing to the increased research activities like new drug development and novel test assay development.

On the other hand, the in-vitro diagnostic is estimated to be the most opportunistic segment. The shift in the paradigm from traditional to advanced diagnostics, which analyzes the gene due to the inclusion of various technologies like gene testing, next generation sequencing, and molecular diagnostic is fostering the segment growth. Moreover, the rising prevalence of various chronic diseases like coronary heart disease among the population is expected to drive the demand for the in-vitro diagnostics. According to the World Heart Federation, around 3.4 million women and 3.8 million men dies each year due to the coronary heart diseases.

Application Insights

Based on application, the hospitals & diagnostic labs segment dominated the global market in 2023, in terms of revenue. In 2023, the demand for the life science reagents suddenly spiked due to the rapid spread of the COVID-19 virus. Diagnostic labs and hospitals were increasingly using the life science reagents to test their patients. Moreover, the life science reagents in the molecular diagnostics are extensively used for extracting nucleic acid, human leukocyte antigens typing, and detection of mutations. Further, the growing prevalence of various chronic diseases among the global population is boosting the consumption of life science reagents for the diagnostic purposes, which boosts the growth of this segment significantly.

On the other hand, the contract research organizations are expected to be the fastest-growing segment during the forecast period. This is attributed to the increased investment by various biotechnology and pharmaceutical companies in the research activities. The rising penetration of various contract research organizations in the developed and developing nations and their activities related to new drug development and new diagnostic tests is expected to foster the demand for the life science reagents across the globe.

Regional Insights

What is the U.S. Life Science Reagents Market Size?

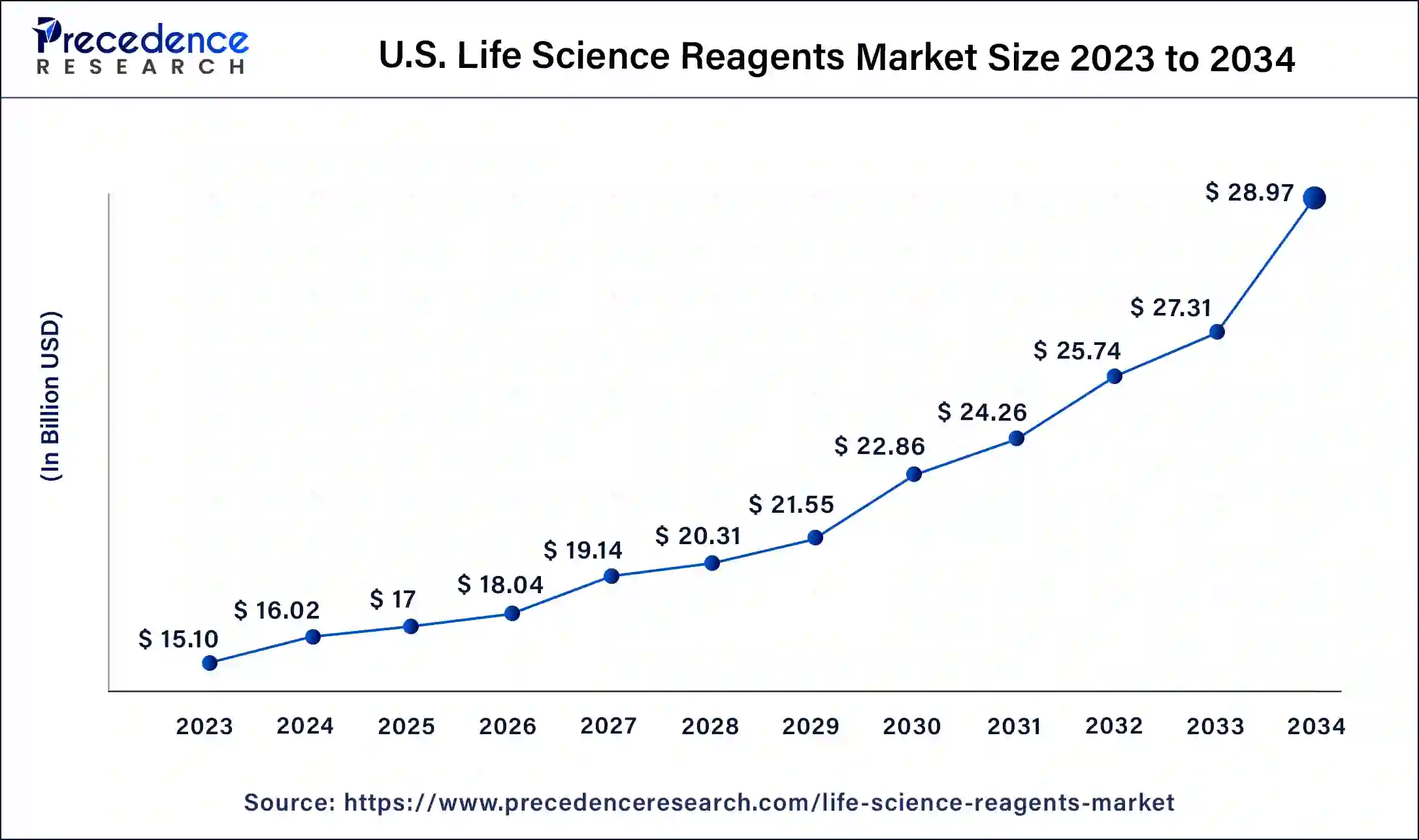

The U.S. life science reagents market size was estimated at USD 17 billion in 2025 and is predicted to be worth around USD 30.57 billion by 2035, at a CAGR of 6.04% from 2026 to 2035.

