What is Life Science Imaging Market Size?

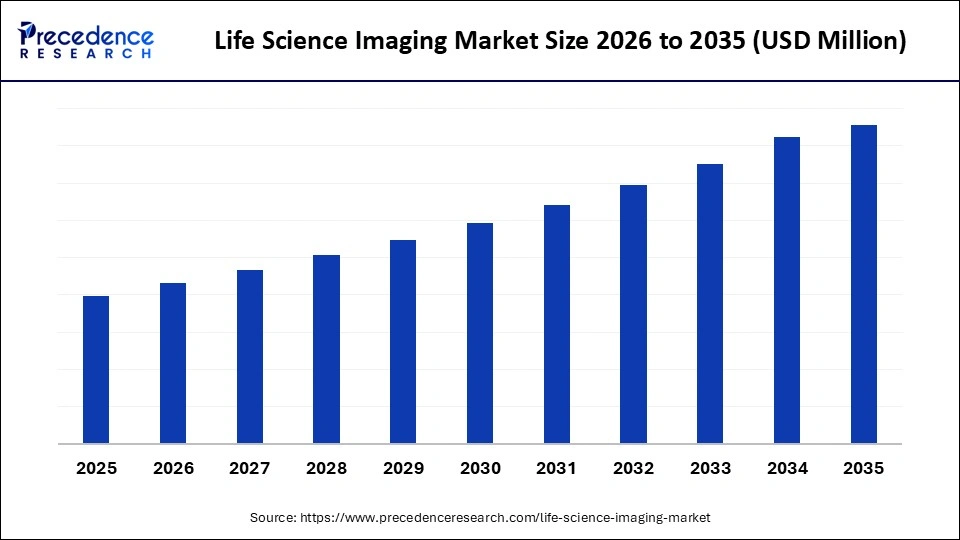

The global life science imaging market is a rapidly growing sector driven by advanced imaging technologies, rising R&D in biotech and pharmaceuticals, and the increasing need for high-resolution biological imaging solutions. Rising cyber threats and the shift toward passwordless and multi-factor authentication across enterprises drive market growth.

Market Highlights

- North America led the life science imaging market with approximately 34% share in the global market in 2025.

- Asia Pacific is expected to expand the fastest CAGR between 2026 and 2035.

- By product type, the whole slide imaging (WSI) systems segment captured around 32% of market share in 2025.

- By product type, the image analysis software segment is expected to grow at the fastest CAGR between 2026 and 2035.

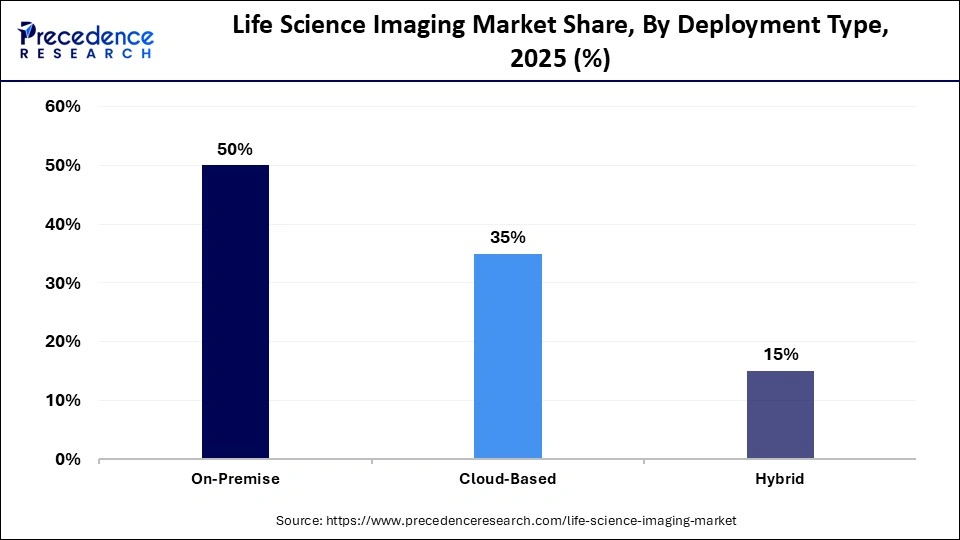

- By deployment type, the on-premise segment held approximate 50% of the market share in 2025.

- By deployment type, the cloud-based segment is expanding at a strong CAGR between 2026 and 2035

- By application, the cancer diagnostics & oncology research segment contributed more than 40% of market share in 2025.

