What is the Life Science Instrumentation Market Size?

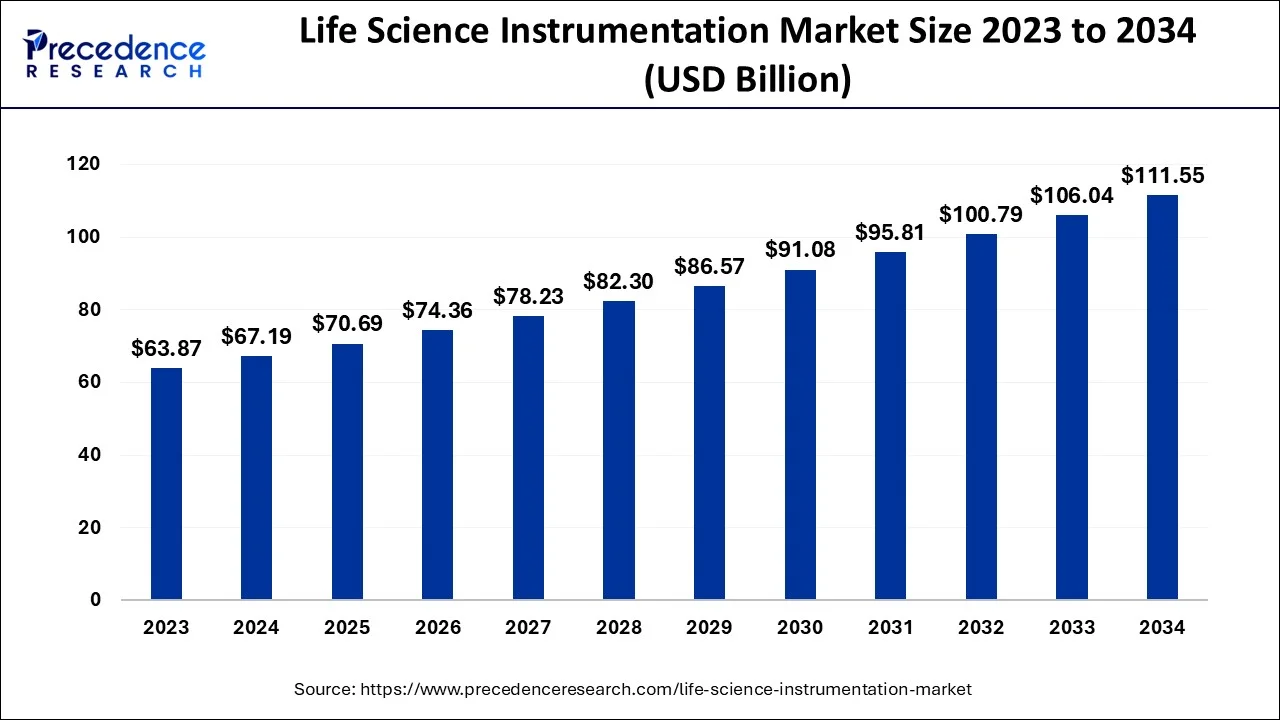

The global life science instrumentation market size is valued at USD 70.69 billion in 2025 and is predicted to increase from USD 74.36 billion in 2026 to approximately USD 117.06 billion by 2035, expanding at a CAGR of 5.17% from 2026 to 2035.