Based on region, North America accounted for the largest revenue share in 2023. North America is witnessing a rapid growth of the biopharmaceutical industry and rising penetration and growth of contract research organizations, which is a major cause of the increased consumption of the life science reagents. Furthermore, rising government support to develop the biopharmaceutical industry is a major factor that is expected boost the demand for the life science reagents. The rising prevalence of chronic diseases and increased demand for the latest diagnostics and medicines in US has huge contributions in the growth of the North America market.

U.S.

The U.S. dominates North America's due to the federal government's extensive support for research and funding for the life sciences sector, including the activities and development of leading life sciences companies. In addition reagents are used in drug discovery and diagnostics; as a result, the consumption of reagents is increasing and will continue to be a trend for many years to come. Due to the continuing collaboration between functional and industry-based research institutions to create new types of reagents, particularly those developed for high-throughput research and precision research applications.

On the other hand, Asia Pacific is estimated to be the most opportunistic market during the forecast period. Asia Pacific is characterized by the presence of numerous bigCROs and CMOs. The rapidly growing biotechnology companies and growing number of diagnostic laboratories in the region is expected to boost the consumption of the life science reagents. The rising government initiatives to attract FDIs is propelling the pharmaceutical companies to expand their production facilities in the region, which will drive the life science reagents market during the forecast period.

China

China has emerged as a leader in Asia Pacific for biotech research, with a vibrant private and public sector, and increasing regional capabilities for local manufacture of reagents. Increasing academic research, the growth of the CRO business, and the expansion of biopharmaceutical development represent a significant factor in the rapid increase in demand for reagents and the market size in China.

What Makes Europe Notably growing Region in Life Science Reagents Market?

Europe notably growing region in life science reagents market because of the heavily funded research institutions; strong regulatory environments; and extensive bio phosphate work activity. Western Europe's mature health care system and innovative collaborative networks are also key reasons supporting Europe's continued demand for a full range of life sciences reagents.

Germany:

An important part of Europe's life-sciences reagent marketplace and supporting Europe's rapid growth is Germany. Germany has the largest biotechnology industry base in Europe, along with one of the most developed biotechnology research infrastructures. Germany continues to lead the European life-sciences reagent marketplace due to its extensive investment in research and development, ongoing investment in molecular biology-related research and initiatives to develop precision medicine

Is Latin America Emerging Gradually?

The life science reagent marketplace in Latin America is showing continual, moderate growth based primarily on increased investment into clinical research, advancing healthcare infrastructure, together with, increased research focus on infectious disease; cancer therapeutics; and acceptance of biotechnology, is creating increased demand for reagents. However, slower rate of increase in funding and differences in regulatory environment are restraining the growth of the life sciences reagent market in Latin America compared to the other advanced regions.

Brazil

Brazil also has one of the most rapidly growing biotech sectors, along with an increasing number of public and private sector research programs. Academic collaborations to produce new biologic drugs or diagnostic products will likely drive the increasing use of reagents within molecular biology and diagnostic applications. With continued improvement to research capabilities, Brazil will likely become a very important marketplace for reagents within the overall slowly growing life sciences marketplace in the region.

Life Science Reagents MarketCompanies

- Hoffmann-La Roche

- Thermo Fisher Scientific Inc.

- Becton

- Dickinson and Company

- Abbott

- BioMerieux SA

- Merck KGaA

- Danaher Corporation

- Siemens Healthineers

- DiaSorinSpA

- Sysmex Corporation

Key Companies Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

In May 2020, Meridian Bioscience, Inc. one of the leading life science reagents raw material provider and diagnostic test solutions, acquired the FDA approval of SARS-CoV-2 antigens.

The various developmental strategies like acquisition, partnerships, mergers, and government policies fosters market growth and offers lucrative growth opportunities to the market players.

Recent Developments

- In September 2025, Beckman Coulter Life Sciences introduces the industry's first IR820 and IR870 infrared dye antibody conjugates for flow cytometry, offering minimal spectral overlap and enhanced human phenotyping in high-parameter research.(Source: https://www.news-medical.net )

- In January 2026 – PacBio plans collaboration with the n-Lorem Foundation and EspeRare to use long-read whole-genome sequencing for advancing precision antisense oligonucleotide therapies for rare genetic diseases.(Source: https://www.pacb.com )

- In May 2025, HP and Tecan expand their partnership to launch the Duo Digital Dispenser, combining single-cell and reagent dispensing to speed research workflows and boost lab efficiency.(Source: https://www.hp.com )

Segments Covered in the Report

By Product

- Molecular

- Cell Culture

- Chromatography

- Immunoassay

- Clinical Chemistry

- Microbiology

- Flow Cytometry

- Others

By Application

- Hospitals & Diagnostic Labs

- Academic Research & Institutes

- Contract Research Organizations

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Rest of the World

Get a Sample

Get a Sample

Table Of Content

Table Of Content