- By application, the research & drug discovery segment is poised to grow at a healthy CAGR between 2026 and 2035.

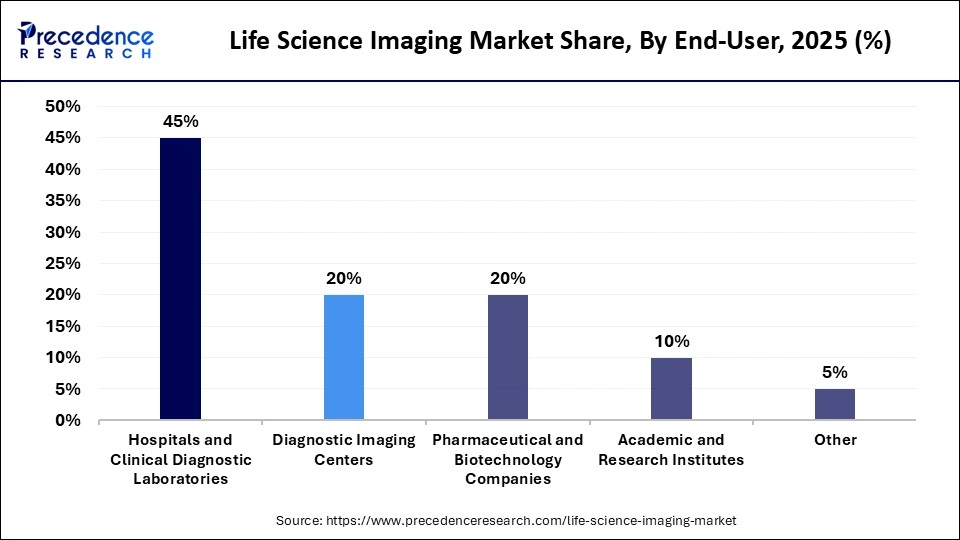

- By end-user, the hospitals & clinical diagnostic laboratories segment held the biggest market share of 45% in 2025.

- By end-user, the pharmaceutical & biotechnology companies segment is expected to expand at the highest between 2026 and 2035.

Life Science Imaging Market Overview

Life science imaging is the use of advanced optical, digital, and molecular imaging technology to provide real-time views of biological structure, cellular activity and molecular interactions. These technologies enable researchers, physicians, and pharmaceutical companies to develop treatments for diseases.

The life science imaging market is expanding enormously as the laboratory market moves toward high-resolution tools such as super-resolution microscopy, Artificial Intelligence-enhanced image analysis, and multimodal imaging platforms. Drivers of growth include increased funding for gene andcell therapy research, the growing need to automate imaging, and the increasing use of digital pathology across hospitals and research facilities. Faster innovation occurs through integrated hardware and software systems that provide faster data processing and improved throughput. The growth of the market is heavily influenced by the expansion of genomics and genetic testing, the emergence of the personalized medicine market, and the increased collaboration between academia and industry.

The Life Science Imaging Market Has Seen the Following Emerging Trends:

- AI Image Analysis: By utilising AI, researchers can now leverage toolsets that enable the automated interpretation of complex cellular imaging and substantially increase the precision of detection capabilities, while minimising the occurrence of manual errors and accelerating research workflows. AI will be used most effectively in high-throughput and pathology settings.

- 3D High-Resolution Imaging: 3D imaging will also take advantage of technological advances to enable researchers to obtain deeper tissue views and obtain more elaborate structural detail for more accurate modelling of disease processes; this enables researchers to study the interactions of cells and the effects of therapies and other biological processes that are more complex than one-dimensional modelling techniques allow.

- Cloud-Based Imaging Platforms: The integration of imaging on the cloud facilitates the opportunity to rapidly store large amounts of data and access data from any location in the world; these cloud-based platforms also enable the opportunity to rapidly process images, seamlessly integrate multiple imaging systems into a single workflow, and enhance the reproducibility of data among various research groups.

- Automated Slide Scanning: Automated whole slide scanners enable laboratories to digitise and process large volumes of sample images more quickly; this provides laboratories with the ability to provide their labs more consistently, and to accelerate their ability to leverage AI for the analysis of digitised pathology images.

Artificial Intelligence Developments in Life Sciences Imaging: Significant Progress Made Recently

There has been enormous progress in the implementation of Artificial Intelligence (AI) technology in the life science imaging market, with increased ability to make accurate and timely diagnoses and to support richer biomedical research. A major milestone happened in June 2025, when PathAI got the go-ahead from the U.S. Food and Drug Administration (FDA) to use its AISight Dx platform as an aid in primary diagnosis. This shows that there is now a pathway to use the power of AI in digital pathology in real-world settings.