Life Science Instrumentation Market Takeaways

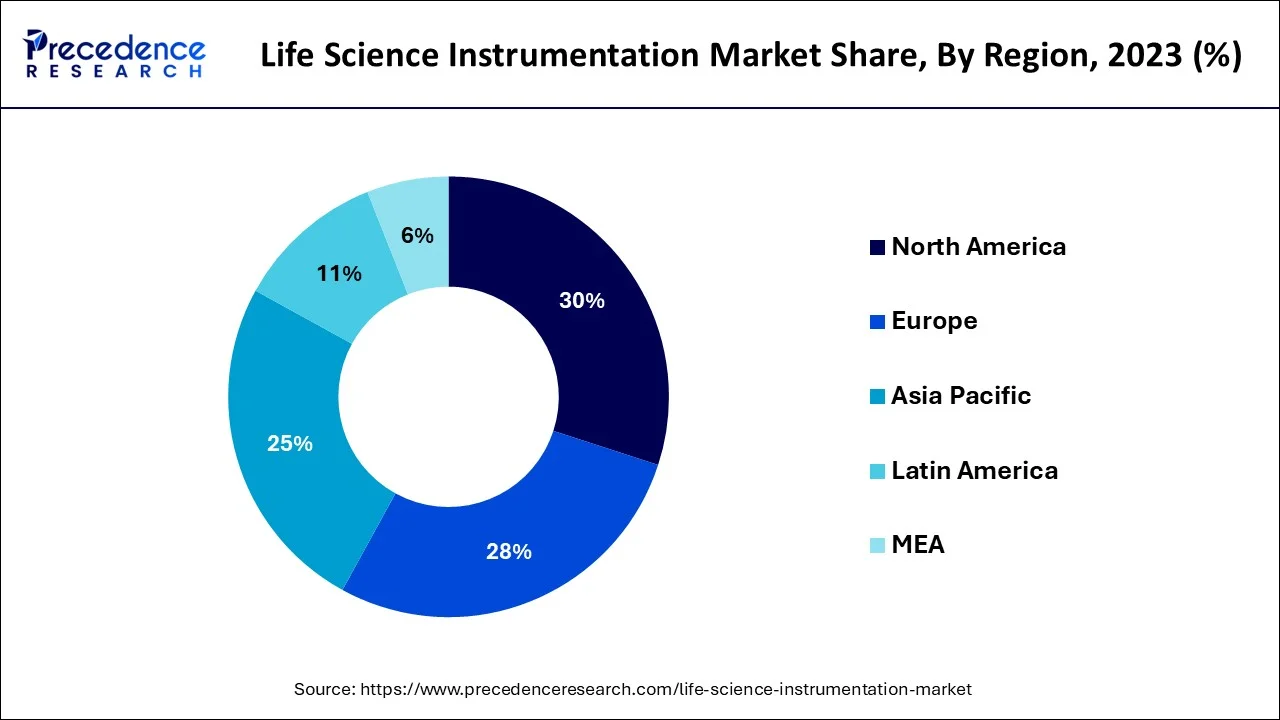

- North America dominated the life science instrumentation market in 2025.

- By technology, the next generation sequencing (NGS) segment dominated the market in 2025.

- By application , the research segment led the market in 2025.

- By end users, the pharma-biotech segment will gain a significant market share over the forecast period.

AI in the Market

AI is interfering in the life science and instrument market by imparting efficiency, accuracy, and speed to R&D, diagnostics, and clinical applications. AI-powered analytical tools accelerate drug discovery by analyzing biological datasets and predicting molecule behavior and therapeutic targets. In laboratories, they execute repetitive functions; perform imaging analysis, genomic, and proteomic analyses, whereas repeated imaging and data interpretation improve diagnoses and predict patient-specific data for personalized medicine. The introduction of AI speeds up productivity and lessens errors in the time-to-market for new technology.

Life Science Instrumentation Market Growth Factors

The life science instruments are commonly utilized for analytical techniques and method validation during drug development. Nowadays, several innovative technologies are used in the medication development process. The life science instrumentation market will benefit from rising demand for analytical instruments, strong growth in the biotechnology and pharmaceutical industries, and expanding application area of analytical instruments. As sequencing technologies aids in determining the origin of an illness, increased attention on next generation sequencing (NGS) is expected to promote market growth.

The life science instrumentation market is expected to benefit from an increase in research and development activities in various sectors such as biotechnology, pharmaceuticals, food and beverage, and agriculture. Moreover, the increased number of novel product launches by numerous prominent players is expected to boost the growth of the life science instrumentation market during the forecast period.

The growing incidence of chronic diseases in both developing and developed countries is projected to increase the demand for effective technology for early disease diagnosis, which will drive up the demand for instruments in life science. Furthermore, the market for life science instrumentation is being driven by increased public-private investments in life science research and technical developments in analytical equipment. However, the high cost of life science instrumentation is inhibiting the market's expansion.