Alongside these MedGemma announcements, in July 2025 Google Research also announced MedGemma: an open-source multi-modal AI platform for health. MedGemma enables medical imaging analysis (such as radiology, pathology, and dermatology) and automates report generation and triage workflows. MedGemma represents a flexible foundation for future imaging-based medical tool development. Therefore, these announcements represent an important step toward transitioning AI from the laboratory into hospitals and diagnostic laboratories to seamlessly integrate these technologies into existing and new, scalable and efficient, imaging workflows. This imaging has resulted in improved diagnostic speed, improved communication between laboratories and hospitals, and improved capabilities for conducting biomedical research.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Deployment Type, Application, End-User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Life Science Imaging MarketSegment Insights

Product Type Insights

Whole-slide imaging (WSI) systems lead the whole-slide life science imaging market with a 32% share, due to their high-speed, accurate digitalization of entire tissue slides. WSI platforms drive broad clinical adoption, and fluorescent WSI systems enhance diagnostic quality by providing the tools needed for complex molecular testing. The integration of WSI platforms into pathology workflows, along with compatibility with digital platforms, is a key enabler of the accelerated adoption of WSI technology by hospitals and diagnostic laboratories.

Image-analysis software is growing rapidly because AI and machine learning are used for pattern recognition and quantitative image analysis in every phase of clinical applications. Automation of tumor grading, biomarker quantification, and anomaly detection enhances clinical decision-making by allowing for rapid and accurate tumor evaluation and treatment recommendations. Increasing patient demand for precision diagnostics and the emergence of automated pathology applications are driving growth in the adoption of image-analysis software in oncology, infectious disease testing, and large-scale research settings.

Deployment Type Insights

On-premises deployment leads the market, with a 50% market share in 2025. While many of these users utilize cloud-based systems, institutions in the healthcare industry primarily use them to value data security and compliance with regulations, as well as to provide data control and storage at a physical location. Hospitals and laboratories processing sensitive clinical information (such as electronic medical records (EMRs)) typically use on-premises systems to ensure they always have access to imaging and diagnostic data.

The fastest-growing segment of imaging software is cloud deployments, which enable scalability and remote access. Companies utilizing cloud-based platforms can access collaborative diagnostic support, Artificial Intelligence (AI) capabilities to assist with analysis of diagnostic images, and the sharing of real-time diagnostic information across multisite research teams. As a result of their flexibility, automatic updates, and the ability to manage the continued growth in imaging data volume, cloud-based imaging products are increasingly becoming a favourite option for newly established imaging research organizations, diagnostic laboratories, and startups taking advantage of new digital pathology methods.

Application Insights

Cancer diagnostics & oncology research dominate the application segment with 40% market share in 2025, due to imaging's central role in tumour detection, biomarker discovery & characterisation, treatment & planning, and therapy monitoring. Digital pathology and advanced microscopy enable accurate characterisation of cancer, while whole-slide imaging (WSI) and molecular imaging provide very high magnification, enabling greater resolution. As cancer rates continue to increase and interest in personalised oncology rises, so do the number of patients being treated at hospitals, cancer centres, and pharmaceutical clinical research sites.

Rapid growth in research and drug discovery is another driving force behind the increasing funding for life science imaging, as it forms the basis for mechanism-of-action studies, target validation, pre-clinical evaluation, etc. The availability of high-content imaging, live-cell imaging, and AI quantification has sped up workflows for early-stage research; the increased use of imaging platforms has enabled pharmaceutical and biotech companies to improve screening efficiency, increase research accuracy, and reduce the time to market for new compounds.

End User Insights

Hospitals and Clinical Laboratories held up 45% of the total market share of life science imaging market 2025, due to the high volume of diagnostic testing performed on patients through diagnostic imaging, pathology workflows, and clinical imaging, utilizing digital microscopy, whole slide imaging (WSI), and automated image analysis tools, hospitals and clinical laboratories increase accuracy by providing faster turnaround times on diagnostic imaging. As the volume of oncology and infectious disease diagnostic testing increases, more hospitals and clinical laboratories will need to rely on advanced imaging systems integrated into clinical decision support pathways.