During the forecast period, the life science instrumentation market is expected to rise due to rising demand for effective diagnostic technologies and increasing government funding in the development of new instruments utilized in the life sciences and medical devices sectors. The growing applications of life science instruments in other industries, such as the food and beverage industry is expected to boost the life science instrumentation market growth during the forecast period.

The majority of life science and analytical technologies are utilized to study DNA in order to develop new pharmaceutical medications and determine food quality. The companies are heavily investing in this area in order to increase the market growth. The development of new products will improve the ability to accurately diagnose samples. It will assist in the targeting of treatment for a specific patient.

The growth of life science instrumentation market is projected to be hampered by high maintenance and operation costs. In addition, without an alternative, diagnosing the samples will be difficult because the lack of such intricate equipment would make the process much more complicated and cause the outcome to be delayed.

- Shortage of skilled forensic scientists in the field has directly resulted in the growth of several educational programs in forensic science, including one of the accelerated developments that the criminal justice community has witnessed.

- Concerns regarding rapid development goals for sequencing and molecular analysis associated with early diagnosis and precision medicine are spurring further development in these fields.

- Public- and private-sector investments in life sciences continue to foster innovation and stimulate the use of upgraded instruments.

- Rising instances of chronic diseases are pushing forward the need for dependable technologies for early detection and disease monitoring.

- The market is also being propelled by frequent product launches and technological breakthroughs in analytical equipment.

What is Life Sciences Instrumentation? How does it help shape Biomedical Research in the Modern Day?

- Industry Growth: The development of advanced analytical technologies, increasing demand for precision diagnostics, and the increased amount of money spent on research and development by the pharmaceuticals, biotechnology, and academic research sectors worldwide are driving a fast increase in the life sciences instrument marketplace.

- Sustainability Trends: As part of aligning themselves with global sustainability mandates and to help reduce the laboratory operational footprint and long-term negative impact on the environment, equipment manufacturers have begun implementing energy-efficient laboratory instruments, recyclable laboratory instrument components, and solvent-reduction processes.

- Global Expansion: There is a growing need for global expansion driven by increased participation in cross-border research collaboration, decentralized clinical trials, and significant investments in laboratory facility infrastructures in newly emerging economies that wish to achieve self-sufficiency in life sciences and healthcare innovation.

- Start-up Ecosystem: An active start-up ecosystem is developing as a result of new trends in life sciences and biomedical research. New start-ups that develop AI-enabled diagnostic technologies, microfluidics technology, and life sciences instrumentation that focus on automation have attracted significant venture capital funding and will therefore be able to quickly bring to market compact, cost-effective, and application-specific products.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 70.69 Billion |

| Market Size in 2035 | USD 117.06 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 5.17% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Value Chain Analysis

- R&D: Discovery and development of new scientific concepts or product prototypes.

Key Players: Thermo Fisher Scientific, Illumina - Clinical Trials and Regulatory Approvals: Checking for maximum possible safety and effectiveness of instrumentation.

Key Players: IQVIA, Labcorp - Formulation and Final Dosage Preparation: Combining raw ingredients into one final product and dosage form.

Key Players: Lupin, Aurobindo Pharma - Packaging and Serialization: Will act to prevent the instrument from any harmful alteration during shipping and storage; serialization for assigning a unique identifier to each unit for tracking and verifying its authenticity.

Key Players: Uhlmann Pac-Systeme, Kezzler - Distribution to Hospitals and Pharmacies: The shipment of final pharmaceutical products through the supply chain network to their predetermined points of sale.

Key Players: DHL Supply Chain, UPS Healthcare - Patient Support and Services: After-quality assurance work, like installation-related assistance, training, maintenance, and technical support.

Key Players: Cognizant, IQVIA

Technology Insights

The spectroscopy segment led the market in 2025, mainly because of its essential role in detecting, identifying, and quantifying molecules in research, clinical, and diagnostic applications. As a fundamental tool for analyzing molecular composition, structure, and electronic properties, spectroscopy is crucial across life sciences. The pharmaceutical and biotech industries rely heavily on spectroscopy for drug development, quality control, and process monitoring. Growing research funding, especially in academic institutions, is increasing demand for advanced spectroscopic equipment.

The Next-Generation Sequencing (NGS) segment is the fastest-growing, owing to its high throughput, scalability, and speed, which enable rapid sequencing of millions of DNA fragments simultaneously. This capability has expanded genomics research, particularly in disease diagnostics, personalized medicine, and drug discovery. NGS technologies are scalable and adaptable, allowing researchers to modify sequencing capacity from small targeted panels to whole-genome sequencing, applicable across cancer genomics, infectious disease analysis, microbiome studies, and more.

Application Insights

The clinical and diagnostic applications segment dominated the life science instrumentation market in 2025. This dominance was driven by the increasing prevalence of chronic diseases, a growing demand for personalized medicine, and technological advancements in diagnostics. There is a strong need for faster, more accurate, and more efficient diagnostic tools in both research and clinical settings. The shift towards personalized medicine, which customizes treatment for individual patients, heavily relies on diagnostic tools for genetic profiling, biomarker identification, and disease stratification. Rising healthcare expenditures and the adoption of advanced technologies in developing countries are also contributing to the demand for clinical and diagnostic instrumentation.

The drug discovery and development segment is the fastest-growing area in the market during the forecast period. This growth is primarily due to advancements in technologies such as artificial intelligence, machine learning, and high-throughput screening, which accelerate the drug development process and increase the need for specialized instruments. Both governments and private companies are making substantial investments in life science research, particularly in drug discovery and development, leading to a heightened demand for cutting-edge instrumentation. The rise of personalized medicine necessitates specialized tools for analyzing individual patient data and developing tailored therapies, further boosting this segment.

End User Insights

Pharmaceutical and biotechnology companies continued to dominate the market in 2025, driven by significant investments in drug discovery and development, along with a demand for advanced technologies to support these processes. This segment utilizes a wide variety of instruments for numerous applications, including genomics, proteomics, and cell analysis, which drives the demand for innovative technologies and collaborations. Continuous advancements in areas such as next-generation sequencing, surface plasmon resonance (SPR), and chromatography have transformed research and development, making these tools essential for pharmaceutical and biotechnology companies and further contributing to the expansion of this segment.

The contract research organizations (CRO) segment is also experiencing rapid growth. This trend is largely due to the increasing complexity of drug development, rising costs of clinical trials, and the growing demand for clinical trial data, prompting pharmaceutical companies to outsource research and development more frequently. Advancements in areas such as personalized medicine, biologics, and gene therapies have created a need for specialized expertise and infrastructure, which CROs are increasingly offering. Furthermore, hybrid and decentralized trial models enhance patient-centricity but also add complexity to trial execution, further driving the demand for CRO involvement.