Pharmaceutical and biotech companies are rapidly adopting imaging solutions to support their expanding research and development activities and the growing need for high-resolution imaging tools utilized in cell biology, genomics, and preclinical testing. Imaging-based drug discovery processes have benefited from recent advances enabled by artificial intelligence-enhanced image analysis, multiplexed imaging techniques, and digital image analysis platforms, thereby improving the efficiency of pharmaceutical companies developing new drugs. Increased investment in regulatory approvals for biologics, immunotherapy products, and precision medicine technologies will drive demand for enhanced R&D capabilities in the pharmaceutical and biotech industries.

Life Science Imaging MarketRegional Insights

North America is the dominant region in Life Science Imaging, largely due to its sophisticated research ecosystem, high adoption of AI-based imaging tools, and rapid adoption of digital microscopy & multimodal platforms in clinical settings. In addition, many biotech companies, academic labs, and healthcare facilities form extensive partnerships to develop and introduce new technologies, all of which contribute to maintaining North America as a leading region for Precision Imaging & Translational Imaging.

The United States is the key country driving growth in North America, through continual advances in imaging and imaging-related technologies for both clinical and research purposes; paired with robust regulations, substantial resources provided to support Imaging R&D, and active use of next-generation imaging systems (e.g., "Smart Imaging") in hospitals and research labs. The rapidly increasing capabilities of digital pathology, intravascular imaging, and real-time cellular imaging keep the United States at the forefront of imaging-related innovations.

For instance, in July 2025, Boston Scientific released its latest version of its iLab IVUS, which improves the precision of intravascular visualization, an example of the rapid advancement in U.S. Innovation.

The rapid digitalization of healthcare in the Asia Pacific region is driving the growth of life science imaging, with the expanding biotech and gene activity and the introduction of artificial intelligence to support imaging and multi-omics. Expansion of the number of research facilities, increasing access to advanced imaging technology, and the growing need for precision medicine across diverse populations drive the expansion of life sciences imaging activities across the region. The growth of life sciences imaging continues to accelerate due to governments in the region driving the expansion of public health initiatives, growing funding, and the rapid adoption of digital health across the Asia Pacific.

China Life Science Imaging Market Trends

Leading the way across the APAC Region is China, which has been the largest investor in biotech, genomics, and integrated platforms. The development of multi-omics analytics, the use of artificial intelligence and imaging together, and the widespread adoption of advanced imaging tools in hospitals and research institutions have significantly increased the pace at which the new generation of life science imaging and diagnostic tools is being used in China.

Recently, BGI Genomics launched a multi-functional health management system known as the 133111i Multi-omic Precision Health Management System, which combines omics, imaging, and large amounts of information (big data) into a single system for precision disease and health management.

The European life-science imaging sector is expanding due to its established healthcare systems, extensive academic and clinical research collaborations, and growing investment in next-generation imaging modalities. The entire market is experiencing increased adoption of high-end imaging technologies, such as advanced-resolution positron emission tomography, along with AI-based diagnostics, driven by a growing need for earlier disease identification, precise diagnosis, and assistance in drug development and clinical trials. Effective regulatory frameworks will help foster innovation across Europe's healthcare providers and enhance the sharing of best practices through cross-border collaborations.

The UK is establishing its regional position through national strategic infrastructure that links hospitals, academic research institutions, and biotech companies into a single imaging network. In June 2025, the NHS launched a new total-body PET scanning facility at the Royal Infirmary of Edinburgh, the first in Scotland, part of the National PET Imaging Platform (NPIP), supported by UK Research and Innovation (UKRI) funding. The total-body PET scanner is 40 times more sensitive, 10 times faster, and can image 50% more patients within a day than some older PET scanners currently in use. Together, these advanced imaging technologies, with enhanced academic, clinical, and industrial collaboration, have improved the UK's ability to provide early diagnosis.

The Middle East and Africa are becoming more active in life science imaging due to increasing medical modernization, increasing numbers of diagnostic services, and the development of new imaging infrastructure, both clinically and for research. Increased focus on early disease detection, the use of digital imaging technologies, and global partnerships between technology companies and healthcare providers have made it easier for hospitals, specialty facilities, universities, and other institutions to develop capabilities to enhance diagnostics.

The UAE is leading other countries in the region in its rapid digital transformation. With substantial government funding and a clear national strategy focused on precision diagnostics, the nation has successfully integrated advanced medical imaging technologies (e.g., artificial intelligence, high-resolution microscopy, and smart imaging systems) into its publicly and privately funded healthcare systems. Strategic alliances with international imaging innovators and the emergence of biomedical research centers in Abu Dhabi and Dubai will enable the UAE to become an advanced technology leader in the application and development of new imaging technologies throughout the broader Mideast and Africa region.