Regional Insights

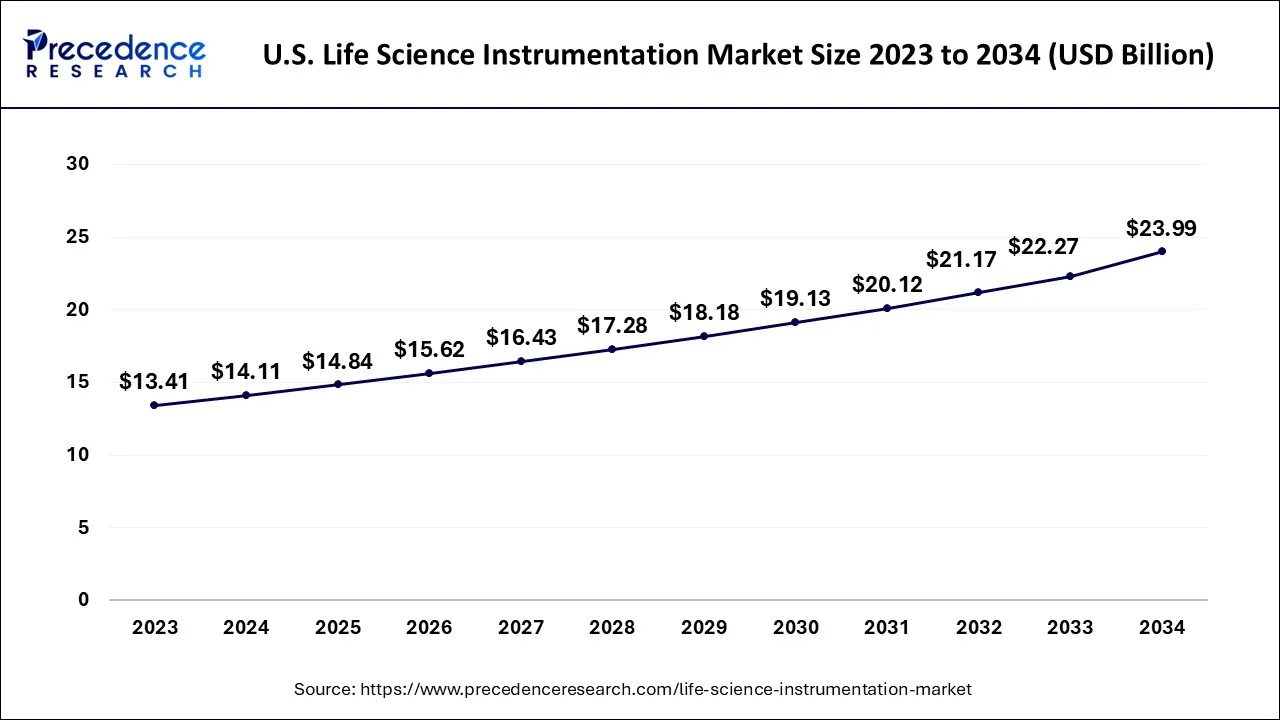

U.S. Life Science Instrumentation Market Size and Growth 2026 to 2035

The U.S. life science instrumentation market size reached USD 14.84 billion in 2025 and is projected to be worth around USD 25.71 billion by 2035, at a CAGR of 5.65% from 2026 to 2035.

Based on the region, the North America segment dominated the global life science instrumentation market in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. The life science instrumentation is employed in a variety of applications in North America. The life science instrumentation has shown to be a useful tool for a variety of applications includingpharmaceutical applications, final product testing, and food safety testing.

On the other hand, in the life science instrumentation market, the Asia-Pacific region is one of the most profitable regions. The region's growth is being fueled by strategic expansions by important market players in rising Asian countries, the growing pharmaceutical industry in China, and India.

Europe: Accurate Science Supported by Excellent Regulatory Practices:

The Life Science Instrumentation Marketplace in Europe is enhanced by a stable regulatory environment, extensive public financing of research in biomedicine, and substantial academic/industry partnerships. There is a strong focus on advanced imaging, genomics, and laboratory automation to assist with drug discovery and the growth of personalized medicine.

Germany Life Science Instrumentation Market Trends

Germany is enjoying significant growth due to its leading role in the manufacture of pharmaceutical products and its significant investments in Analytical Instrumentation for quality control and Bioprocess optimization. The expansion of personalized medicine and precision diagnostics is further increasing demand for high-end analytical and sequencing technologies.

Latin America: Development of Biological Medicine Infrastructure:

Governments throughout Latin America are increasing their investment in healthcare infrastructure and research capacity, providing the foundation for increasing clinical trial activity, an expanding number of diagnostic laboratories, and gradual adoption of modern analytical platforms by both public and private institutions.

Brazil Life Science Instrumentation Market Trends

Brazil is the leader in the region for growth, driven by an increase in the number of biotechnology research centres and an increased demand for Advanced Laboratory Instruments in both Academic and Diagnostic environments. Growth is fueled by rising investments in healthcare infrastructure, genomics research, and personalized medicine, which are driving adoption of instruments such as PCR systems, flow cytometers, mass spectrometers, and next-generation sequencers.