Life Science Imaging Market Value Chain

Research & Development and Components Manufacturers develop, manufacture, and supply Sensors, Pumps, Plates, Microfluidics, and Consumables that are used to automate Hardware and Assays and provide Performance, Scalability, and Compliance (e.g., FDA).

Key Players: Corning, Eppendorf, SPT Labtech, Agilent.

OEMs design, manufacture, and assemble Automated Platforms (Liquid Handlers, Robotic Arms, Incubators), along with providing validated workflow and regulatory documentation to enable reproducible use of automation in high-throughput environments.

Key Players: Thermo Fisher Scientific, Tecan, Hamilton Company, Beckman Coulter, Agilent.

Software vendors provide a combination of LIMS, ELNs, Orchestration, and Scheduling tools, along with Instrument integration, Workflow Automation, Data Management, and Audit Trail for compliance.

Key Players: Benchling, Agilent (VWorks), Thermo Fisher (workflow software), PerkinElmer (lab IT/OneSource).

Distributors and suppliers provide for global accessibility of Consumables, Spare Parts and Reagents, as well as streamlining Supply Chain Management for Laboratories, admin savings, inventory management and regulatory compliance.

Key Players: Avantor / VWR, Thermo Fisher (distribution channels), Corning, PerkinElmer.

CROs, Clinical Labs, and integrators validate/certify and/or customize Automated Systems; additionally, they provide Training, Maintenance, Regulatory Certification, and Data Analytics in a scalable manner.

Key Players: Charles River Laboratories, Thermo Fisher (service/support), Beckman Coulter (integration), PerkinElmer

Life Science Imaging Market Comapnies

- Thermo Fisher Scientific

- Danaher Corporation

- Agilent Technologies

- PerkinElmer, Inc.

- Carl Zeiss (ZEISS)

- Olympus Corporation

- Nikon Corporation

- Bruker Corporation

- Bio-Rad Laboratories

- GE Healthcare (including Cytiva/GE Life Sciences)

- Shimadzu Corporation

- Hitachi High-Tech

- Hamamatsu Photonics

- Oxford Instruments (including Andor)

- Molecular Devices (part of Danaher)

- Luminex Corporation

- Miltenyi Biotec

- Siemens Healthineers

- LI-COR Biosciences

- Keyence Corporation

Recent Developments

- In February 2025, Boston Scientific announced the completion of a 1.5 billion senior notes offering via its subsidiary, refinancing debt and supporting future operations and potential acquisitions. (Source: https://www.prnewswire.com)

- In June 2025 Meril Life Sciences unveiled MyClip TEER System India's first transcatheter edge-to-edge repair system for severe mitral regurgitation, offering a minimally invasive alternative for high-risk cardiac patients. (Source: https://ehealth.eletsonline.com)

- In October 2025, Evident launched its new FLUOVIEW FV5000 confocal and multiphoton imaging microscope, delivering photon-level quantitation, high-speed scanning, and AI-based workflows for advanced cellular and tissue imaging. (Source: https://evidentscientific.com)

- In January 2025, Ramona Optics introduced the Vireo live cell imaging system, capable of imaging an entire 96-well plate across five channels in under two minutes, dramatically accelerating throughput for drug discovery and live-cell assays.

Life Science Imaging MarketSegments Covered in the Report

By Product Type

- Whole Slide Imaging (WSI) Systems

- Brightfield WSI

- Fluorescence WSI

- Image Analysis Software

- AI-based pattern recognition

- Quantitative analysis tools

- Digital Microscopes

- Optical digital microscopes

- Electron digital microscopes

- Preclinical Imaging Systems

- MRI-based systems

- PET/CT imaging

- Computational Pathology Platforms

- Cloud-based pathology platforms

- Integrated workflow platforms

- Ancillary Tools & Accessories

- Storage devices

- Workstations

By Deployment Type

- On-Premise

- Cloud-Based

- Hybrid (On-Premise + Cloud)

By Application

- Cancer Diagnostics & Oncology Research

- Infectious Disease Analysis

- Research & Drug Discovery

- Genomics & Rare Disease Studies

- Other Applications

By End-User

- Hospitals & Clinical Diagnostic Laboratories

- Diagnostic Imaging Centers

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Other End-Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content