Middle East & Africa (MEA): Increasing Research Capacity through Strategic Investment:

The MEA Region has been a major contributor to the growth of Life Science Instrumentation. Government investment in healthcare modernization, genomic research programs, and disease surveillance programs has contributed to the increasing demand for robust, scalable, and automation-ready laboratory systems.

Life Science Instrumentation Market Companies

- Bruker Corporation

- Eppendorf AG

- Hitachi High Technologies Corporation

- Becton Dickinson and Company

- Bio-Rad Laboratories Inc.

- Waters Corporation

- Thermo Fisher Scientific

- Agilent Technologies

- Shimadzu Corporation

- Qiagen N.V.

Key Companies & Market Share Insights

- In March 2025, Beckman Coulter Life Sciences, a Danaher Corporation subsidiary, introduced the CytoFLEX mosaic Spectral Detection Module, the first modular spectral flow cytometry solution in the industry.

https://www.pharmtech.com - In March 2025, Diasorin launches Simplexa™ C. auris Direct kit in CE mark countries, aiding in identifying patients suspected of Candida auris colonization for infection control and preventing deadly infections.

https://www.selectscience.net

Segments Covered in the Report

By Technology / Instrument Type

- Spectroscopy

- UV-Visible Spectroscopy

- Mass Spectrometry (MS)

- Single Quadrupole

- Triple Quadrupole

- Time-of-Flight (TOF)

- Ion Trap

- Atomic Absorption Spectroscopy (AAS)

- X-ray Crystallography

- Nuclear Magnetic Resonance (NMR) Spectroscopy

- Infrared (IR) and Near-Infrared (NIR) Spectroscopy

- Raman Spectroscopy

- Fluorescence Spectroscopy

- Chromatography

- Liquid Chromatography (LC)

- High-Performance Liquid Chromatography (HPLC)

- Ultra-High-Performance Liquid Chromatography (UHPLC)

- Gas Chromatography (GC)

- Ion Chromatography

- Thin Layer Chromatography (TLC)

- Supercritical Fluid Chromatography (SFC)

- Liquid Chromatography (LC)

- Polymerase Chain Reaction (PCR)

- Real-Time PCR (qPCR)

- Digital PCR (dPCR)

- Conventional PCR

- Next-Generation Sequencing (NGS)

- Whole Genome Sequencing

- Targeted Sequencing

- RNA Sequencing

- Flow Cytometry

- Cell Analyzers

- Cell Sorters

- Microscopy

- Optical Microscopy

- Electron Microscopy

- Transmission Electron Microscopy (TEM)

- Scanning Electron Microscopy (SEM)

- Confocal Microscopy

- Atomic Force Microscopy (AFM)

- Super-Resolution Microscopy

- Electrophoresis

- Gel Electrophoresis

- Capillary Electrophoresis

- Centrifuges

- Microcentrifuges

- Ultracentrifuges

- Refrigerated Centrifuges

- Lab Automation & Liquid Handling

- Robotic Systems

- Pipetting Systems

- Microplate Readers & Washers

- Cell Counting Instruments

- Automated Cell Counters

- Manual Hemacytometers

- Other

- Thermal Cyclers

- Spectrophotometers

- Bioanalyzers

- Microarrays

By Application

- Clinical and Diagnostic Applications

- Infectious Diseases

- Cancer Diagnostics

- Genetic Testing

- Research Applications

- Genomics

- Proteomics

- Metabolomics

- Cell Biology

- Drug Discovery & Development

- Lead Identification

- Pharmacokinetics

- Toxicology Studies

- Quality Control & Manufacturing

- Forensic Testing

- Environmental Testing

- Agricultural & Food Testing

By End-User

- Pharmaceutical & Biotechnology Companies

- Clinical Diagnostic Laboratories

- Academic & Research Institutions

- Hospitals & Healthcare Facilities

- Contract Research Organizations (CROs)

- Food & Beverage Industry

- Environmental Testing Labs

- Agricultural and Industrial Labs

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- MEA

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting